TL:DR

This research article explains how you can access Ethereum's security and liquidity while reducing financial data exposure. It will show how Aztec enables private balances, counterparties, and business logic on Ethereum; which business situations require private execution and how Aztec solves problems that other blockchain platforms cannot solve.

What is Aztec Network

In 2018, the Aztec Network was launched to act as a private layer-2 of ethereum with a privacy focus, building on ideas around confidential execution explored here. The first version of the Aztec Network’s Mainnet went live on November 20th, 2025; however, the final AZTEC Smart Contract Execution Layer will be rolled out throughout 2026.

Although the AZTEC token was released in late 2025 as documented on Aztec’s official website, it can’t be sent or received by users until at least February 2026. Currently, there are approximately $7 – 8 million dollars worth of value locked (TVL) within the AZTEC network. Tokens are held in on-chain vaults where holders will be able to stake, delegate, and participate in governance ahead of broader trading.

The Missing Capability: Private Execution

Most Ethereum Layer 2 platforms optimize the wrong problem for enterprises. Layer 2 platforms are blockchains that build on top of Ethereum. These platforms generally focus on making transactions faster and cheaper, an approach commonly reflected in general blockchain development guidance. However, they do not solve a critical enterprise problem.

Enterprises do not need private tokens. Tokens are digital representations of value on blockchains. Making tokens private does not solve enterprise problems. Enterprises need private execution with public settlement. This is a fundamentally different requirement.

Private execution means that the actual calculation and decision-making happen in secret. Public settlement means that the final result is visible and recorded on the public Ethereum blockchain. This combination allows enterprises to keep sensitive calculations private while ensuring that the results can be verified and trusted.

What Enterprises Actually Need

Enterprises specifically need four things from a blockchain platform. First, they need confidential inputs. Inputs are the information going into a calculation. Confidential inputs means that no one can see the original information being used in the calculation.

Second, enterprises need hidden balances. Balances are the amount of money or assets an organization holds. Hidden balances means that no one can see how much money or assets an organization holds.

Third, enterprises need shielded business logic. Business logic is the rules and procedures that a business uses to make decisions. Shielded business logic means that no one can see the specific rules and procedures an organization uses.

Fourth, enterprises need verifiable correctness. Verifiable correctness means that other parties can verify that a calculation was done correctly without seeing the underlying information.

Comparing Ethereum’s Layer-2 and Aztec

This table shows the critical differences. MEV means “Maximal Extractable Value”. MEV refers to the value that can be extracted by observing transactions before they are confirmed.

High strategy leakage means that people watching the network can see your strategies and potentially profit from them. Near-zero strategy leakage means that strategies remain hidden.

Compliance burden is higher on Ethereum Layer 2 because regulators can see everything. Compliance burden is lower on Aztec because private information does not need to be shared with regulators.

Observability risk is structural on Ethereum Layer 2 because the network design itself makes everything visible. Observability risk is minimized on Aztec because the network design keeps information hidden.

How Aztec Redefines Execution and Data Visibility on Ethereum

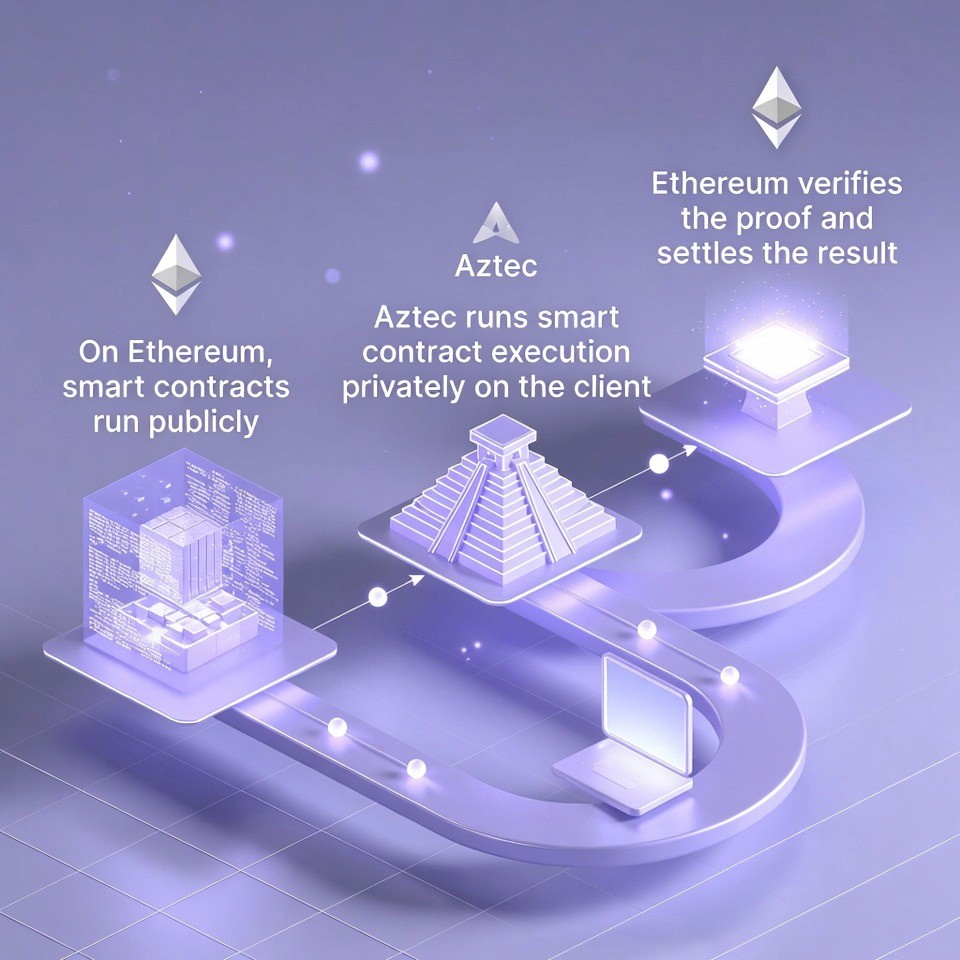

Aztec Network changes where execution happens. Execution is the process of running a calculation or smart contract. A smart contract is a computer program that runs on a blockchain.

On standard Ethereum and Ethereum Layer 2 platforms, execution happens on-chain and publicly. This means that the calculation is performed by all nodes in the network. Nodes are computers that run the blockchain software. Because the calculation is performed by all nodes, everyone can see what is happening.

Aztec removes sensitive execution from the public network. Instead, execution runs privately on the client. The client is the computer or application that is making the transaction. On the client, a zero-knowledge proof is generated, a concept covered in this foundational cryptography resource. A zero-knowledge proof is a mathematical certificate that proves something is correct without showing the underlying information. Ethereum then settles the result without seeing the data.

This architectural shift is what makes confidential use of Ethereum possible for businesses. The calculation stays hidden. The proof of correctness is visible. Ethereum can verify the proof without seeing the calculation.

Detailed Table Comparing Smart Contract Execution Models

The following table shows the detailed differences between how Ethereum Layer-2s and Aztec Network execute transactions:

Dimension | Ethereum (Layer 2) | Aztec Network |

Where execution happens | On-chain, publicly | Client-side, privately |

Visibility of inputs | Fully visible (calldata) | Hidden by default |

Visibility of state updates | Public state transitions | Private state, not globally readable |

Smart contract logic | Fully inspectable | Executed privately |

Counterparty exposure | Publicly linkable | Shielded |

Balance visibility | Public | Private |

Verification method | Re-execution by all nodes | Zero-knowledge proof of correctness |

What Ethereum sees | Inputs, outputs, state changes | Proof + minimal public data |

Settlement security | Ethereum L1 | Ethereum L1 |

Data exposure risk | High (structural) | Low (by design) |

This table shows that Aztec changes every aspect of how transactions work. The biggest changes are where execution happens and what information is visible.

How Aztec Executes a Transaction

Understanding how Aztec executes a transaction is important for business leaders evaluating the platform. The process works like this.

Step One: Business logic runs privately on the client. The client is the computer or application controlled by the business. The business's computer runs the transaction logic privately. No one else can see what is happening on the client's computer. The business decides what information to keep private.

Step Two: Sensitive data never enters a public mempool. A mempool is the waiting area where transactions sit before they are confirmed on the blockchain. On standard Ethereum, transactions sit in the mempool where everyone can see them. This is called transaction visibility. On Aztec, sensitive data never enters the mempool. The client keeps sensitive data private.

Step Three: A proof is generated showing rules were followed. After the transaction is calculated, the client generates a zero-knowledge proof. This proof shows that all the rules were followed. The proof shows that the calculation was done correctly. The proof does not show the underlying data.

Step Four: Ethereum only sees the proof, not the data. The client sends the proof to Ethereum. Ethereum checks the proof. Ethereum does not see the underlying transaction data. Ethereum only verifies that the proof is correct.

Step Five: Settlement remains fully Ethereum-secured. After Ethereum verifies the proof, the settlement is recorded on the Ethereum blockchain. Settlement means the transaction is finalized and recorded. Because settlement happens on Ethereum, the transaction receives the full security of the Ethereum network. Ethereum is the most secure blockchain in existence.

Why This Process Matters for Businesses

This process matters because it solves a critical business problem. Businesses need transactions to be secure, verifiable, and private. Standard Ethereum provides security and verifiability but not privacy. Aztec provides all three.

Businesses can prove that they followed all rules and regulations without revealing sensitive financial information. Regulators can verify compliance without seeing transaction amounts, counterparty names, or business strategies.

How Aztec Provides Compliance Without Data Leakage

The Compliance Model Problem

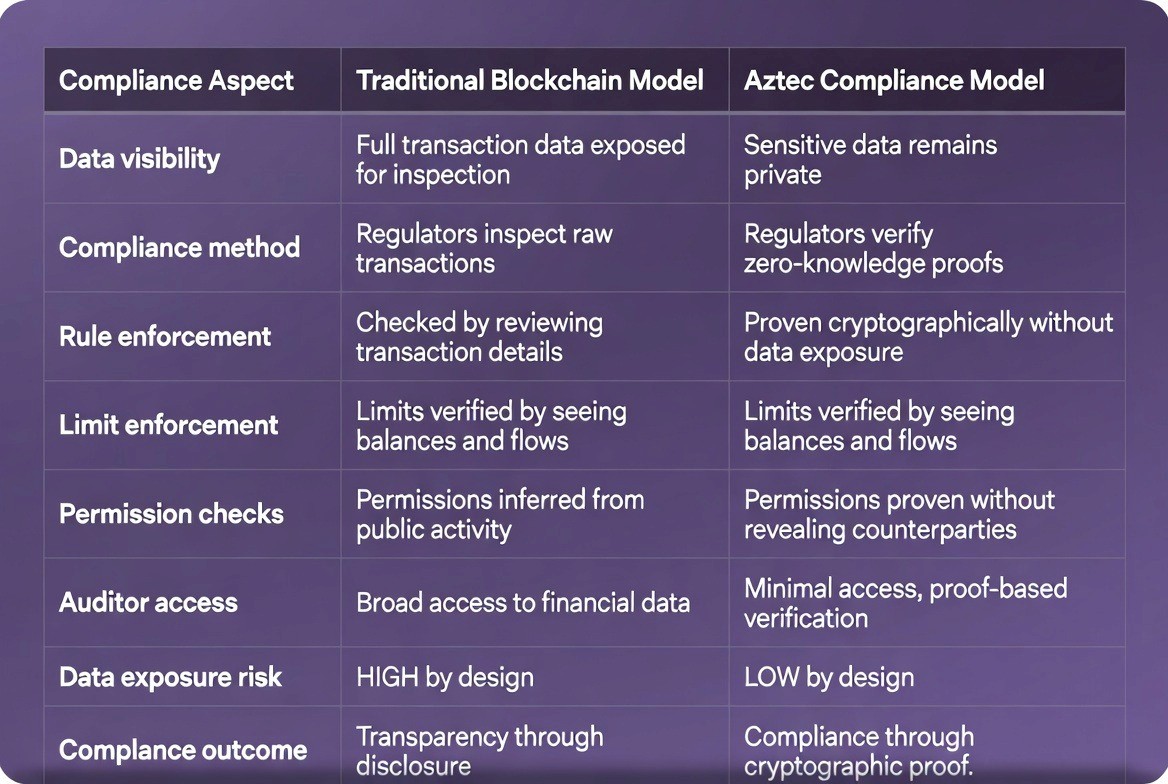

Traditional blockchain compliance models require data exposure. The compliance model is the process a business uses to demonstrate that it is following government rules and regulations.

On public blockchains, the compliance model requires exposing data so regulators can inspect it. Regulators see transaction amounts, counterparty names, business strategies, and other sensitive information. This data exposure creates risk.

The risk is that this sensitive information can be leaked or used against the business. Competitors can see transaction amounts and business strategies. Market participants can see the business's intentions and front-run the business. Front-running means that someone makes a transaction before the business's transaction to profit from the business's action.

How Aztec Flips the Compliance Model

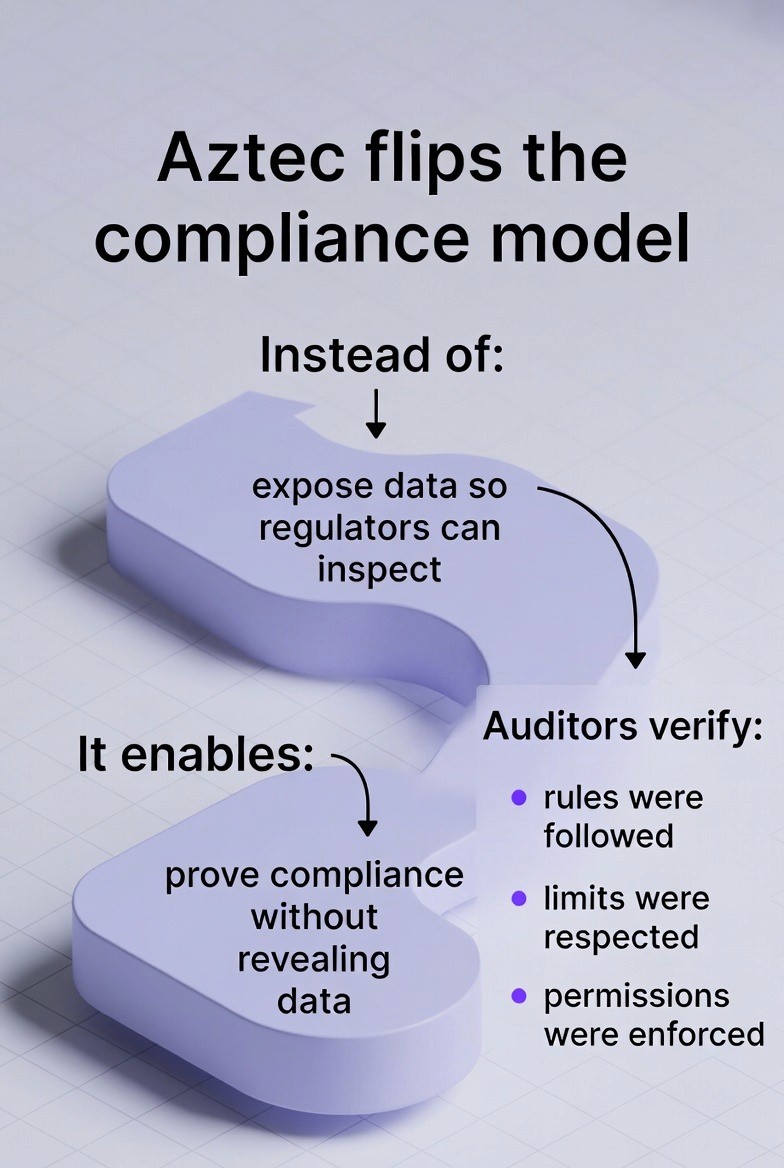

Aztec flips the compliance model by removing the need to expose sensitive data for oversight. Instead of making transactions transparent so regulators can inspect them, Aztec allows businesses to prove compliance using zero-knowledge proofs.

This is a fundamental change in how compliance works. Instead of showing regulators all the data, Aztec shows regulators zero-knowledge proofs that prove compliance.

Auditors can verify that rules were followed without seeing the underlying financial data. Auditors verify three things. First, auditors verify that rules were followed. The business's transactions complied with all applicable rules. Second, auditors verify that limits were respected. The business did not exceed any limits that were imposed. Third, auditors verify that permissions were enforced. The business only made transactions that it had permission to make.

What Regulators Can Verify

The following information shows what auditors and regulators can verify using Aztec:

Rules were followed: All business transactions complied with applicable government rules and regulations.

Limits were respected: The business did not exceed maximum transaction amounts, did not exceed maximum daily volume, and did not exceed any other limits that were imposed.

Permissions were enforced: The business only made transactions that it had permission to make. Employees could not make unauthorized transactions. Unauthorized transactions were automatically rejected.

The Business Benefit

The business benefit is significant. The business can demonstrate compliance without exposing sensitive financial information. Regulators receive proof of compliance without receiving sensitive information that could be leaked or misused.

This creates a win-win situation. Regulators get proof that the business is complying with the rules. The business gets to keep its sensitive financial information private.

How Aztec Preserves Access to Ethereum Liquidity

The Liquidity Problem

A critical concern for enterprises considering private blockchains is isolation. Isolation means separating assets into a separate blockchain that is not connected to the main Ethereum network. If assets are isolated, liquidity is reduced. Liquidity means the ease with which assets can be bought and sold.

On isolated blockchains, assets cannot be easily bought and sold because fewer buyers and sellers are present. This reduces the value of the assets. The business might not be able to find a buyer for assets it wants to sell.

How Aztec Solves the Liquidity Problem

Aztec does not isolate assets into a privacy silo. A silo is a separate system that is disconnected from other systems. Aztec keeps assets connected to the Ethereum network.

Assets remain Ethereum-native. Ethereum-native means that the assets are built on Ethereum and follow Ethereum standards. The assets are real Ethereum assets, not copies or substitutes.

Liquidity continues to flow from the broader Ethereum ecosystem. The Ethereum ecosystem includes many platforms where assets can be bought and sold. These platforms remain available to Aztec users. Users can access Ethereum's liquidity without leaving Aztec.

Private execution does not fragment markets. Fragmentation means breaking markets into separate pieces. When markets are fragmented, prices can differ between markets and liquidity is reduced. Aztec does not fragment markets because assets remain Ethereum-native and connected to the Ethereum ecosystem.

Settlement Stays Fully Composable with Public Ethereum

Settlement is composable, which means different blockchain systems can work together. When settlement is composable, transactions on one system can interact with transactions on another system.

Aztec settlement is fully composable with public Ethereum. This means that transactions on Aztec can interact with transactions on public Ethereum. Aztec users can access Ethereum's liquidity while keeping their transactions private.

The principle is simple: liquidity stays public, execution stays private. The Ethereum network remains public. Users can see all public transactions and markets. Aztec transactions can access these public markets while keeping their own transactions private.

Practical Example of Liquidity Access

A business on Aztec might need to buy a specific token. The token is traded on a public Ethereum market. The business can buy the token from the public market while keeping its transaction private. The public market remains public. The business's transaction remains private. The business gains access to Ethereum's liquidity without losing privacy.

Institutional Adoption of the Aztec Network

Taurus SA: Private Security Token Infrastructure for Banks

Taurus SA is a global leader in digital asset infrastructure. Digital asset infrastructure means the systems and platforms that manage digital assets.

Taurus SA released an open-source confidential token standard specifically designed for banks and debt securities issuance on Aztec. A token standard is a set of rules that tokens must follow. A confidential token standard is a set of rules for tokens that keep information private.

Debt securities are financial instruments that represent money that is owed. They are similar to loans. Banks issue debt securities when they borrow money. The security tokens represent the debt.

Taurus SA built this integration on Aztec's Layer-2 protocol powered by zero-knowledge proofs. This integration enables asset issuers to maintain powerful control over information visibility. Asset issuers can determine exactly who can see what data about tokenized assets on public blockchains.

The benefit is significant. Banks can issue securities on the blockchain while keeping sensitive information private. Banks can determine who can see what information. This allows banks to comply with regulations that require keeping some information private.

Multi-Chain Privacy Bridges - Cross-Chain Enterprise Access

Substance Labs, TRAIN, and Wormhole have built permissionless Ethereum-to-Aztec bridges. A bridge is a connection between two blockchains. A permissionless bridge means that anyone can use the bridge.

These bridges extend privacy to existing decentralized finance ecosystems on Arbitrum, Base, Optimism, Unichain, Solana, and Aptos. These are all different blockchain networks. The bridges allow users on these networks to access Aztec's privacy features.

The benefit is that users do not need to move their assets to a new blockchain. They can stay on their current blockchain and access Aztec's privacy through the bridge.

Bitcoin Suisse: Institutional Staking and Infrastructure Support

Bitcoin Suisse is Switzerland's leading crypto finance service provider. Switzerland is a country in Europe. Crypto finance service provider means a company that offers financial services related to cryptocurrency.

In November 2025, Bitcoin Suisse participated in Aztec's token sale. A token sale is when a blockchain project sells tokens to raise money. Bitcoin Suisse participated alongside Solstice, a Swiss institutional staking partner.

This institutional participation signals confidence in Aztec as foundational infrastructure for the Ethereum ecosystem. Foundational infrastructure means basic systems that other systems are built on. Institutional participation means that serious financial institutions believe in Aztec.

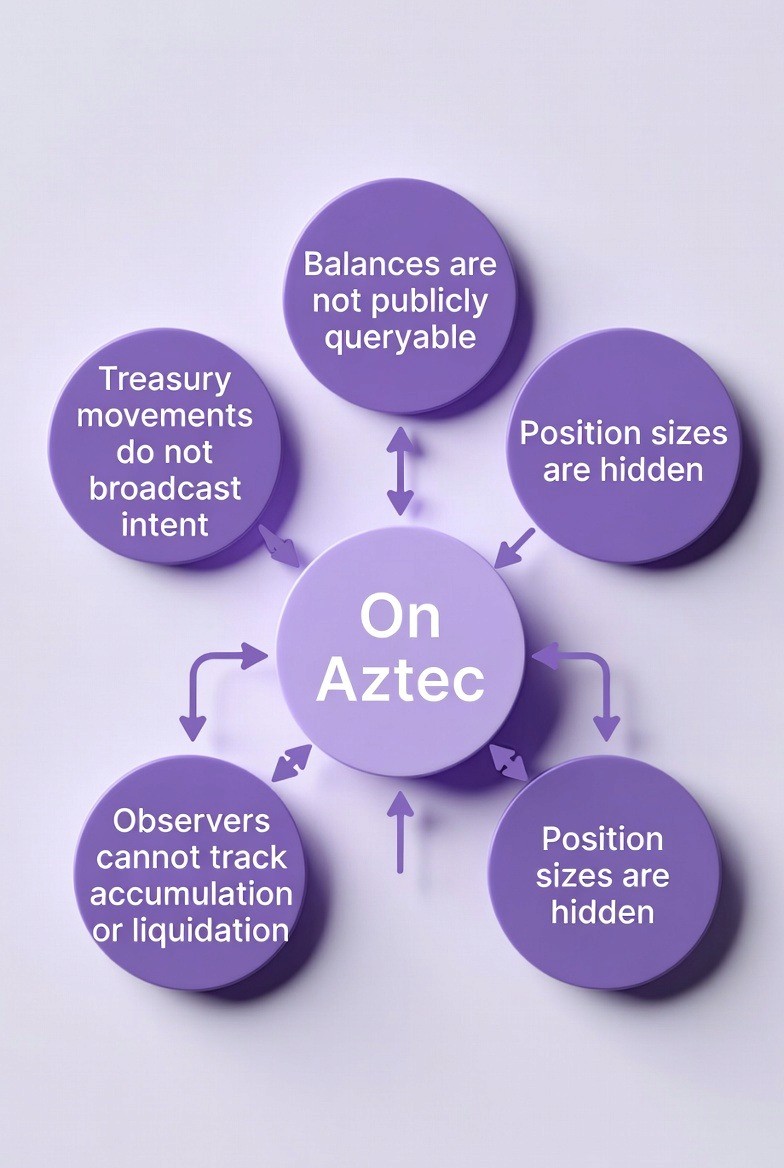

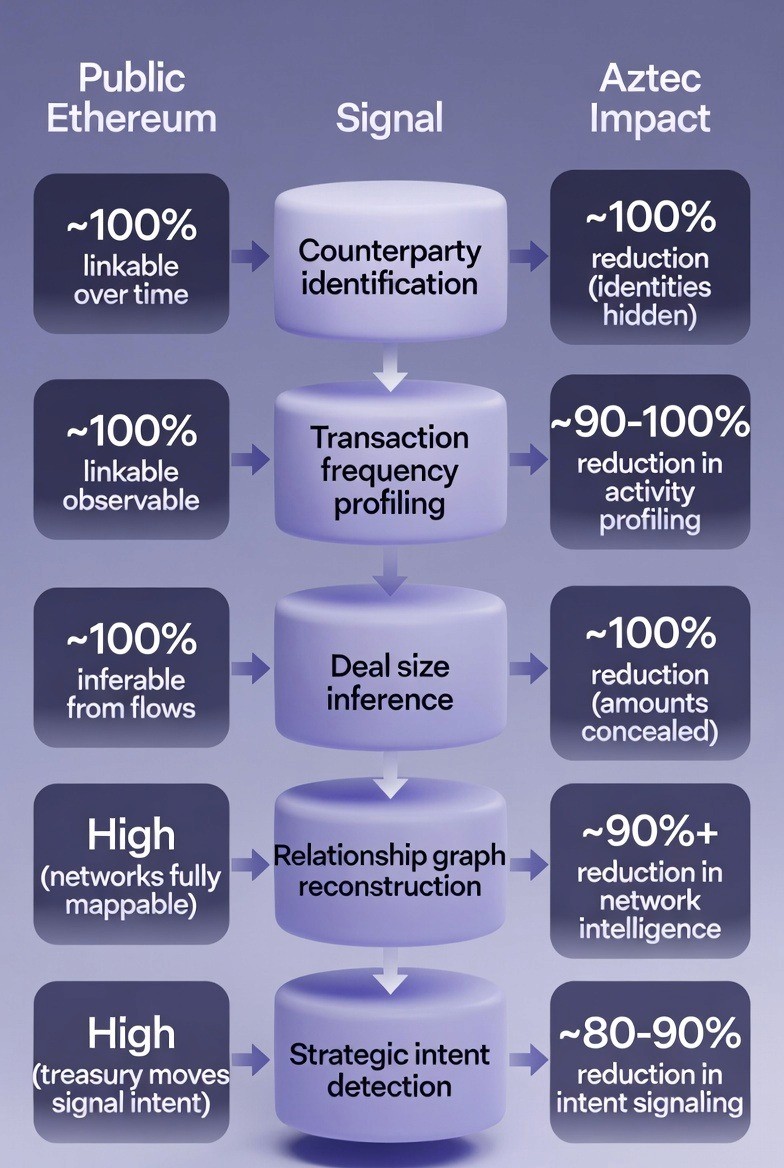

Aztec Features: Private Balances

On Aztec, balances are not publicly queryable. Queryable means that someone can look up and view the information. On public Ethereum, anyone can look up and view any account balance. On Aztec, balances are hidden. No one can look up and view an account balance without permission.

Position sizes are hidden. Position size refers to the amount of an asset that a business holds. On public Ethereum, anyone can see how much of an asset a business holds. On Aztec, position sizes are hidden.

Observers cannot track accumulation or liquidation. Accumulation means buying more assets. Liquidation means selling assets. On public Ethereum, observers can watch a business accumulate assets or liquidate assets. This reveals the business's strategy. On Aztec, observers cannot track these activities.

Why Private Balances Matter

By removing these visibility signals, Aztec eliminates a major class of financial risk tied to front-running, market manipulation, and competitive intelligence leakage.

Front-running is a serious risk. When traders know that a large purchase is coming, they buy the asset before the large purchase. This pushes the price up. The large purchaser must pay a higher price. Front-runners profit at the expense of the business. Private balances prevent front-running because traders cannot see that a large purchase is coming.

Market manipulation is another risk. Traders can manipulate markets if they know a large seller is coming. They sell assets to drive the price down. The large seller receives a lower price. Manipulators profit at the expense of the business. Private balances prevent market manipulation.

Competitive intelligence leakage is the third risk. Competitors can learn about a business's strategy by watching its transactions. If a business is accumulating a particular asset, competitors learn that the business thinks the asset will increase in value. Competitors can copy the business's strategy. Private balances prevent this intelligence leakage.

Treasury movements do not broadcast intent. Treasury movements are the activities of a business's treasury department. The treasury department manages a business's money and assets. On public Ethereum, treasury movements broadcast the business's intent. Everyone can see what the treasury is doing. On Aztec, treasury movements are hidden.

Aztec Features: Private Counterparties

The Counterparty Problem on Public Ethereum

On public Ethereum, anyone can map who transacts with whom, how often, and at what scale. Mapping means creating a record or picture of transactions. This is a serious problem for businesses.

If a business transacts with a supplier, everyone can see that the business uses that supplier. Competitors learn about the business's supply chain. If a business transacts with a customer, everyone can see that the business serves that customer. Competitors learn about the business's customer base.

The frequency of transactions reveals business activity. If a business transacts with another party ten times per week, observers know that the business is very active with that party. If the business transacts once per month, observers know the relationship is minor.

The scale of transactions reveals the importance of the relationship. Large transactions indicate important relationships. Small transactions indicate less important relationships.

All of this information is valuable to competitors. Competitors can learn the business's supply chain, customer base, and relationship priorities.

How Aztec Solves the Counterparty Problem

Aztec prevents this by default. Counterparty identities remain private. No one can see who the business transacts with.

Relationship graphs cannot be reconstructed. A relationship graph is a map showing which parties transact with each other. Even if observers see multiple transactions, they cannot connect the transactions to reconstruct the relationship graph.

Business networks stay confidential. The entire network of parties that a business works with remains secret.

This is essential for business-to-business finance and institutional flows. Business-to-business finance means financial transactions between businesses. Institutional flows means financial transactions between large institutions.

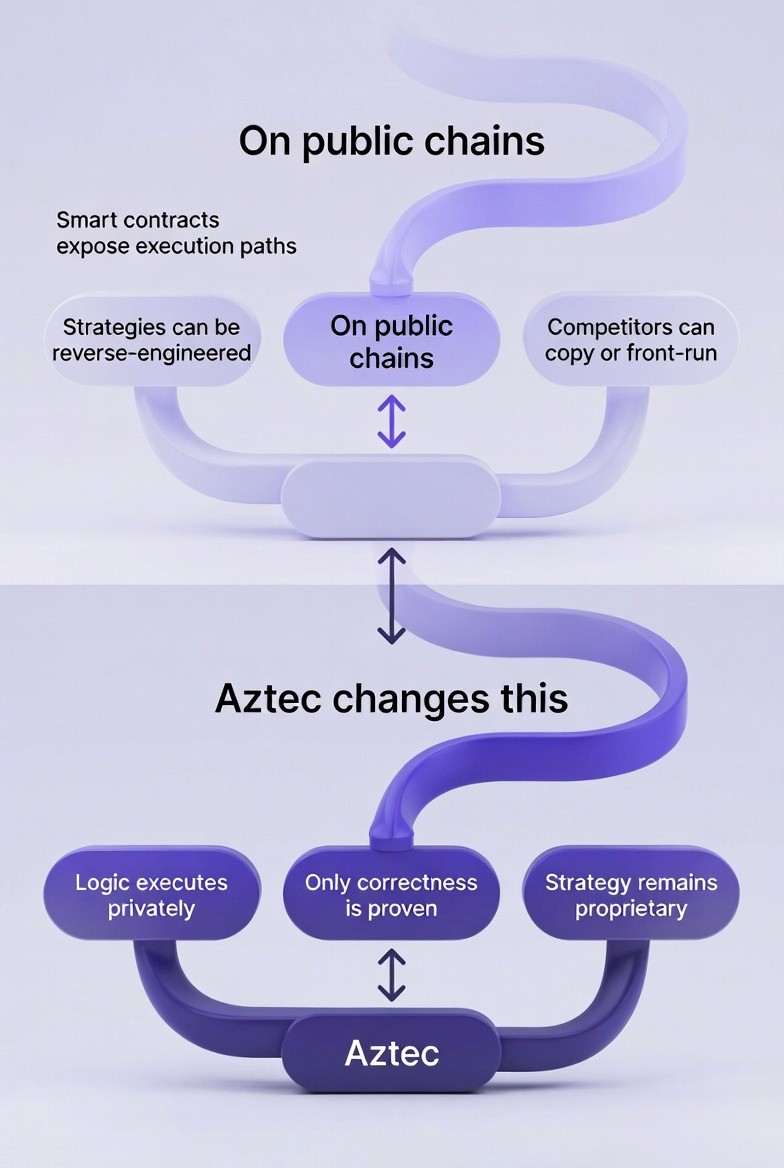

Aztec Features: Private Business Logic

The Business Logic Problem on Public Blockchains

On public blockchains, smart contracts expose execution paths. An execution path is the sequence of decisions and calculations that a smart contract goes through. Anyone can read the smart contract code and understand the execution path.

Strategies can be reverse-engineered. Reverse-engineering means figuring out how something works by examining it carefully. If an execution path is visible, competitors can reverse-engineer the business's strategy.

Competitors can copy the strategy. If competitors understand how a business makes trading decisions or manages risk, they can make the same decisions and compete directly.

Competitors can front-run the strategy. If competitors know what trading decisions a business is about to make, they can make the same trades before the business. This pushes prices against the business.

This is a serious problem for any business that uses advanced strategies.

How Aztec Solves the Business Logic Problem

Aztec changes this fundamentally. Logic executes privately. The business's computer runs the smart contract logic locally. Only correctness is proven. The business's computer generates a zero-knowledge proof that shows the logic was executed correctly. Strategy remains proprietary. No one can see the strategy because no one can see the execution path.

This makes on-chain finance viable for real businesses. Real businesses have real strategies. These strategies are valuable and proprietary. Real businesses cannot share these strategies with competitors. Aztec allows real businesses to use blockchain technology without exposing their strategies.

Why Private Business Logic Matters

Private business logic matters for several reasons. First, it protects competitive advantage. If a business has developed a superior trading strategy or risk management approach, keeping this strategy private protects the business's competitive advantage.

Second, it enables innovation. Businesses are more willing to experiment with advanced techniques if they can keep the techniques private. Private business logic encourages innovation.

Third, it enables real institutional participation. Large institutions have sophisticated strategies and risk management approaches. These institutions will not use blockchain technology if it exposes their strategies. Private business logic enables institutional participation in blockchain finance.

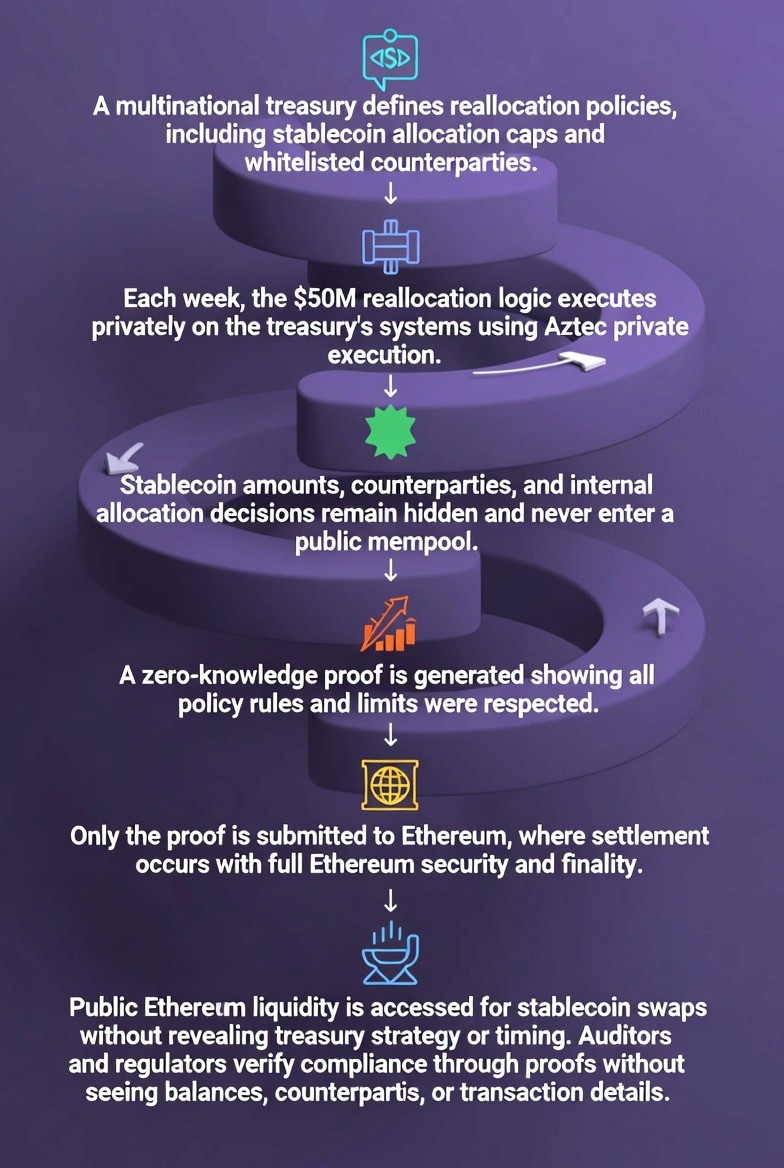

End-to-End Enterprise Flow Example: Using Aztec Network in Practice

Use Case overview

A large, international treasury department utilizes Aztec Network to settle on Ethereum $50 million each week in stablecoin while maintaining private balances, counterparties, and strategies, and at the same time verifying the treasury's compliance. Here is the steps.

1. Policy

The treasury creates a policy that is encoded on chain, including caps for allocations, the approved stable coins to be utilized and a list of white listed counterparties to be allowed for trading.

2. Private Execution

Logic to execute weekly reallocations are executed privately by the treasury, thus preventing any information related to amounts, timing, or intent from being exposed.

3. Data Containment

All sensitive data remain contained within the treasury's system and do not ever enter into a public mem pool, thereby eliminating front running, and the risk of competitive intelligence being leaked to third parties.

4. Proof Generation

A zero knowledge proof is generated to demonstrate that all policies and restrictions were adhered to during the execution of the transaction.

5. Settlement on Ethereum

Only the proof is sent and settlement is finalized on Ethereum providing total security and finality.

6. Access to Liquidity

Publicly available Ethereum marketplaces are used for swaps, while the treasury maintains confidentiality regarding its execution process.

7. Verification of Compliance (Auditing)

Compliance can be verified by auditors and regulatory agencies through proof, and they will not have access to actual balances or counterparties.

The Outlook: Aztec's Future in the Blockchain Ecosystem

Aztec is positioned to become a core privacy layer for Ethereum as institutional adoption accelerates. A privacy layer is a system that provides privacy for transactions on a main blockchain.

Institutional adoption means that large institutions are beginning to use the technology. As more institutions use Aztec, Aztec becomes more important to the Ethereum ecosystem.

Confidentiality Becomes a Requirement, Not a Feature

As businesses and financial institutions move beyond experimentation, demand is shifting toward blockchains that support confidentiality by design. Confidentiality by design means that privacy is built into the fundamental design of the blockchain, not added afterward as an optional feature.

Early blockchain users accepted that transactions were public. These early users were individuals and small organizations. Now businesses and financial institutions are beginning to use blockchains. These organizations require confidentiality.

Aztec addresses this requirement by enabling private execution and compliant workflows without isolating assets or liquidity from Ethereum. This is what businesses and financial institutions need.

Hybrid Architectures Become the Institutional Standard

Looking ahead, Aztec is likely to be used alongside public Layer-2 networks in hybrid architectures. A hybrid architecture uses multiple systems to solve different problems.

High-volume settlement remains public on public Layer-2 networks. Settlement is the process of recording a transaction as final. High-volume settlement means many transactions being recorded. Public settlement means these transactions are visible.

Sensitive financial operations execute privately on Aztec. Sensitive financial operations are transactions that contain confidential information.

This model aligns with how regulated institutions actually deploy technology at scale. Regulated institutions need to make transaction details visible to regulators. However, they also need to keep some information private.

The model of hybrid architectures becoming the institutional standard shows that blockchain technology is maturing. Blockchains are no longer one-size-fits-all systems. Instead, organizations combine multiple blockchains to solve different problems.

Ethereum Without Data Exposure

The future vision is Ethereum without data exposure. Data exposure is the public visibility of sensitive information. The future of blockchain is using Ethereum's security and liquidity without exposing sensitive data.

Privacy as a baseline requirement means that organizations expect privacy to be available by default. Privacy is not a special feature for unusual cases. Privacy is a basic requirement for all organizations using blockchain.

Hybrid deployment becomes default means that organizations will combine Aztec with public Ethereum and other Layer-2 networks. This combination will be the standard way that organizations deploy blockchain technology.

FAQ

1. What business problem does Aztec Network solve that Ethereum alone cannot?

Aztec enables private execution with public settlement, allowing businesses to use Ethereum’s security and liquidity without exposing balances, counterparties, or business logic.

2. How does Aztec Network reduce financial data exposure?

Sensitive logic and data execute privately on the client, while Ethereum only verifies a zero-knowledge proof; meaning no transaction details ever become publicly visible.

3. Can we still access Ethereum liquidity while using the Aztec Network?

Yes. Assets remain Ethereum-native, liquidity stays public, and markets remain composable; only execution is private, preventing market fragmentation.

4. How does Aztec Network support compliance without revealing data?

Aztec enables compliance through zero-knowledge proofs, allowing auditors and regulators to verify rules, limits, and permissions without accessing raw financial data.

5. When Is Aztec the Right Infrastructure Choice for a Business?

Aztec is ideal for treasury operations, institutional finance, regulated workflows, and proprietary strategies where data exposure creates material risk.

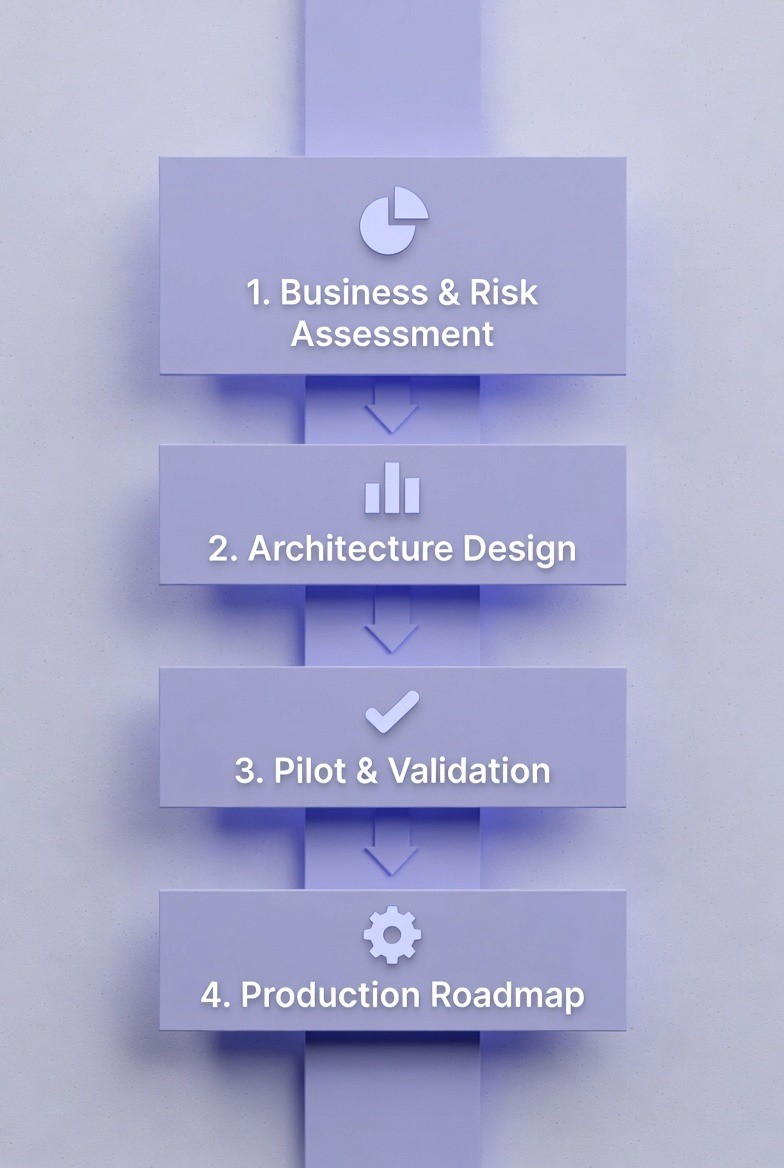

How TokenMinds Supports Aztec Adoption for Enterprises

TokenMinds helps businesses and financial institutions adopt Aztec in a way that aligns with real operational, regulatory, and commercial requirements.

TokenMinds starts by assessing which workflows truly require confidentiality versus public settlement. Not all workflows require privacy. Some workflows benefit from public settlement. Organizations should use private execution only where it creates business value.

Our team then designs an architecture that combines Aztec with Ethereum and relevant Layer-2 networks without unnecessary complexity. Complexity creates problems. The architecture should be as simple as possible while meeting business requirements.

Conclusion

The development of Aztec and similar platforms shows that blockchain technology is moving from early experimentation to serious enterprise infrastructure. As privacy features mature, more enterprises will adopt blockchain technology. This will create significant opportunities for businesses and financial institutions that deploy blockchain technology effectively. Platforms like Aztec that provide privacy will attract institutional participation.

Schedule a complimentary consultation with TokenMinds to assess how your institution can leverage Aztec Network to run confidential transactions on Ethereum; balancing privacy, compliance, and liquidity; while evaluating whether Aztec is the right infrastructure for your payment, settlement, and private execution workflows without disrupting existing systems.