TL:DR

This article explains how financial institutions can centralize cross-chain treasury operations across multiple blockchains without managing separate wallets or manual controls, while reducing cross-chain risk and operational complexity.

THE MULTI-CHAIN REALITY FOR FINANCIAL INSTITUTIONS

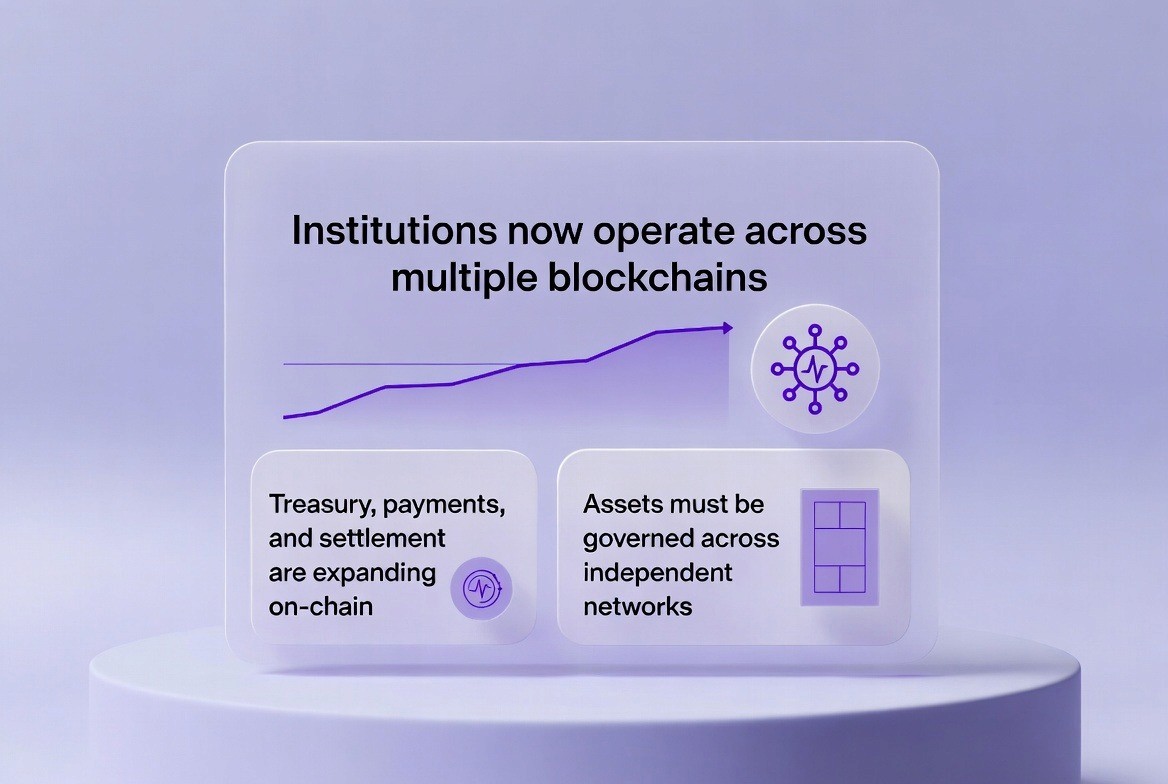

Banks and large financial institutions no longer operate in a single technology environment. Blockchain technology is now being integrated into treasury operations, payment systems, and settlement infrastructure. This means institutions must now manage assets across multiple independent blockchains at the same time, as outlined in this overview. This creates a fundamental problem that traditional treasury systems were never designed to address: how to govern and control financial operations across different networks while maintaining the security, consistency, and accountability that regulators require.

This challenge is real and it is growing rapidly. The global treasury management market reached $6.6 billion in 2025 and is expected to grow to $16.31 billion by 2032. This represents a compound annual growth rate of 13.8 percent. Much of this growth is driven by the increasing complexity of managing financial operations across multiple blockchains. However, most financial institutions still use fragmented systems that cannot effectively control treasury activities across different blockchains.

The solution exists in a technology category called cross-chain treasury control. This method fundamentally separates decision-making from where execution happens. It allows institutions to maintain unified governance while keeping assets on their original blockchains.

Managing operations across multiple blockchains represents one of the most significant operational challenges that financial institutions face in the modern blockchain era. Traditional banking systems were built on the assumption that all assets exist in one central location under one system of control. This assumption no longer works in today's financial infrastructure.

Institutions now operate across dozens of different blockchain networks. Each network has different rules, different speeds, and different security characteristics. The institutions that can manage this complexity efficiently will gain significant competitive advantages. Those that continue using fragmented systems will face increasing costs and growing operational risks.

WHAT IS CROSS-CHAIN TREASURY?

Cross-chain treasury control refers to the ability to execute treasury actions across multiple blockchains using a single governance and approval framework, as discussed in this guide. The key principle is simple: assets do not move between chains. Instead, authenticated instructions are delivered to the chains where assets already exist.

A traditional treasury model is based on the premise that all institutional assets can be governed through a single source of truth. In a multi-blockchain environment this premise is broken. Institutions will hold different asset types (ie, Crypto A, Crypto B, etc.) across multiple blockchains (Blockchain A, Blockchain B, etc.). Therefore, an institution cannot govern all assets through a singular approval process; each blockchain will require its own governance, wallet and execution logic. This creates complexity and risk.

Modern cross-chain treasury systems change how this works. Rather than moving assets continuously between chains, the system keeps assets in place on their native chains. The control plane sends governance instructions to each chain. A treasury team approves an action one time in the control plane. That action automatically executes on all relevant blockchains. The result is unified control without moving physical assets between chains.

This distinction matters significantly for how institutions operate. It reduces trust assumptions because no bridges are needed to move assets from one chain to another. It improves consistency because all blockchains receive the same instructions and apply the same policies. It increases transparency because all actions are recorded in the control plane and on every destination chain.

The control plane serves as the central brain of the entire treasury operation. All approval decisions happen in the control plane. All policies and rules are enforced in the control plane. All activity is recorded in the control plane. This creates a single source of truth that auditors and regulators can examine. When treasury teams need to understand what happened and why it happened, they can look in one place instead of searching across multiple separate systems.

Execution occurs on destination chains through authenticated messages. These messages contain the specific instructions that need to be carried out. The destination chains execute these instructions using their own native capabilities. They then report the results back to the control plane. This architecture means that institutional treasury teams never need to directly manage wallets on individual blockchains. They work through the control plane and let the system handle the technical details of delivering instructions and executing them.

THE INSTITUTIONAL CHALLENGE: FRAGMENTATION CREATES RISK

Treasury management is fundamentally about control, accountability, and policy enforcement. These principles developed over time in environments where one system of record could govern all financial activity. Multi-chain environments break this assumption by design.

As treasury execution spreads across multiple blockchains, the institution can't rely on a uniform approval process. Spending limits and risk exposure also vary. A spending limit on one chain doesn't apply to another. An automated approval process that takes minutes on one blockchain might need manual work on another. This lack of automation adds operational risk, which increases with each new blockchain the institution uses.

The practical problems are substantial and create real costs. Auditors must trace activity across multiple independent systems. Compliance teams must verify that treasury policies apply uniformly across all chains. Risk managers cannot determine true exposure in real time because information is scattered across different systems. Each fragmented system adds cost and complexity to operations.

For regulated institutions, fragmentation is particularly problematic. Regulators expect institutions to demonstrate clear control of all assets. They expect consistent enforcement of treasury policies. They expect the ability to explain every single transaction. A treasury operation split across multiple independent chains cannot meet these expectations reliably.

When an auditor attempts to verify that an institution followed all its treasury policies, they must check each blockchain separately. A policy that limits how much money can be spent per day should apply equally on every chain. But in a fragmented system, there is no automatic enforcement. Spending oversight must be checked individually on each system. A unified control plane would enforce these limits immediately because all spending is tracked in one central location.

The market data confirms the challenge is urgent and significant. Companies that have implemented cross-chain interoperable solutions have reported up to 80 percent reduction in transaction costs compared to traditional methods. This demonstrates the financial impact of poorly coordinated multi-chain operations. Financial institutions are recognizing that fragmentation is not just operationally inefficient. It is also a significant financial burden that reduces profitability.

Risk management becomes nearly impossible in fragmented systems. A chief risk officer responsible for the institution's overall exposure cannot see the complete picture. They must gather reports from multiple systems. Each system has different formats and timelines. By the time they understand the total risk exposure, the situation may have changed. In a unified system, risk metrics are available in real time across all chains.

WHY TRADITIONAL BRIDGES AND MANUAL PROCESSES FALL SHORT

Most institutions manage cross-chain treasury operations by using bridges and manual off-chain coordination. Here’s how it works: the treasury team approves an action in a central system. Then, they coordinate with wallet operators on each chain to carry out that action. If assets need to move, they use a bridge service to transfer value between chains. After that, they execute the intended transaction.

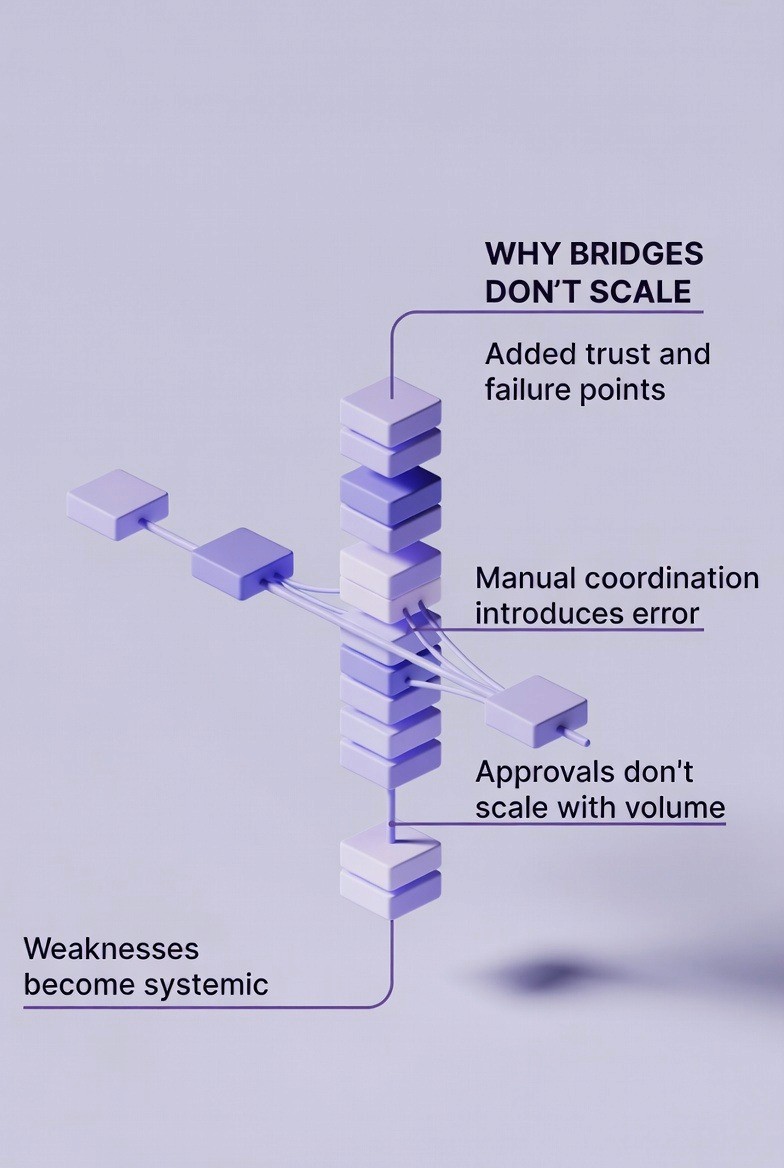

This method of building cross-chain bridges adds extra levels of risk and complexity.

First, there are significant trust issues with bridges themselves as they have to be fully operational (secure) at all times. Therefore, if a bridge were to fail or be breached; it would result in the loss of institutional assets, or more specifically; the inability for an institution to complete its intended transactions. There are also very well documented weaknesses with respect to bridge security in blockchain systems. As such, cross chain bridge hacks/ exploits have resulted in over $2.6 Billion being lost by users. Therefore, there is a clear systemic risk associated with using bridge technology to allow institutions to transact across chains..

Bridges are essentially software services that move assets from one blockchain to another. They work by locking assets on the source blockchain and releasing equivalent assets on the destination blockchain. This requires the bridge itself to be completely trustworthy and secure. If the bridge software has a bug or security flaw, attackers can steal the assets locked in the bridge. Many major bridge exploits have happened exactly this way. An attacker found a security flaw in the bridge code and stole millions of dollars in assets.

Second, the approval process for cross-chain asset transfers are typically highly manual. The user will need to login to their wallet on both chains. They will also have to manually confirm each transaction on the blockchain. The approval of each transaction will be time-sensitive and therefore require the user to ensure that all approvals occur at the correct time. As such, manual tasks will provide opportunities for humans to make mistakes with respect to the execution of important Treasury-related operations. Missed steps, incorrect amounts, or errors in timing can cause the loss of large sums of money as well as disrupt an organization's operation.

Third, as transaction volume grows and institutions expand to more blockchains, these weaknesses become systemic rather than exceptional. What started as a manageable process breaks down completely. Teams cannot scale manual approvals. Bridges become bottlenecks for transaction processing. Coordination overhead grows faster than the business value being generated.

When an institution manages assets on five blockchains, manual coordination might be feasible. When they expand to fifteen blockchains, the situation becomes chaotic. The number of possible communication breakdowns grows exponentially. The coordination overhead consumes time and resources that should go toward actual treasury strategy and financial decision-making.

Chainlink's product data illustrates this problem clearly. In Q1 2024 alone, Chainlink CCIP experienced a 900 percent increase in the number of cross-chain transactions and a 4,000 percent increase in transfer volume compared to Q4 2023. This explosive growth demonstrates institutional demand. However, it also shows the limitations of existing systems. Institutions are pushing transaction volumes beyond what manual coordination can handle effectively.

The growth rate shows that financial institutions are already moving toward multi-chain operations. They are not waiting for perfect solutions. They are implementing solutions with bridges and manual processes because they must operate across blockchains immediately. However, they are experiencing the pain points these solutions create. The demand for better solutions is increasing rapidly.

HOW MODERN CROSS-CHAIN INSTRUCTION DELIVERY WORKS

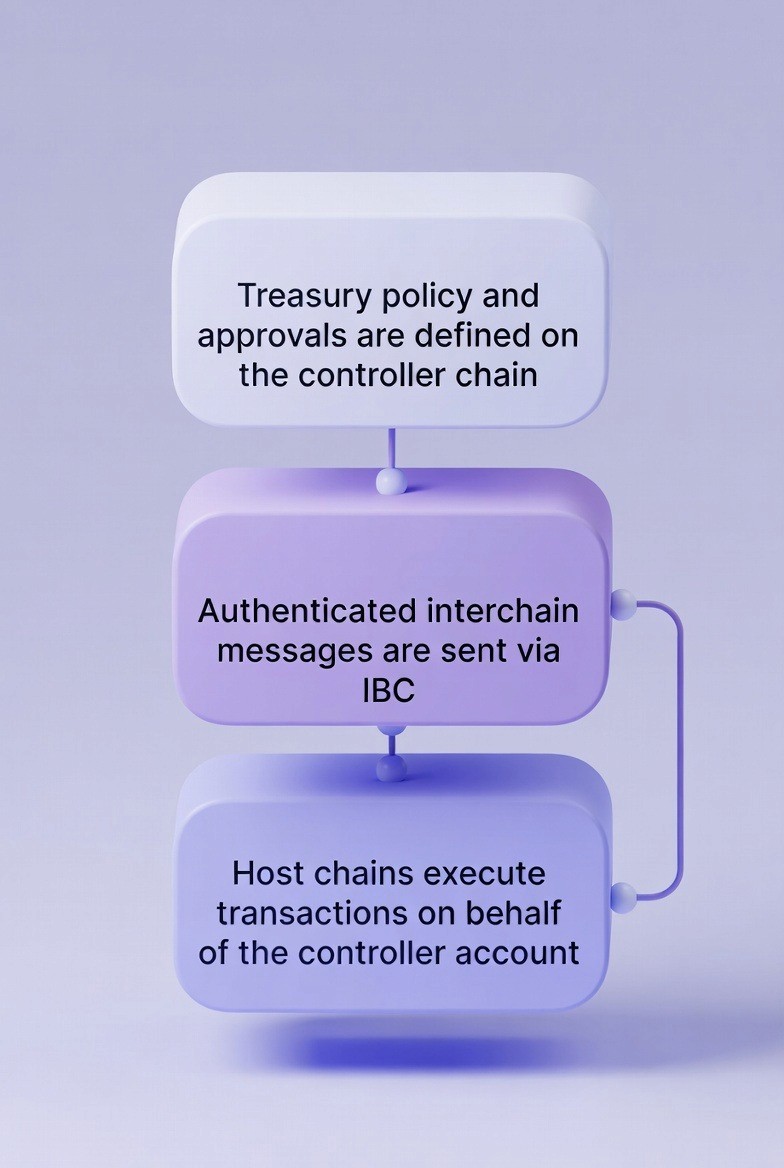

Modern cross-chain treasury systems separate decision-making from execution location. Treasury logic and approvals live in a control plane. The control plane serves as a single source of truth for all treasury decisions. Execution occurs on destination chains through authenticated messages that are sent to each chain automatically.

The difference from traditional systems is profound and significant. Rather than moving assets between chains, the system moves instructions. A treasury team approves an action one time in the control plane. That action is transmitted automatically to all relevant blockchains. Each blockchain receives the same instruction. It executes the instruction using its native capabilities. It reports the result back to the control plane. Assets never move. Instructions flow instead.

This is a fundamentally different way of thinking about multi-chain operations. In traditional multi-chain approaches, the institution focuses on moving assets between blockchains. Assets get transferred from chain to chain using bridges. Each transfer requires separate execution. In the instruction-based approach, the institution focuses on sending commands to blockchains. The money stays where it is originally located. But each chain receives instructions about what to do with that money.

This approach requires infrastructure that meets several important requirements. First, it must securely deliver instructions across chains. It must verify that those instructions came from an authorized source. Second, each destination chain must be capable of executing the instruction using its native capabilities. It must not require external intermediaries. Third, the system must remain deterministic. The same instruction on the same chain always produces the same result.

When these requirements are met, treasury operations become radically simpler and more efficient. Institutions no longer need separate wallets on each chain. They do not need separate approval workflows for each chain. Treasury teams do not need to coordinate with different operators or bridge services. Instead, they interact with a single control environment.

It simplifies operations by allowing a single point of entry to multiple blockchains, as described in this layered architecture overview. It provides transparency as each operation performed in the control layer will be documented on the control layer and also on each destination blockchain. It provides consistency for regulatory compliance as the same policies are applied to all chains. It minimizes risks as there is less user intervention and no need for an asset bridge.

COSMOS INTERCHAIN ACCOUNTS: NATIVE CROSS-CHAIN CONTROL

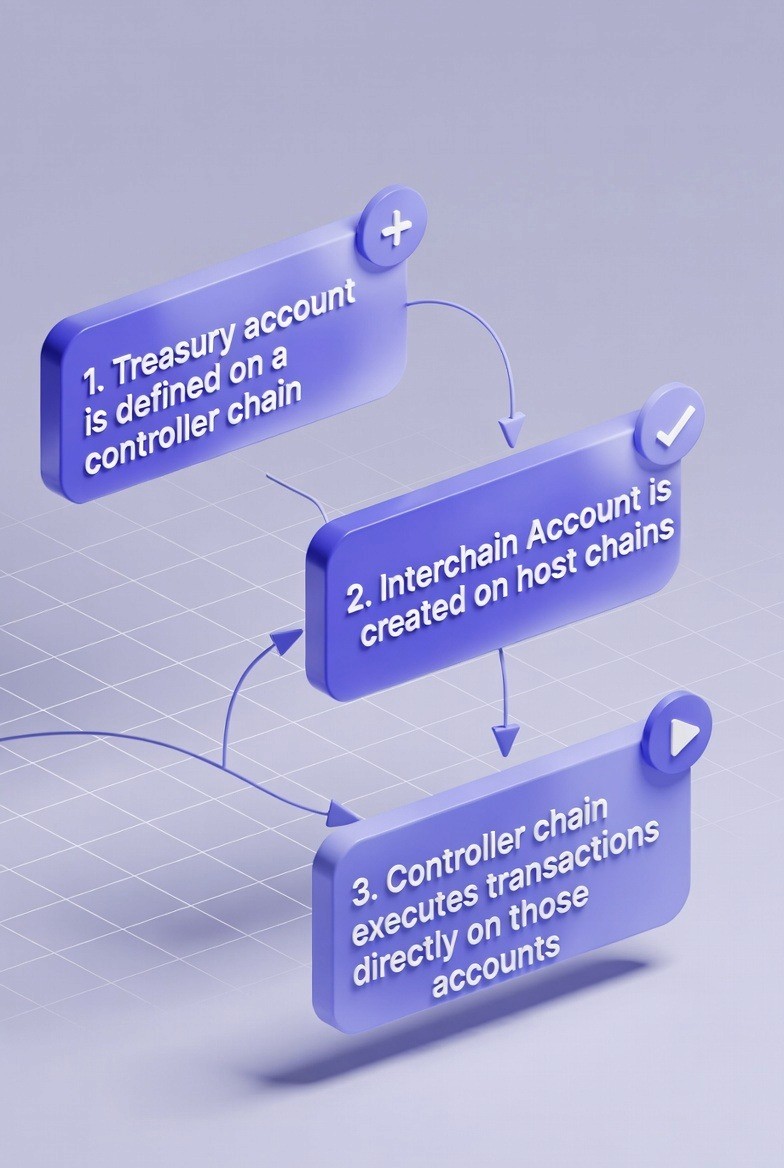

Cosmos Interchain Accounts (ICA) offer a way to manage cross-chain treasuries in blockchain. With ICA, one blockchain can control accounts on other blockchains directly. This is made possible through protocol-level interoperability.

How ICA works is straightforward from an architectural perspective. A controller blockchain sends a message to a host blockchain. That message contains instructions for an account on the host chain. The host chain executes the instruction as if the account holder had submitted it directly. The result is returned to the controller chain. No asset bridges are needed. No external intermediaries are required.

The ICA provides three fundamental functions for Treasury Operations.

First, cross-chain account control gives Treasury Teams full access to accounts on other blockchains. They don’t need to manage separate keys or wallets. Second, Centralized Treasury Logic centralizes all policies, like approval rules and spending limits, into one point of control. Lastly, Native Execution on Destination Chains means instructions use the Destination Chain’s native features. This eliminates the need for an Adaptor or Intermediary Layer.

Cosmos's ecosystem has experienced substantial acceptance and growth. Additionally, Cosmos's IBC has seen a large growth in use with respect to inter-blockchain communication. At the end of 2023, IBC was operational on 107 blockchains with $2.5B in monthly transaction volume. In 2024, the number of chains supported by IBC increased to 114 and monthly volume increased to $3B with 8.8M monthly transactions processed. These are very positive indicators for increased institutional usage and belief in Cosmos' technology.

Table of Cosmos Growth Data

Metric | Late 2023 | 2024 | Growth |

Number of Chains | 107 | 114 | 6.5% |

Monthly Transaction Volume | $2.5 billion | $3 billion | 20% |

Monthly Transactions | 5.3 million | 8.8 million | 66% |

These numbers show real institutional usage of cross-chain infrastructure. These are not theoretical numbers or test transactions used for development. These are actual financial transactions executed across real blockchain networks. The growth in both the number of chains and transaction volume demonstrate that institutions are actively adopting this technology.

Stride Protocol demonstrates ICA's practical application for treasury operations. Stride uses Cosmos Interchain Accounts to enable liquid staking across the Cosmos ecosystem. The protocol acts as a controller chain that executes native transactions on multiple host chains. When users deposit assets, Stride automatically stakes those assets on host chains. It manages reward accumulation from a single control plane. Stride has completed 10 audits from industry leaders in blockchain security. It currently manages $26.86 million in total value locked across multiple Cosmos chains.

The fact that Stride completed ten security audits is important to understand. It means that major security firms have examined the code in detail. It means security professionals have verified that it works correctly. It means that the technology has been tested extensively. It means that institutions can rely on it without excessive worry about unknown security flaws.

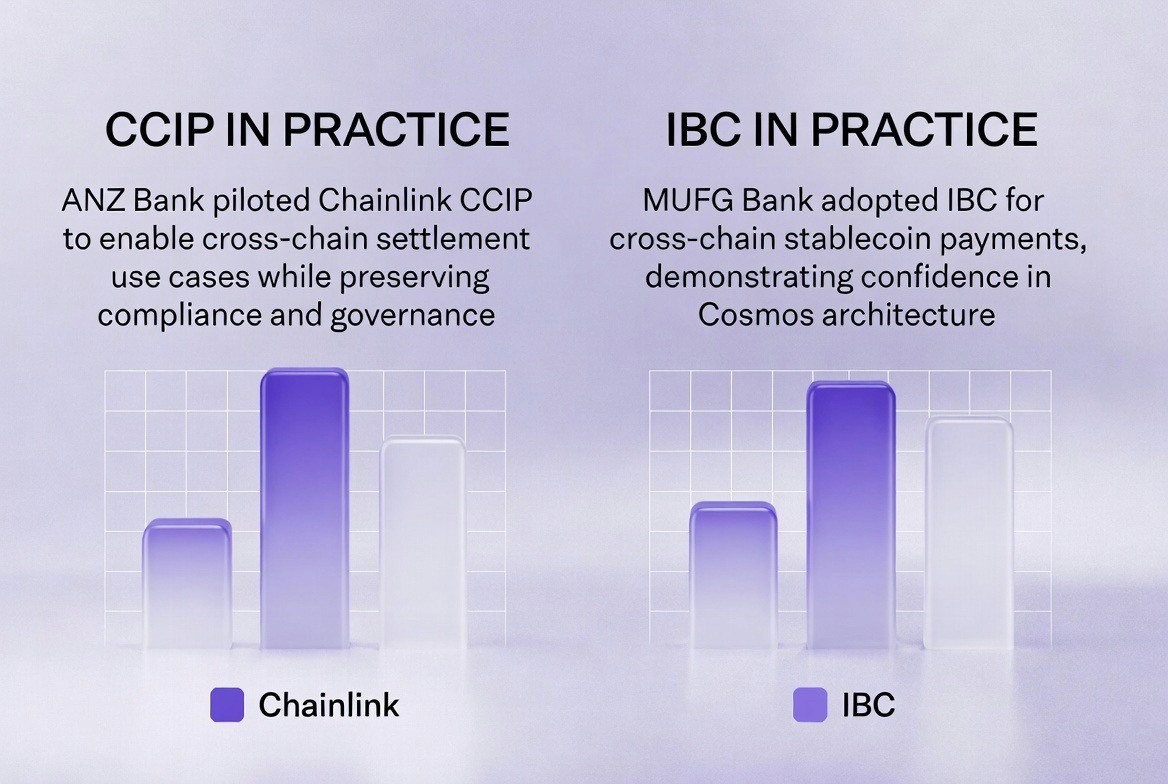

The Cosmos ecosystem's approach has proven effective for institutional adoption. Japan's MUFG Bank, one of the world's largest banks, adopted IBC for cross-chain stablecoin payments. This demonstrates that Cosmos ICA technology meets enterprise requirements for security, compliance, and operational consistency. When a major bank like MUFG Bank adopts a technology, it sends a strong signal of confidence in that technology. Banks are highly regulated and extremely cautious about the systems they adopt. Their decision to use ICA for production treasury operations carries significant weight in the industry.

POLKADOT XCMP: MESSAGE-BASED EXECUTION FOR PARACHAIN ECOSYSTEMS

Polkadot takes a unique approach to cross-chain coordination. Unlike independent chains that connect peer-to-peer, Polkadot uses separate blockchains called parachains. These are all managed by a common security layer known as the Relay Chain. This setup allows Polkadot to offer unique cross-chain coordination options and specific restrictions that set it apart.

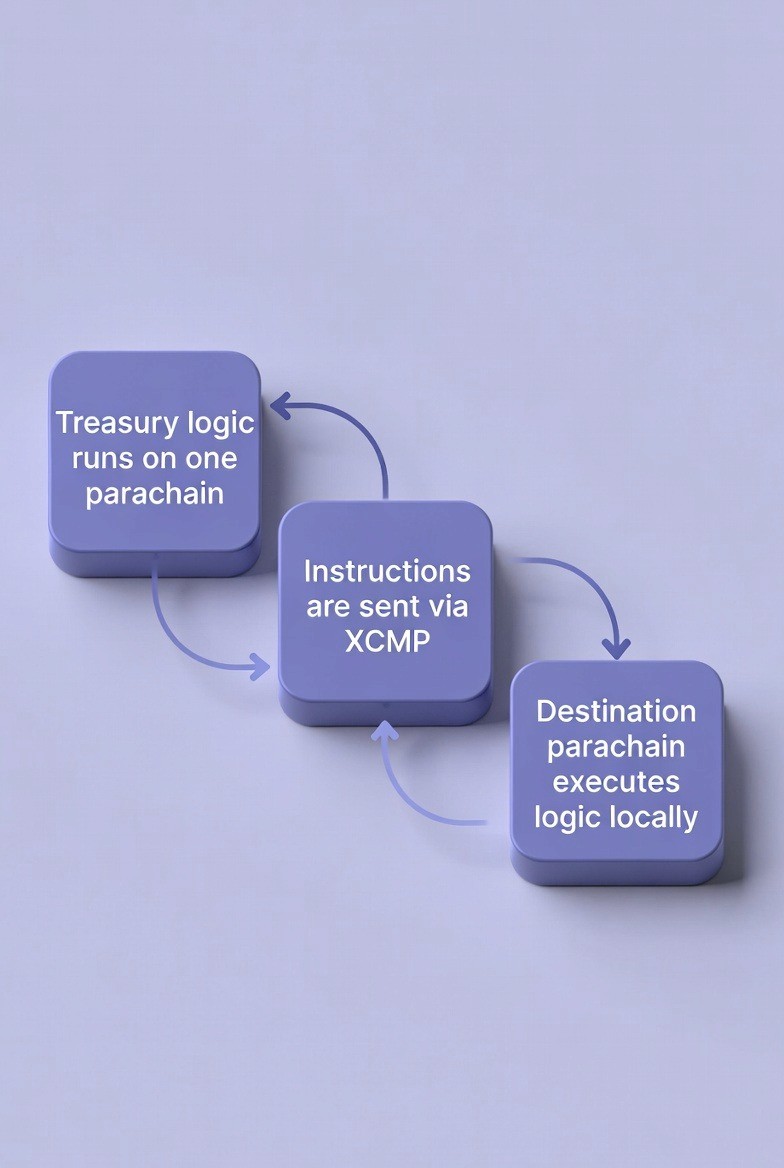

Polkadot's XCM (Cross-Consensus Messaging) format and XCMP (Cross-Chain Message Passing) protocol enable secure message passing between parachains. A parachain can send a message to another parachain. That message can instruct the recipient to take specific actions. The recipient chain then executes those actions.

Unlike Cosmos ICA, Polkadot XCMP does not provide cross-chain account control in the same way. Instead, it provides coordinated execution. A parachain can instruct another parachain to execute a specific action. However, that execution happens according to the recipient's own logic. It is not a direct account operation.

XCMP works best when messages are sent in a clear, controlled way, and when chains share security. For instance, a Treasury Operation on one parachain can instruct another to transfer funds, create records, or call a smart contract function. If the Relay Chain approves the message, signed by the right key, all parachains will process it consistently.

The differences between Cosmos ICA and Polkadot XCMP are small but important. With ICA, the "controller" chain acts as the account holder on the "host" chain. The "host" chain can't limit the actions of the "controller" chain. In contrast, with XCMP, the "controller" chain sends a message to the "recipient" chain. The "recipient" chain then processes the message based on its own rules.

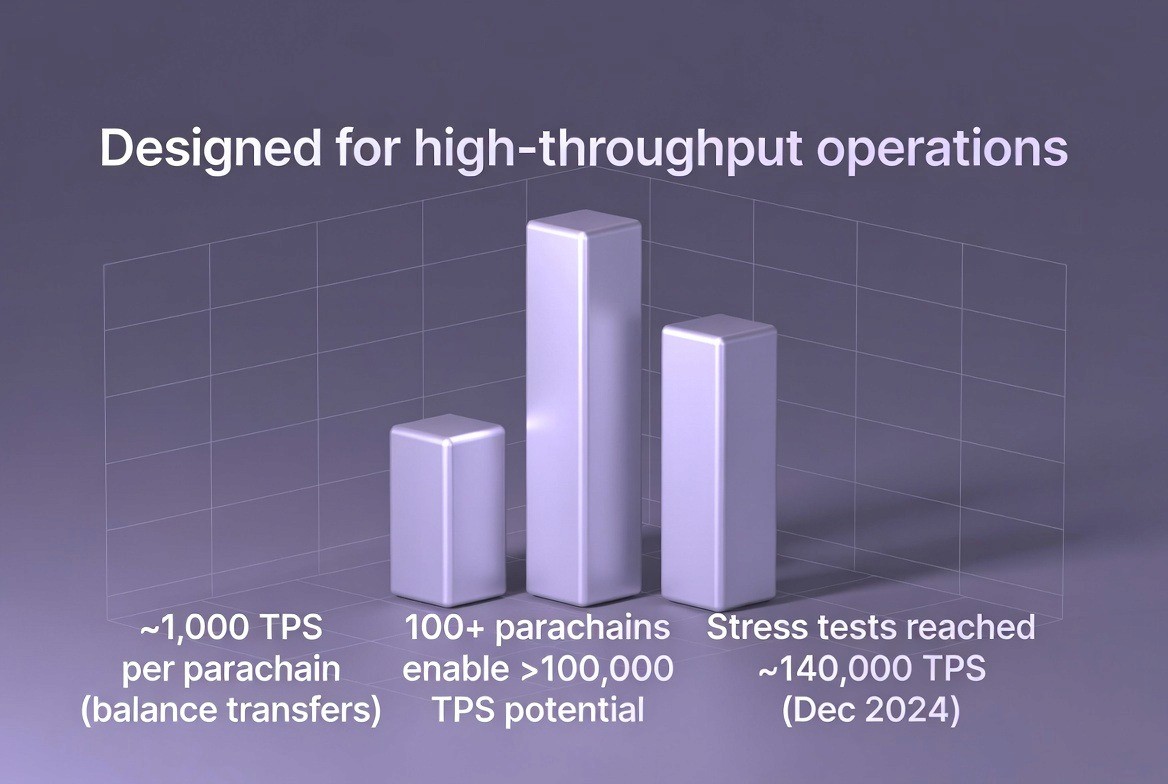

Polkadot's performance is crucial for large treasury operations. Official documents state that blockchains in the Polkadot ecosystem can handle over 1,000 transactions per second for balance transfers. If Polkadot operates more than 100 parachains, its theoretical capacity could exceed 100,000 transactions per second. Stress tests from December 2024 show that Polkadot might reach up to 140,000 transactions per second under ideal conditions.

These numbers matter for institutions that manage high transaction volumes. When an institution must process millions of transactions daily across multiple chains, it needs enough throughput to avoid delays. Polkadot's design and performance indicate it can effectively support large workloads.

Key features of Polkadot XCMP include cross-chain instruction delivery. This is done through deterministic message routing via the Relay Chain. It ensures messages are received and executed in order. Additionally, shared security across parachains prevents any single parachain from compromising system integrity or security.

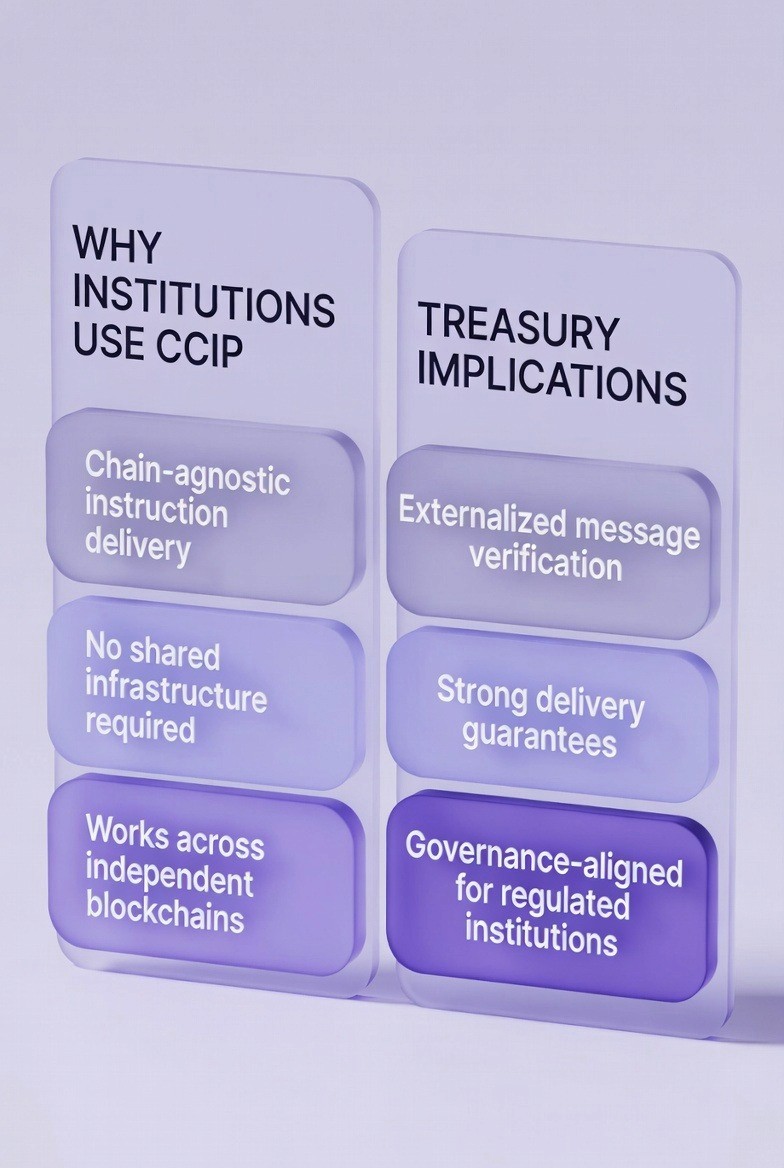

CHAINLINK CCIP: CHAIN-AGNOSTIC INSTRUCTION DELIVERY

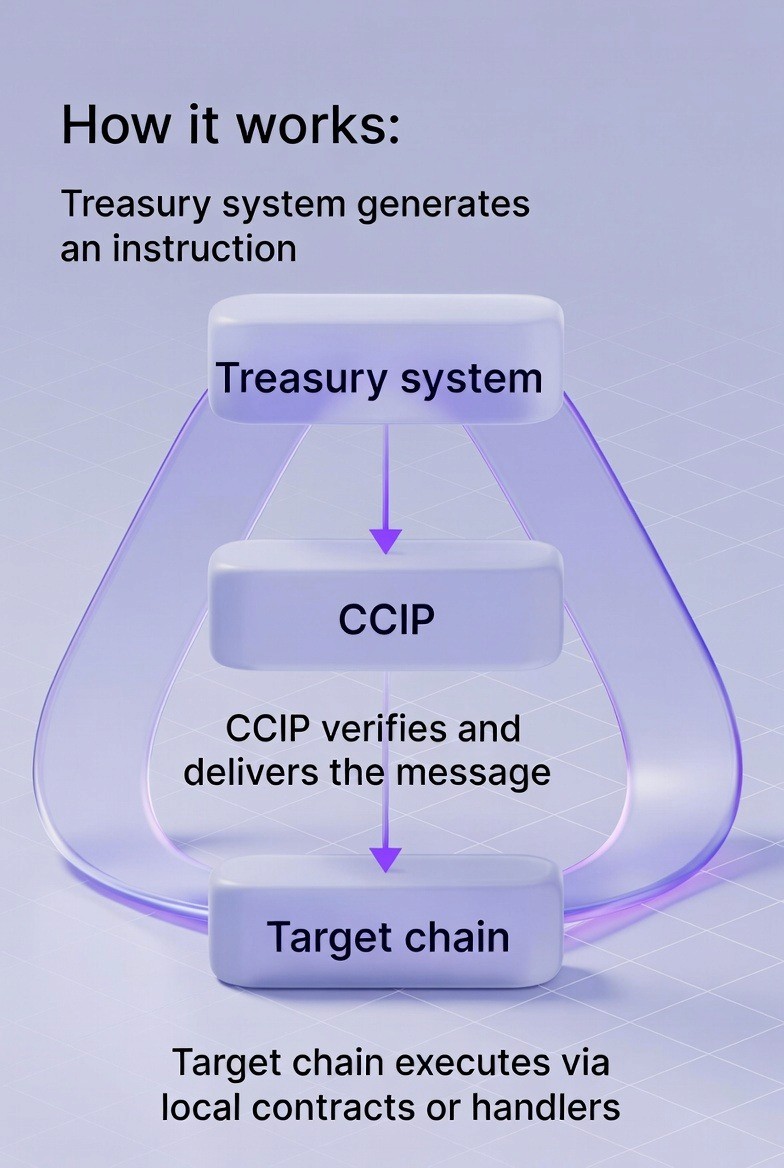

Chainlink's Cross-Chain Interoperability Protocol (CCIP) offers a distinct solution, as detailed in this reference. It does not depend on shared security between blockchains or peer-to-peer methods. Instead, CCIP utilizes external verification and routing. This makes it well-suited for institutions that operate across various blockchains without a shared infrastructure.

CCIP entered general availability in April 2024 and has since become widely adopted across diverse blockchain ecosystems. The protocol is now available on Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Kroma, Optimism, Polygon, and WEMIX. Additional chains are being added continuously to the network.

CCIP works through a specific process. A smart contract on one blockchain initiates a message. That message is picked up by Chainlink's oracle network. The oracle network verifies the message and routes it to the destination blockchain. A smart contract on the destination chain executes the message according to its specific logic.

The advantage of this approach is flexibility and openness. Institutions can use CCIP to coordinate treasury operations across Ethereum, Solana, Polygon, Avalanche, and other independent blockchains. They do not need those blockchains to share any common infrastructure. The disadvantage is additional trust assumptions. The oracle network must be trustworthy. The routing must be reliable. Verification must be robust and secure.

For treasury operations, CCIP delivers chain-agnostic instruction capabilities. Institutions can send instructions to any blockchain that has a CCIP receiver contract. Chainlink's oracle network provides external verification and routing, ensuring reliable message delivery. Its strong risk management controls make Chainlink a good fit for regulated institutions needing strict governance.

Chainlink has already processed over $19 trillion in transaction value across the blockchain economy through its oracle and CCIP services. This shows that Chainlink's infrastructure is reliable and tested at a massive scale. When an institution uses CCIP, it leverages a system that has handled trillions in actual transactions.

The ANZ Bank case study demonstrates real-world implementation and success. ANZ, one of Australia's largest banks, piloted CCIP to settle tokenized assets and stablecoins across chains. It maintained compliance and governance controls throughout. This represented a major financial institution successfully executing treasury operations across multiple blockchains. Bank employees did not need to manage wallets or on-chain execution logic directly.

TABLE OF COMPARATIVE ANALYSIS: SELECTING THE RIGHT TECHNOLOGY

The choice between Cosmos ICA, Polkadot XCMP, and Chainlink CCIP depends on the institution's blockchain infrastructure and operational requirements. Each approach has distinct advantages and different limitations.

Dimension | Cosmos ICA | Polkadot XCMP | Chainlink CCIP |

Ecosystem Lock-in | High (Cosmos-specific) | High (Polkadot parachain) | Low (chain-agnostic) |

Typical Latency | Seconds to minutes | Seconds to minutes | Minutes (oracle verification) |

Transaction Throughput | 10,000 TPS per chain | 100,000+ TPS (theoretical) | Limited by oracle capacity |

Cost Structure | Low native fees | Medium (Relay Chain overhead) | Higher (oracle fees + chain fees) |

Security Model | Protocol-level IBC | Shared Relay Chain security | Oracle network + destination chain |

Institutional Adoption | Established (MUFG, Stride) | Emerging | Advanced (ANZ, institutional banks) |

Native Execution | Yes (full account control) | Partial (coordinated execution) | Via smart contracts |

Cosmos Interchain Accounts are optimal when the institution operates primarily within the Cosmos ecosystem. They are also good when the institution plans to integrate deeply with Cosmos-based infrastructure. The tight integration at the protocol level provides superior performance and security. The limitation is ecosystem lock-in. ICA is not easily adapted for non-Cosmos blockchains. Transaction costs on Cosmos are approximately 500 times lower than equivalent Chainlink operations on Ethereum. This makes ICA particularly cost-effective for high-volume treasury operations.

When an institution executes thousands of transactions per day, costs multiply rapidly over time. A $1 fee per transaction on Ethereum becomes $1,000 per day for 1,000 transactions. The same transaction on Cosmos might cost $0.002, which is $2 for 1,000 transactions. Over a year, this difference becomes enormous. An institution might save millions of dollars annually by using Cosmos instead of Ethereum for high-volume treasury operations.

Polkadot XCMP serves institutions building infrastructure as parachains within Polkadot. It also serves institutions operating primarily across Polkadot parachains. The shared security model and deterministic routing provide excellent guarantees for treasury operations that must remain consistent across multiple chains. The limitation is that Polkadot's parachain ecosystem is still smaller than other blockchain ecosystems. This may not fit all institutional requirements and preferences.

Chainlink CCIP is best for institutions operating across diverse, heterogeneous blockchains that do not share infrastructure. If an institution needs to manage treasury operations on Ethereum, Polygon, Arbitrum, and Optimism simultaneously, CCIP is the most practical choice. The trade-off is reliance on external oracle infrastructure. The institution must accept additional trust assumptions about the oracle network.

In many cases, institutions use multiple technologies simultaneously. A treasury operation might use Cosmos ICA for the core blockchain infrastructure. It might use Polkadot XCMP for parachain-specific operations. It might use Chainlink CCIP for connections to non-Cosmos, non-Polkadot blockchains. The key is that each approach addresses the same fundamental problem: executing treasury actions consistently across multiple blockchains from a single control plane.

INSTITUTIONAL ADOPTION ACROSS MULTIPLE SECTORS

The market for institutional cross-chain treasury solutions is expanding very rapidly. Corporate cryptocurrency treasury adoption accelerated dramatically throughout 2024 and 2025. MicroStrategy became the most prominent and visible example. The company acquired 257,000 Bitcoin in 2024 alone. It established a treasury strategy worth more than $2 billion. Other corporations followed with substantial commitments.

Company | Asset/Allocation | Amount | Year |

MicroStrategy | Bitcoin | $2+ billion | 2024 |

Windtree Therapeutics | Digital assets | $520 million | 2024-2025 |

Sharps Technology | Solana acquisition | $400 million | 2024-2025 |

These are not small experimental transactions or test programs. These are major corporations committing billions of dollars to blockchain-based treasury operations. When a company with shareholders and fiduciary responsibilities allocates $2 billion to a treasury strategy, they are sending a signal that this is serious business. They have conducted thorough due diligence. They have analyzed the risks carefully. They have decided this is a good use of corporate capital.

This institutional adoption has created substantial infrastructure investments and growth. Chainlink CCIP experienced significant growth between Q4 2023 and Q1 2024. The protocol experienced a 900 percent increase in the number of cross-chain transactions. It experienced a 4,000 percent increase in transfer volume during the same period. World Chain recently integrated Chainlink CCIP. This enables development of secure cross-chain applications connecting World Chain to 20 additional blockchains.

The growth of transaction volumes demonstrates real institutional demand. This is real demand from real institutions executing real transactions. The 900 percent growth in transaction numbers and 4,000 percent growth in transaction volume show that institutions are moving beyond pilots and experiments into production usage.

Banking sector adoption shows strong institutional confidence. ANZ Bank's successful pilot of CCIP for cross-chain settlement proved that major financial institutions can manage treasury operations across multiple blockchains. They can do this while ensuring compliance and governance controls. Similarly, MUFG Bank’s use of IBC for cross-chain stablecoin payments reflects confidence in Cosmos-based solutions.

When banks adopt new technology, they proceed with caution. They face strict penalties for any system that fails or breaches compliance. Therefore, they conduct thorough testing and due diligence. The fact that several major banks are using cross-chain treasury solutions indicates a high level of trust in these technologies.

The regulatory environment has shifted to support this adoption and growth. The SEC approved Bitcoin and Ethereum spot exchange-traded products in 2024. This reduced regulatory friction and legitimized institutional digital asset participation. By September 2025, the SEC had streamlined crypto ETF approval processes to a 75-day timeline. This is down from the previous 270-day standard. This enables faster institutional product launches.

Regulatory approval is critical for institutional adoption. Institutions cannot invest significant capital in infrastructure that regulators view negatively or suspiciously. They need regulatory clarity and formal approval. The SEC's approval of Bitcoin and Ethereum ETFs, and the streamlined approval timeline for crypto products, demonstrate that regulators are accepting blockchain-based financial infrastructure. This removes a major barrier to institutional adoption.

PERFORMANCE METRICS: COMPARING OPERATIONAL CHARACTERISTICS

When implementing cross-chain treasury systems, several performance dimensions significantly impact operational effectiveness and success. These metrics are important to understand before selection.

Latency and Transaction Speed

Latency measures the time required for an instruction to be sent, routed, executed, and confirmed on all destination chains. Cosmos ICA typically has latency measured in seconds to minutes. This is because blocks finalize relatively quickly in the Cosmos ecosystem. Polkadot XCMP has similar latency characteristics. Block finalization occurs within minutes. Chainlink CCIP may have slightly higher latency due to oracle verification requirements. However, it remains acceptable for most treasury operations that do not require immediate sub-second execution.

For most treasury operations, latency of several minutes is acceptable and normal. Treasury teams do not execute transactions in real time. They typically plan transactions hours or days in advance. A transaction that takes five minutes to execute across multiple chains is faster than the hours it might take to coordinate manually.

Throughput Capacity

Throughput measures the number of transactions the system can process per second. Cosmos chains can handle approximately 10,000 transactions per second. Polkadot's theoretical throughput exceeds 100,000 transactions per second when running more than 100 parachains. Stress tests suggest potential performance of 140,000 TPS. Chainlink CCIP throughput depends on oracle network capacity and destination chain congestion. This varies by implementation and deployment.

A major financial institution can execute 100,000 transactions daily in treasury operations. That’s about one transaction every second. Even if it spikes to 10 transactions per second at peak times, the discussed technologies can manage this volume easily. For most institutional treasury operations, throughput is not a limiting factor.

Cost Structure Analysis

Cost is measured in transaction fees and infrastructure requirements. Cosmos ICA costs are typically very low. ICA messages are small and processed efficiently. Polkadot XCMP costs depend on parachain configuration and Relay Chain capacity. Chainlink CCIP involves oracle fees on top of destination chain fees. This increases total transaction cost compared to native protocol solutions.

Cost differences become significant over time and with scale. An institution executing one million transactions per year might pay different amounts depending on which system they use. A $1 fee per transaction costs $1 million per year. A $0.01 fee per transaction costs $10,000 per year. Over multiple years, this difference accumulates significantly. An institution that chooses the wrong system based on cost could waste millions of dollars annually.

Cost Factor | ICA on Cosmos | Polkadot XCMP | Chainlink CCIP on Ethereum |

Per-Transaction Cost | 1x (baseline) | 3-5x | 500x |

Fixed Infrastructure Cost | Low | Medium | Medium-High |

Scalability Cost Efficiency | High | Medium | Lower at scale |

1 Million Annual Transactions | ~$2,000 | ~$6,000-10,000 | ~$500,000-1,000,000 |

Security Characteristics

Security characteristics differ significantly between systems. Cosmos ICA security is derived from the IBC protocol and the security of participating chains. Polkadot XCMP security is underwritten by the Relay Chain. This provides uniform security across all parachains. Chainlink CCIP security depends on the oracle network's design and the security of destination smart contracts.

Each security model has different strengths and weaknesses. Cosmos ICA security depends on multiple independent chains being secure. This creates some diversity in security sources. If one chain is compromised, others may still be secure. Polkadot XCMP security is centralized in the Relay Chain. The Relay Chain must be extremely secure. However, there is a single system responsible for security. Chainlink CCIP security depends on Chainlink's oracle network being secure and honest. It also depends on destination chains being secure.

CROSS-CHAIN TREASURY IMPLEMENTATION GUIDE FOR INSTITUTIONS

The transition to cross-chain treasury operations requires both technical and organizational work. A realistic implementation roadmap follows several distinct phases.

1. Assessment Phase

In the assessment phase, institutions audit their current cross-chain treasury operations. They identify pain points caused by fragmentation. They model what a unified control plane would enable and accomplish. This phase typically takes four to eight weeks. It should involve treasury teams, compliance, risk management, and technology leadership. The assessment should document current transaction volumes, operational costs, compliance challenges, and risk exposures across all blockchains where the institution operates.

During assessment, the institution should ask important questions.

How many transactions does the organization execute per day?

How much time does the team spend on manual coordination?

What errors have occurred in the past with current systems?

What happens if a blockchain is compromised?

What compliance challenges exist?

How much does the current system cost annually?

What would an ideal system look like for the institution?

2. Design Phase

In the design phase, the institution selects an appropriate technology based on its blockchain ecosystem. It defines the control plane's governance structure carefully. It creates detailed specifications for execution on each destination blockchain. This phase typically takes eight to twelve weeks. It requires deep technical expertise in both traditional treasury systems and blockchain infrastructure. The design process should result in comprehensive documentation of the technical architecture, governance procedures, and risk controls.

The design document should specify exactly how the control plane works.

It should specify what approvals are required.

It should specify what limits are enforced.

It should specify how errors are handled.

It should specify what happens if a blockchain is unavailable.

It should specify how the system is monitored.

This documentation becomes the blueprint for implementation.

3. Development Phase

In the development phase, the institution implements the control plane on the selected blockchain infrastructure. It develops adapters for each destination blockchain. It creates testing infrastructure to validate behavior across different scenarios. This phase typically takes twelve to twenty weeks. It should follow established software development practices with thorough testing at each stage. Security audits should be conducted by external firms specializing in blockchain infrastructure.

Testing is critical during development. The system should be tested with normal transactions, error conditions, extreme transaction volumes, and failure scenarios. What happens if one blockchain becomes unavailable? Can the system continue operating on other blockchains? What happens if a transaction fails on one chain but succeeds on another? All of these scenarios should be tested before production deployment.

4. Pilot Phase

In the pilot phase, the institution deploys the system to a limited set of blockchains with controlled transaction volumes. It allows treasury teams to operate it in parallel with existing systems. It monitors both technical and operational performance carefully. The pilot typically runs for four to eight weeks. It serves as the foundation for team training and system refinement before full production deployment.

During pilot, the institution should intentionally find problems and fix them. The pilot is the time to discover that something was forgotten or implemented incorrectly. It is better to discover these problems with controlled volumes than in production when billions of dollars are at stake. Treasury teams should be trained thoroughly during the pilot. They need to understand how to use the new system.

5. Production Phase

In the production phase, the institution transitions treasury operations to the new system. It decommissions legacy systems and bridges. It scales to additional blockchains as needed. This phase typically runs continuously as the institution's multi-chain presence expands and grows.

The transition to production should happen gradually and carefully. During the first week, 10 percent of transactions run through the new system. During the second week, 25 percent. During the third week, 50 percent. This gradual approach allows the team to monitor for any issues. It maintains the ability to roll back if necessary. Once the institution is confident the system is working, 100 percent of transactions can move to the new system.

THE OUTLOOK: CROSS-CHAIN TREASURY AS FOUNDATIONAL INFRASTRUCTURE

As financial institutions expand into multi-chain environments, effective treasury control will be crucial. Those that implement unified cross-chain treasury systems will gain a strong edge over competitors still using fragmented, manual processes.

The technology for cross-chain treasury is already available and has proven itself in real-world use. Cosmos Interchain Accounts, Polkadot XCMP, and Chainlink CCIP all offer paths to unified control. The market shows strong demand, with rising transaction volumes and easier regulatory approvals. Major banks are already testing these systems.

Success or failure often hinges on how an organization approaches the project. If a firm sees it as just installing new software, it may struggle. In contrast, organizations that view it as a chance to redesign treasury operations are more likely to succeed. The best results come when firms use new technology to rethink their entire treasury management strategy.

The global treasury management market is growing at 13.8 percent each year. It is expected to reach $16.31 billion by 2032. A large part of this growth will benefit institutions that embrace modern cross-chain treasury architectures. Those that act quickly and wisely will gain operational and strategic advantages that competitors will find hard to match.

This market growth means competition will intensify significantly. Institutions that adopt cross-chain treasury systems first will have lower costs. They will have fewer errors. They will have better compliance. They will have better risk management. They will be able to move faster than competitors. They will be able to offer new products and services faster. Over time, these advantages compound significantly. The institutions that move first gain competitive advantages that last for years.

FAQ

1. Why do traditional treasury systems fail in multi-blockchain environments?

Traditional treasury models assume a single system of record, but multi-chain operations fragment assets, approvals, and visibility. This breaks unified governance, increases manual work, and makes real-time risk and compliance oversight extremely difficult.

2. What is cross-chain treasury control and why is it different from asset bridging?

Cross-chain treasury control separates decision-making from execution, allowing institutions to approve actions once in a central control plane while assets remain on their native blockchains. Unlike bridges, it moves instructions—not assets—eliminating major security and operational risks.

3. How does a unified control plane reduce operational and regulatory risk?

A single control plane enforces policies, approvals, and limits consistently across all blockchains, creating one auditable source of truth. This simplifies compliance, improves accountability, and gives regulators and auditors clear visibility into every treasury action.

4. Why are manual processes and traditional bridges unsustainable at scale?

Manual approvals do not scale beyond a few chains and introduce human error, while bridges add systemic security risk and operational bottlenecks. As transaction volume and chain count grow, these weaknesses become structural failures rather than isolated issues.

5. How should institutions choose between Cosmos ICA, Polkadot XCMP, and Chainlink CCIP?

The choice depends on ecosystem exposure and governance needs: Cosmos ICA offers native account-level control within Cosmos, Polkadot XCMP enables coordinated execution within parachains, and Chainlink CCIP provides chain-agnostic instruction delivery across heterogeneous networks. Many institutions adopt a hybrid approach.

HOW TOKENMINDS SUPPORTS CROSS-CHAIN TREASURY IMPLEMENTATION

TokenMinds helps institutions design and implement cross-chain treasury architectures using many frameworks, such as Cosmos Interchain Accounts. We align technical execution with governance, risk management, and audit requirements from day one.

Our approach prioritizes control-plane integrity, deterministic execution, and clear auditability across all connected blockchains. As a result, treasury teams gain scalable multi-chain exposure without increasing operational or regulatory risk. This enables institutions to move from fragmented pilots to production-grade multi-chain treasury operations with confidence.

CONCLUSION

Cross-chain treasury is a key part of future blockchain operations for institutions. Right now, institutions can gain a competitive edge by using these systems. Moving from fragmented, manual processes to smooth, automated cross-chain treasury control is essential for those managing large blockchain assets. It’s a must, not just an option. The institutions that adopt these systems will set the standards and best practices for blockchain operations.

Schedule a complimentary consultation with TokenMinds. We can help you design and implement cross-chain treasury architectures across multiple blockchains. This enables centralized control, reliable execution, and clear asset management while fitting with your current financial systems, governance, and risk frameworks.