TL;DR

This guide will help you to lower operating costs in financial systems by automating payments, settlement, and reconciliation with smart contracts, and by making those contracts economically viable at scale through performance upgrades such as EIP-5656 (MCOPY), Layer-2 execution, and optimized runtimes that reduce execution overhead and improve efficiency.

WHAT ARE SMART CONTRACTS IN FINANCE

Smart contracts are digital agreements that execute according to code on a blockchain or similar runtime, as outlined in this development guide. In financial systems, they have moved beyond experiments and pilot projects. They are now part of core operational infrastructure.

Smart contracts already support:

Automated payments.

Settlement logic for different assets and transactions.

Collateral management and related controls.

Compliance workflows and rule enforcement.

In many financial institutions, smart contracts run key workflows instead of sitting at the edge of the system. They help manage recurring processes that previously depended on manual tasks, separate systems, and repeated reconciliations.

The main value for institutions is not only programmability. The key value is the ability to:

Replace costly, manual operations with deterministic execution.

Run processes that scale in a predictable way.

Reduce variability in how rules are applied.

Smart Contracts are designed to run in Deterministic mode, so, if you call the Smart Contract with the same input values at different times, the output will always be the same, as discussed in this reference. The determinism of Smart Contracts, makes them ideal for all types of Core Financial Operations including; the enforcement of Payment & Settlement Rules, Collateral Calls and Release Conditions, and Compliance Checks using well-defined standards.

Determinate operation enables financial institutions to automate key components of their financial operations into Code, which allows them to execute payments and settlements automatically, step-by-step, to manage collateral and risk within the financial process logic, and to create consistent and repeatable financial workflow processes, reducing the dependency upon manual processing, decreasing the overall cost of operating and increasing efficiency throughout the entire financial ecosystem.

WHY SMART CONTRACT DESIGN DETERMINES COST

Smart contracts lower operational costs when they automate execution in an efficient way. Cost reduction does not come only from lower transaction fees. It comes from how the contracts are designed, how they use memory and compute, and how they fit into the overall architecture, as explained in this enterprise overview.

When smart contracts are designed with optimized execution and memory use, they:

Process transactions faster.

Use fewer computing resources.

Reduce overhead on nodes and supporting systems.

This efficiency turns automation into a real financial advantage. It affects several key areas:

1. Payment Settlement

Faster settlement will allow the Operations Team to spend less time on follow-up work for each exception that occurs. As well as providing a reliable and predictable process for settling payments, this will also minimize the need for manual intervention, disputes and the need to check on the status of payments – all of which will lead to lower costs of processing payments and increased reliability of the payment system.

2. Treasury Operations

The more efficient execution of daily treasury operations will make continuous or frequent rebalancing and liquidity movements more practical at a much lower cost. Rather than waiting for an occasional large adjustment to be made, treasury teams can continually adjust their cash positions to improve capital utilization and reduce the operational burden of managing many bank accounts and funding flows.

3. Compliance

The rule-based execution ensures that defined rules are consistently enforced across all transactions. Instead of compliance staff reviewing every transaction multiple times, defined rules enforce the automatic application of policy, therefore lowering the compliance cost and increasing the confidence that regulatory requirements and company-wide standards are adhered to with each transaction.

4. Reconciliation

As systems move toward near real-time automation and determinism, they will have the capability to reconcile on a continuous basis as opposed to relying almost exclusively on end of day batch cycles. Near real-time reconciliation results in shorter detection times for mismatches, reduces back office labor requirements, and provides better visibility into the current state of your financial position during the business day.

In this context, real cost savings come from combining automation with efficient execution, not just from reducing transaction fees. Fees are only the most visible part of the overall expense, while a large share of operating cost is driven by how smart contracts are designed, including their structure and low-level execution behavior. Well-optimized contract design turns automation into a true cost advantage rather than just a technical improvement.

HOW SMART CONTRACTS LOWER OPERATING COSTS IN FINANCIAL SYSTEMS

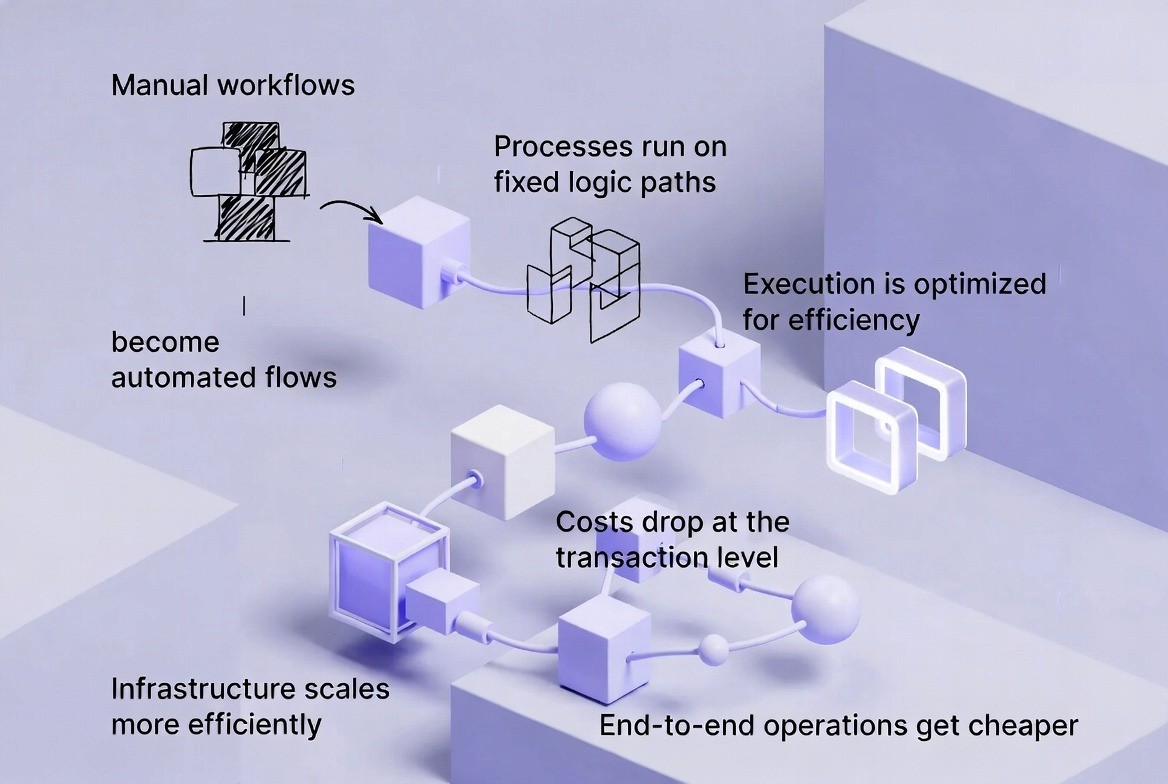

Smart contracts reduce operating cost by changing how financial workflows are executed at several levels. The effect can be seen in five main changes:

1. MANUAL STEPS ARE REPLACED BY DETERMINISTIC CONTRACT EXECUTION

What changes technically

Financial work flows (in the past) have involved many steps performed manually; including:

- Approvals from various groups/roles.

- System reconciliations.

- Transfers between departments/team members.

- Ticketing & updates.

- Manual verification via email confirmations.

State Machines in Smart Contracts

Prior to smart contracts, financial transactions were typically tracked across a number of systems, spreadsheets, and human approvals. It was quite easy for these transactional states to become "out of sync." In contrast, a state machine is a highly structured method for tracking each transaction's place in the life cycle of a transaction, at any point in time.

Each transaction will go through a series of predefined stages, such as Initiated, Pending Approval, Executed, Settled, Failed. The contract will know which stage is currently active and based upon the current state, define which actions can take place next. This structure provides discipline to how financial work flows are processed. For example: Payments can't settle prior to an approval being granted, Collateral can't be released prior to all obligations having been fulfilled, and Reconciliation can't occur until a final confirmation has occurred. The end result is a fully automated financial workflow system; one where the order of processing is determined by code rather than by manual coordination.

For institutions, this means fewer operational errors, fewer handoffs between teams, and a much clearer audit trail. Every state change is recorded and verifiable, which improves transparency for risk teams, compliance officers, and auditors.

Rule-Based Execution Paths

In addition to defining the location of a transaction (State Machine), Rule Based Execution defines how a transaction progresses. In Smart Contracts, all transitions from one State to another are determined by explicit rules which are coded into the Smart Contract. These Rules will evaluate various conditions including but not limited to; Payment Amounts, Time Windows, Approvals, Collateral Ratios, or Regulatory Flags prior to allowing the next step to occur.

A Settlement Step for example can only occur after the required conditions have been met including; Confirmation of Funds, Counterparty Conditions Met, Compliance Checks Passed. If at least one condition is not met, the Contract does not require Human Intervention to block the Transition or route the Process into an Exception State. The use of Deterministic Logic replaces Subjective Decision Making with the same result occurring every time.

In financial operations, this has a major impact. Compliance controls are applied consistently, risk limits are enforced automatically, and exception handling becomes structured instead of ad hoc. In turn, this reduces manual review; lowers operational costs; and converts what may have been complex workflows into predictable and repeatable execution paths that scale with transaction volume as opposed to headcount..

In this setup:

Instead of handling actions through tickets or email, the workflow advances through on-chain or rule-enforced transactions.

Each transition is triggered according to the rules embedded in the contract logic.

The same rules apply in the same way every time.

Cost impact

This change reduces cost in a direct way:

Fewer people (and fewer "touchpoints") are involved, as many of the actions are automated.

There will be much less need for exception handling; the decision logic has already been built into the contract.

The staffing and coordination overhead will decrease, as staff members spend significantly less time on pushing processes through or fixing out-of-sync process steps.

Smart contracts act as a shared, always-on process engine, which simplifies coordination and lowers daily operating expenses.

2. EXECUTION PATHS ARE OPTIMIZED TO REDUCE COMPUTE AND MEMORY USAGE

Even though an automated workflow will always use some amount of resources to execute, automation alone doesn't guarantee low costs for execution; it's only through optimization that you can minimize those costs.

Smart contracts can be made efficient in a few ways:

1. Reduce or eliminate dynamic execution (branching) as much as possible and create more static execution graphs.

2. Use shallower call stacks to improve performance and reduce execution delays.

3. Remove all nonessential fallback logic and condition checks from your contract.

4. Optimize how your smart contract uses memory by:

Using fewer MLOAD and MSTORE operations in loops.

Shortening calldata decoding loops.

Using efficient opcodes such as MCOPY (from EIP‑5656) to perform memory copying in a single operation instead of many.

These choices reduce the number of instructions required per transaction and make execution more predictable.

Cost impact

The obvious benefits of executing an application using optimized execution costs are:

The smaller number of instructions executed results in less execution gas used by the platform on which it runs (for example Ethereum).

A smaller increase in the memory footprint of the smart contract reduces the additional gas paid for increasing the size of the smart contract’s memory footprint while the contract executes.

Using less CPU time for each transaction reduces the load placed upon every node processing the smart contract.

When financial institutions run high-volume systems, these savings compound across thousands or millions of operations.

3. PER-TRANSACTION COST DROPS THROUGH LOWER GAS AND FASTER PROCESSING

A large number of smart contract systems charge gas with every operation; therefore, a high amount of gas consumed per transaction increases both cost and unpredictability.

In addition to high costs and unpredictability, inefficient smart contracts can consume gas by performing numerous SLOADs (reads from persistent storage) and making numerous external CALLs (calls to other contracts).

Contract designers can optimize their contracts to minimize these gas-consuming activities as follows:

1. SLOAD (storage reads): Smart contracts often consume a significant amount of gas when reading from persistent storage due to the cost associated with these operations.

2. SSTORE (storage writes): Smart contracts also consume an enormous amount of gas when writing to persistent storage; in fact, they are even more costly than storage reads and result in permanent changes to the contract's state.

3. CALL and DELEGATECALL (external calls): Calling another contract (calling an external function) consumes additional gas and can also increase the complexity of a contract.

While minimizing gas consumption is important, it is equally as important for contract designers to create deterministic execution paths within their contracts so that gas consumption can be predicted at all times and thus:

Tighter gas bounds per transaction type may be established.

More consistent fee models may be developed to account for differing types of transactions.

Cost impact

As a result of these design elements there are:

- A lower gas price per transaction as an average.

- The occurrence of fewer "fee spikes" when the network gets congested; with each transaction being more efficient, there will be less congestion (and thus better throughput).

- Better budget planning predictability for Treasury, Payments, and Product Teams that rely on consistent operating costs.

The per-transaction cost savings for institutions that manage high transaction volume can contribute significantly to their overall yearly operating budgets.

4. HIGHER THROUGHPUT SPREADS INFRASTRUCTURE COST ACROSS MORE ACTIVITY

Institutions often operate fixed infrastructure that includes blockchain nodes or validator connections, application servers and databases, monitoring and alerting systems, and security and compliance tools, all of which create baseline operating costs that exist regardless of transaction volume and make efficiency in system design critical for controlling long-term expenses.

These elements create baseline operating costs whether volume is high or low. Smart contract and system-level optimization allow more activity to run on the same base.

At the system level, optimized transactions consume:

Fewer gas units, so more transactions can fit into each block or batch.

Fewer CPU cycles and less memory, so infrastructure can support more concurrent activity.

Additional execution models, such as Layer‑2 batching and parallel execution, increase this effect by:

Packing more financial actions into each block or Layer‑2 batch.

Reducing the amortized cost per operation because many actions share the same underlying resources.

Cost impact

The overall impact is:

The same infrastructure supports more transaction volume.

Fixed costs (such as node operation, infrastructure teams, and monitoring) are spread across a larger set of workflows.

Cost per workflow and per transaction falls as scale increases.

5. TOTAL OPERATING COST PER FINANCIAL WORKFLOW DECREASES

When institutions combine deterministic execution, optimized code, and efficient system-level design, the full financial workflow becomes less expensive.

Key changes include:

Payments: There are fewer settlement exceptions and faster closure of payment cycles. Rules for matching, netting, and settlement can run in contracts.

Treasury: Rebalancing and liquidity movements become cheaper and can occur more often because each adjustment costs less to execute.

Compliance: More controls are automated in smart contracts and workflows, so fewer manual reviews are necessary. Rules are applied in a consistent way.

Reconciliation: Data across systems is updated closer to real time instead of only through end-of-day or end-of-period batches.

Cost impact

Taken together, these changes produce:

Lower direct fees related to executing payments, settlements, and other financial transactions.

Lower indirect operating expenses from reduced manual work and fewer error-correction cycles.

Lower risk-driven overhead, since problems can be detected earlier and handled with fewer delays.

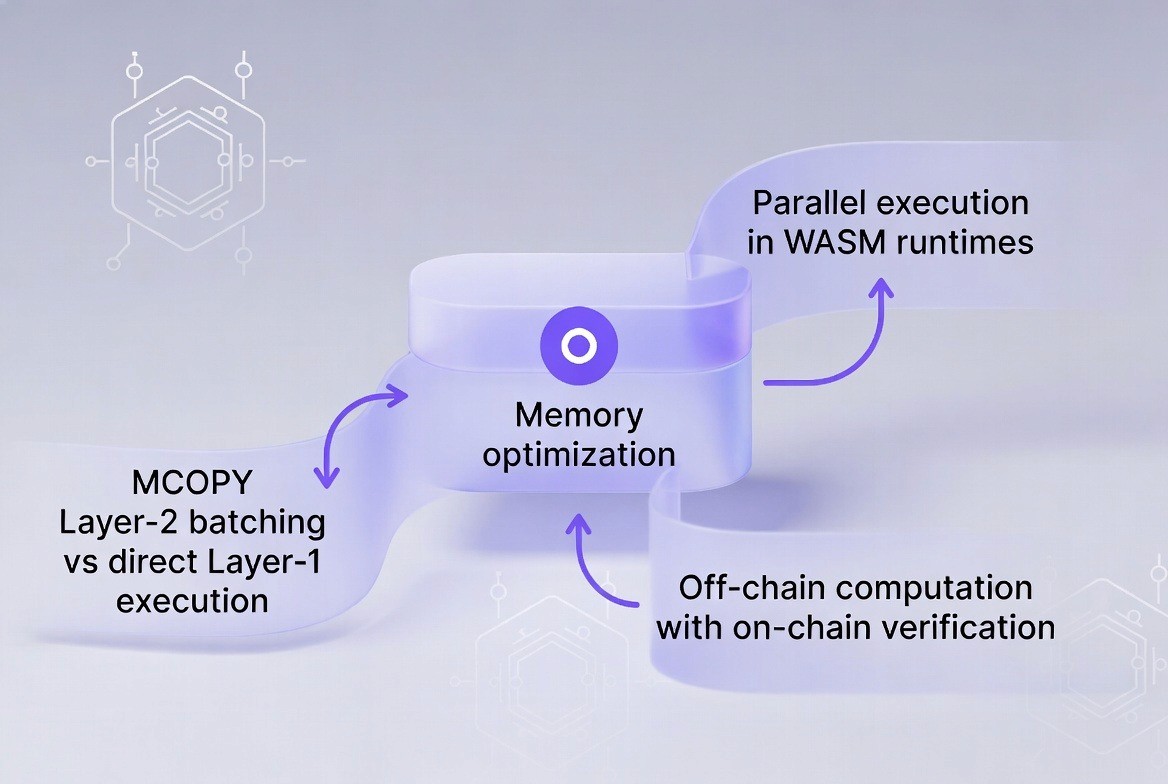

FRAMEWORKS FOR LOWERING EXECUTION COST

Smart contract code design is one part of cost reduction. Execution frameworks and runtime environments also play an important role. The document focuses on four types of frameworks:

EIP‑5656 (MCOPY) for efficient memory copying in the EVM.

Layer‑2 execution and batching for high-throughput, low-cost environments.

WASM and parallel execution models as alternatives to strictly sequential EVM execution.

Off‑chain processing with on‑chain verification to separate heavy computation from verification.

These frameworks are described in the following sections.

1. EIP‑5656 (MCOPY) – LOWERING EXECUTION COST

EIP‑5656 is an Ethereum Improvement Proposal that introduces a dedicated opcode, MCOPY, for efficient memory copying inside the Ethereum Virtual Machine (EVM).

Memory copying matters in finance because many smart contracts handle complex, data-heavy operations such as structured encoded data, arrays of transactional instructions, and grouped transfers or settlement batches. When these operations run efficiently, contracts can process large volumes of financial information faster and at lower cost, turning memory management from a technical detail into a real driver of performance and operating efficiency.

In traditional EVM operation, the contract has to use multiple MLOAD and MSTORE instructions within loops to move data from one memory segment into another. The result is:

- Multiple single instructions.

- More gas to utilize.

- Greater memory growth expenses as operations hit new memory segments.

Key features of EIP‑5656 (MCOPY)

1. The MCOPY opcode allows for fast memory range copy as a built-in operation.

MCOPY is specifically designed to be used by smart contract developers to quickly and efficiently copy large areas of memory. Instead of using the general-purpose operations that exist (i.e., looped loads/stores), smart contract developers can transfer memory much more directly to create a faster, more predictable experience for data-rich smart contracts.

2. Replaces repeated MLOAD/MSTORE loops with a single operation.

Traditionally, copying memory required looping through multiple load and store instructions, which adds overhead and complexity. MCOPY replaces this pattern with a single, streamlined operation, cutting down both execution time and the chance of inefficiencies in contract code.

3. Significantly reduces instruction count for memory heavy logic

MCopy (consolidation of several memory-based steps into one) results in a significant decrease in total instruction count that an application contract has to perform to handle a large amount of data (i.e., it speeds up processing time and reduces processing cost). This is particularly beneficial for applications which process large amounts of data at once, such as, batch transactions or settlement routines.

4. Decreases memory expansion cost resulting from copying large amounts of data

Memory-intensive operations typically cause larger memory expansions, therefore increasing the cost of expanding memory for the EVM (e.g., to copy large amounts of data). As MCOPY optimizes the access and copy of memory, it minimizes the expansion costs and enables large data transfers to be performed economically on high volume smart contracts.

Impact on financial systems

For high-volume, data-heavy contracts, MCOPY has meaningful impact:

It lowers gas costs for calldata decoding tasks.

It improves performance for batch transfers.

It makes settlement loops that process many items more efficient.

These improvements reduce operating costs across key financial workflows, including treasury batch settlements, multi-party payment instructions, and complex financial data handling in encoded formats, by making execution faster, more efficient, and less resource-intensive at scale.

2. LAYER‑2 EXECUTION AND BATCHING

Layer‑2 environments move execution off the main blockchain (Layer‑1) and then settle results back to Layer‑1 in batches.

Key features

Off-chain execution: Transactions run inside a Layer‑2 environment, such as a rollup, rather than directly on the base chain.

Batched settlement: Many processed transactions are combined into a compressed batch or proof.

Shared security with Layer‑1: The main chain verifies the proof instead of re-executing each transaction.

How it works

1. Users submit transactions to the Layer-2 environment.

Instead of sending every transaction directly to the main blockchain, users route their transactions to a Layer-2 network where processing is cheaper and faster. This offloads congestion from the main chain while giving users a smoother experience with lower fees and quicker confirmations.

2. The Layer-2 system orders and executes transactions according to its rules and the underlying virtual machine.

Once transactions enter the Layer-2 environment, they are sequenced and executed based on predefined rules and the logic of the virtual machine it runs on. This ensures that execution remains deterministic and consistent, even though it happens off the main chain.

3. The system produces a batch or proof that represents the combined effect of many transactions.

After processing a large number of transactions, the Layer-2 system compresses their results into a single batch or cryptographic proof. This summary captures the net effect of all activity, making it possible to represent hundreds or thousands of operations with one compact record.

4. This proof or batch is sent to the main chain, which verifies it and updates the state accordingly.

The main blockchain receives the batch or proof and verifies that the Layer-2 execution followed the agreed rules. Once verified, the main chain updates its state to reflect the outcomes, preserving security and finality while keeping most of the heavy computation off-chain.

Impact on financial systems

Payment systems and settlement platforms can reach high throughput levels at a fraction of the per-transaction cost compared to direct Layer‑1 execution.

Financial products can support more frequent and smaller transactions without making costs prohibitive.

Institutions gain access to shared security guarantees from the base chain while working in a more efficient environment for day-to-day operations.

Layer‑2 execution and batching directly support the trend toward automated, high-volume financial workflows with controlled operating costs.

3. ALTERNATIVE: WASM AND PARALLEL EXECUTION

Some blockchains use WebAssembly (WASM) runtimes or design execution models that support parallel transaction processing. These models approach the limitations of strictly sequential execution in traditional EVM settings.

Key features

Lower instruction overhead in some computations compared to classic EVM bytecode.

Deterministic execution, so all participants can agree on the same outcome.

Parallel transaction processing, where non-conflicting transactions are run simultaneously.

How it works

1. Contracts compile to WASM bytecode or to structured units that the runtime can manage.

Smart contracts are first converted into a standardized format, such as WebAssembly bytecode or other structured execution units, so the runtime can analyze and control how they run. This makes execution more predictable and allows the system to apply advanced scheduling and safety rules before the contract logic is actually processed.

2. The runtime identifies transactions that do not touch the same resources or state.

Before execution begins, the runtime examines which parts of the system each transaction will access, such as balances, accounts, or data records. Transactions that operate on completely separate resources are flagged as independent, meaning they can run at the same time without risking conflicts or inconsistent results.

3. Non-conflicting transactions are scheduled in parallel threads or processes.

Once independence is confirmed, the system executes these transactions simultaneously across multiple threads or processing units. This parallelism increases throughput significantly, allowing the network to handle far more activity without waiting for each transaction to finish one by one.

4. The combined results respect the correct overall state and order where needed.

After parallel execution, the runtime merges all results into a single, consistent system state. Where transaction order matters, such as in dependent updates or shared balances, the system enforces the correct sequence, ensuring accuracy while still benefiting from faster, parallel processing.

Impact on financial systems

Throughput increases without raising gas cost per individual operation.

Latency drops for workflows that can benefit from parallel processing, such as sets of independent payments or multiple collateral updates.

High-volume financial applications gain more room to grow while keeping costs aligned with operational targets.

This model helps systems overcome the bottlenecks of strictly sequential execution while maintaining correctness and predictability.

4. ALTERNATIVE: OFF‑CHAIN PROCESSING WITH ON‑CHAIN VERIFICATION

Heavy computation does not always need to occur on-chain. Modern architectures separate the work of computation from the work of verification.

Key features

Off-chain computation: Business logic runs in one or more external services, specialized networks, or dedicated processors.

On-chain proofs or commitments: Results of computations are posted on-chain as cryptographic proofs, hashes, or summarized state commitments.

Reduced on-chain gas usage: The chain only needs to verify these proofs, not re-run the full computation.

Verification-based security: The chain checks correctness through cryptographic means.

How it works

1. A set of inputs and rules defines a financial process.

Every automated financial workflow starts with clearly defined inputs, such as transaction data, thresholds, or approval conditions, along with the rules that govern how decisions should be made. This creates a precise framework that determines what outcomes are allowed and how the process should behave in different situations.

2. Off-chain services process the data and apply the rules, following clear, verifiable procedures.

Instead of running all computation on the blockchain, specialized off-chain systems handle the heavy processing. They apply the predefined rules in a controlled environment, ensuring that each step follows transparent and auditable procedures.

3. After computation, the results are turned into proofs or commitments.

Once processing is complete, the outcomes are summarized into cryptographic proofs or commitments. These compact representations capture the correctness of the work without exposing all the underlying data or steps.

4. These proofs are sent to the blockchain, which verifies them.

The blockchain receives the proof and checks it against known verification rules. This step ensures that the off-chain computation followed the agreed logic and that the results can be trusted without redoing all the work on-chain.

5. If the proof is valid, the chain updates on-chain state accordingly.

After successful verification, the blockchain applies the results to its official state. This final step connects off-chain efficiency with on-chain security, allowing financial processes to scale while preserving trust and integrity.

Impact on financial systems

Complex automation becomes economically scalable because heavy logic does not consume on-chain gas for each internal step.

Only final outcomes and proof verification consume on-chain resources.

Large data sets, document checks, or multi-step workflows can stay aligned with blockchain security while keeping cost under control.

This approach supports financial activities that involve many operations and checks while limiting their direct footprint on the main chain.

Here’s a new section you can add to the article, including a clear explanation and an expanded decision matrix in table form (not HTML).

Choosing the Right Execution Model: A Practical Guide

As smart contracts move into core financial operations, one of the most important design choices institutions face is where execution should happen. Not every workflow belongs on the same runtime. High-volume treasury operations, complex trade finance processes, and simple recurring payments all have very different cost, performance, and risk profiles.

To manage this complexity, institutions need a clear way to match each workflow to the execution model that delivers the best balance between efficiency, security, and operating cost. The decision matrix below provides a practical guide for selecting between Layer-1 execution, Layer-2 batching, WASM-based parallel runtimes, and off-chain computation with on-chain verification.

Table: Execution Model Decision Matrix

Workflow Type | Recommended Model | Why This Model Fits |

High-volume treasury rebalancing | Layer-2 batching | Delivers the lowest amortized cost by spreading fixed fees and infrastructure overhead across many frequent adjustments. |

Multi-party trade finance | Off-chain + on-chain proof | Heavy document validation and conditional logic run efficiently off-chain, while on-chain proofs preserve shared trust and auditability. |

Simple recurring payments | Optimized EVM + MCOPY | Deterministic execution with low overhead keeps costs predictable for routine, high-frequency payment flows. |

Large batch settlements | Layer-2 batching or WASM runtime | Batch execution reduces per-transaction fees, while parallel processing improves throughput without raising unit cost. |

Compliance screening and rule enforcement | Off-chain processing + on-chain verification | Complex checks stay off-chain, while verified outcomes are anchored on-chain for transparency and audit needs. |

Independent high-frequency transfers | WASM + parallel execution | Non-conflicting transactions can run simultaneously, improving throughput while keeping latency low. |

Low-volume, high-value transactions | Layer-1 optimized execution | Direct on-chain settlement provides maximum security and finality where cost sensitivity is lower than risk sensitivity. |

This decision framework helps financial teams move away from a one-size-fits-all approach to smart contracts. Instead of forcing every workflow onto the same execution layer, institutions can align cost structure with business reality: heavy computation moves off-chain, high-frequency flows move to Layer-2 or parallel runtimes, and critical finality stays on Layer-1.

The result is not just better performance, but a systematic reduction in operating cost, where each financial process runs in the environment best suited to its scale, complexity, and risk profile.

Turning Architecture Choices into Measurable Cost Gains

Conceptual explanations are useful, but real adoption in financial systems depends on quantified impact. Decision-makers want to know not just what improves, but by how much. Adding conservative, experience-based ranges helps convert technical design into business-level clarity—making execution models easier to justify, budget, and prioritize.

Below are example cost deltas that translate smart contract optimization into practical operating metrics.

Quantified Impact Examples

Memory optimization with MCOPY

Replacing looped MLOAD/MSTORE operations with the MCOPY opcode in batch settlement flows typically reduces memory-related opcodes by ~60–80%, which translates into a 20–35% predictable gas reduction per batch execution in data-heavy contracts such as treasury settlement loops and multi-party payment processing.

Layer-2 batching vs direct Layer-1 execution

Moving high-frequency workflows from Layer-1 to Layer-2 batching commonly lowers per-transaction execution cost by 70–95%, depending on batch size and proof model. For treasury rebalancing that runs hundreds of times per day, this often turns an economically marginal process into a scalable, always-on operation.

Parallel execution in WASM runtimes

For workflows with independent transactions, parallel scheduling can increase throughput by 3–6× without increasing per-operation gas cost. In practice, this reduces infrastructure cost per transaction by 40–60%, as the same node and monitoring stack supports much higher activity.

Off-chain computation with on-chain verification

When heavy logic such as document validation or complex compliance checks moves off-chain, on-chain gas usage typically falls by 80–95% for that workflow. The blockchain only verifies proofs, turning multi-step processes that once cost dollars per run into cent-level verification events.

These ranges do not promise exact outcomes—but they frame realistic expectations. They help institutions compare execution models on measurable terms:

not just faster vs slower,

but $0.80 vs $0.08 per workflow,

five servers vs one,

daily reconciliation teams vs near-zero manual review.

By attaching conservative cost deltas to execution choices, smart contract design shifts from theoretical efficiency to operating-cost engineering; where architecture decisions directly map to financial outcomes.

REAL USE CASES

The concepts described above are not limited to theory. Several major financial institutions already operate platforms that use these patterns in real-world environments.

JPMORGAN KINEXYS AND CITI TOKEN SERVICES

JPMorgan Kinexys and Citi Token Services process encoded financial data in Ethereum-compatible environments. The data often includes:

Foreign exchange (FX) payloads.

Deposit token metadata.

Structured information for batch settlement across entities.

These platforms operate in EVM-like settings where performance improvements from post‑Dencun features, including MCOPY, are relevant.

Key points:

Programmable FX flows handle array-like batches of transactions.

Permissioned EVM forks can adopt MCOPY-equivalent functionality.

Memory operations in batch transfers and settlement loops are optimized to reduce instruction count.

In high-volume treasury and FX environments, these optimizations lower the gas-related cost of processing large volumes of structured transactions, improve performance in areas such as calldata decoding and batch transfers, and ultimately help institutions run complex treasury operations in a more economical and scalable way.

HSBC, THE CONTOUR NETWORK, AND TRADE FINANCE

HSBC participates in trade finance solutions such as the Contour network. These networks manage multi-party trade finance steps, including:

Issuance of letters of credit (LCs).

Document presentation and review.

Conditional payments and settlement steps between buyers, sellers, and banks.

Document validation and related checks are often handled off-chain in specialized environments that can manage complex logic and sensitive data more efficiently, while key outcomes such as settlement proofs and major milestones are recorded on a shared ledger that all parties rely on as a common reference. To keep the system efficient, many separate actions are compressed into concise on-chain summaries that represent verified results, ensuring accountability and trust without the overhead of recording every individual step.

This structure is similar to how Layer‑2 rollups work:

Many actions are bundled and verified together.

Processing time for trade finance workflows is reduced from days to hours.

Operating costs fall because participants coordinate over a shared ledger rather than reconciling separate records in isolation.

HSBC and other participants gain both speed and cost advantages through this shared-verification, batch-oriented model.

THE OUTLOOK

Cost efficiency is a decisive factor in the future of blockchain adoption in financial systems. As institutions move past early experimentation, they compare options not only by base transaction fees, but by the total cost to automate real workflows.

In the next phase of competition, the focus will shift to which execution models deliver the lowest cost per automated transaction, how well platforms keep unit costs low and predictable as volume grows, and how effectively their architecture supports automation without increasing operational or compliance risk.

At the same time, smart contracts will be judged less as experimental tools and more as long-term cost infrastructure. They will be evaluated as core components that must meet strict performance and cost targets, and as strategic building blocks for payments, treasury, compliance, and reconciliation systems.

FAQ

How do smart contracts actually lower operating costs in financial systems?

Smart contracts reduce operating costs by replacing manual coordination with deterministic execution. Payments, settlements, compliance checks, and collateral actions move from emails, tickets, and handoffs into automated workflows that run the same way every time. This cuts exception handling, shortens processing cycles, and reduces the labor needed to keep financial operations running.

Why does smart contract design matter more than transaction fees?

Because most cost savings come from execution efficiency, not cheaper fees. Contracts that minimize storage access, external calls, and memory usage consume fewer resources and create predictable operating costs. In high-volume environments, these design choices compound across millions of transactions and directly affect infrastructure spend, system load, and long-term maintenance cost.

How does deterministic execution reduce both risk and cost?

Deterministic execution ensures that the same rules are applied in the same way every time. This removes ambiguity in approvals, settlements, and compliance enforcement, which reduces disputes, reprocessing, and manual review. Over time, predictability lowers audit effort, compliance workload, and operational risk management overhead.

How do Layer-2, parallel execution, and off-chain models improve cost efficiency?

These models separate heavy computation from final verification. Layer-2 batching and off-chain processing move most execution away from the main chain while keeping security guarantees through proofs and verification. This allows high-frequency workflows like treasury rebalancing and batch settlement to scale without proportional increases in cost.

Why are smart contracts now treated as financial infrastructure, not just technology?

Because institutions no longer evaluate them only by innovation value but by reliability, predictability, and unit cost. Smart contracts are becoming core execution engines for payments, treasury, compliance, and reconciliation. The focus has shifted from “can we automate this?” to “can we automate this at a sustainable operating cost for years to come?”

HOW TOKENMINDS HELPS REDUCE OPERATING COST WITH SMART CONTRACTS

TokenMinds works with financial institutions and fintech companies to design smart contract architectures that focus on operating cost, not just speed or feature sets. The goal is to support financial automation that scales economically and safely.

Key areas of support include execution model and architecture design, where TokenMinds helps teams decide which parts of a financial workflow should run on-chain, which steps are better suited for Layer-2 execution, and which processes can move to off-chain computation with on-chain verification to achieve the best balance between cost, performance, and security.

Conclusion

Smart contracts are no longer just tools for automation; they are becoming cost-critical infrastructure for financial systems. When designed with deterministic execution, optimized code paths, and modern execution frameworks such as EIP-5656 (MCOPY), Layer-2 batching, parallel runtimes, and off-chain verification models, they turn automation into a measurable operating advantage. The result is lower processing cost, more predictable unit economics, reduced manual overhead, and scalable workflows across payments, treasury, compliance, and reconciliation.

Schedule a complimentary consultation with TokenMinds to explore how your organization can apply these execution models in real-world financial workflows. Our team will help you assess where smart contracts can reduce operating cost today, design the right on-chain, Layer-2, and off-chain balance, and build an automation strategy that delivers sustainable efficiency without increasing operational or compliance risk.