TL:DR

This article explains how stablecoins can be issued with built-in controls and lower technical risk using Hedera Token Service. You will understand how Hedera HTS moves stablecoin control from application code to the underlying ledger system and why this shift is important for financial institutions that need to follow regulations and maintain operational safety.

About Hedera Distributed Ledger

Hedera is a public distributed ledger designed for enterprise and regulated use cases. A distributed ledger is a database that is stored across many computers rather than in one central location. This design allows businesses to record transactions in a way that is transparent and cannot be changed after the fact. After the fact means after something has already happened.

Hedera focuses on serving organizations that require certainty in their transactions and protection against technical failures. Unlike general-purpose blockchain systems designed for any application, Hedera was built specifically for businesses and regulated industries such as banking, insurance, and payment processing. Regulated industries are businesses that are closely supervised by government agencies.

What Is the Hedera Token Service?

Hedera's Token Service (HTS), is a native protocol component (native means it was integrated into Hedera's own architecture, rather than as a separate application). The primary function of the Hedera Token Service is to provide token functionality at the protocol level. The "protocol level" refers to the underlying architecture of the Hedera platform (the system itself, rather than applications running upon it).

The significance of this approach is that issuers will be able to issue and manage their tokens without needing to develop custom smart contracts for core token logic, as described in this development guide. A smart contract is an application that runs on a blockchain network and automates the execution of tasks based on pre-defined conditions. Instead of having to develop these smart contracts themselves, HTS manages token logic as a standard part of the system.

There are three ways in which the Hedera Token Service is utilized. First, HTS enables payment capability, allowing organizations to use tokens as a medium of exchange, as outlined in this guide. Secondly, it manages regulated asset tokens (tokens subject to regulatory, legal and/or financial requirements). Finally, it facilitates enterprise settlements (the confirmation and finalization of business-to-business transactions). All three uses require both deterministic outcomes and security to ensure safe operation. Deterministic refers to a system in which the same inputs always produce the same outputs. Security, in this context, refers to the ability to prevent previously identified vulnerabilities and attacks.

The Missing Piece in Stablecoin Design

Most stablecoins today use a different approach that inverts this model, as discussed in this research. Inverts means reverses or flips. A stablecoin is a cryptocurrency designed to maintain a stable value, usually equal to a specific amount of traditional currency such as the US dollar or euro. Rather than embedding the rules about how the stablecoin works into the system's infrastructure, stablecoin designers place the core monetary logic inside smart contracts.

This means the actual rules that govern how the token behaves—including how transfers happen, how balances are tracked, and how supply is controlled—are written as code that runs on the blockchain. Supply means the total amount of a token in existence. The smart contract code becomes responsible for enforcing the rules about money.

This creates a fundamental mismatch. Fundamental means basic and important. Financial risk managers think about money rules in terms of infrastructure and controls built into the system itself. However, most stablecoins enforce these rules through code that individual companies have written. This difference creates structural problems. Structural means it is built into the basic design.

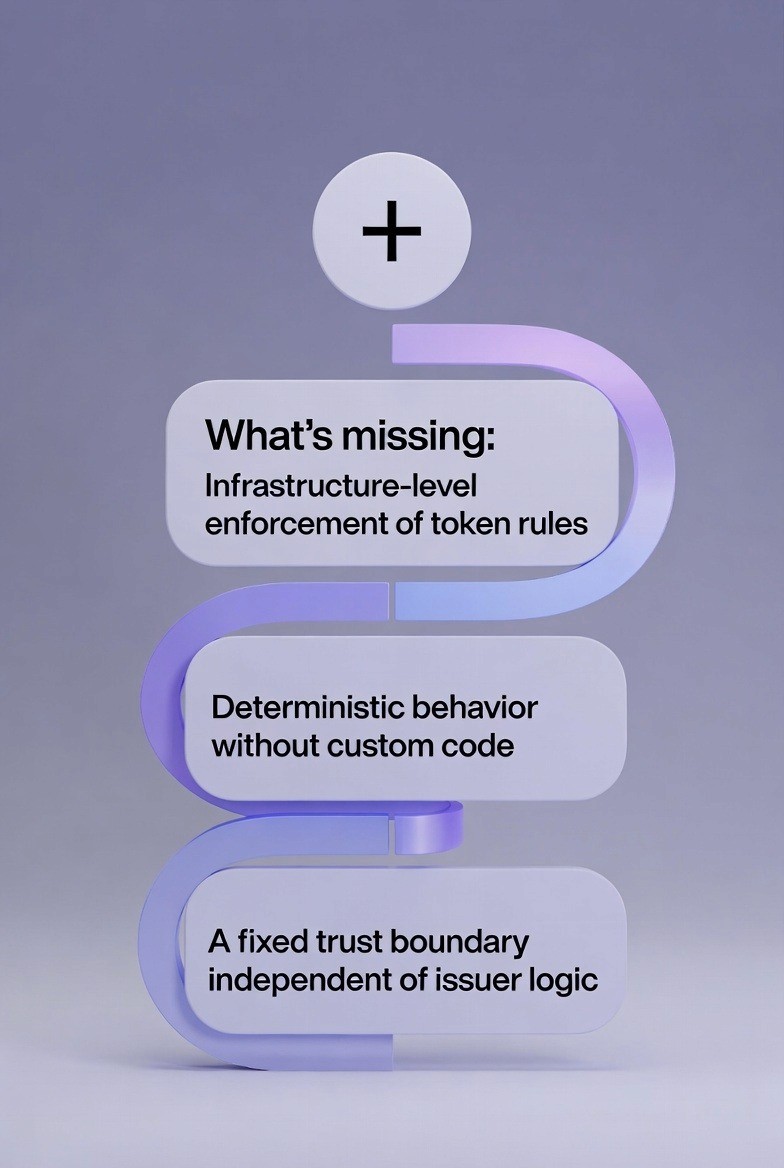

What Is Missing from Current Stablecoin Design

Three critical pieces are missing from current stablecoin designs.

First, there is no infrastructure-level enforcement of token rules. The rules are written in code rather than enforced by the system itself.

Second, there is no deterministic behavior without custom code. Traditional systems provide certainty without requiring programmers to write new code. Stablecoins require programmers to write code correctly every time, which introduces risk of mistakes.

Third, there is no fixed trust boundary independent of issuer logic. A trust boundary is the set of things that users must trust to be safe. In traditional systems, users trust the system's infrastructure. In stablecoins, users must trust that the issuer's programmers wrote the code correctly.

The structural mismatch between how financial organizations think about money and how stablecoins are currently built creates ongoing problems. Ongoing means continuous and without end.

Why Smart-Contract Stablecoins Fail at Scale

The Problems That Emerge

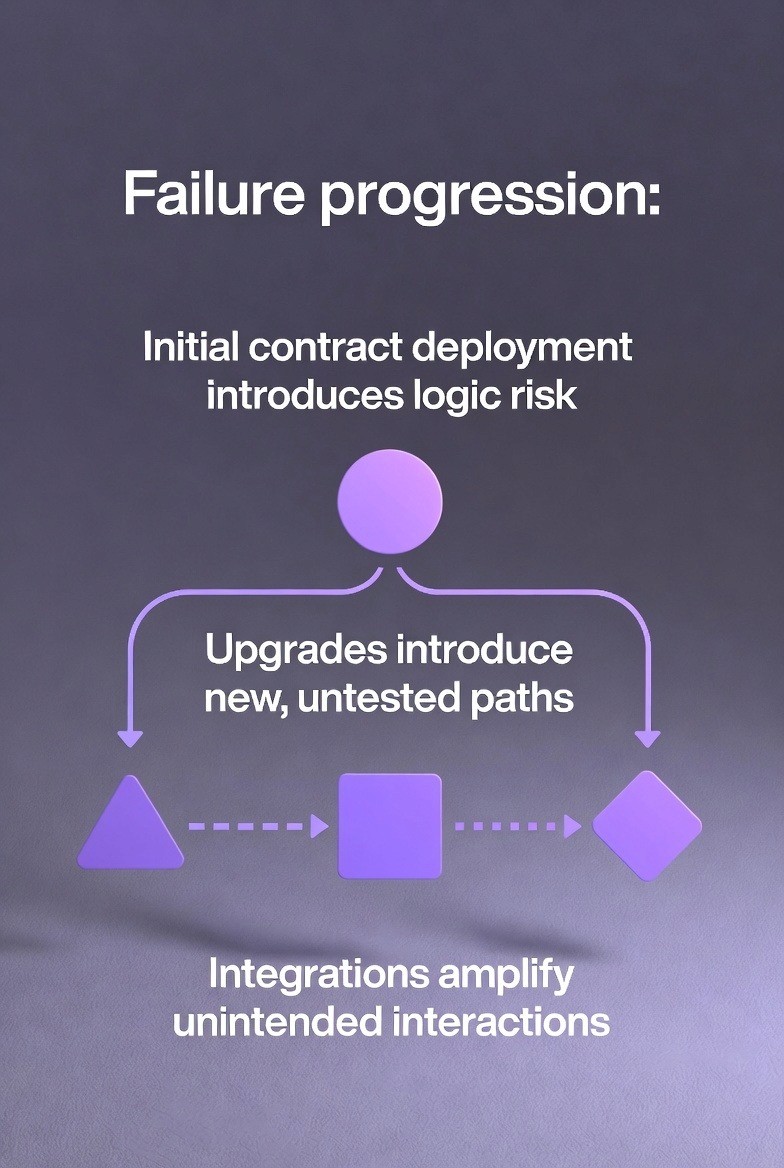

Smart-contract-based stablecoins introduce problems that become worse as the stablecoins grow in size and complexity. At scale means when dealing with large amounts or many transactions.

Professional security audits; detailed reviews of the code by experts looking for problems; reduce risk but cannot eliminate all problems. These reviews cannot find every logic error, cannot prevent all upgrade exploits, and cannot stop all unforeseen interactions between different parts of the system.

Three specific types of risks emerge.

Logic Bugs (code bugs): Logic bugs are a result of coding errors resulting in unwanted program functionality. Examples include logic errors in number calculations, permissions check errors, and/or bugs caused by interactions between different components of code.

Proxy Risks/Upgrade Risks: Proxy Risks/Upgrade Risks occur after the code has been released for production use. A proxy is a design pattern that uses a proxy contract that simply passes on user request to a back-end contract that can either be updated or replaced as needed. As code is updated (upgraded), there is potential for new security vulnerabilities to arise due to lack of full testing of the new code.

Reentrancy & Permission Errors: Reentrancy and Permission Errors can occur if functions are called in unexpected manners, or if access controls are not correctly enforced. Functions are blocks of code that accomplish a particular task. Permissions are rules governing who can do what. Reentrancy occurs when a function is called repeatedly in rapid succession prior to completion of the first call.

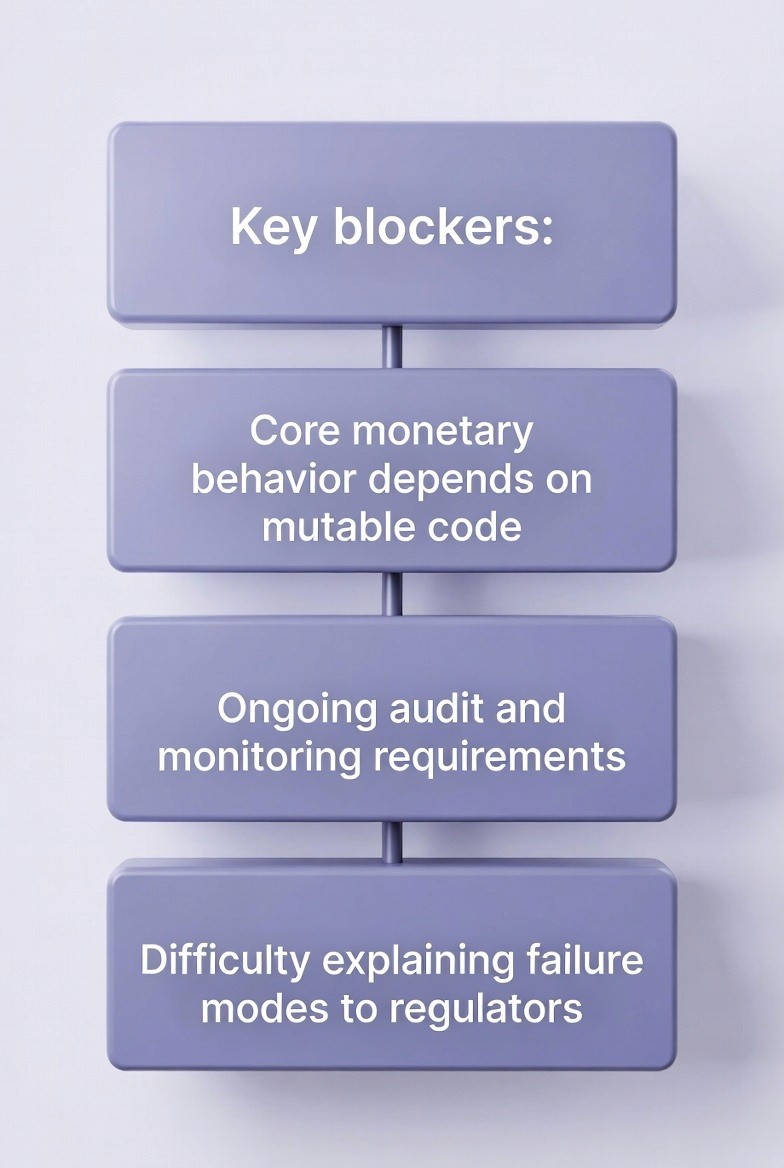

The Three Main Barriers to Deployment

Three key factors prevent broader institutional deployment of smart-contract stablecoins.

First, core monetary behavior depends on mutable code, which creates ongoing risk. Mutable means changeable. If the code can be changed, the rules governing money can be changed, which introduces uncertainty that compliance teams cannot accept.

Second, ongoing audit and monitoring requirements mean that institutions must continuously review the code for problems. This creates perpetual operational overhead—work that must be done continuously without end. Perpetual means lasting forever.

Third, there is difficulty explaining failure modes to regulators. A failure mode is a way that something could fail or break. A compliance officer must be able to explain to a regulator exactly how the stablecoin works and what could go wrong. When the answer is "money rules are embedded in smart contracts that can be upgraded," the conversation becomes complex and raises questions that regulators cannot easily address.

These barriers are not theoretical objections; they are based on real experience with smart contracts that have failed, lost money, or behaved unexpectedly. Theoretical means existing only in theory, not in reality.

What Hedera HTS Actually Changes

The Fundamental Shift in Architecture

Hedera HTS does not improve smart contracts or make them safer. Instead, it removes smart contracts entirely from the trust boundary. The trust boundary is the set of things that users must trust to be safe and correctly implemented. With traditional stablecoins, the trust boundary includes the issuer's smart contracts. With HTS, the trust boundary includes the Hedera network infrastructure instead.

The architectural change is this: Token balances, supply, and permissions are enforced directly by the Hedera network rather than by issuer-deployed smart contracts. Balances are the amount of tokens that a person or organization owns. Supply is the total amount of tokens in existence. Permissions are the rights to perform certain actions. The Hedera network itself maintains and updates all account balances. When someone transfers a token, the network checks that they have the balance to transfer and updates the balances accordingly. Accordingly means in a way that is appropriate.

Issuers configure token behavior instead of programming execution logic. Issuers are organizations that create and manage tokens. Rather than writing code that executes when a transfer occurs, an issuer sets parameters when the token is created. Parameters are settings or values. These parameters might include the token name, the maximum supply, whether transfers are allowed, and who has permission to burn tokens. Burn means to remove tokens from circulation. The Hedera network reads these parameters and enforces them.

This removes user-written code from the core monetary trust boundary. The trust boundary no longer depends on whether the issuer's programmers wrote code correctly. It depends on whether the Hedera network's infrastructure works correctly. The Hedera network has been built and tested to provide this infrastructure reliably.

The model changes from programmable money to infrastructure-enforced money. With programmable money, the issuer writes code that defines what money can do. With infrastructure-enforced money, the system enforces rules that the issuer has configured.

How HTS Enforces Token Safety

There are three main ways Hedera HTS protects token transactions — the three approaches work together to secure the transactions. A method is the approach used to get a desired outcome.

1. Rules for token transactions are set at the time of token creation

As part of creating an HTS token, an issuer sets the specifications for the token, including its specifications and any limitations to the token (i.e., when the token can be transferred, etc.). Specifications are the details of the token; they are set by the issuer as parameters to include how many times a token can be transferred, whether the number of tokens can increase or decrease, and what addresses will be able to access the token to allow them to perform administrative actions such as minting a new token.

After a token has been created, these rules will no longer be changed because they are now permanent attributes of the token.

2. Hedera Network Validation

Every transaction involving the transfer of an HTS token or inquiry about an account balance must first pass validation by the Hedera network. Validate means to verify that the proposed transaction complies with the rules of the token.

Every time a user submits a transaction request to transfer HTS tokens or to inquire about an account balance, the Hedera network first determines whether the account submitting the transaction actually has the required amount to complete the requested action. Then, the network determines if the transaction complies with the token's configuration rules. Finally, the network updates the accounts to reflect the successful completion of the transaction.

3. State Changes Consensus

Each state change made to the network must occur in accordance with a process called consensus. State changes refer to the changes made to the status of the tokens. Consensus refers to each node agreeing that the change occurred and that the change reflects the actual result of the transaction. Each node is a computer running the blockchain software.

Once consensus is achieved among the nodes, the state change is finalized, and the state change becomes a permanent change that cannot be modified. Unlike other blockchain networks, once a transaction is processed by Hedera’s blockchain network, it cannot be undone because of unintended behavior by the code.

How This Eliminates Smart Contract Risks

This architecture eliminates entire classes of smart contract risks by design because these risks cannot exist in a system that does not use smart contracts for core token logic.

There is no reentrancy risk. Reentrancy is an attack where a function is called multiple times in rapid succession before the first call finishes executing. Rapid succession means one after another very quickly. With HTS, the network handles token transfers, not user-written code, so this attack cannot occur.

There is no upgradeable logic risk. Smart contracts can be upgraded, which means new code can be deployed to replace the old code. Deployed means put into operation. These upgrades can introduce vulnerabilities or change how the token behaves. With HTS, token behavior cannot be upgraded because there is no code to upgrade.

There is no custom transfer code. Each smart contract's transfer function is unique code written by the issuer. A function is a piece of code. If this code has bugs, transfers will not work correctly. With HTS, all token transfers go through the same network code, which has been thoroughly tested and audited. Thoroughly means completely and carefully.

Features of Hedera Token Service

Consensus-Level State Validation

One of the most important features of HTS is that token state changes are validated by Hedera consensus rather than by smart contract execution order. To understand why this matters, consider how other blockchains validate transactions. They typically rely on execution order, meaning the first transaction is processed first, then the second, and so on. The person controlling which transactions are included in each block can influence which transactions get processed in which order, and this ordering can affect outcomes in ways that benefit them.

With HTS, the process works differently. A token state change is submitted to the Hedera network. The Hedera consensus mechanism orders and validates this change. The consensus mechanism is an agreement process where multiple nodes reach agreement about what happened and in what order it happened. The state is then finalized deterministically, meaning there is only one possible result and it will always be the same.

Because the network itself decides the order and validates each step, there is no miner or validator discretion over token logic. A miner or validator is a participant in the network who has the power to decide which transactions get included in the next block. Discretion means freedom to make decisions. With HTS, these participants cannot manipulate how token transfers work. Manipulate means to control or change in a way that is intended to deceive.

This approach eliminates several specific attack vectors. An attack vector is a way that someone could attack or harm the system. There are no execution-ordering exploits, which are attacks that take advantage of the order in which transactions are processed to benefit the attacker. An exploit is a technique used to take advantage of a weakness.

There is no MEV, which stands for maximum extractable value. MEV is profit that validators can earn by reordering transactions in a way that benefits them but harms other users. With HTS, validators cannot manipulate token transfers to create MEV. Finally, there are deterministic finality guarantees, which means that once a token transaction is confirmed, it will definitely not change.

For regulated issuers, these guarantees are critical. Critical means very important. A bank issuing a stablecoin needs absolute certainty that once a payment settles and is confirmed, it will not be reversed or changed due to a technical issue or manipulation. HTS provides this certainty by design.

Table: The Validation Process

Step | What Happens | Who Controls It |

Token state change submitted | A transfer or other operation is sent to the network | The user initiating the transaction |

Hedera consensus orders it | The network's consensus mechanism determines when this transaction should be processed | The Hedera network collectively |

Consensus validates it | The network checks that the transaction follows all token rules | The Hedera network collectively |

State is finalized | The transaction result is recorded permanently and cannot be changed | The Hedera network collectively |

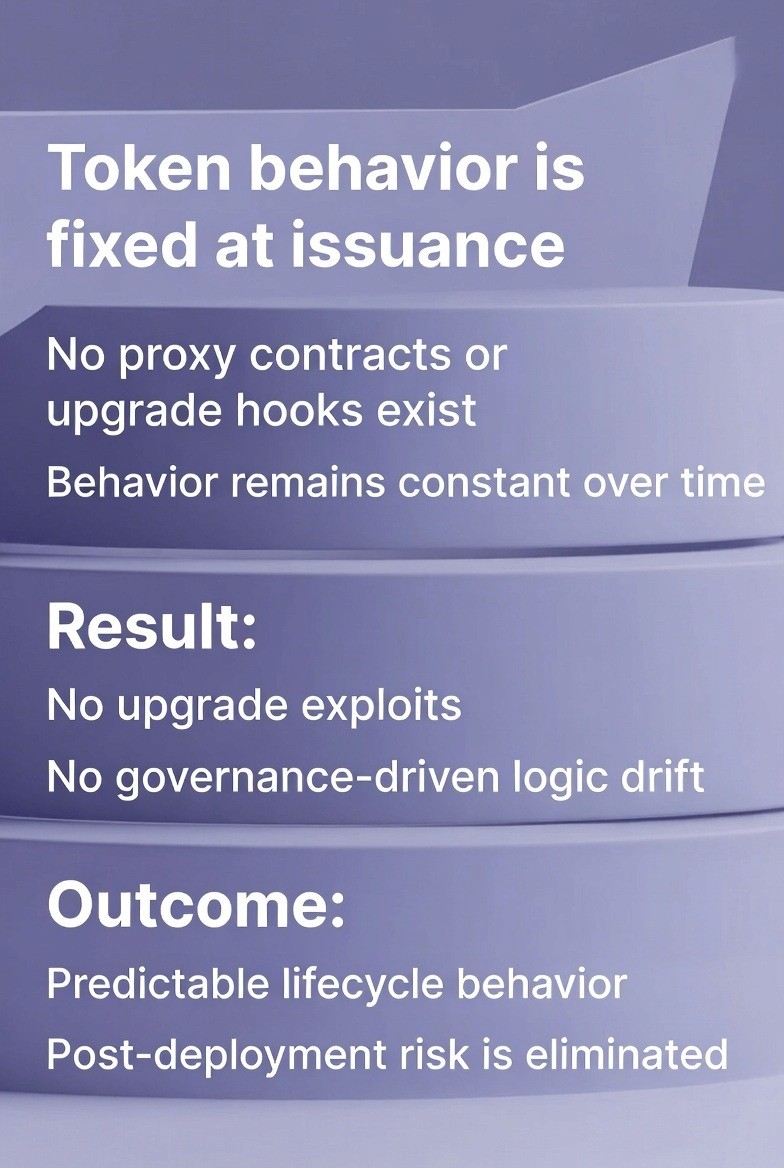

Non-Upgradeable Token Behavior

A second critical feature of HTS is that token behavior cannot be upgraded after issuance. Issuance means the process of creating and issuing tokens for the first time. HTS tokens do not rely on upgradeable proxies or mutable contract logic. An upgradeable proxy is a design pattern used in smart contracts where one contract can forward requests to another contract, and the second contract can be replaced without changing the first. This allows smart contracts to be upgraded, but it also creates opportunities for vulnerabilities.

By removing proxies entirely, HTS prevents many attack vectors. Token behavior is fixed at issuance. When an issuer creates an HTS token with specific characteristics such as a maximum supply or whether burns are allowed, those characteristics are permanent. Permanent means lasting forever and never changing. No proxy contracts or upgrade hooks exist that would allow the behavior to change later. An upgrade hook is a place in the code where changes can be made. The behavior remains constant over the entire lifecycle of the token.

This eliminates several types of post-deployment risks. Post means after. There are no upgrade exploits, which are vulnerabilities introduced when contract code is changed. When code is upgraded, new bugs can be introduced, or new attack vectors can be created. With HTS, there is no code to upgrade, so this risk does not exist. There is no governance-driven logic drift, which occurs when the rules of the token slowly change over time through governance decisions.

Governance means decision-making. In some systems, users can vote on changes to how the token works, and these changes can shift the token's behavior in ways that not all users expected. Shift means to change. With HTS, the token's behavior is locked in at creation.

Issuers gain predictable lifecycle behavior. The token will behave the same way next year as it does today. Users can rely on this consistency. Consistency means remaining the same over time.

Table: Results of Non-Upgradeable Design

Risk Type | Smart Contract Tokens | HTS Tokens |

Upgrade exploits | Risk present | Eliminated |

Governance-driven logic drift | Risk present | Eliminated |

Post-deployment vulnerabilities | Risk present | Eliminated |

Behavior predictability | Variable | Guaranteed |

For a bank issuing a stablecoin, this is a major advantage. An advantage is something that provides a benefit. Regulatory approval often depends on understanding exactly how the token will behave. Regulators need to know that the behavior is locked in and will not change without explicit regulatory approval. Explicit means clear and definite. Once that behavior is locked in, the bank can explain to regulators that the behavior will not change, eliminating ongoing regulatory risk.

No Contract-Level Gas Variability

A third feature of HTS is that there is no contract-level gas variability. Variability means the amount can change. Gas is a measure of the computational work required to execute a transaction on a blockchain. Computational means involving computation or calculation. On traditional smart-contract blockchains, the amount of gas consumed by a transaction depends on the code executed, and this amount can be difficult to predict in advance.

With HTS, token operations do not execute user-defined smart contract logic. Instead, fees are determined by network-defined operations, not runtime code paths. A network-defined operation is a standard action that all tokens use. Runtime means the time when the program is running. Because all tokens use the same operation, all transfers cost the same amount. This is different from smart contracts, where different contracts can have different code that consumes different amounts of gas.

Every transfer of an HTS token costs the same amount, regardless of how many times the network has processed similar transfers or how congested the network is. Congested means crowded or full. The fee is calculated by protocol rules, meaning the rules are written into the system itself, not determined by calculation at runtime.

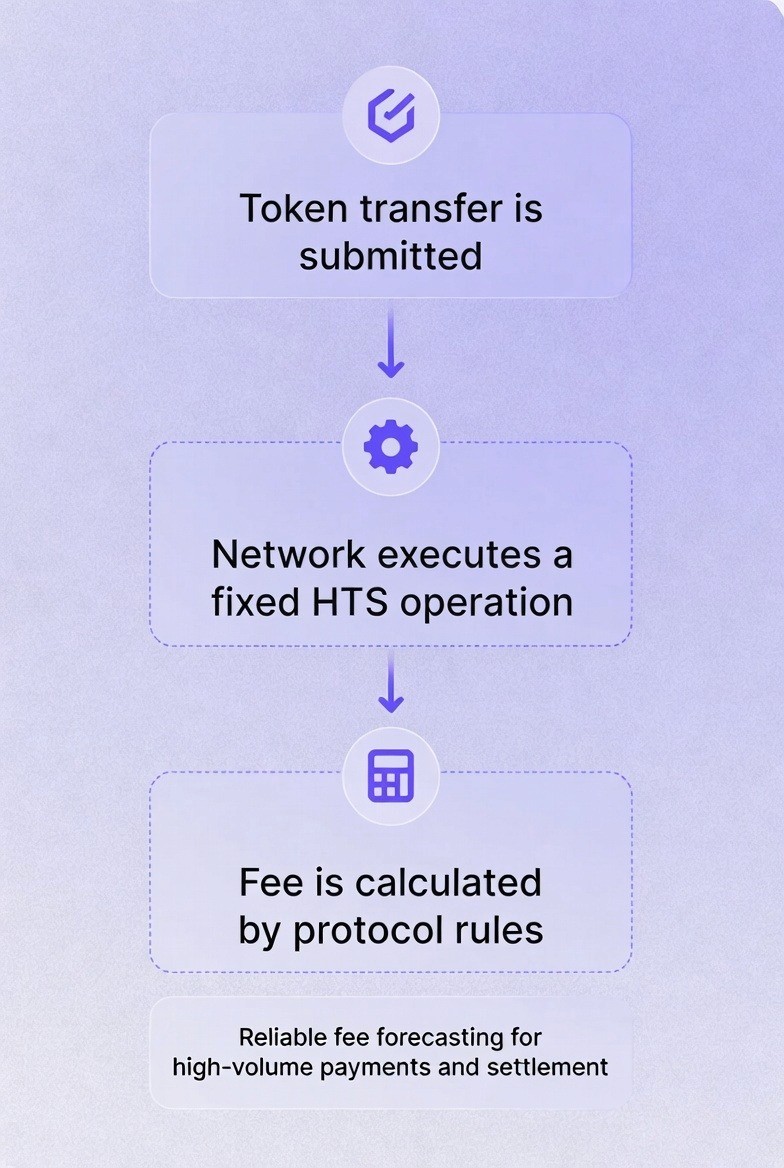

The transfer process is straightforward. Straightforward means simple and direct. A token transfer is submitted to the network. The network executes a fixed HTS operation; the same operation every time. The fee is calculated by protocol rules, not by measuring how much computation the operation required. As a result, there is reliable fee forecasting for high-volume payments and settlement.

This is critical for use cases like international payments, where banks need to know exactly how much it will cost to move money before committing to the transaction. Banks cannot commit to a transaction if they do not know the cost. With smart contracts, fees can spike unexpectedly when the network is congested or when the contract's code path is more complex than expected. Spike means to suddenly increase. With HTS, fees are predictable and bounded, meaning they will not exceed a known maximum amount.

Table: Fee Predictability Impact

Payment Type | Cost Certainty with HTS | Importance for Business |

International transfers | Very high | Critical for planning |

Cross-border settlement | Very high | Critical for planning |

Batch payments | Very high | Critical for cost control |

Retail stablecoin transfers | Very high | Important for user experience |

Technical Guide: How to Issue a Stablecoin Using Hedera Token Service

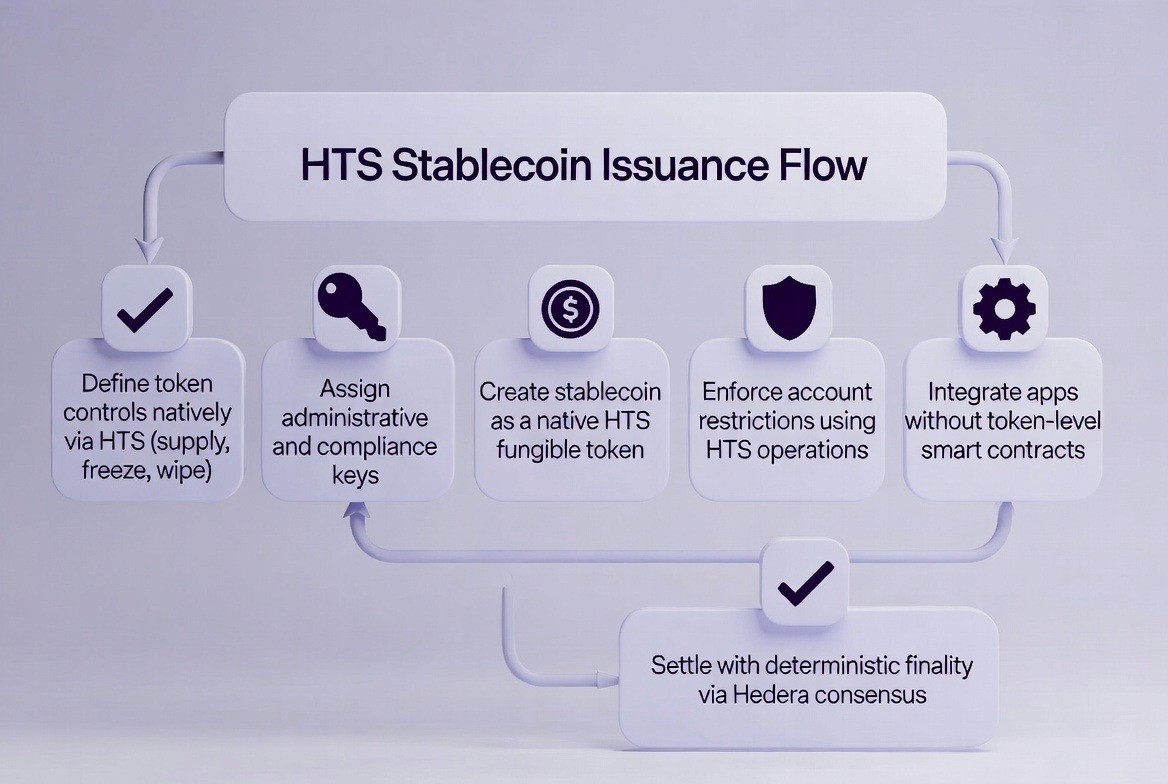

Define controls at token creation

Configure supply, freeze, wipe, and administrative permissions directly in HTS so token behavior is enforced by the ledger, not application code.Assign administrative and compliance keys

Separate minting, freezing, and update authority across operational and compliance roles using native HTS key controls.Issue the stablecoin as a native HTS token

Create the stablecoin as a fungible HTS token; all state changes are processed as ledger transactions validated by Hedera consensus.Apply account-level enforcement

Use HTS freeze and wipe operations to enforce compliance consistently across all integrations without custom logic.Integrate applications without token logic

Applications interact with the stablecoin via HTS transfers but do not control token behavior, keeping the trust boundary at the protocol layer.Rely on deterministic finality

Final settlement is immediate and irreversible, simplifying reconciliation, audit, and dispute handling.

Real-World Use Cases and Deployments

Live Deployments

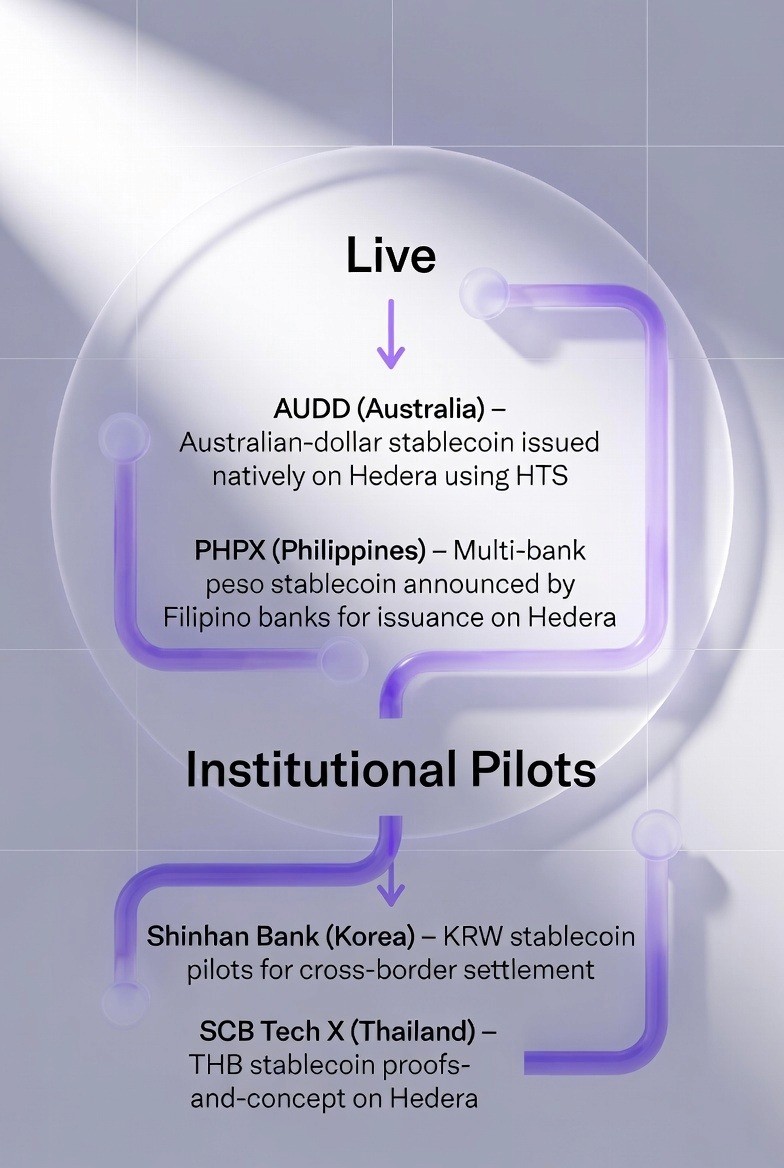

Several institutions have already begun deploying stablecoins using Hedera HTS in live production environments, demonstrating that this approach works in practice with real money. Production means the system is being used for actual business operations, not just testing.

AUDD is an Australian-dollar stablecoin that has been issued natively on Hedera using HTS. Natively means directly using the system's built-in features, not separate programs. This stablecoin is in active use for regulated payments in Australia. Active use means it is being used regularly with real transactions. This means that real Australian dollars in digital form are being moved through HTS tokens today. The stablecoin represents actual Australian dollars held in reserve.

PHPX is a multi-bank peso stablecoin announced by Filipino banks for issuance on Hedera. The Philippine peso is the currency of the Philippines. Multi-bank means it is issued by multiple banks working together. This is a planned launch, which means it has been announced and is in development but is not yet available for trading or use. The fact that multiple banks in the Philippines have coordinated together to build this stablecoin on HTS demonstrates that institutional financial institutions believe the platform meets their technical and regulatory requirements.

Institutional Pilots

In addition to these live deployments, several major banks are conducting institutional pilots, which are tests in controlled environments before full deployment. Controlled environments means limited situations where everything can be carefully monitored. Shinhan Bank in Korea is running KRW stablecoin pilots for cross-border settlement on Hedera. The Korean Won, abbreviated KRW, is the currency of South Korea. Cross-border settlement means transferring money between countries. Shinhan Bank is testing whether it can use Hedera's HTS to move Korean currency across international borders.

SCB Tech X is a subsidiary of the Siam Commercial Bank in Thailand. A subsidiary is a company that is owned or controlled by another company. It is conducting THB stablecoin proofs-of-concept using Hedera infrastructure. The Thai Baht, abbreviated THB, is the currency of Thailand. A proof-of-concept is a demonstration that a technology can work in principle before full investment in deployment. SCB Tech X is testing whether Thai banks can use Hedera for stablecoin operations.

Table: Hedera HTS Real Use Cases

Deployment | Country | Currency | Status |

AUDD | Australia | Australian Dollar (AUD) | Live/Active |

PHPX | Philippines | Philippine Peso (PHP) | Planned Launch |

Shinhan Bank | South Korea | Korean Won (KRW) | Institutional Pilot |

SCB Tech X | Thailand | Thai Baht (THB) | Proof-of-Concept |

The Outlook for Stablecoin Infrastructure

Short-Term Impact

In the short term, HTS lowers issuance and operational risk for regulated stablecoins. Issuance means the process of creating and issuing tokens. Institutions can issue stablecoins with confidence that the core rules are enforced by the Hedera network, not by custom code that needs ongoing monitoring and auditing. This removes a major barrier to production deployment.

Long-Term Evolution

In the long term, protocol-native token primitives are likely to replace smart-contract-based money for institutional use. Protocol-native means built directly into the system. This does not mean smart contracts will disappear completely. Rather, it means that for the core monetary logic; the rules that govern how money moves; institutions will prefer systems where the rules are enforced at the protocol level rather than in smart contracts.

FAQ

1. Why are smart-contract-based stablecoins risky for financial institutions?

Because core monetary rules depend on mutable application code, institutions face ongoing risks from logic bugs, upgrades, reentrancy issues, and unclear failure modes that are difficult to explain to regulators.

2. What fundamental shift does Hedera Token Service introduce?

HTS moves stablecoin control from issuer-written smart contracts to protocol-level enforcement, meaning balances, supply, and permissions are enforced directly by the ledger infrastructure.

3. How does HTS reduce operational and compliance risk?

Token behavior is fixed at issuance, validated by Hedera consensus, and cannot be upgraded—eliminating audit churn, upgrade exploits, MEV, and unpredictable execution behavior.

4. Why does deterministic finality and fixed fees matter for banks?

Banks need certainty in settlement and cost forecasting; HTS provides deterministic finality and predictable, bounded fees that support high-volume payments and cross-border settlement planning.

5. Is HTS proven in real institutional environments?

Yes. Stablecoins like AUDD (Australia) are live in production, while multi-bank and cross-border pilots such as PHPX, Shinhan Bank, and SCB Tech X demonstrate institutional confidence in HTS.

How TokenMinds Supports Institutional HTS Deployment

TokenMinds is an organization that believes bank-grade stablecoins require protocol-level enforcement, not smart-contract complexity. BHedera Token Service enables this by enforcing token rules natively, reducing operational and compliance risk. Native enforcement means the system itself ensures that all rules are followed, without requiring code audits or monitoring.

We help institutions design, pilot, and scale HTS-based stablecoin architectures aligned with real regulatory, treasury, and payment requirements. Aligned means matched or consistent with. This is not a one-size-fits-all service; different institutions have different regulatory environments, different treasury operations, and different payment systems.

Conclusion

Hedera Token Service represents a fundamental shift in how stablecoins can be designed and deployed. By moving token control from application code to the underlying ledger, HTS eliminates entire classes of risks that have plagued smart-contract stablecoins. For financial institutions considering stablecoins, the message is clear: protocol-level enforcement provides the safety, certainty, and reliability that institutions require.

Schedule a complimentary consultation to explore how Hedera Token Service (HTS) can be integrated into your payment and stablecoin architecture, enabling protocol-level controls, reduced smart contract risk, and seamless alignment with your existing financial systems.