TL;DR

How to design and build a production-ready DeFi insurance platform with clear risk models, deterministic claims, and capital controls, and integrate it into existing crypto rails to reduce loss impact, restore trust, and support long-term platform growth.

DeFi loses billions each year to a variety of losses due to hacks, bugs in smart contracts and system failure. Users have expectations for protection from loss (insurance) and recovery as quickly as possible. In practice, many of the insurance systems fail at exactly the time that users need them most.

Decisions on claims take an unacceptable amount of time, coverage terms are not clearly defined, and decision making is delayed through governance.

Once again, this gap between what insurance promises to do and what it actually does creates permanent damage to trust, a structural issue increasingly examined through DeFi-for-business adoption models. Users will leave the platform once they believe that insurance will not be there to help them when they need it, and it will be unlikely that they will ever return to the platform. Trust is very difficult to repair once it has been lost.

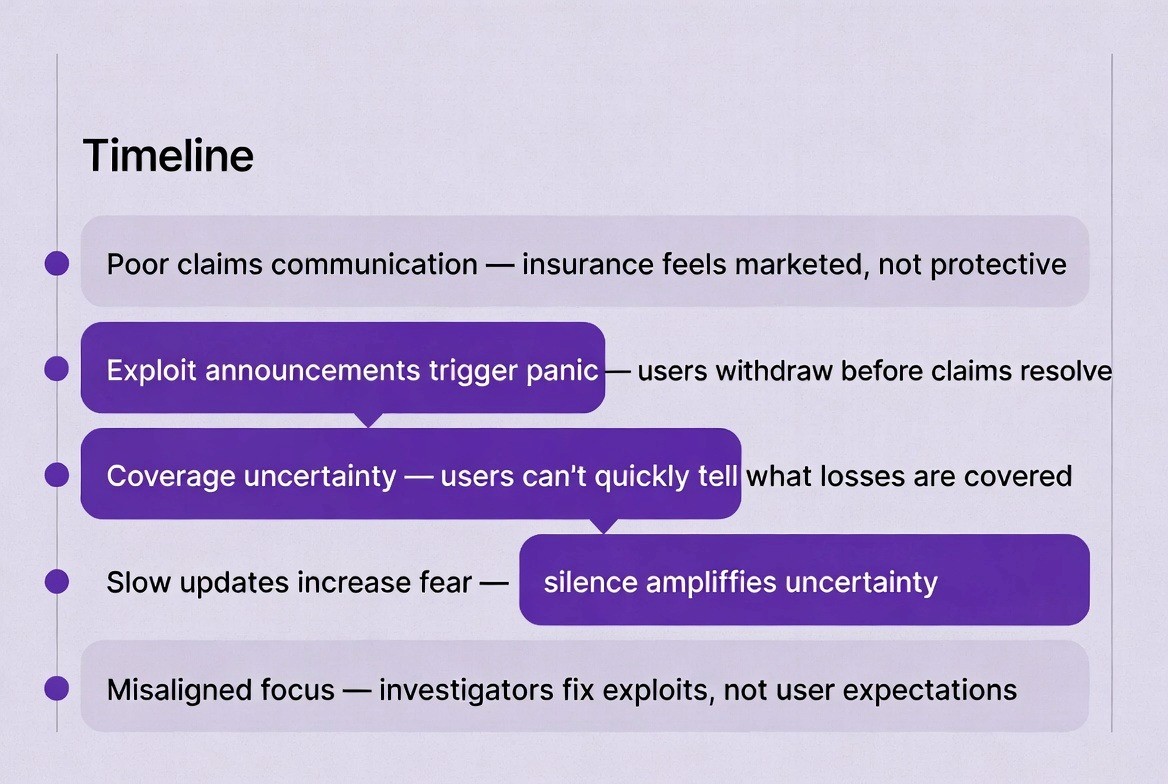

Why Post-Exploit Chaos Destroys User Trust

Panic occurs after an exploit as users can't be certain if their loss is going to be covered by the protocol. Most protocols have no defined plan of action regarding what users can expect from a coverage standpoint (coverage limits, how to file a claim, etc.) when it comes to paying out for losses.

Users will continue to search social media for updates on the status of their claims while waiting for funds to become available again to transfer from contracts damaged in the event of an exploit.

Claims investigations occur manually and can take anywhere from weeks to months to complete, so while users may see another platform offer fast recovery or compensation programs to those who were affected by an exploit, these claims are still pending with the original platform, a failure mode often discussed in DeFi 2.0 design thinking.

The lack of timely communication in regard to user claims creates the perception that insurance was just being marketed rather than protecting users of the protocol.

When a protocol announces an exploit, users will withdraw their funds prior to claims being resolved.

Users are unable to quickly determine which losses are covered in times of crisis.

The slow rate of communication within the community increases fears.

Claims investigators are primarily focused on addressing the issue causing the exploit, rather than educating the community regarding what they should expect from the insurance offered through the protocol.

Why Third-Party Insurance Integrations Often Fail During Incidents

External insurance typically offers generic policy coverage which is generally not tailored to the specific risk profile of a particular protocol. There are many ways an attacker can take advantage of this (e.g., manipulating the oracle, governance attack, cross-chain failure) where the typical external provider would deny coverage due to their generic coverage terms.

Additionally, in most cases, users will only find out about their lack of coverage for certain events once they submit a claim, long after the fact. Another problem with governance is that while an external insurance DAO may allow token holders to vote on claims, those voting will always be trying to protect the insurance treasury's funds, and not try to help the user.

In some cases, the DAO may reject claims if there is a potential threat to the solvency of the insurance treasury, regardless of whether the user actually suffered a loss. In either case, protocol teams have no ability to override the DAO decision, but as such, protocol teams will also take the blame for the denial of the claim by the DAO, a limitation that stems from how insurance logic is implemented by underlying blockchain system design.

Other problems with using an external insurance policy include:

Policies provided by an external insurance company do not provide coverage for many common DeFi exploit types;

The time required to obtain approval through governance voting is longer than necessary for emergency situations;

The trigger mechanism for filing a claim with an external insurance company may not align with what constitutes a failure under the contract.

Trust will be lost by protocol teams when they do not have control over the outcome of a claim submitted to an external insurance company.

Diagram Description: A timeline showing an exploit event, claim submission, governance delays, treasury pressure, claim rejection, and user exit.

Why Building a Custom DeFi Insurance Platform Is Better Than Simple Integration

Teams that build their own insurance platforms control coverage rules, claim processes, and payouts. This control allows insurance to match real protocol risks. Internal governance enables faster decisions during emergencies. However, teams must also manage underwriting, reserves, and disputes themselves.

Coverage Gaps in Existing DeFi Insurance Products

Most of today's insurance options only address the typical smart contract vulnerabilities that occur. Bridge failures, oracle hacks and governance exploits are typically excluded from most insurance options available today. Exclusions exist for one reason: it is difficult for an outside insurer to completely understand how a particular protocol was built.

There is no consideration given to custom pricing. Protocols with more robust audit and monitoring practices have to pay the same premium prices as protocols that are less secure. This makes investing in security more expensive.

- Typical standard insurance coverage does not protect against oracle or cross-chain issues.

- An outside insurer does not have visibility into the specific protocol level.

- The premium you will be required to pay does not take into account the quality of your security investments.

- Insurance coverage limits do not increase with the growth in TVL (total value locked)

Dependency Risk on External Insurance Governance

The use of external insurance introduces risk of dependency. The loss of coverage through a rejected claim by an external DAO is a loss for which protocol teams have no remedy; i.e., risk is now based on a decision made by the governance rather than an exploit.

Additionally, external treasuries may also run out of cash during a market wide crash. The reserves of many insurance companies are typically invested in high-yielding strategies that lose money when the market declines. During times of low liquidity, delays/cancellations occur in making the required payout(s).

External DAOs will deny legitimate claims.

Real-time auditing of reserve health is not possible.

A pool with shared resources depletes rapidly during large scale events.

Terms of coverage can be changed at the discretion of the DAO without consent

Core Design Assumptions for a DeFi Insurance Platform

Insurance systems must be designed to work under stress. Weak assumptions lead to failure during real incidents. Teams must test assumptions before launch to ensure predictable behavior during crises.

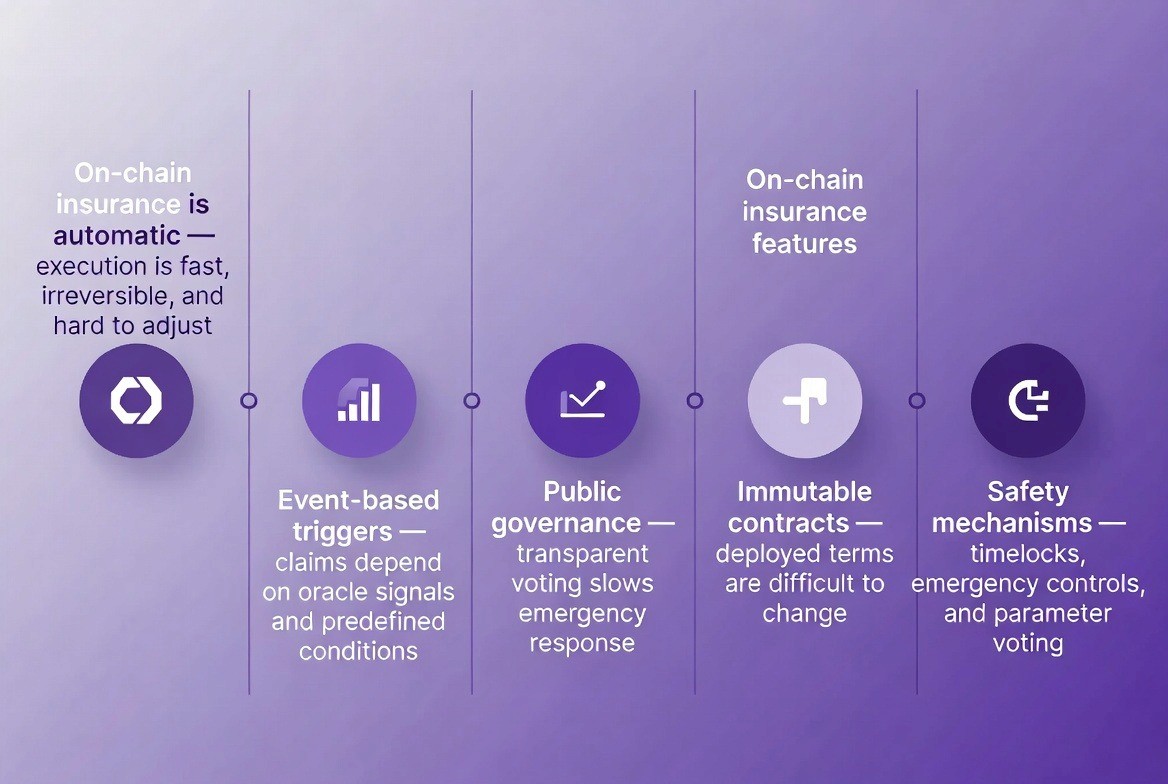

On-Chain Insurance Logic and Smart Contract Enforcement

All of the underlying logic for insurance must be executed on a blockchain network. The Smart Contract will then enforce the stated rules with automaticity via use of Oracle Data; which removes Human Bias but requires that each rule is precisely defined as well as being subject to permanent errors upon deployment.

The On-Chain Logic enables anyone to independently audit the rules governing coverage utilizing a Blockchain Explorer, thereby increasing the Transparency of the Policy but also exposing the Logic to the Attacker. So the design needs to strike an optimal Balance Between Openness and Security.

- Smart Contract definitions of Policies will determine how the system works.

- Users can initiate claims using data collected by the system (Objective On-Chain Data).

- There is no longer a need for a Manual Approval Process for each Claim submitted.

- The Public Auditing of Terms of Coverage (Rules) governs how coverage is awarded.

The exchange has its wallet's smart contract(s) connected to the insurance smart contracts.

Transparent Capital Pools and Solvency Rules

Reserve pools must hold enough stablecoins to cover worst-case scenarios. Users need real-time visibility into reserves. Solvency rules define minimum reserve ratios and pause policy sales when limits are breached.

By setting low reserve requirements you can encourage greater efficiency of use of funds but at a higher level of risk. Conversely by establishing high reserve requirements you can provide additional safety for the system, but also lower returns. In order to strike an optimal balance between these two competing objectives, teams will need to consider both.

The utilization of stablecoin based reserves reduces systemic volatility

The implementation of minimum reserve requirements protects against insolvency

Reserve dashboards provide transparency and monitoring on the health of reserve systems

Overextending the system through circuit breaker implementations prevents further deterioration of the reserve system

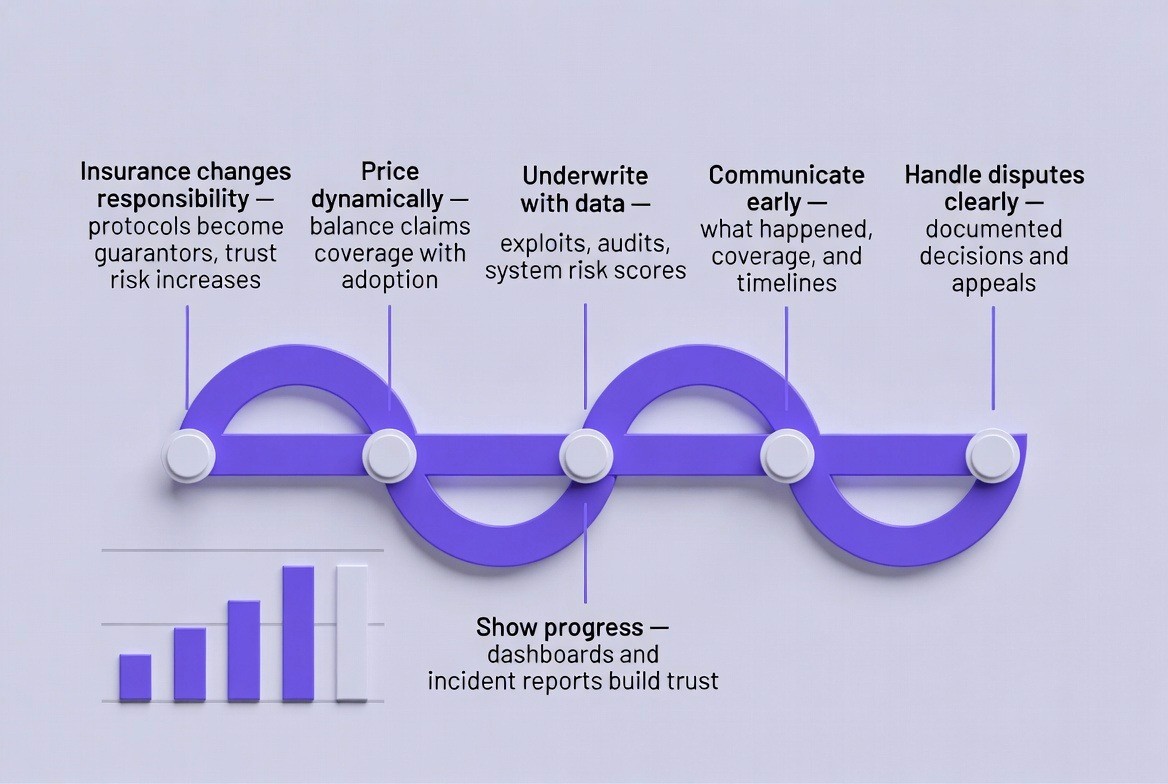

Becoming an On-Chain Insurer

Insurance turns protocols into financial guarantors. This adds legal, operational, and reputational responsibility. Failure damages trust more than exploits.

Underwriting and Pricing Risk Correctly

Premiums should cover expected future claims, and premiums that are too low will drain reserves. Premiums that are too high will reduce adoption of the product. The teams can look at exploit data, audit information and system complexity as part of their team's analysis.

Risk is not constant and therefore the pricing of the premium should be adjusted based on new risks to the system.

Historical exploit analysis, audits and/or code quality (risk scoring) and the ability for premium formulas to change in response to changing risk; as well as dynamic pricing based on changing claim frequency (the number of claims per unit of time), are all examples of how this could be done.

Managing Disputes and Communication During Incidents

Open Communication Helps Build Trust. The team needs to clearly state what occurred, who will receive coverage and when they can expect it. Lack of communication causes fear and harm to your customers.

The dispute resolution process takes care of the ambiguous issues that may arise. The appeal allows the user to seek a fair decision. All decisions must have documentation.

Establishing the Incident Report in a timely manner helps establish credibility with your policyholders.

Creating a dashboard to track claims and their status keeps the policyholder informed of where their claim is at.

Creating an appeals process allows policyholders to correct any errors in their claims.

Keeping a record of past disputes creates precedence for future disputes.

What Makes DeFi Insurance Technically Different From Traditional Insurance

Insurance in DeFi operates through public blockchain networks. The execution of insurance is automatic and irreversible. This facilitates fast processing but also constrains the ability to adjust how a claim is processed.

Event-Based Claim Triggers and Oracle Dependence

All forms of governance are publicly visible. Changes to governance are made based on votes from the community. The use of community vote increases visibility into governance decision-making; however, it can hinder response times during emergencies.

Once smart contract terms are agreed upon and deployed to a blockchain network, those terms cannot be changed with ease.

- Time locks protect user funds.

- Emergency controls allow developers to correct errors in a contract that may have been created in the testing phase.

- Voting mechanisms provide public input into parameter choices.

- Thorough testing should be conducted prior to the deployment of a smart contract.

Public Governance and Cryptographic Enforcement

All governance is public. Changes are made through voting. This increases transparency to the community; however, it can slow down emergency situations.

Automatic payment enforcement is one advantage of smart contracts. Once a smart contract is launched, the smart contract is locked in, and its rules are very difficult to change.

Smart contracts contain time lock mechanisms to protect users from errors or unauthorized access.

Smart contracts also have built-in emergency controls for fixing bugs.

Smart contracts use public voting to set parameters (e.g. risk coverage levels).

Critical testing must occur prior to the deployment of a smart contract to ensure a smooth and reliable experience for users.

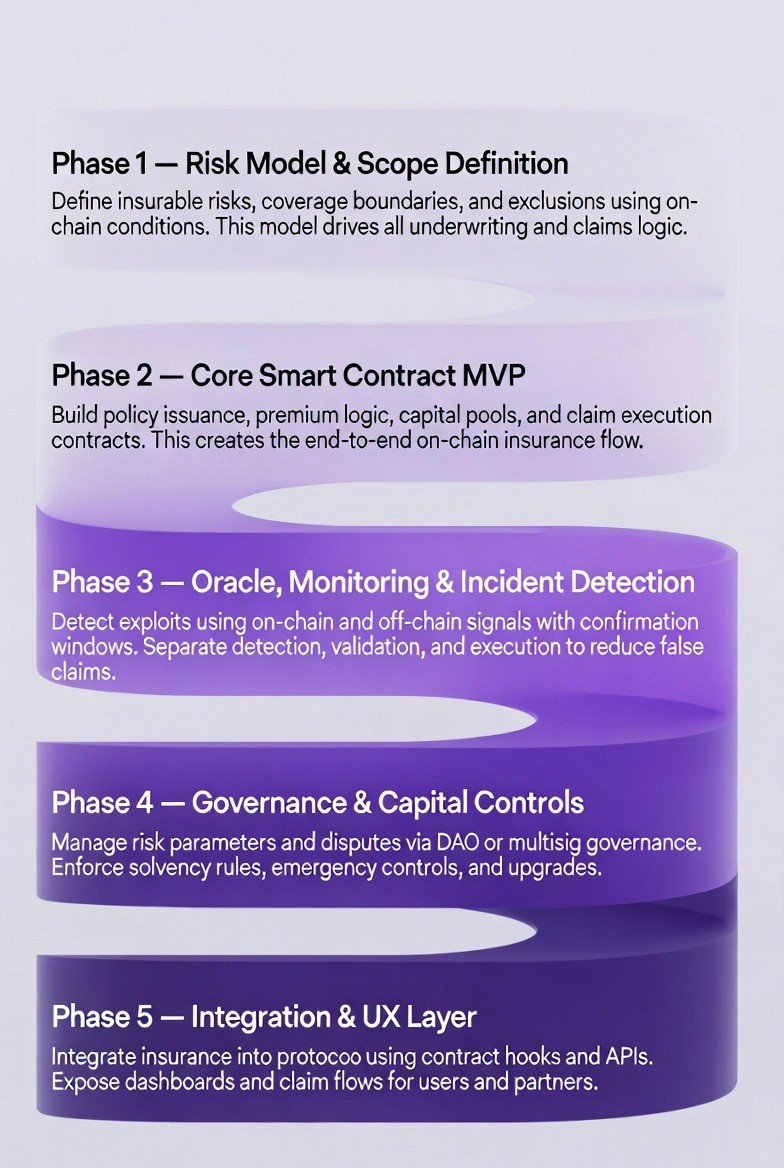

Step-by-Step: Building and Integrating a Production-Grade DeFi Insurance Platform

1. Defining Insurance Scope and Model

Teams define covered risks and choose mutual, underwritten, or hybrid models.

Risk coverage documentation

List all events that the insurance will cover; e.g., smart contract errors, oracle errors, and/or bridge collapses. The definition of coverage must clearly and specifically detail how users and smart contracts view the same loss during an incident claim.

Define Exclusions

Clearly outline those losses that the insurance does not cover, e.g., user error, market volatility, etc. Clearly defined exclusions minimize potential for disputes to arise in times of high stress.

Capital Model Choice

Determine if the coverage is funded via user premiums (mutual), funding from investors/protocol (underwritten) or a combination of both. Capital model selection defines the risk level of insolvency, levels of control over governance and the incentives of participants in the system.

Set up coverage tiers and limits.

Establish coverage tiers with defined maximum payout and corresponding premium levels. The tier structure protects the reserve funds from being depleted due to a single loss while enabling users to select the desired level of protection.

2. Identifying and Classifying Insurable Risks

Risks should be quantifiable and verifiable.

Risk assessment of an exploit: Research previous DeFi hacks to determine the most likely attacks, their occurrence frequency, and the average losses per attack to help identify realistic claims scenarios.

Assessing the severity of identified risks

Establish how much damage each type of risk could do (small problems vs. significant system-wide failures) so you can price the risks appropriately and how you will use your reserves to address those risks.

Determining catastrophic risks

Determine what would be an extreme low probability of occurring but if it did occur could result in severe consequences, i.e. if a bridge were compromised or an oracle failed; you might also consider setting up reserve funds to cover this type of risk or excluding them from your primary reserves.

Develop objective criteria

Convert each risk into a condition that a smart contract or oracle can measure, including things like price deviations, or transaction failure counts.

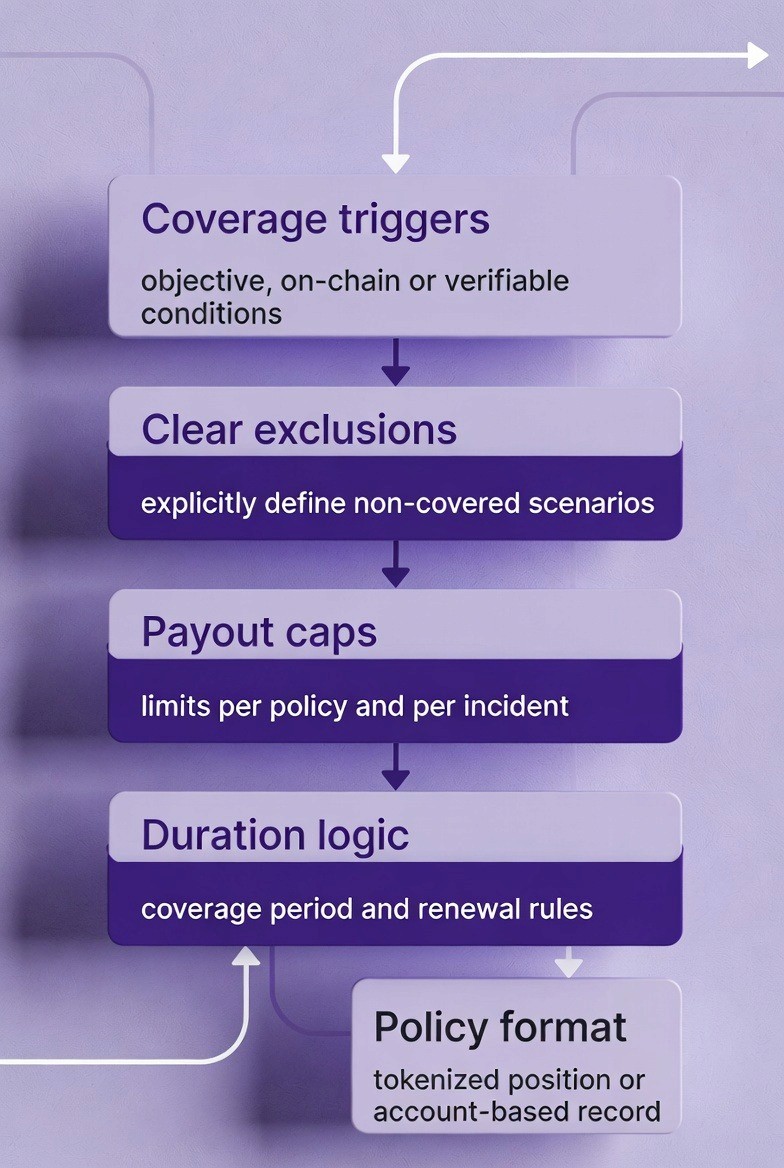

3. Designing Policies and Coverage Logic

Policies define limits, premiums, triggers, and duration.

Establish Coverage Ranges

Determine both the lowest and highest amount of coverage per each policy to allow smaller consumers to use the product, yet prevent an excessive amount of exposure for the system.

Establish Premium Logic

Determine how much you want to pay based upon your risk score, the amount of coverage you have purchased, and the length of time you are purchasing it for. The pricing formula needs to be dynamic so when your risk condition changes, then your pricing will also change.

Establish Triggers

Describe the specific on-chain or oracle events which will cause a claim to be activated (i.e., pause contract, failed transaction, abnormal price movement).

Address Edge Cases

Account for partial loss of value, overlap of claims caused by the same incident, and/or multiple claims related to a single event. A clear set of rules will reduce potential for confusion if there is a complicated failure of the product.

4. Underwriting and Risk Assessment Framework

Risk scoring combines automation and manual review.

Automated Evaluation of Risk

Risk is evaluated using an algorithm with the data collected from audits, the complexity of code, dependencies, and user behavior; automation provides for a rapid and uniform evaluation process.

Manually Review Large Policies

Large policy requests should require manual review prior to approval as it will greatly limit the amount of damage that can occur due to unknown risks (and subsequent loss).

Ongoing Monitoring of Risk

Ongoing monitoring of policy protocols, newly discovered vulnerabilities, and external threats post-policy issuance; risk does not remain constant through time.

Adjustments Based on Change in Risk Profile

Premiums/limits may be adjusted as the risk profile changes; dynamic systems help to prevent drain of reserves resulting from out-of-date assumptions.

5. Capital Pool and Solvency Architecture

A reserve strategy finds the balance between liquid reserves which will be available as a source of immediate cash flow and reserves with a potential to earn interest over long periods of time without having to tie up large amounts of capital.

Reserve Strategy:

The majority of your reserves should be held in stablecoins so you are able to make payouts to customers based on predictable prices during periods of panic selling in the market.

Yield Strategy:

Use low risk DeFi applications for your idle funds to earn income while maintaining your liquidity available for an immediate withdrawl.

Risk management:

Keep a minimum of the reserves available as a buffer to assure that you will be able to meet all claims if needed, even with an increased number of claims.

Portfolio rebalancing logic:

Automate the process of adjusting the portfolio based on the growth/decline of reserves to keep the risk exposure consistent with the original target.

6. Core Insurance Smart Contracts

Understood. Below is a simple, technical, step-by-step version, written clearly, compactly, and easy to follow, while still being implementation-level. No narrative, no NFTs, no extra theory.

Core Insurance Smart Contracts

Steps

Create a

Policydata structure with:user address

coverage amount

premium amount

start time and end time

deductible and max payout

risk type

active status

Store policies in a mapping using a unique policy ID.

When a user buys insurance:

calculate premium from risk and coverage

transfer premium to treasury

create and activate the policy

Automatically deactivate policies when the end time is reached.

Reject claims if the policy is inactive or expired.

Oracle-Driven Claims (Claim Verification)

Steps

User submits a claim with:

policy ID

loss amount

incident timestamp

Check that:

policy exists

policy was active at incident time

Request data from oracles:

price feeds

protocol status (paused, failed, abnormal state)

Compare oracle data with predefined trigger rules.

Approve the claim only if all trigger conditions are met.

Automated Payouts (Fund Transfer)

Steps

Calculate payout:

verified loss minus deductible

capped at policy max payout

Check treasury balance and solvency ratio.

Transfer stablecoins from treasury to user wallet.

Record payout details on-chain.

Mark claim as paid and prevent duplicate payouts.

Governed Updates (System Control)

Steps

Store key parameters on-chain:

premium formula

coverage limits

reserve ratio

oracle sources

Allow parameter changes only through governance contracts.

Use time locks before changes take effect.

Restrict emergency actions to approved roles.

Log all changes on-chain for transparency.

7. Oracle and Incident Detection Layer

Oracles can identify when a specific event occurs or a system has failed.

The price feed will monitor asset prices to determine the loss in value that occurred due to an event or if there was an abnormal move in the price.

An automation trigger is used to detect time-based or condition-based events using automated services.

A custom metric is created to track specific data associated with the protocol such as TVL drops, transaction failure rates etc.

Consensus rules are implemented requiring all oracles to agree on the occurrence of an event so that it cannot be manipulated by one oracle or that false triggers do not occur.

8. Claims Submission and Validation

Automatic verification or escalation occurs with claims.

Automated collection of standardized data for structured submissions: Examples of structured data include; policy id, timestamp, loss amount etc.

Oracle checks validity of claim submission: Automatic validation of submitted claims using the oracle system compared to transactions in the oracle database.

Fraudulent claims detection: Automatic identification of fraudulent claims based on overclaims and/or fabrication of claims via analysis of transaction data and claim dollar thresholds.

Escalation to governance review: The process routes a claim to be reviewed as part of the DAO system when the automated validation processes cannot determine if the claim is valid or invalid.

9. Payout Execution and Loss Handling

Payouts execute automatically within limits.

Immediate Payouts

Once an insurance claim has been approved, the payout contract makes direct transfers of stablecoin to the user's wallet from the Treasury Contract. The Treasury Contract prevents partial payment or delayed payment by executing the transfer of funds in one single transaction.

Loss Deductible Logic

Prior to a payout, the contract deducts the defined deductible amount from the verified loss amount. If the verified loss is less than the deductible, the claim is immediately rejected with no payout.

Solvency Ratio Checks

Prior to a payout the Treasury Contract ensures the payout will not drop the reserve below the minimum solvency ratio. If the solvency ratio will be dropped below the minimum, the payout will be halted and flagged for governance review.

Payout Limits

If the verified loss exceeds the limits of the policy, the contract will pay out the entire amount that the policy allows (i.e., the policy limit). Any additional loss remains uninsured and is documented for clarity.

10. Governance and Dispute Resolution

DAO governs updates and disputes.

Timelocked Proposals

Proposed governance changes are placed into a timelock smart contract where they will remain until the time frame is completed. This allows all parties an opportunity to review proposed changes and make any necessary position adjustments prior to the new parameters taking place.

Governing Rules of Voting

The Governance mechanism sets the minimum quorum and percentage of votes required to pass proposals. Votes are counted and verified on the blockchain. If the proposal does not meet the quorum or approval requirements it fails and cannot be passed.

Appeal Process

If a user feels that their claim was incorrectly denied or disputed, they can appeal the decision. They must provide further evidence such as additional information from a transaction or reference to an oracle to support their case. An appeal will initiate a second review process via a vote of the governance group or a review committee established specifically for this purpose.

Emergency Powers

A limited emergency role or multisignature account can temporarily halt contracts, turn off the ability to file claims and/or cancel payout processes when there is a catastrophic failure. All actions taken under emergency powers are recorded on the blockchain. It is then up to the governance body to determine whether the emergency action was justified and therefore should be allowed to remain in place.

11. Treasury Management and Capital Efficiency

Treasury balances safety and yield.

Primary liquidity

Keep sufficient liquid funds for immediate claims.Conservative yield

Avoid high-risk strategies that could lock or lose reserves.Allocation controls

Limit exposure to any single protocol or strategy.Risk limits

Set maximum loss thresholds for treasury operations.

12. Integration Into Existing Crypto Rails

Insurance embeds into existing apps.

Standard interfaces

Expose insurance contracts through stable, versioned interfaces (e.g., policy creation, claim submission, coverage query).

Define ABI-compatible functions for:

buyPolicy()getActiveCoverage()submitClaim()getClaimStatus()

Use standardized input/output formats so external protocols can call insurance contracts without custom adapters.

Lock interface changes behind version upgrades to avoid breaking integrations.

SDK integrations

Build client SDKs (JavaScript/TypeScript) that wrap contract calls and handle:

wallet connection

network selection

gas estimation

Expose high-level functions such as:

purchaseInsurance(positionId, amount)checkCoverage(userAddress)

Abstract contract complexity so frontend teams do not interact directly with low-level ABI calls.

Version SDK releases to match smart contract upgrades.

Bundled transactions

Combine insurance purchase with the main protocol action (deposit, swap, bridge) using a single transaction flow.

Use smart contract routers or multicall contracts to:

execute core action

collect insurance premium

issue policy atomically

Ensure that if any step fails, the entire transaction reverts to prevent partial execution.

Optimize gas by sharing calldata and approvals across bundled operations.

Security coordination

Share insurance contract architecture and integration points with partner protocol security teams.

Align audit scope so both insurance and core protocol interactions are reviewed together.

Synchronize deployment timelines to avoid mismatched contract versions.

Require post-deployment verification and monitoring before enabling insurance in production interfaces.

13. User Communication and UX

Clear UX improves trust.

Dashboards

Display coverage status, reserves, and claims clearly.Transparent pricing

Show premium calculations before purchase.Notifications

Alert users about expirations, incidents, and payouts.Plain language

Avoid technical jargon in user-facing communication.

14. Incident Response Playbooks

Transparency builds trust in Clear UX.

Dashboards

Provide a clear view of how covered you are, what your reserves and claims are.Transparency of Pricing

Show the customer what they will pay for their premium before they buy it.Notifications

Send the user notifications when there is an expiration, an incident or a payout.Using Plain Language

Use plain language in all communication with the user.

15. Monitoring and Continuous Improvement

Updates are driven by metrics.

Real-time dashboards

Provide live status of the systems being tracked.

Notifications

Send alerts to teams when threshold values are exceeded.

Reviewing data monthly

Review claims, pricing, and performance for reserves.

Feedback from users

Use actual input from users to enhance processes and provide clarity to users.

Technical Architecture Overview

The platform connects policy, claims, treasury, governance, and oracle layers into a unified system.

Smart Contracts, Oracles, Governance, and Treasury Layers

Each layer handles a specific function and communicates on-chain.

Policy NFTs

Oracle consensus

Treasury payouts

Governance controls

How Data and Funds Move During an Incident

Oracles detect events, claims verify, payouts execute, and records remain public.

Event detection

Claim validation

Reserve checks

Automated transfers

Diagram Description: Full system architecture.

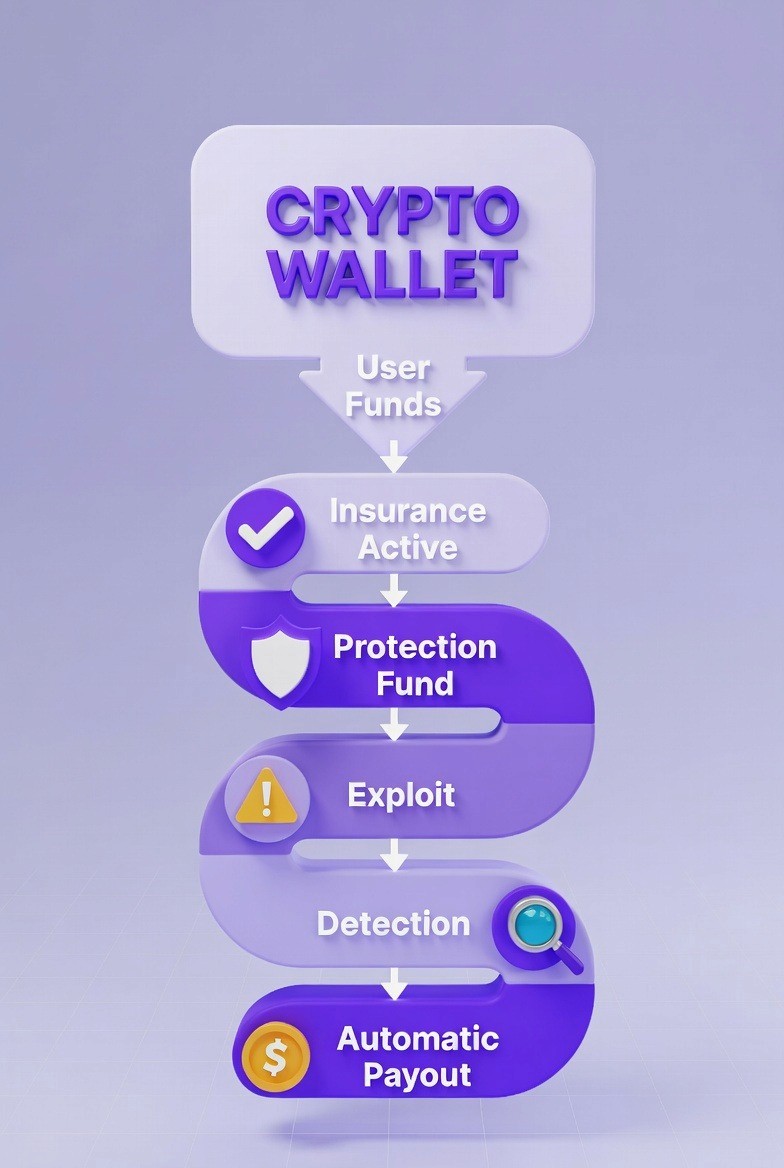

Real Implementation

DeFi insurance is implemented as a hidden safety net directly into an exchange or wallet's architecture instead of as a separate product users can choose to activate.

Automatic activation of insurance occurs via associated insurance contracts when a user deposits or holds funds in their wallet. The protection funds reside on the blockchain at all times, thus completely public.

Monitoring protocols are active 24/7 and track both wallet behaviors and on-chain transactions, allowing for detection of potential exploits early enough to trigger automatic payments without delay due to lengthy governance processes.

Manual review by a DAO (Decentralized Autonomous Organization) or a governing body would only occur in the case of a rare event, one with significant financial implications, or an ambiguous loss.

STEP-BY-STEP PROCESS

Exchange connects their wallet smart contract to the smart contract(s) for insurance.

When a user deposits money in their wallet or holds funds, insurance will be activated automatically.

Protection fees are automatically transferred to an on-chain protection fund that is always transparent and publicly auditable.

Logic-based monitoring of the wallets is performed continuously, analyzing all transactions and activities occurring on-chain.

Once an anomaly is identified or an exploit is discovered, predetermined insurance protocols are executed automatically.

Upon determining that a covered loss has occurred, an immediate payout from the on-chain protection fund is made, without having to wait days or weeks.

Large-losses, ambiguity-losses, or edge-case-losses are reviewed manually by a trusted group of individuals or a DAO.

By providing this architecture, the goal is to have DeFi insurance operate as "background" infrastructure; fast, predictable, and reliable, rather than as a reactive system which fails to perform when users need it most.

How TokenMinds Helps with Custom Defi Insurance Platform

TokenMinds helps protocols build their own custom DeFi insurance to solve the trust failures that are outlined in the above article. The company builds each protocol's insurance as a part of its core infrastructure and does not build it as an optional add-on for the protocol. TokenMinds provides customized smart contract insurance, oracle triggers, treasury logic and governance controls that are all tailored to be relevant to real on-chain risk events including oracle failures, bridge issues and system halts.

TokenMinds also integrates each of these smart contracts directly into the current crypto rails via standard interfaces, SDKS and bundled transaction sets. This means that, the user will have automatic access to the insurance once they start lending, swapping or bridging.

Conclusion

DeFi insurance must be built as core infrastructure. Custom platforms provide control, speed, and trust. Clear rules, transparent reserves, and automation create reliable outcomes during crises.

Teams that invest in proper insurance design protect users and strengthen long-term platform credibility.

FAQ

What makes DeFi Insurance Different than Traditional Insurance?

DeFi Insurance is executed through Smart Contracts that trigger automatically based on the DeFi Platform's Chain, where Claims and Payouts follow a predetermined set of Rules and Oracle Data for Faster On-Chain Settlement with Less Manual Review.

Why do most DeFi Insurance Systems Fail in Real Exploits?

DeFi Insurance Systems are typically governed by Slow Governance Processes, Vague Coverage Terms, and Manual Claim Handling Processes, which create Delayed Resolution and Uncertainty when Users Need Clear Answers and Action Immediately.

Why will a Custom DeFi Insurance Platform be Better than Third Party Insurance?

A Custom DeFi Insurance Platform allows the Protocol to have Full Control over all Coverage Rules, Claim Triggers, and Payouts, therefore the Insurance can be tailored to the Real Risks associated with the Protocol rather than generic External Policies.

How Are Claims Triggered and Validated On-Chain?

Claims Activate via Objective On-Chain Events or Oracle Data (Contract Pauses or Unusual Price Movements) that are Automatically Verified by Smart Contracts.

How Will a DeFi Insurance Platform Remain Solvent During Crises?

Solvency is Protected Using Transparent Reserves, Minimum Reserve Ratios, and Circuit Breaker Thresholds that Limit Payouts and Pause Policies When Such Thresholds are Met.

How Does DeFi Insurance Integrate into Existing Crypto Applications?

Integration occurs via Standard Contract Interfaces, SDKs, Bundled Transactions so that the Insurance Activates Seamlessly as part of Actions such as Swaps, Lending, Bridging, etc.