TL;DR

In this article, you’ll learn how to identify real regional Web3 micro-influencers by validating engagement quality, audience location, and on-chain activity, and how to build conversion-driven influencer campaigns using performance-based partnerships that focus on real user actions instead of vanity reach.

What are Crypto Influencers

Crypto Influencers are social media creators that have built an audience based on a focus on Blockchain, Cryptocurrency and Web3 topics, a role increasingly shaped by approaches outlined in this guide. These creators produce educational content, provide market analysis, review DeFi protocols, show off NFT projects and help explain emerging technology such as Smart Contracts and Decentralized Finance. Unlike traditional influencers that influence the fashion, lifestyle and entertainment industries, Crypto Influencers are focused on educating their followers about the Digital Asset Space.

Crypto Influencers come in all sizes – Nano-Influencers that have 1,000 followers and Mega-Influencers that have millions of followers. They can be found on various platforms including Twitter (X), TikTok, YouTube, Discord and Telegram. Their followers view them as experts in providing market insight, reviewing projects and explaining complex technical concepts. Ultimately, the most successful Crypto Influencers demonstrate that they truly understand the space in which they are promoting, through actual use of the wallets and by showing the transactions that prove they have actually used the projects they are promoting.

The best Crypto Influencers answer community questions and when unsure of information they will also admit that they don't know. This level of transparency is what creates credibility that no amount of temporary Celebrity Endorsements can provide.

Crypto influencers matter for Web3 projects because they bridge the gap between developers and users. A new DeFi protocol needs people who understand it and explain it clearly. A gaming blockchain needs players who demonstrate how it works. An NFT project needs collectors who vouch for its legitimacy. Crypto influencers fill this role.

Why Crypto Startups Choose Influencers Over Traditional Ads

Most crypto startups operate with limited budgets. Building a cryptocurrency from scratch costs money for development, security audits, legal compliance, and infrastructure. Marketing budgets shrink quickly. This is where influencer marketing becomes essential, a shift that has pushed many teams toward the micro-influencer model outlined in this approach

Traditional advertising costs far more. Paid search ads cost three dollars to five dollars per click. Programmatic display ads cost one dollar to three dollars per thousand impressions. Radio and podcast ads cost thousands per spot. These channels also show skepticism toward crypto projects, making placements difficult or impossible.

Influencer marketing costs significantly less. A micro-influencer with 30,000 engaged followers charges five hundred to one thousand dollars per post. For that investment, you reach 30,000 people who follow that creator specifically because they trust their recommendations. Compared to a five thousand dollar Google ad campaign that spreads across random audiences, the influencer route delivers better targeting for lower cost.

The math is clear. Crypto startups with five thousand to twenty thousand dollar monthly marketing budgets cannot afford major ad campaigns. They can afford five to ten influencer collaborations monthly. These collaborations create authentic conversations with audiences. As a result, conversion rates hit 6.5% to 15% versus 3.75% for traditional ads. For startups, this efficiency determines survival.

Google and Facebook have other limitations for crypto advertising; they need to be approved on an individual basis, are restricted from certain content, and in many cases completely block crypto advertisements. Crypto advertisers can do much more with influencers. Influencers have far less regulation over what they share than do big platforms. Influencers have the ability to post educational content, participate in AMAs (Ask Me Anythings) or even video tutorials. Therefore, due to this flexibility, influencers are becoming the default medium of choice for most crypto start-ups to market their products.

The Critical Issue: Fake Followers, Fake Engagement, and Inflated Metrics

The influencer marketing world has a serious problem. Many influencers buy followers, engagement pods, or bot comments to inflate their metrics, a risk that becomes clearer when teams rely on curated industry lists like this reference. A creator might claim 100,000 followers but only have 20,000 real followers and 80,000 bots. Their engagement rate appears healthy at 2%, but the real engagement on actual followers is 0.5%.

This deception destroys marketing budgets. A startup pays five thousand dollars to an influencer with claimed 100,000 followers expecting real reach. Instead, fifty thousand followers are inactive bots who never see the post. The startup loses money on worthless impressions.

Fake engagement works in different ways. Comment pods consist of 50 to 100 influencers who agree to like and comment on each other's posts within minutes of posting. This artificial engagement tricks algorithms into showing posts to wider audiences. The comments are meaningless (usually emojis or generic praise like "fire"). Real followers see fake discussions and lose trust.

Purchased followers are the most obvious red flag. An account grows from 5,000 followers to 50,000 followers in one week. Real organic growth never happens that fast. Social Blade will show a spike line going straight up. This pattern means purchased followers. These fake accounts have no profile pictures, no post history, and follow thousands of other accounts. They never engage with real content.

How to Spot Fake Influencers Data

1. Look at comment quality

Real comments ask questions or discuss the topic. Read the last 20 comments on a post. Count how many are real discussions versus emojis or one-word replies. Real crypto communities debate protocols. They ask about APY rates or smart contract details. If comments are all emojis like "🔥 nice project," the engagement is likely fake.

2. Check follower-to-engagement ratio on every platform

If a Twitter account has 50,000 followers but only 200 likes per tweet, something is wrong. Average tweets should get 0.5% to 2% engagement. Below 0.5% suggests dead followers. Above 10% suggests pods.

3. Analyze growth patterns on Social Blade

Healthy growth shows steady lines. Sudden spikes mean purchased followers. Look for growth on all platforms to be consistent. If someone has 50,000 Twitter followers but only 5,000 YouTube subscribers, audience sizes do not align. They may have bought Twitter followers but not YouTube.

4. Verify through on-chain data

Real DeFi influencers show actual wallet transactions. Use Etherscan or other block explorers to check. A DeFi expert should have swap history showing they actually use protocols. An NFT influencer should show past NFT purchases. If they cannot prove wallet activity, they lack real experience.

5. Check previous partnerships carefully

Ask for client references from past campaigns. Contact those brands directly. Ask specific questions: Did this influencer deliver the promised reach? How many clicks did they generate? What was the conversion rate? Did their followers actually buy or engage? Many influencers will not provide references because their past performance was poor.

6. Look for consistency in niche focus

Real experts stay in one area for six months or longer. They build deep knowledge. Fake influencers jump topics weekly. One week they promote a DeFi project. The next week they promote a gaming token. Then an NFT collection. Real experts know that switching topics loses credibility. They specialize instead.

7. Verify their previous partnerships for quality

A micro-influencer promoting scam projects shows poor judgment. Real experts reject shady projects. Real experts promote only quality protocols. If their history shows promotions for projects that later rugged (collapsed), they lack discernment or judgment. Avoid them.

8. Engage them in technical conversation

Ask a DeFi influencer detailed questions about yield farming or cross-chain bridges. Real experts give detailed answers. Fake experts give generic responses like "yield farming is great for passive income." Real experts explain APY calculations and impermanent loss risks.

Why Regional Micro-Influencers Work Best

Micro-influencers have follower counts between 10,000 and 100,000. These creators get better results than big influencers with millions of followers. In North America and Europe, small influencers get engagement rates between 3% and 6%. Bigger influencers on average get only 1.5% to 1.8% engagement. This means small influencers create more real conversations with their followers.

Businesses find more success with these smaller creators. They get 40% higher returns on their money compared to macro-influencers. Crypto campaigns with influencers see 6.5% conversion rates. This beats Google search ads at 3.75% and email marketing at 5%.

North America, Europe, and Asia have massive social media bases. TikTok engagement rates average 8-18% across these regions depending on niche. YouTube reaches millions daily with long-form technical content. Twitter (X) hosts crypto communities with strong engagement for focused accounts. Asia adds Telegram dominance in Indonesia/Singapore and YouTube tutorials in India/Japan, creating additional high-conversion platforms for regional campaigns.

Micro-Influencer Stats Beat Big Influencers

Small influencers keep close contact with followers. People see them as real experts, not paid ads. Nano-influencers (1,000 to 5,000 followers) actually get 6% to 9% engagement rates. Micro-influencers (10,000 to 100,000) get 3% to 5%. This inverts the follower-to-engagement relationship.

Small influencers help explain how DeFi and NFTs work well for Web3 projects because their followers believe what they say about technical stuff. Large influencers will read a script and quickly lose trust among their audience. Campaigns that are actually successful have shown that micro-influencers can create conversion rates of up to 15% on chain. That means, when you use a micro-influencer to promote your project, 15 of every 100 people who click on an ad will connect a digital wallet or make a purchase of tokens.

Additionally, micro-influencers based in the U.S., Canada, Europe, and Asia enjoy platform benefits tailored to regional regulations. TikTok allows crypto content in the US and Canada for FinCEN/FINTRAC-registered entities. Most European countries permit blockchain education content. Japan supports compliant DeFi discussions on Twitter. Singapore enables institutional content on LinkedIn/Telegram. Indonesia's TikTok thrives with gaming/memecoin content. YouTube delivers long-form technical tutorials globally while Twitter hosts real-time DeFi discussions across all regions. These platforms create multiple high-engagement channels for localized campaigns.

Table 1: Engagement Rates by Influencer Size in North America and Europe

Influencer Size | Follower Range | North America Rate | Europe Rate | On-Chain Conversion |

Nano | 1,000-5,000 | 6-9% | 6-8% | 12-18% |

Micro Early | 5,000-10,000 | 4-6% | 4-5% | 8-15% |

Micro Growth | 10,000-50,000 | 3-4% | 2.5-4% | 6-12% |

Micro Max | 50,000-100,000 | 2-3% | 1.8-2.5% | 4-8% |

Macro | 100,000+ | 1.5-1.8% | 1.5-1.8% | 2-4% |

How to Find Regional Web3 Micro-Influencers That Convert

To find Web3 micro-influencers in your region that can create wallet engagements using a systematic approach of seven steps for each Web2 platform to search for influencers based on their authenticity, audience characteristics and performance.

Using this method creates opportunities to identify creators with 10K to 100K followers that have 6-15% on chain wallet conversions from the United States, Canada, and Europe.

Step 1: Create A Platform & Location Based Keyword Matrix To Find Influencers

Twitter (X) Search Terms By Platform

"DeFi yield US" near:New York within:15mi

"NFT mint Canada" near:Toronto within:25mi

"Web3 gaming" near:London within:20mi

"Ethereum developer" near:Berlin lang:de

TikTok Searches By Platform

#DeFiUS + #NYCcrypto (US trading focus)

#NFTCanada + #TorontoWeb3 (Canadian NFT collectors)

#Web3Europe + #ParisBlockchain (French DeFi)

YouTube Advanced Search:

"Solana tutorial" + Canada filter

"Polygon DeFi" + Germany location

"NFT strategy 2026" + UK filter

Discord/Telegram: Join 20+ regional servers (NYC Crypto, Toronto Blockchain, London DeFi) and identify top voices by reply count and question quality.

Step 2: Initial Filter - Follower Range + Engagement Threshold

From search results, filter to:

10K-100K followers (micro-influencer sweet spot)

Minimum 2.5% engagement rate (likes+comments+retweets ÷ followers)

Last 30 days posting frequency: 3+ posts/week

Profile age: 6+ months in crypto niche

Quick Engagement Math:

text

Engagement Rate = (Likes + Comments + Retweets) ÷ Followers × 100

Example: 50K followers, 1,800 total engagement = 3.6% (GOOD)

Example: 50K followers, 400 total engagement = 0.8% (DEAD)

Step 3: Geographic Audience Verification

Regional marketing campaigns are doomed to fail if they do not have clear geographic targeting. An example of this is an influencer with 40% of their followers from New York City would work great for a U.S.-based trading campaign while the same influencer with 40% of their followers from Mumbai would kill returns on investment (ROI) in a similar campaign. Here are four tools that will validate the shortlist of creators you have selected to ensure that the creators you select have a sufficient number of followers in your target geography before you spend one dollar.

Twitter Analytics (natively available on Twitter platform): Reviewing audience demographics by region

You can access the location demographics of your influencer’s followers by accessing the Twitter Analytics dashboard → Audience Insights Tab. This native tool provides a breakdown of the top countries, metropolitan areas, and cities where the followers live based on the location data associated with the profiles of the followers. It helps establish whether or not there is enough concentration of followers from major cities such as NYC / Miami / Chicago (and not international cities) so you know which influencers to go after. Once you have established a baseline level of geographic relevance, you can then dig deeper into the influencers’ locations.

HypeAuditor: Follower country breakdown + Audience Quality Score

HypeAuditor creates a pie chart of the follower countries for each influencer along with an “Audience Quality Score” (0-100). HypeAuditor flags when an influencer has an unusually high concentration of followers from the same country (e.g., India/Brazil/Nigeria), and it also gives you a threshold of 70%+ of followers from countries such as US / Canada / Europe that you want to include in your campaign(s). In addition, the “Audience Quality Score” measures how much of an influencer’s followers are bots; and while the raw follower count may look good, many bots have fake follower accounts located in other parts of the world.

Modash: Interactive demographic heat maps by city/region

Modash creates an interactive heat map of each influencer’s follower density by state/province/country, and specifically by major city. For example, you could see that an influencer has 45% of their followers from California and 20% from New York City. This gives you granular geographic targeting capabilities that are better than just using the country-level data. If you are looking to target traders in Los Angeles, you need to be able to target them at the city level (Los Angeles) and not just at the country level (US).

SparkToro: Comparing influencer followers to your target keywords (influencers that write about trading)

SparkToro compares the followers of the influencers you are interested in to your target keywords (traders / DeFi / NFTs). They then give you a percentage overlap of those followers with your ideal audience (i.e., people who follow influencers writing about trading-related topics and not lifestyle browsers), and where else the followers of the influencers you are considering are located. This helps prevent you from wasting money on influencers whose followers do not align with your niche or geography.

Table: Common Red Flags

Campaign Target | Problematic Follower Distribution | Issue |

US | 40%+ from India/Brazil/Nigeria | Wrong geography entirely |

Canada | 30%+ from United States | Message dilution across borders |

Germany | Majority UK followers, no German speakers | Language + cultural disconnect |

Japan | 35%+ English-only global audience | Must be Japanese language focused |

Singapore | 40%+ retail memecoin followers | Need institutional/trading focus |

Indonesia | Under 50% Bahasa Indonesia speakers | Local language essential for conversions |

Step 4: Authenticity Screening (Fake Follower Detection)

Apply these 5 mandatory checks:

Social Blade Growth Pattern: Steady 5-15% monthly growth (no spikes)

Comment Quality Analysis: Read last 30 comments - 70%+ should ask real questions

Er Ratio Test: Followers ÷ Average Engagement should be 25-50x (not 100x+)

Cross-Platform Consistency: Twitter 40K ↔ YouTube 15K-30K (reasonable ratio)

On-Chain Proof: Etherscan shows 10+ DeFi swaps or NFT purchases past 90 days

Step 5: Niche Expertise Validation

Score influencers 0-10 across these criteria (minimum score: 7):

Content Depth: Explains APY math, impermanent loss, MEV (not "good project")

Consistency: 85%+ posts same niche past 6 months

Community Interaction: Answers 70%+ follower questions in comments/Discord

Proof of Work: Shows wallet screenshots, live demos, testnet transactions

Past Results: 3+ documented campaigns with client testimonials

Step 6: Conversion Potential Assessment

Before final selection, test conversion likelihood:

DM Technical Question: "What's your strategy for mitigating IL in volatile pairs?"

Request Case Study: "Show me your best campaign ROI from Q4 2025"

Audience Overlap Check: Use SparkToro to verify 30%+ audience matches your ICP

Content Fit Test: Ask them to write sample thread (paid $50 test)

Step 7: Performance Contract Structure

Structure deals to guarantee results, for example

Base: $300 + $2/click (CPC model)

Bonus: $500 if 8%+ conversion rate

Revenue Share: 7% of trading volume from their links

Minimum: 2,500 clicks guaranteed

Duration: 90-day partnership minimum

Table: Regional Platform Weighting Guide

Region | Platform Priority | Content Type | Target Audience |

US | TikTok (40%), Twitter (35%), YouTube (25%) | Fast trading tutorials, quick wins | 18-34 traders |

Canada | Twitter (45%), YouTube (30%), TikTok (25%) | Balanced yield + trading | 22-40 DeFi users |

UK | Twitter (50%), YouTube (30%), Discord (20%) | Educational deep dives | 25-45 governance |

Germany | YouTube (45%), Twitter (35%), LinkedIn (20%) | Technical analysis | 28-45 developers |

France | TikTok (40%), Twitter (35%), YouTube (25%) | NFT + gaming focus | 20-35 collectors |

Japan | Twitter (60%), YouTube (25%), Discord (15%) | Smart contract tutorials (Japanese) | 25-45 developers |

Singapore | LinkedIn (40%), Twitter (35%), Telegram (25%) | Institutional DeFi/CeFi | 28-50 funds/traders |

Indonesia | TikTok (45%), Telegram (35%), Twitter (20%) | Gaming, memecoins, retail | 18-30 retail traders |

India | YouTube (50%), Twitter (30%), Instagram (20%) | Hindi DeFi tutorials, remittance | 20-35 mass market |

Expected Results Matrix:

Campaign Size | Influencers | Budget | Expected Wallet Connects | Conversion Rate |

Test | 10 | $3K | 150-300 | 8-12% |

Growth | 50 | $15K | 800-1,500 | 10-15% |

Scale | 150 | $45K | 2,500-4,000 | 12-18% |

The combination of geographic precision, authenticity screening, and performance-based contracts eliminates 90% of campaign risk while maximizing on-chain conversion rates.

Regional Micro Influencer Campaign Execution & Management Steps

After finding the right regional micro-influencers using the discovery process, these execution steps activate your campaign, track performance, optimize results, and build lasting partnerships across US, Canada, and Europe markets.

Step 1: Know Your Exact Target Users

Start by writing down who you want to reach. List specific user types for your blockchain project. Traders buy and sell tokens fast. Liquidity providers earn yields. Governance users vote on decisions. Developers build apps. New users come from Web2. NFT collectors mint projects. DeFi users chase yields.Each group needs different messages. DeFi projects need influencers who explain tokenomics. NFT projects need creators who know minting and markets. Pick one main user type first.

Location matters most for regional campaigns. US crypto users follow different trends than European users. US users focus on trading and quick gains. European users (especially Germany and France) focus on sustainable DeFi yields. Canadian users bridge both approaches. Write down these details:

Main user type (traders, collectors, developers)

Target countries (US, Canada, or specific EU countries)

User age range

Crypto experience level

Problems your project solves

Content type they prefer (video, text, audio)

Platform preference (TikTok, YouTube, Twitter, Discord)

This list guides all influencer searches.

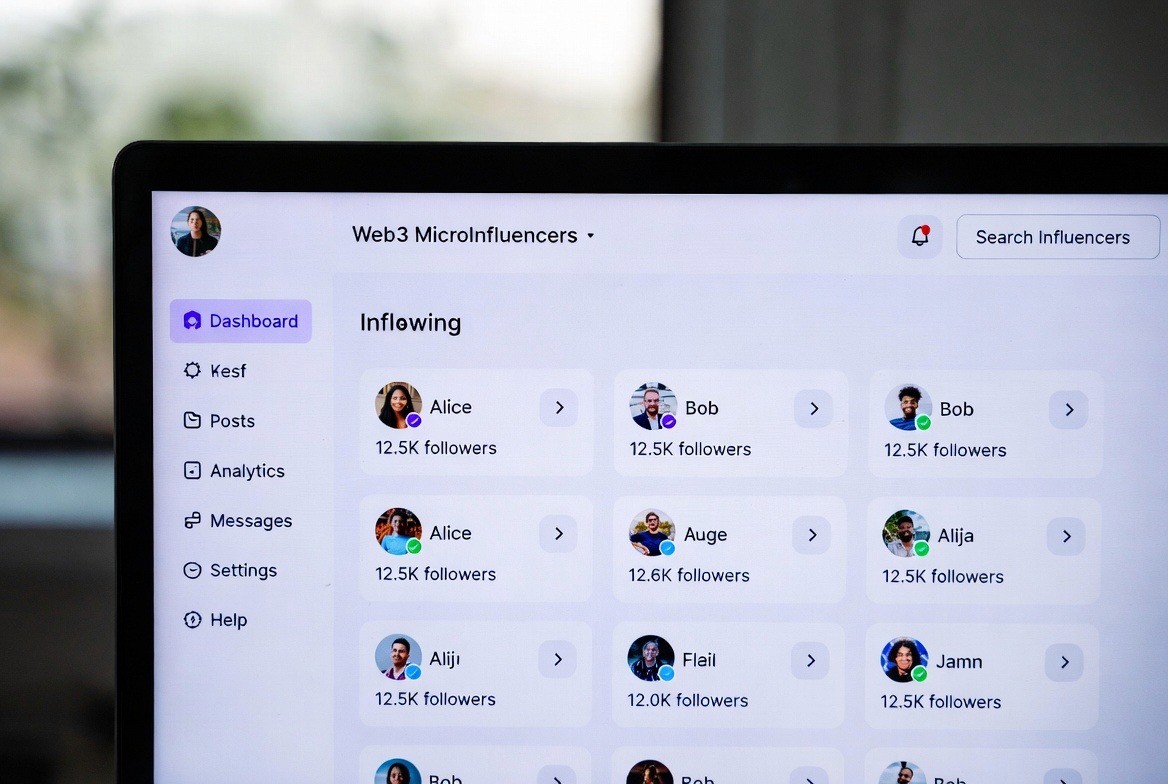

Step 2: Use Web3-Specific Search Platforms

Regular Instagram tools miss crypto creators. Use platforms built for blockchain. Influur has 30,000+ Web3 influencers. They check for real crypto knowledge, not just bio keywords. Smart contracts handle payments. Dashboards track campaigns.

StarNgage filters by DeFi, NFT, or metaverse focus. It blocks fake engagement. Archive finds natural project mentions. Its AI scans video, audio, and text across platforms. Blockwiz manages full campaigns. They pick creators and run Twitter, YouTube, and Discord posts.

For North American and European searches specifically, use Twitter search directly. Search "DeFi tutorial" or "NFT guide" to find organic creators. Look for verified accounts. Use Feedspot's DeFi Influencers list which ranks top 100 creators by real engagement and follower quality.

Use all these tools together:

Influur for Web3 creators

StarNgage for niche filters

Archive for community voices

Feedspot for ranked DeFi creators

Twitter search for organic discovery

This finds influencers from multiple sources with verified audiences.feedspot+1

Step 3: Check Real Engagement Numbers

Do not look only at follower counts. A 50,000 follower account with real fans beats 500,000 fake followers. Calculate engagement rate first. Take total likes plus comments plus shares plus retweets. Divide by followers. Multiply by 100.

Good rates run 2% to 4% on most platforms. Web3 rates hit 4% to 6% for active creators. Below 1.5% shows dead accounts. Above 10% suggests engagement pods or artificial inflation.

Read recent comments carefully. Real comments ask smart questions. They discuss post content. Fake comments use the same phrases or emojis only. Web3 comments talk protocols and yields. "WAGMI" spam without context shows no real interest.

Use these verification tools:

HypeAuditor: audience quality scores

Social Blade: growth patterns

Modash: demographic breakdowns

Followerwonk: Twitter analysis

Look for steady growth. No sudden spikes. Followers match your country targets. No bot patterns like empty profiles or sudden follower jumps.

Step 4: Match Audience to Your Users

Real followers must fit your project. 40,000 teen followers help NFT games but not DeFi for traders. Check these factors:

Country breakdown (70%+ in target area)

Age groups that match users

Crypto interests (wallet activity)

On-chain proof (DeFi swaps, NFT buys)

Klear shows demographics. Formo tracks wallet types: traders versus governance users. US campaigns need 60%+ local followers. Canada campaigns need similar levels. European campaigns should split across target countries (UK, Germany, France). Regional mismatch fails conversion.

Step 5: Test Niche Knowledge Depth

Web3 splits into separate areas. DeFi creators cover yields and contracts. NFT creators discuss mints and flips. Gaming creators explain play-to-earn. Match your project exactly.

Check last 3 months of posts:

Same topic focus?

Clear explanations of hard ideas?

Proof they tested projects?

Followers ask expert questions?

6+ months in the same niche?

Real experts show DeFi math or yield calculations. Generic "buy this coin" posts show no depth. Check their Twitter history. Real DeFi influencers debate tokenomics. Real NFT influencers discuss floor prices and rarity. Ask for past campaign results. Contact those brands. Check if they got real conversions.

Table 2: Niche Check List

Check Item | Good Sign | Warning Sign |

Post Focus | 90% same niche | Jumps topics weekly |

Tech Detail | Explains APY math | "Buy now" only |

Follower Talk | Asks about contracts | Emojis only |

Content Types | Threads plus video | Reposts only |

Past Work | 3+ campaign results | No examples |

Community Role | Answers Discord questions | Never mentioned |

Step 6: Set Up Conversion Tracking

Track every click to wallet action. Use UTM links per influencer: utm_source=john_crypto_id. On-chain tags record which creator drove each wallet connect.

Track these numbers:

CTR: clicks divided by impressions

CPE: spend divided by interactions

CPC: spend divided by clicks

Wallet connects per creator

Conversion: on-chain actions divided by clicks

Revenue per influencer

Dune Analytics shows real-time wallet moves. Google Analytics handles web traffic. Most crypto campaigns should aim for 6% to 15% on-chain conversion rates from influencer clicks.awisee+1

Step 7: Pay for Results, Not Posts

Flat fees create no accountability. Five thousand dollars for one post means no follow-through. Pay per result instead:

CPC: one dollar to three dollars per click

Revenue share: 5% to 10% of sales

Bonus tiers: five hundred dollars plus two dollars per wallet

Hybrid: five hundred dollars base plus performance

Micro-influencers earn six hundred to one thousand dollars from 30k followers at two dollars per click. Smart contracts auto-pay on milestones. Influur runs these automatically.

Step 8: Build 3-6 Month Partnerships

One post gets awareness. Monthly posts build trust. Seven times higher conversions come from repeat mentions. Pay one thousand to three thousand dollars monthly for 4 to 8 posts plus Discord help.

Second-month content shows real knowledge. Followers see growing expertise. Influencers gain from token growth. They promote harder when invested.

Agencies in North America reported that campaigns with repeat influencer partnerships generated 19% average engagement and 1.5 million plus interactions over six months. Projects using 300 to 400 micro-influencers across regions achieved five times higher ROI compared to single macro-influencer campaigns.

Step 10: Final Vetting Process

Check growth charts on Social Blade. Steady lines good, spikes bad. Read 50 recent comments. Real talk versus spam. Get 3 past client contacts. Verify results.

Cross-check platforms. 50k Twitter should match YouTube engagement. Etherscan their wallet. Real DeFi promoters show swaps. Value match: do they skip scam projects? Do they promote only quality projects? Influencers who turned down questionable projects show integrity.

Table 3: 12-Week Campaign Plan

Week | Action | Goal | Metrics |

1-2 | Research plus vet | 20 candidates | Engagement 3%+ |

3 | Sign contracts | 8-12 deals | Terms locked |

4-6 | First posts | 3k clicks | 10% CTR |

7-8 | Analyze plus adjust | Double winners | 15% conversion |

9-12 | Monthly content | 5x initial | 30-day retention |

Proven Regional Micro-Influencers By Country

Region / Country | Influencer | Platform | Audience Size (approx.) | Niche / Focus |

USA | @DeFi_Dad | X (Twitter) | 150K+ | DeFi education, yield strategies |

USA | @0xngmi | X (Twitter) | 60K+ | DeFi analytics, on-chain data |

USA | @DefiIgnas | X (Twitter) | 80K+ | DeFi research, community insights |

Asia (Singapore) | @AnalisaCrypto | X (Twitter) | 70K+ | Crypto education, Asian markets |

Asia (Indonesia) | @GabRey99 | X (Twitter) | 80K+ | Local Web3 insights, community building |

Asia (India) | Hitesh Malviya | YouTube | 20K+ | Hindi crypto tutorials |

Asia (Japan) | @IHayato | X (Twitter) | 40K+ | Japanese crypto education |

Asia (Japan) | @poipoikunpoi | X (Twitter) | 30K+ | Crypto news, trends in Japan |

Asia (Japan) | @Coin_and_Peace | X (Twitter) | 25K+ | Blockchain learning, Japanese audience |

FAQ

Why do regional Web3 micro-influencers convert better than big crypto influencers?

Because micro-influencers have tighter communities and higher trust. Their followers engage in real conversations about DeFi, NFTs, and Web3 tools, which leads to stronger credibility and higher on-chain conversion rates than large influencers who often feel like paid ads.

How can Web3 teams avoid fake influencers and inflated metrics?

By checking engagement quality, growth patterns, and on-chain activity instead of follower counts. Real influencers show steady audience growth, meaningful comments, and actual wallet usage, while fake ones rely on bots, engagement pods, and sudden follower spikes.

Why does regional targeting matter so much in crypto influencer campaigns?

Because user behavior differs by geography. US audiences focus more on trading speed, Europeans care about sustainable DeFi, and Canadian users sit in between. Regional creators speak the language, culture, and regulatory context of their audience, which drives higher trust and conversion.

What makes a Web3 micro-influencer truly effective for conversions?

Depth of expertise, not reach. Influencers who explain APY math, smart contract risks, and real use cases attract serious users. This technical credibility turns clicks into wallet connections instead of just impressions.

Why should crypto startups use performance-based influencer contracts?

Because paying for results protects marketing budgets. Models based on clicks, wallet connects, or revenue share align incentives, reduce risk from underperforming creators, and turn influencer marketing into a predictable growth channel rather than a gamble.

How TokenMinds Can Help You Solve Regional Influencer Challenges

Finding the right regional micro-influencers represents one of the biggest hurdles for crypto projects. The ten-step process outlined earlier works, but executing it requires time-intensive research, deep platform knowledge, and constant vigilance against fake metrics. Most crypto teams lack bandwidth to analyze Social Blade charts, read thousands of comments, or cross-check Etherscan wallets while building their protocol.

TokenMinds addresses these exact pain points by handling the complexity of regional influencer discovery and management. Our approach directly solves the challenges of fake followers, audience mismatch, and niche expertise gaps that plague most campaigns.

Conclusion

Regional micro-influencers are no longer just a tactical alternative to large creators; they are becoming a core growth engine for Web3 teams that care about real outcomes. When campaigns are built around audience relevance, trust, and measurable engagement rather than raw reach. They consistently deliver higher-quality users, stronger community ties, and more reliable conversion performance. The result is a shift from vanity-driven marketing to a disciplined, performance-led model where creator partnerships become a predictable driver of adoption, not just awareness.

Schedule a complimentary consultation with TokenMinds to explore how your organization can design a creator growth strategy that delivers real users, not just impressions. Our team will help you identify high-impact regional creators, structure performance-based partnerships, and build a scalable activation framework that turns local communities into active participants while keeping your marketing spend efficient, accountable, and aligned with long-term ecosystem growth.