TL:DR

How tokenized Murabaha enables Islamic banks to reduce execution costs, eliminate settlement delays, and scale Shariah compliant financing through onchain verification, controlled token transfers, and immutable transaction records.

Every day, Islamic banks buy and sell millions of dollars worth of commodities. Not because they need the metals. But because Islamic law prohibits interest, and commodity trading provides a workaround.

The system has three problems. High costs make small deals impossible. Long delays create chaos. Manual processes prevent growth.

For banks processing hundreds of transactions weekly, this is a nightmare. Trading desks coordinate across time zones. Compliance teams verify paperwork. Settlement staff track dozens of deals, a strain that becomes more manageable through this asset tokenization approach.

Murabaha in Islamic Finance

Murabaha is Islamic finance's most common tool for providing financing without interest. A client needs $1 million for 90 days. In conventional banking, they borrow money and pay interest. Islamic law forbids this.

Instead, the bank buys commodities (like copper or aluminum) for $1 million. The bank sells the commodities to the client for $1.03 million, payable in 90 days. The client immediately sells the commodities back to the market for $1 million cash. The $30,000 markup comes from a sale transaction, not from lending at interest.

The asset must be real. Ownership must genuinely transfer. Pricing must be transparent. Banks process billions in murabaha transactions annually.

What Is Tokenization?

Tokenization represents real assets as digital tokens on a blockchain. A token is a unique digital asset recorded on a distributed ledger. When you own a token representing 100 ounces of gold, the blockchain records your ownership. When you sell that token, the blockchain updates instantly.

For murabaha, commodities become digital tokens. When the bank buys the commodity, tokens transfer to the bank's address. When they sell to the client, tokens transfer to the client's address. Ownership moves digitally in seconds instead of days.

Smart contracts verify ownership transfers at each step. They check pricing is transparent. They confirm the commodity is approved. Manual checking becomes automatic, a workflow executed through this tokenization platform.

The Core Problems

1. Issuance Friction

Every murabaha needs extensive setup. The bank verifies client identity. Compliance checks sanctions lists. Shariah desk approves structure. Legal prepares documents.

Fixed costs hit $150 to $200 per transaction. For a $25,000 murabaha, that's 0.8% overhead before the client gets funds. For deals under $100,000, the economics don't work. Small businesses get locked out, a constraint exposed when issuance is not optimized in this asset tokenization guide.

2. Execution Delays

Traditional murabaha has five steps. Client approval takes four to six hours. Commodity purchase takes two to four hours. Ownership verification takes 12 to 24 hours. Documentation takes four to six hours. Final resale takes two to four hours.

Total time spans two to three days. Market prices move during this period. Coordination gets complex with volume.

3. Scaling Constraints

Manual processing creates hard limits. Doubling volume might need triple the staff. Coordination complexity grows faster than volume. Systems designed for simple loans need workarounds for commodity trades.

High costs limit the market. Limited markets prevent infrastructure investment. Lack of infrastructure keeps costs high.

Why ADIB as a Case Study

Abu Dhabi Islamic Bank (ADIB) is one of the largest Islamic Banks globally, with operations across several jurisdictions with strict Shariah requirements. ADIB was also one of the earliest blockchain adopters and its implementation of tokenized murabaha has been validated by Shariah scholars and regulators alike and therefore represents a credible and proven real-world example of how tokenization can be implemented securely, on a large scale and within regulatory compliance.

Relevant AAOIFI Shariah Standards for Tokenized Murabaha

AAOIFI Shariah Standard No. 8: Murabaha to the Purchase Orderer

AAOIFI Shariah Standard No. 17: Possession (Qabd)

AAOIFI Shariah Standard No. 5: Guarantees

AAOIFI Shariah Standard No. 21: Financial Papers (Sukuk-related ownership principles)

AAOIFI Shariah Standard No. 41: Islamic Windows (governance and segregation of contracts)

The Implementation Guide

Abu Dhabi Islamic Bank (ADIB), as an example of how some real world Islamic banks have been implementing Blockchain into their Murabaha type financing processes in actual use cases.

Abu Dhabi Islamic Bank (ADIB) has actually applied Distributed Ledger Technology in its Trade Finance and Murabaha based transactions to digitally document the flow of the transaction, and enforce the proper sequence of the transactions, while also improving coordination among all parties involved under Shariah rules and regulations.

How Abu Dhabi Islamic Bank (ADIB) Implemented Tokenized Murabaha

1. Asset-Native Issuance Implementation

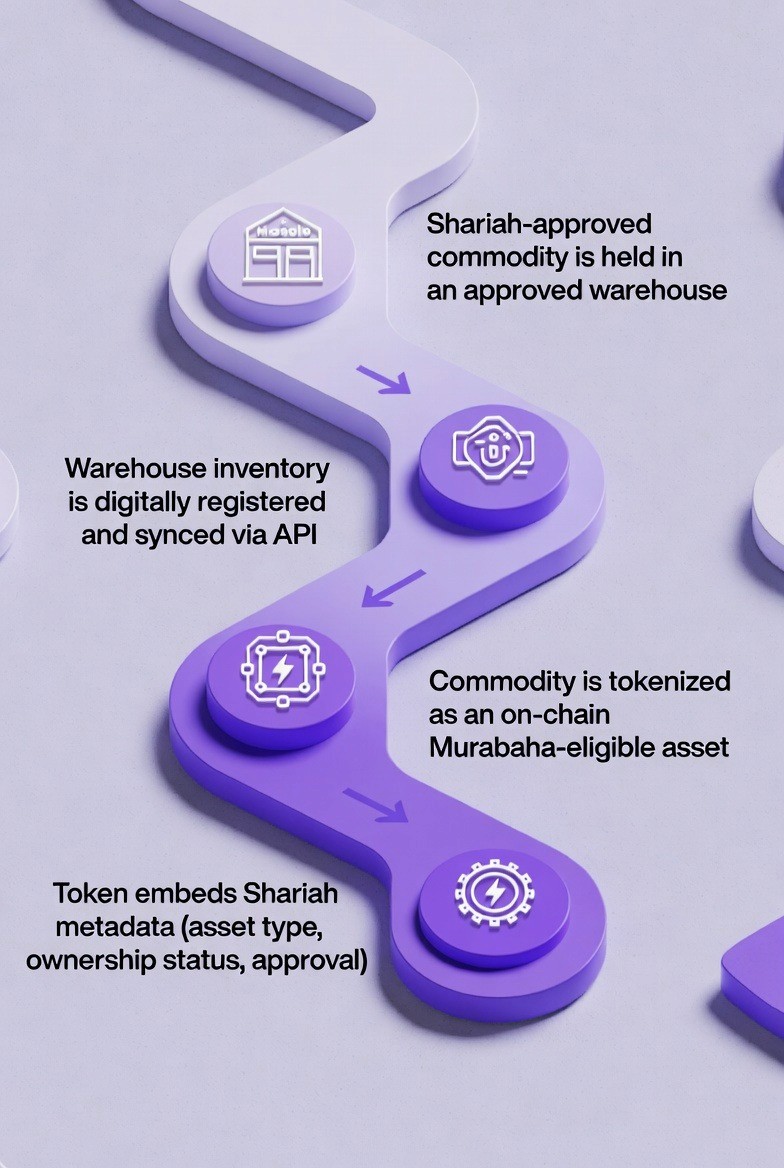

ADIB partnered with approved warehouses that maintain digital inventory registries. When creating a commodity token, ADIB links it to specific metal in a specific warehouse using the ERC-1155 standard on Hyperledger Fabric.

The warehouse registry updates via API when tokens transfer. Records stay synchronized between blockchain and physical inventory. Legal agreements across jurisdictions ensure token ownership equals legal commodity ownership.

Each token contains metadata. Warehouse location. Metal type. Quantity. Registry reference. Current market value. Shariah compliance certification. Ownership history. Quality certificates. Insurance documents.

Benefits: Ownership verification that took 12-24 hours now happens instantly through cryptographic proof. Eliminates back-office staff who verified ownership manually. Creates immutable audit trail. Transaction costs drop from $175 to $12, a 93% reduction.

Legal Enforceability Boundary Conditions:

Warehouse Bailment Agreement

The warehouse bailment agreement was modified to provide protection for token holders. As bailees, the operators maintain legal title to the tokens; however, the token holders maintain all beneficial rights to the tokens.

Protection of Assets

All tokens are held in segregated accounts off of the balance sheet. In the event that the operator becomes insolvent, the token holders will be entitled to claim the value of the assets before anyone else.

Enforceability of the Ledger Agreement

The Ledger Agreement is a legally binding contract pursuant to The UK Electronic Communications Act 2000 and jurisdiction can be asserted in UAE, Singapore and Switzerland. In addition, the English Commercial Court has been given the power to enforce the Ledger Agreement.

2. Atomic Execution Implementation

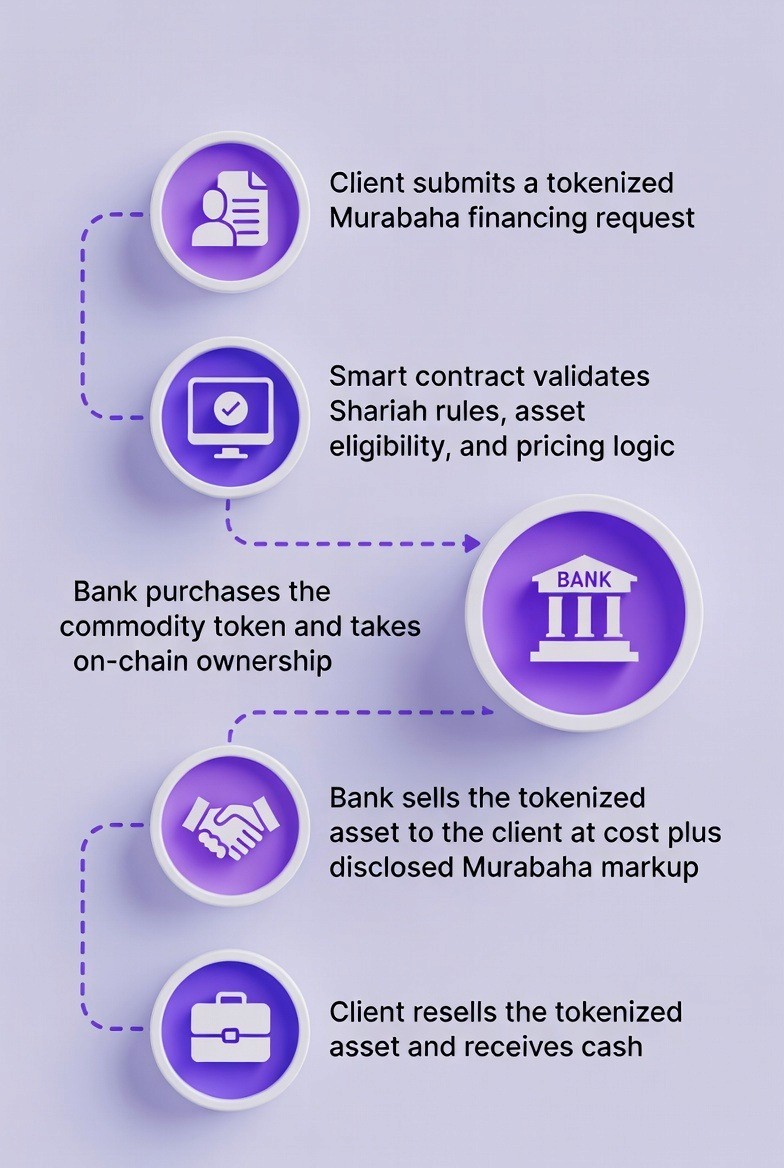

To facilitate the client's request for funding, the system generates an initial transaction proposal. Upon approval of the proposal, the contract then initiates a series of eligibility checks. This includes checking the client's information as well as their credit score through Oracle-based API calls. After that, it will check whether or not the transaction is compliant with Shariah rules and if there are no sanctions against the client.

The contract calculates markup using Shariah-approved formulas. It considers amount, term, credit profile, and market conditions. It identifies available commodity tokens. Queries suppliers. Selects optimal options.

Then executes an atomic bundle. Purchases tokens from broker. Transfers to bank's address. Records on blockchain. Transfers from bank to client. Executes markup sale creating payment obligation. Sells from client back to market. Settles cash to client account. Finalizes all records.

In terms of Settlement Integration, Atomic Swap Logic is used to "lock" commodity tokens in Escrow. It sends payment instructions to banking systems using SWIFT. It receives confirmation that the cash has been transferred. The tokens are released from Escrow only upon receipt of confirmation of the cash. If the cash transaction fails, the tokens automatically return.

Failure Modes & Dispute Resolution:

Scenario | Trigger | Response | Timeout |

Price Discrepancy | >0.5% variance | Auto-expire transaction | Immediate |

API Outage | Registry offline | Escrow tokens; rollback if unresolved | 15 min |

Payment Delay | No SWIFT confirmation | Reverse transfer | 30 min |

Shariah Breach | Invalid asset/party | Rollback; flag for review | Immediate |

Dispute | Contested outcome | Blockchain proof → arbitration → court | Variable |

Key Takeaways:

Either all five steps complete or the transaction rolls back.

No partial execution.

Collapses 26-44 hour process into 90 minutes.

Time reduction of 96%.

Eliminates reconciliation.

Error rate drops from 2.3% to 0.02%.

3. Embedded Shariah Controls Implementation

ADIB encoded Shariah rules into smart contract logic. The commodity whitelist lives on-chain. Maintained by the Shariah advisory board. Currently includes LME base metals: copper, aluminum, nickel, zinc, lead, tin. The board updates the list. The contract enforces it automatically.

The ownership verification occurs through cryptography. The smart contract will only allow the bank to sell to their clients after verifying that they own the tokens as verified by the bank's address. The mathematical proof is done automatically eliminating the need for manual verification.

Markup transparency is programmatic. The contract displays principal, markup, total payment, and due date. Requires client digital signature. Records acknowledgment on blockchain.

Party authorization queries identity credentials. Verifies banks have Islamic banking licenses. Clients completed KYC. Brokers have AAOIFI approval. The contract won't execute without verification.

For price data, ADIB connects to CME Group, Refinitiv, and Bloomberg. The contract queries all three. Uses median price. Updates every 60 seconds during market hours. For credit scoring, API connections to Experian and Equifax provide real-time data. For Shariah compliance, connections to AAOIFI registry verify approved scholars and structures. Sanctions screening connects to OFAC, UN, and EU lists.

Key Takeaways:

Shariah scholars review code once.

It enforces compliance for thousands of transactions. Reduces manual compliance workload by 75%.

Creates permanent verification record.

Multiple data sources with cryptographic verification prevent manipulation.

Real-time data eliminates waiting for quotes.

Table of Comparison:

ADIB vs. Conventional Bank Tawarruq Desks

Aspect | Conventional Bank Tawarruq | ADIB's Tokenized Approach |

Execution Model | Batch-processed via broker chains | Atomic on-chain execution |

Settlement Time | T+2 documentation cycles | Real-time (90 minutes) |

Reconciliation | End-of-day manual reconciliation | Automated cryptographic verification |

Broker Dependency | Multiple broker queuing required | Direct on-chain settlement, no broker queues |

Transaction Costs | $150-$200 per transaction | $12 per transaction |

Ownership Verification | Manual (12-24 hours) | Instant cryptographic proof |

Batch Risk | High (partial execution possible) | Eliminated (atomic all-or-nothing) |

Scalability | Linear staff increase with volume | Code-enforced, minimal staff increase |

Murabaha vs. Tawarruq: Structural Distinction

Element | Murabaha | Tawarruq (Organized) |

Primary Purpose | Asset acquisition financing | Liquidity generation |

Client Intent | Acquire and keep the asset | Immediately convert to cash |

Final Ownership | Client retains the commodity/asset | Client sells commodity to third party |

Sale Parties | Bank sells to client (bilateral) | Client sells to market/broker (tripartite) |

Transaction Flow | Bank buys → sells to client → client keeps | Bank buys → sells to client → client resells |

Shariah Concern | Lower (asset needed by client) | Higher (appears interest-like if not structured properly) |

AAOIFI Status | Widely accepted (Standard 8) | Accepted with conditions (Standard 30) |

How TokenMinds Helps with Tokenized Murabaha

TokenMinds has experience helping major Banks create tokenization structures that can be used for mass production, through creating asset-native, on-chain execution models that are developed in conjunction with Shariah Boards to include all required rules, pricing logic and ownership flow into a smart contract.

Our team will also define the governance models for Shariah Board approvals, Change Management approvals and Auditing Access, as well as the Issuance, Execution and Settlement Flows for AAOIFI compliance. All regulatory, operational and Shariah compliance is checked prior to execution and therefore no compliance gap exists allowing for same-day Murabaha execution at scale.

Conclusion

Tokenized Murabaha eliminates obstacles by making commodities on-chain, enables atomic transaction executions, and enforces Shariah requirements through direct coding. It transforms multi-day, manual processes into fast, auditable processes for the true owner of an asset while ensuring true ownership, transparency, and compliance are maintained. Lower cost and faster settlement allow Islamic banks to scale Murabaha without taking on additional operational risk or personnel.

TokenMinds assists Islamic Financial Institutions to integrate tokenized Murabaha into existing banking systems by developing compliant Shariah and Regulatory frameworks that are implemented within live banking environments.

FAQ

Why is traditional Murabaha inefficient for Islamic banks today?

Traditional Murabahah is currently not efficient enough for Islamic banking because it is based upon a manual commodity trading model with multiple parties involved in the process and post transaction compliance checks which are very costly due to their high fixed costs as well as time-consuming (multi-day) to execute and thus limited in terms of scalability.

What does tokenized Murabaha change at a structural level?

Tokenized Murabahah changes the structure of the Murabahah commodity at a fundamental level by converting Murabahah commodities into on chain assets, executing the entire Murabahah transaction in one atomic event and enforcing the Shari'ah compliant conditions of the transaction via smart contract rules rather than requiring the manual compliance checks that have been used in the past.

How does tokenization reduce Murabaha transaction costs?

By eliminating manual ownership verification, document handling, and reconciliation. Cryptographic proof and automated workflows reduce per-transaction costs from roughly $150–$200 to low double-digit dollars.

How does atomic execution improve speed and risk management?

All Murabaha steps will be executed simultaneously; otherwise they will not execute at all. The removal of settlement risk, prevention of partial execution of Murabaha and the compression of what is typically a multi day process into minutes or hours will benefit parties to Murabaha by increasing their speed.

Why does embedded Shariah enforcement enable scaling?

The compliance with Shariah rules, the asset eligibility criteria, the pricing transparency, and the party authorization prior to execution of Murabaha allows for this to be done through code, as opposed to manual human review. Therefore, thousands of transactions can occur without proportionally large increases in staff.