TL’DR

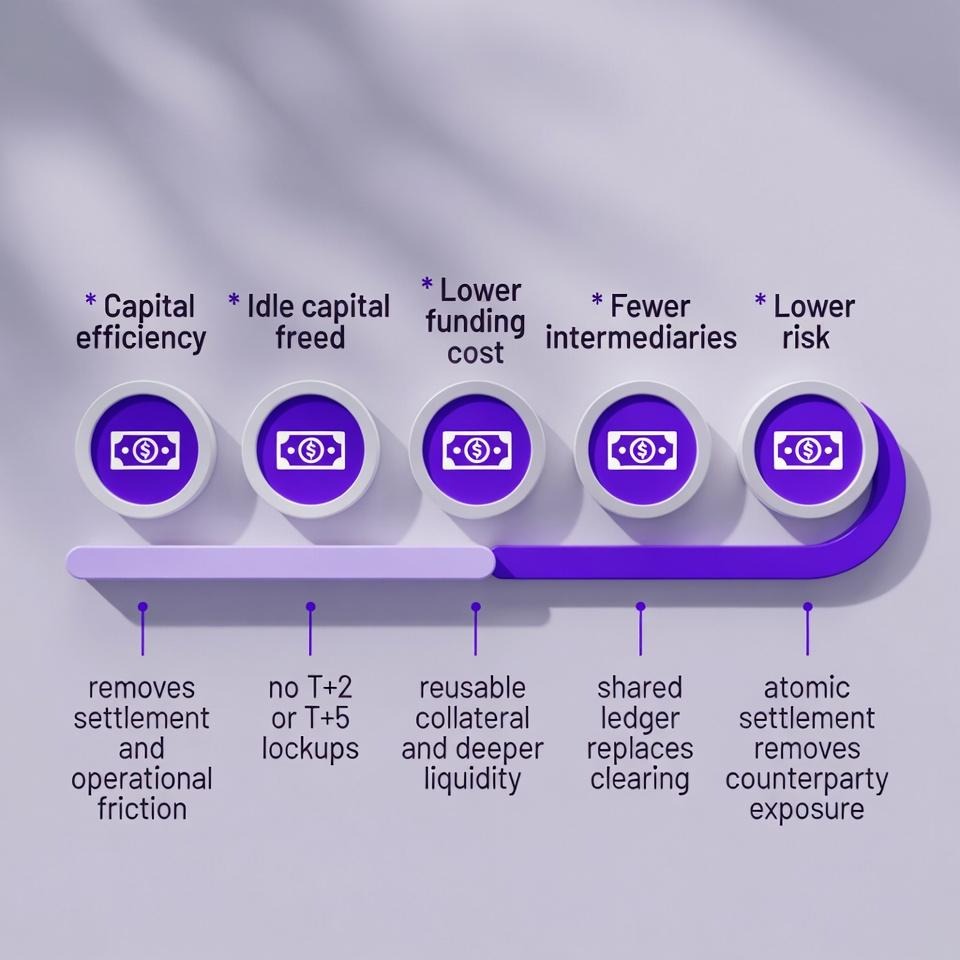

How tokenization eliminates multi-day settlement cycles and unlocks trapped capital; enabling institutions to redeploy billions in idle collateral, reduce funding costs, and gain competitive advantage through real-time settlement infrastructure.

Banks lose billions each year to old settlement systems. These systems trap money for days in transit. They force banks to pay high fees just to access cash. Staff waste time on manual checks across many databases.

Tokenized securities fix these problems through blockchain technology. They settle trades in seconds instead of days. They turn still assets into working collateral that can be used many times. They split big assets into small pieces so more buyers can join, a transformation enabled in this asset tokenization approach. The result is lower costs and better cash flow for banks.

The Core Problem in Capital markets

Most banks face the same three problems today. Each problem drives up costs in different ways. Each one locks money that could work elsewhere. Together, they make the old system expensive and slow.

Problem 1: Money Trapped in Settlement

Old systems take days to settle trades between banks. The standard is T+2, which means two full days. During those two days, billions of dollars sit frozen in accounts. Banks cannot use this money for other trades or investments.

Every trade involves many middlemen along the way. There are custodians who hold the assets. There are transfer agents who record the changes. There are clearing houses that manage the risk. Each middleman adds time to the process. Each one takes fees for their service. The costs add up fast.

International trades are even worse than domestic ones. Cross-border settlements can take 3-5 days to complete. Each country has different banks that need to work the transaction. Currency exchanges add another layer of delay and cost. Banks pay fees at every step of this chain, a structure shaped by how settlement infrastructure was designed in this blockchain development reference.

Problem 2: The Liquidity Issues

High minimum investments block most potential buyers from entering. Many corporate bonds require $100,000 just to start. Private credit deals often need $1 million or more. Only big institutions can play at this level.

Limited secondary markets mean banks pay big premiums for liquidity. When banks need cash fast, they have few buyers. With few buyers, they must accept lower prices. This gap between buy and sell prices is the liquidity tax. It can cost 2-5% of the asset value.

Private assets are negatively impacted by this issue the most. The money invested in real property can be locked away for 5 to 10 years. Similarly, private equity funds have 7 year investment horizons and little opportunity to exit an investment. As investors accept these "illiquidity premiums" (the return they require above and beyond what would be needed if they were able to buy/sell the asset at will) to compensate them for their lack of liquidity, it increases the cost of capital for banks.

For example, the illiquidity premium is as high as 20-30% on some assets; therefore, a bond that would generate a 5% yield in a liquid market may need to offer a 6-7% yield when there is little liquidity available. Over time, this increased cost of capital results in significant loss in value.

Problem 3: High Operating Costs

Research shows tokenized bonds cost 0.22 percentage points less than regular bonds. On a $1 billion bond issue, that is $2.2 million in savings. This gap reveals how much the old infrastructure really costs banks.

Many databases exist across different firms in the settlement chain. Custodian banks have their own records. Transfer agents keep separate books. Clearing houses maintain their own systems. All these databases need to match up perfectly.

Executive Synthesis: The Tokenization Impact at a Glance

Table of Tokenization Impact:

Metric | Traditional Settlement | Tokenized Settlement | Impact |

Settlement Time | T+2 (2 business days) Cross-border: 3-5 days | T+0 (instant) Cross-border: seconds | 100% reduction in settlement window |

Idle Capital | $100B trapped in-flight (for $50B daily volume) | $0 trapped | $8M+/year funding cost savings (at 3% funding rate) |

Regulatory Buffers | High NSFR/LCR requirements Excess liquid asset holdings | Reduced buffer needs Capital redeployed | 15-20% improvement in capital efficiency ratios |

Operating Cost | 0.22% of issuance value Manual reconciliation teams Multiple intermediary fees | Near-zero marginal cost Automated settlement No clearing house fees | $2.2M saved per $1B bond issue 25.8% cost reduction (UBS data) |

Balance-Sheet Velocity | Capital turns 1-2x/year Assets sit idle between trades | Capital turns 3-5x/year Programmable collateral works 24/7 | 2-3x multiplier on capital productivity |

Liquidity Premium | 2-5% bid-ask spread Limited secondary markets | 0.1-0.2% spread Continuous automated market-making | 23.9% reduction in yield spread (UBS data) |

Market Access | $100K-$1M minimums Institutional buyers only | $1K+ fractional ownership 10x larger buyer pool | Democratized access Deeper, more resilient markets |

Collateral Efficiency | Single-use: choose investment OR liquidity | Dual-use: investment AND margin simultaneously | 100% additional utility from same asset base |

The Balance-Sheet Impact: Quantifying the Cost of Trapped Capital

The liquidity that is held back due to the settlement process can create a significant amount of both regulatory burden and funding challenges. For example, if a bank settles $50 billion on a daily basis using a two-day settlement cycle, or T+2, then at any given time, there will be around $100 billion of liquidity that is being held back as it sits idle for two days. If we assume a relatively low intraday funding rate of 3%, then this would equate to about $8 million in avoidable liquidity expense annually to the bank. Eliminating this expense is one of the primary benefits of atomic settlement.

In addition to the costs associated directly with retaining liquidity from clients, the settlement risk for a bank will also affect the bank’s capacity to meet both the liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) requirements of regulators. Settlement risk requires banks to retain reserves of high-quality liquid assets in order to provide a buffer against potential settlement exposures, thereby tying up capital that would otherwise be available to generate revenue through lending or other financial transactions. Therefore, an atomic settlement process eliminates the need for banks to reserve these types of buffers and therefore improves both the regulatory ratios and the cost of compliance for banks.

Why Clearing Houses Become Obsolete: Function-by-Function Replacement

Clearing houses exist to manage risk during the settlement window. When that window disappears, so does their economic purpose. Smart contracts directly replicate each clearing house function:

Clearing House Function | Smart Contract Equivalent |

Netting | Atomic delivery-versus-payment (DvP) settles gross in real-time, eliminating the need for netting cycles |

Default Risk Management | No settlement window = no counterparty exposure during settlement |

Margin & Collateral | Programmable collateral enforces margin automatically via code, no central guarantor required |

The Clearing House incurred costs for accepting to bear the risk of non-settlement (risk) as well as coordinating reconciliation. The removal of both risks and of the coordination costs will be achieved by Atomic Settlement. Smart Contracts enable DvP to take place immediately, using cryptographic finality instead of trusting that a central intermediary acts properly.

The Solution: Tokenization Mechanisms

Tokenization attacks each problem with a specific technical fix. These fixes use blockchain to automate what humans do manually today. Together, they cut costs and free up cash that old systems trap.

1. Instant Settlement

All Tokens are settled simultaneously via Atomic Transactions. In computing "atomic" is used to denote an all-or-nothing event; either the full trade takes place instantaneously or nothing occurs at all. There is never an intermediate position whereby one party has made payment while the other party has not yet been able to receive it.

No 2-day wait allows no money to sit idle as capital. Money that was formerly locked in for 48 hours is now available at once. As banks can use the capital they have immediately for another trade of their own, there is an immediate multipliers effect on capital efficiency.

All trades are closed in real time by smart contract on a blockchain. Smart contracts will automatically execute based on set conditions. There is no human involvement in checking or approving every single step; all the steps are taken care of by the code.

2. Programmable Collateral

Tokenized shares can replace cash in many transactions. This feature is called programmable collateral. The same asset can serve two purposes at once. It stays invested and earns returns while also backing other trades.

This dual use cuts pressure to sell assets for cash. Banks used to have to choose: keep the asset or get liquidity. Now they can have both at the same time. The asset keeps generating yields while also providing margin.

Dead assets now work actively for the bank. Bonds sitting in a portfolio used to just collect interest. Now those same bonds can back derivatives trades or repo agreements. The bank earns interest plus trading profits from the same capital.

Banks keep their investment position while using assets for margin. This is especially valuable for long-term holdings. A bank might own 10-year bonds it wants to hold to maturity. Before tokenization, those bonds were locked up. Now they can actively support daily trading operations.

Smart contracts manage the collateral transfers automatically. When a trade needs margin, the contract moves the token. When the trade closes, the contract returns the token. No humans need to process paperwork or update databases. This automation cuts costs and eliminates errors.

3. Assets Fractionalization

Tokens split big assets into small pieces through fractionalization. A $100 million bond can become 100,000 tokens of $1,000 each. Now buyers with $1,000 can participate. Before, they needed the full $100 million.

More people can buy in when minimums drop dramatically. Retail investors can access assets that were only for institutions. Smaller institutions can diversify across more positions. The total pool of potential buyers grows 10x or more.

With more buyers in a market, that creates a deeper market, which means there will be more sellers/buyers at different price points. A deep market is one that can absorb a lot of trading volume, without having large movements in price. This stability will attract even more market participants.

Tokenization in Capital Markets

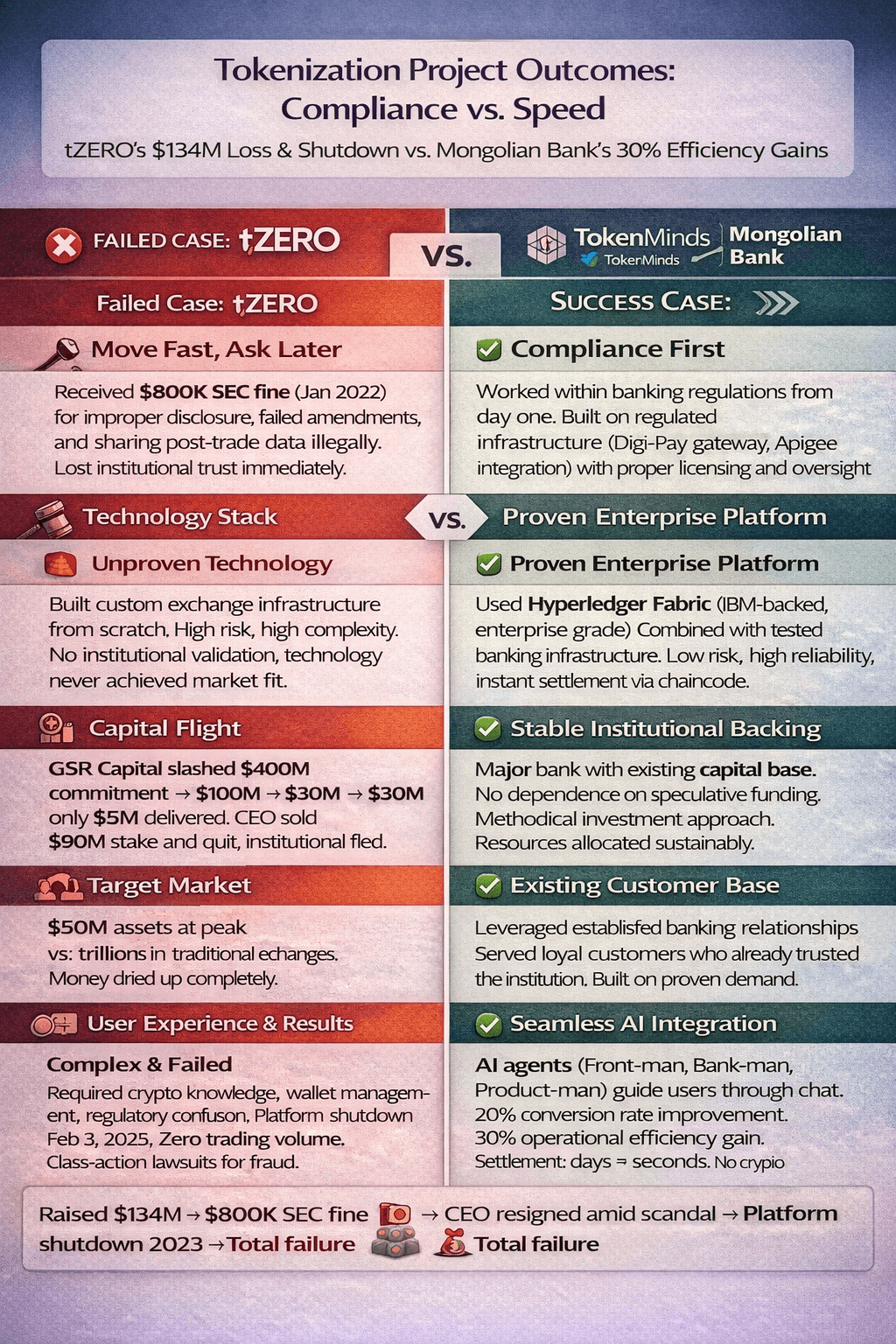

At this point, the mechanisms behind tokenization are clear. However, understanding how tokenization works is not enough to succeed in practice. The real difference between success and failure lies in execution; particularly around regulation, infrastructure choices, and institutional adoption.

To illustrate this gap, it is useful to compare two real-world approaches: one that failed despite significant funding and ambition, and one that succeeded by building within regulatory and operational realities.

Success vs. Failure Case Study of Tokenization

Although many tokenization projects are successful and profitable, some have failed; even those that received large amounts of funding and employed skilled staff. The examples of TokenMinds Client “Major Mongolian Bank” and tZERO show the difference between successful companies and unsuccessful ones. Successful companies understand how to comply with regulations and implement them properly.

As shown below.

Table of Comparison:

Failed Case: tZERO's $134M Loss

In 2014, tZERO began as a company based on big ideas and bold claims. The Overstock.com CEO Patrick Byrne created tZERO with a radical vision. In 2018, tZERO raised $134 million by conducting its own security token offering. Their goal was to create a completely new type of exchange for tokenized stocks with fast settlement.

tZERO focused on operating a crypto-style exchange under securities rules, but it did not fundamentally replace post-trade clearing, reconciliation, or prefunded liquidity. As a result, capital still sat idle, operational complexity remained, and the business depended entirely on trading volume and fees. When volume failed to materialize and regulatory trust weakened, there was no underlying efficiency gain to sustain the platform.

What Went Wrong

SEC Fine ($800K): In January 2022, tZERO paid an $800,000 fine to the SEC. The SEC stated that there were several instances of improper disclosure and access. tZERO shared post-trade order data improperly. After material changes occurred they failed to file required amendments. Because of these violations, tZERO lost the trust of institutional investors, who require regulatory clarity.

Money Dried Up: GSR Capital promised $400 million in initial funding. They backed off and cut the commitment to $100 million. Then they reduced it again to just $30 million. By May of that year, only $5 million had actually arrived.

CEO Quit: CEO Patrick Byrne stepped down in August 2019. Allegations emerged that he had become entangled with a Russian spy. The CFO resigned immediately after Byrne left. Byrne then sold his entire 13.6% stake for $90 million.

Platform Closed: On February 3, 2023, tZERO announced shutdown of the crypto exchange. They cited regulatory uncertainty as the reason. The real issue was lack of trading volume and business viability. No volume means no fees. No fees means no revenue. No revenue means no business.

Success Case: TokenMinds Client - Major Mongolian Bank

TokenMinds' client took a completely different approach to tokenization. A major bank in Mongolia implemented a tokenized payment system on private blockchain infrastructure. The system processed real transactions through Hyperledger Fabric with smart contract enforcement.

This dual-layer architecture gave users choice and security. Customers could interact through familiar chat interfaces powered by AI agents. The underlying payments ran on a private, permissioned blockchain. This flexibility drove adoption among users who wanted simplicity without sacrificing security.

Settlement via Hyperledger Fabric chaincode is instant and automatic. Chaincode functions as the smart contract layer on Hyperledger Fabric. No central clearing counterparty is required in the process. This structure eliminates three major cost layers at once.

First, manual approval workflows disappear completely. Traditional bank payments require multiple human approvals and reviews. The tokenized system uses cryptographic signatures for instant authorization.

Second, reconciliation overhead vanishes. Banks usually employ teams to match transactions across systems. Instant blockchain settlement means perfect records automatically with no reconciliation needed.

Third, multi-day settlement delays are gone entirely. Traditional bank transfers can take 1-3 days domestically and 3-5 days internationally. Funds execute immediately on the private ledger. That capital can be redeployed instantly for other uses. The velocity of transactions increases dramatically.

AI-Enhanced Execution Breakthrough

The bank integrated AI agents with the Digi-Pay wallet gateway through Apigee. Front-man agent guides users through checkout in natural conversation. Bank-man agent prepares transactions and requests cryptographic approval. Product-man agent recommends items using Data Lakehouse signals. The transaction settles automatically through the bank's payment infrastructure.

The TokenMinds tokenized solution eliminated all this friction. Smart contracts handled the payment logic automatically. Custodial wallets managed keys without exposing complexity to users. Loyalty points and balances updated instantly after each transaction. The entire process completed in seconds through a single chat conversation.

Results:

Conversion rates improved 20% through the streamlined tokenized checkout. Agent-led payments reduced cart abandonment significantly. Users completed purchases faster with cryptographic approval instead of passwords and OTPs. The chat interface kept everything in one conversation.

Operational efficiency increased 30% through blockchain automation. Manual reconciliation work dropped to near zero on tokenized transactions. The private ledger provided perfect audit trails automatically. Staff focused on customer service instead of back-office processing.

Transaction settlement time dropped from days to seconds. What took 1-3 business days through traditional rails now completes instantly. The tokenized payments on Hyperledger Fabric execute in real-time. Customers see balance and loyalty updates immediately instead of waiting for batch processing.

The gap is clear from this comparison. tZERO tried to skip rules and build too fast. They focused on retail customers instead of institutions. They built unproven technology instead of using tested platforms.

TokenMinds' client worked within the law from day one. The major Mongolian bank took a methodical approach to build properly. They focused on their existing customer base who trusted the institution. They used Hyperledger Fabric, a proven enterprise blockchain platform, combined with regulated banking infrastructure through Digi-Pay and Apigee integration.

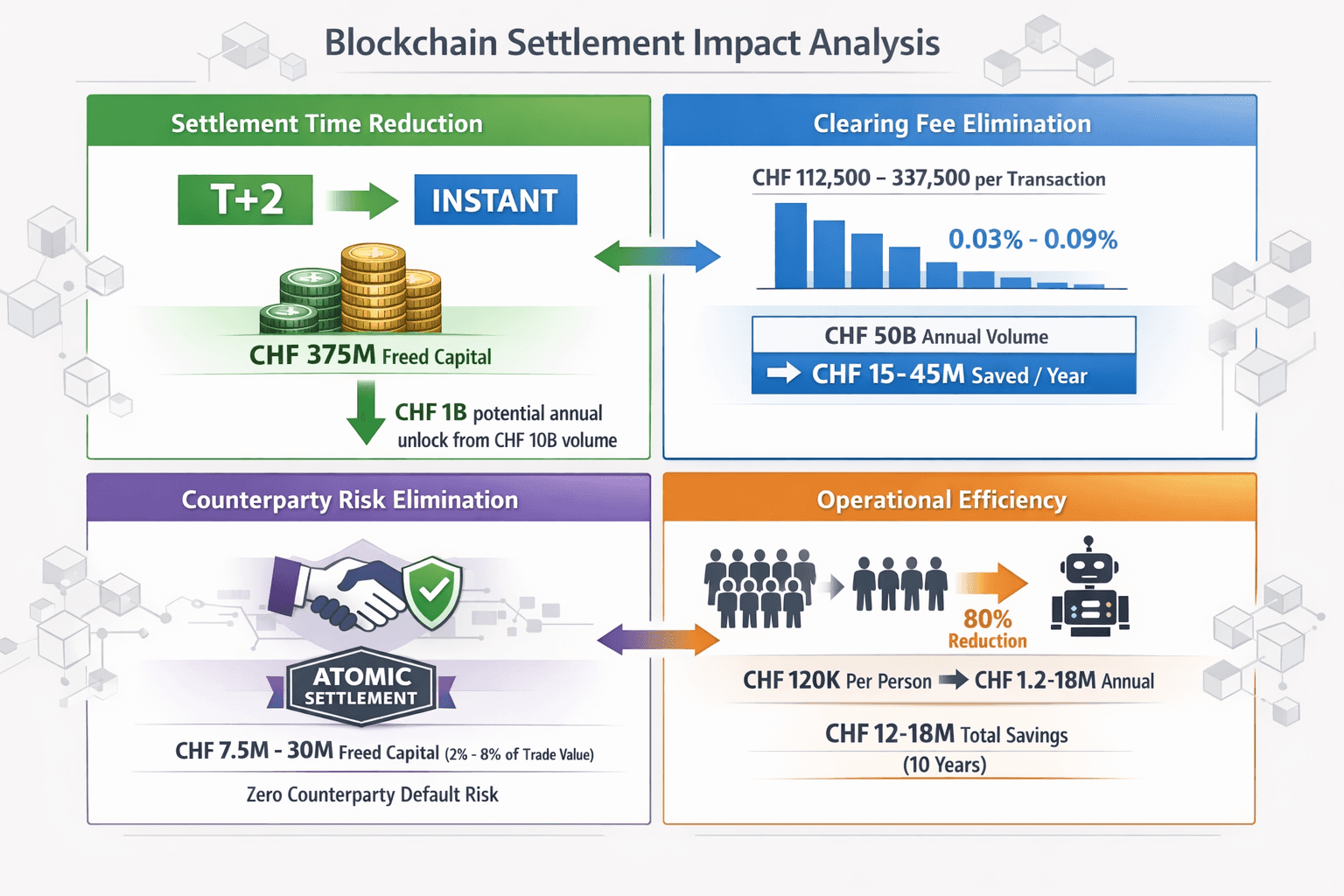

Step-by-Step Implementation Guide (Using UBS Digital Bonds Case Study)

We will use UBS, a global investment bank, as the real implementation example to demonstrate how tokenized securities work in practice. This case study shows how a major financial institution successfully deployed tokenized bonds through regulated blockchain infrastructure.

UBS achieved this by using a combination of careful planning and methodical execution to implement all three mechanisms listed above. Below are the exact ways that UBS used each mechanism to create the entire solution. Each mechanism lists a step-by-step process that builds upon each other to achieve the total solution.

Step 1: How UBS Builds Instant Settlement

Tech Setup: UBS collaborated with SIX Digital Exchange (SDX) for the technical infrastructure. SDX was launched in 2021 as the blockchain subsidiary of SIX which is Switzerland’s primary stock exchange with over 150 years of history. SDX uses distributed ledger technology with Swiss financial laws and regulations written directly into the code of the blockchain.

This integration of law and code is critical for compliance. The smart contracts enforce regulatory requirements automatically. Transfer restrictions check investor qualifications before allowing trades. This prevents accidental violations that could bring fines.

Key Parts That Make It Work:

Smart contracts execute delivery-versus-payment automatically. DvP means the bond and the money swap at the exact same instant. If the buyer's payment fails, the seller keeps the bond. If the seller cannot deliver, the buyer keeps the money. No one can get stuck with only one side of the trade.

Integration with SDX Central Securities Depository enables instant settlement. The CSD is the official registry of who owns what. When the smart contract executes, the CSD updates immediately. There is no gap between trade and settlement.

No clearing house is required in this setup. Traditional trades go through a clearing house that guarantees both sides. The clearing house protects against one party defaulting during the settlement period. Instant settlement eliminates the settlement period entirely.

Step 2: How UBS Implements Programmable Collateral

Tech Setup: UBS built smart contracts that let the bond serve as collateral. The bond token can be locked in a smart contract for margin. While locked, it still earns interest for the owner. But it also backs a derivatives trade or repo agreement simultaneously.

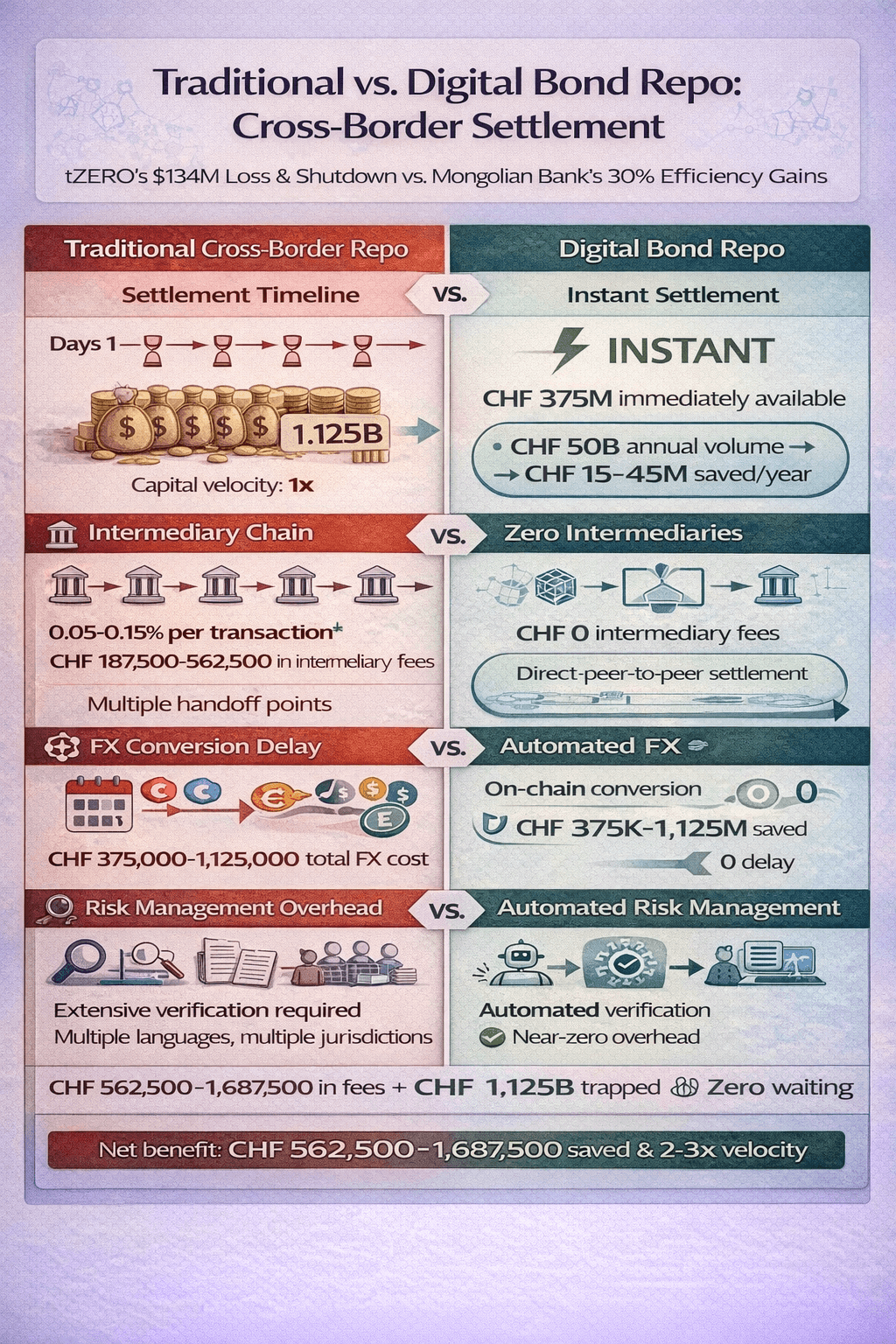

This comparison highlights the difference between Traditional and Digital Bonds.

This dual function was impossible with traditional bonds. Paper bonds sit in a vault providing zero utility. Digital bonds can work 24/7 in multiple capacities. The smart contract manages all the logic automatically.

Cross-Border Implementation: UBS, SBI, and DBS executed the first cross-border repo together. Three banks in three different countries participated. Switzerland, Japan, and Singapore each have different legal systems. Yet the repo settled instantly across all three.

The legal terms for the repo were encoded in the smart contract code that all three banks evaluated and agreed on prior to its implementation. The code was implemented with no human intervention after it had been agreed upon by the three banks. As a result, the bond was transferred from UBS to SBI as collateral and cash was also transferred from SBI to UBS to be used as a loan. Upon the expiration of the loan, the same process occurred automatically.

No people processed paperwork anywhere in this chain. No correspondent banks facilitated currency exchange. No lawyers checked compliance in each jurisdiction. The smart contract handled everything according to the pre-agreed terms. This automation saved time and eliminated errors.

Step 3: How UBS Implements Bond’s Fractionalization

Tech Setup: The digital bond was broken into smaller portions than a standard bond. Typically a standard UBS bond requires a CHF 100,000 minimum to purchase. The fractional ownership of the tokenized bonds allows for a much smaller amount to be invested. This opens the market up to those that have been excluded from buying a bond due to the higher cost.

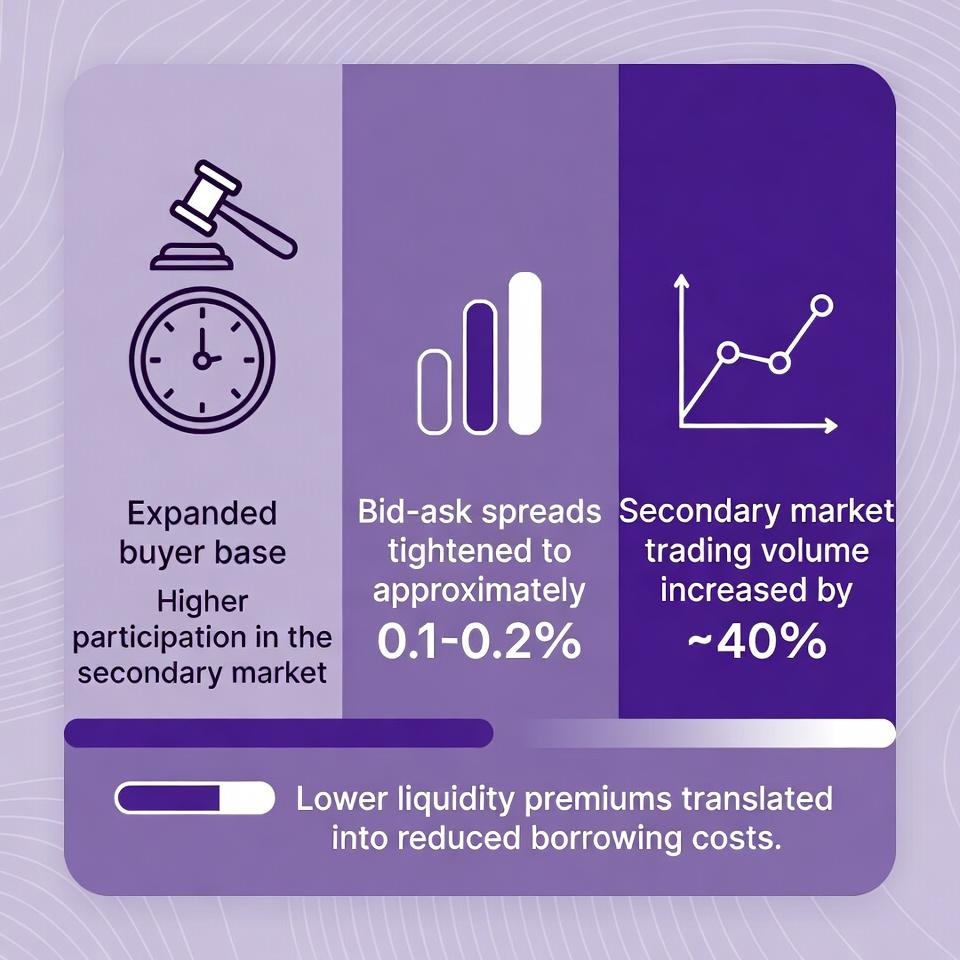

SDX and SIX Swiss Exchange dual listed the bond. Institutional investors that are tech savvy can trade on the blockchain platform, while institutional investors that do not have experience with the blockchain platform can still trade on the regular exchange. Broader participation among all types of investors is being encouraged by giving them the option to buy the bond using one or both platforms.

The dual listing also provided a price discovery mechanism. Any gap between the two platforms would be arbitraged away quickly. This kept pricing efficient and fair across both venues. No one could get a worse deal just because they used one platform over the other.

Market Making Infrastructure: UBS set up automated market makers on the SDX platform. These algorithms provide continuous buy and sell quotes. They profit from the bid-ask spread like traditional market makers. But they operate 24/7 without human intervention.

The automated system keeps spreads tight through competition. Multiple market makers compete for flow on the platform. This competition drives spreads down to minimal levels. Traditional bond markets might have 0.5-1% spreads. The tokenized market achieved 0.1-0.2% spreads.

The Outlook

Tokenization will dramatically alter capital markets during the next 3-5 years as regulators and infrastructures come together. The EU's MiCA regulations go into effect by 2026; similar regulatory initiatives are being implemented on a global basis; and, central banks are developing rails for digital currencies which can seamlessly interoperate with the tokenized security space. In addition to this, major custodian banks are beginning to add tokenization services; interoperability standards will allow for 24/7 cross border settlements.

There will also be competition in this area. Those early adopters of tokenization in the capital markets will be able to "lock-in" liquidity, issuers, and market share of trading and collateral services. By 2028-2030, it is expected that tokenized settlement will become table stakes. Any institution that delays entering this space will either have to pay higher fees to third party platforms or face a permanent cost disadvantage compared to those institutions already using tokenization.

How TokenMinds Can Help: TMX Tokenize

Creating the same kind of success as UBS requires a lot of special knowledge and experience that most banks do not have. Building an internal team with the necessary blockchain skills is expensive and will take at least two to three years. TokenMinds has found a quicker way to build your own internal team by using their TMX Tokenize platform.

The TMX Tokenize Platform by Token Minds is a full service for tokenization projects. It includes all of the technical development needed to create a tokenization project, regulatory compliance and how to get a token into a marketplace. Banks can use this platform to access TokenMind’s expertise so they don’t have to develop it themselves. By doing this, the time it will take for a bank to bring a new product to market goes from years to just a few months.

Technical Infrastructure:

Smart contract development for instant settlement and programmable collateral. TokenMinds has deployed contracts handling millions in value. Our code has been audited by top security firms. Banks get battle-tested contracts instead of untested experimental code.

Integration with regulated custody solutions and existing bank systems. TMX Tokenize connects to BitGo, Fireblocks, and Anchorage for custody. It also integrates with core banking platforms and trading systems. This integration ensures smooth operations across all systems.

Security audits by leading blockchain security firms before launch. Every contract gets reviewed by Quantstamp or Trail of Bits. These audits find vulnerabilities before they can be exploited. This protection saves banks from potentially catastrophic hacks.

Multi-chain deployment for maximum liquidity and reach. TMX Tokenize supports Ethereum, Polygon, Avalanche, and private chains. Banks can choose the best platform for their needs. They can even deploy across multiple chains simultaneously.

Regulatory Compliance Built In:

KYC/AML infrastructure built into smart contracts from day one. Token transfers automatically check wallet addresses against whitelists. Blocked addresses cannot receive tokens under any circumstances. This prevents accidental violations of sanctions or money laundering rules.

Transfer restrictions and buyer lists to stay legal in all jurisdictions. Different countries have different rules about who can buy securities. The smart contracts enforce all relevant restrictions automatically. A US investor cannot buy if the security is not registered in the US.

Jurisdiction-specific compliance for multi-country operations. TMX Tokenize handles the legal nuances of operating globally. They work with local counsel in each target market. This ensures full compliance without expensive mistakes.

Conclusion

The transformation of capital markets infrastructure is happening now. Major banks like UBS, JPMorgan, and Goldman Sachs are deploying tokenization. Governments are creating regulatory frameworks like MiCA in Europe. The technology is proven and the benefits are clear.

Tokenized securities cut capital costs through three proven mechanisms working together. Instant settlement frees billions trapped in 2-day settlement cycles. Programmable collateral lets the same assets serve multiple purposes simultaneously. Fractional access expands the buyer pool and deepens market liquidity.

Schedule a complimentary consultation with TokenMinds to explore how your institution can implement tokenized settlement, programmable collateral, and fractionalized assets to unlock capital efficiency and modernize market operations.

FAQ

What is atomic settlement?

In Atomic Settlement, delivery and payment occur simultaneously when a transaction occurs. If there is a failure of either party to a trade (the buyer or seller) both parties will fail immediately. This method completely removes counter-party risk while the transaction is settling; it also reduces the time required for the settlement process and therefore frees up capital that was being held by the parties involved. "Atomic" originates from the field of Computer Science where it refers to operations which cannot be broken into smaller pieces.

How much can banks save with tokenization?

According to real-world data provided by UBS, banks may reduce their issuance costs by approximately 25.8%. Banks may be able to reduce yield spreads through increased liquidity by as much as 23.9%. Banks may eliminate their entire cost associated with the infrastructure used for settlements.

Is tokenization legal and regulated?

Yes. Tokenized security is subject to the same securities laws that govern traditional security. It is not an attempt to avoid securities laws. UBS consulted with Swiss authorities as they developed their project and utilized SIX Digital Exchange, a fully licensed and regulated exchange. The Securities Exchange Commission (SEC) of the United States has approved several tokenized offerings. Regulatory compliance is crucial to the success of a tokenized offering and cannot be circumvented.

How long does tokenization implementation take?

Project development was approximately six to twelve months for setting up its technology stack and performing testing. Then another twelve to twenty-four months for bringing the system to full-scale operational status. To rush through the development phase increases the risk of regulatory and technical issues. Banks must plan and test their tokenization solution for an extended period of time before implementing it on a large scale. Banking organizations must therefore allocate at least eighteen to thirty-six months to develop and deploy a successful tokenized offering.

Can tokenized securities work across borders?

Tokenized securities can be used across borders and one of their major advantages is that they allow for this type of cross border usage. In fact, the world's first cros-border rep transaction was completed by UBS and it settled instantly across Japan, Singapore, and Switzerland at the same time. Traditional cros-border rep transactions take between 3 to 5 days and require several intermediary banks; tokenization will remove these delays and intermediaries entirely with Smart contracts automatically managing legal terms and currency conversions.

What is programmable collateral and why does it matter?

Programmable collateral means that tokenized assets can serve both as a margin while also remaining invested. In other words, the same bond earnings interest and supporting trading positions simultaneously. Intraditional bonds must choose either role. This dual functionality enhances capital efficiency by up to 2-3 times. In other words, banks can give more value from the same base of capital. Smart contracts manage the collateral movements automatically and based on trading needs.