TL;DR

This research article explains how tokenized equities can operate across multiple blockchains such as Ethereum and Solana.You will understand how xBridge changes the traditional role of transfer agents and how xBridge enables cross-chain coordination of shareholder records, governance, and accountability.

About xBridge

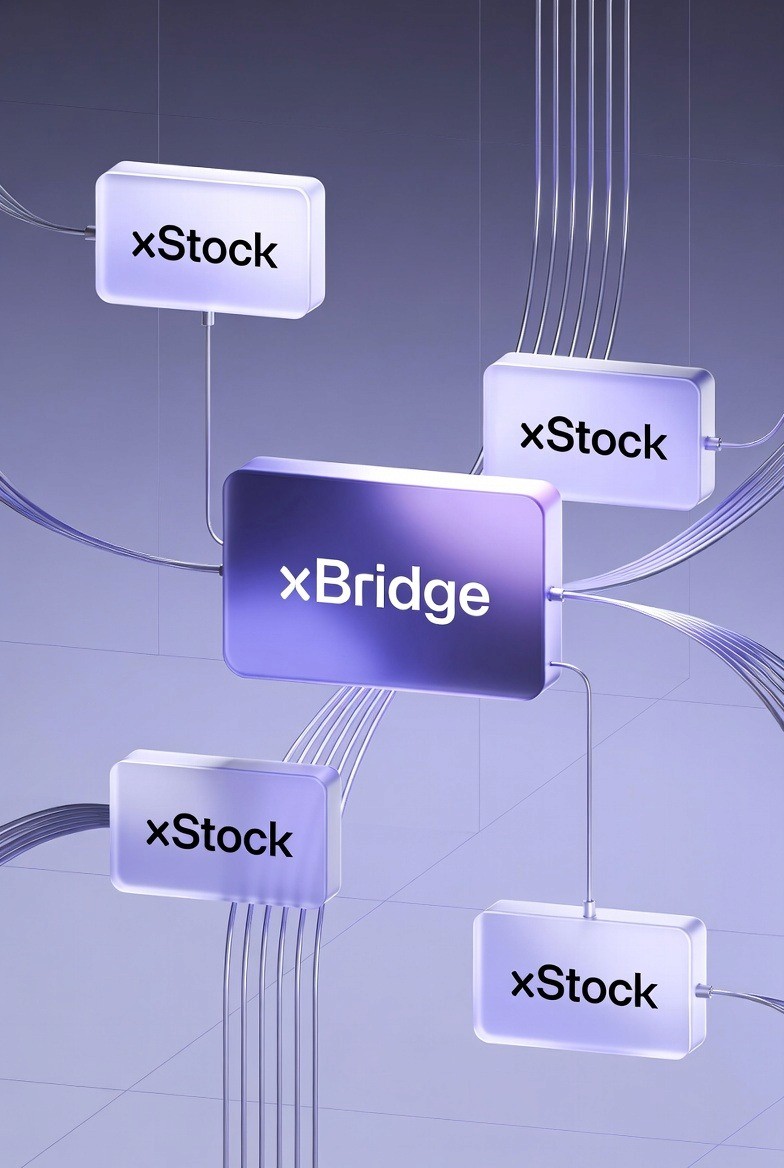

xBridge is infrastructure developed with Chainlink and Backed Finance to enable tokenized stocks to move between blockchains, as described in this guide. Tokenized stocks are shares of companies that are recorded on a blockchain instead of in traditional paper or electronic form. Moving between blockchains means that a tokenized stock can exist on multiple blockchains such as Ethereum and Solana, a pattern enabled by this concept.

xBridge preserves critical financial properties when tokenized stocks move between blockchains. Critical financial properties are the essential characteristics that make a stock valuable and meaningful. These properties include corporate actions, ownership integrity, and compliance expectations.

Corporate actions are events that affect the value of a stock. Examples include dividend payments, stock splits, and rights offerings. Ownership integrity means that the record of who owns the stock remains accurate and trustworthy. Compliance expectations means that the stock complies with government rules and regulations.

When xBridge Was Launched

xBridge was publicly launched on December 12, 2025. The initial production use case enables Backed's tokenized stocks to move between Ethereum and Solana. Ethereum and Solana are two major blockchain networks. Production use case means that the system is not an experiment but an actual system being used for real business.

Backed Finance is a provider of compliant tokenized equities and exchange-traded funds. Exchange-traded funds are investment funds that trade like stocks. Backed Finance specializes in creating tokenized versions of stocks and funds that follow all government regulations.

The Missing Piece: A Single Shareholder Record

How Traditional Equity Markets Work

Traditional equity markets are built on a fundamental assumption. The assumption is that there is one authoritative record of ownership at any point in time. An authoritative record means the official, accurate, and trusted record. One point in time means one moment in the past.

This assumption means three things. First, traditional equity markets maintain one authoritative shareholder registry. A shareholder registry is a list of all people who own shares. This list is official and authoritative. Second, traditional equity markets have one transfer agent maintaining the official record. A transfer agent is an organization that handles the buying and selling of shares and updates the shareholder registry. Third, traditional equity markets tie corporate actions to a single ledger snapshot. A ledger snapshot is a picture of all ownership at one moment in time.

This system works because ownership is in one place. All shares are recorded in one official location. The transfer agent manages one ledger. Corporate actions happen on that one ledger.

The Problem with Cross-Chain Tokenized Stocks

Cross-chain tokenized stocks break this assumption, as discussed in this analysis. When a tokenized stock can exist on multiple blockchains, the ownership record is no longer in one place.

The following table shows the differences between traditional markets and cross-chain tokenized stocks:

Characteristic | Traditional Equity Markets | Cross-Chain Tokenized Stocks |

Shareholder Registry | Single shareholder registry | Ownership spread across blockchains |

Transfer Agent Role | One transfer agent maintains official record | Records must be coordinated across networks |

Source of Truth | One ledger snapshot | Multiple ledger states |

Corporate Actions | Corporate actions applied once to one ledger | Risk of misalignment between chains |

Governance and Voting | Clear governance eligibility | Fragmented voting rights |

Outstanding Share Count | One official count | Potential for conflicting counts |

Compliance Verification | Single point of verification | Multiple verification points required |

This table shows that cross-chain tokenized stocks create serious problems. Ownership is spread across blockchains. Records must be coordinated. There are multiple ledger states instead of one. Corporate actions might not be applied the same way on all blockchains. Voting rights might be fragmented. The total number of outstanding shares might be unclear.

These problems are not minor. They strike at the core of how equity markets work. The entire system depends on accurate ownership records and consistent treatment of all shareholders.

Why This Problem Matters

This problem matters because tokenized equities are beginning to operate on multiple blockchains. Different blockchains have different advantages. One blockchain might have more liquidity. Another might have lower fees. Another might have better integration with other financial systems.

If shares cannot move between blockchains without losing their essential properties, they cannot take advantage of these benefits. If shareholders voting rights become fragmented, corporate governance fails. If corporate actions are not applied consistently, some shareholders are treated unfairly.

xBridge solves these problems. xBridge enables tokenized stocks to move between blockchains while maintaining ownership records and applying corporate actions consistently.

What xBridge Actually Changes

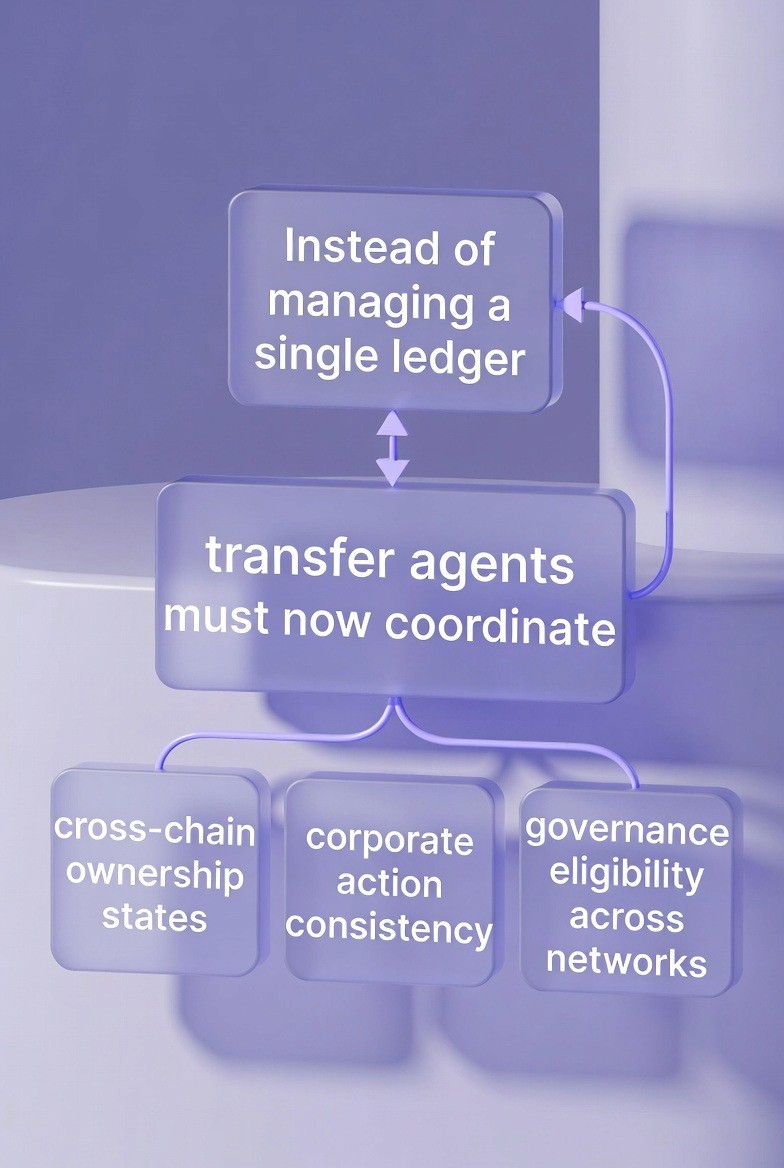

xBridge does not remove transfer agents. Transfer agents will continue to exist. Instead, xBridge changes their responsibilities. Transfer agents will now operate across multiple blockchains instead of managing a single ledger.

Traditional transfer agents manage ownership on a single ledger. A ledger is a record of ownership. A single ledger means all ownership information is in one place. Transfer agents update this ledger when shares are bought and sold. Transfer agents apply corporate actions to this ledger.

With xBridge, transfer agents must now coordinate cross-chain ownership. Cross-chain ownership means that shares exist on multiple blockchains. Transfer agents must ensure that ownership information is consistent across blockchains. Transfer agents must ensure that corporate actions remain consistent across blockchains. Transfer agents must preserve governance and voting eligibility as tokenized stocks move between networks.

This is an expansion of the transfer agent role. Instead of managing a single ledger, transfer agents must coordinate across multiple systems. This requires new tools and new processes.

The Specific Responsibilities Transfer Agents Now Have

Transfer agents are now responsible for four main areas.

First, transfer agents must coordinate cross-chain ownership. When a shareholder moves shares from Ethereum to Solana, the transfer agent must update records on both blockchains. The shareholder's position on Ethereum must decrease. The shareholder's position on Solana must increase. The total number of shares the shareholder owns must remain the same.

Second, transfer agents must ensure corporate actions remain consistent. If a dividend is paid, all shareholders must receive the dividend regardless of which blockchain their shares are on. If a stock split occurs, all shareholders must have the same increase in share count. The timing and amount of corporate actions must be the same on all blockchains.

Third, transfer agents must preserve governance and voting eligibility. If a shareholder is eligible to vote, they must be eligible to vote regardless of which blockchain their shares are on. If a shareholder is not eligible to vote because of their share count, they must not be eligible to vote on any blockchain.

Fourth, transfer agents must act as accountability anchors between chains. An anchor is something that holds things in place. Transfer agents must ensure that shareholder records across blockchains are linked together. Transfer agents must ensure that anyone can verify that a shareholder's position is the same across all blockchains.

Table of Comparisons

xBridge vs Traditional Token Bridges vs Wrapped Assets

Dimension | xBridge (Tokenized Equities) | Traditional Token Bridges | Wrapped Assets Model |

Asset type focus | Regulated tokenized equities (stocks, ETFs) | Crypto-native tokens | Synthetic representations |

Corporate actions (dividends, splits) | Preserved and synchronized | Not supported | Not natively supported |

Shareholder record integrity | Single economic position across chains | Fragmented by chain | Fragmented by wrapper |

Governance & voting rights | Maintained across chains | Typically broken | Often unclear or lost |

Supply duplication risk | Prevented by design | High risk | Inherent |

Accountability & auditability | Clear, message-level traceability | Opaque | Depends on issuer |

Suitability for institutions | High | Low–Medium | Medium |

Typical use case | Cross-chain tokenized equities | DeFi token transfers | Asset exposure, not governance |

How xBridge Supports Record Integrity

What Record Integrity Means

Record integrity means that ownership records are accurate, complete, and trustworthy. Record integrity is essential for equity markets. If ownership records cannot be trusted, then property rights cannot be enforced. If shareholders do not trust ownership records, they will not buy shares.

How xBridge Enables Verified Movement

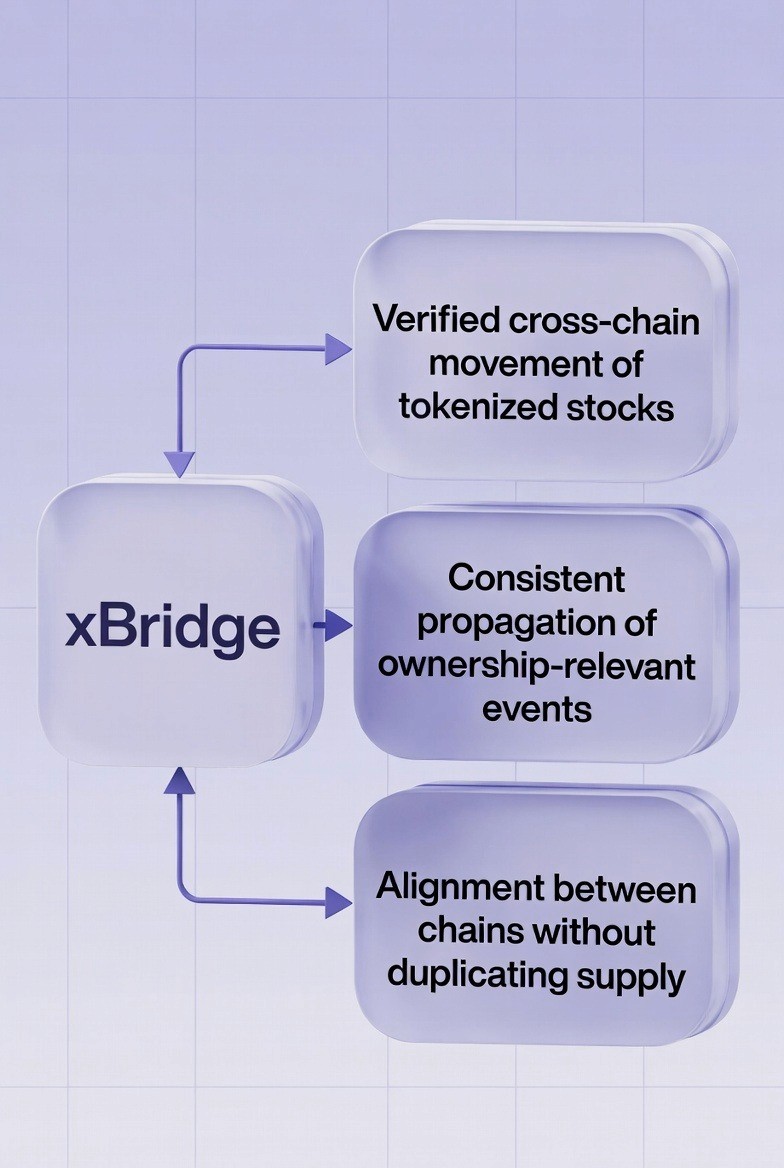

xBridge supports shareholder record integrity by enabling verified movement of tokenized stocks across blockchains. Verified movement means that the system proves that the transfer is real and authorized.

xBridge ensures that assets can move while remaining part of a single, coherent equity structure. Coherent equity structure means that all ownership information refers to one company and one issuance of shares.

The key technical capability is that xBridge prevents duplicate or conflicting ownership records. Duplicate records means that the same share is recorded twice. Conflicting records means that different blockchains show different ownership. xBridge prevents both of these problems.

How xBridge Propagates Ownership-Relevant Events

xBridge is a method for sending and receiving "ownership relevant" data (events) between blockchains in real-time. Ownership relevant events are those that affect either the quantity of shares owned by someone or the identity of the owner. Events such as buying or selling shares, receiving dividend payments, and participating in a stock split are examples of ownership relevant events.

Upon an occurrence of an ownership relevant event on any one blockchain, xBridge will ensure that the occurrence of that event is reflected on every blockchain where shares exist. Therefore, regardless of which blockchain(s) the shares exist on, the ownership records will be up-to-date across all blockchains.

xBridge synchronizes state without adding supply. State is defined as the current state of the shares' ownership. Adding supply refers to creating new shares. When shares are moved from one blockchain to another, xBridge ensures that the total amount of shares has remained constant. The number of shares in existence on the original blockchain decreased while the number of shares in existence on the destination blockchain increased. The total number of shares in existence across all blockchains remains the same.

How Transfer Agent Responsibilities Evolve

From Static Record Keepers to Cross-Chain Registry Coordinators

As tokenized stocks become cross-chain, transfer agents evolve from static record keepers into cross-chain registry coordinators. A static record keeper maintains a single ledger. A cross-chain registry coordinator manages multiple records across multiple blockchains.

This is an evolution, not a replacement. Transfer agents are not being eliminated. Instead, their role is expanding. Transfer agents will continue to maintain official shareholder records. However, these records will now span multiple blockchains.

From Single Ledger to Multi-Network Oversight

Traditional transfer agents oversee ownership continuity on a single network. A single network means one blockchain. Multi-network oversight means managing ownership continuity across multiple blockchains.

Ownership continuity means that as shares move between blockchains, ownership is preserved. A shareholder does not lose their shares when moving between blockchains. A shareholder does not gain extra shares. The number of shares remains constant.

From Record Keepers to Governance Stewards

Transfer agents now act as governance and accountability stewards. A steward is someone who protects something on behalf of others. Transfer agents protect shareholder rights. This means ensuring that voting rights, dividend rights, and other shareholder rights remain intact across blockchains.

Transfer agents also act as accountability anchors between chains. An anchor holds things in place. Transfer agents ensure that ownership is consistent across blockchains. They provide the proof that ownership on one blockchain is the same as ownership on another blockchain.

This is a significant expansion of the transfer agent role. Transfer agents are no longer just record keepers. They are stewards of shareholder rights across multiple systems.

xBridge Features: Governance

What Corporate Actions Are

Corporate actions are events that affect shares or shareholders. Examples include dividends, stock splits, and rights offerings. A dividend is a payment of profits to shareholders. A stock split is when a company divides shares into smaller pieces. A rights offering is when a company offers shareholders the opportunity to buy additional shares.

Corporate actions change the value or number of shares that shareholders own. If a company declares a dividend, shareholders who own shares on a specific date receive a payment. If a company splits shares, shareholders receive additional shares. If a company offers rights, shareholders can choose to buy more shares.

How xBridge Preserves Corporate-Action State

xBridge preserves corporate-action state when tokenized stocks move across blockchains. This means that corporate actions apply the same way regardless of which blockchain a share is on.

For example, suppose a company declares a dividend of one dollar per share. A shareholder owns one hundred shares on Ethereum and fifty shares on Solana. When the dividend is paid, the shareholder should receive one hundred fifty dollars. The shareholder should receive one hundred dollars for the shares on Ethereum and fifty dollars for the shares on Solana.

Without xBridge, there is a risk that the dividend is only paid for shares on one blockchain. The shareholder might miss fifty dollars. With xBridge, the dividend is paid consistently on both blockchains.

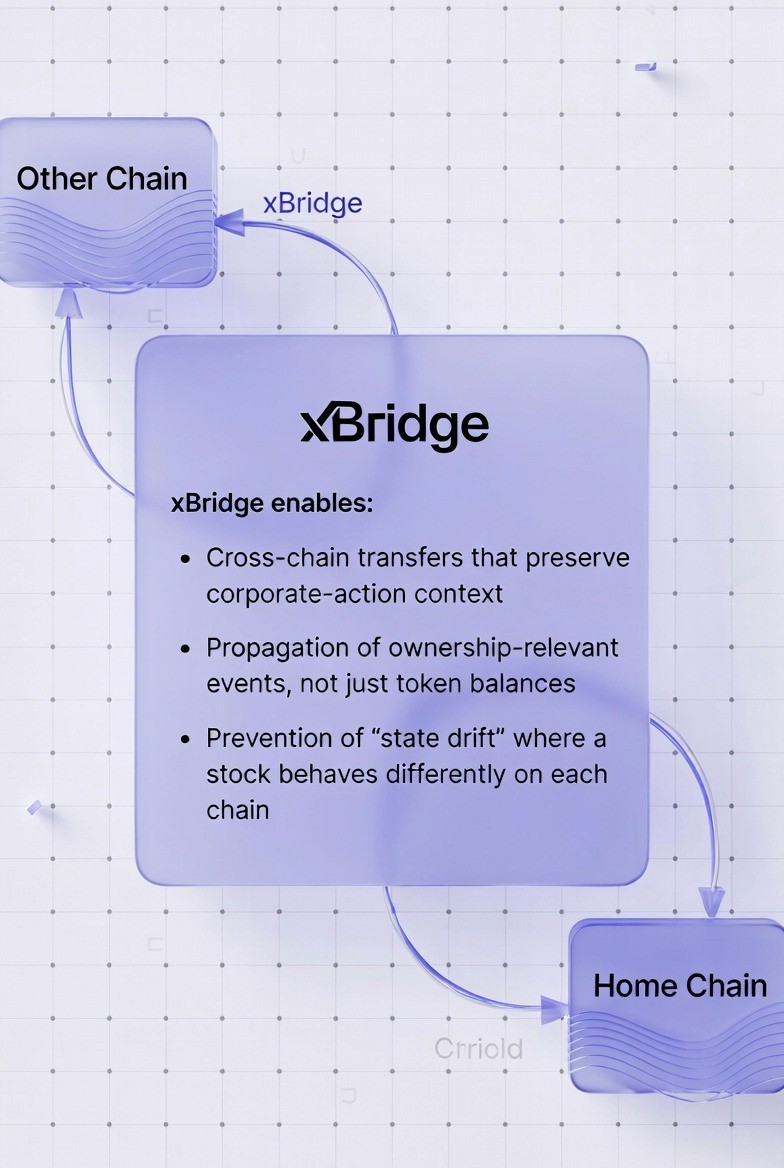

How xBridge Prevents State Drift

State drift occurs when a stock behaves differently on different blockchains. For example, a stock might have a one-to-one exchange rate on Ethereum but a different exchange rate on Solana. Or a stock might have different dividend amounts on different blockchains.

State drift is dangerous because it means the same stock has different values on different blockchains. This creates opportunities for fraud. A bad actor could buy shares on one blockchain at a low price and sell them on another blockchain at a higher price.

xBridge prevents state drift by ensuring that stocks behave the same way on all blockchains. Dividends are the same amount. Stock splits are the same ratio. Exchange rates are the same. This prevents fraud and maintains market integrity.

How to Enable Cross-Chain Corporate-Action Context with xBridge

xBridge enables cross-chain transfers that preserve corporate-action context. Corporate-action context means the information about what corporate actions have been applied to a share.

For example, a share might have been split three times. The share was originally worth one hundred dollars, but after three two-for-one splits, it is worth twelve dollars and fifty cents. When the share moves to a different blockchain, this context must be preserved. The share must still be worth twelve dollars and fifty cents on the new blockchain.

Without this context, the share might be valued incorrectly on the new blockchain. xBridge preserves this context, ensuring that shares maintain correct value across blockchains.

xBridge Features: Shareholder Records

What Single Economic Position Means

A single economic position means that there is one official value for a shareholding. A shareholding is the number of shares that a person owns. A single economic position means that across all blockchains, a person's total shareholding has one official value.

For example, a shareholder owns one hundred shares on Ethereum and fifty shares on Solana. The single economic position for this shareholder is one hundred fifty shares. This is the official, authoritative total.

How xBridge Enforces Single Economic Position

xBridge enforces a single economic position for tokenized equities. This means xBridge maintains one official record of how many shares each shareholder owns across all blockchains.

xBridge prevents duplicated or shadow supply. Duplicated supply means that the same share is counted multiple times. Shadow supply means hidden shares that are not in the official count. xBridge prevents both problems.

For example, suppose a share is moved from Ethereum to Solana. Without xBridge, the share might still exist on Ethereum while also existing on Solana. This would double the share count. With xBridge, the share is removed from Ethereum and added to Solana. The total share count remains constant.

How To Maintain Shareholder Registry Coherence with XBridge

A shareholder registry is the official list of shareholders and how many shares each owns. A coherent registry means all the information in the registry is consistent and related to the same issuance of shares.

xBridge ensures that total outstanding shares remain consistent across Ethereum and Solana. Outstanding shares means shares that are currently owned by shareholders. If a company has one million shares outstanding, then the total shares across all blockchains should add up to one million.

Without xBridge, shares might be double-counted. A share could be counted on Ethereum and also counted on Solana. This would make it seem like there are two million shares outstanding when there is really only one million.

With xBridge, shares are counted only once. If a share moves from Ethereum to Solana, it is removed from the Ethereum count and added to the Solana count. The total remains one million.

xBridge Features: Accountability

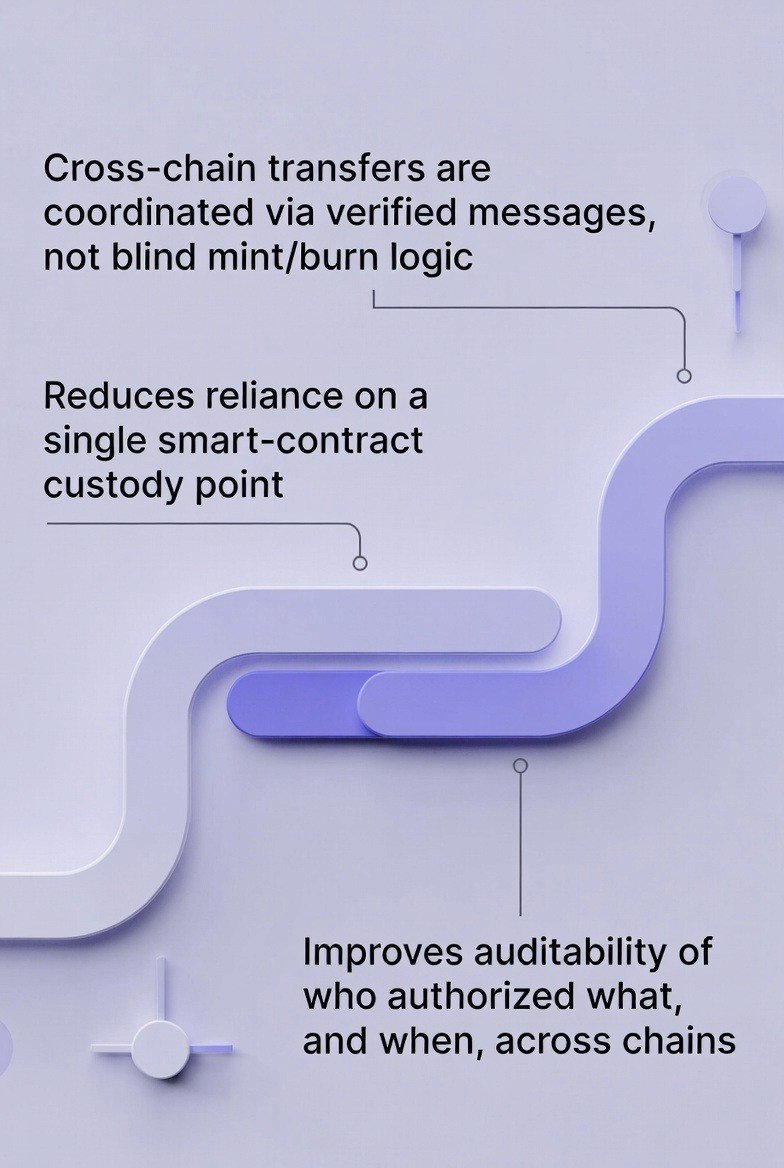

What Verifiable Cross-Chain Messages Are

Verifiable cross-chain messages are communications between blockchains that can be proven to be legitimate. A message is information sent from one place to another. Verifiable means that it can be proved to be true. Cross-chain means between different blockchains.

Traditional asset bridges use a technical approach called mint and burn. Mint means creating new tokens. Burn means destroying tokens. With mint and burn logic, when tokens move from one blockchain to another, they are burned on the first blockchain and minted on the second. This process is not transparent about who authorized the move.

How xBridge Uses Verifiable Messages Instead

To give an example, let’s say there is a shareholder that has shares on Ethereum and they want to move those shares to Solana. That shareholder will send a request for the transfer of their shares and include the shareholder’s Ethereum address, how many shares, and which blockchain they are transferring them to. This message will be verified as being sent from the shareholder’s approved wallet. Once this transfer happens, the time it took place will be included.

How to Improve Auditability with xBridge

Auditability refers to the ability for someone to verify/audit that a process occurred as expected. Auditors are responsible for reviewing organizations' adherence to guidelines and processes in place.

xBridge increases the auditability of transactions across blockchain networks by recording who authorized a transaction, when they did so, etc. Therefore, auditors will be able to determine who authorized a specific transfer and when it was approved.

If no such tracking existed, auditors would not know if a transfer had been properly authorized. In addition, auditors could not identify fraudulent activity; nor could they confirm that the organization is adhering to any applicable regulations.

In summary, through its use of xBridge, auditors will have full transparency into their auditing process. Specifically, auditors will be able to view the entire history of who authorized each transaction, and when they did so.

How xBridge Reduces Reliance on Single Points of Failure

xBridge reduces reliance on a single smart-contract custody point. A custody point is a location where something is stored or held. A single point of failure means that if this location fails, the entire system fails.

Traditional custody contracts are single points of failure. If something goes wrong with the custody contract, all assets could be lost.

xBridge reduces this risk by using verified messages instead of relying on custody contracts. Verified messages are less likely to be forged or compromised. This makes the system more secure.

Real-World Use Cases

Backed Finance xStocks Cross-Chain Pilot

Backed Finance is a provider of compliant tokenized equities and exchange-traded funds. Compliant means that the equities follow all government rules and regulations. Backed Finance uses xBridge, powered by Chainlink CCIP, to enable xStocks to move across blockchains.

xStocks are Backed's tokenized equities. These are shares of real companies that have been converted to digital tokens on the blockchain. Backed Finance has created tokenized versions of major stocks such as Tesla, Microsoft, Apple, and many others.

How Backed Finance Uses xBridge

Backed Finance uses xBridge to enable xStocks to move between Ethereum and Solana while preserving critical financial properties. Critical financial properties include dividends, stock splits, and ownership state.

When a shareholder moves xStocks from Ethereum to Solana, the xStocks retain all their properties. If a dividend has been declared, the shareholder will still receive the dividend on Solana. If a stock split is pending, the shareholder will still receive the split on Solana. The shareholder's ownership state is preserved.

Current Status

The solution is currently live in a production pilot. A production pilot means the system is being used with real users and real assets, but it is still being tested and monitored closely. This is not an experiment in a test environment. This is a real system handling real assets.

The solution demonstrates how regulated tokenized stocks can operate cross-chain without breaking corporate actions, governance, or shareholder record integrity. This is significant because it shows that the problems xBridge solves are real and serious. It also shows that xBridge actually solves them.

Future Plans

Broader rollout is expected as adoption expands. As more institutions and users begin using xBridge, Backed Finance will expand the number of stocks available and the number of blockchains supported. This will increase access to tokenized equities and make the market more liquid.

The Outlook

Short-Term Outlook

The live Backed Finance xStocks pilot demonstrates that cross-chain tokenized equities are viable only when corporate actions and ownership state remain synchronized. Synchronized means that they stay the same across blockchains.

This is an important finding. It shows that the problem of maintaining consistent ownership records across blockchains is real and serious. It also shows that this problem can be solved.

The live pilot validates the need for equity-aware infrastructure rather than generic asset bridges. Generic asset bridges are tools that move any asset between blockchains without understanding what the asset is. They do not understand stocks, corporate actions, or shareholder rights.

Equity-aware infrastructure means tools that understand stocks and equity markets. These tools know about corporate actions, shareholder rights, and voting. This specialized infrastructure is necessary for tokenized equities.

Long-Term Outlook

As adoption grows, coordination layers like xBridge will be essential to maintain a single source of shareholder truth across networks. Source of truth means the official, authoritative information. Maintaining a single source of truth across networks is difficult but essential.

xBridge will drive the evolution of transfer agents into cross-chain governance and accountability stewards. Transfer agents will no longer just manage records on a single system. They will manage records across multiple systems and ensure that governance and accountability are maintained across all systems.

This evolution will create new opportunities and challenges for transfer agents. They will need to develop new skills and processes. They will need to work with blockchain platforms and infrastructure providers. But they will remain essential to equity markets.

FAQ

1. Why do cross-chain tokenized equities break the traditional transfer agent model?

Old transfer agents keep track of who owns what using one main list, but cross-chain digital stocks spread ownership across many blockchains. Without working together, this creates mixed-up ownership records, broken company actions, and voting problems that hurt how stock markets work.

2. How does xBridge change the role of transfer agents rather than replacing them?

xBridge makes transfer agents do more than just keep one list—now they coordinate across many blockchains, keeping track of who owns what, making sure company actions happen fairly, and managing voting rights across multiple blockchains while making sure there's still one true ownership record.

3. How does xBridge preserve ownership integrity when shares move between blockchains?

xBridge stops shares from being created twice or counted twice by making sure when shares move from one blockchain to another, the number goes down on the old blockchain and up on the new one, so the total number of shares stays the same everywhere.

4. How does xBridge ensure corporate actions and governance remain fair across chains?

xBridge sends important ownership information—like dividend payments, stock splits, and voting rights—across all blockchains at the same time, preventing different blockchains from getting out of sync and making sure all shareholders are treated the same way no matter which blockchain their stocks are on.

5. Why is xBridge superior to generic asset bridges for tokenized equities?

Regular bridges just move tokens without understanding stock market rules, which creates legal and voting problems. xBridge is different because it understands how stocks work, using messages that can be checked and verified to keep clear records, show who approved what, and prove everything is correct like the government requires for real stock markets.

How TokenMinds Supports Institutional Adoption of xBridge

TokenMinds believes that the future of capital markets will be cross-chain. This means that the same security or stock will be tradeable on multiple blockchains. This will provide more liquidity and more options for investors.

TokenMinds helps institutions navigate this shift by designing cross-chain tokenized equity solutions that align with real regulatory, operational, and market requirements. TokenMinds does not just implement technology. We ensure that technology aligns with business needs.

Our team will work with your team to pilot and scale infrastructure such as xBridge in a practical way. This means validating ownership records and corporate-action integrity early. Ensuring that cross-chain equity systems grow with trust, not complexity.

Conclusion

xBridge lets digital stocks (which keep all ownership, voting, and record information) move between different blockchains by making sure each asset keeps all its features as it goes from one network to another. This fixes a major problem that has stopped financial markets from working well when you have many different blockchains. Companies and groups that can learn how to use tools like xBridge early will be in a great spot to benefit from the future of stock markets that use blockchains.

Schedule a complimentary consultation with TokenMinds to learn how xBridge works in the future of cross-chain stock markets, and how your organization can get ready for digital stocks that move across blockchains without losing control or clarity.