Layer 2 solutions sit at the center of blockchain scaling in 2026. Ethereum reached a record two million daily transactions in January 2024. That growth exposes hard limits on fees, latency, and user experience. Layer 2 solutions now process a rising share of this activity. For founders, the question shifts from experimentation toward long term architecture decisions. Enterprises need predictable costs, clear compliance paths, and resilient transaction capacity. A blockchain development company now treats Layer 2 as core infrastructure.

This article explains layer 2 solutions and the business impact behind them. Let's dive into it!

What Is a Layer 2 Solution?

A layer 2 solution is a network built on top of a base chain. It processes transactions off the main chain, then settles results back. The base chain keeps its role for security, consensus, and final records. Layer 2 handles the heavy traffic where speed and cost matter most.

Most designs bundle many transactions into a single update on the base chain. This batching reduces fees and lifts throughput without changing core security. The result is a more practical environment for products with frequent activity. A strong layer 2 strategy turns blockchain into a workable substrate for growth.

For a blockchain development company, layer 2 solutions are now standard tools. They support payment flows, trading systems, and consumer apps at lower cost. They also keep alignment with major ecosystems that anchor trust and liquidity.

What Is the Difference Between Layer 1 and Layer 2

Layer 1 is the main blockchain that runs consensus and protects security. Examples include Ethereum, Bitcoin, and other base settlement networks. These networks store final state and enforce rules for valid transactions.

Layer 2 is an extension of that base layer. Layer 2 sits on top of Layer 1 and depends on its security. It processes many actions off chain, then posts proofs or summaries back. This structure creates a blockchain layer 2 that focuses on scale and cost.

Category | Layer 1 | Layer 2 |

Core Role | Security and settlement | Execution and scale |

Main Function | Validates and finalizes transactions | Processes activity off chain |

Speed | Lower throughput | Higher throughput |

Fees | Higher fees | Lower fees |

Use Case Fit | Asset security and final records | High-volume apps and daily activity |

Control | Neutral and decentralized | Depends on design and operator |

Example Networks | Ethereum, Bitcoin | Arbitrum, Optimism, Starknet, zkSync |

In simple terms, Layer 1 secures value while Layer 2 moves activity faster. Layer 1 favors robustness and neutrality instead of raw performance. Layer 2 favors user experience and transaction volume within that secure frame.

For product teams, the key point is role separation across both layers. Layer 1 acts as the trust anchor and settlement court. Layer 2 becomes the day to day environment where usage actually happens.

How Layer 2 Solutions Work

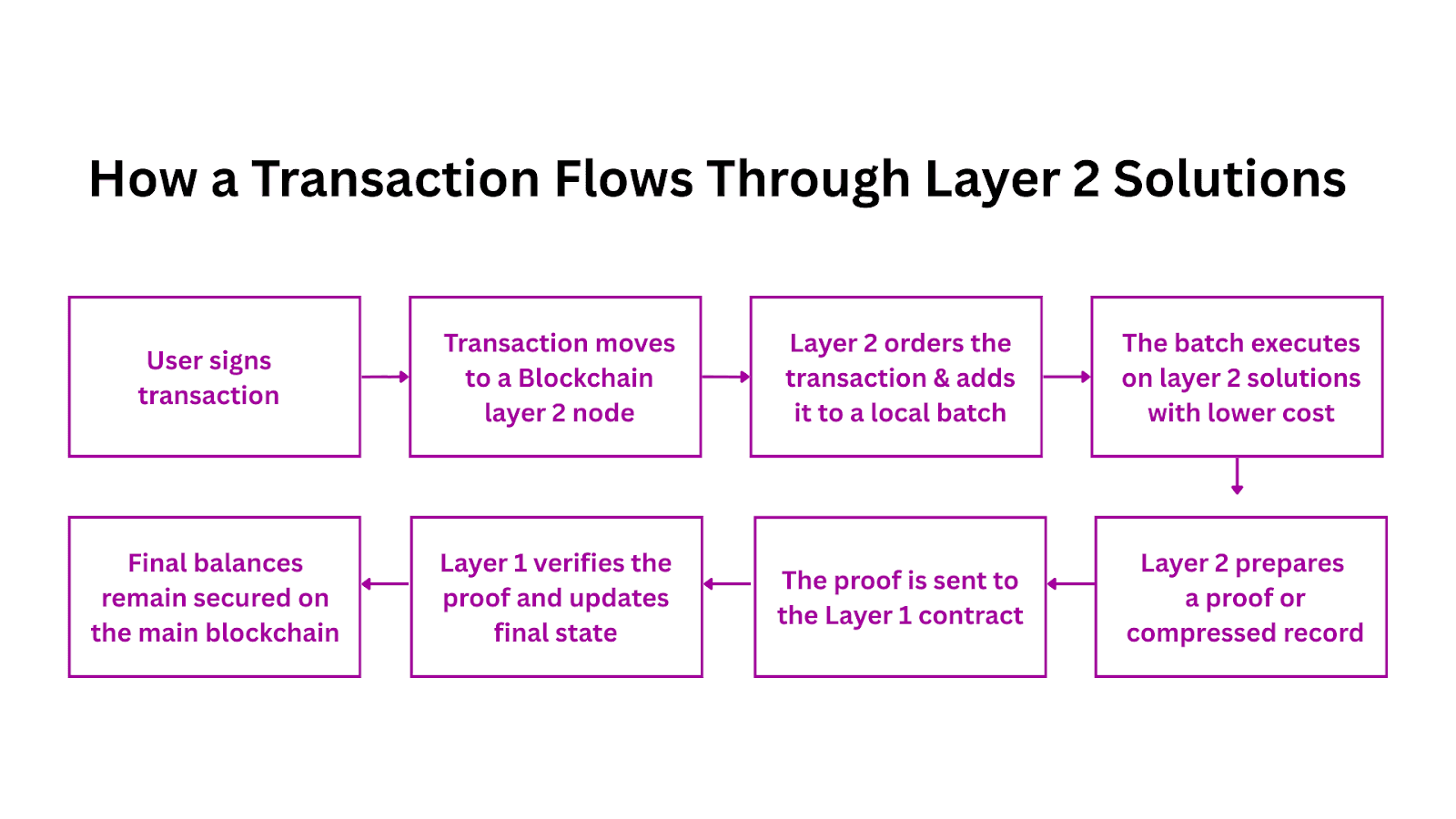

Layer 2 solutions sit between users and the base chain. Transactions first land on a Blockchain layer 2 network instead of Layer 1. A coordinator orders these transactions and builds local blocks or batches. The network then sends compressed data or proofs back to the base chain.

Layer 1 still decides the final truth for balances and contract state. Layer 2 focuses on handling high traffic, interaction logic, and user experience. This split reduces gas per transaction and raises effective throughput. It also keeps strong alignment with the security of the base network.

From a Blockchain development company view, this creates a layered architecture. Critical assets and settlement stay anchored on the base chain. High frequency actions move to layer 2 solutions where cost and speed improve. The result is a structure that can support real products at scale.

Main Types of Layer 2 Architectures

Most layer 2 solutions fall into a few clear categories. Each category uses a different method for scale, speed, and cost control. These methods help teams choose the right structure for long term growth.

1. Rollups

Rollups move execution off the base chain while keeping security on Layer 1. Transactions run on the rollup, then the network sends compressed data back to Layer 1. Layer 1 verifies this data and anchors the final state.

This structure reduces fees, increases throughput, and preserves trust. Rollups also keep strong alignment with major ecosystems because settlement stays on Layer 1. Most large layer 2 solutions today fall under this rollup category.

Rollups split into two main groups with different validation methods:

Optimistic Rollups

Optimistic rollups treat transactions as valid unless challenged. A time window allows fraud proofs to dispute incorrect results. This model supports open participation and broad smart contract use.

Common examples include:

Arbitrum

Optimism

Base

These networks suit DeFi, NFT markets, and high-activity consumer apps.

ZK Rollups

ZK rollups produce validity proofs for each transaction batch. The proof shows correct execution without revealing full details. Finality is faster and exits are simpler, with deeper math behind the system.

Common examples include:

Starknet

zkSync

Polygon zkEVM

Linea

These networks work well for high volume activity and privacy-focused flows.

Aspect | Optimistic rollups | ZK rollups |

Validation model | Assume valid, challenge if fraud suspected | Prove every batch with validity proofs |

Finality speed | Slower withdrawals due to dispute window | Faster finality and exits |

Cost profile | Lower proving cost, higher data cost | Higher proving cost, lower data per transaction |

Best fit | General DeFi, NFT markets, broad apps | High volume apps, complex flows, some privacy needs |

Maturity today | Larger ecosystems and TVL on some networks | Rapid growth with strong technical focus |

Example networks | Arbitrum, Optimism, Base | Starknet, zkSync, Polygon zkEVM, Linea |

2. State Channels and Payment Channels

State channels create a private pathway between two or more parties. Funds or state lock in a contract on Layer 1 before activity starts. Participants then exchange many updates off chain without touching the base chain. Only the final result returns to Layer 1 when the session ends.

This approach removes fees for every action inside the channel. It also gives very fast speed because no blockchain confirmation is needed. The model works best when participants are known in advance and interact often.

Examples include:

Lightning Network (Bitcoin payment channels)

Raiden Network (Ethereum payment channels)

These channels fit fixed partners with stable relationships. Trading desks, game sessions, and rapid settlement flows benefit most.

3. Sidechains and Validium-Style Systems

Sidechains act as separate blockchains that connect to a main network through a bridge. They have their own validators, block rules, and security guarantees. Transactions run entirely on the sidechain, then sync with the base chain when needed.

This structure gives more control over speed, cost, and feature design. It also introduces separate trust assumptions because security depends on the sidechain. Teams often use sidechains when custom features or regional rules matter.

Validium systems follow a similar pattern but store data off chain. They post proofs to Layer 1 while keeping full data in external systems. This improves scale but relies on trusted operators to store that data.

Examples include:

Polygon PoS (sidechain)

Immune X or zkPorter on zkSync (validium-based systems)

These models serve enterprise needs, privacy rules, and large-volume consumer apps.

Where Layer 2 Delivers Value for Businesses

Real products need low fees, fast execution, and predictable operations. Layer 2 solutions support these needs by moving heavy activity off the base chain. Layer 1 keeps security, while Layer 2 handles volume at lower cost. This structure creates practical gains for payments, trading, gaming, and enterprise systems.

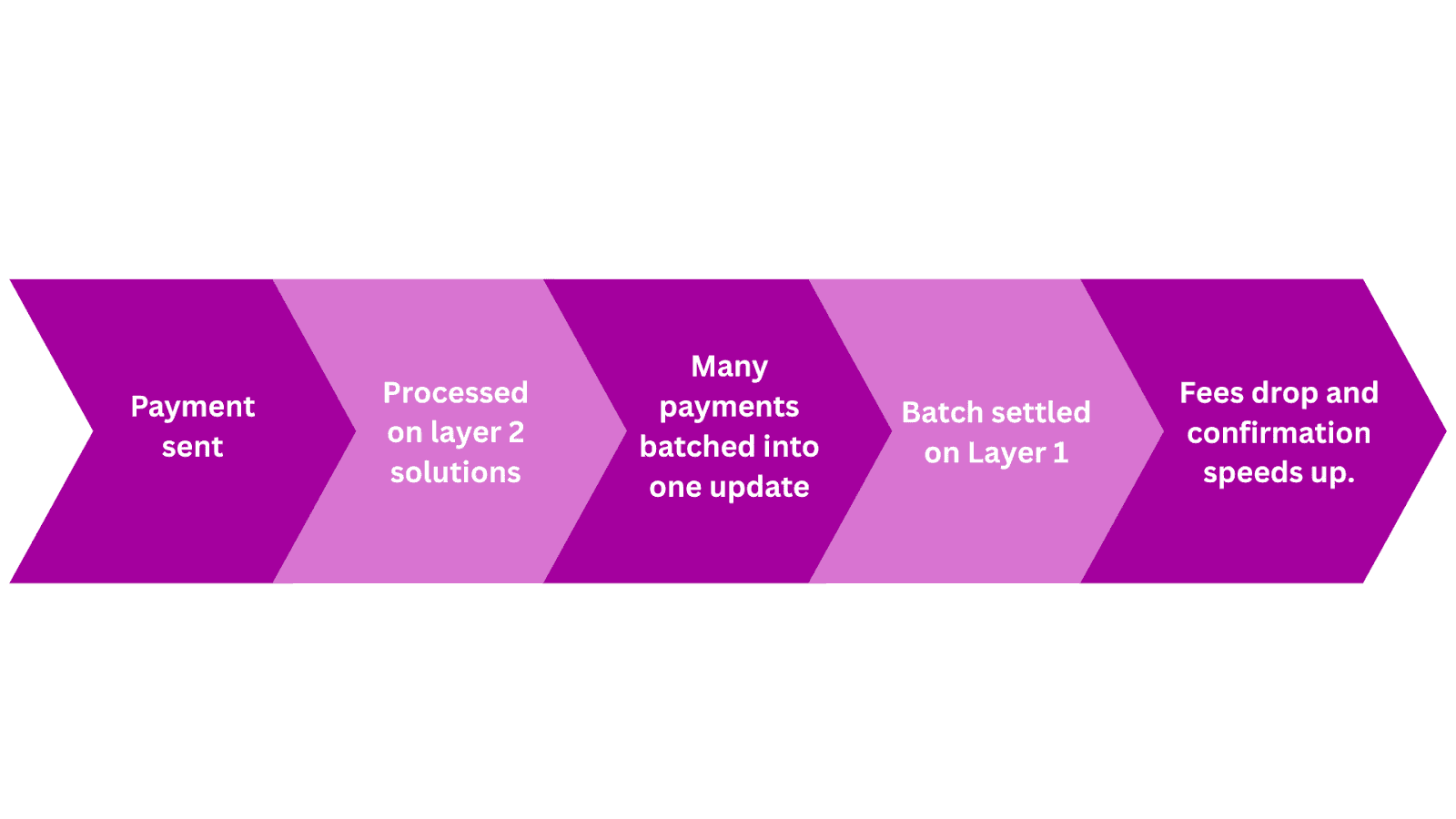

1. Payments and Treasury Flows

Payments become workable when fees stay low and confirmation times drop. A Blockchain layer 2 reduces fees by batching many transfers into one Layer 1 update. This cuts cost per transfer while keeping the same security base. Faster block production on Layer 2 also reduces delays in cross-border flows. Treasury teams gain more reliable settlement times and better capital rotation.

2. DeFi, Trading, and Liquidity Products

DeFi platforms need fast execution to keep markets efficient. Layer 2 improves this by running swaps and contract calls in local batches. Lower gas per action reduces slippage, reverts, and failed trades during peak hours. Exchanges and lending markets see more stable operations when activity moves off Layer 1. These gains create a better base for liquidity growth and product expansion.

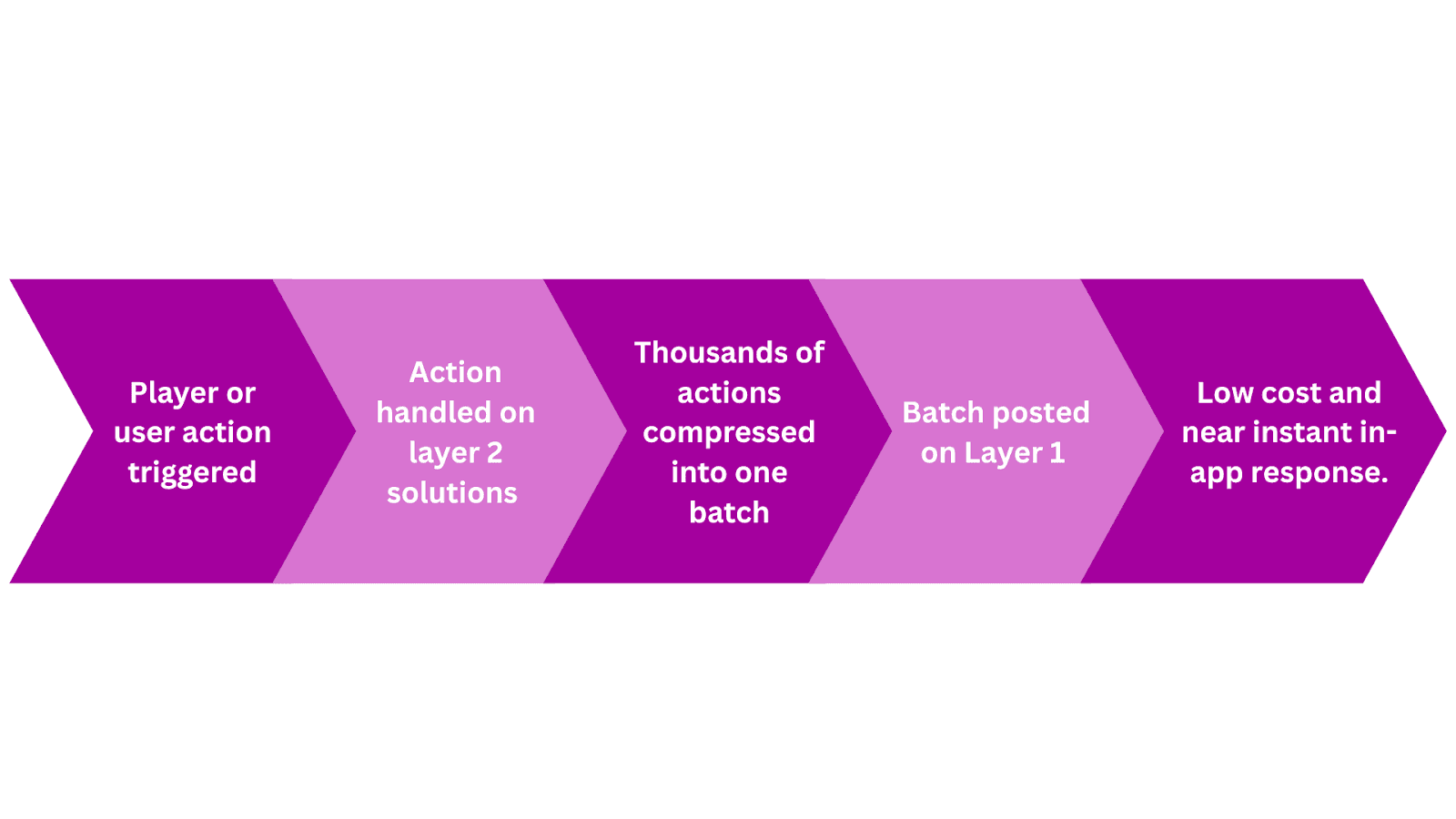

3. Gaming, NFTs, and Digital Assets

Games and NFT apps rely on frequent interactions. Layer 1 fees make each action expensive, which blocks user growth. Layer 2 solves this by processing thousands of small actions in a compressed batch. This reduces cost for minting, trading, and in-game updates. User flow improves because confirmations feel instant at the application level.

Real-World Layer 2 Implementations From Enterprise Projects

Many enterprise programs mix public layer 2 solutions with private or regulated systems.

This creates fast user experience while keeping strict control over payments and records.

Recent TokenMinds projects show how this works in real deployments.

Hybrid Rollup and Private Ledger Payments

One large e-commerce platform used a hybrid scaling design. User actions ran in a fast Blockchain layer 2 style environment. Cart updates, loyalty points, and agent-led checkout stayed in this execution layer. Final settlement and regulated payment flows moved into a Hyperledger Fabric network. Auditable smart contracts enforced rules on the private ledger for every payment.

This model kept instant front end experience and strict payment compliance. A pure Layer 1 approach could not meet both goals at once.

Layer 2 Scaling for High-Volume Token Sales

Token launch platforms often face short bursts of very high activity. KYC checks, purchase flows, and vesting schedule updates hit systems at the same time. In recent TGE projects, high frequency steps moved to off-chain or rollup style batching. Verified token mints, vesting contract changes, and liquidity actions stayed on the base chain.

This structure let platforms handle thousands of actions without fee spikes. It also preserved clear on-chain records for core token events and liquidity.

TokenMinds Layer 2 Rollout Framework

Successful adoption of layer 2 solutions works best in clear phases. This mirrors TokenMinds delivery for token sales, DeFi platforms, and private systems.

Phase 1: Architecture and prototyping

Define the Layer 2 type and settlement flow.

Map compliance needs and external integration points.

Outcome: clear technical blueprint for the full stack.

Phase 2: Smart contract and execution layer development

Implement core contracts and sequencer or execution logic.

Build off chain components or proof modules when needed.

Outcome: Layer 2 logic ready for integration work.

Phase 3: Compliance, identity, and operational modules

Add KYC and AML checks and access control rules.

Configure admin rights, dashboards, and governance flows.

Outcome: enterprise grade safety and control across environments.

Phase 4: Testing and security

Run audits and stress tests across key components.

Simulate challenges and cross layer transaction flows.

Outcome: verified stability under realistic load patterns.

Phase 5: Staged mainnet launch

Launch with limited features or selected user groups first.

Expand traffic while tracking cost, latency, and failure rates.

Outcome: smooth transition from pilot to full production.

Snapshot of Leading Layer 2 Ecosystems

Most layer 2 solutions today anchor around Ethereum and Bitcoin. These networks provide security, liquidity, and deep developer ecosystems. They form the main base for scalable production deployments.

Ethereum Rollup Ecosystem

Ethereum hosts the largest Blockchain layer 2 ecosystems today. Rollups extend Ethereum by running execution off chain with L1 security. Optimistic rollups include Arbitrum, Optimism, and Base. ZK rollups include Starknet, zkSync, Polygon zkEVM, and Linea. This mix supports DeFi, NFTs, identity, and consumer applications at scale.

Bitcoin and Lightning

Bitcoin focuses on secure settlement and simple transfers on Layer 1. This creates limits on speed, cost, and transaction capacity. The Lightning Network adds fast, low cost payments above Bitcoin. Payments move through channels instead of the base chain each time. This structure fits high frequency payments and small value transfers.

Other Emerging Layer 2 Stacks

Other chains also support structured scaling layers. Polygon, Avalanche, and modular stacks like Celestia help rollups build. These systems often act as a blockchain layer for dapps. They tailor throughput, privacy, and governance for a single product. This pattern fits complex blockchain for dapps platforms with special needs.

Practical Checklist: Choosing the Right Layer 2 Solutions for a Project

This checklist assists teams to determine the place of layer 2 solutions in a roadmap. Every step causes options to become limited until architecture work begins in a detailed manner.

1. Elaborate Product and Volume Requirements.

Establish the essence of product and primary user behaviors.

Making estimates of the transactions per day under normal and peak conditions.

Mark important markets, time zones and note areas.

Mark flows which will not stop short under load.

2. Set Cost and Fee Targets

Determine a fixed fee per transaction or user action.

Manage current Layer 1 charges of the selected base network.

Flow which occurs should move to a second layer, the Blockchain to strike targets.

Mark any flows which can remain on Layer 1 to provide additional safety.

3. Match Use Case to L2 Type

In the case of general DeFi and NFTs, mature rollup ecosystems are preferable.

In the case of regular partner contacts, consider state channels or payment channels.

To achieve maximum privacy or special regulations, consider sidechain and validium models.

To focus on payments, evaluate Bitcoin and Lightning as well as Ethereum rollup.

4. Check Ecosystem and Tooling

Support for current stack and languages.

Check wallet support and on-ramp and off-ramp.

Scan block explorers, surveillance solutions and analytics coverage.

Examine the size and activity of core applications in that network.

5. Evaluate Security and Operator Model.

Know whom to run sequencers or validators on the target Blockchain layer 2.

Check upgrade privileges, administrator keys, emergency controls.

Examine history of incidents, audits and community security reports.

Confirm bridge design and bridge accidents in the past, in case there are any.

6. Map Requirements and Requirements.

List information that should remain confidential or localized.

Record retention and audit access rules should be noted.

Data OSI location in the proposed layer 2 solutions stack.

Determine the need of local partners or nodes in strategic areas.

7. Plan Migration and Rollout

Make a decision on what features to migrate and those to remain on Layer 1.

Develop a phased release of early adopters and internal teams.

Establish success measures, such as cost, failure rate, and latency.

Lay down rollback plans in case of failure to achieve the initial goals.

8. Confirm Support and Partner Roles.

Make decisions on what work remains in-house and what work requires outsourcing.

An architecture, rollout, and long term care can be owned by a Blockchain development company.

Picture confirmation hours, response times and service levels.

Create incentives such as uptime, cost management and security achievements.

9. Enterprise Architecture Factors

Administrative multi approvals and permission based roles.

KYC and AML checks, compliance and data control, blacklist control and audit logs.

Dashboards to monitor the rate of errors, token events, and major risk factors at the operational level.

Risks, Limits, and the Future of Layer 2 Solutions

Layer 2 solutions offer clear gains, but each design carries limits. These limits affect cost, security, and long term reliability. A clear view of these risks helps teams plan stable deployments.

Key Risks

Bridge exposure

Bridges remain a major failure point when moving assets across layers.

Sequencer control

Many Blockchain layer 2 networks still rely on one operator for ordering.

Data availability gaps

Some designs place data off chain, which adds operator trust.

Liquidity fragmentation

Assets spread across multiple rollups lower efficiency and user flow.

Practical Limits

Layer 2 designs still face constraints that shape real deployment work. Higher throughput increases long term storage and data handling needs. ZK systems demand heavy proving resources that raise operational cost. State channels and sidechains fit narrow patterns because they require fixed parties or separate trust assumptions. These limits do not block adoption but set boundaries on where each model works best.

Future Direction

Layer 2 development moves toward more connected and resilient systems. Shared proving and shared data layers aim to reduce fragmentation across networks. Decentralized sequencer models should lower operator concentration and improve fairness. Cross-L2 messaging will help applications move assets and information smoothly. These shifts point to a future where layer 2 solutions become more secure, more unified, and easier to build on at scale.

Develop and Implement Layer 2 Solutions with TokenMinds

The right Blockchain development company shapes long term results for any scaling plan. Strong partners balance technical depth, clear delivery, and stable operational models across networks.

As a blockchain development company, TokenMinds supports advanced layer 2 solutions across Ethereum, Bitcoin Lightning, and emerging rollup stacks. The team guides programs that need secure execution, lower cost, and reliable performance at scale.

A short discovery call can confirm fit for current Layer 2 plans. Schedule a discussion for a free consultation to receive a tailored rollout plan.