TL’DR

Tempo Network enables businesses to move from multi-day settlement cycles to near-instant payments, improving cash flow and liquidity management. It allows institutional payments to run on stablecoins without the operational complexity of managing crypto assets, while reducing per-transaction costs for high-volume payments to approximately <$0.001, making large-scale payment operations faster, simpler, and more cost-efficient.

About Tempo Network

Tempo Network, marks a major turning point in the design of blockchain architectures. From the general-purpose "world computer" models used today, Tempo will move to the development of an exclusive, Layer-1 blockchain, which is specifically designed for transactions and stablecoin settlements.

Developed and incubated by two leaders in the digital economy; Stripe (a global provider of payments infrastructure), and Paradigm (a crypto-native investor and researcher) - Tempo has been engineered to solve the key areas of friction that have limited the adoption of blockchain-based transaction rails by traditional institutions. Unlike the Layer-1 blockchains such as Ethereum and Solana which are both built to provide support for complex DeFi trading applications, NFT mints, etc., Tempo has only one focus; to support the flow of funds between institutions. This institutional payment focus reflects patterns already seen in global fund movement and settlement models discussed here.

By enabling this type of chain, Tempo has an opportunity to remove the inefficiencies seen in general-purpose blockchains. This is intended to allow high volume merchant payment, corporate treasury settlement, and international transactions to have a degree of reliability and cost predictability comparable to, if not better than, banking wires, yet will provide the speed and programmability of crypto.

The project is being led by Matt Huang, co-founder and managing partner of Paradigm, who also sits on Stripe’s board and continues in his role while serving as Tempo’s CEO.

Characteristics of Tempo Network:

Native Layer-1 Payment Chain: This is a layer one blockchain that is designed specifically for simple value transfer and not for expensive, gas consuming complex calculations.

First-Class Treatment for Stablecoin: In terms of how the network settles transactions, USD pegged assets are treated as first class citizens; as such, fees can be settled using stable coins versus the volatile native token.

Designed for High Volume, Real-Time Transaction Processing: It is capable of processing greater than 100,000 TPS with less than one second of finality, so it is capable of processing the transaction volume of a large card network.

Compatible with EVM for Developer Adoption: The network is compatible with the Ethereum Virtual Machine (EVM); thus, the millions of solidity developers and current institutional tools (e.g., Fireblocks, Coinbase Prime) will operate without any issues.

Focus on Financial Infrastructure: Network governance and technical road map focus on the stability of the network and availability.

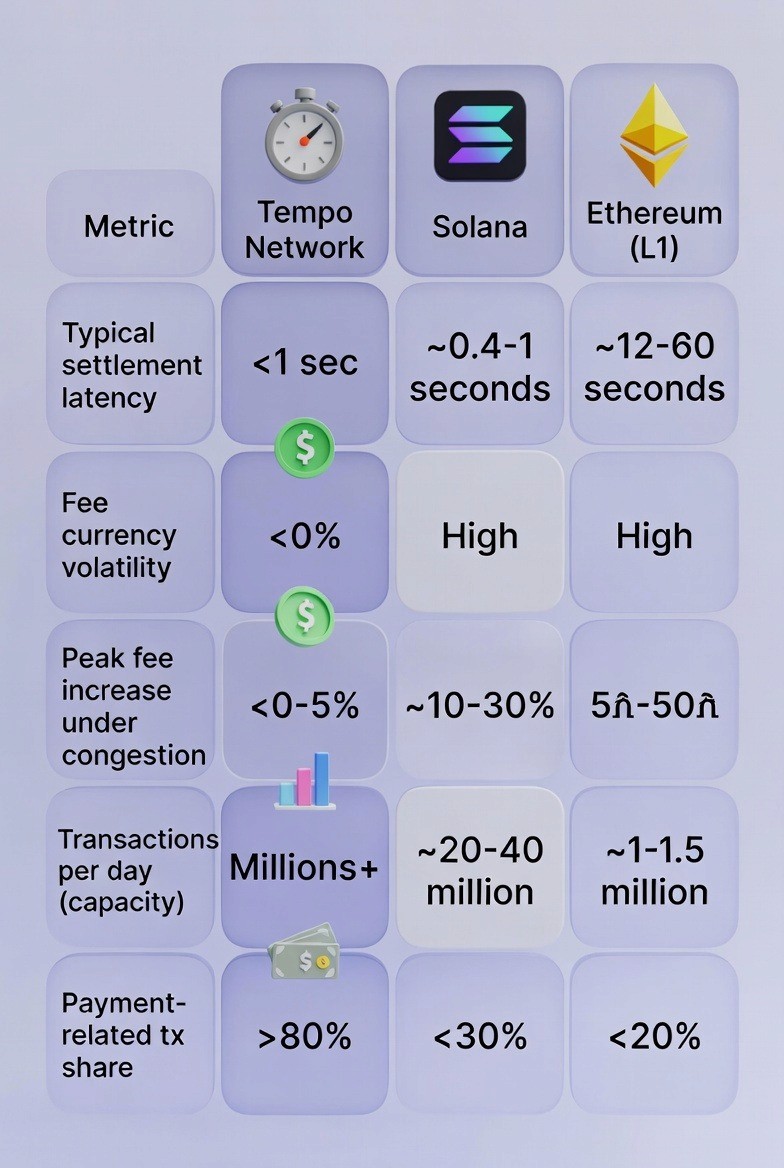

TABLE OF COMPARISON

To understand where Tempo Network fits in the evolving payments landscape, it helps to compare it directly with other Layer-1 blockchains that are often considered for payment and settlement use cases.

The above comparison shows that Tempo Network is built with the objective of achieving payment certainty as opposed to general blockchain activities. While both Solana and Ethereum may have speed in common, Solana and Ethereum exhibit volatility in fees due to congestion; and they also have relatively lower shares of payments related transactions compared to other types of workload, such as DeFi and trading.

How Tempo Fits Into Payment and Settlement Flows

The purpose of Tempo is not to serve as a replacement for end-user facing fintech applications (i.e., a banking application or checkout page), but rather as the high-performance back-end settlement layer that supports such applications, as seen in how modern Web3 payment flows are described here. Tempo enhances and expands the capabilities of current financial architecture by providing a faster, digitally-based alternative to the legacy “rails” (i.e., ACH and SWIFT) that are currently used for the clearing of financial transactions through a batch process over several days.

By integrating Tempo into its operations, an institution is effectively upgrading its “plumbing” from a back-end perspective. This upgrade provides the ability to rapidly move value (versus waiting two business days for a T+2 settlement cycle).

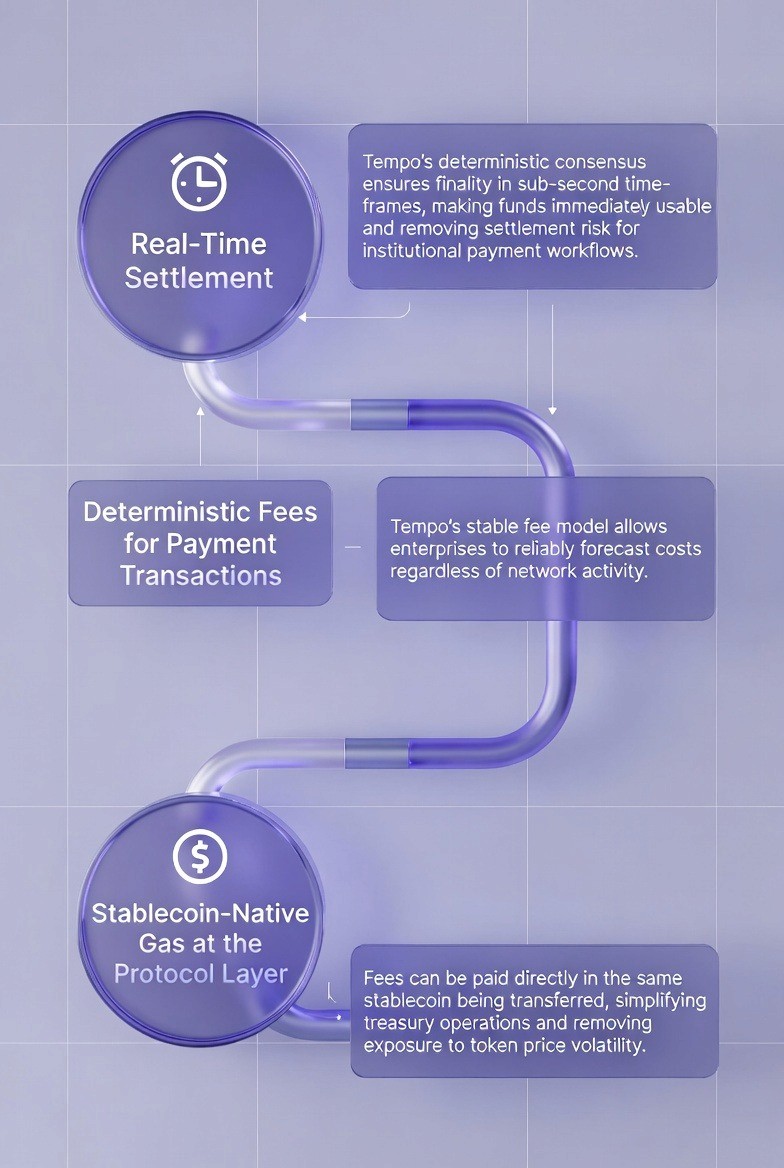

1. Stablecoin-Based Payment Initiation and Settlement

In general, a user must hold a volatile asset (e.g., ETH) to cover gas expenses for moving a stable coin (e.g., USDC) in most traditional blockchain platforms. Tempo eliminates this impediment, a pattern that aligns with stablecoin platform mechanics explained in this reference. Payments are submitted and settled directly using USD-backed digital assets.

The network provides a seamless experience that results in “dollars in” being equivalent to “digital dollars out,” without having to separately manage inventory of tokens for fees.

2. Dedicated Payment Execution Paths

One of the largest risks that banks face when using public blockchain networks is “congestion.” For example, if a new NFT collection becomes popular, the cost of executing a transaction on Ethereum may rise to $50. Additionally, transactions may become delayed.

Tempo resolves this issue by creating “payment lanes” – i.e., dedicated paths for payment execution within the protocol level. As a result, even during periods of high activity elsewhere in the network, payment transactions will bypass other traffic and always achieve timely execution.

3. Deterministic Sub-Second Finality

Financial institutions require “finality” for a payment to occur before it is considered to be successfully executed and irreversible. Credit cards have probabilistic finality (i.e., charges may be reversed weeks, months, or years after they were incurred). Bitcoin has slow finality (typically 10-60 minutes).

Tempo provides deterministic finality (approximately 0.6 seconds = real time). Therefore, once a payment is submitted, it is immediately settled and ready for use. This capability enables the creation of “real time finance,” which in turn allows treasurers to utilize the same capital multiple times a day because they do not have to wait for those funds to settle.

4. Predictable and Low Cost Fee Model

Businesses cannot budget for transaction fees that vary randomly between $0.01 and $5.00. Tempo has been designed with a predictable and very low cost fee structure (i.e., approximately $0.001 or 0.1 cents per transaction) that will remain constant, regardless of the volume of usage.

5. Structured Data for Reconciliation and Reporting

Another significant challenge associated with B2B payments is understanding the context of each payment. For instance, a wire transfer arrives; however, the reference number was truncated. Tempo provides structured data standards (e.g., ISO 20022 compliant fields) to include metadata about each payment, including invoice numbers, customer identification numbers and tax codes, etc. As a result, businesses’ ERP systems (e.g., SAP, Oracle, etc.) can perform automated reconciliation of accounts without manual intervention.

Key Challenges in Institutional Payments

While digital banking is growing, there are still many outdated elements when it comes to how money moves around the world.

Long Settlement Cycles

When a U.S.-based company makes an international payment to a Japanese-based supplier, funds pass from one correspondent bank to another before finally arriving at the recipient. There is usually a delay between when funds leave the sender’s account and when they arrive at the recipient’s account; typically taking 2-5 days. In many cases, the sending company is left with no access to the funds until the recipient receives the funds, causing a problem referred to as "trapped liquidity." Companies using this process must keep extra cash on hand as working capital in anticipation of future delays in receiving funds, which creates unnecessary costs.

Large Fees Paid to Intermediaries and Exchangers

Correspondent banking arrangements charge a fee to each bank in the chain through which the funds flow. Funds also go through exchangers who convert the funds from one currency into another, creating additional expense to both parties. A small business or individual sending/receiving funds internationally may find that the fees charged by intermediaries and exchangers amount to 3-5 percent of the total value of the transaction.

Diverse International Payment Infrastructure

The U.S. uses the Federal Reserve’s FedNow and Automated Clearing House (ACH) systems, while the European Union uses the Single Euro Payments Area (SEPA) system and the United Kingdom uses its Faster Payments Service. These systems communicate differently and require costly interfaces ("bridge") to be built between them to allow interoperability. Businesses that expand across multiple countries need to develop unique integration projects for each country they serve, which adds to their overall technical debt.

Price Fluctuations in Blockchain-Based Networks

While blockchain technology offers many advantages over traditional banking methods, including transparency and security, existing blockchain networks like Ethereum use a first-come, first-served pricing model for access to the blockchain. As more users begin to send transactions via the blockchain, the cost of accessing the blockchain increases rapidly. Because large enterprises are required to operate under strict budget constraints, price fluctuations can make it difficult for them to reliably manage transactions that occur on public blockchain networks.

Limited Programmability in Traditional Banking Systems

Banks typically provide a simple "move money" function for customers, but programmable capabilities (e.g., "only move the money if the product was shipped") are limited within legacy banking systems. Therefore, companies wishing to automate transactions typically must implement a third-party application to achieve this level of functionality. Additionally, traditional banking systems rarely include real-time decision-making capabilities, so businesses must utilize a variety of manual controls to ensure that transactions comply with applicable rules.

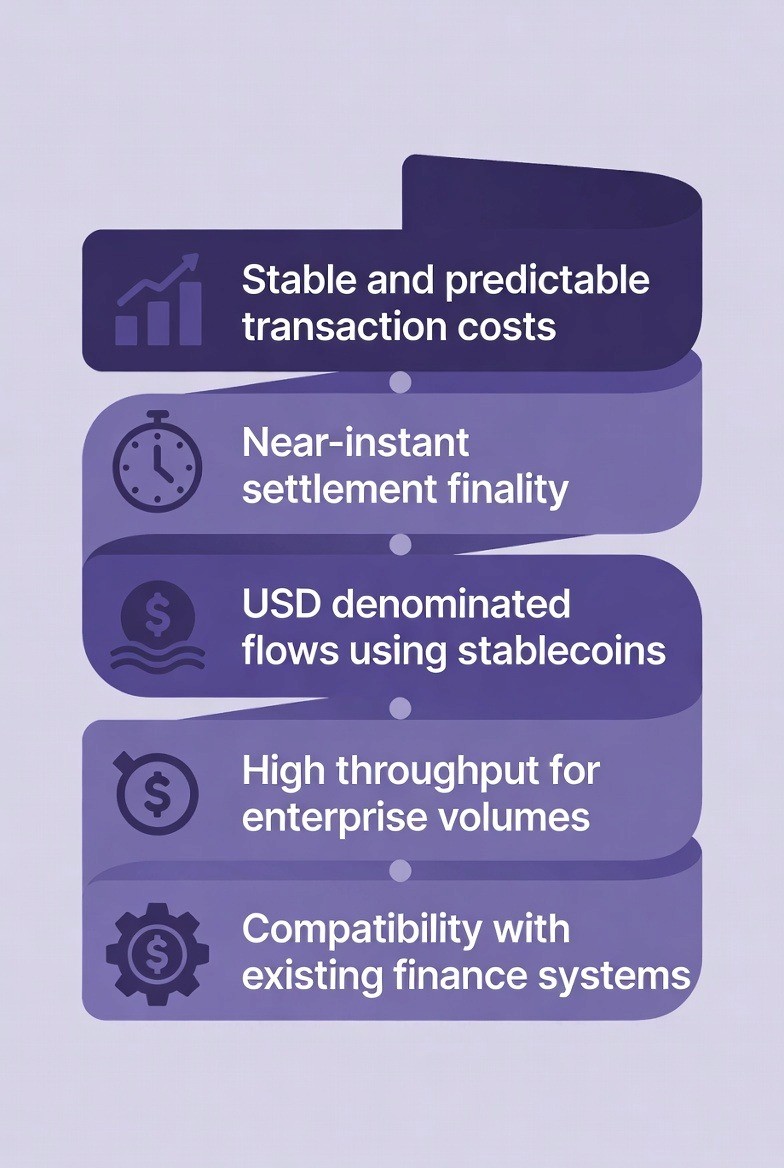

What Institutions Actually Need

Institutional payment networks and major payment processors need systems that are reliable and behave similarly to other financial system components, and not like new untested technologies. Institutional users value reliability, predictability and stability more than innovation.

1. Reliable and Predictable Transaction Costs

Organizations need predictable transaction costs in order to forecast and price goods and services appropriately. The cost of a transaction must be the same tomorrow as it is today ($0.01 today = $0.01 tomorrow) regardless of what the cryptocurrency markets may be experiencing.

2. Fast, Near-Instant Settlement Finality

With faster settlement finality there will be improved cash flow management. When a business receives its money from an instant settlement they can immediately utilize these funds to purchase inventory; this velocity of money enables businesses to avoid borrowing funds from third parties for working capital purposes and also limits counter-party risk (the risk that a party to a contract will become insolvent prior to the completion of a transaction).

3. Digital Dollar Movement with USD-Denominated Flows using Stablecoins

CFO's do not wish to have cryptocurrency price volatility on their corporate balance sheets. CFO's wish to have digital dollars (USD). Stablecoins enable the use of cryptocurrency-based solutions for high-speed movement of digital dollars without exposing organizations to price volatility associated with cryptocurrency price fluctuations.

4. High Transaction Volume

Visa processes approximately 65,000 transactions per second during peak periods; a blockchain that processes 15 transactions per second (for example, Ethereum) will never be able to support a global payment processing system. Institutional customers require scalable, reliable systems that can process millions of daily transactions without failing.

How Tempo Technology Works for Institutions and Businesses

Tempo Network functions as an in-real-time settlement layer for stablecoin payments. It is designed to be invisible to the end consumer (who just sees "Payment Complete") but powerful for the developer (who gets programmable money). Unlike current methods of batch processing—where payments are bundled up and sent once a day—Tempo facilitates continuous, event-driven settlement.

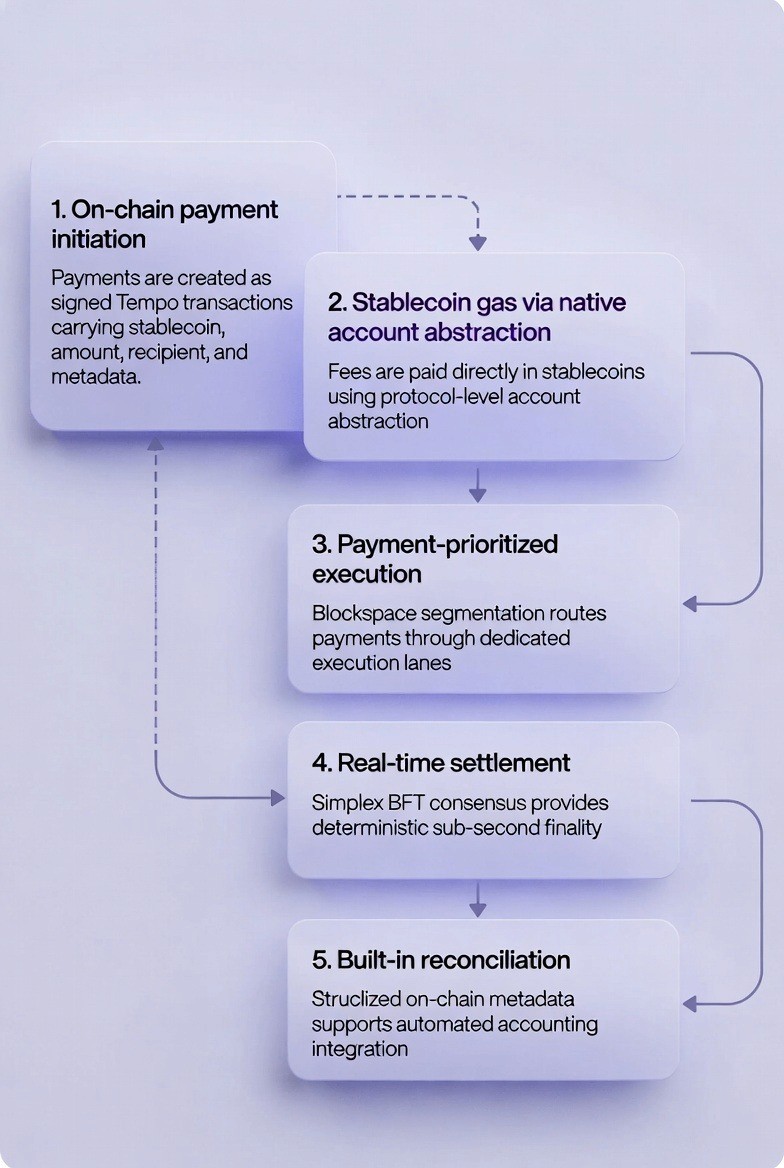

The following is the detailed, step-by-step technical and operational flow of a transaction on Tempo, highlighting the specific architectural innovations that allow a Layer-1 blockchain to rival the speed of a centralized card network.

Step 1 - Payment Initiation

The Trigger:

A user (consumer) or system (automated payroll) initiates a payment. This could happen inside a standard fintech app, a merchant checkout page, or a corporate treasury dashboard. The user simply confirms "Pay $1,000".

The Technical Action:

Instead of sending an ISO 20022 XML message to a bank (which requires a complex chain of intermediaries), the application constructs a cryptographically signed blockchain transaction. This transaction specifies:

Asset: USDC or KlarnaUSD (stablecoin).

Amount: $1,000.00.

Destination: The wallet address of the recipient (or a smart contract).

Metadata: Invoice #12345, Vendor ID: 9988.

Tempo Network Solution: Native Account Abstraction & Stablecoin Gas

In traditional blockchains (like Ethereum), a user cannot send USDC unless they also hold a completely different volatile token (ETH) to pay for "gas" (transaction fees). This is a nightmare for corporate treasurers who do not want to hold volatile assets.

Tempo solves this with Native Account Abstraction. The protocol allows "Paymasters"; smart contracts that sponsor gas on behalf of users.

Result: The user pays fees in the stablecoin they are transferring (e.g., paying $1,000.01 USDC to send $1,000.00). The network handles the swap in the background via an enshrined Automated Market Maker (AMM). The user never touches a native "gas token."

Step 2 - Stablecoin Execution

The Routing:

The signed transaction is broadcast to the Tempo Network RPC (Remote Procedure Call) nodes. This is the digital "entrance ramp" to the highway.

The Priority Lane:

The validator nodes recognize this transaction specifically as a TempoTransaction (a specialized EIP-2718 transaction type). Because it is flagged as a payment, it is routed into a Dedicated Payment Lane.

Tempo Network Solution: Blockspace Segmentation

This is the critical answer to "Why doesn't it get clogged?"

Most Layer-1 blockchains are "single lane" highways. If a popular NFT game launches or a memecoin craze hits, the highway gets jammed. A $10 million treasury transfer sits in the same traffic jam as a $5 cartoon monkey transaction.

Tempo architected Dedicated Payment Lanes. This reserves a specific percentage of the block’s computing power exclusively for financial transfers. Even if the rest of the network is 100% congested with other applications, the payment lane remains wide open, guaranteeing that institutional flows are never delayed by "noisy neighbors."

Step 3 - Predictable Fees

The Cost Calculation:

The network calculates the fee. Unlike Ethereum's "dynamic fee market" where you must outbid other users to get processed (leading to unpredictable spikes), Tempo uses a deterministic fee schedule for standard payment operations.

The Payment:

The fee is deducted instantly. Because of the Simplex Consensus efficiency, the cost is microscopic—targeted at ~$0.001 (one-tenth of a cent) per transaction.

Tempo Network Solution: Deterministic Fee Modeling

Enterprises rely on forecasting. You cannot run a business if your transaction cost is $0.05 today and $5.00 tomorrow. Tempo’s fee model is designed to be inelastic to demand. The network scales horizontally to accommodate more throughput rather than raising prices to choke off demand. This allows CFOs to budget for blockchain costs with the same precision they budget for AWS or Visa fees.

Step 4 – Fast Settlement (The "Real-Time" L1 Engine)

The Consensus:

Tempo uses Simplex Consensus, a high-performance variant of Byzantine Fault Tolerance (BFT) integrated with the "Reth" (Rust Ethereum) client.

The Finality:

Within approximately 600 milliseconds (0.6 seconds), the block is finalized. The validators cryptographically sign off on the state change.

Tempo Network Solution: Deterministic Sub-Second Finality

How can a Layer-1 be "Real-Time"?

This is the most common objection from skeptics. Traditional blockchains like Bitcoin use "Probabilistic Finality." You are never 100% sure the money is yours; you are just 99.999% sure after waiting 60 minutes (6 blocks).

Tempo replaces probability with certainty. Its consensus mechanism allows validators to agree on the state of the ledger instantly. Once that 0.6-second window passes, the transaction is mathematically irreversible.

The Result: It feels like a centralized database (Instant), but has the security of a decentralized blockchain (Immutable). This allows "Real-Time Finance"; money received at 10:00:00 AM can be re-spent at 10:00:01 AM, completely eliminating settlement risk and "float."

Step 5 - Reconciliation & Reporting

The Data Payload:

Along with the value transfer, the transaction permanently records the Structured Data (the metadata added in Step 1) on the public ledger.

Automated Ops:

The receiver’s backend system listens for the Transfer event on the blockchain. It parses the metadata ("Invoice #12345").

Tempo Network Solution: ISO 20022 Compatibility

Tempo doesn't just move money; it moves context. The metadata fields are designed to map directly to ISO 20022 standards (the language banks use).

Result: A smart contract can read "Invoice #12345," check the amount, and trigger a "Paid" status in an Oracle NetSuite ERP system via a webhook. This closes the loop between "Money Movement" and "Accounting" automatically, potentially saving global finance billions in manual reconciliation labor hours.

REAL USE CASES

1. Mastercard – Payments Infrastructure Collaboration

Mastercard has joined Tempo’s public testnet as a "design partner." They are not just testing the waters; they are actively working with Stripe and Paradigm to explore how card rails can interoperate with stablecoin rails. This validates the thesis that the future is hybrid—cards for the consumer interface, blockchain for the settlement backend.

2. UBS - Institutional Settlement Experimentation

Swiss global bank UBS is participating in the Tempo testnet. UBS is experimenting with "tokenized deposits"—moving bank-grade money on-chain. This signals institutional interest in blockchain rails for real-time, low-cost interbank settlement and cross-border transfers that bypass the slow correspondent banking network.

3. Klarna – Launching a USD Stablecoin (KlarnaUSD)

Perhaps the most significant adoption signal, Buy-Now-Pay-Later giant Klarna is leveraging Tempo infrastructure to launch its own USD-pegged stablecoin, KlarnaUSD. Instead of just accepting payments, Klarna is issuing money. This allows Klarna to settle with merchants instantly and reduce their own cost of capital, potentially passing savings to consumers.

4. Kalshi - Stablecoin Transaction Testing

Prediction markets operator Kalshi handles millions of small, rapid-fire transactions. They have joined Tempo’s ecosystem to explore how stablecoin settlement can support real-time financial services beyond trading. For Kalshi, high throughput and low latency are existential requirements, making them a perfect stress-tester for Tempo.

5. Deutsche Bank & Standard Chartered — Design Partner Participation

Major global banks like Deutsche Bank and Standard Chartered are listed as early "design partners." These institutions move trillions of dollars annually. Their involvement is in helping validate payment workloads, governance models, and ensuring the infrastructure meets the strict compliance/KYC standards required for enterprise use.

THE DATA

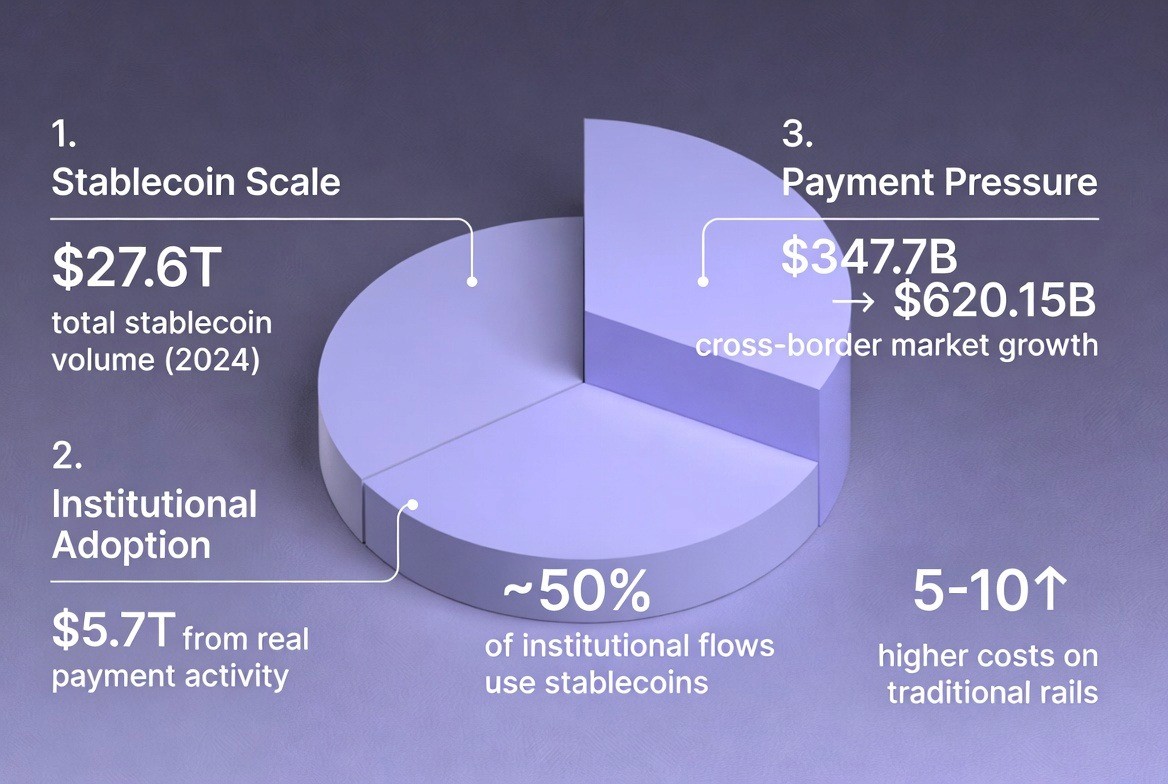

The shift to stablecoin payments is supported by massive underlying data trends.

Metric | Value | Context |

Global Stablecoin Volume (2024) | $27.6 Trillion | This volume has now surpassed the combined volumes of major card networks like Visa and Mastercard. It proves stablecoins are no longer niche. As reported by ModernTreasury here. |

Payment-Specific Volume | ~$5.7 Trillion | This is not trading volume; this is value transfer related to commercial payments, showing real utility usage is already massive. |

Institutional Share | ~50% | On institutional platforms like Fireblocks, stablecoins represent nearly half of all flows. Big money is already using these rails. |

Cross-Border Market Size | $347.7 Billion (2024) | Projected to nearly double to $620.15 Billion by 2032. The demand for cheaper international settlement is the biggest growth driver in fintech. |

Cost Disparity | High vs. Low | Traditional cross-border payments cost 5-10x more than domestic ones. Blockchain reduces this disparity to near zero. |

Key Insight: The data proves that "Stablecoins" are the "Killer App" of blockchain. Tempo is simply building a dedicated highway for this traffic which is already congested on other roads.

THE OUTLOOK

Tempo reflects a broader shift in global finance toward always-on, programmable payment infrastructure powered by stablecoins. As institutions look to modernize settlement, payroll, and cross-border money movement, payment-first blockchains like Tempo are positioned to become core financial rails rather than experimental technology.

Stablecoins as Payment Infrastructure: Stablecoins are increasingly viewed as "practical digital dollars." They are evolving from trading chips in casinos (crypto exchanges) to the fuel for global payroll, merchant payouts, and supplier settlements.

Convergence of TradFi and On-Chain Rails: The era of "Crypto vs. Banks" is ending. The new era is "Banks on Crypto Rails." Tempo’s design—supported by Visa, Mastercard, and Stripe—shows how blockchain infrastructure serves as the backend upgrade for traditional finance. It integrates with the system rather than trying to burn it down.

The End of Batch Processing: The most profound change is the death of "Business Hours." Money on Tempo moves at the speed of information. This will unlock new business models we haven't thought of yet, just as the internet unlocked streaming.

FAQ

1. How does Tempo improve cash flow and liquidity?

Tempo settles payments in under one second instead of days, freeing trapped capital and allowing funds to be reused immediately; reducing working capital needs and liquidity risk.

2. How much does Tempo reduce payment costs?

Transaction fees are roughly $0.001, compared to 3–5% for cross-border payments, delivering major cost savings for high-volume payment operations.

3. Does Tempo expose us to crypto volatility?

No. Payments and fees use USD-backed stablecoins, so finance teams move digital dollars without balance-sheet volatility.

4. Will Tempo integrate with our existing systems?

Yes. Tempo works as a back-end settlement layer, integrating with ERPs, treasury systems, and institutional custody tools while supporting ISO 20022 data standards.

5. Why is Tempo more reliable than other blockchains?

Tempo is purpose-built for payments, with dedicated payment lanes, fixed fees, and sub-second finality—ensuring predictable performance even at high volumes.

HOW TOKENMINDS HELPS WITH TEMPO NETWORK DEPLOYMENT

TokenMinds supports institutions and fintech companies in adopting Tempo Network by aligning stablecoin-based payment infrastructure with real-world business, operational, and compliance requirements.

Use-Case & Payment Flow Assessment: TokenMinds acts as the strategist. We work with your team to audit your current payment flows. Where are you paying too much in FX fees? Where is your capital trapped for 3 days? We identify the high-impact areas where Tempo can improve ROI immediately.

Architecture & Integration Design: We are the architects. We design how Tempo integrates with your existing legacy stack. We map out how your wallet infrastructure, payment APIs, and Treasury Management Systems will talk to the blockchain securely.

Implementation & Pilot Execution: We are the builders. TokenMinds assists in writing the smart contracts, setting up the RPC nodes, and building the middleware. We deploy the pilot in a controlled environment to prove the technology works before you risk real capital.

Compliance & Operational Readiness: We are the safeguard. Blockchain introduces new risks (key management, regulatory reporting). We help align Tempo deployments with internal controls, audit requirements (SOC2), and regulatory considerations (KYC/AML) relevant to stablecoin payments.

Scaling & Optimization Support: We are the partner for growth. After a successful pilot, TokenMinds supports scaling transaction volumes to millions of users, optimizing gas strategies to save every fraction of a cent, and expanding Tempo usage across new business lines.

Conclusion

Deterministic sub-second finality, predictable low fees, dedicated payment execution paths, and well-structured transactional data enable Tempo Network to overcome the constraints of legacy rail or general-purpose blockchain applications. Tempo enables constant, automatic, and cost-effective settlements with no operational complexity, which helps facilitate a transition to always on, programmable financial infrastructure for institutional users.

Schedule a complimentary consultation with TokenMinds to explore how Tempo Networkcan be integrated into your payment and settlement flows, enabling real-time stablecoin settlement, predictable costs, and seamless integration with your existing financial systems.