The Shift Toward Agentic Payments

Commerce now moves through smart automation. Agentic payments let AI make secure financial decisions. This change is shaping how industries such as e-commerce, logistics, and digital services process payments.

A 2025 Basis Theory report noted that merchant systems must adapt as AI takes over payment logic. Working with an AI development company builds safe rules, access rights, and token control.

At TokenMinds, Agentic AI turns automation into full independence. AI agents process payments under merchant control and compliance checks.

Agentic systems connect suppliers, customers, and platforms for secure and fast transactions—no manual input needed.

Key Insights:

Agentic payments use reasoning before action. A trusted AI development company ensures safety, compliance, and fast performance under the TokenMinds framework.

How Agentic Payments Work

AI agents run payments through encrypted APIs. Tokens check and confirm each step. The process stays fast and traceable.

In business, agents deal with billing, paying out suppliers and repaying money back when there are predetermined regulations. DeFi for Business explains how verified IDs and intent layers keep every move honest.

Examples of adoption:

Google – AP2 Protocol for verifiable intent in AI authorization.

Mastercard – Agent Pay (2025).

Visa & PayPal – Context-based checkout with AI reasoning (Finovate).

Perplexity x PayPal – Real-time payments using AI context.

More examples appear in the TokenMinds Agentic Payments blog.

Key Insights:

Agentic systems handle ID, logic, and risk checks automatically. Ideal for Web3, SaaS, and instant payment networks.

Business Value for Modern Commerce

1. Faster Conversions

The friction is eliminated with Agentic Payments such as OTPs or additional forms. Statistics indicate that the success rates may increase more than 10%. In the case of SaaS, retail or B2B invoicing, it implies quicker payments and improved flow of revenues.

2. Contextual Commerce

Agentic AI triggers small payments based on behavior or usage. Safety comes from caps, time limits, and compliance filters.

Examples:

A retail AI reorders inventory.

A digital app renews a license when activity rises.

These systems work like those in TokenMinds AI marketing guide.

3. New Data Intelligence

Every AI decision creates data that improves risk checks and personalization. This mirrors transparency in TokenMinds Regenerative Finance (ReFi) models.

Key Insights:

Agentic Payments can lift conversions by 10% and order value by 19%. Secure automation supports steady growth.

Core Infrastructure Requirements

Tokenization and Vaulting

AI agents use short-term credentials kept in token vaults. A PCI-ready AI development company handles tokenization and access control.

Network Token Provisioning

Multi-rail fiat-crypto systems reduce lag and fraud. Token networks speed settlement and reconciliation.

API Governance

Tight ID and session checks stop misuse. DeFi for Business offers guidance for safe API design.

Key Insights:

Strong token vaults, global payment rails, and managed APIs keep systems secure and compliant.

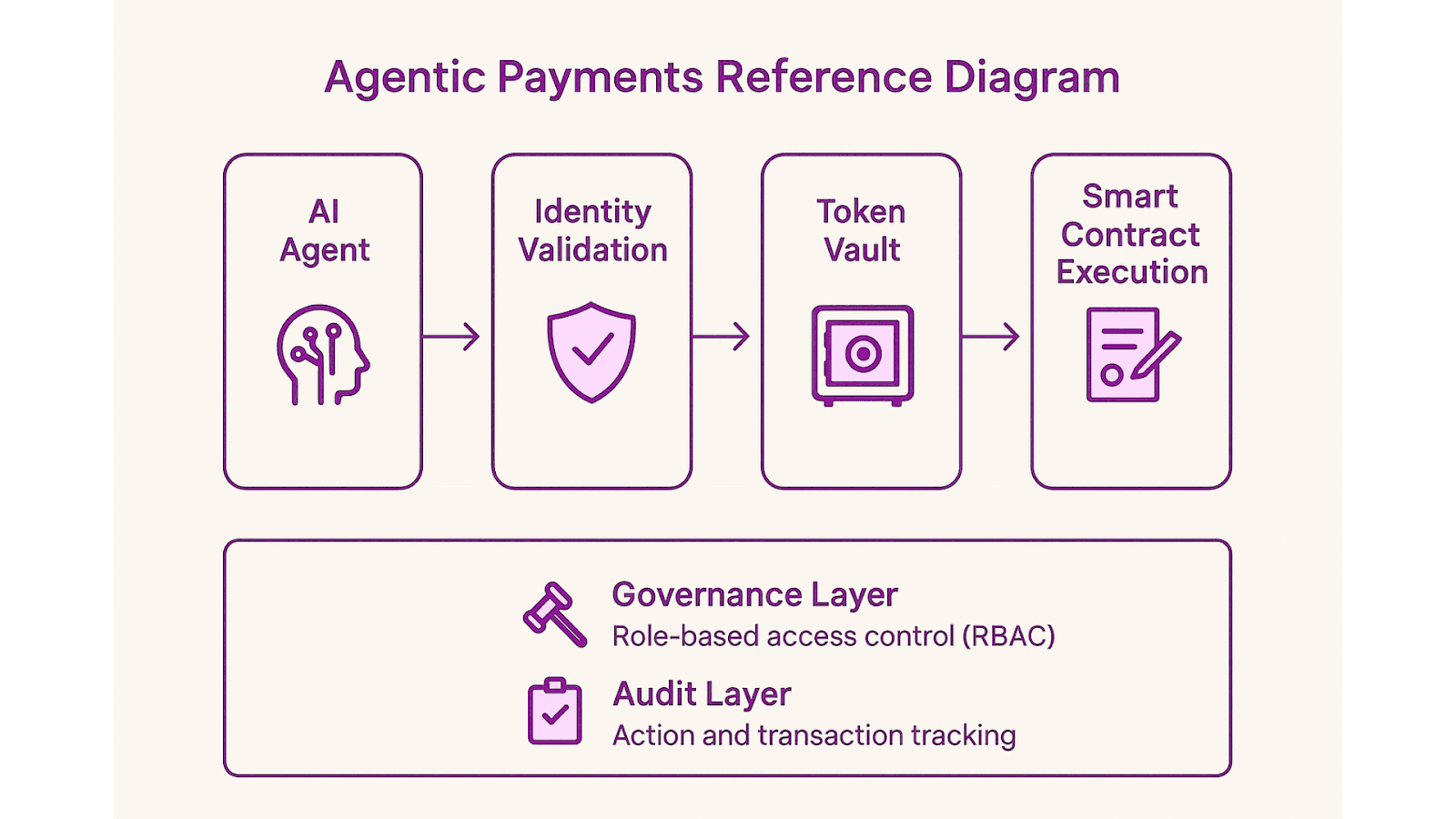

Agentic Payment Flow

Agentic Payment Architecture

Agentic platforms link AI agents, payment gateways, and smart contracts. Each transaction follows:

AI Agent → Identity Check → Token Vault → Smart Contract Execution.

Governance Layer: Role-based access and multi-admin review for large payments.

Audit Layer: All actions recorded for compliance.

This structure matches enterprise models and Mastercard’s Agent Pay design.

Key Insights:

The TokenMinds Stablecoin Governance Dashboard keeps each transaction free and compliant.

Challenges and Risk Controls

Risk Type | Description | Mitigation Strategy |

Chargeback | Accidental or unauthorized actions | Multi-step intent validation |

Fraud | Stolen or spoofed credentials | Behavioral anomaly detection |

Overspend | Logic or budget errors | Spending limits and caps |

Compliance | AML or KYC issues | Oversight dashboards |

The system from DeFAI: AI in DeFi adds layers of defense and visibility.

Key Insights:

Layered rules lower fraud and disputes.

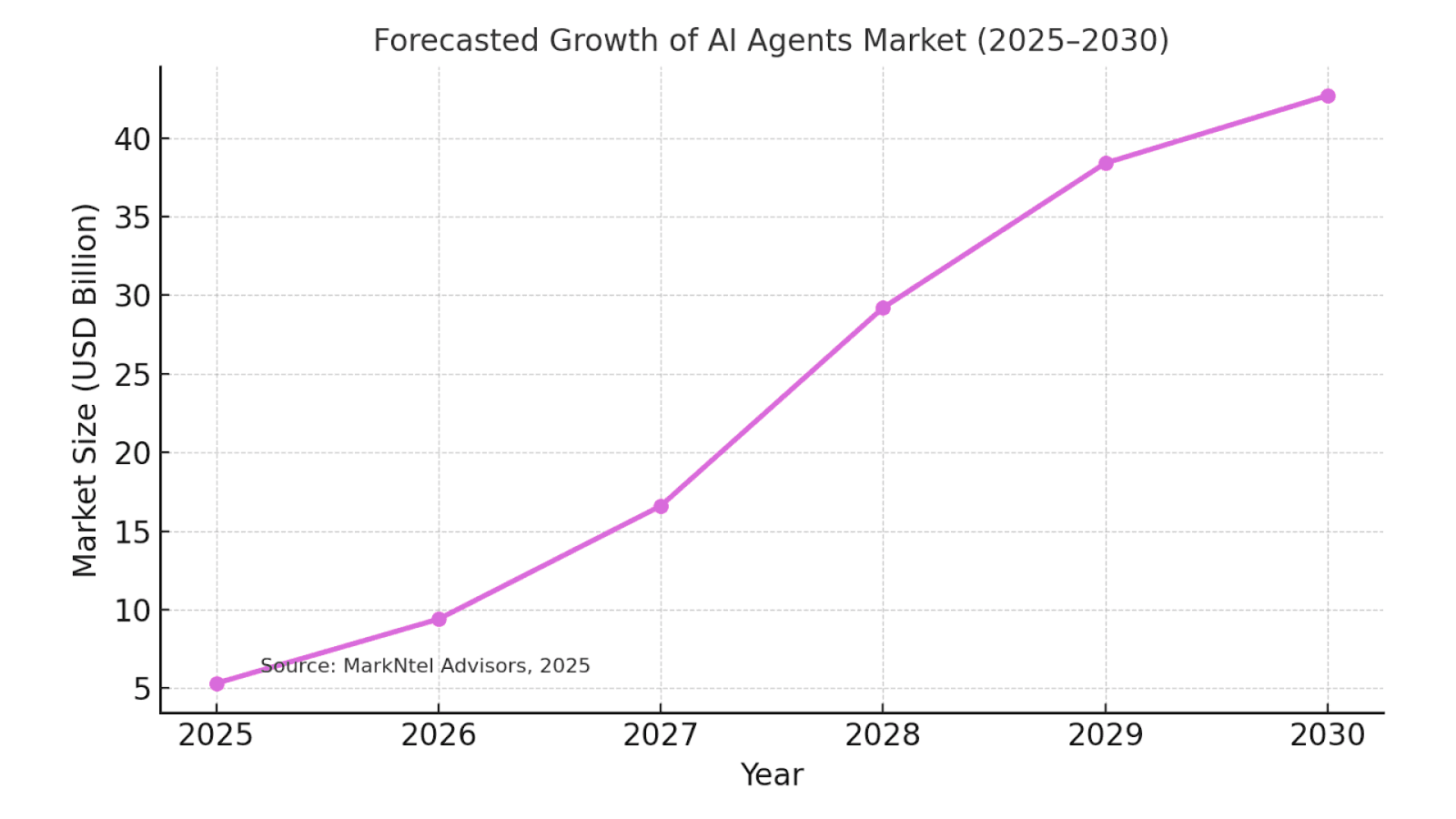

Market Adoption Forecast

Adoption of Agentic Payments (2024–2030)

The global AI Agents Market will grow from USD 5.32 billion (2025) to USD 42.7 billion (2030). Source: MarkNtel Advisors – AI Agent Market 2025–2030

Year | Market Size (USD Billion) | YoY Growth (%) |

2025 | 5.32 | — |

2026 | 9.40 | +76.7% |

2027 | 16.60 | +76.6% |

2028 | 29.20 | +75.9% |

2029 | 38.40 | +31.5% |

2030 | 42.70 | +11.2% |

Growth will come from better compliance and AI-fintech collaboration.

Key Insights:

Early adopters in retail, logistics, and SaaS gain faster settlement, trust, and retention.

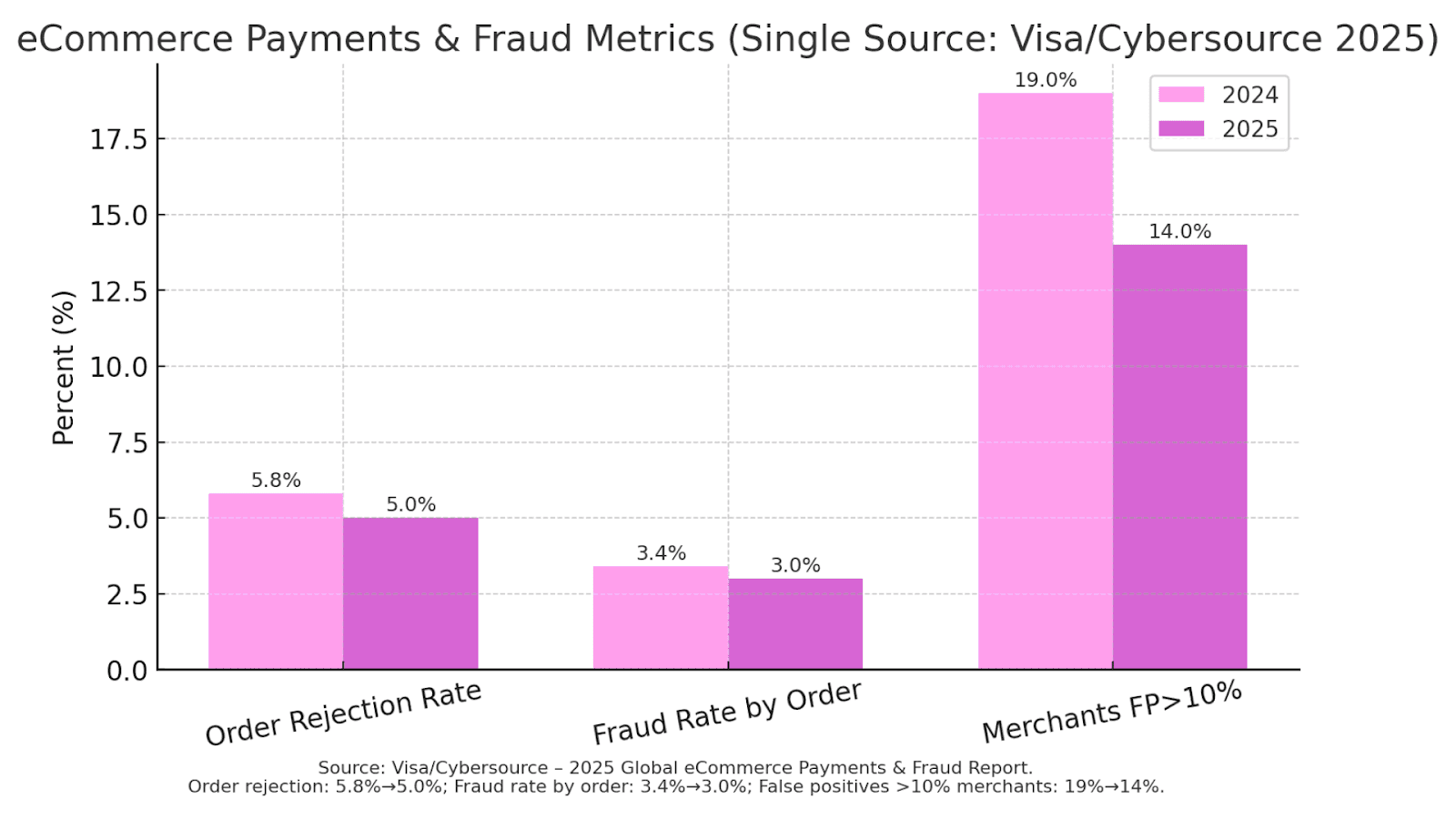

Global eCommerce Payments

Source: Visa/Cybersource – 2025 Global eCommerce Payments & Fraud Report (PDF)

Metric | 2024 | 2025 | Δ Change |

Order Rejection Rate | 5.8% | 5.0% | −0.8 pp |

Fraud Rate by Order | 3.4% | 3.0% | −0.4 pp |

Merchants With False Positives >10% | 19% | 14% | −5 pp |

False Declines | 5.8% | 4.6% | −1.2 pp |

Key Insights:

Agentic Payments deliver 13 points higher conversions and 18.7% more value. Governance tools balance slight chargeback increases.

Integration Roadmap for Merchants

System Audit: Review APIs with ReFi frameworks.

Partner Selection: Choose an expert AI development company.

Closed Beta: Test vendor or recurring payments.

Scale and Monitor: Measure progress via DeFAI: AI in DeFi.

Key Insights:

Start small. Validate results. Then scale with data.

Applications Across Commerce Sectors

E-commerce & Retail: Automated refunds and restocking.

B2B & Logistics: Smart supplier payments via contracts.

Digital Services & SaaS: AI-managed renewals and upgrades.

Financial Services: Smart reconciliation and inter-wallet transfers.

Key Insights:

Micro-sales and audits build safer, fairer ecosystems.

The Role of AI Development Companies

Deployment requires partners skilled in blockchain and governance.

TokenMinds integrates DeFi for Business and Top DeFi platforms to deliver scalable and compliant systems.

Key Insights:

Reliable partners ensure transparency, security, and growth.

Outlook: Balancing Autonomy and Oversight

Commerce will balance AI independence with human oversight. Clear, explainable Agentic systems will define digital trust.

It is already being adopted by Google, Visa, Mastercard and Web3 innovators, with apparent momentum moving towards mainstream agentic models of payments.

Key Insights:

Explainable logic and early use build durable strength in the Agentic age.

FAQs

What are Agentic Payments?

AI systems that complete payments autonomously using secure credentials.

How do Agentic Payments benefit businesses?

They automate complex transactions, speed B2B payments, and maintain compliance via Agentic AI development.

What’s required to implement them?

Vaults, tokens, and API controls from a compliant AI development company using DeFi for Business standards.

Plan Your Agentic Payment Roadmap

To assess your readiness for Agentic Payments, book your free consultation with TokenMinds AI development team for a detailed system audit.