TL:DR

Business leaders will learn how ERC-8004 enables trustless automation by giving AI agents verifiable on-chain identities, allowing enterprises to automate finance, compliance, audits, and cross-border operations with full transparency. Reduces operational risk and reconciliation time, improves compliance visibility, and prepares banks and enterprises for a future where autonomous agents execute and audit financial workflows at scale.

Finance still depends on people and slow systems. Tokenization made assets easier to move and verify. The next step is trustless automation — where AI agents act on their own, with proof stored on-chain.

The ERC-8004 standard makes this possible. It gives every agent a unique blockchain identity.

That identity lets companies automate deals, compliance, and audits with full visibility. For enterprises building AI agents, ERC-8004 links traditional finance and decentralized systems.

ERC-8004 adopts a hybrid model, unlike conventional blockchain systems that process all operations on-chain. It records only critical trust elements directly on the blockchain, offloading intensive computations to external systems.

From Tokenization to Trustless Agents

Tokenization made assets digital. ERC-8004 makes trust digital. Old tokenization turns assets like funds or bonds into blockchain tokens. That process speeds up settlements and audits. But it does not help agents act safely without people involved.

Trustless agents fix that. They prove identity and record each action directly on the blockchain.

Data from TokenMinds AI agent development shows ERC-8004 plus tokenization builds financial systems that can act, trade, and audit themselves.

For enterprises, this shift leads to measurable outcomes such as faster reconciliation, lower fraud exposure, and consistent compliance reporting.

What Is ERC-8004 and Why It Matters for Finance

ERC-8004 brings Google’s A2A (Agent-to-Agent) logic to Ethereum. It shows how agents can prove who they are, share data, and complete tasks safely.

Every agent holds a cryptographic signature and an on-chain ID. That means another agent can check identity before running a task. In finance, each action stays transparent and easy to audit.

For CISOs and compliance officers, this provides a verifiable security layer. Each agent transaction can be validated in real time, minimizing insider risks and ensuring data integrity across jurisdictions. The audit team gains immutable records without depending on centralized log servers.

Technical Overview:

ERC-8004 agents include a function: verifyAgent(address agentId, bytes signature). This connects an agent’s identity with its blockchain proof. No middle party is needed.

An AI development company can use this to create digital agents for banks or funds.

These agents negotiate, settle, and record activity while meeting compliance rules.

In regulated environments, this setup supports full traceability of financial operations. Enterprises can demonstrate compliance to ISO 27001 or SOC 2 standards more efficiently because every transaction carries its own proof-of-origin.

How Trustless Agents Work in Enterprise Systems

Smart contracts can run logic but cannot make choices. ERC-8004 agents add that missing step. Each agent — payment bot, auditor, or risk node — has a verifiable blockchain identity.

Agents check requests, confirm access rights, and record every move in a shared ledger.

For example, two agents from different banks can finish a cross-border bond trade in seconds. Pricing, checks, and settlement all happen on-chain and stay public for review.

This model supports ideas shared in TokenMinds finance insights — automation and audit now live in one system.

In operational terms, this reduces reconciliation time from hours to minutes, eliminates duplicate reporting, and cuts the cost of error correction. CISOs can integrate ERC-8004 agents with existing SIEM tools to gain instant event correlation between blockchain actions and enterprise logs.

Enterprise Use Cases

1. Tokenized Asset Management

ERC-8004 gives tokenized funds a layer of automation. Agents can price, rebalance, and confirm holdings automatically. Tests by SmartStream report 100% higher match rates in one week, 89% shorter preparation time, and a 5% reduction in reconciliation effort. Funds also achieve stronger segregation of duties. Each agent role—valuation, risk check, audit—is cryptographically separated, reducing insider conflict and manual override risks.

2. Cross-Border Transactions

Agents identify each counterparty and complete transfers in seconds. Each step is recorded in real time for audits. Financial institutions using ERC-8004 agents for settlements report reduced SWIFT dependencies, faster liquidity cycles, and improved compliance readiness for multi-jurisdiction operations.

3. Compliance and Risk Intelligence

ERC-8004 agents apply KYC, AML, and audit rules. When linked with TokenMinds EchoMind AI, the system can detect risk before it spreads.

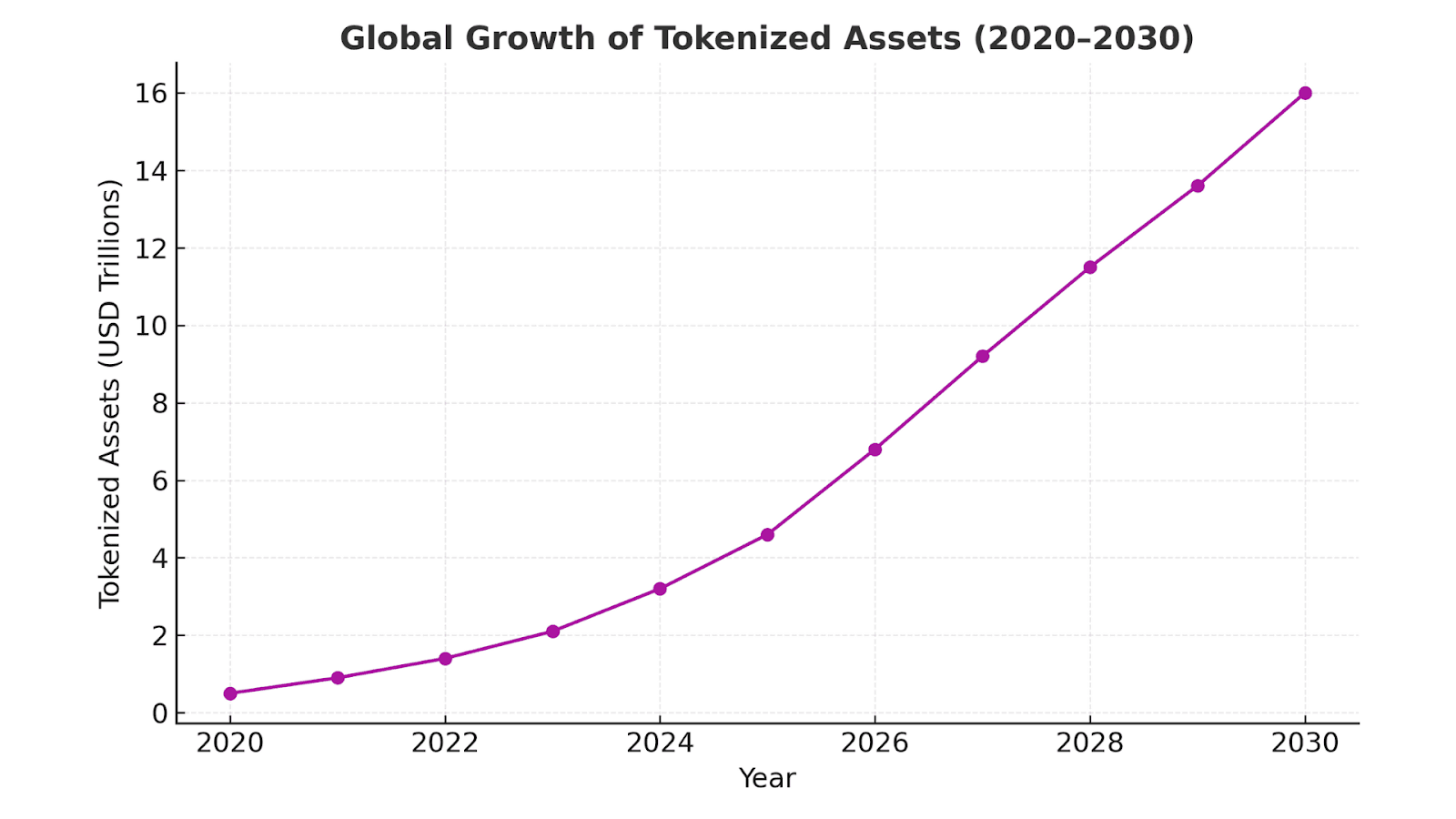

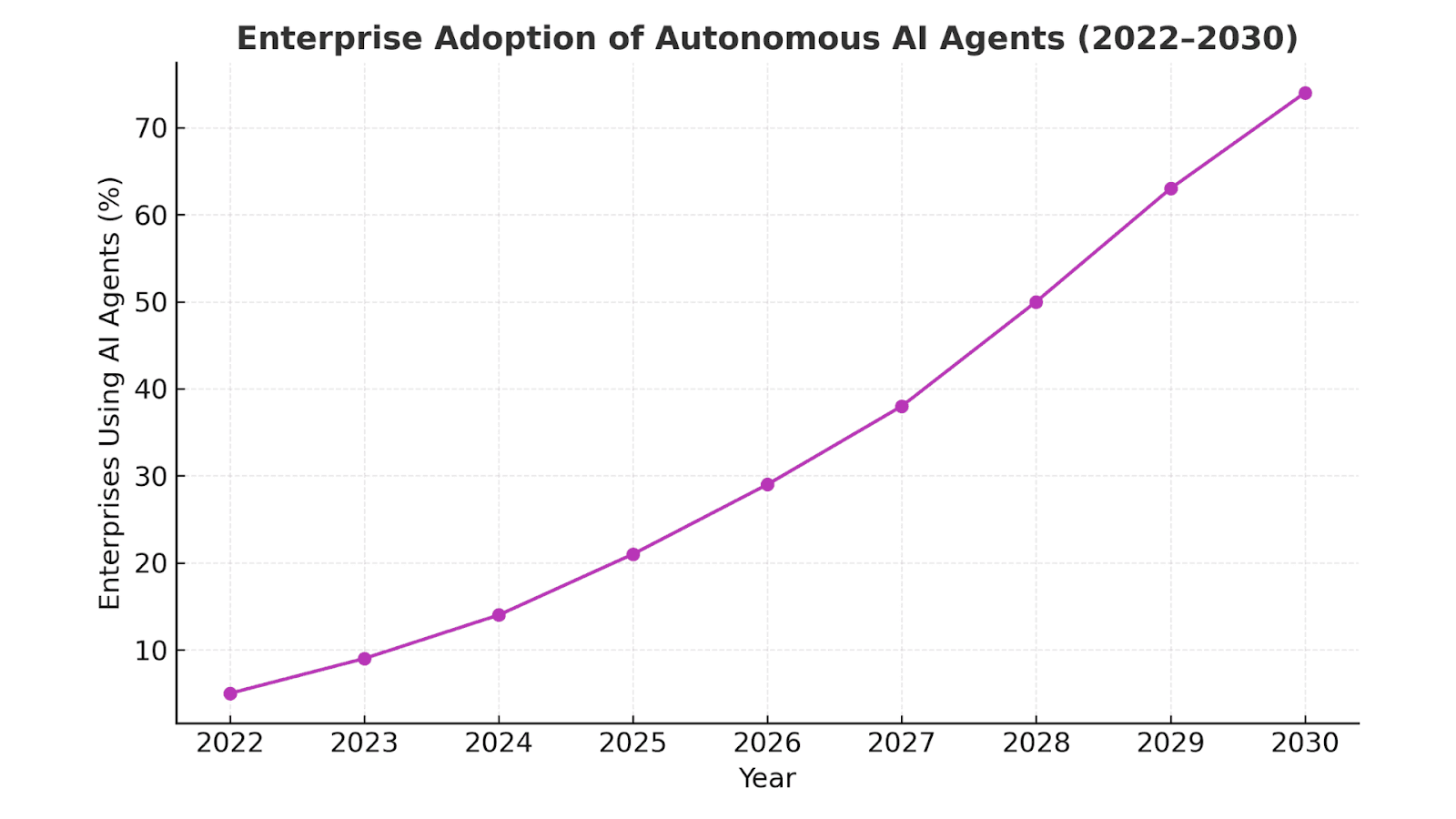

Market Outlook

Global Growth of Tokenized Asset (2020-2030)

Source: “Tokenized real-world asset market expected to reach US$18.9 trillion by 2033” (CoinDesk)

Enterprise Adoption of Autonomous AI Agents (2022-2030)

Source: “90 % of enterprises actively adopting AI agents” (PR Newswire)

By 2030, more than half of enterprise financial operations are expected to include autonomous agent layers. Early adopters will benefit from faster audit cycles, leaner operations, and improved digital trust metrics across partners and regulators.

AI Agent Development and Integration

As automation grows, AI agent development becomes key. Agents must follow clear, verifiable rules. An expert AI development company can build ERC-8004 registries and secure access control. This keeps automation transparent and compliant.

ERC-8004 agents also link to TMX AI tools like ShopWhisper and EchoMind. Through AI agent frameworks, teams can unite logic, learning, and blockchain records in one platform.

The combination of AI and on-chain identity allows enterprises to measure business impact clearly: faster trade execution (up to 3x), 99% data integrity, and verifiable risk scoring. For CISOs, this means visibility into both human and machine actions within one control layer.

Challenges and Adoption Path

Adoption needs strong key management, clear rules, and governance. Most firms begin with tokenized payments or asset workflows, then expand.

The rollout model suggests small pilots first. Each stage adds more autonomy and visibility.

ERC-8004 can also connect with ERC-725 for identity, ISO 20022 for messaging, and Basel III for risk tracking.

Success depends on governance maturity. Enterprises must define signing authorities, encryption key lifecycles, and fallback procedures for compromised agents. When aligned with NIST zero-trust principles, ERC-8004 becomes part of a verifiable defense model.

The Future of Trustless Finance

The merge of tokenization, AI, and ERC-8004 changes enterprise automation. Banks and fintech firms will run agent networks that trade, audit, and manage assets automatically.

Machine-to-machine commerce is next. Agents will handle liquidity, payments, and compliance in real time. Blockchain becomes an intelligent operating system for finance. Learn more through AI agent development services and discover how your organization can design, deploy, and govern its own trustless automation network.

CISOs and CFOs that adopt ERC-8004 early will lead in operational resilience, transparency, and security automation. The model turns governance from reactive oversight into continuous proof — every transaction verified, every agent accountable.

FAQs

What are ERC-8004 trustless agents?

Autonomous AI systems with on-chain identity. Every action is recorded and verifiable.

How does ERC-8004 help compliance?

Each step logs on-chain. Auditors and regulators can check records at any time.

Can ERC-8004 manage tokenized assets?

Yes. ERC-8004 agents can handle, settle, and audit tokenized assets using current blockchain setups.

Unlock Trustless Finance with ERC-8004

Book your free consultation with TokenMinds to plan an ERC-8004 pilot with clear KPIs and guardrails. Each plan starts with a small pilot, then grows into a full network of trustless agents.