A token sale is more than fundraising. It helps modern businesses raise money, reward users, and build trust. Fintech, gaming, and SaaS brands use digital tokens to grow and reach investors.

When done right, a token sale brings order, clarity, and long-term growth. A poor plan can cause risk and lose trust.

This guide explains the four stages of a token sale. It is based on global best practices and TokenMinds project experience. Each stage links technology, compliance, and investment goals. A trusted crypto token development company helps each step run smoothly.

TL;DR — What This Guide Covers

The way businesses conform to a token sale strategy.

The design, development and execution steps to a secure launch.

Techniques of minimization of legal and technical risks.

Structures of transparent after-sale governance.

Stage 1 — Strategic Design and Planning

Define Token Purpose and Economic Model

All token sales begin with intent. Every token has to be put to a good use access, voting, profit sharing.Make decisions in advance about overall supply, vesting and token allocation. An attractive model secures investors and treasury.

Example: MovitOn token sale was based on TokenMinds TMX TGE system. It enhanced compliance by 97% and was a success model.

Learn fair distribution and compliance in the token sale structure guide.

A good token model supports digital asset tokenization, helping assets trade more easily. Record all plans in a whitepaper and data room before launch. For templates and valuation plans, see How to Launch a Token.

Investor Readiness and Documentation

Investors want clear and honest information. Prepare a whitepaper, tokenomics sheet, and legal notes. Keep all materials consistent and easy to follow.

The Token Sale Legal Considerations guide explains AML and global security rules.

A professional crypto token development company helps align documents with blockchain logic, making due diligence faster.

Scenario and Risk Planning

Market changes, high gas fees, or new laws can affect schedules. Build backup plans and assign decision-makers. Use data dashboards to track milestones.

Tools on the TokenMinds Token Sales page help teams plan timelines and manage risks.

More insights are in How to Launch a Token and Token Sale Legal Considerations.

Sample Tokenomics Table

Allocation | Percentage | Vesting & Notes |

Founding Team | 15% | 48-month vest, 12-month cliff |

Advisors | 2.5% | 24-month vest |

Community & Incentives | 5% | Engagement rewards |

Treasury & Operations | 20% | Governance reserves |

Public Sale | 12% | Market liquidity |

Liquidity & Market Making | 10% | Exchange operations |

Future Reserve | 25.5% | Expansion funding |

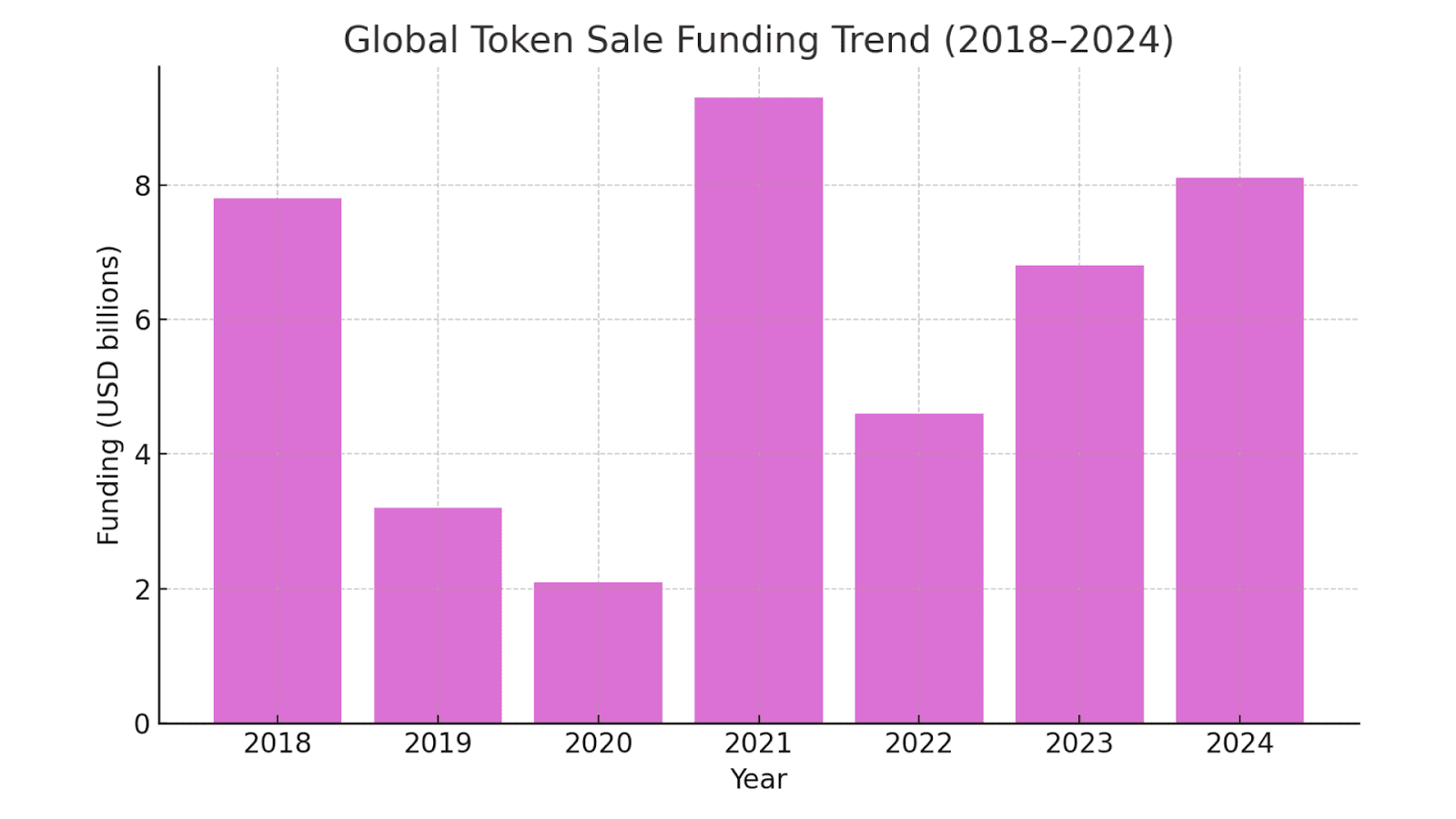

Token Sale Funding Trend (2018–2024)

This chart shows global capital raised annually in USD billions.

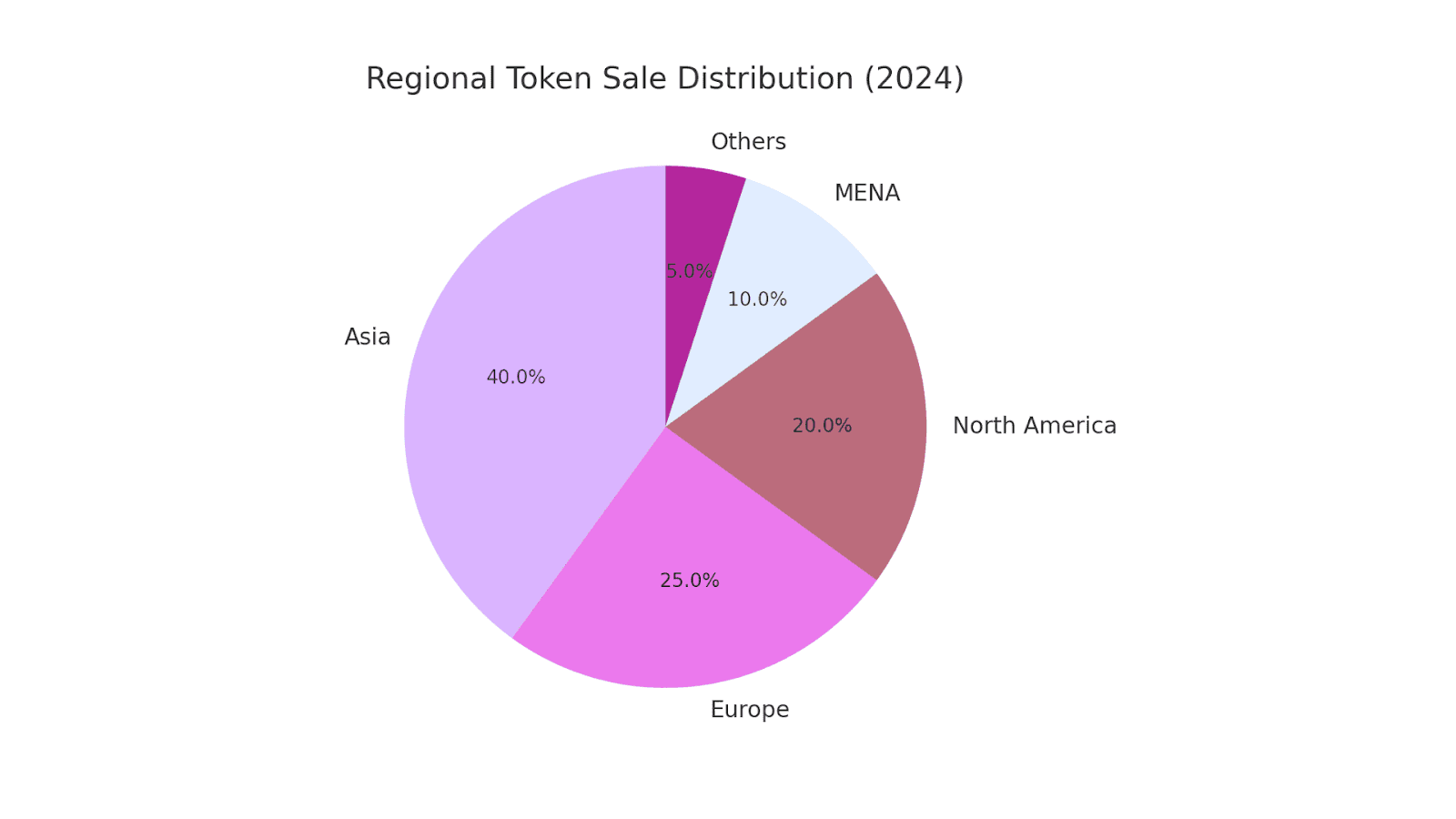

Regional Token Sale Distribution (2024)

This chart compares Asia, Europe, North America, and MENA contributions.

Stage 2 — Development and Infrastructure

Smart Contract Engineering

After planning, turn the token model into code. Use ERC-20, ERC-721, or ERC-777 standards. Run automated tests to avoid errors after launch.

The TokenMinds blockchain engineering process includes audits and testing for every build. Partnering with a trusted crypto token development company ensures secure code and reliable setup.

See the blockchain development insights for secure deployment steps.

Technical Infrastructure and Monitoring

A powerful system is required with every token sale. This is in the form of investor dashboards, KYC and allocation. Add uptime alerts and secure payment logs.

Modern token sales use AI tools that spot suspicious wallets. This makes them safer than early ICOs.

Follow the Token Sale Structure guidelines to keep systems compliant. Good engineering, combined with rule awareness, helps sales move faster within the TokenMinds Token Sales system.

Audit Preparation and Collaboration

Bring in auditors early. Review code, use version control, and complete audit checklists before the final review.

Learn audit planning and QA steps from How to Launch a Token. Good documentation builds trust across investors and regions.

Stage 3 — Security, Compliance, and Risk Mitigation

Audits and Verification

Audits confirm logic, fairness, and safety. TokenMinds’ audit templates helped clients cut audit times by 40%, as seen with FinTech Alpha.

Hire a trusted crypto token development company to create public audit reports. Use the Token Sale Legal Considerations guide to keep everything compliant.

Treasury Management

Safe fund management keeps investor trust. Use multi-signature wallets, time-locked vaults, and open dashboards. Transaction policies approved by the board strengthen credibility.

Treasury plans are available in the TokenMinds Token Sales framework.

Legal and Regulatory Integration

Rules change as technology evolves. Map key regions, set investor limits, and include KYC/AML steps in smart contracts.

The Token Sale Structure guide gives tips for legal planning in multi-region projects. Prepare early to avoid public sale risks.

Explore more at TokenMinds Token Sales, How to Launch a Token, and Token Sale Legal Considerations.

Stage 4 — Capital Raise and Execution

Fundraising Rounds and Investor Relations

The token financing usually proceeds in three categories, which are the private, strategic and public financing. All rounds are characterized by varying prices and disclosure rules, rights. Awareness is created through public rounds, alliances are created through private placements. Structuring so as to cushion long term value.

Comparative Insight: Unlike IPOs that centralize governance, tokenized capital models distribute power through programmable voting and decentralized governance.

The TokenMinds Token Sales page details pricing frameworks and vesting options for balanced fundraising.

Investor Onboarding and Automation

A smooth onboarding system helps capital flow fast. Add KYC, AML, and wallet checks in one step.

The Become Our Client page has templates that automate the process and connect with CRM tools. Investor dashboards improve trust and transparency.

Liquidity and Market Preparation

Plan liquidity before launch. Work with exchanges, announce listing dates, and create a public liquidity calendar. Add staking or liquidity mining to strengthen value after listing.

Read How to Launch a Token for liquidity frameworks.

Parallel Pillars — Governance and Community

Corporate Governance

Good governance creates a long-term stability. Add voting systems, board rules, and clear reports for investors and regulators.

Be transparent with templates of Token Sale Legal Considerations. Learn more at TokenMinds Token Sales, Become Our Client, and How to Launch a Token.

Community and Brand Engagement

Community drives growth. Post updates, host AMAs, and share analytics to show progress. Create referral rewards like UXLINK’s viral model to increase engagement.

Explore more strategies in the TokenMinds Token Sales content hub.

Business Case Studies

FinTech Alpha saved 40% of audit hours with the help of the audit templates of TokenMinds.

Gaming Beta automated registration, reduced the registration process by 35%.

Multi-signature treasury systems enhanced the interest of institutions in DeFi Gamma by 28% better.

These examples show how expert crypto token development leads to real results.

Strategic Takeaways for Executives

Treat tokenization as a structured financial process.

Connect crypto token development with legal and treasury planning.

Keep transparent governance and open reports.

Work with a certified crypto token development company.

Track results with KPIs like compliance rate, funds raised, and liquidity.

Why This Framework Matters

It is a four-step model to mediate between traditional capital structure and decentralized finance innovation. It simplifies the intricate tokenization process to a conformable procedure to the contemporary enterprises.

With AI-based monitoring, data visualization, and case-based insights added, your following token sale is going to be not only compliant, but also smart, scalable, and investor-ready.

FAQ

Q1. What are the four stages of a token sale?

Design & Planning, Development, Security & Risk, and Capital Raise & Execution.

Q2. How should companies manage compliance?

Integrate KYC/AML verification within onboarding workflows and embed jurisdictional rules in contracts.

Q3. When should audits start?

Begin internal checks during development and commission external audits six to eight weeks before the public sale.

Q4. How can treasury management boost investor confidence?

Use multi-sig wallets and transparent reporting to demonstrate responsible capital handling.

Q5. How do token sales fit traditional fundraising models?

They supplement venture and equity rounds as they offer liquidity and ownership of the communities without dilution. Confidently Plan the next token launch.

Plan Your Next Token Launch with Confidence

Design a secure, compliant, and efficient token sale strategy tailored to your organization’s goals. Book your free consultation with TokenMinds today!