TL:DR

How to evaluate the four stablecoin rail types based on structural differences in privacy, settlement guarantees, and governance, and align rail selection with your institution’s workflow complexity and risk profile to reduce operational friction, strengthen risk control, improve capital efficiency and gain strategic advantage in digital settlement.

Financial institutions face a difficult choice. Which stablecoin rail should they use? The answer matters to the sustainability of their business.

Stablecoins are no longer a crypto experiment. They've become the settlement layer for global finance. JPMorgan estimates the total supply of stablecoin between $500 - $750 billion in the coming years. That's up more than 50% from the start of the year.

JP Morgan has processed over $1.5 trillion worth of stablecoin transactions. Visa and Mastercard integrated stablecoins into their settlement systems.

But stablecoins are not all the same. The rail matters as much as the token. A bank choosing the wrong stablecoin infrastructure risks settlement failure. Counterparty opacity. Operational overhead that kills any efficiency gain, risks addressed through this stablecoin settlement integration system.

Why Choosing Stablecoin Rail Matters

With over $310 billion in stablecoins in circulation, they've evolved from crypto-native trading tools into legitimate payment rails. For banks and financial institutions, this is no longer optional, a transition accelerated through this payments infrastructure.

Competitors are Already Live

JPMorgan completed transfers with clients in seconds instead of days. B2C2. Coinbase. Mastercard. All using blockchain rails.

SoFi became the first national bank to issue a stablecoin on a public blockchain. Regional banks like Cross River and Lead Bank already settle Visa transactions in USDC.

Settlement Costs Are Compressing

A USDC transfer on Solana costs less than $0.01. It settles in under 5 seconds.

A SWIFT cross-border payment costs $25 to $50. It takes 1 to 3 business days.

Institutions that don't engage with stablecoin rails pay a compounding cost premium every day.

The Workflows Are Real: Cross-border treasury payments. Tokenized collateral. Intraday repo. Margin call automation.

Each one has a stablecoin rail solution available today. The question is which rail fits which workflow.

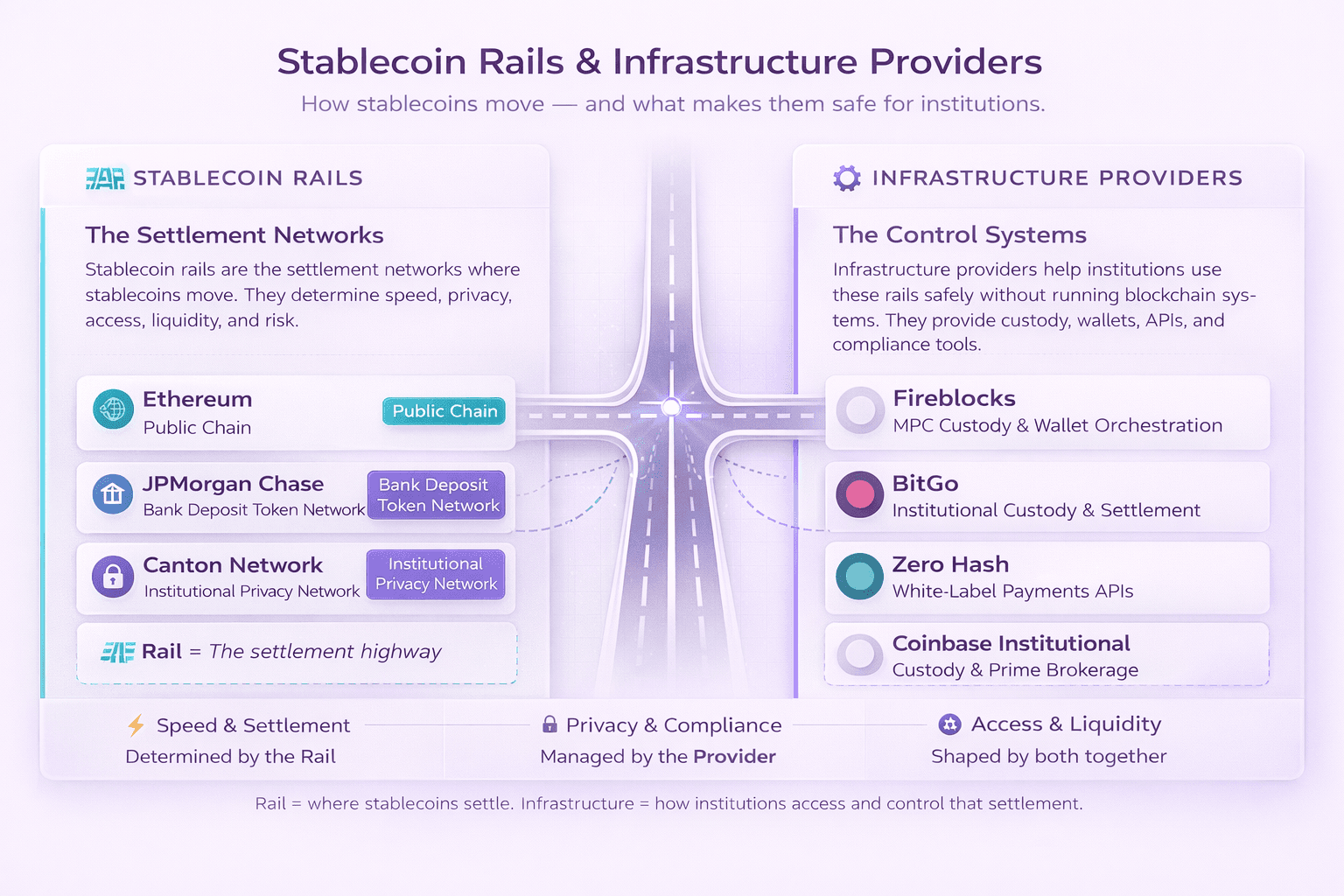

The Four Rail Types: A Structural Overview

Before comparing specific stablecoins, understand this. The token and the rail are two different decisions.

The same USDC token can run on public Ethereum. On Solana. On a private permissioned chain. Or through a regulated custody API.

Each combination creates a different risk profile. Different cost structure. Different operational posture, a distinction clarified in this Hedera HTS stablecoin design.

There are four rail types that matter for institutions today:

Rail 1: Public blockchain rails (Ethereum, Solana, Base, Polygon)

Rail 2: Permissioned private chains (JPMorgan Kinexys, SWIFT blockchain experiments)

Rail 3: Regulated custody API rails (Circle API, Paxos API, bank-grade on/off ramps)

Rail 4: Institutional privacy chains (Canton Network, purpose-built permissioned networks)

Each serves different institutional needs. None is universally superior. The right choice depends on what you're settling. Who you're settling with. And what your operational requirements demand.

Rail 1: Public Blockchain Stablecoins

What are Public Blockchain Stablecoins

Public blockchain stablecoins are tokens issued on open, permissionless networks. Anyone with a wallet can hold and transfer them.

The two that dominate are USDC and USDT.

Circle's USDC has processed over $50 trillion in lifetime on-chain transaction volume. Across more than 20 blockchains.

Tether's USDT controls over 60% of the stablecoin market by supply.

How They Work Technically

On public chains, stablecoins follow the ERC-20 standard on Ethereum. Or equivalent token standards on Solana and other networks.

Ownership is recorded in a shared global ledger. Visible to all participants.

Transfers are broadcast to the network. Validated by miners or validators. Finalized after a set number of confirmations.

Transferring USDC via Solana typically costs less than $0.01 in network fees. Settles in under 5 seconds.

On Ethereum mainnet, costs and times vary based on network congestion.

Reserve Structure and Trust Model

USDC and USDT differ a lot here. For institutions this matters.

USDC is issued by Circle. Each token is fully backed by reserves. Held at regulated US financial institutions. Monthly attestations by Grant Thornton.

Reserve composition is primarily cash and short-term US Treasuries.

USDT is issued by Tether. USDC's granular reserve disclosures enhance market predictability. USDT's opacity complicates analysis.

Tether holds near-zero bank deposits in its reserve mix. Compared to USDC's roughly 13%.

Where Public Rails Fit for Institutions

Public rails work well for cross-border payments. Interoperable settlement across counterparties. Reaching markets where no other shared infrastructure exists.

Stablecoins issued on Solana currently take only a second or two to appear in the destination wallet. 30 seconds to become irreversible. At a fee of usually less than $0.01.

Where They Fall Short

Three institutional requirements break on public rails.

Privacy: Every transaction is visible to every participant on the network. Competitor counterparties. Clients. Regulators. All can see your positions and transaction history.

For institutions managing proprietary portfolios or client assets, this is a non-starter.

Compliance automation: KYC verification. Investor eligibility. Sanctions screening. All happen off-chain through separate systems. This creates friction and audit gaps.

There is no native way to embed these checks into the settlement logic itself.

Settlement guarantees: Public chains don't natively support atomic delivery versus payment. If you transfer the asset leg of a trade and the cash leg fails, there is no automatic rollback.

You have a partial settlement and a reconciliation problem.

Rail 2: Permissioned Private Chain Stablecoins

Permissioned chains restrict participation to vetted institutions. The most prominent example is JPMorgan's Kinexys platform and its deposit token JPMD.

JPMorgan began offering blockchain deposit accounts to institutional customers in 2019. On a permissioned version of Ethereum. Before its recent embrace of Base, a public blockchain.

It's important to understand the distinction. A deposit token is different from a stablecoin.

Tokenized deposits are digital representations of a customer's bank deposits. They inherit deposit insurance. Payment stablecoins do not.

JPMD is issued by a regulated bank. Represents actual bank deposits sitting inside the traditional financial system. Permissioned and limited to vetted institutional users. Not the general public.

How They Work Technically

Each participant institution runs a node on the permissioned network. Transactions are validated by the network's permissioned validators. Not a public miner or staking pool.

The ledger state is shared across approved participants only.

JPM Coin automates and facilitates transactions 24/7. In near real time. Across borders. Using a next-generation deposit ledger and payment rail.

JPMD is permissioned and fully controlled by the bank. JPM Coin remains restricted to whitelisted parties. Who have been onboarded to the JPM Coin platform.

Where Permissioned Private Rails Fit

For large institutions that primarily transact with a defined set of counterparties, permissioned private rails offer a strong combination. Speed and balance sheet treatment.

Deposit tokens from banks offer similar on-chain usability. While retaining bank features. Deposit insurance. Possibility of interest. Stronger integration with bank accounting.

That makes them attractive to institutions that need balance-sheet treatment consistent with banking rules.

Since deposit tokens can be interest-bearing, they're more fungible with existing deposit products. Institutions don't have to mentally separate bank money from blockchain money. It's the same thing. Just in a new wrapper.

Where They Fall Short

Closed networks limit counterparty reach: Permissioned private chains work well within a single bank's ecosystem. But fall short the moment you need to settle with a counterparty on a different network.

Moving between private chains requires custom bridge arrangements. Rebuilding counterparty integrations.

Concentration risk: If your settlement depends on a single bank's private chain infrastructure, you inherit that bank's operational risk at the infrastructure level.

An outage stops settlement for all participants at once.

Limited composability: Assets and workflows that need to interact across different institutional systems cannot do so natively on a closed chain.

Everything outside the network falls back to traditional rails.

Rail 3: Regulated Custody API Rails

Custody API rails are not a blockchain at all in the traditional sense. They are regulated intermediary services.

They let institutions issue, hold, transfer, and redeem stablecoins through API connections. While the infrastructure provider handles the blockchain layer.

Circle's API, Paxos, and similar providers sit in this category. They abstract the blockchain complexity. While providing regulated on and off ramps. Compliance tooling. Custody.

How They Work Technically

An institution connects to the provider's API. The provider handles token issuance on the underlying chain. Custody of reserves. Redemption processing. Compliance checks.

The institution interacts with familiar banking-style interfaces. Rather than blockchain nodes.

Paxos provides API connections. Integrated custody. Established banking channels for institutional flows.

This includes cross-border supplier payments. Corporate treasury management. On-chain settlement between regulated parties.

Where Custody API Rails Fit

Institutions that want stablecoin functionality without running blockchain infrastructure will find custody APIs the fastest path to market.

The compliance overhead is managed by the provider. Reserve transparency is handled through the provider's attestation process.

This rail works well for treasury operations. Cross-border payments. Any workflow where the institution is not the settlement counterparty. And does not need to control the settlement logic directly.

The Drawbacks

You inherit the provider's risk: Your settlement chain is only as reliable as the API provider. Outages. Actions against the provider. Reserve problems. These flow directly into your operations.

No programmability at the contract level: Compliance rules. Eligibility checks. Lifecycle automation. These cannot be embedded into the settlement logic itself.

They remain external, manual, or dependent on the provider's own systems.

Limited cross-institutional atomic settlement: Like public chains, custody API rails don't natively guarantee that two legs of a trade settle at once. Across two different institutional participants.

Rail 4: Institutional Privacy Chains

Institutional privacy chains are purpose-built permissioned networks. They solve a problem the other three rails cannot.

How do you run atomic multi-party settlement across institutions? Where each institution needs to keep their data private from each other?

Canton Network is the primary example. It handles over $6 trillion in assets. With $280 to $300 billion in daily transaction flows.

Used by Goldman Sachs. HSBC. DTCC. European Investment Bank.

How They Work Technically

Unlike permissioned chains where all participants share a common ledger view, Canton uses a different approach to privacy.

Each asset exists as a self-contained record. Carrying its own ownership information.

Each institution runs its own node. Only receives the contract data it is entitled to see. Other participants never see unrelated transactions. Not because access was blocked. But because the data was never sent to them in the first place.

Daml smart contracts define the compliance logic. Eligibility rules. Lifecycle automation at the contract level.

Coupon payments. Maturity. KYC eligibility. Transfer restrictions. All embedded in the contract. Execute when conditions are met.

A sync domain coordinates atomic commits across all participant nodes at once. Either the full transaction completes for every party at the same moment. Or nothing changes on any ledger.

The Benefits

This rail is built for workflows where:

Multiple institutions must coordinate on a single transaction

Each institution cannot expose its positions to the others

The settlement must be atomic with no failure window

Compliance must be enforced at the contract level, not through external processes

Existing systems cannot be replaced but must be integrated

Treasury collateral mobilization. Tokenized bond issuance with multi-party custody. Cross-institutional repo. Margin call automation. All natural fits.

The Cons

Narrower counterparty network: Not every institution is on Canton today. Settlement is limited to participants on the same network. Or connected through bridge arrangements.

Higher implementation complexity: Deploying participant nodes. Configuring privacy domains. Writing Daml contracts. This requires more specialized expertise than connecting to a custody API.

Table: Side-by-Side Rail Comparison

Aspect | Public Rails | Private Permissioned | Custody API | Institutional Privacy |

Privacy | None - all data visible | Within network only | Provider-managed | Per-transaction, by design |

Atomic Settlement | No native guarantee | Within network only | No | Across institutions, guaranteed |

Compliance | Off-chain, manual | Partial, bank-managed | Provider-managed | Embedded in Daml contracts |

Legacy Integration | Manual / custom | JPMorgan systems | API-based | Canton integration layer |

Implementation | Low complexity | Medium | Low | High |

Best For | Cross-border payments | JPM clients, collateral | Treasury ops, fast deploy | Multi-party settlement |

How to Choose the Right Rail

No institution should run on a single rail. The right architecture combines rails based on workflow type.

Use Public Blockchain Rails When:

You need to reach counterparties across many institutions and jurisdictions

Speed and cost are the primary drivers

Privacy is not a concern for the specific workflow

Use Permissioned Private Chain Deposit Tokens When:

You are a JPMorgan institutional client or similar relationship-based arrangement

You need deposit insurance and balance sheet treatment as a bank deposit

Your counterparties are on the same permissioned network

Interest-bearing digital cash is part of the product design

Use Custody API Rails When:

You want stablecoin functionality without running blockchain infrastructure

Time to market is the priority

Your workflows are primarily one-directional (treasury funding, cross-border payout) rather than multi-party settlement

You need a fast on/off ramp for a specific corridor

Use Institutional Privacy Chain Rails When:

You need to settle across multiple institutions at once

Each institution must keep its position data private from the others

Settlement must be atomic with no failure window or reconciliation risk

Compliance must be enforceable at the contract level, not through external processes

You are working with tokenized RWAs, repo, collateral mobilization, or structured products

Stablecoin Infrastructure Providers

Choosing a rail is only half the decision. The other half is choosing the infrastructure provider. This determines how your institution actually accesses and controls stablecoin settlement.

Infrastructure providers handle custody. Wallets. APIs. Compliance tools. Each takes a different approach. Each serves different institutional needs.

Understanding these differences matters. The wrong provider creates operational bottlenecks. Compliance gaps. Security risks. The right provider enables smooth operations from day one.

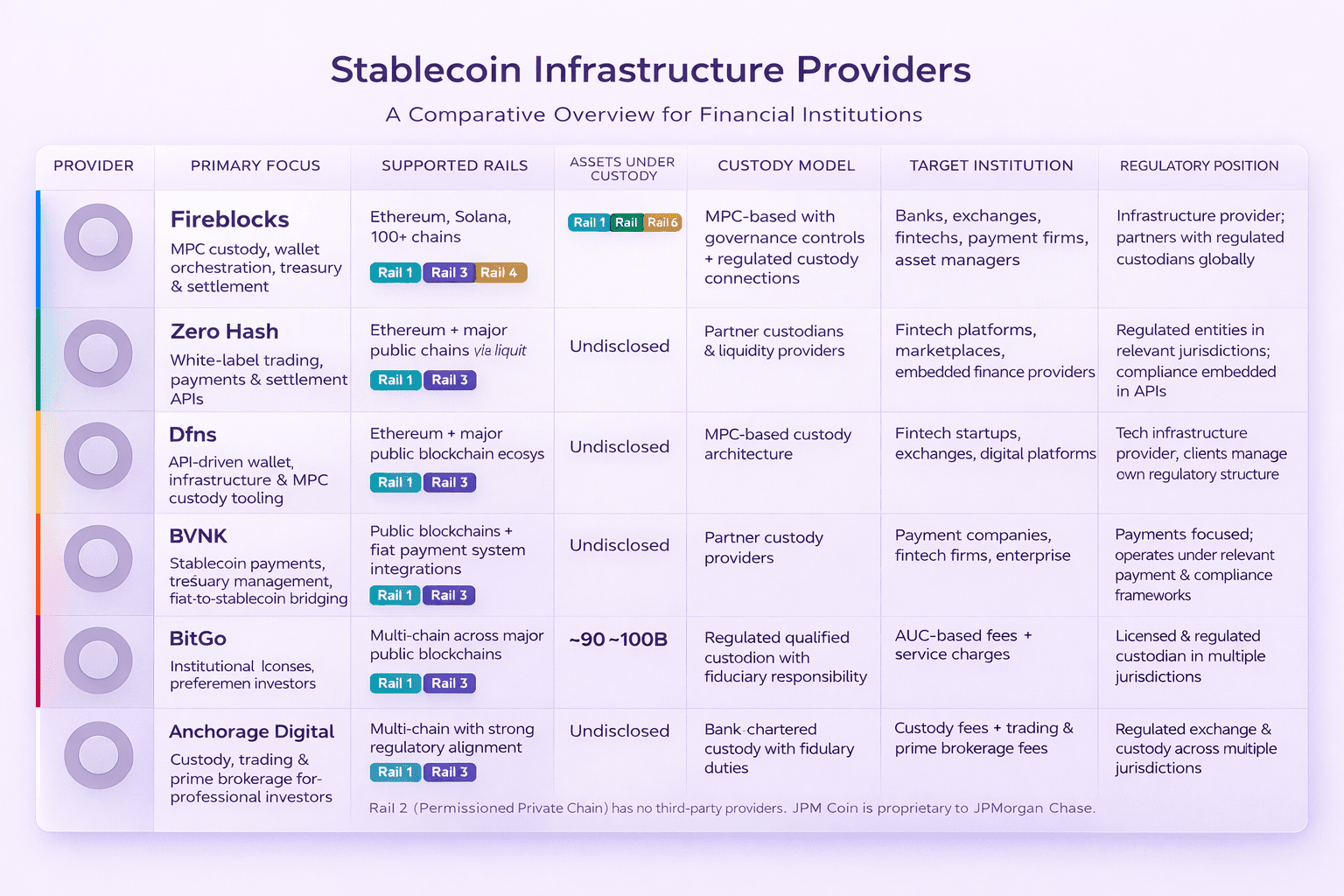

1. Fireblocks: The Multi-Chain Orchestration Platform

Fireblocks built its platform for institutions that need to operate across many blockchains at once. They support over 100 chains. Ethereum. Solana. And dozens more.

The core technology is MPC custody. Multi-party computation. This splits private keys into multiple shares. No single person or system holds a complete key. Transfers require multiple parties to approve. This reduces insider risk.

Fireblocks works with Rails 1, 3, and 4. Public blockchains. Custody APIs. Institutional privacy chains. This flexibility matters for institutions running multiple workflows on different rails.

They don't hold assets directly. Instead, they partner with regulated custodians globally. The institution's assets sit with a licensed custodian. Fireblocks provides the technology layer. The wallet infrastructure. The governance controls. The transaction orchestration.

Real Use Case: BNY Mellon uses Fireblocks infrastructure to custody digital assets for institutional clients. ANZ Bank deployed Fireblocks for their stablecoin pilot. Revolut uses Fireblocks to secure crypto holdings for millions of retail customers.

Key Stats:

Supports 100+ blockchains and 4,500+ tokens

Processes over $4 trillion in annual transaction volume

Secures assets for 2,000+ institutional clients

Used by 6 of the top 10 crypto exchanges globally

Zero security breaches since founding in 2019

This model works well for banks and fintechs that need custody but want to choose their own custodian. Or institutions that already have custody relationships and just need the technology infrastructure.

Target clients include banks, exchanges, fintechs, payment firms, and asset managers. Basically any institution that needs to move assets across multiple chains. With strong governance controls. And integration with regulated custody.

The regulatory position is clear. Fireblocks is an infrastructure provider. Not a custodian. They partner with regulated custodians. This lets institutions choose custodians based on jurisdiction. Insurance requirements. Regulatory comfort.

2. BitGo: The Institutional Custody Standard

BitGo takes a different approach. They are a regulated qualified custodian. They hold the assets themselves. Under fiduciary duty.

Assets under custody reached roughly $90 to $100 billion. This makes them one of the largest institutional crypto custodians. They've been operating since 2013. Long track record in the industry.

BitGo supports Rails 1 and 3. Public blockchains and custody APIs. Multi-chain across major public blockchains. They don't support permissioned private chains or institutional privacy chains.

The custody model includes fiduciary responsibility. This means a legal duty to act in the client's best interest. Different from technology providers who just provide infrastructure.

Real Use Case: Galaxy Digital uses BitGo as their primary custodian for institutional crypto assets. Mike Novogratz's firm chose BitGo for regulatory clarity and insurance coverage. Bitstamp exchange uses BitGo custody for customer assets across multiple jurisdictions.

Key Stats:

$90-100 billion in assets under custody

Custodies assets in 60+ countries

Processes $30 billion+ monthly in transactions

Supports 700+ coins and tokens

$250 million insurance coverage through Lloyd's of London

Regulated in US, Germany, Switzerland, and other jurisdictions

BitGo is licensed and regulated in multiple jurisdictions. This matters for institutions that need custody with clear regulatory oversight. Banks. Institutional investors. Asset managers.

Fee structure is AUC-based. Assets under custody. Plus service charges for transactions and additional services. This creates predictable costs based on holdings.

Target clients are institutional investors who want a single custodian relationship. With deep regulatory compliance. And proven track record at scale.

The difference from Fireblocks is clear. BitGo is the custodian. Fireblocks partners with custodians. If you want a direct custody relationship with a regulated entity, BitGo fits. If you want flexibility to choose custodians while using best-in-class technology, Fireblocks fits.

3. Zero Hash: The Embedded Finance API

Zero Hash built for a specific use case. Fintechs and platforms that want to embed stablecoin functionality. Without building blockchain infrastructure themselves.

They provide white-label trading and settlement APIs. A fintech company can integrate Zero Hash's API. Instantly offer stablecoin payments or trading to their users. The fintech brand. Zero Hash's infrastructure.

Zero Hash supports Rails 1 and 3. Ethereum and major public chains via liquidity partnerships. They don't operate their own custody. Instead they partner with custodians and liquidity providers.

This matters for understanding the operational model. When a fintech's user wants to buy USDC, Zero Hash routes that to a liquidity provider. Settle it. Handles custody through a partner. Fintech never touches blockchain infrastructure directly.

Real Use Case: Stripe uses Zero Hash infrastructure to power crypto payouts for creators and platforms. Interactive Brokers integrated Zero Hash to offer crypto trading to their 2.5 million customers. Checkout.com uses Zero Hash for stablecoin settlement on cross-border payments.

Key Stats:

Powers crypto services for 200+ fintech platforms

Processes $12+ billion in annual transaction volume

Supports settlement in 40+ countries

Average API integration time: 6-8 weeks

99.95% platform uptime in 2024

Partnerships with 20+ liquidity providers globally

4. Anchorage Digital: The Bank-Chartered Custodian

Anchorage Digital holds a unique position. They're a federally chartered digital asset bank. First in the US. This means they operate under OCC supervision. Office of the Comptroller of the Currency.

Bank charter changes everything. Anchorage can offer custody with fiduciary duties. FDIC insurance on USD deposits. Federal regulatory oversight. All things non-bank custodians cannot provide.

They support Rails 1 and 3. Multi-chain with strong regulatory alignment. Their focus is regulatory-compliant infrastructure. For institutions that need that level of oversight.

Services include custody, trading, and prime brokerage. Professional investors use Anchorage when they need bank-grade custody. With the ability to trade and borrow against holdings.

Real Use Case: Visa uses Anchorage Digital to custody USDC reserves for their crypto settlement pilot. PayPal chose Anchorage as a custody partner for institutional crypto services. a16z (Andreessen Horowitz) uses Anchorage for custody of their crypto fund assets.

Key Stats:

First federally chartered digital asset bank (OCC approval January 2021)

Supports 70+ digital assets across multiple chains

Serves 300+ institutional clients

Custodies assets for major crypto funds and family offices

Bank-grade security with SOC 2 Type II certification

Direct access to Federal Reserve payment systems

5. Dfns: The Developer-Focused Infrastructure

Dfns built for a different audience. Fintech startups. Digital platforms. Developers who want to embed wallet functionality into their applications.

They provide API-driven wallet infrastructure and MPC custody tooling. The approach is developer-first. Clean APIs. Good documentation. Fast integration.

Dfns supports Rails 1 and 3. Ethereum plus major public blockchain ecosystems. Their MPC-based custody architecture lets developers create wallets programmatically.

A fintech building a consumer app can use Dfns to create a wallet for each user. On signup. Automatically. The fintech's application controls the wallet through Dfns APIs. Users never see private keys. Fintech never holds private keys. MPC distributes key shares.

Real Use Case: Ledger Enterprise uses Dfns infrastructure for institutional wallet management. Crossmint integrated Dfns to enable wallet creation for NFT marketplaces. Multiple Web3 gaming platforms use Dfns to create in-game wallets for millions of players without requiring seed phrases.

Key Stats:

Powers wallet infrastructure for 100+ applications

Supports creation of millions of wallets programmatically

Average API response time under 200ms

99.9% uptime SLA

Supports Ethereum, Polygon, Solana, Avalanche, and 15+ other chains

Integration completed in 2-4 weeks on average

6. BVNK: The Payment-Focused Provider

BVNK focuses on a specific workflow. Stablecoin payments. Treasury management. Fiat-to-stablecoin bridging.

They are built for companies that need to move money in and out of stablecoins. Smoothly. Businesses paying suppliers in USDC. Platforms accepting stablecoin payments. Treasuries managing working capital in stablecoins.

BVNK supports Rails 1 and 3. Public blockchains plus fiat payment system integrations. Fiat integration is key. They connect traditional banking rails to stablecoin rails. So businesses can move between them easily.

A company can send USD from their bank account. BVNK converts to USDC. Sends on-chain to the recipient. Or reverse. Receive USDC. Convert to USD. Settle to bank account.

Real Use Case: Checkout.com integrated BVNK to enable merchants to receive crypto payments and settle in fiat. Several European e-commerce platforms use BVNK to pay international suppliers in USDC while maintaining local currency accounting. Crypto exchanges use BVNK for fiat on/off ramp services.

Key Stats:

Processes $2+ billion in annual stablecoin payment volume

Supports fiat settlement in 30+ currencies

Average conversion time: under 60 seconds

Operates in 50+ countries

150+ enterprise clients using payment infrastructure

Fiat settlement typically completes in 1-2 business days

Comparing Infrastructure Providers

The right provider depends on your institution's needs.

Need multi-chain operations with governance controls? Fireblocks provides the broadest chain support. Over 100 chains. Strong governance. Partnership flexibility with custodians.

Need a direct custody relationship with a regulated entity? BitGo offers qualified custodian status. Fiduciary duty. $90-100 billion in assets under custody. Proven track record.

Building a consumer fintech and need to embed stablecoin features fast? Zero Hash provides white-label APIs. Fast deployment. Built-in liquidity and custody partnerships.

Regulators require bank-chartered custody? Anchorage Digital is the only federally chartered digital asset bank. OCC supervision. Fiduciary duties.

Building a wallet-based application and need developer-friendly APIs? Dfns offers API-driven infrastructure. MPC tooling. Developer-first approach.

Primary use case is payments and fiat-to-stablecoin conversion? BVNK specializes in payment flows. Treasury management. Fiat bridges.

How TokenMinds Helps with Stablecoin Rails Strategy

TokenMinds helps institutions select and implement the right stablecoin rail from day one. Drawing on direct experience with institutional clients and live deployments.

Our team has worked on live stablecoin integrations involving custody APIs, smart contract settlement layers, and compliance-ready payment corridors. From initial architecture decisions to production deployment, we guide clients through rail selection, infrastructure setup, liquidity routing and regulatory alignment.

For example, we recently designed and deployed a fiat- and gold-indexed basket stablecoin platform for a fintech client. We architected the basket and peg smart contracts, implemented multi admin mint and burn governance with MFA and role-based controls and embedded KYC AML workflows with blacklist and freeze functions.

What We Deliver

Evaluate Your Profile: Business model. Volume. Counterparty structure. Privacy needs. Regulatory exposure.

Select the Right Rail: Public. Private. Custody API. Institutional Privacy. Matched to long-term goals.

Implement With Confidence: Avoid structural debt. Choosing the wrong rail is expensive and complex to fix later.

Why This Matters

Unlike most technology choices, stablecoin rail selection has consequences that compound over time.

The counterparty relationships you build. The operational processes you embed. The node infrastructure you deploy. The smart contract logic you write. All become harder to unwind at scale.

Institutions that choose a rail based on ease of entry often find themselves rebuilding from scratch. When their volume or risk profile demands something more capable.

The institutions moving fastest today are not choosing the simplest rail. They are choosing the most structurally sound one for their long-term position in the market.

Conclusion

The question is not which rail is easiest to start with. The question is which rail will still be the right infrastructure when your stablecoin settlement volume is ten times larger. And your counterparties are asking harder questions about settlement guarantees.

Stablecoins are no longer optional for financial institutions. Competitors are live. Settlement costs are compressing. The workflows are real.

The rail you choose determines your settlement speed. Your privacy posture. Your capital efficiency. Your counterparty reaches.

Choose wrong and you pay for it in fees. Trapped capital. Reconciliation overhead. Limited counterparty access.

Choose right and you unlock efficiency. Speed. Privacy. Atomic settlement.

Ready to evaluate which stablecoin rail fits your institution? Contact TokenMinds to discuss your settlement infrastructure strategy.

FAQ

What is the difference between a stablecoin and a deposit token?

A stablecoin is issued by a non-bank entity. Backed by reserves held separately from the banking system. Not covered by deposit insurance.

A deposit token is a digital representation of an actual bank deposit. Issued on-chain by a regulated bank. It inherits deposit insurance. Can earn interest. Sits inside the traditional banking system's balance sheet treatment.

Why does counterparty reach matter more for some institutions than others?

For fintechs and regional banks, the primary use case is reaching end customers and businesses in payment corridors. Counterparty reach is the whole game.

For Tier-1 banks and asset managers, most high-value settlement happens with a defined set of institutional counterparties. They would rather have deep settlement guarantees with a smaller network. Then shallow guarantees with a large one.

Can an institution run more than one rail at the same time?

Yes. And most institutions eventually should.

Cross-border payments run on public rails. Collateral and multi-party settlement run on institutional privacy chains. Treasury operations start on custody APIs while the team builds operational knowledge.

Each rail serves a different workflow. They don't conflict.

What is the real cost of choosing slow settlement rails?

The direct cost is transaction fees and settlement time.

The indirect cost is trapped capital. A $500 million daily collateral position on T+2 rails keeps roughly $1 billion in idle capital unavailable at any given time.

At a 4% yield, that is $40 million per year in foregone returns. The reconciliation labor cost adds another layer on top.

How does atomic settlement work across institutions on Canton Network?

Each institution runs its own Canton participant node. When a multi-party transaction is initiated, all required authorizations are submitted to the sync domain.

The sync domain coordinates the commit across all nodes at once. If all parties confirm within the transaction window, every node updates its ledger state at the same moment.

If any party fails to confirm, every node reverts to its prior state. No assets move. No manual cleanup needed.

Is USDC a safer choice than USDT for institutional use?

From a reserve transparency standpoint, yes.

USDC provides monthly attestations by a registered accounting firm. With detailed reserve composition disclosures.

USDT provides less granular disclosure.

For institutions where reserve transparency and audit trail quality are operational requirements, USDC is the cleaner choice.