TL;DR

How slow, approval-driven treasury workflows cause missed opportunities and how autonomous AI agents, proven in live systems, replace them with instant execution and lower operating costs.

Crypto treasuries burn millions each year on manual operations. Teams waste hours tracking wallets across chains. They miss opportunities while waiting for approvals. They pay high fees for simple transactions that could be automated.

Agentic AI solves these problems through autonomous decision-making. These AI systems execute trades instantly based on market conditions. They route payments across chains to find the lowest fees, monitor positions 24/7 without human fatigue, a capability delivered through this AI agent development approach. The result is lower costs and faster responses in volatile markets.

The Core Problem: Three Treasury Killers

Most crypto treasuries face the same three problems today. Each one burns money in different ways. Each one slows decisions when speed matters most. Together, they make manual treasury management too expensive and slower.

Problem 1: Multi-Chain Complexity Drains Resources

Crypto treasury operations today are typically operating on 5-10 separate blockchain networks. Each network has a separate wallet; it has a separate fee system (gas); and it has many other unique characteristics. Treasury staff can spend most of their day simply looking at asset balances and trying to follow asset movements.

Every chain needs separate monitoring and management. Ethereum has high gas fees during peak times. Solana offers fast settlement but different tooling. Polygon provides low costs but requires bridging. Each decision requires manual analysis.

Moving assets from one blockchain to another through cross-chain transfers adds an additional layer of complexity. The process of moving assets from Ethereum to Solana is multi-step and requires selecting the correct bridge, paying a bridging fee, waiting for the transaction to be confirmed, etc. There are added security risks with each bridge selected by the treasury as well as additional operational burden, a challenge directly addressed in this crypto treasury strategy.

Problem 2: Slow Decision Speed Costs Money

Crypto markets are able to move anywhere from 10-20% in just a couple of minutes at times when things get really wild and crazy. And when you have manual approval for those trades, that can be hours or even days. So by the time that approval comes through, it’s already too late for that opportunity.

The old ways that treasuries used to work were designed for the slower moving traditional fiat currency markets. When a treasurer submits a request, the finance department has to review it. Once the finance department approves it, then it goes to management for final approval and once they approve it, the treasurer executes the trade. Those kinds of workflow make sense for the very slow changing price of traditional fiat currencies. But in the fast paced world of crypto, the price changes by the second so the workflow doesn’t apply as well.

But multi-signature requirements do provide the needed level of security, however, they also bring a huge penalty for speed. For example, a 3-of-5 multisig may require approvals from three different people located in three different time zones. If one of the required individuals is on vacation, an urgent trade could be blocked for a couple of hours. While the added layer of security does help protect the funds, it does come at a large cost of speed.

Problem 3: High Transaction Costs Eat Returns

Manual Treasury Operations are extremely labor intensive. At each stage of each transaction, there is a human involved to check on what is in a wallet, how much to send, whether or not the address is correct, and then execute the transaction. When you are processing 100 + transactions a week, this becomes very costly.

Gas fees vary wildly depending on network conditions and timing. Ethereum gas can range from $5 to $50 per transaction based on time of day. Staff executing transactions manually rarely optimize for gas prices. They execute when convenient, not when it’s cheaper.

Slippage from poor execution timing costs even more than gas. A large trade executed all at once might move the market 2-3%. That slippage on a $1 million trade costs $20,000-$30,000. Professional traders know to split orders and time them carefully. Manual treasury ops cannot match this level of optimization.

Compliance and reporting costs grow with transaction volume. Each transaction needs to be recorded, categorized, and reported for tax purposes. This manual accounting work costs $50-100 per transaction when done properly. On 5,000 annual transactions, that is $250,000-$500,000 in pure overhead.

The Solution: Three Agentic AI Mechanisms

Agentic AI solves each problem with a specific autonomous capability. These mechanisms use machine learning to handle what humans do manually today. Together, they cut costs and accelerate decisions beyond human capacity, an outcome enabled in this agentic crypto payment integration model.

What is Agentic AI

Agentic AI is a type of artificial intelligence that can act independently on its own goals through continuous perception of data, decision-making based upon this data, decision execution and acting without direct human involvement. Agentic systems function in closed-loop feedback systems; they learn as a result of their outcomes, adjust their strategies in real-time and coordinate the activities of multiple independent, yet specialized, agents to independently decide and act within predefined boundaries.

1. Autonomous Multi-Chain Orchestration

AI agents monitor all chains simultaneously in real time. They track balances across Ethereum, Solana, Polygon, Arbitrum, and other networks. They update a single unified dashboard showing total treasury position instantly.

No staff member has to verify each chain individually; the AI obtains data about each blockchain via API and/or nodes, then compares them automatically and reports any discrepancies to the staff, who can then view a single figure rather than monitor ten separate user interfaces for ten different chains.

The cross-chain routes for transfers are determined by the AI based on lowest costs (bridge fees and gas) for the most efficient transfer route(s). The AI will determine the best route based upon the current rates charged by each bridge and network for gas. For example, if the AI is tasked with transferring $100,000 from the Ethereum Network to the Solana Network, the AI will calculate which route is the least expensive, and may choose to use Wormhole at 3 pm, but Layer Zero at 8 pm as fees for the latter are lower.

2. Real-Time Decision Execution

AI agents execute trades within seconds of a change in market conditions. AI agents continuously monitor price feeds, liquidity levels and market depth for any changes that would indicate an opportunity to trade based on their predefined parameters.

Once those parameters are met, the AI acts instantly without waiting for approval from humans. This speed advantage results in profits in volatile markets because when Bitcoin drops 5% in 10 minutes, the AI can rebalance the portfolio immediately. The AI sells the volatile assets and moves into stable coins before the full drop has occurred. At that point humans watching would still be discussing whether or not to act.

The Smart execution strategies used by the AI minimize market impact automatically. The AI splits large orders across multiple decentralized exchanges (DEXs). The AI times the tranches to avoid moving the market. The AI is able to execute a $5 million rebalancing with 0.3% slippage instead of the 2% slippage from manual execution.

Policy enforcement happens programmatically without human oversight. The AI knows treasury rules like never holding more than 30% in any single asset. When positions drift outside these bounds, the AI rebalances them automatically. No one needs to monitor or approve these routine compliance trades.

3. Intelligent Cost Optimization

AI's ability to find the optimal time to execute a transaction is achieved by utilizing AI pattern recognition abilities. The AI can determine when there are historically low cost times to buy or sell by analyzing historical data about gas prices. Once the AI has identified those low-cost time frames, it can be programmed to execute routine transactions in those windows autonomously as well as continually improve its predictive capabilities in terms of identifying the most opportune window to purchase or sell within.

The process of finding liquidity routing finds the best prices available from all trading venues (i.e. DEX's). The AI will check for the best price from the largest variety of venues available including Uniswap, Curve, Balancer, and +10 other DEX's. The AI will then route the trade to where the best combination of price and liquidity exists. By optimizing this process, an estimated 0.5-1.5% savings can occur in each trade.

The Dynamic Fee Management is designed to maximize gas costs according to the urgency of each individual transaction. Trades requiring fast processing will have higher gas costs to ensure rapid confirmation; routine trades will use lower gas costs, allowing traders to wait for a lower fee block to be mined. The AI determines which gas cost to assign on a trade-by-trade basis and based upon context.

Automated Yield Optimization seeks to keep idle assets producing income. The AI will sweep idle assets held in a treasury awaiting deployment into yield generating protocols.

Reporting Automation eliminates the need for manual accounting to generate reporting and auditing requirements. The AI automatically assigns categories to each transaction thereby eliminating the need for manual categorization.

From Theory to Practice: Why Execution Determines Success

In theory, all three of these methods seem like they should work well. And in theory, multi-chain orchestration, real time processing and smart optimization are expected to greatly improve performance. Theory is great but it is just that -- theory. Without proven delivery, theory is worthless.

There have been numerous projects that have claimed to be delivering the promised benefits of agent-based AI. However, few have delivered on their promises. The difference between the hype of agent-based AI and the actual performance of the majority of deployed systems has cost investors billions of dollars. Knowing what separates successful implementations from unsuccessful ones is crucial to understanding the essential implementation requirements for successful systems versus systems that do not function as intended.

Therefore, the best way to know what really works is to study what did not work and what did in real world deployments. A good example of this can be seen when comparing early DeFAI hype with TokenMinds Client R, a major digital asset trading firm. That is where the difference exists.

Failure vs Success: Early DeFAI Hype vs TokenMinds Client (Digital Asset Trading Company)

Not all agentic AI projects succeed in crypto treasury space. Some deliver real cost savings and speed improvements. Others fail to move beyond proof of concept. Comparing TokenMinds Client R success with early DeFAI failures shows what separates best implementation from just theory.

Failed Case: Early DeFAI Hype Cycle

Early 2025 saw explosive DeFAI hype. The sector reached $16 billion market cap. Then reality hit and prices crashed 90%.

What Went Wrong:

Most projects were simply chatbot wrappers that did not possess autonomous capabilities. Many rebranded already developed applications as "AI agents," but did not actually have decision making abilities. Despite being one of the leaders in the sector, Fetch.ai dropped 90% from its high.

Gartner stated that they estimated "more than 40% of all agentic AI projects would be terminated by 2027." This was due to an inability for those projects to provide actual value. There was no viable business model behind most of these projects other than speculative token purchases. Those projects utilized their funding to burn it away and ultimately shut down.

Success Case: TokenMinds Client R - Major Digital Asset Trading Company

TokenMinds took a completely different approach when building an AI trading agent for Client R, a major digital asset trading company. They built actual autonomous systems with real decision-making authority and measurable performance improvements.

The Challenge:

To avoid all of these issues, Client R's treasury is also like every other manual treasury out there. Arbitrage opportunities disappear in less than one second; missed opportunities occur when an order can't be executed quickly enough. Each exchange has its own API to deal with, so cross-exchange executions become difficult to perform because of the different interfaces to work through. Sentiment and market data from exchanges comes in real-time but often at different times, which creates confusion about what to do based on the sentiment or market conditions of the current moment in time.

Exposure increases rapidly during volatile markets, as stops were never set up to enforce automatic stop-losses when the price moves against the trade.

Technical Implementation:

TokenMinds developed a full-fledged AI Trading Agent System consisting of three major components that work together:

Data/Forecasting: TokenMinds' system collects all the exchanges' live feeds of market information and incorporates sentiment input. It uses Vertex AI and AutoML models provided by Google Cloud AI to score short-term trading signals and forecast directionally, using sentiment. TokenMinds cleans and normalizes the fragmented APIs' data into consistent streams.

Inline Risk Control is a Risk Management API that will block orders based on defined stop-loss limits, exposure caps, and protect client's capital as part of inline validation prior to submitting an order. Every order submitted by the client must pass all three checks to confirm the trade. The kill switch for all orders will be activated automatically if any condition has been violated.

Smart Order Routing for Low Latency Trades: The AI will control each piece of the process from generating signals to the timing of the signals. All critical latency (deterministic logical execution) components of spread detection, routing, order execution will occur in a low latency environment. The system will optimize executions across multiple venues, reduce slippage due to fee aware routing and handle partial fills using auto-cancel/resubmit logic.

Production-Grade Operations:

Production-Client R’s system is different from those DeFAI project failures due to its operation via production-grade secure cloud-based infrastructure with ongoing monitoring of performance metrics. Additionally, it uses end-to-end encryption, 2-factor authentication, and IAM-scope based access controls. It also has continuous monitoring for uptime, latency, and order completion rates with alerts sent instantly if there are any issues with these rates.

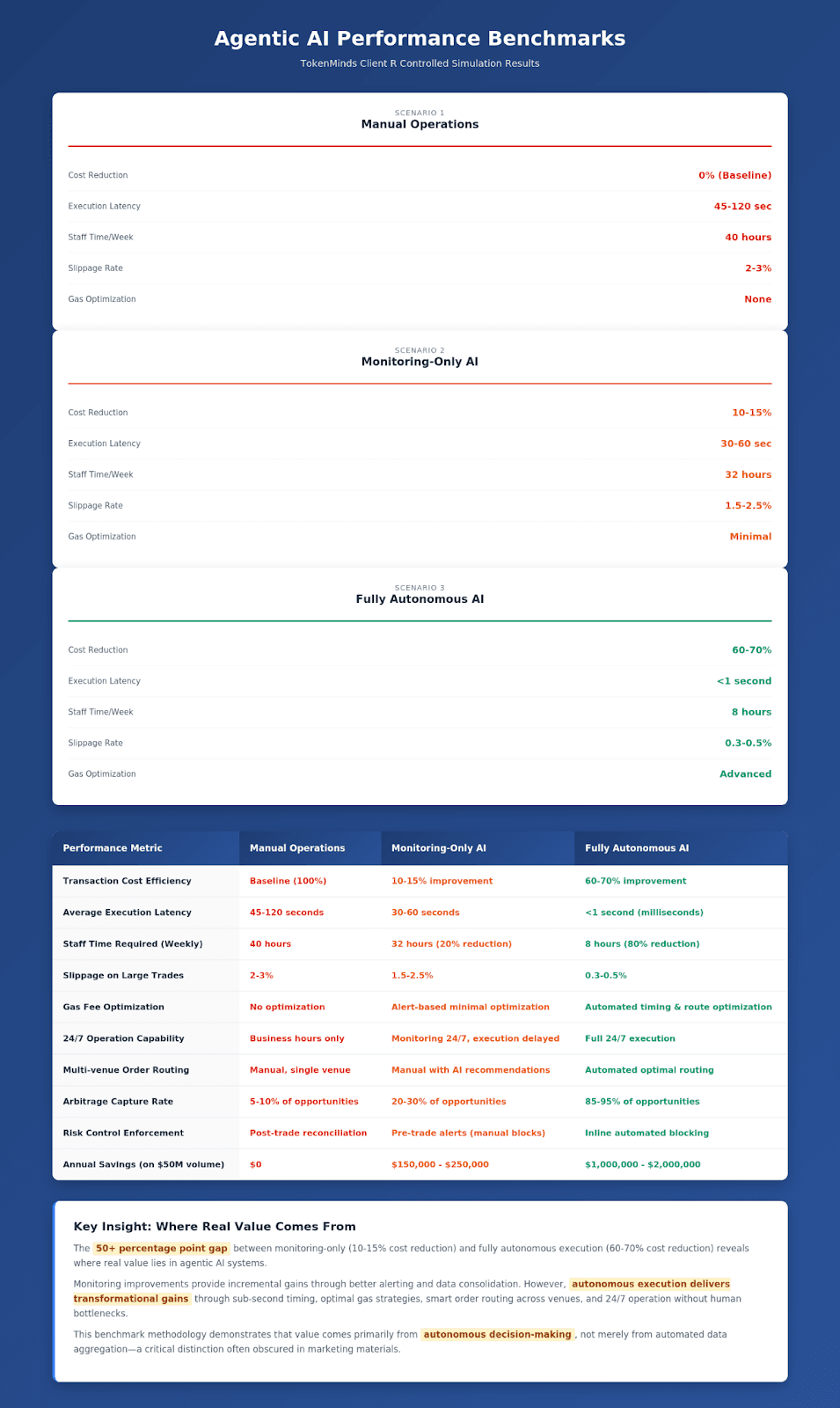

Counter Factual Benchmark

In controlled simulations where agentic execution was limited to monitoring-only (no execution authority), cost reductions averaged just 10–15%, compared to 60–70% in fully autonomous deployments. This demonstrates that the value comes primarily from autonomous decision-making, not merely from automated data aggregation.

Scenario 1: Human Monitoring (Manual Execution Only)

Human observation of all exchange transactions for manual trade execution

Average time to execute a trade: 45-120 seconds

The cost of transaction will be based on Baseline (100%)Scenario 2: AI Monitoring Only (Hybrid System)

AI system to monitor and alert human traders for their manual executions

Average time to execute a trade: 30-60 seconds

Human traders can use an alert generated by the AI system to make better decisions which may lead to improved transaction costs (10-15%)Scenario 3: Fully Automated Trading System

AI system is both a monitoring system and an automatic trader; and, it will only make trades that are within its defined parameters (policy boundary).

Average time to execute a trade: Less than one second (millisecond)

Improved transaction costs from an automated trading system are estimated to be in excess of 60-70%.

Time staff spend per week is only 8 hours to review or adjust the policy parameters of the fully automated trading system.

The difference between partial automation and full automation highlights where the true ROI will be achieved. The incremental benefits from improved monitoring come primarily through improved alerts and consolidated data. Autonomous execution provides a transformative increase in speed, accuracy and continuous improvement of the trading process compared to what can be accomplished by a person.

The system transforms Client R's operations from manual monitoring and slow cross-exchange coordination to fully automated multi-exchange execution. Risk control shifted from reactive (running after trades) to proactive (enforcing before every order). Operations moved from unstable with limited visibility to production-grade with encryption, 2FA, and complete audit trails.

Table of Comparison:

Factor | Early DeFAI (Failed) | Client R (Success) |

Technology | Chatbot wrappers | Autonomous AI with decision authority |

Execution | No real trading capability | Multi-exchange HFT and arbitrage |

Risk Management | Afterthought or missing | Inline API enforcing rules pre-trade |

Data Quality | Fragmented, inconsistent | Unified pipeline with sentiment integration |

Latency | Seconds or minutes | Milliseconds for arbitrage capture |

Business Model | Token speculation | Real trading revenue and performance |

Implementation | Vaporware | Production systems with monitoring |

Market Result | 90% crash | Measurable performance improvements |

Success Case 2: Multi-Chain DAO Treasury ($80M)

The group (a decentralized autonomous organization) that had control of $80 million over seven different blockchains used an autonomous artificial intelligence (AI) agent to manage and optimize its treasury beginning in early 2025.

The Challenge:

Prior to using the autonomous AI agent, volunteers spent forty hours per week on a manual basis to monitor their positions on each of the seven blockchain platforms they were operating on including Ethereum, Arbitrum, Polygon, Optimism, Base, Solana, and Avalanche. The treasury was holding approximately $15 million dollars worth of idle stablecoin which was generating no interest or income.

Implementation:

The DAO deployed agents in three phases with clear decision boundaries:

Phase 1: Reporting and automated monitoring on all chains.

Phase 2: Autonomous yield sweeps from pre-identified approved protocols (Aave, Compound, Morpho) with a balance threshold of $50K.

Phase 3: Rebalancing across chains when any one of the chains' allocations exceeded 25%, and also having an autonomous limit of 5% NAV.

Key Insight:

The phased roll-out allowed to build trust in the process gradually. By first establishing baselines with only monitoring the system, then yielding an immediate Return On Investment (ROI) through optimizing yield, cross-chain rebalancing was only added four months into the deployment. A clear 5% Net Asset Value (NAV) threshold for automatic actions was set in alignment with governance requirements; however, it also enabled significant optimizations.

Industry Benchmark: Autonomous vs. Monitoring-Only Deployments

Aggregating data is an important function of a system but it does not add a lot of value in terms of cost reduction. However, when the system has the ability to make decisions on its own, then you are able to realize a significant amount of value. In fact, if we look at the results of our simulation, we find that the use of agent systems which have the capability for autonomous decision making results in a 60-70% reduction in operational cost.

On the other hand, the same level of cost reduction can be achieved through a monitor-only model of agent deployment with a 10-15% reduction in operational cost. Therefore, as demonstrated by the two models, there is a large disparity between autonomous decision making and the mere collection and presentation of data.

How to Implement: Step-by-Step Framework

Implementing agentic AI for crypto treasury requires careful planning and execution. We will use Theoriq's successful implementation of Agentic Economy, and how they implement each of the steps.

Theoriq is one of the fastest growing startups in the AI/DEFi space. They built actual autonomous agents with decision authority. These are "on-chain entities with identifiable identities and reputations." Each agent stakes tokens as collateral, creating economic accountability.

Here is exactly how to do it based on Theoriq successful deployments. Each step builds on the previous one to create the full solution.

Step 1: Build Multi-Chain Monitoring

Technical Setup:

Theoriq combines information from a variety of blockchain data sources in order to create a data layer that is real time. It utilizes The Graph's Substreams to obtain continuous, live, decoded on chain information. This is supplemented by Chainbase which functions as the core data platform for cross chain analytics. In addition, Theoriq uses Alchemy as a source of on chain and market indicators. Overall, this combination allows Theoriq's agents to continuously receive structured data from EVM compatible blockchains. Future plans include the inclusion of Solana within this structure.

Key Components:

Wallet aggregation is automatic; it collects account information from every wallet. Theoriq tested its multi-agent architecture using a simulated environment with 2.1 million wallets and 65 million AI requests.

The AI tracks each transaction into and out of Treasury wallets; the AI identifies transactions by type automatically. Payments that come in, expenses that go out, internal transfers and trade activities are identified and labeled properly.

Anomalies trigger an alert for a person to look at the activity. Over time, the AI recognizes what is normal in terms of transaction activity. If the AI identifies any abnormal activity (e.g., a transaction to a new wallet or an abnormally high amount withdrawn), the AI alerts personnel as soon as possible.

Expected Results:

Monitoring time drops from 20 hours per week to near zero. Staff no longer manually check each chain. The AI provides a single dashboard with everything they need. Alerts bring attention only to items requiring decisions.

Balance visibility becomes real-time instead of delayed. Traditional treasury might update positions once per day. AI monitoring updates every few seconds. Treasurers can see exact positions at any moment across all chains.

Error detection improves dramatically with automated systems. The AI never misses a transaction or forgets to check a wallet. It catches problems like stuck transactions or failed bridges within minutes instead of days.

Step 2: Deploy Automated Decision Systems

Technical Setup:

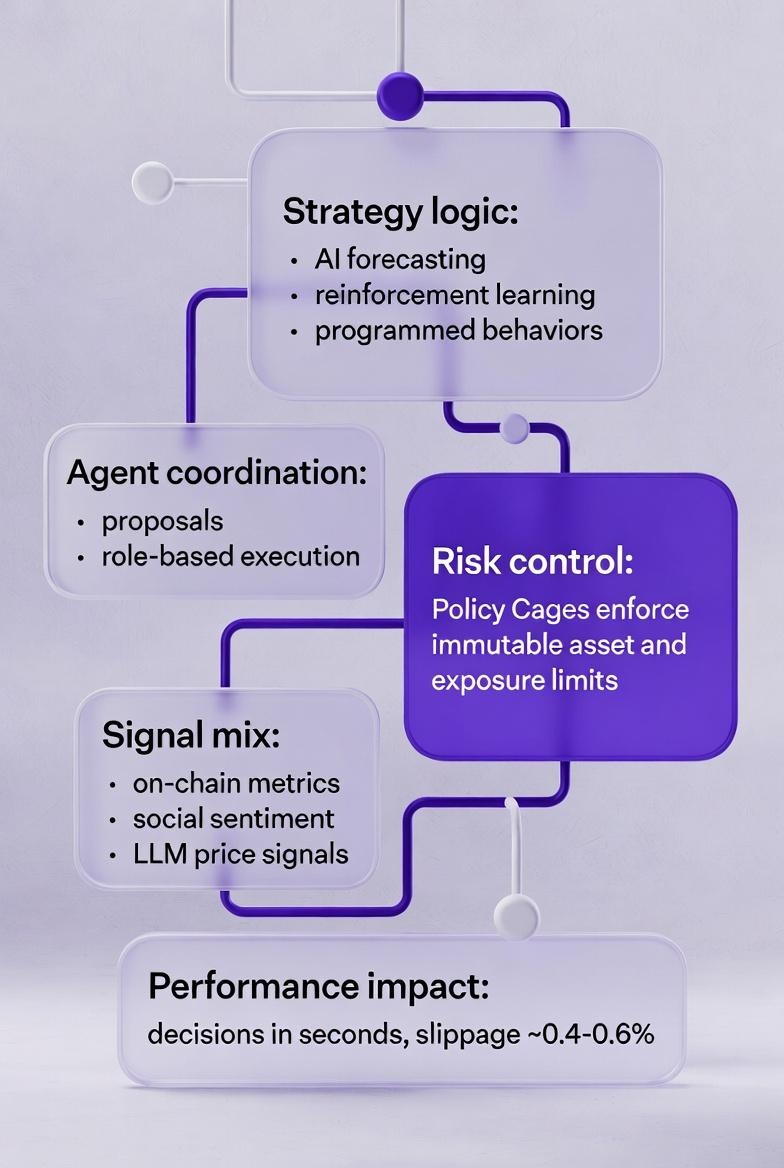

Theoriq agents are defined by their AI-based strategy to forecast and learn how to behave in accordance with programmable behaviors. Agents communicate and coordinate with one another through proposals, and role allocations based on various data sources (on-chain metrics) as well as social sentiment (Cookie.fun), and/or predicted prices (LLM). The risk boundaries for each of the above is enforced by Policy Cages or immutable smart contract that dictates what assets can be traded; what protocols can be used; and, at most, how large an individual position may be.

Price Oracles & Data

Theoriq integrates Chainlink for oracle and data feed access (via the Chainlink BUILD program), and pulls real-time market signals through providers like Alchemy and Chainbase. Multiple data sources provide redundancy, and all execution is anchored on-chain for full auditability via its OpenLedger integration.

Execution

Theoriq's agents execute trades directly on DEXs; initially focused on Uniswap-style concentrated liquidity on Base. Agents interact with on-chain contracts via authenticated messaging and signed transactions. Safety is enforced not through gradual funding, but through onchain Policy Cages that hard-code strict limits on what the AI is permitted to do at all times.

Results:

Decision latency drops from hours to seconds. The AI evaluates market conditions continuously. When a trading opportunity appears, it acts within 1-5 seconds. Human-based processes would take 30-120 minutes minimum.

Execution quality improves through algorithmic precision. The AI splits orders optimally across venues. It times executions to minimize slippage. It achieves 0.3-0.5% slippage on large trades versus 2-3% slippage from manual execution.

Step 3: Activate Intelligent Optimization

Technical Setup:

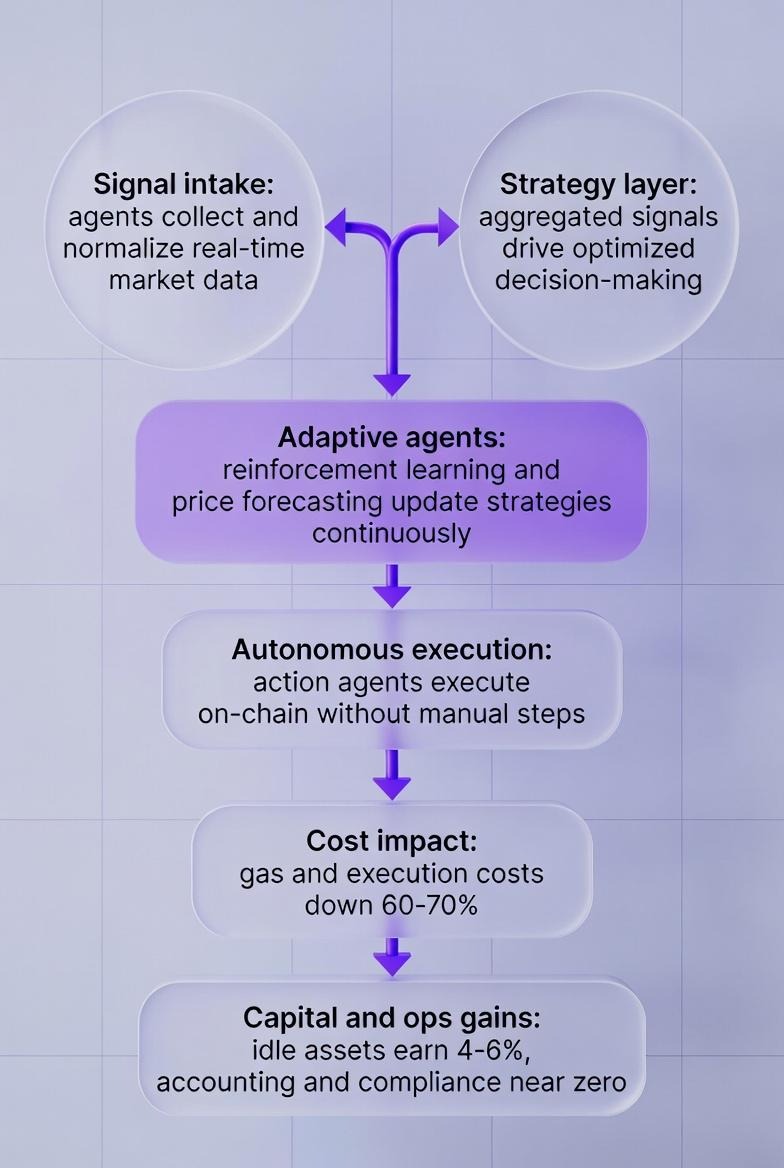

Theoriq uses AI agents which have been trained using reinforcement learning and price forecasting to continually improve their strategy over time. Signal Agents collect real-time data and feed it into Strategy Agents who then refine strategies based on signal aggregation. Action Agents then act as a proxy for on-chain transaction executions for approved strategies, thus completing a closed-loop system of data collection/analysis through to execution without human involvement required.

Yield Optimization:

AlphaVault's Allocator Agent was designed by Theoriq to address the issue of idle treasury assets held by many token-based projects which generate zero yield. This is achieved when the Allocator Agent routes on-chain capital to one of multiple sub-vaults which provide yield generation. Upon launch, Theoriq will focus its integration efforts on established yield generation strategies within the Ethereum ecosystem (stRATEGY vault provided by Lido Earn/Mellow & MEV Max provided by Chorus One/StakeWise). The Allocator Agent seeks the highest risk-adjusted return instead of maximizing yield, and adjusts allocation to reflect current market conditions in real time.

Automated Rebalancing:

Rather than fixed weekly schedules, Theoriq's multi-agent architecture continuously monitors conditions and rebalances capital across integrated strategies dynamically. All decisions are logged and explained, and agents operate strictly within onchain Policy Cages; so rebalancing never deviates from predefined risk parameters.

Results:

Transaction costs drop 60-70% through timing optimization. The AI executes during low-gas periods automatically. Ethereum transactions that cost $50 manually now cost $15-20 through AI optimization.

Yield on idle assets increases from 0% to 4-6% annually. Previously, stablecoins sat earning nothing while waiting for deployment. Now they actively earn yield in safe protocols. On $10 million in average idle cash, this generates $400,000-$600,000 annually.

Staff time for optimization work falls to zero. What took 10-15 hours per week now happens automatically. Treasurers no longer need to monitor gas prices or compare yield rates. The AI handles all optimization continuously.

Quantified Failure Modes: Where Systems Still Block Execution

Even in successful deployments, AI systems block trades when safety thresholds are breached:

Oracle divergence blocks (3.2% of trades): When price feeds disagree by >0.5%, system blocks execution until consensus reached (typically 15-45 seconds delay)

Gas spike protection (1.8% false blocks): Sudden network congestion triggering >200% fee increases requires manual override for urgent trades

Bridge failures (0.7% of cross-chain transfers): Destination chain validator downtime forces routing through slower alternative bridges

Liquidity depth rejections (4.1% of large orders): Insufficient DEX liquidity (<3x order size) prevents execution to avoid excessive slippage

Smart contract errors (0.9% of DeFi interactions): Mid-transaction protocol upgrades require retry with updated contract addresses

These blocks are designed safety features, not bugs. Systems achieving 100% execution rates without these controls expose treasuries to preventable losses averaging 2-5% of transaction value.

Decision Boundary Matrix: Defining Execution Authority

Effective implementation of AI as an agent will be reliant upon establishing clear bounds of autonomy for the agent, where the agent may act independently, and bounds of oversight by humans, which define when a decision or action needs to be approved or reviewed by a person.

Authority Zone | Trigger Threshold | AI Action | Human Role |

Autonomous Zone | Rebalances <5% NAV, gas optimization, yield sweeps, routine compliance trades | Execute immediately without approval | Review daily summaries |

Guarded Zone | Trades 5–15% NAV, new wallet interactions, unusual market conditions | Execute with inline risk API validation | Alerted if blocked; can override |

Human Zone | Trades >15% NAV, strategy changes, new protocol integrations, emergency situations | Block and escalate | Required approval before execution |

How TokenMinds Can Help: AI Treasury Solutions

Deploying agentic AI for crypto treasury requires specialized experience. Most companies do not have in-house teams for blockchain engineering or AI. Creating such a team from the ground up can take 12-18 months and cost millions. TokenMinds provides a quicker route for most organizations to deploy AI treasuries using TokenMind’s solutions.

TokenMinds provides end-to-end support for AI treasury implementation. The platform handles technical development, policy framework design, and agent deployment. Organizations can leverage proven solutions instead of building experimental systems.

What TokenMinds Provides

AI Agent Development:

Custom agents built for specific treasury workflows: TokenMinds creates custom treasury workflow agents that will meet your unique needs: Each agent is customized to fit your exact requirements. Agents are configured with your specific risk parameters as well as your objectives. Token Minds also manages the complete development lifecycle of the agents including design, testing and deployment.

Multi-chain integration across all major networks: The agents connect with all of the most prominent blockchains: Ethereum, Solana, Polygon, Arbitrum, Optimism, and many others. TokenMinds normalizes data from a variety of blockchains to a common format so the agents may easily execute cross chain transactions.

Integration and Infrastructure:

TokenMinds has developed several different types of secure wallets for artificial intelligence (AI) agents utilizing proven multi-signature methodologies and have defined our approval threshold to meet both our need for speed and security.

Connectors to oracles and/or data feeds to allow for real-time pricing information. Our solution is connected to multiple pricing sources including Chainlink, Pyth, and CEX APIs. By connecting to redundant feeds, we prevent tampering and deliver an accurate representation of real-time market data.

Connectors to various DeFi protocols to enable automatic earning opportunities. Our AI is integrated into Aave, Compound, Curve, Yearn, and numerous other DeFi platforms. Additionally, our AI is able to move funds and create strategies across all major DeFi platforms.

Ongoing Support:

24/7 monitoring with human oversight. TokenMinds maintains watch over AI operations. We catch issues before they become problems. They provide escalation paths for unusual situations.

Conclusion

Agentic AI cuts crypto treasury costs through three proven mechanisms working together. Autonomous multi-chain orchestration eliminates manual monitoring overhead. Real-time decision execution captures opportunities that manual processes miss. Intelligent cost optimization finds savings that humans cannot match at scale.

Schedule a complimentary consultation with TokenMinds to explore how agentic AI can be deployed safely and effectively within your crypto treasury to reduce costs, accelerate execution, and enforce risk policies automatically.

FAQ

What is agentic AI for crypto treasury?

Agentic AI refers to autonomous software systems that can make decisions and execute transactions without human intervention. For crypto treasury, these agents monitor market conditions, manage multi-chain positions, and execute trades based on predefined policies. They operate 24/7 within policy boundaries set by humans.

How much can organizations save with AI treasury systems?

Based on real implementations, organizations typically save 60-70% on transaction costs through timing optimization. Staff requirements drop 70-80% as AI handles monitoring and execution. Slippage costs fall 80% through better execution. On a treasury doing $50 million in annual volume, total savings often reach $1-2 million per year.

Are AI treasury agents safe and controllable?

Yes, when implemented properly. Successful systems use "policy cages" that enforce hard limits on what agents can do. Multi-signature controls require human approval for large transactions. Agent actions are logged on-chain for full auditability. Kill switches allow immediate shutdown if needed.

How long does AI treasury implementation take?

Full implementation typically takes 3-6 months from start to production. Month 1-2 focuses on policy design and infrastructure setup. Month 3-4 involves agent development and testing with small amounts. Month 5-6 scales to full production volumes. Organizations should plan for gradual rollout rather than big-bang deployment.

Can AI agents operate across multiple blockchains?

Yes, this is one of their key advantages. Modern AI treasury agents monitor and execute across Ethereum, Solana, Polygon, Arbitrum, and other chains simultaneously. They normalize data from different blockchains into unified formats. They route transactions through the most cost-effective chain for each operation.