TL;DR

How to integrate AI payment layers into existing rails with real-time verification, controlled execution, and immutable audit trails, enabling faster approvals and scalable execution while preserving regulatory compliance and risk controls.

Banks can no longer rely on old payment systems that use fixed rules and manual checks. These systems block good customers, miss modern fraud, and cost too much to run.

An AI-powered payment layer helps banks approve more real transactions, stop fraud faster, and cut operating costs. This turns payments into a system that protects revenue and strengthens customer trust in real time, an evolution delivered through this agentic crypto payment integration approach.

The Core Problem in Bank Payment Operations

Banks have automated many of their back-office processes, including payment processing, reconciliations, and settlements. However, much of the decision making still occurs within static rule-sets with periodic manual intervention. This model is breaking as both payment volume and complexity continue to grow, a limitation increasingly exposed in this blockchain-and-AI automation approach for banks.

Because rules are so rigid and they can only be updated periodically by a person, legitimate customers are being denied payments when the rules should allow for it. Traveling outside of your own country may trigger an alert for fraud; a rapidly growing business will hit arbitrary limits before you know it. The rules cannot keep up.

Fraud adapts faster than manually maintained controls. Fraudsters test limits, find gaps, and exploit them. By the time banks update rules, the attack pattern has evolved.

Exception handling scales linearly with volume. Every flagged transaction needs review. Every mismatch needs investigation. More volume means more staff, not better efficiency.

Payments remain operational, but not strategically intelligent. The core issue is real-time decisioning across the payment lifecycle.

What Are AI Payment Layers?

AI payment layers are intelligent systems that sit between payment requests and execution. They analyze, decide, and act on payments in real time without human intervention.

Unlike traditional systems that use fixed rules, AI payment layers use dynamic intelligence. They evaluate wallet behavior, transaction history, and risk signals instantly. They adjust approval thresholds based on context. They learn from every transaction to improve accuracy.

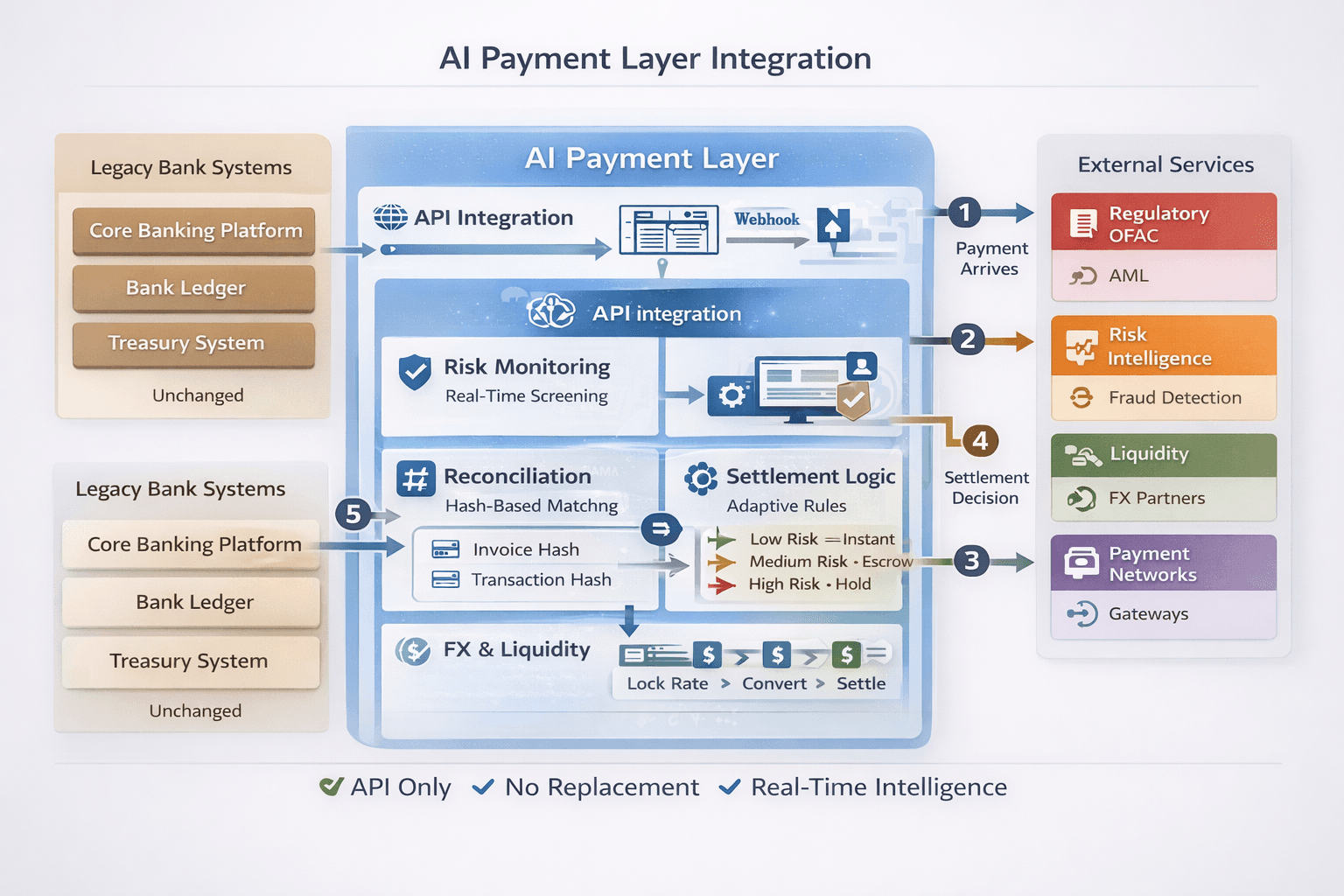

A bank can create an AI payment layer that acts as a new risk screening and settlement engine. A bank can use AI to automatically detect fraud and make programmable payouts without replacing all of its core banking systems. Payment events will flow from the API's into the banks' existing ledgers, but the AI will add intelligent capabilities at the edge of the system, while the banks' core systems remain the same, a model enabled through this AI-driven payments design.

Explicit Model Architecture & Decision Explainability

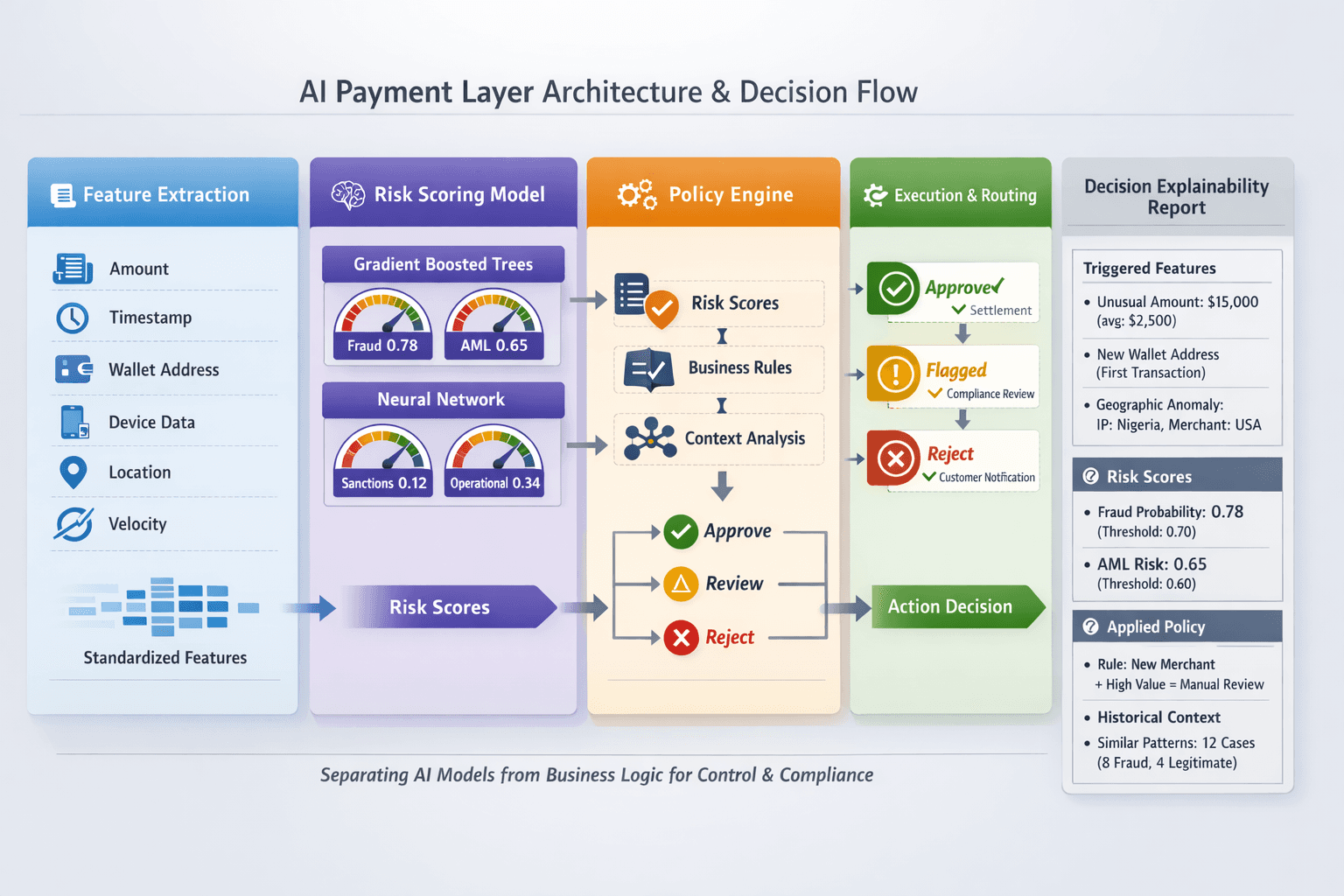

The AI payment system operates through four distinct processing layers:

Layer 1: Feature Extraction

The payment data will be converted into a format that can be used in an ML model for feature extraction.

Layer 2: Risk Scoring

Fraud, Anti Money Laundering (AML), Sanctions, and Operational risk scores will be generated by the ML models.

Layer 3: Policy Engine

Business rules and context will be applied to the risk scores to evaluate them.

Layer Four: Results of Processing

Layer 4: Execution

The payments will be either approved, reviewed, or denied; the processing of each payment will have a full audit trail.

The Solution: Three Implementation Steps

Building an AI payment layer requires three core steps that work together.

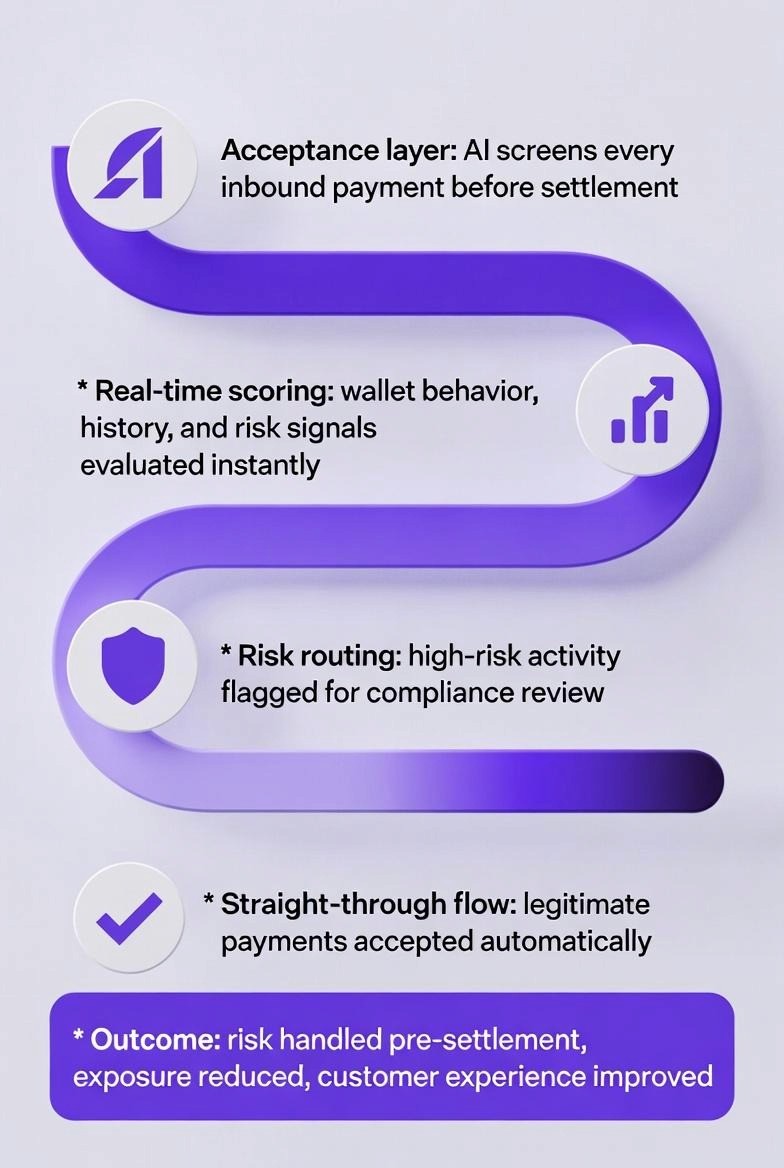

Step 1: Build Smart Payment Acceptance with Real-Time Risk Screening

The first step is to create an electronic payment processing system which accepts payment via different mediums such as credit card, PayPal and wire transfer, and at the same time performs real-time risk assessment for every transaction. The system will be able to assess the validity of the transaction using the following data:

The wallet address linked to both the sending account and receiving account

Device Fingerprint Information (information related to hardware being utilized in order to facilitate the transaction)

Sanctions Lists (list of entities/individuals that are subject to financial sanctions)

Any patterns established from past transactions in order to verify whether the transaction is valid or invalid

If the transaction is deemed to be legitimate, the AI will allow the transaction to pass into the bank's system, otherwise it will flag it as potentially fraudulent.

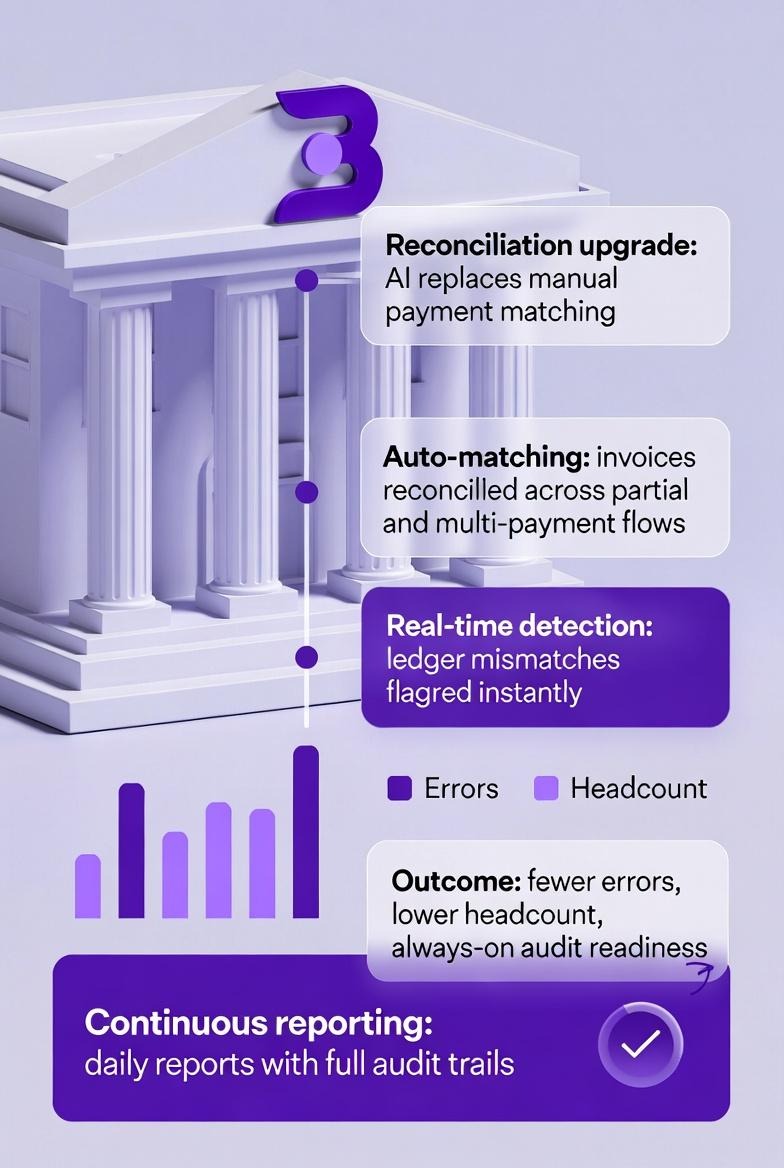

Step 2: Deploy Intelligent Reconciliation and Monitoring

Develop a system utilizing artificial intelligence for reconciliation that will reconcile payments automatically with invoices received, handle partial payments and overpayments, and also detect discrepancies between the blockchain record of the transaction, and the company’s internal ledger.

Each time the AI performs a transaction it will continue to learn from the transaction and identify potential patterns such as: Which merchants have the most issues with receiving their payments? What wallet addresses consistently trigger a compliance issue?

Step 3: Automate Programmable Settlement with Adaptive Rules

Eliminate static scheduling of settlements and replace with intelligent rules that will make decisions regarding when and how to settle funds to the merchant based upon the current circumstances.

For example low-risk merchants could receive their funds immediately after approval, high-risk transactions would remain in escrow until additional confirmation was provided. Weekend settlements could follow different routing paths than those utilized during the week. The Treasury could allocate its funds automatically based on liquidity requirements and target exchange rates for foreign currency.

Implementation Case Study: Client Payment Buddy

Payment Buddy is a leading fintech company in Pakistan. They enable businesses to digitally issue invoices and collect payments from customers across cards, bank transfers, wallets, and over-the-counter points.

Their platform automates payment presentment via digital invoices and links, merchant receipt of payments through multiple channels, and reconciliation and reporting between payer and merchant ledgers.

But they faced the same problems as banks. Risk screening was manual. Reconciliation was periodic. Settlement timing was fixed. As volume grew, the cracks showed.

Through AI-enabled integration of payment layers, Payment Buddy successfully connects to large banks, digital wallets, and collection networks. They also automate all aspects of the entire payment cycle including risk assessment, reconciliation and settlement.

As an exemplary case study for implementing AI payment layer technology, Payment Buddy has the ability to operate at a bank-scale level while processing payments via both traditional and digital channels; are subject to the same regulations as other financial institutions; and provide services to merchants who have real money tied up in their business operations.

These results show that AI-based payment layers can be used in live environments (production) as opposed to being simply theoretical.

How to Build AI Payment Layers: Payment Buddy Implementation

Step 1: Smart Payment Acceptance with AI Risk Screening

Payment Buddy implemented an AI-driven acceptance layer for all inbound payments.

Technical implementation: Payment Buddy built a system that checks every payment before accepting it. The system checks wallet addresses against global sanctions lists in real time. It blocks payments from blacklisted or high-risk wallets automatically. It flags wallets that show strange behavior, like sending money through risky platforms.

The AI uses payment amounts, time to complete payment and other payment characteristics to identify suspicious transactions. The AI freezes suspect payments for further review and analysis by the bank's compliance team. In addition, the AI logs each and every decision made regarding all transactions with a timestamp, which may be used at a future date for auditing purposes by regulatory agencies.

The system connects via API to payment gateways. When a payment arrives, the AI layer queries transaction history from the database. It checks wallet behavior patterns. It compares against known fraud signatures. It calculates a risk score. It routes based on that score.

All low-risk transactions (less than a 30 credit score) are routed directly to settlement. All medium-risk transactions (a credit score of 30 through 70) have an added step of verification in order to obtain a valid SMS confirmation prior to settlement. All high-risk transactions (greater than 70 credit score) require an additional level of compliance review using all supporting documentation which is pre-populated.

Results: The timing of risk assessment has been pushed forward to before settlement and therefore significantly reduced exposure to risk as well as increased the level of customer satisfaction. Payment Buddy's false decline rate decreased by 75% and the number of customer complaints regarding payments being blocked decreased by 70%. The number of compliance reviews in queue each day decreased from 500 to 50.

Step 2: Intelligent Reconciliation and Monitoring

Payment Buddy replaced manual matching with AI-driven continuous reconciliation.

Technical implementation: The reconciliation engine is based on deterministic hashing technology. When an invoice is generated, it is given a unique identifier. The payment record will reference this identifier. The AI algorithm will then find these two items and create a match regardless of if the payment was less than or greater than the invoice amount.

Each blockchain transaction is connected to the corresponding invoice. There is no double counting of a single transaction. This process also allows for partial payments to be processed automatically. Additionally, there can be multiple transactions associated with one invoice. The AI does all of this automatically.

When a partial payment is made, the AI compares the total of all payments made up to that point to the amount of the original invoice. If the total of the payments equals the total of the invoice, the AI indicates that the invoice has been fully paid. If the total of the payments is still short of the total of the invoice, the AI will continue to track the remaining balance until the invoice has been completely paid. If the payments exceed the amount of the invoice, the AI will indicate this as well.

If the AI finds a mismatch, it will flag the item and provide a possible solution to resolve the issue.

Once a day, the system will produce a report detailing which payments have matched and which have not. In addition to reporting which payments have matched and which have not, the system will confirm that the blockchain balances are equal to the amounts that merchants are owed. The system will also produce audit ready files for accounting and compliance personnel to review.

The engine runs continuously, not in batches. Every payment triggers reconciliation immediately. By the end of day, reconciliation is already complete rather than just starting.

Results: Error rates and reconciliation headcount dropped while audit readiness became continuous instead of periodic. Reconciliation time dropped from three days to same-day. Reconciliation staff reduced from eight people to three. The error rate in merchant settlements fell from 2% to 0.1%.

Step 3: Adaptive Settlement and Payment Rules

Payment Buddy's AI layer manages settlement logic dynamically.

Technical implementation: Payment Buddy replaced fixed payout schedules with smart settlement rules. The settlement engine uses programmable logic with configurable confirmation thresholds.

The system pays trusted merchants faster with fewer checks. It holds higher-risk payments until extra confirmations are done. It uses escrow to release funds only when conditions are met. It delays weekend payouts until business hours. It releases funds automatically when rules are satisfied.

For established merchants with clean history, settlement triggers after one confirmation. For new merchants, settlement requires three confirmations plus 24-hour hold. Time-based payout triggers adjust to context. Weekday settlements happen same-day. Weekend settlements queue for Monday morning when liquidity is better.

The system splits funds between merchants, reserves, and fees automatically. It locks exchange rates when payments arrive. It converts stablecoins to local currency within seconds. It uses same-day payouts for trusted merchants and next-day payouts for new ones. It minimizes crypto price risk by converting funds quickly.

Conditional release through an escrow-based model, would hold all funds until a condition that indicates risk is identified. An example of this could be an immediate and dramatic increase in transaction volume automatically triggering the hold on the funds. Once the merchant has confirmed that the activity is legitimate, the funds are then released.

Results: Time-to-settlement improved due to the ability to manage risk, and adjustments to Treasury Allocations occurred almost instantly. On average, low-risk merchants were able to reduce their time-to-settle from three (3) business days (T+3), to one (1) business day (T+1). High-Risk merchants still experienced a settlement period of T+3 days, however, they had better management of their risk exposure. Additionally, Treasury Allocation efficiency increased by 40%.

Table: Payment Buddy Results: Before and After

Metric | Before AI Layer | After AI Layer | Improvement |

False Decline Rate | 12% | 3% | 75% reduction |

Compliance Review Queue | 500 items/day | 50 items/day | 90% reduction |

Reconciliation Time | 3 days | Same day | 67% faster |

Reconciliation Staff | 8 people | 3 people | 63% reduction |

Settlement Error Rate | 2% | 0.1% | 95% reduction |

Settlement Time (Low Risk) | T+3 | T+1 | 67% faster |

Transaction Capacity | Baseline | 300% increase | 3x growth |

Fraud Losses | Baseline | 60% decrease | Major reduction |

Operational Cost/Transaction | Baseline | 45% decrease | Nearly half |

First Year Impact: Payment Buddy processed over $200 million through the AI payment layer. Transaction processing capacity increased 300% with the same infrastructure. Customer satisfaction scores increased 25%. The system scaled without proportional cost increases.

How AI Payment Layers Integrate With Existing Bank Systems

A payment layer (using AI) can function as both a risk assessment tool AND an automated clearing house (settlement engine). The banking system has an opportunity to automate fraud detection (risk assessment) and programmable payments (clearing house), while NOT having to replace their existing core systems. Each of the following components functions in the following way:

API-First Integration Layer

The payment event is processed through either a REST API and/or a Webhook based on confirmation to current banks' ledgers. There are no blockchain nodes to run, nor do they have to build new core systems.

As soon as a payment occurs, the payment gateway will send a webhook to the AI layer. The AI layer will evaluate that information. The AI layer will then send its evaluation back to the payment gateway by API. The AI layer will update the bank's ledger by making another API call. The bank will be able to view this payment just like any other payment from their existing systems; but now there is also additional metadata added to the payment.

Compliance and Risk Monitoring

Wallet risk scoring, sanctions screening, and transaction monitoring sync with AML providers. Suspicious wallets get flagged. High-risk payments freeze in real time.

The AI layer connects to OFAC sanctions lists, local regulatory databases, and third-party risk intelligence providers. Before accepting a payment, it checks all sources. If any flag appears, the payment stops automatically.

Reconciliation Engine

The Reconciliation Engine is an algorithm that determines which invoices match to specific transactions based upon their "hash" or digital signature. This will allow us to determine when a partial payment has been made as well as ensure on-chain balances are in sync at all times with our internal ledgers (i.e., the reconciliation report at the end of each day).

Ultimately, the engine is the "single source of truth" and every payment, every invoice, every ledger entry will be associated with a unique identifier. Reconciling accounts therefore becomes simply identifying these unique identifiers versus attempting to match vague amounts and dates.

Programmable Settlement Logic

Using configurable confirmation threshold values, programmable escrow-based conditional releases, and programmable time-based payout triggers, the settlement process is routed through existing payment rails, utilizing a dual rail architecture (e.g., fiat and crypto).

Once the rules have been configured by banks, the AI will execute those same rules thousands of times. Based on patterns that develop, banks may then adjust the rules. The AI will learn from those adjustments and suggest additional optimizations.

Liquidity and FX Integration

Real-time FX rate locks and immediate conversion via liquidity partners feed into treasury systems. T+0 or T+1 settlement with minimal exposure windows.

When a cross-border payment arrives, the AI layer locks the FX rate immediately. It executes conversion through pre-integrated liquidity partners. It settles to the merchant in their preferred currency. The bank's treasury system sees completed FX transaction with locked rate and settlement confirmation.

Banks retain existing systems. Payment screening, reconciliation, and settlement become real-time and automated.

How TokenMinds Helps Build AI Payment Layers for Banks

What TokenMinds learned from working with banks and fintech across multiple markets is that most institutions struggle not with understanding AI benefits, but with integrating AI into existing payment infrastructure without disrupting daily operations.

Over many years, TokenMinds has worked with numerous banks, including one of the largest banks in Mongolia and as one of the top fintech companies in Pakistan (Payment Buddy), and have successfully developed, deployed and operated AI payment layers while at no time did we disrupt existing payment rails.

Through its end-to-end infrastructure solutions combining both AI and Blockchain technologies, TokenMinds can assist banks to modernize their payment systems and has created a solution that addresses the three key areas that will enable banks to build successful AI payment layers.

AI Payment Monitoring and Automation

TokenMinds is developing a number of intelligent monitoring solutions, including those capable of monitoring all aspects of a payment flow in "real-time." All of these solutions are designed to detect anomalies, identify suspicious patterns and automatically direct payments based on risk levels. TokenMinds' monitoring solution can be used in conjunction with other anti-money laundering (AML) and fraud detection tools and systems without replacing them.

Implementation Approach: TokenMinds starts with a pilot on limited payment types. This delivers immediate value with contained risk. Once proven, the system scales across different payment channels. Banks learn how AI performs in their environment before deeper integration.

For banks ready to start: Begin with smart payment acceptance. This delivers quick wins. The AI evaluates incoming payments without changing settlement processes.

For comprehensive transformation: Implement all three steps sequentially. Smart acceptance first. Intelligent reconciliation second. Adaptive settlement third. Each step builds on the previous. Each delivers independent value.

Conclusion

Banks process payments efficiently. But efficiency is not intelligence. Static rules worked when payment volumes were manageable and fraud patterns were stable. Neither is true anymore.

AI payment layers provide real-time risk intelligence, adaptive decision execution, and continuous learning. They reduce false declines. They limit fraud losses. They remove scaling constraints.

Banks that implement AI payment layers will process more payments with less cost and lower risk. Banks that don't will watch their operations become increasingly expensive and fragile. The technology is ready.

FAQ

What is an AI payment layer?

An AI payment layer is an intelligent system that sits between payment requests and execution. It analyzes, decides, and acts on payments in real time using machine learning models. The layer integrates with existing bank systems through APIs without requiring core system replacement.

How does AI payment screening differ from traditional rule-based systems?

Traditional systems rely on a fixed set of rules to apply under certain conditions; whereas traditional systems are static in nature, they are also unable to model dozens of variables at one time; and the rules do not evolve as the fraud evolves. Modern artificial intelligence (AI) systems are able to model hundreds of variables at once and continue to evolve as new patterns emerge. As such, modern AI-based systems will be better than traditional systems at detecting fraud that is evolving over time.

Can AI payment layers integrate with legacy banking systems?

Yes. AI payment layers integrate through API-first architecture. Payment events flow through webhooks and REST APIs into existing ledgers. Banks don't need to replace core systems or run new infrastructure. The AI adds intelligence at the edges while core banking platforms stay unchanged.

How long does implementation take?

A pilot implementation on limited payment types takes 2-3 months. Full implementation across all payment channels takes 6-9 months. Payment Buddy completed their three-phase rollout in six months with measurable results at each phase.

What are the main benefits for banks?

Reduced false declines (75% reduction for Payment Buddy). Lower fraud losses (60% reduction). Decreased operational costs (45% reduction per transaction). Increased transaction capacity (300% increase). Better customer satisfaction (25% improvement). Faster settlement times for low-risk transactions.

What regulatory approvals are needed?

The use of AI to make payment decisions will require that regulatory bodies have an understanding of the decision making process. Banks will be required to document the logic behind the models they develop, the data source, and the procedures for addressing errors or issues encountered during processing. Regulatory approval of AI systems will depend upon the jurisdictions in which they operate.

How does the AI handle new types of fraud?

The continuous learning methodology allows AI models to recognize new fraudulent behavior and avoid requiring banks to manually update their rules. Fraudsters continue to develop their tactics and the AI model continues to identify anomalous activity based upon behavioral signals and not previously identified patterns.

What happens if the AI makes a wrong decision?

Human review is integrated into the system for high-risk transactions and edge cases. All transactions flagged by AI include a full audit trail. If a bank determines that a false flag has been made by the AI model they can review the false flag, determine why the false flag was made and modify the AI model's parameters. The continuous learning mechanism uses any corrections from the bank to improve the model's performance going forward.

Is AI payment suitable for small and mid-sized banks?

Yes. The API-first strategy for integrating AI into a bank's payment layer will allow small to mid-sized banks to access advanced AI-based technologies without having to invest heavily in IT infrastructure. Furthermore, it will enable them to begin with a proof-of-concept or pilot implementation related to a few payment types and then expand upon those initial results based on their success. Additionally, no major investments will be required from a data science team to implement the technology.

How does this work with cross-border payments?

The liquidity and FX integration component handles cross-border complexity. The AI layer locks FX rates in real time, executes conversion through liquidity partners, and settles in preferred currencies. This reduces FX exposure windows and provides faster settlement than traditional correspondent banking.