TL:DR

How to implement the RGE Growth System to lower CAC, shorten payback periods, and extend runway by building Web3 acquisition around activation and retention from day one, turning community growth into compounding LTV and predictable revenue instead of short-term spikes, backed by forward economic modeling and analysis of 50+ Web3 growth systems.

Web3 companies spend far more on customer acquisition than traditional software firms. They launch massive campaigns. They attract thousands of users. Then 80% leave within the first few months.

Why does this happen? Three reasons. Acquisition focuses on volume, not quality. Retention isn't built into the acquisition strategy. Most users come for incentives, not product value.

The data is stark: Flipside research shows the average Web3 project loses 80% of acquired users in 90 days. Traditional SaaS loses 25%. The difference isn't in the product. It's in how users are acquired and activated, a gap addressed through this Web3 pre-launch traction strategy.

The Acquisition Problem in Web3

Most Web3 projects follow the same playbook. Launch token. Run an airdrop campaign. Partner with influencers. Offer referral rewards. Watch user numbers spike.

The problem isn't volume. Projects can acquire users. A well-funded airdrop campaign brings 50,000 wallets. Influencer partnerships drive 100,000 Twitter followers. Referral programs add 25,000 Discord members.

But these aren't customers. They're extractors waiting for value to claim. When the airdrop ends or the token launches, they leave. Acquisition cost per user could reach $50-200 and lifetime value range from $0-5, a disconnect often reinforced in this crypto marketing approach.

Real customer acquisition builds a system where users arrive, activate, and stay because the product delivers value. Not because incentives delay their exit.

What Is Scalable Customer Acquisition?

Scalable customer acquisition is when you are able to grow your user base without the proportional increase in customer acquisition cost (CAC). The equation for scalable customer acquisition: CAC goes down + LTV (lifetime value) of customers goes up = Scalable Customer Acquisition.

In Web3, scalable customer acquisition can be achieved by:

Organic user growth using product value and network effects

User referrals from satisfied users - not paid incentives

Retention rates above 40% for cohorts with retention at or above 90 days

Decreasing CAC as acquisition methods improve

Increasing LTV as the product gains additional features and utility.

When a Web3 project spends $100 on acquiring a user, and that user only produces $50 in value before leaving, it is a broken acquisition. When a Web3 project spends $30 on acquiring a user, and that user produces $300 in value over a 12-month period, it has scalable customer acquisition.

The problem; Web3 customer acquisition strategies all optimize for the first example of customer acquisition. Strategies that produce scalable customer acquisition require an overhaul of how users find out about your project, how they join, how they become activated and retain engagement.

How Scalable Acquisition Works

In order to approach strategies on acquisition we need to understand how acquisition is connected to Retention and ultimately to lifetime value (LTV) of users:

Example acquisition process:

Discovery: user has discovered your project via organic content (not paid ads)

Evaluation: user evaluates whether they can see the value that you are providing them with; they evaluate the community, product, etc.

First action: the first meaningful action user takes (e.g. Connects wallet, makes a purchase, etc.)

Activation: the user experiences your core value within 7 days

Retention: user returns to your platform at least 3 times in their first 30 days

Value Creation: users create value for you through usage, holding or network effects

Referral: satisfied users bring in 1-2 new users organically

If you do not have a scalable acquisition strategy: a user finds out about your project via an airdrop announcement and joins your Discord server for free tokens which they will never use after claiming them. Your customer acquisition cost (CAC) is: $80. Your lifetime value (LTV): $0.

If you have a scalable acquisition strategy: the user discovers that your project provides a real solution to one of their problems, they try it, experience the value provided by your project, they regularly visit your project and refer friends to your project. Your customer acquisition cost (CAC) is: $25. Your lifetime value (LTV) is: $250.

This matters because it shows acquisition quality determines retention and LTV, not just user count.

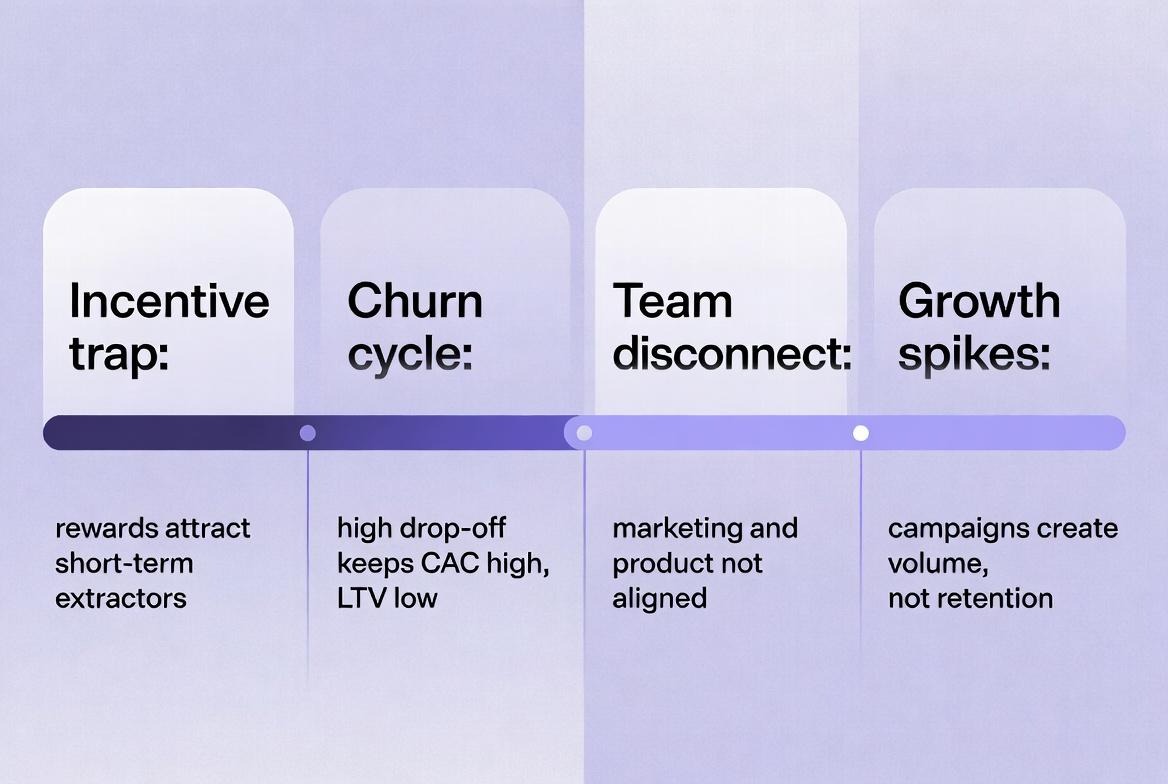

The Core Problems

1. Incentive-Driven Acquisition Attracts Wrong Users

Most Web3 acquisitions rely on incentives to attract users: airdrops, token rewards, referral bonuses, point systems, etc. These are effective for generating volume but ineffective for creating retention. Users who are optimizing for extraction are not evaluating the value of your product; they are determining the Return On Investment (ROI) of their time/attention.

A user who joins because "Complete 5 tasks, earn 500 tokens" has different intent than a user who joins because "Swap tokens are 60% cheaper than competitors."

Result: 80% of incentive-acquired users churn within 90 days. CAC stays high because you constantly replace churned users. LTV stays low because extractors don't generate revenue.

2. Acquisition and Retention Are Separate Systems

Traditional Web3 marketing: Run acquisition campaigns. Hand users to the product team and hope they will stick.

This breaks the feedback loop. Marketing doesn't know which acquisition sources retain. The product doesn't know why users leave. Neither team optimizes for the full journey.

A user acquired through airdrop campaign gets the same onboarding as a user acquired through educational content. But their intent, knowledge level, and likelihood to retain are completely different.

Result: Acquisition brings users product can't activate. Product builds features marketing doesn't communicate. CAC and churn both increase.

3. Growth Tactics Don't Compound

Web3 projects use one-off growth tactics: airdrops, influencer campaigns, AMAs, giveaways, partnerships announcements.

Each tactic spikes users then decays. An airdrop brings 10,000 users this month. Next month, you need another campaign for 10,000 more. Growth is linear, not compound.

Scalable acquisition builds systems where growth accelerates: product improvements increase retention, retained users refer others, referrals retain better than paid acquisition, word-of-mouth reduces CAC.

Result: Projects spend more each month to maintain growth. CAC increases. Teams burn out running constant campaigns.

Table: Acquisition Approaches Comparison

Factor | Incentive-Driven Acquisition | Scalable Acquisition |

Primary Method | Airdrops, rewards, paid campaigns | Product value, organic growth, referrals |

User Intent | Extract value, claim rewards | Solve problem, use product |

CAC | $50-200 per user | $10-50 per user (decreasing) |

90-Day Retention | 10-20% | 40-60% |

Activation Rate | 5-15% | 30-50% |

LTV | $0-20 | $100-500 |

Growth Pattern | Linear spikes, constant decay | Compounding, accelerating |

Team Focus | Running campaigns | Building systems |

How To Build Scalable Acquisition in Web3

Scalable acquisition requires five integrated systems: product-market fit validation, user journey optimization, activation engineering, retention loops, and referral mechanics.

1. Validate Product-Market Fit Before Scaling (MMAON)

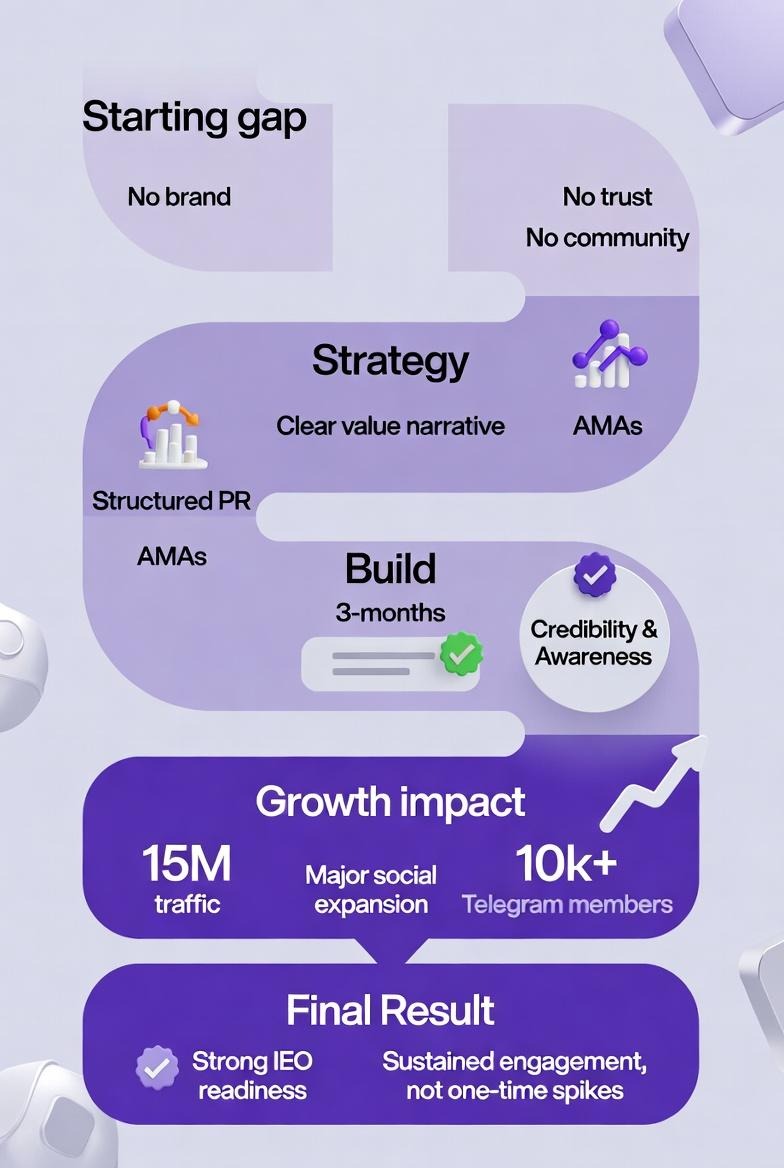

MMAON is an online social networking system that connects MMA fans to fighters in order to build what they believe will be the world's largest MMA fanbase and to lead mass adoption of MMA fans from Web2 to Web3.

As a relatively new project, MMAON has the classic problems of new Web3 startups including, no existing community, no exposure for their brand, no technical infrastructure to support their TGE, and no clear method to raise capital, a structure explained through this token sale demand framework.

The Problem: Establishing Credibility and Community Before the Token Sale

For MMAON to build trust with potential investors and create awareness of the MMAON brand, they first had to establish credibility and a community prior to launching a token sale. The lack of current users and brand recognition made a token sale unlikely to succeed.

They implemented:

Positioned fighter-to-fan connection as the core value proposition

Supported content creation including PR, articles and social media campaigns

Built community through organic growth strategies and influencer outreach

Executed a structured marketing plan prior to token sale

Outcome: 15 million traffic and clicks generated through PR distribution; +300% Twitter followers; +500% Twitter engagement; +1,500% Instagram followers; +2,000% Instagram engagement; 200,000+ AMA outreach reach.

Sustained engagement growth and community expansion over three months indicated continued user participation rather than one-time traffic spikes.

2. Map and Optimize Complete User Journey (MMAON)

In this case, MMAON decided to develop brand awareness and credibility and build out their community through every part of the user experience prior to conducting their token sale, instead of developing an analytical tool to monitor wallets and transaction paths.

Implementation of how it was done:

Increased PR (public relations) coverage with top quality cryptocurrency media outlets to improve credibility and develop public trust.

Conducted AMA (Ask Me Anything) sessions and launched influencer-based campaigns to increase high-quality exposure of the brand.

Built social proof by consistently creating and posting new content as well as increasing user engagement within the community.

Established a three month marketing plan that included all aspects of marketing including PR, content creation, community building, and preparations for the token sale.

The outcome:

Generated 15 million hits from PR and significant increase in community engagement of the overall platform. Also created a community of 10,000+ organic Telegram subscribers who helped support the IEO by showing potential investors that there is real traction behind the project rather than solely using paid acquisitions.

Table: Example Journey Breakdown

Stage | Action | Drop-off Rate | Time to Next Step |

Discovery | Sees project | - | - |

Evaluation | Visits website | 60% leave | 2-5 minutes |

Consideration | Reads docs/whitepaper | 40% leave | 10-30 minutes |

First Touch | Connects wallet | 50% leave | Immediate or never |

First Action | Completes transaction | 30% leave | 1-7 days |

Activation | Uses product 3+ times | 20% leave | 7-30 days |

Retention | Returns after 30 days | 15% leave | Ongoing |

Each drop-off point needs optimization.

3. Turn Retention Into Referral Loops (MMAON)

The primary drivers of the development of MMAON were community building through formal processes, relationships with influencers and consistent engagement versus documented gated referral programs.

They implemented:

Strategies for organic community growth on Telegram and other social platforms

AMA (Ask Me Anything) and influencer partnerships to establish trust and promote the brand

On-going public relations publications in Asia, Southeast Asia, Europe and the U.S.

Campaigns of ongoing social engagement to keep MMAON visible and engaged as an active participant in the global community.

The results:

Community led growth based on organic referrals and community engagement generated continued growth in MMAON's social media presence. Community led growth became the main source of acquisition and was facilitated and enabled by the strategic planning and execution of all marketing efforts at MMAON vs solely incentivizing people with monetary or material compensation.

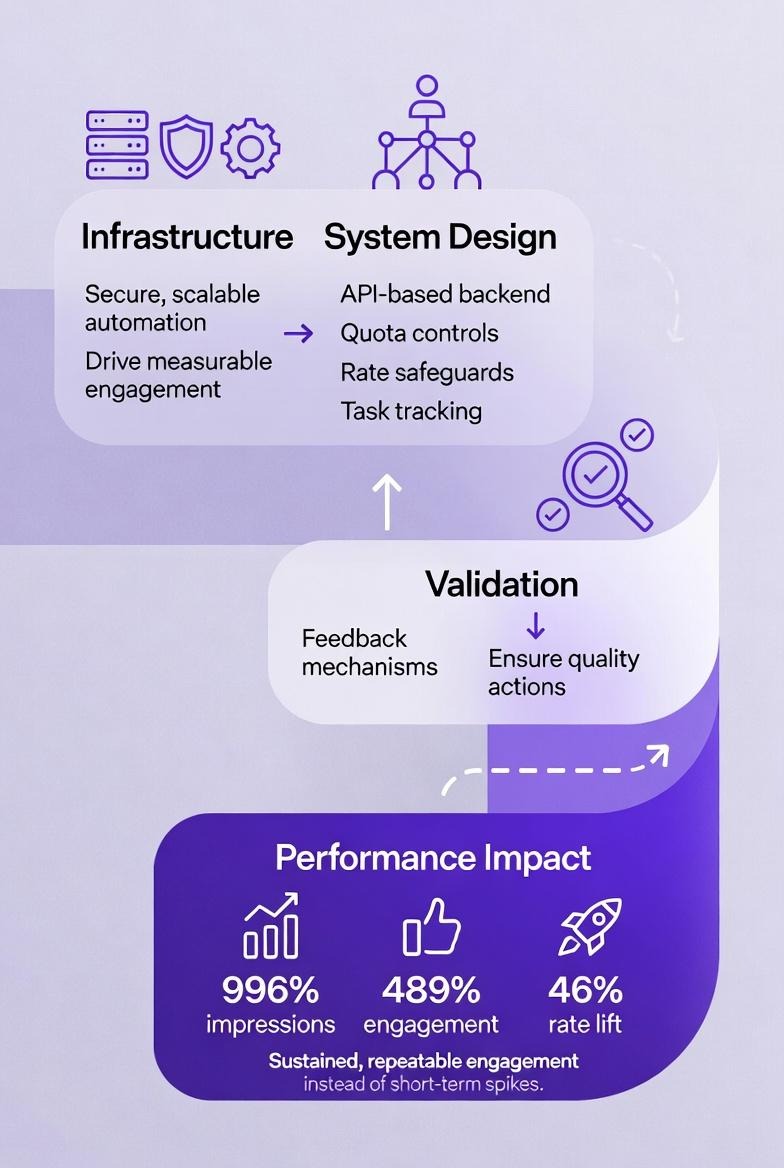

4. Engineer Activation with Specific Systems (UXLink)

UXLINK created a solid foundation for a secure, flexible automation environment to increase measurable user engagement and visibility across all social platforms.

Implementation steps:

API-first backend architecture which secured users' connections to their X accounts through authentication and binding.

Automated actions using a defined set of tasks on X accounts (follow, comment, repost, post).

Quota tracking and rate limiting by each individual account to protect the platform from abuse.

Queue based processing and scalable task routing architecture.

User feedback on tasks and task histories to aid in validating rewards.

The results from this strategy:

996% increase in impressions to 7k; 489% increase in engagement (total engagement was 324); and 46% increase in engagement rate for the structured automation platform resulting in increased consistent engagement and an increased measurable social presence.

The automation framework was designed to promote repeatable, measurable user action over time versus one-time user interaction to create long-term engagement versus short-term spikes in engagement.

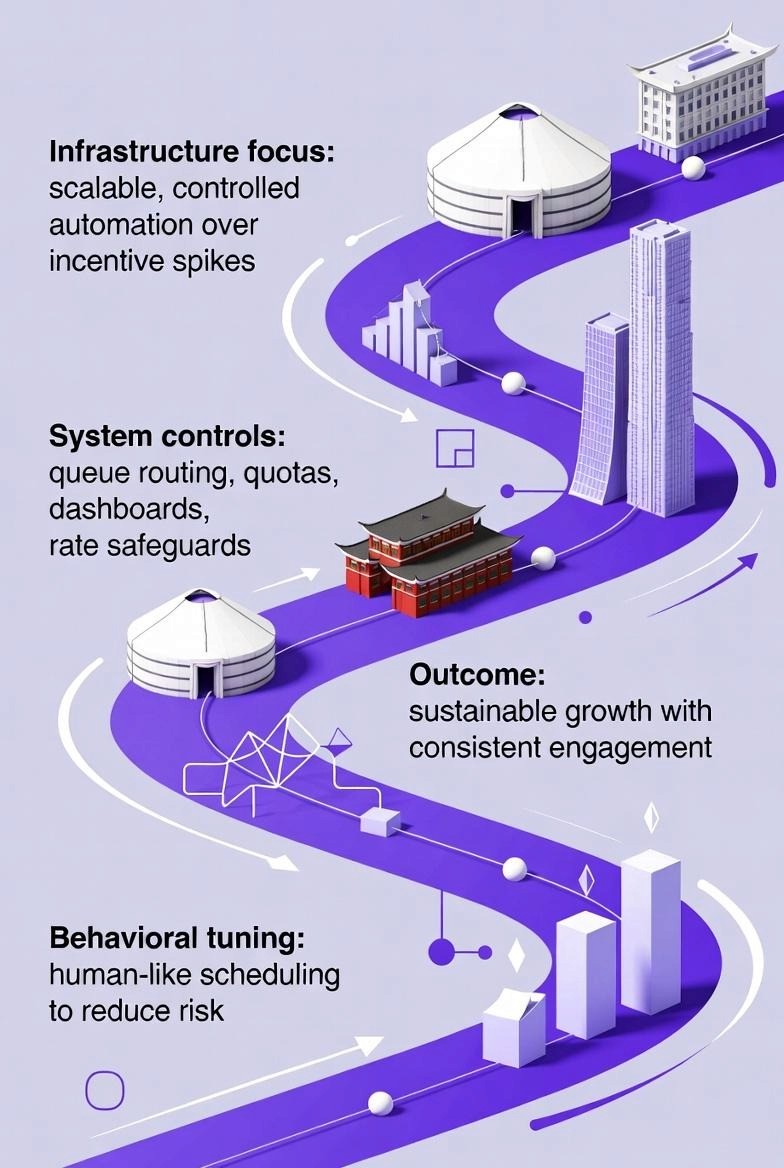

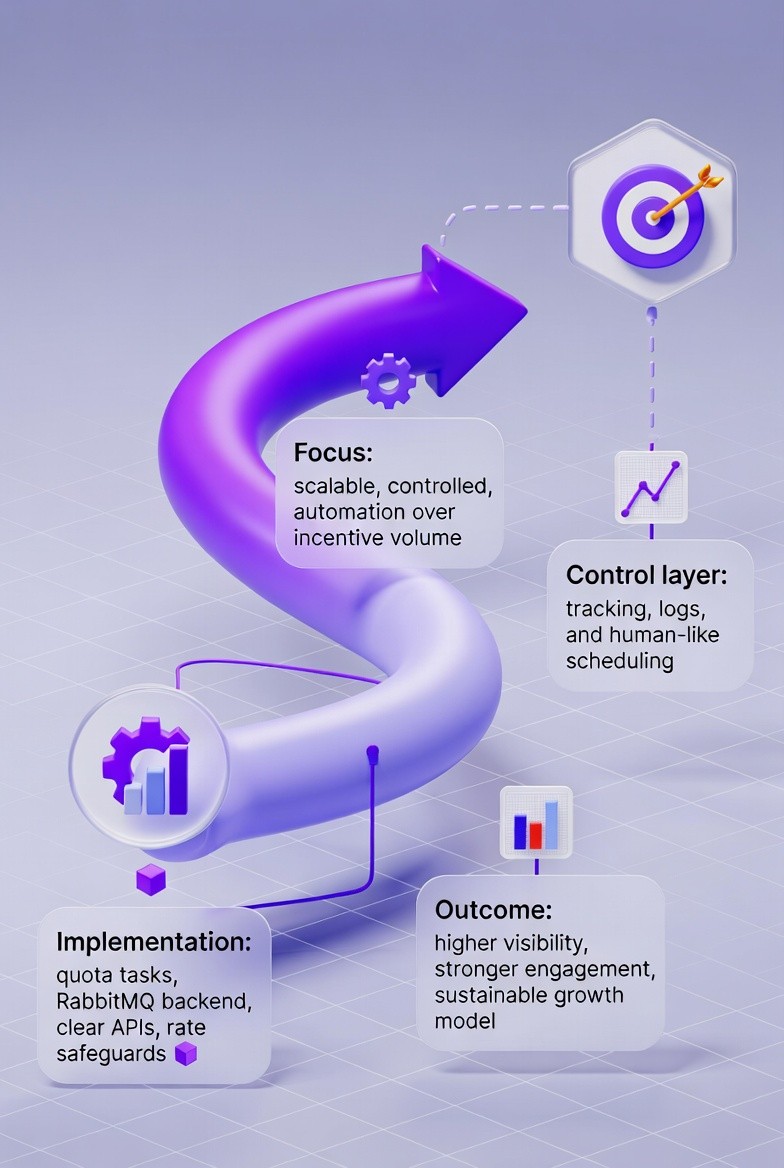

5. Build Retention Into Acquisition Strategy (UXLink)

UXLINK focused on scalable infrastructure, measurable output metrics and automated processes that were controllable rather than the high volume of incentive-based campaigns.

How this implemented:

Designing quota-controlled task executions and providing transparent usage tracking

Creating a scalable backend architecture with RabbitMQ queuing and routing as well as S3 task flows

Implementing clear API endpoint calls for both the frontend control system and the admin control system

Including rate limit guardrails and providing human-like scheduling to prevent risks and provide sustainability.

By providing quota controls, task tracking, and clear execution logs the system provided a way for users to participate repeatedly while also maintaining an ability to view ongoing activities, thus supporting long-term participation via structural support.

Outcome: Provided increased visibility of social interaction with improved participant engagement via automated scalability of the system. The focus was moved from a volume-based model of user growth to a controlled engagement model that was measured by having system-level transparency.

Source | Users | CAC | Activation | 30-Day Retention | 90-Day LTV | ROI |

Airdrop Campaign | 10,000 | $50 | 8% | 10% | $15 | -70% |

Twitter Ads | 2,000 | $80 | 15% | 18% | $45 | -44% |

Educational Content | 500 | $30 | 42% | 55% | $280 | +833% |

Referral (Organic) | 300 | $5 | 48% | 62% | $320 | +6300% |

Partnership | 1,500 | $40 | 25% | 30% | $95 | +138% |

This data shows a clear pattern: Organic channels (content, referrals) have lower CAC, higher activation, better retention, superior LTV.

Retention First Acquisition Principles:

Measure retention by source, not just volume

Kill channels with retention below 25% at 30 days

Scale channels with retention above 40%

Accept lower volume for higher quality

Track cohort economics, not vanity metrics

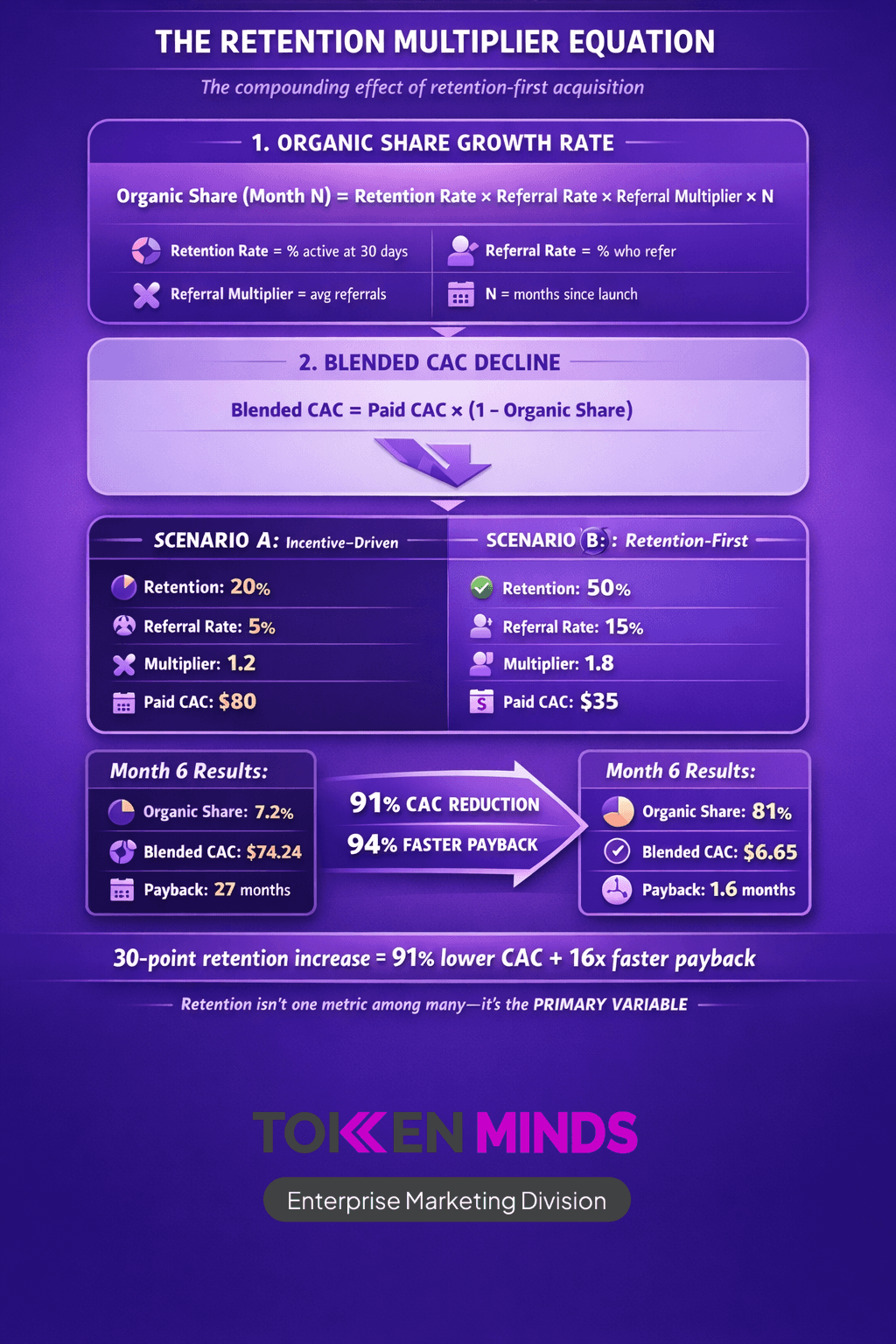

The Retention Multiplier Equation

The compounding effect of retention-first acquisition can be formalized into predictive equations that model growth trajectory and economic outcomes.

Core Formulas:

1. Organic Share Growth Rate:

Organic Share (Month N) = Retention Rate × Referral Rate × Referral Multiplier × N

Where:

Retention Rate = % of users active at 30 days

Referral Rate = % of retained users who refer others

Referral Multiplier = Average referrals per referring user

N = Number of months since launch

2. Blended CAC Decline:

Blended CAC = Paid CAC × (1 − Organic Share)

3. Payback Period Compression:

Payback Period = CAC ÷ (Monthly Revenue per User × Retention Rate)

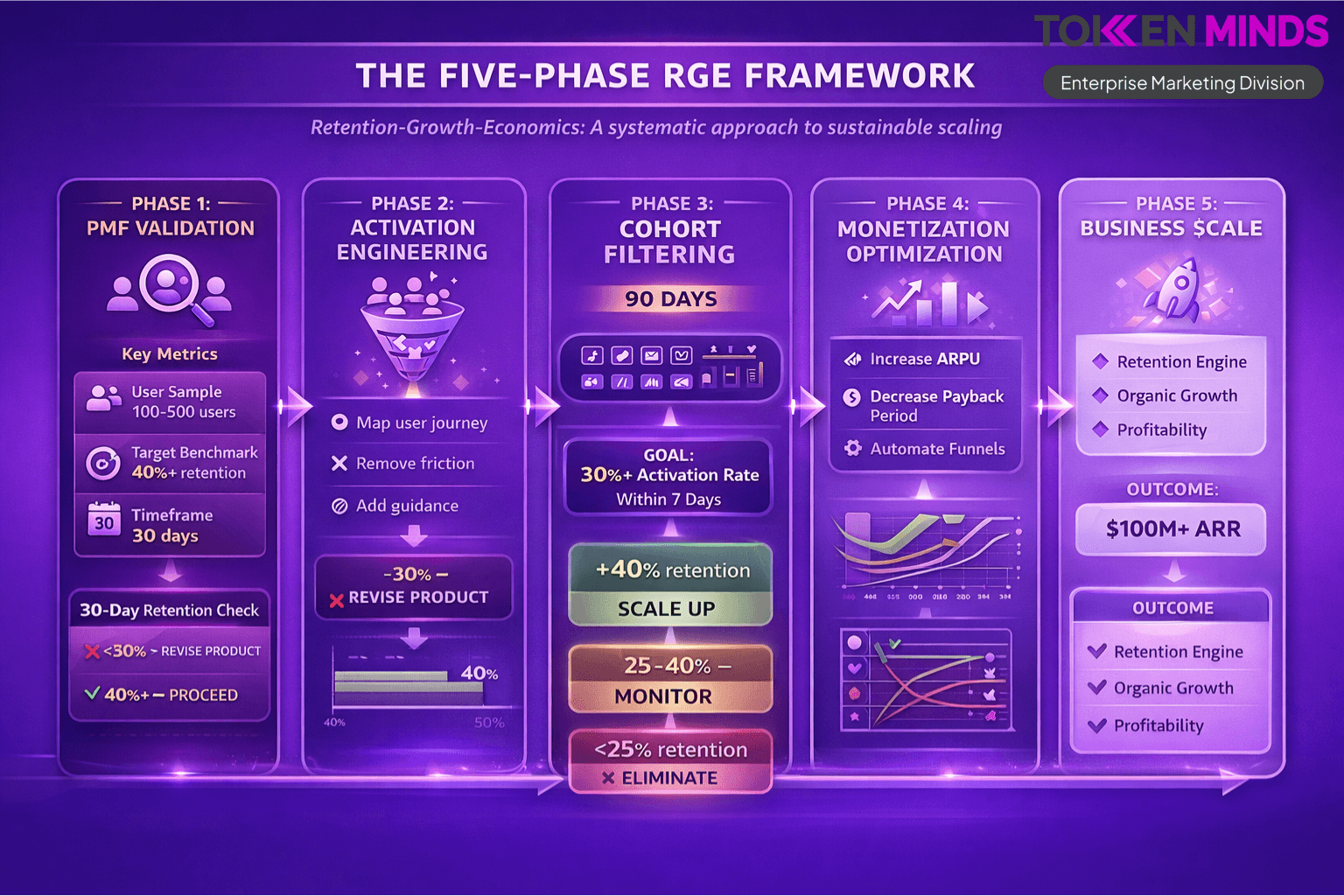

The Retention-First Growth Engine (RGE Framework)

TokenMinds developed the Retention-First Growth Engine (RGE); an acquisition strategy model created through a study of more than 50 Web3 project's methods for acquiring new users. Most growth models are focused on creating as many users as possible, while the RGE is focused on developing high-quality users in every step of the growth process.

The Five-Phase RGE Framework (Infographic)

The RGE Framework helps ensure you don't simply acquire customers but build a system where each phase supports the others to create compounding growth as opposed to linear spend.

Success Benchmark

Traditional metrics (total users, followers, community size) don't show acquisition quality. Focus on cohort economics.

Key Metrics:

Metric | What It Measures | Healthy Benchmark |

Activation Rate | % who complete core action | Above 30% |

30-Day Retention | % who return after 30 days | Above 40% |

90-Day Retention | % still active at 90 days | Above 25% |

CAC | Cost to acquire one user | Decreasing over time |

LTV | Revenue per user lifetime | Increasing over time |

CAC/LTV Ratio | Return on acquisition spend | Below 0.5 (LTV 2x CAC) |

Payback Period | Time to recover CAC | Under 90 days |

Organic % | % from referrals/word-of-mouth | Above 30% |

Economic Modeling: How Retention Compounds Growth

Most Web3 projects measure results retrospectively. Scalable acquisition requires modeling how current metrics compound into future economics.

Example Compounding Model:

Starting State (Month 1): At the beginning of month 1 there are 1000 customers paying at an average cost to acquire customers of $40.

The retention rate is 40% in month 2 compared with month 1; 12% of these retained customers refer to other customers.

These referred customers generate on average 1.4 referrals.

Projected Compounding (Month 6):

At month 1: 400 retained from Month 1; 48 referral; 67 organic users;

At month 2: 400 pay and 67 organic retained (187+27); Total retained = 214; 26 referral; 36 organic;

At months 3-6: Organic compounding continues while the number of paid remains constant.

Economic Impact by Month 6:

Organic share: 38% of new acquisition (up from 0%)

Blended CAC: $31 (down 22% from $40)

Payback period: 68 days (compressed from 110 days)

Monthly profitability: Achieved at month 5 vs. month 9 with paid-only

The Multiplier Effect: Every 10-point improvement in retention rate accelerates organic share by 4-6 months. A project with 50% retention reaches organic majority by month 4. A project with 30% retention never achieves organic majority.

This demonstrates why retention isn't just a metric, it's the primary driver of acquisition economics.

Behavioral Filtering Engine

Most Web3 projects identify user groups through demographic information, as well as how they were acquired into the system.

In order to scale an acquisition strategy, you need to build a behavioral profile of the users that have remained in the system, and filter new acquisitions based on that behavioral profile.

Identify the behavioral patterns in the first 30 days of your top 20% retained users (users who remain active in the system for 90+ days).

1. Time to Complete First Action: The average time for a user to complete their first action was approximately forty-eight hours; whereas, the average time for a "churned" user to take their first action was five to seven days.

2. Average Action Frequency: Your top 20% of users took two or more core actions within the first week; whereas, the average number of times a "churned" user took one or no core actions in the first week.

3. Community Involvement: Prior to taking their first transaction, these users had already engaged with a community (Twitter, Discord, Forums etc.)

4. Return Pattern: These users returned to the system within seventy-two hours after they experienced the core value of your system.

5. Recognizing the Value: They engaged in an educational process about the product or they asked questions that demonstrated an understanding of the product.

Example Behavioral Profile “DeFi Protocol”:

Connected their wallet within 24 hours of creating an account

Tested their ability to successfully complete a transaction less than $50 within 48 hours

Utilized one of the support channels (e.g., asked questions in Discord; read the documentation)

Completed a second transaction by the 5th day

Returned to the system within 72 hours after the user completed their first successful swap.

How TokenMinds Helps Build Scalable Acquisition for Web3 Projects

Most Web3 project teams understand how to benefit from user retention; however, they are typically challenged by developing scalable acquisition systems that emphasize quality rather than quantity of users while still allowing for rapid growth in their user base. As a result of its experience in assisting many Web3-based platforms to achieve success, TokenMinds enables its clients to build scalable acquisition systems which convert users into long-term customers.

TokenMinds helps Web3 projects grow from early launch to long-term scale by implementing RGE, combining strong marketing execution with solid technical development. Based on the MMAON and UXLINK case studies, the team supports projects with PR campaigns, social media growth, influencer outreach, community building, token sale preparation, and AI-powered backend systems.

Our expertise includes generating large media exposure, increasing real engagement on social platforms, growing active communities, designing behavioral filtering engines and building secure automation systems with clear tracking and usage control. By connecting marketing efforts with reliable technical infrastructure, TokenMinds helps Web3 platforms gain visibility, attract the right users, and build steady engagement instead of short term hype.

Conclusion

Building scalable customer acquisition in Web3 means rejecting the standard playbook. Don't optimize for volume, optimize for retention. Don't incentivize extraction, deliver product value. Don't run campaigns, build systems.

Scalable acquisition requires five integrated approaches:

Validate product-market fit before scaling acquisition

Optimize complete journey from discovery to retention

Engineer activation with specific systems that guide users to value

Build retention into acquisition by scaling high-retention channels only

Create referral loops from satisfied users, not paid incentives

The difference between spending $500K to acquire 10,000 users who leave (80% churn) and spending $150K to acquire 3,000 users who stay (50% retain) is simple math: The second approach costs less, generates more LTV, and compounds through referrals.

Web3's 80% churn rate isn't inevitable. It's a symptom of acquisition strategies that optimize for the wrong metrics. Fix acquisition by fixing what you measure: Not how many users you get, but how many stay and why.

FAQ

How do you know when you have product-market fit?

Track 30-day retention. If 40%+ of users return after 30 days without incentives, you likely have fit with that user segment. Also measure: Do users complete core action 3+ times? Do 10%+ refer others organically? Can users articulate specific values ("I use this because X")?

What's a realistic CAC for Web3 projects?

CAC depends upon the user's LTV. If your DeFi protocol has an average transaction size that equals $300+, then it may be possible to spend as much as $100-150 per user to acquire them, depending on other variables. However, if you're building a platform where users will pay a lower price immediately, such as a social media or gaming platform, then you should aim to spend no more than $20-40 per user to acquire them. The important thing is to get the CAC/LTV ratio to less than 0.5, which means you need to have a minimum of twice as much value coming back to the platform as the cost to acquire the customer.

How long should you test acquisition channels before deciding?

Minimum 90 days to see retention patterns. Some channels activate users faster but retain worse. Others activate slower but retain better. You need a full retention curve to calculate true ROI. Exception: If a channel shows under 10% activation after 30 days, cut it earlier.

Should Web3 projects avoid airdrops completely?

No, you should reconsider what you are using an airdrop for. Do not use airdrops for acquisition. Use them for rewarding your users that already exist and actively engage with the platform.

Example: Give an airdrop to your users that have completed five or more transactions. Do not give an airdrop to just anyone that joins your discord. This will reward the actions that you want to encourage even more.

How do you improve activation rate?

First, map out how the user goes through the process of signing up and activating. Then find the areas where the majority of your users are dropping off and test a solution. Some possible ways to test a solution include: Reducing the number of steps in the activation process (by removing as much unnecessary friction as possible), adding guidance (i.e., showing the user exactly what he/she needs to do next), providing instant gratification (i.e., making it easy and worthwhile for the user to complete his/her first action), and eliminating costs (i.e., covering the cost of gas and reducing the amount required to be eligible).

What if organic acquisition is too slow?

Then begin by investing in a limited paid acquisition effort to higher quality channels (e.g., technical content, educational partnerships, targeted communities). Use paid acquisition to help establish your first user base. As soon as you can demonstrate a 40 percent + retention rate and users begin to refer to one another, your organic growth will accelerate. Do not scale paid acquisition until you can prove retention.

How do you calculate LTV in Web3?

Calculate LTV in Web3 by tracking the revenue per user over time. For protocols: The transaction fees generated by each user. For NFT platforms: The minting fees, trading fees and creator fees generated by each user. For gaming platforms: The in game purchases and subscriptions made by each user. Add indirect value: If the user brings other users, the referral value. If there are network effects, add the increase in total value. Measure at 90 days, 180 days and 365 days to show the LTV curve.

What's the biggest mistake in Web3 acquisition?

Scaling before product market fit. Projects raise funds, feel the need to grow quickly and spend millions on acquiring users before proving retention. Results: Millions are spent, 80% of users churn and go back to zero. It would be far better to spend $50,000 on acquiring 500 users, and iteratively work until 40% + of those users remain. At that point you may scale and it will cost less and work better.