TL;DR

How to build Web3 communities that attract real buyers instead of passive followers so engagement translates into higher token sale conversion, faster sellouts, and less wasted marketing spend.

Every day, crypto projects add thousands of followers. They celebrate Discord milestones. They track engagement metrics. But when the token sale launches, most members disappear.

Why does this happen? Three reasons. Followers aren't buyers. Hype doesn't equal conviction. Engagement doesn't predict investment.

Projects spend months building communities of 50,000+ members. Marketing teams celebrate vanity metrics. Community managers host endless AMAs. Growth hackers optimize referral programs. Then the token sale raises 20% of the target, a mismatch often revealed in this crypto marketing approach.

The Community Growth Issues in Web3

Building a large community is standard in crypto. A project needs funding to build its protocol. Traditional fundraising means pitching investors. In crypto, projects build communities first.

The logic seems sound. Get 100,000 Twitter followers. Launch a Discord with 50,000 members. Run a Telegram with 30,000 users. Then convert 5-10% into buyers during the public sale.

But size rarely predicts success. A project with 200,000 members might raise $500,000. Another with 15,000 members raises $5 million. The difference isn't size. It's who joins and how you activate them, a distinction highlighted in this community-building strategy.

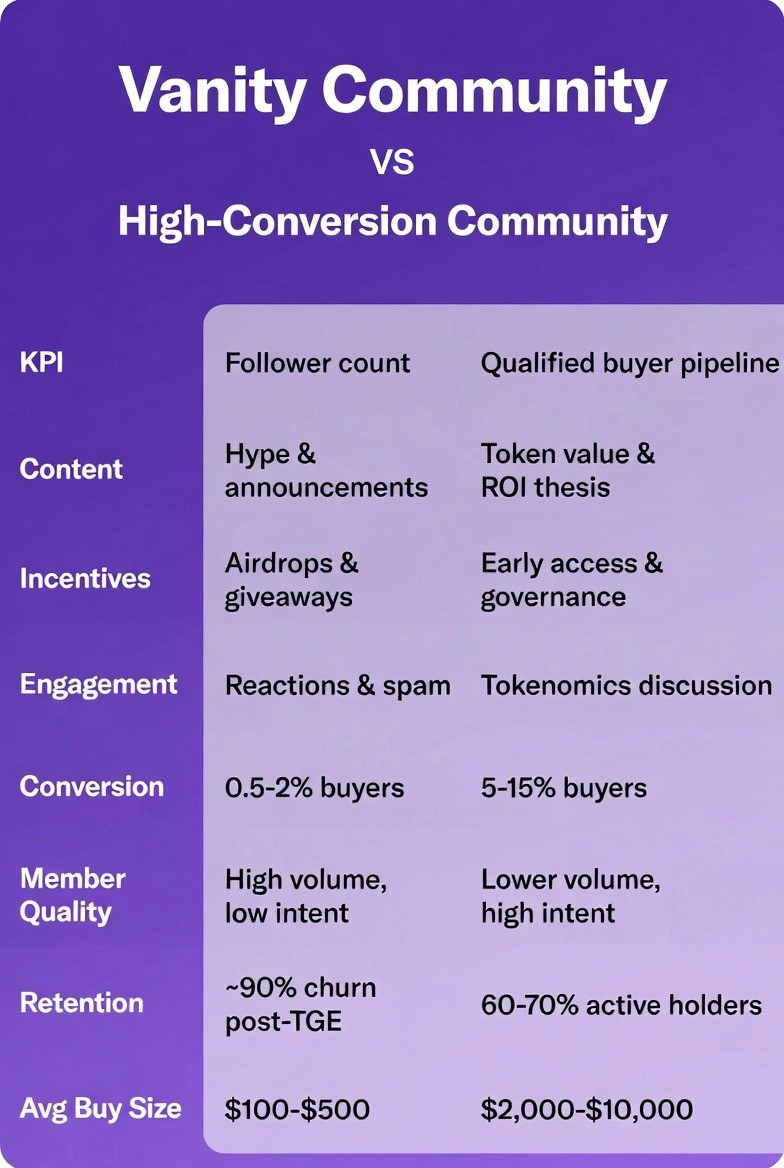

Table: Community Growth vs. Token Demand Metrics

The Core Problems

1. Audience Misalignment

Most growth strategies focus on the wrong metric. Projects use giveaways to boost followers. They run contests that require Discord joins. They offer points for Telegram referrals.

These tactics attract farmers, not believers. Someone who joined for a $50 giveaway won't invest $5,000 in tokens. The audience wants to extract, not contribute.

2. Value Communication Gap

Community content focuses on hype, not value. Announcements center on partnerships. AMAs discuss technical features. Marketing emphasizes ecosystem growth.

None of this answers the buyer's core question: "Why should I invest my money now?" Followers understand what the project does. They don't understand why owning the token creates value.

The pattern is familiar. Partnership announcements generate buzz but no clarity on token utility. Technical deep-dives explain mechanics without investment thesis. Milestone celebrations don't translate to purchase conviction.

3. Activation Failure

Even communities with qualified buyers fail at activation. The token sale creates friction. Whitelisting needs multiple steps. KYC processes are hard. Payment methods are limited.

A buyer needs to:

Join whitelist

Complete KYC

Connect wallet

Approve contract

Calculate allocation

Execute purchase during a narrow window

Manage gas fees during congestion

Each step loses 20-40% of interested buyers. A sale with 5,000 interested members ends with just 800 purchases.

The Solution Framework

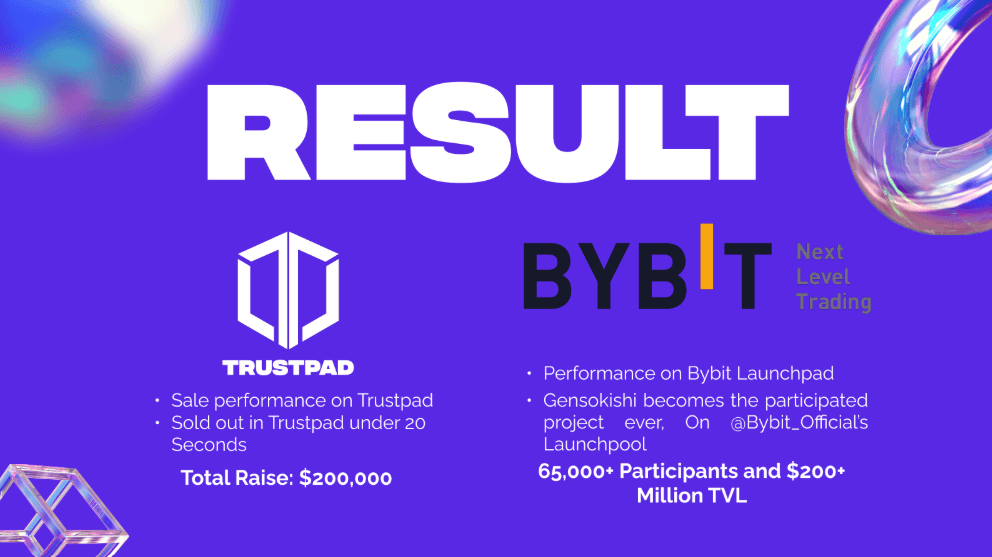

Throughout this guide, GensoKishi Online will be used as an example for a GameFi metaverse project that took the very successful game "Elemental Knights" and converted it into a Play-to-earn gaming platform. They were able to achieve incredible success when launching their token sale by selling out in under 20 seconds on Trustpad, having over 65,000 people participate in their token sale, securing over $200 million in Total Value Locked on Bybit and raising a total of $250,000 from their token sale.

What makes GensoKishi's approach valuable is how they applied each conversion strategy methodically. They weren't the largest project. They didn't have the biggest marketing budget. But they executed the fundamentals perfectly. Their success came from building a qualified community and removing friction at every step. Let's examine how they implemented each strategy.

How GensoKishi Converts Community Into Token Demand

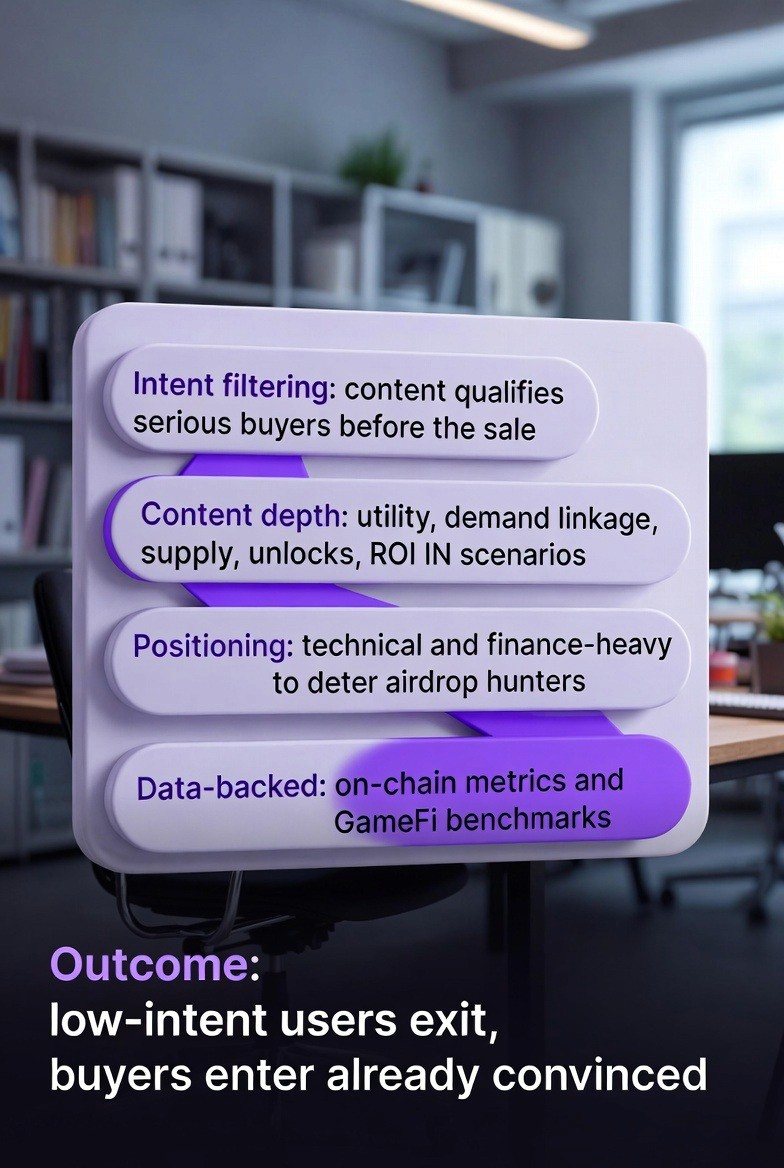

1. Pre-Qualify Through Value-Based Content

Top project filters its audience out BEFORE a sale, not DURING. The top project creates content that will attract buyers, while creating content that will push out farmers.

GensoKishi's content strategy is now in an educational phase versus announcement phase. Deep dive into token economics every week. Break down how each value is accrued. Compare side-by-side with competitors. Create ROI models for different scenarios.

This content is technical and finance-focused on purpose. It bores airdrop hunters. It attracts people who evaluate investments. A project explaining "How Protocol Revenue Converts to Token Buybacks" loses 10,000 low-intent followers. But it gains 500 high-intent members asking smart questions.

Projects use structured calendars:

Week one: utility of token and use cases

Week two: Revenue model and how to capture value

Week three: dynamics of Supply and emission schedule

Week four: standpoint compared to competitors

Week five: holder benefits and governance rights

Week six: factors that present risks, and how they can be reduced

Each piece includes:

Numbers that we have used to build models

Comparable data for other similar projects

Base case, worst case, best case scenarios

How do I get a reasonable answer to "why buy this token?"

Links to on chain data or research

GensoKishi used this strategy as they expanded into the English speaking market. They did not go after mass market awareness; instead, they educated the gaming communities about the Play-to-Earn mechanics of GensoKishi, as well as the token utility within the Elemental Knights universe.

Key Takeaways:

Their content showed how token ownership linked to in-game asset trading and earning systems.

This targeted approach drew qualified gaming investors who got the value.

This helped their token sale sell out fast on Trustpad.

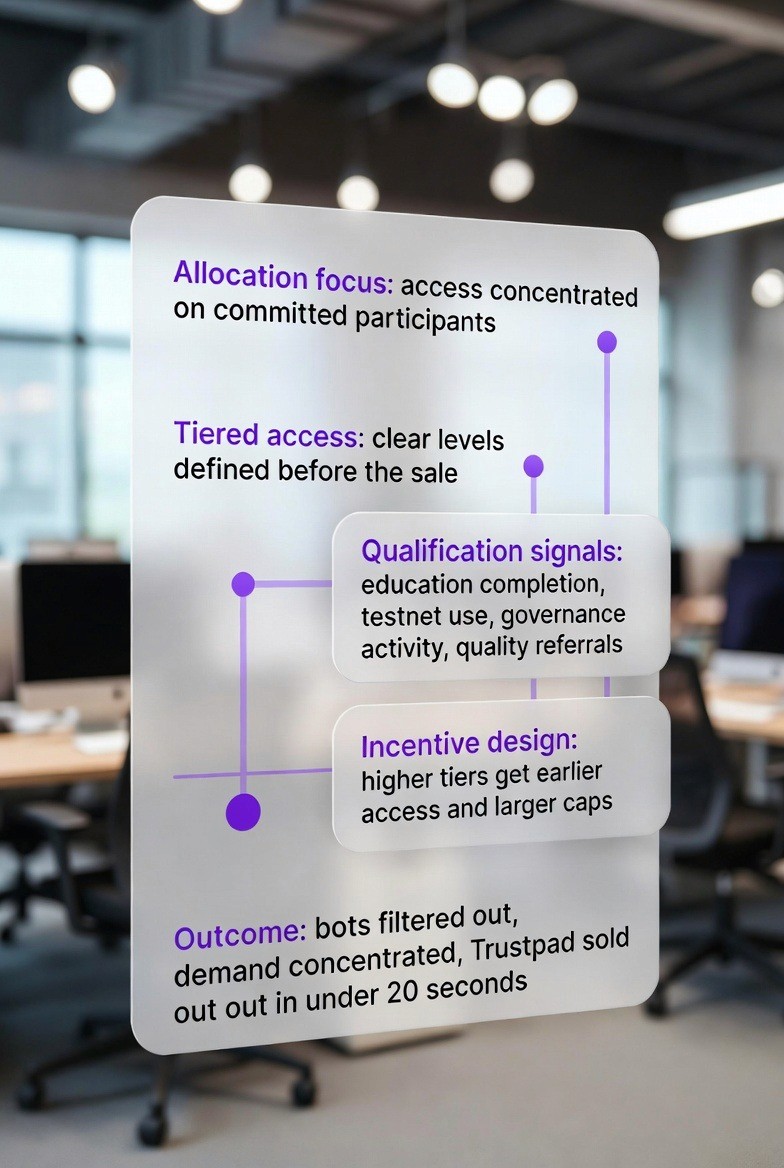

2. Create Tiered Access and Strategic Scarcity

Web3 projects don't treat all members the same. They create clear tiers based on engagement quality and capital signals.

Tier structure works like venture capital. Inner circle gets earliest access and best terms. Middle tier gets standard allocation. Outer tier gets what remains. Access isn't random. You earn it through commitment.

Commitment signals include:

Taking part in governance

Giving feedback on the protocol

Finishing advanced modules

Using the testnet with real activity

Bringing other qualified buyers (not just anyone)

Table: Access Tier Setup

Tier | What You Need | Allocation Access | Token Price | Cap Per Wallet |

Genesis | Protocol contributor, governance participation, 3+ qualified referrals | Guaranteed allocation, 48hr early access | 20% discount | $50,000 |

Core | Finished all educational modules, testnet usage, 1+ qualified referral | Priority allocation if available | 10% discount | $25,000 |

Community | KYC verified, wallet connected, whitelist joined | Standard FCFS allocation | Public price | $5,000 |

Public | Basic requirements only | Remaining allocation if any | Public price | $1,000 |

How GensoKishi implement it:

Monitor On-Chain and Off-Chain Transactions

Track Quality Contributions vs. Spam via Discord Bots

Token Economics Quizzes Unlocks Tier Upgrades

Identify Testnet Participants through Wallet Analysis

Quality over Quantity Referral Tracking

GensoKishi used strategic scarcity through their whitelist system on Trustpad and Bybit launchpads. They didn't open sales to everyone. They picked real community members through whitelist qualification. This filtered out bots and low-intent people while creating urgency among qualified buyers.

Key Takeaways:

The whitelist strategy made sure the most committed members of their NFT gaming community got priority access.

Combined with trusted launchpad platforms, this created instant demand pressure.

They kept long-term engagement with 65,000+ active participants on Bybit.

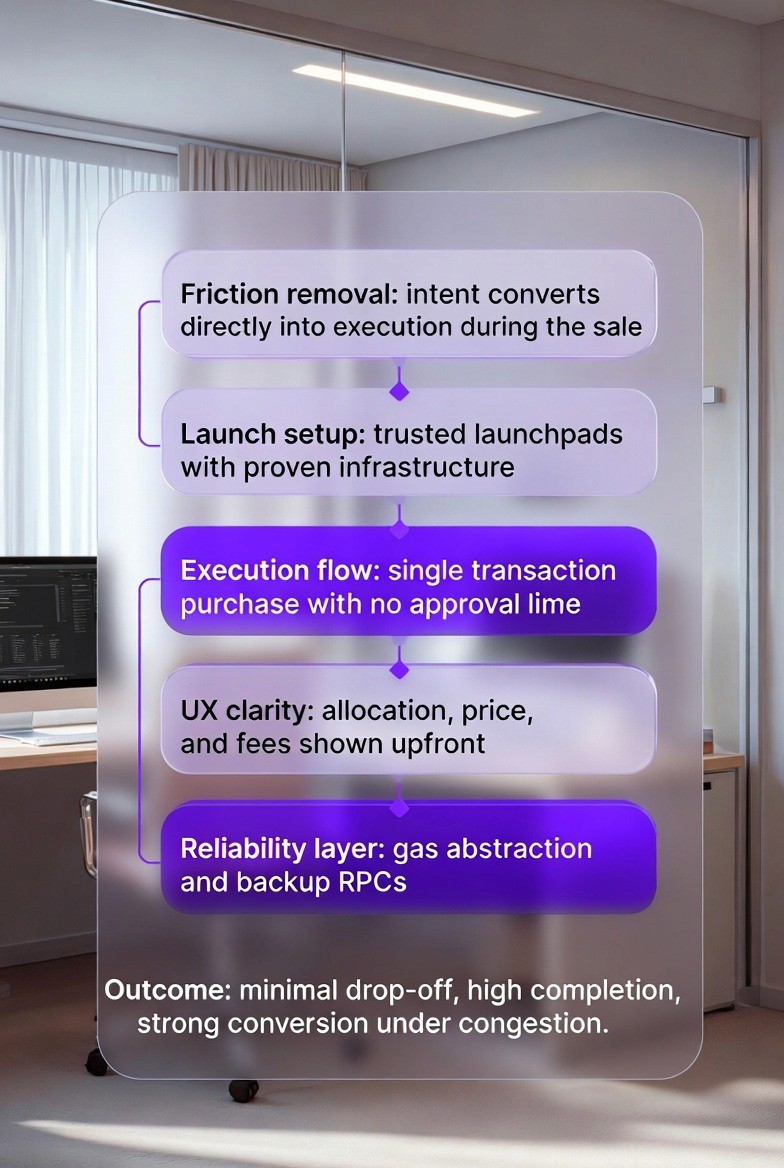

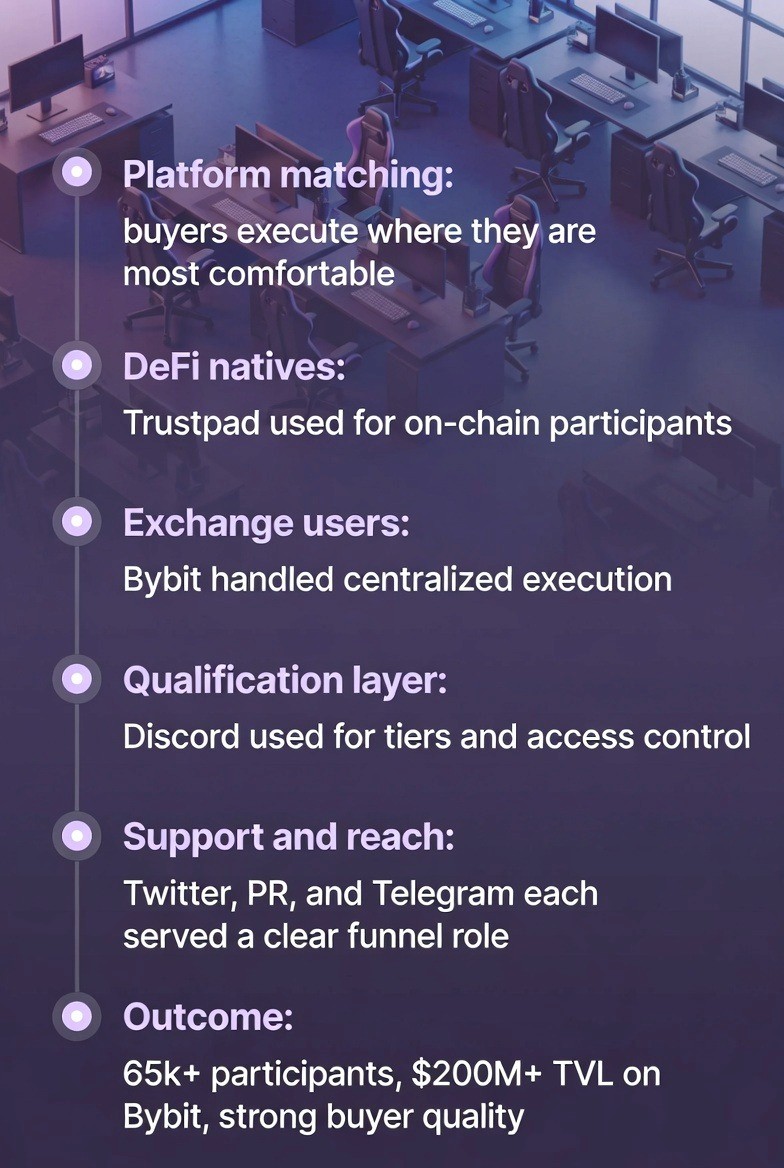

3. Remove Friction and Optimize Purchase Path

Communities that are successful will ultimately fall when the buying process fails. Top projects focus on funnel optimization as a major factor in their success much like the top e-commerce companies do.

The standard sales process has 8-12 steps and you lose 30-50% of your prospects at every single step in the process. An optimized process has only 3-4 steps with only a 10-15% loss of prospects at each step.

Implementation:

Using trusted platforms (e.g. Trustpad, Bybit)

Reducing the number of wallet and approval steps

Removing manual calculation of allocations

Utilizing native UX of platforms for non-decentralized finance (non-DeFi) users

Support optimization:

Support is available via live chat during every step of the sales process and the support staff should be able to respond within two minutes.

Users can view video tutorials that show them how to navigate through the purchase process while they are going through the process.

Users may be able to resolve common issues using a one-click fix.

Users may be able to test whether or not their wallet is properly set up by conducting a $1 test transaction.

GensoKishi executed their Token Sale on several Launchpads. They also understood each platform was made to attract a particular user type. In addition to executing their allocation on Trustpad in seconds (which indicates little friction from the time of intent to the time of execution), GensoKishi took advantage of the Trustpad native User Experience. The same is true with GensoKishi using the built-in User Experience of Bybit. In this case, there was no need for an external wallet connection or for users to perform gas calculation.

Key Takeaways:

This multi-platform approach removed barriers for both DeFi-native users (Trustpad) and exchange-based investors (Bybit).

Result: $250,000 raised and $200M+ TVL across platforms.

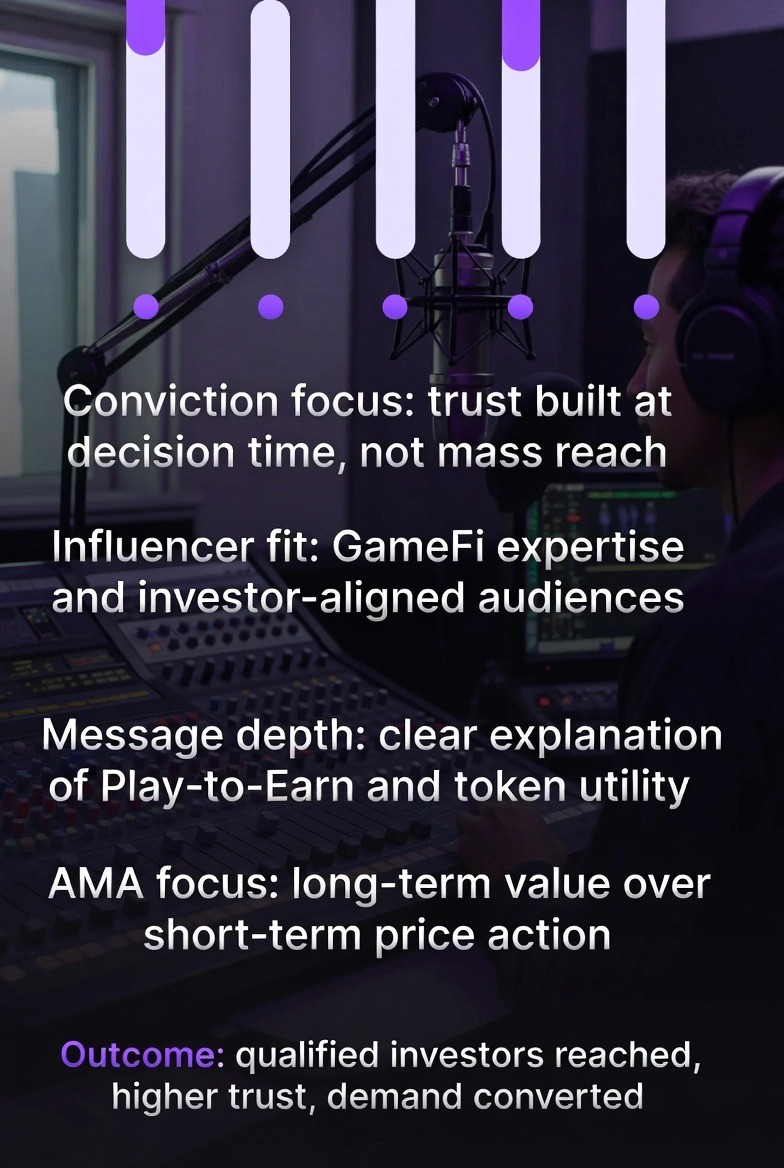

4. Use Strategic Influencer and Community Engagement

Good Web3 projects should do influencer marketing strategically. The good ones are focused on reaching the right people who have credibility, as well as a targeted reach versus vanity metrics. In addition to doing that, they also directly engage with their community via AMAs (Ask Me Anything) and other interactive sessions.

Influencer selection focuses on:

Alignment of their audience to your target investor profile

The influencers' level of real expertise within the project's space/sector

Engagement rates are more important than follower counts

They have a history of supporting successful projects

The ability to communicate and explain the complexities of the project's tokenomics to their audience.

GensoKishi partnered with high-conversion influencers in the NFT gaming and metaverse space. They didn't use generic crypto influencers. Their influencer strategy focused on creators who could explain Play-to-Earn mechanics and metaverse value to engaged gaming communities in a real way.

Key Takeaways:

The goal of a focused, buyer-centric approach was to be seen by qualified potential customers who had already shown an interest in investing in GameFi-related products or services.

5. Use Multi-Platform Marketing Strategy

Social media has changed how we create awareness about our brand and project. The top performing projects do not have just a single method of creating awareness but instead use several platforms including social media, PR distribution, cryptocurrency forums, and also specialized platforms. All are created to target the specific audience that uses each platform.

Platform-specific strategies include:

Use Twitter to post real time updates, and to build your community.

Use Medium/Blog as a place to post long form articles educating people on your tokenomics.

Use Crypto Media as a way to build credibility with your audience and increase your reach.

Use Telegram as a place to manage your community, and to provide customer service directly to users.

Use Discord as a place to engage with your community at a deeper level, and as a place to offer different levels of access based upon tiered user status.

Use YouTube as a place to post video explainers, and tutorials.

GensoKishi ran a full multi-platform campaign. They knew different investor segments use different channels. They combined whitelist campaigns on specialized launchpads (Trustpad for DeFi natives) and major exchange platforms (Bybit for broader retail access). They added social media amplification for awareness and targeted PR distribution to crypto gaming media.

Key Takeaways:

This diverse approach made sure they reached both cryptocurrency investors and traditional gamers entering Web3.

The strategy's success was clear in the breadth of their results: instant sellout on Trustpad, massive participation on Bybit (65,000+ participants), and sustained engagement ($200M+ TVL).

Each metric shows a different audience segment converted.

Results of GensoKishi’s Token Sale Marketing

Post-Sale Activation and Holder Conversion

The sale isn't the end. It's the beginning. Top projects turn buyers into engaged holders and advocates.

Right after sale:

Personalized onboarding based on purchase tier

Exclusive holder-only content and channels

Clear roadmap of upcoming governance decisions

Education on how to use tokens within protocol

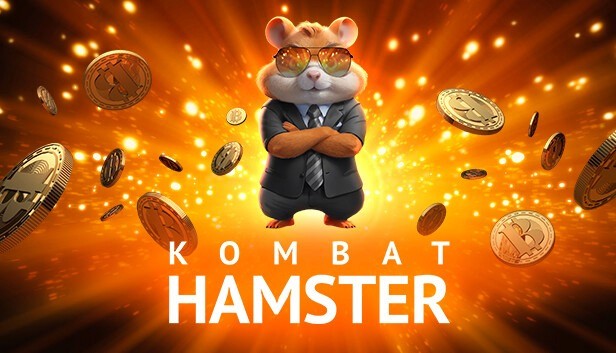

Failure Counter Example: Hamster Kombat

In September 2024, Hamster Kombat released its HMSTR token using an audience of over 300 million people, that it created with viral tap-to-earn gameplay via Telegram. The huge user base did little to help the token's Generation Event on September 26, 2024 however, as the tokens were being sold and there was a huge issue in converting tokens into USD.

Within the first 24 hours of trading, the token dropped 43%. By the end of November 2024, the number of active users had fallen 86%, down to only 41 million while the price of the token fell by 76% from the time of launch.

It was obvious; the huge number of users who played Hamster Kombat due to the promise of 'free crypto for tapping' were not investors in crypto, they were not interested in tokenomics (token economics) or liquidity, and therefore were not looking to hold the token for long term value. Users said their airdrop allocations were worth only around $10 after months of playing the game every day and thus immediately put downward pressure on the price with almost zero demand for the token from the organic buy side.

Key Failure Indicators:

Acquisition: As an example, the tap-to-earn model attracted both airdrop farmers and casual gamers who were looking to earn some "free" tokens, not serious investors.

Content: The content strategy for Hamster Kombat focused primarily on building hype around the game experience rather than demonstrating the utility and/or the economic value of the HMSTR token.

Qualification: Although Hamster Kombat did not filter for only those users with prior experience in cryptocurrency, nor users who intended to purchase tokens, they still expected all users would participate in the token generation event.

Perception: In addition, many users perceived the HMSTR token as simply being "free points" to be used for dumping purposes rather than a long term investment opportunity.

Outcome: As a result of these perceptions, there was significant selling pressure on the HMSTR token with very few actual buyers participating in the initial token generation event.

Buyer Qualification Score

Projects should use automated scoring to grant tier access based on verifiable on-chain and off-chain behavior. Smart contracts and Discord bots track real engagement and update eligibility in real time, rewarding actions that signal buying intent. Members clearly see what’s required to unlock better allocations.

Activity Type | Weight | Example Actions | Points Earned | Tier Unlocked (Score Threshold) |

Token Economics Education | 30% | Complete all modules (30 pts), Pass quiz >80% (20 pts), Ask investment thesis questions (10 pts) | 0-60 pts | Genesis: 85+ pts |

Governance Participation | 25% | Vote on proposals (15 pts), Submit quality feedback (20 pts), Attend governance calls (10 pts) | 0-50 pts | Core: 60-84 pts |

Testnet Activity | 25% | Real usage sessions (20 pts), Bug reports (15 pts), Protocol interaction variety (15 pts) | 0-50 pts | Community: 40-59 pts |

Quality Referrals | 20% | Refer qualified member who scores 40+ (20 pts each, max 3 referrals) | 0-40 pts | Public: 0-39 pts |

How TokenMinds Helps with Community Growth for Token Sales Success

What we see repeatedly across Token Sales is that there is a repeated trend of building large communities using giveaways, hype, and other shallow forms of participation leading to almost zero actual buying power from these communities. The projects that do best with their sales are those that attract participants who believe in the project, have faith that the token will be valuable for the long term, and are able to participate in a sale without any significant barriers or frictions in doing so.

These projects achieve this through providing clear and concise information about the project to its participants, token economic designs that align with the needs of the participants, thoughtful and strategic design of participant access to the sale, and a streamlined process that can be easily executed across multiple platforms.

TokenMinds used this same methodology in the GensoKishi project to create a high-quality community first environment that resulted in the token sale selling out in seconds across multiple launchpads, which demonstrates that a smaller but more intentional community can produce better results in terms of conversion, and a more sustainable and resilient long-term holder base.

What TokenMinds supports:

Community strategies focused on buyer quality

Clear content that explains token value and economics

Tiered access and whitelist planning

Simple and user-friendly token sale execution

Post-sale engagement to keep holders active

The result is a smaller but stronger community that creates real demand during token sales.

Conclusion

Creating actual demand for your token sale based on a growing community of interested buyers will require you to stop measuring your success through vanity metrics (e.g., number of people in your community) and start tracking actual buying intent. The projects that best accomplish this are those that have attracted the right participants, educated those participants on the value of their tokens, and removed all barriers to the purchase of those tokens, thereby converting more quickly, raising money more efficiently, and retaining a higher percentage of long-term token holders.

FAQ

What's the difference between community growth and token sale conversion?

Community growth measures follower count across platforms. Token sale conversion measures the percentage who buy tokens. Most growth strategies optimize for the wrong metric. They attract people who will never buy. High-converting communities are smaller but made of qualified buyers.

Why do large communities often fail in token sales?

Large communities built through giveaways and airdrops attract followers seeking free value, not investors. These members have no intent to buy. When the sale launches, they wait for listings or airdrops instead of buying. Quality matters more than quantity.

How can projects find high-intent community members before a sale?

Track engagement with token economics content. Watch participation in governance discussions. Monitor testnet activity with real usage patterns. Check completion of educational modules on value accrual. Look at the quality of questions in AMAs. Low-intent members only engage with price speculation and airdrop questions.

What conversion rate should projects target for token sales?

Industry average: 0.5-3%. Good performance: 5-8%. Great performance: 10-15%. Conversion above 15% usually means the community is too small or the sale is underpriced. Below 2% means audience misalignment or activation failure. Focus on qualified buyer percentage, not total size.

How do tiered access systems improve conversion without seeming unfair?

Tiers reward real commitment, not randomness or wealth alone. Contributors who educated themselves, participated in governance, and brought other qualified members earn better access. This is merit-based, not wealth-based. It also makes sure the most aligned members get best terms and hold longest.

What are the biggest mistakes projects make in token sale execution?

Making the purchase process too complex (8+ steps instead of 3-4). Setting unrealistic sales windows that create gas wars. Poor KYC vendor integration causing bottlenecks. Failing to communicate clearly about allocation calculations. Ignoring mobile user experience when 40%+ purchase from phones.

How should projects balance community building with buyer qualification?

Run parallel strategies. Keep a broad community for brand awareness and ecosystem growth. Build a qualified buyer sub-community through gated content, tiered access, and economics-focused discussion. The first drives awareness. The second drives conversion.

What metrics predict token sale success better than follower count?

Engagement rate on token economics content (vs. general announcements). Percentage of community asking investment-thesis questions. Testnet active users as percentage of total community. Completion rate of advanced educational content. Wallet connections per 1,000 community members. These show buyer intent better than vanity metrics.