TL:DR

How to design tokenomics by aligning token supply, on-chain utility, incentives, and value capture to create sustained post-TGE buying pressure, strengthen demand durability, and support long term price stability as real usage scales.

Most Web3 projects get a lot of interest before they have a token launch event. People are excited about the idea of the project; people who are early adopters are getting in on potential gains; investors are all in on the project's vision.

Within days of the Token Generation Event, the demand to buy this token dropped but the rush to sell increased, a post-launch pattern analyzed by how the TGE should be designed and executed on this guide. The pattern is repeated by almost every single token launch regardless of how great the story was and how much hype existed prior to the launch.

This is due to the fact that the demand for the tokens prior to the token launch was based on speculation as opposed to real usage. Since the demand is speculative, once the tokens unlock and the early participants make a profit, there will be no way to generate demand again for those tokens, a dynamic often reinforced by how early access is structured in private token sale setups.

As long as there is no continued buying pressure that is directly related to the use of the network, the price of the tokens will continue to fall, which creates a lack of confidence in the project and the team. Project teams need to develop their tokenomics so that there is a structured mechanism to create buying pressure after the token launch.

Hype-Driven Demand vs Usage-Driven Demand

Most hype driven demand occurs right before a TGE (Token Generation Event) and falls off rapidly after the event, a pattern clearly illustrated across the different stages of a token sale.

There is no fundamental reason why any other investor would want to purchase the coin as soon as the hype dies down. At this point in time the token has become completely speculative and has lost all of its "utility" based purchasing.

Usage-based demand comes from using the network. Users must purchase the required amount of tokens in order to have access to certain services, pay fees associated with those services or participate in the governance of the network. Usage-based demand is tied directly to the growth of the network and NOT to how people feel about the network.

When used properly, the demand for tokens will increase at the same rate as the demand for the services provided by the network.

Key differences between demand types:

Hype-driven demand: peaks at TGE, drops fast, driven by price expectations

Usage-driven demand: grows with adoption, lasts during bear markets, tied to product numbers

Guessing buyers: exit after quick gains, create sell pressure during unlocks

Utility buyers: hold longer, buy again regularly, less affected by short-term price

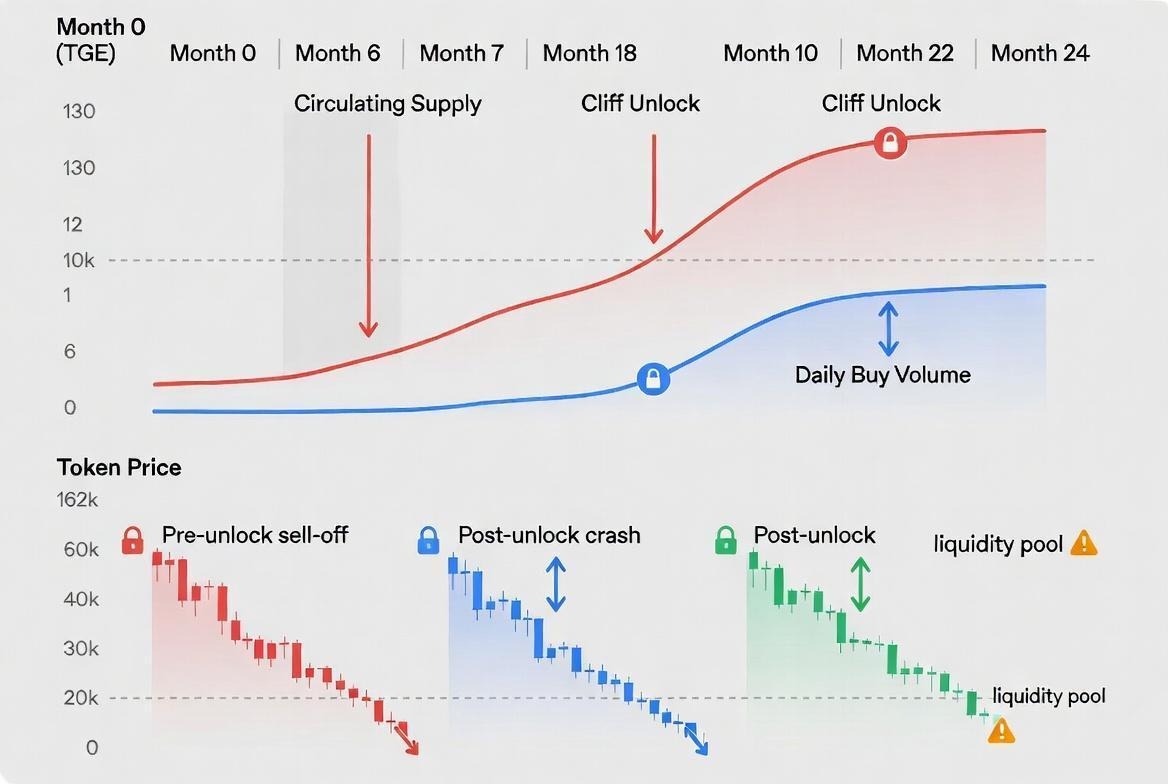

Supply Unlocks and Post-Launch Sell Pressure

Most post-launch threats to token price are caused by token unlocks. Teams, Investors, and Advisors all receive millions of tokens on fixed dates after a project's TGE (Token Generation Event).

If only a small number of holders sell, the amount of new tokens that enter circulation is many times larger than the average number of tokens that buyers purchase in TGE. Sellers cannot easily find sufficient liquidity to buy their own tokens back so when they try to sell their tokens to get some cash, token prices will drop.

Most teams underestimate how much an unlocking event can be affected by little or no buying force to absorb the new tokens into circulation, a risk that becomes evident when reviewing common token sale structures. An example of this would be having a vesting schedule which looks great on paper, however, if there is no demand for the newly unlocked tokens, then every time tokens are unlocked it will cause a shock to the price. The market knows when these events occur, therefore prices will fall prior to the unlocking date.

Supply unlock rules that affect buying pressure:

Cliff unlocks: release large amounts at once, create massive sell pressure spikes

Linear vesting: release smaller amounts continuously, still beat demand if usage is low

Unlock announcements: cause price drops weeks before actual unlock dates

Circulating supply increases: reduce scarcity without matching demand growth, squeeze prices

Liquidity depth: decides whether unlocks cause ten percent drops or fifty percent crashes

Supply Unlock Flow illustration:

Token Failure Framework

TokenMindsuUse this “5 Critical Failure Checks” diagnostic to evaluate whether a token has fundamental structural problems:

Check 1: Mandatory Utility Test

Question: Is ≥40% of supply required for core product usage?

Pass: Users must hold/spend tokens to access primary features

Fail: Token is optional, speculative, or governance-only

Check 2: Supply Trajectory Test

Question: Do daily unlocks stay below conservative daily demand?

Pass: Vesting schedules match realistic adoption curves

Fail: Supply increases faster than usage growth

Check 3: Value Capture Mechanism Test

Question: Is value capture direct and unavoidable?

Pass: Every transaction burns/locks tokens automatically

Fail: Value capture is indirect, voluntary, or governance-based

Check 4: Product-Token Coupling Test

Question: Can users access core product value without holding tokens?

Pass: No - token ownership is mandatory for core features

Fail: Yes - product works fine without tokens

Check 5: Usage-Scaled Deflationary Pressure Test

Question: Do burns/locks automatically scale with product usage?

Pass: More usage = more tokens removed from circulation

Fail: Burns are manual, optional, or don't scale

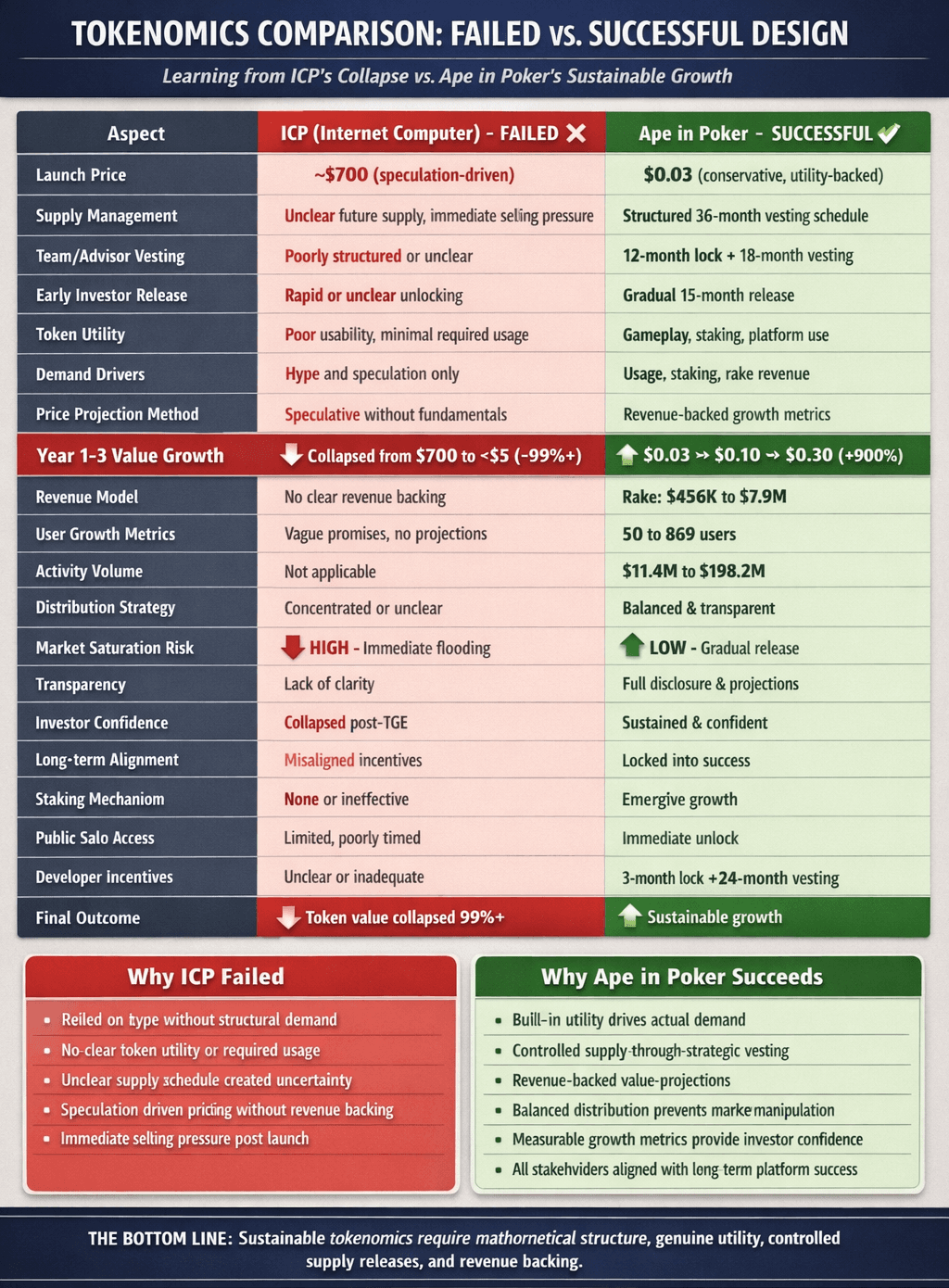

Failed Tokenomics Designs: ICP

Hundreds of tokens launch each year with smart white papers and complex economic models. Most fail to maintain buying pressure beyond the first few months. The failures follow clear patterns that teams continue to repeat. Understanding these patterns helps avoid designing tokenomics that cannot keep demand after launch.

Failed tokenomics share common traits no matter their specific sector or use case. They rely on stories instead of mechanics, treat utility as optional, and ignore the math of supply versus demand. These projects generate excitement before TGE but lack the structural elements needed to create continuous buying pressure. Learning from these failures is more valuable than studying successful outliers.

One of the most well-known examples of this is ICP (Internet Computer). At its launch, ICP touted itself as the "decentralized internet" and obtained several major exchanges where it would be listed. At the time of the Token Generation Event (TGE), ICP reached a price of nearly $700, primarily fueled by both hype and speculation.

After the TGE, the demand for ICP tokens dropped dramatically in large part because of poor token useability, little to no required usage and a lack of clarity regarding the potential future supply of ICP tokens. The selling pressure on the tokens increased and investor confidence collapsed.

It's worth noting that the failure of ICP was NOT related to either the technology behind the project or the marketing efforts. It was due to tokenomics which failed to sustain sufficient buying pressure on the tokens.

Successful Tokenomics Design: The Ape in Poker Case Study

In contrast to failed models like ICP, TokenMinds designed a sustainable tokenomics framework for Ape in Poker that addresses the core challenges of maintaining long-term buying pressure. The key differences highlight why proper tokenomics advisory matters.

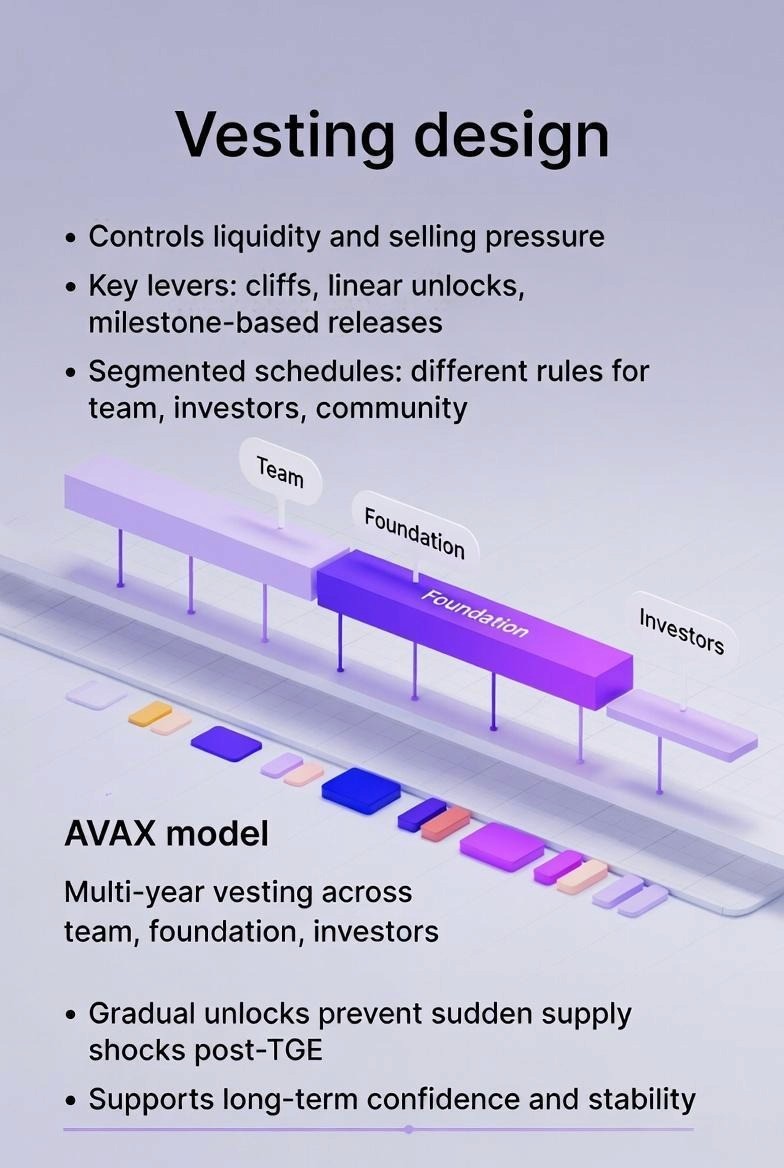

Controlled Supply Management vs. Market Flooding

While ICP was threatened by uncertainty about the future of its supply, as well as immediate sell pressures due to lack of structure, Ape in Poker created a 36 month vesting schedule for each group involved.

The team and advisors are locked up for 12 months and have an 18-month vesting period. The seed and private investors have a 15-month gradual token release, eliminating the explosive increase in circulating supply associated with market dumping at the ICP launch.

Built-in Utility vs. Speculative Value

Unlike ICP's unclear token utility, Ape in Poker's token has many specific uses as part of a decentralized poker platform. Tokens are needed to play games; long term holders receive staking rewards which will increase the desire to hold tokens; and rake fees collected by the platform flow back into the treasury.

These create real demand generators instead of relying only on speculation. The proposed user growth from approximately 50 users at the end of year one (Q1) to approximately 869 users by the end of year five (Q4) shows increasing utility that is directly related to an increase in demand for the token.

Revenue-Backed Growth vs. Hype-Driven Pricing

The $700 Launch Price for ICP was a purely speculative measure that had no basis in supporting revenue. In contrast to ICP, Ape in Poker uses conservative token valuation estimates based on direct correlation of platform performance.

The token is expected to increase from $0.03 in year one to $0.10 in year two to $0.30 in year three; this growth will be based on an expanding rake collection (from $456,250 in Q1 Year 1 to $7.9 million in Q4 Year 5), as well as the increased bet volume (from $11.4 million to $198.2 million) during the same time frame.

Balanced Distribution vs. Concentrated Allocation

The Distribution Strategy will distribute tokens among seed investors, the public sales participants, staking rewards, team allocations, and treasury reserves. In doing so, it provides an equitable distribution of the token to provide a balance against the selling of tokens by one segment of the community at a time to avoid creating a huge sell off like we have seen in other projects where the early investors or teams have a large share of the tokens that they can dump after the lock up is removed.

Measurable Prognosis vs. Vague Promises

Instead of making a generalized statement about “decentralizing the Internet,” the tokenomics of Ape in Poker are based on forecasting specific numbers for user growth, betting volume, rake (a commission collected by an online poker site) and increases in treasury over the next five years. The specific numbers used to forecast the above items provide concrete measures of success for the project and enable investors to evaluate the value of their tokens relative to real-world activity at the platform versus just hype.

This difference is illustrative of a basic principle; for tokenomics to be long term sustainable, there needs to be mathematical structure, actual use of the tokens, measured release of supply of tokens, and revenue generated from the tokenized product.

Any project that does not build-in the above aspects, regardless of technological advancements or marketing budgets will experience declining buying pressure once the excitement surrounding the launch has faded.

Table of Comparison: ICP vs Ape in Poker

What Happens When Utility Is Optional

A project with optional utility means that users do not need to purchase tokens in order to access the network or product. Tokens exist primarily for speculation or governance purposes, and not as an alternative way to utilize the core functionality of the network or product.

Therefore, removing optional utility takes away the primary driver of continued interest and purchase of tokens. Users will be left with little incentive to obtain tokens, other than the possibility of future price increases.

Projects utilizing optional utility will be dependent on guessing the level of interest (demand) at the time of the launch of their token sale. As market conditions deteriorate and the excitement surrounding the new token sale fades, there will be no underlying demand to provide a floor price for the token.

In addition to the issue of pure speculation, the problems associated with governance tokens are exacerbated by the fact that voting rights are typically not sufficient to justify purchasing tokens. In many cases, the token becomes merely a decorative item rather than a tool used by the user to interact with the product or service being offered.

The results of using optional utility:

Zero Demand Floor: There is zero buying pressure, regardless of how large the network becomes.

Pure Speculation: All of the buyers are focused solely on price, rather than usage.

Large Price Swings: The lack of a floor price means that prices can swing wildly up and down, with no intrinsic value to anchor the price in times of low activity.

Disconnect Between Token Demand and Product Usage: Even though the number of people using the product may be increasing, the demand for the token remains unchanged.

Exit Waves: The first sellers of tokens create panic among the remaining sellers who realize that no one has to buy the tokens to use the product or service.

Strong Narratives Fail Without Demand Mechanics

Stories draw early focus and create the momentum for pre-launch awareness.

Excitement generated by stories (i.e., disruptive technology, innovation, or solutions to big problems) gets investors excited, too.

However, a story alone will not create the ongoing purchase momentum once the story is fully incorporated into the price.

Once the story is "priced in," the fundamental reason to continue purchasing the token does not exist. The mechanics of how people are going to be able to use the token after it has been purchased is what creates the continued momentum.

Story drives an initial distribution faster, however, it adds nothing to sustained post-launch demand. It is only when there is a clear mechanism that requires the token owner to make additional token purchases that the purchasing momentum continues.

Why do stories cease to drive demand:

1. There is no need for a token transaction; the user has bought into the story, so they have no reason to buy tokens.

2. The initial buyers are all invested, and there are no longer enough potential buyers to continue generating momentum.

3. Other competing stories emerge from other projects that present more compelling and interesting stories than yours.

4. Reality sets in; during bear markets (or times of low investor confidence), it is much harder for a story to create and maintain demand for your tokens.

5. As the hype surrounding the market begins to fade (the "hype cycle" ends), what was once able to generate interest and support for your project at ten cents may be unable to do the same at $1.

TokenMinds 7 Tokenomics Elements to Sustain Buying Pressure

A sustained buying pressure is created by many working parts, operating as an entire unit. The purchase of tokens will be generated through one mechanism; it will not be generated from one source. The design of utilities, the structure of incentives, and the mechanics of supply, and value capture must all operate in harmony to provide the buyer with continuous reasons to purchase additional tokens.

This is the basis upon which a successful post-launch sustainable tokenomic model will be built.

Each element within this framework will serve its own function to generate or protect the purchasing power of buyers of the token. Some elements will generate the purchasing power of buyers by mandating the purchase of a minimum amount of tokens. Other elements will protect the purchasing power of buyers by limiting supply or creating alignment in the incentives of the participants in the ecosystem.

These elements collectively form a system that converts the growth of the network into the purchase of additional tokens. It is imperative that the interaction of each of these elements be well understood when designing a successful tokenomic model.

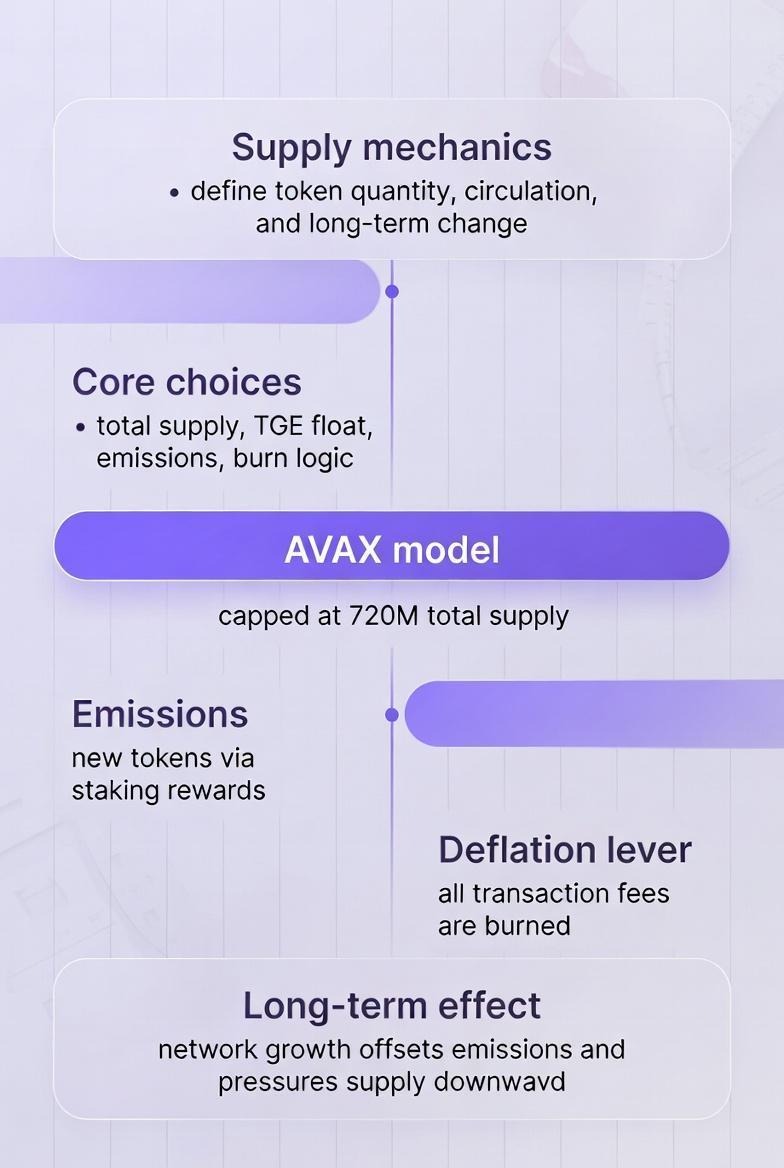

1. Supply Mechanics

Tokenomics engineers are responsible for deciding how many tokens are in existence and how many there will be at different periods of times. A fixed supply of tokens creates a scarcity that is unchangeable. An inflationary supply can help grow a network by funding its development, but it could also outpace demand. Deflationary mechanisms remove tokens from circulation which can lead to increased buying pressures as a result of scarcity.

The correct supply mechanism will depend on how the network generates revenue and if it has the capability to burn tokens.

Token emission schedules control when and how new tokens are placed into circulation after a token generation event (TGE). Emissions that are front loaded create early liquidity and potential for long term selling pressure. Emissions that are back loaded create initial scarcity, but they may not provide sufficient incentives for participants to join the network early.

A majority of successful networks have used declining emission rates that decline as the network matures and the revenue generated from fees increases.

Supply design elements that affect buying pressure:

Maximum supply caps: create long-term scarcity, prevent endless dilution

Emission curves: decide sell pressure intensity at different growth stages

Burn mechanisms: remove tokens permanently, reduce circulating supply over time

Staking locks: temporarily reduce liquid supply, decrease available tokens for sale

Supply watching: track emission-to-burn ratios, adjust mechanisms based on network usage

2. Distribution Model

The distribution model determines which people receive an amount of tokens when the platform is first launched. Concentrating heavy amounts of token supply on the team and investors creates tremendous future pressure to sell. A broad distribution model to the users limits each user's ability to sell tokens in large quantities, but may indicate that the project has weak long term commitment to its community.

The distribution model establishes the basic structure for the first few months of the market and determines the quantity of supply that will be entering into circulation in those months. Fair distribution allows a fair reward to early contributors while avoiding excessive distribution of token supply to the team and investors.

The team and investors need enough token supply to keep them motivated. If the team and investors have seventy percent of the total supply of tokens, they could create significant selling pressure as soon as restrictions are lifted from their token supply.

Community token distributions can help establish loyalty to your project, if the token is being distributed to actual users and not just to "airdrop" farmers.

Distribution factors influencing post-launch pressure:

Team allocation: typically fifteen to twenty percent, higher percentages signal misaligned incentives

Investor allocation: usually twenty to thirty percent, shapes unlock schedule importance

Community allocation: thirty to fifty percent for sustainable projects, must reach real users

Treasury reserves: ten to twenty percent for ecosystem development, avoids future emergency sales

Liquidity provisions: five to ten percent for market making, prevents manipulation from low liquidity

3. Vesting Schedules

Vesting schedules control when locked tokens can be traded.

If vesting is done correctly, early participants are not able to dump their tokens right away after the TGE. It helps align long-term interests by ensuring those who helped build the project have an economic interest in its success. Poor vesting creates predictable sell pressure that markets will front run before tokens are even unlocked.

What matters more than total duration of vesting is how vesting structure works out. If all tokens released at the same rate over two years (linear), then this would create constant sell pressure. If one year cliff followed by monthly releases over next year, selling concentrated into certain time periods.

Neither of these approaches is better on its own, but teams must match vesting structure to expected growth in demand.

Vesting schedule components that protect buying pressure:

Cliff periods: prevent any sales for six to twelve months, allow network to mature before supply increases

Release frequency: monthly unlocks create less shock than quarterly releases

Duration length: two to four years for team, one to three years for investors, matches commitment expectations

Performance conditions: tie unlocks to usage metrics, make sure tokens release only as demand grows

Lock extensions: allow voluntary extended vesting for bonus tokens, reward long-term alignment

4. Utility Design

Utility design determines whether users have to obtain a token to access network services. Mandatory utility generates baseline demand regardless of interest in guessing. Optional utility relies entirely on interest in guessing.

Strong utility design makes the token essential to core functions, not some side feature.

Users purchase tokens because they need them, and not for exposure to price movements.

The best utility designs create repetitive purchases as opposed to one-time purchases. If users buy tokens but then hold them forever then initial demand is high but there will be no long-term buying pressure.

Systems that consume tokens through use generate continuous demand as network activity increases. Fee burning, transaction requirements and consumable token models all create repetitive purchase needs.

Sustained-demand utility mechanisms:

Transaction fees: purchase a token for each network transaction

Gas (payment): require token purchase for computation; increases with network use

Token staking: lock tokens to enable specific functions; reduces circulating supply

Governance: require token ownership to participate in governance; creates sustained demand from engaged users

Access to service: require token balance to access premium services; ties demand to the perceived value of the product

5. Incentive Structures

Incentive is one of the reasons network users want to keep their tokens in a wallet instead of selling them. The incentive structure that governs how people behave is based on staking rewards, yield generation, and fee sharing. These create alignment between a participant's self-interest and network development.

However, these incentives need to be structured to provide a competitive rate of return without causing an excessive amount of new tokens to be created. If they are poorly structured, they will be used by those who "farm" (rapidly acquire) and "dump" (rapidly sell) tokens instead of using them for long-term.

The distinction between users and mercenaries is where good incentives make a difference. A user stakes tokens to have influence in governance decisions; for network security; or for the potential long-term appreciation of value in a token. On the other hand, mercenary capital will seek out the largest possible yield and exit the moment that yield drops.

Therefore, designing incentives to attract and retain committed users while discouraging mercenary capital from participating is key. Frequently this involves creating moderate, sustainable yields as opposed to unsustainable triple digit returns.

Incentive design elements supporting buying pressure:

Staking yields: five to fifteen percent annual returns, funded by network revenue not emissions

Lock periods: thirty to ninety day unstaking delays, prevent instant exits during ups and downs

Reward vesting: distribute staking rewards over weeks, not instantly

Loyalty bonuses: increase yields for longer staking commitments

Penalty mechanisms: charge fees for early unstaking, redirect penalties to long-term holders

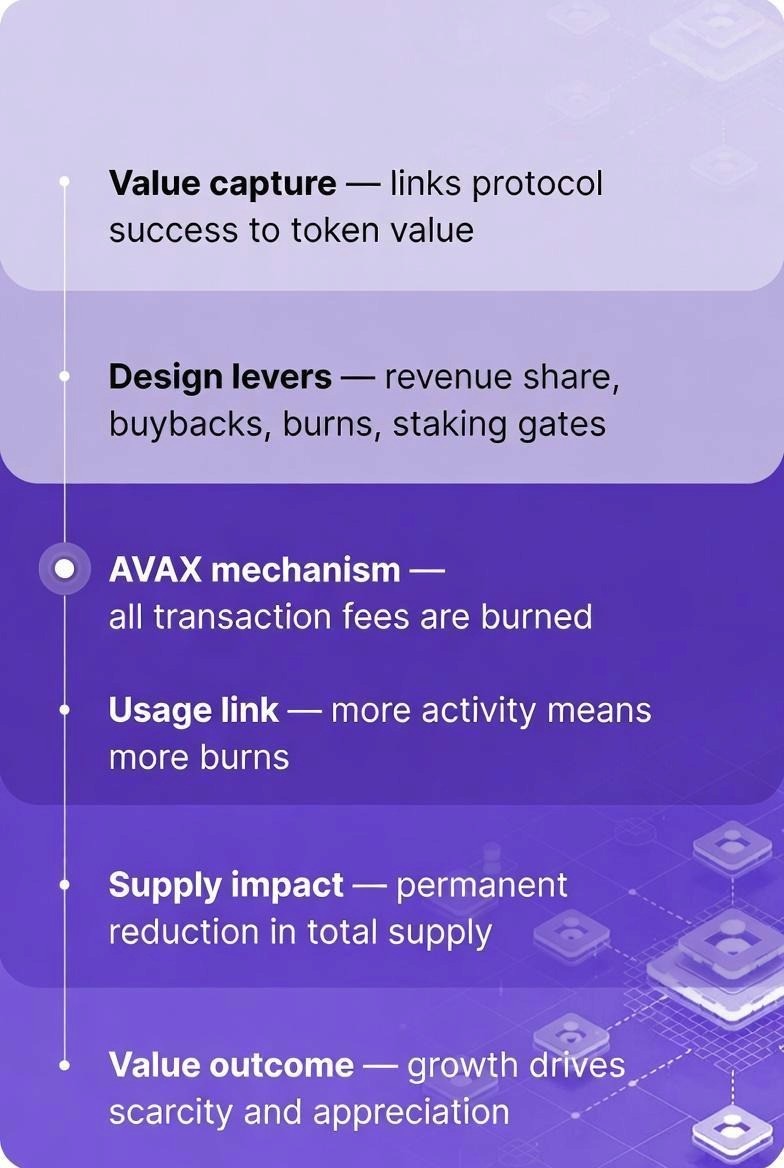

6. Value Capture Mechanisms

Value Capture describes how token holder(s) receive Network Revenue. The Protocol generates revenue through Transaction Fees, Service Charges, Ecosystem Activity, etc. If the generated revenue is deposited into Treasuries and distributed to non-token holders then token holders do not have any claim on that revenue due to the Networks success. Good value capture gives basic reasons for holding tokens outside of speculation.

The most direct value capture model includes Fee Sharing or Token Buyback models that are funded by the Protocol Revenue. As the usage of the Network grows so does the revenue generated by the Fees (e.g., increased usage = increased revenue = increased token demand).

This provides a transparent link between the success of the Network and the demand for Tokens. In the absence of such a link there can be no increase in user or revenue that will drive an increase in Token Demand.

Methods of value capture that build buying pressure:

- Revenue Share: The distribution of protocol fees to stakers, creating yield from actual revenue

- Token Buyback Models: Use treasury funds to repurchase tokens; consistent demand will be created through this method

- Burn Mechanisms: Destroy tokens by utilizing fee revenue, as the use of tokens increases the supply will decrease

- Dividend Models: Pay owners with stable coins or ETH, making the token a productive asset

- Fee Discounts: Discounted fees for holders of the token, encouraging the buying and holding of the token

7. Demand Drivers

Demand Drivers are those reasons that create a need for new participants to purchase Tokens. Therefore, they are different from Utility (what Tokens can be used to do) and Incentives (why someone would want to hold a Token).

Therefore, Demand Drivers help explain what forces new purchases of Tokens after the Launch event. The most effective Demand Drivers are tied directly to an increasing number of users in the Network, or an increasing User Base.

Successful Demand Drivers that are Sustainable must be based on a Product-Market Fit, not just on Tokenomics. The success of a product will create demand for Tokens that consumers must purchase in order to utilize the product.

Tokenomics can only build upon the natural demand generated by a successful product; they cannot artificially generate demand for a project. Projects that have issued Tokens before establishing a viable product-market fit will likely fail to sustain any buying pressure, no matter how well-designed the economics may be.

Demand driver categories affecting buying pressure:

User growth: Each time a new user is created they have to purchase a token in order to gain access to their account or to use a service.

Higher transaction volumes: More people using the network means that more will be purchasing tokens in order to pay for fees.

Expansion of the ecosystem: All applications that are developed for the protocol require tokens to function properly.

Institutional adoption: Large companies and financial institutions will have to purchase tokens and then add them to their treasury or utilize them in some capacity for their day-to-day operations.

Demand from cross-chain (multiple blockchains): Other blockchain platforms will require tokens as part of their bridge or joint efforts to work with the original network.

Quantitative Token Flow: Buying Pressure

A network faces a 150,000 token investor unlock over 30 days. Will organic buying pressure absorb this supply without crashing the price?

Step 1: Calculate Daily Demand

12,000 daily active users × 2 transactions/user × 0.3 tokens burned = 7,200 tokens/day

Step 2: Calculate Daily Unlock Supply

150,000 token unlock ÷ 30 days = 5,000 tokens/day

Step 3: Compare Demand vs Supply

Daily demand: 7,200 tokens

Daily unlock: 5,000 tokens

Net burn: 2,200 tokens/day

Step 4: Conclusion

Unlock comfortably absorbed by organic demand

Price pressure minimal due to positive net burn

Network fundamentals remain strong throughout unlock period

Real Implementation Example: Avalanche (AVAX)

One of the best examples of a sustainable buying pressure model is Avalanche’s tokenomic incentive model that was established after launch. Since launching in September 2020, Avalanche has generated ongoing buying pressure throughout multiple bear markets.

How AVAX Links Usage to Demand

All Avalanche transactions destroy a part of the paid fee as an "Avalanche Burn". Rather than going to validators, the burning of tokens is directly related to the use of the Avalanche network. Therefore, the more you use Avalanche, the more tokens are destroyed. With increased transaction volume, this results in more burning (reduction) of total token supply.

Creation of each Subnet requires significant amounts of AVAX purchased and locked. Also, each new Subnet will run validations on the main network and therefore require validators to lock up AVAX. As the number of Subnets increases, so does the amount of tokens that are locked within staking contracts.

Therefore, the more successful Avalanche grows, the less tokens will be available for trading.

Demand-creation methods for usage of AVAX:

Burning fees on each transaction: when a user creates a transaction on the AVAX blockchain, the user is required to pay an amount of AVAX that will be burned from circulation.

Minimum validator balances (staking): validators are required to hold at least 2,000 AVAX as collateral; many subnet validators also choose to maintain larger balances to enhance their standing as validators.

Security of Subnets: Incentives exist to encourage validators to "lock up" additional AVAX by providing them with the ability to earn rewards through validation services. This can increase the total amount of AVAX being used to secure the network.

Fees paid for gas on transactions: All computations on the AVAX blockchain require the payment of AVAX and scale with network usage.

Transfer fees for cross-subnet transactions: To move assets from one subnet to another within the AVAX ecosystem, users must pay fees that burn AVAX

How Emissions, Burns, and Staking Interact

Avalanche is in a delicate balance when it comes to burning, locking, and minting tokens; and the protocol will incentivize (mimic) network security through minted AVAX as rewards for staking. Emissions of AVAX can create downward pressure on price through selling pressure; however, there are several mechanisms that help offset this effect. The three main mechanisms are that staking lock period, minimum stake required, and burn fees all work together to limit net supply growth over time.

Rewards from staking are given to validators that hold a substantial amount of AVAX. These individuals have a long term interest in the network and they usually "re-stake" their staking reward instead of selling them right away.

There are also minimum amounts of stake required, and unstaking periods that help deter validators from engaging in short-term farming activities. Additionally, the number of transactions burned with every use may be greater than the amount of tokens emitted by the system during times of high usage.

Effects on the market from interactions of tokenomics components:

The emission rate is approximately ten percent each year by way of staking rewards

The burn rate is variable based upon usage but reached a higher amount than emission rates at times of peak activity.

Staking participation: Fifty to sixty percent of the supply is locked in staking thereby reducing the overall selling pressure.

Net supply: Has been reduced when usage was high and even though there are continuing emissions.

Market Impact: The combination of burns and locking have produced net supply reduction that is greater than emissions which produces the effect of supply scarcity in the market.

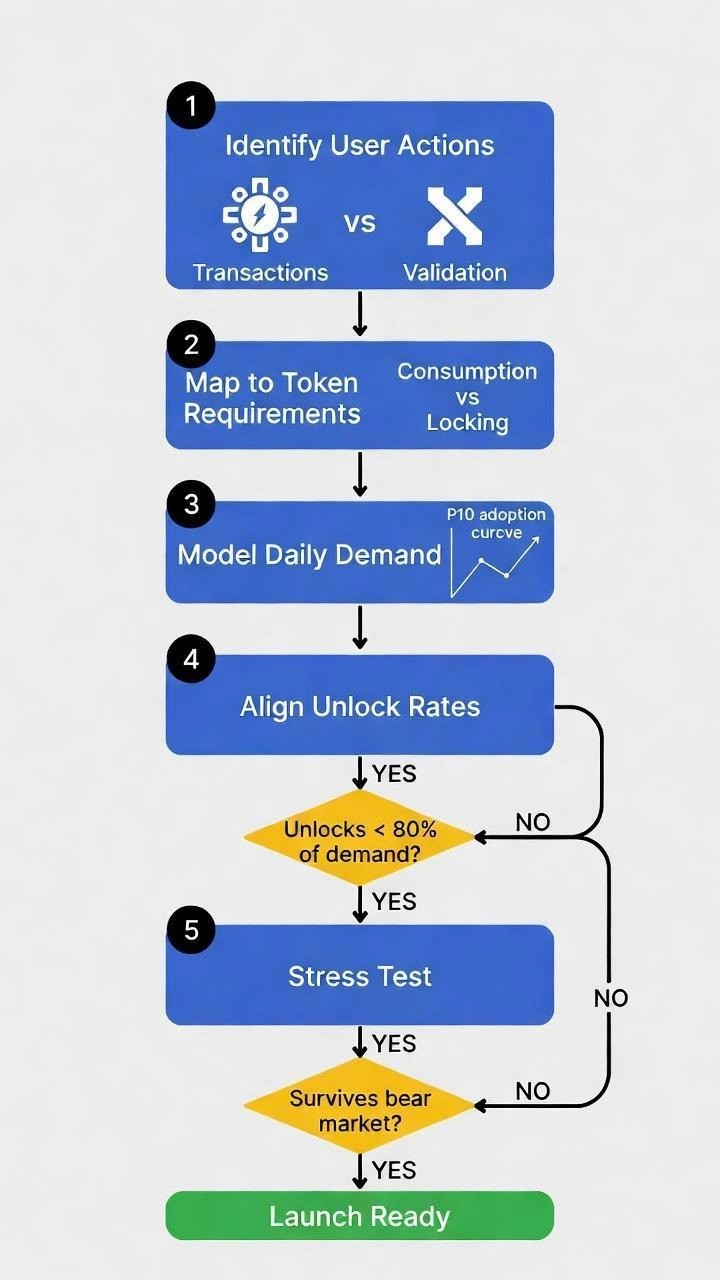

Tokenomics Design Workflow: Five Steps Before TGE

Teams need a clear process to design tokenomics that sustain buying pressure after launch. Most projects skip essential steps and jump straight to distribution percentages without understanding demand mechanics.

This five-step workflow ensures token design connects to real usage patterns rather than speculative hopes. Following this sequence before TGE dramatically increases the probability of maintaining post-launch demand.

Identify non-speculative user actions like transactions, service access, and network validation

Map each action to mandatory token consumption through burns or token locking through staking

Model daily token demand using conservative adoption projections at tenth percentile scenarios

Align unlock release rates to sixty to eighty percent of projected daily demand

Stress-test design with zero speculative buyers and fifty percent trading volume drops

Diagram Flow: Five Steps Before TGE

How TokenMinds Designs Tokenomics for Long-Term Demand

At TokenMinds, tokenomics is designed to work for the long run, not just for a token launch. The focus is on giving the token a real purpose, who needs it, why they use it, and how demand grows as more people use the platform. Token supply and releases are planned to match real usage, so tokens don’t flood the market faster than people actually need them.

Incentives are set up to reward people who help the ecosystem grow over time. By linking rewards to real activity and controlling how tokens enter circulation, demand stays strong as the project scales. This helps keep the token more stable and valuable because it is driven by real use, not hype.

TokenMinds will also create a decision framework that analyzes the trade-offs between conflicting objectives. A higher staking yield will attract more "lockers" but the increased sell pressure caused by emissions will make them want to sell. A longer vesting period can prevent dumping but may also deter investor involvement.

These decision frameworks allow teams to calculate the trade-offs and identify the optimal point at which to strike a balance given their own particular situation and risk tolerance.

Key framework components guiding tokenomics decisions:

Emission-to-revenue ratios: sustainable projects reach one-to-one within eighteen to twenty-four months

Circulating supply targets: twenty to thirty percent at TGE, reaching sixty to seventy percent within two years

Unlock concentration limits: no single unlock exceeding two percent of circulating supply

Utility requirements: minimum forty percent of token supply needed for core functions

Demand driver diversity: at least three independent sources of buying pressure

Conclusion

Sustained buying pressure after TGE cannot be hoped for or assumed. It must be deliberately designed through coordinated supply mechanics, mandatory utility, aligned incentives, and clear value capture. Projects that generate only guessing demand before launch face inevitable decline once that guessing ends. Only tokens with mechanical demand drivers survive multiple market cycles and growing competition.

The seven elements framework provides structure for building tokenomics that work post-launch. Supply controls prevent dilution from beating demand. Distribution and vesting protect against concentration and dump risks. Utility and incentives create reasons to get and hold tokens. Value capture and demand drivers tie token performance to actual network success. These elements must work together, not in isolation.

Teams must put long-term sustainability over short-term launch metrics. A spectacular TGE followed by rapid decline helps no one. Thoughtful tokenomics design that creates buying pressure through real usage builds projects that last. The goal is alignment between network growth and token demand, where each strengthens the other continuously.

Schedule a complimentary consultation with TokenMinds to explore how your project can design tokenomics that sustain buying pressure after launch and remain resilient across market cycles.

FAQ

Why do most tokens lose demand after the Token Generation Event (TGE)?

Most demand before TGE comes from hype and speculation, not real usage. Once early buyers sell and tokens unlock, there is no reason for new buyers to keep purchasing unless the token is required to use the network.

What is the difference between hype-driven and usage-driven demand?

Hype-driven demand depends on excitement and price expectations and fades quickly. Usage-driven demand comes from people needing tokens to use services, pay fees, or participate in the network, so it grows as the product grows.

Why are token unlocks so dangerous after launch?

Unlocks add new tokens to the market suddenly, often in amounts much larger than daily buying demand. Without strong usage-based demand, these unlocks create heavy sell pressure and price drops.

Why does optional utility fail to support token prices?

If users can use the product without buying tokens, there is no reason to hold or buy them. This creates a zero demand floor, making the token purely speculative and highly unstable.

How does mandatory utility create sustained buying pressure?

Mandatory utility forces users to buy tokens repeatedly for transactions, fees, staking, or access. As network activity increases, token demand increases automatically.

What role does value capture play in long-term token demand?

Value capture links token ownership to real network revenue through mechanisms like fee sharing, buybacks, or burns. This gives holders a clear reason to hold tokens beyond price speculation.

What is the biggest mistake teams make when designing tokenomics?

They design for launch excitement instead of post-launch survival. Strong tokenomics must work even with low hype, slow growth, and bear markets, relying on real usage rather than speculation.