TL:DR

How to integrate Shariah-compliant smart contracts into Islamic banking products workflows and redesign governance, compliance, and operations to improve execution speed, transparency, and Shariah audit readiness.

Islamic banks can use smart contracts to automate Murabaha, Ijara, and Sukuk products. These digital contracts help banks reduce verification time from several weeks to just a few hours. At the same time, they lower operating costs and reduce daily operational risks, a result achieved by faster smart contract execution in financial systems.

Smart contracts are computer programs that run automatically when set conditions are met. In Islamic banking, they help ensure that transactions follow Shariah rules at every step. Instead of relying on manual checks and paper documents, banks can use code to confirm ownership, calculate profits, and release payments in a clear and consistent way.

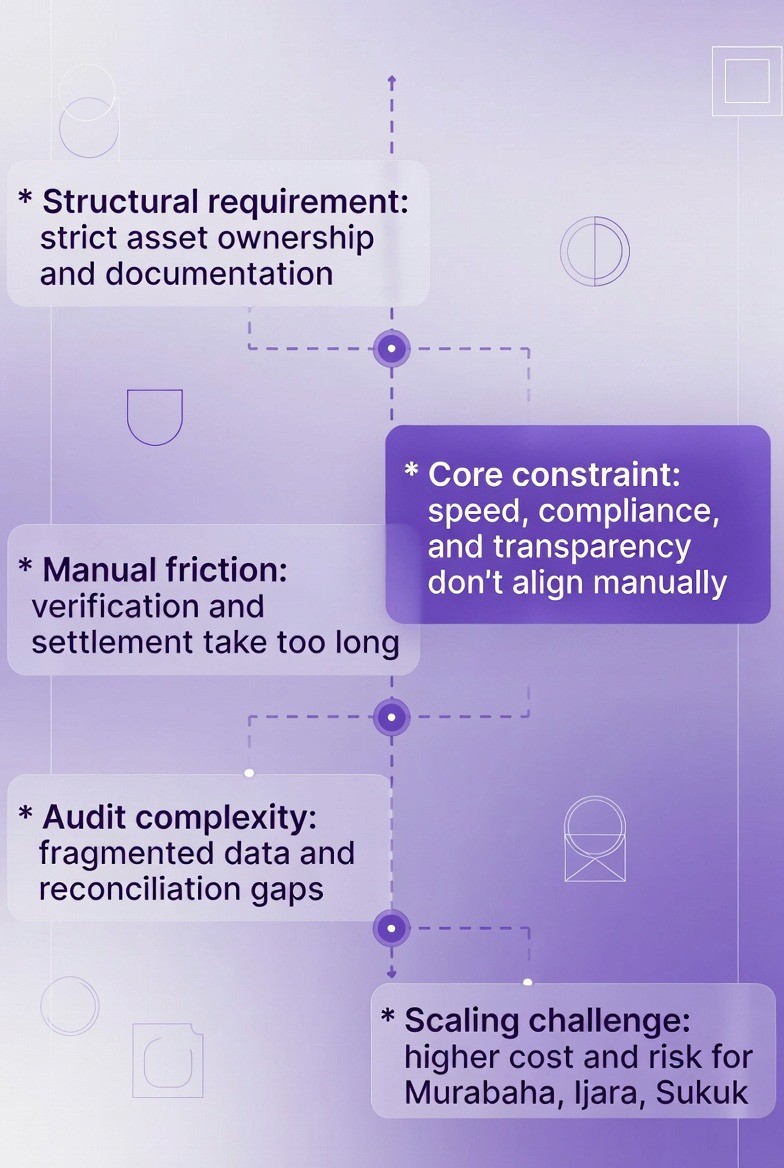

The Core Problems in Current Islamic Banking Systems

Many Islamic banks still depend on paper documents and separate computer systems. Each department works on its own system. Asset ownership may be stored in one place, payment records in another, and compliance reports in a third system. Because these systems do not fully connect, it is hard for banks to see the full picture of a transaction at one time.

One major problem is slow asset verification. Checking ownership, delivery, and contracts often takes 3 to 5 days for a single transaction. When a deal involves more assets or suppliers, the process takes even longer, a bottleneck commonly addressed by structured smart contract development practices. This slows down Murabaha, Ijara, and Sukuk transactions and increases daily operating costs.

Trust and Transparency

Another problem is there isn't one system for all of the necessary sources of truth (asset ownership; payment status; profit calculation). As such, staff must gather data from multiple systems to verify Shariah compliance. This makes it more likely that data will be missed, records out-dated, or errors will occur.

Manual Reconciliation

Manual reconciliation creates more problems. Ownership records and payment records do not match automatically. Teams must reconcile them by hand at the end of each month or quarter. This work takes time, costs money, and often leads to human error as transaction volume grows.

Compliance

Additionally, Compliance reporting is delayed. Most reports are compiled on a monthly basis or quarterly basis. When issues show up in reports, by then most non-compliant transactions would have occurred. Reports provide insight into what caused past issues, however, they do not prevent real-time issues. This creates Regulatory Risk and adds pressure on Shariah Boards during Audits.

Smart contracts solve these problems by keeping ownership, payments, and compliance rules in one shared system, an outcome delivered by a cohesive blockchain system framework. Verification happens automatically, and records update in real time. This allows Islamic banks to reduce delays, lower errors, and maintain Shariah compliance as operations scale.

Shariah-compliant Smart Contracts

Shariah compliant smart contract is a type of digital contract that is run automatically via blockchain which uses computer programming (as its underlying language) to implement Islamic financial rules and regulations. In other words, a Shariah compliant smart contract functions as both a legally binding and religiously binding contract once it has been activated and the terms have been approved by Shariah scholars.

Smart contracts are programmed so that once they are activated, each transaction is executed automatically without the need for manual approval at each stage of the transaction process.

Smart contracts that are Shariah compliant are created specifically to comply with Shariah rules, principles and standards. Shariah compliant smart contracts do not permit interest to be earned or paid, require actual ownership of an asset prior to the execution of any transaction involving the asset, and provide for fair treatment of profits and losses. In addition, the smart contract can only execute if all Shariah conditions are satisfied. That is, if there is a condition that is not met, the transaction cannot proceed.

An important feature of a Shariah compliant smart contract is automatic enforcement. Instead of verifying compliance after a transaction has occurred, the smart contract verifies compliance during the execution of the transaction. To illustrate, in the case of a Murabaha smart contract, the contract will prevent the sale from occurring until the bank has acquired the asset. Similarly, in the case of an Ijara smart contract, the contract will prevent the initiation of lease payments until the asset has been registered and delivered to the lessee.

Furthermore, Shariah compliant smart contracts create permanent and unalterable records of all transactions. Each ownership transfer, payment, and profit calculation will be permanently recorded on the blockchain and may not be altered thereafter. Therefore, Shariah boards, auditors, and regulators will find it easier to verify the accuracy of past transactions and confirm compliance with Shariah principles.

Finally, Shariah compliant smart contracts will never replace Shariah Boards. Shariah Boards are still responsible for determining the rules and approving the contract logic prior to being placed into the Smart Contract. The Smart Contract simply executes those approved rules in a consistent and automated fashion. By allowing Islamic Banks to implement this type of system they can reduce errors, speed up the transaction process and build/maintain trust; all while remaining fully compliant with Islamic Principles.

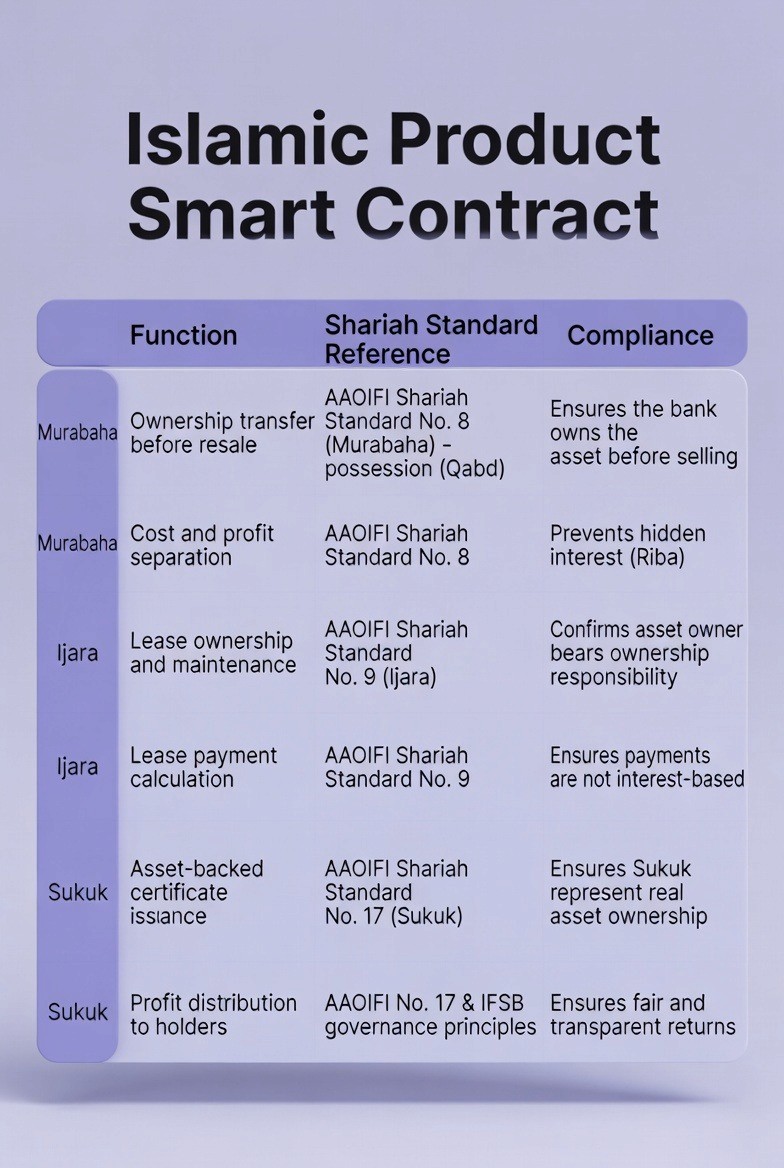

Explicit Mapping to AAOIFI and IFSB Standards

Saying a system is “Shariah-compliant” is not enough on its own. Regulators and Shariah boards expect clear proof that each smart contract rule follows recognized Islamic finance standards. This is why direct mapping to AAOIFI and IFSB standards is important.

In a Shariah-compliant smart contract, each key function is linked to a specific standard or clause. For example, Murabaha contracts must follow AAOIFI rules on asset ownership and possession before sale. Ijara contracts must follow rules on lease ownership and responsibility. Sukuk contracts must follow standards on asset backing and profit distribution.

Example mapping:

Murabaha ownership transfer logic aligns with AAOIFI Shariah Standard No. 8 (Murabaha) on possession before resale

Ijara lease structure aligns with AAOIFI Shariah Standard No. 9 (Ijara) on asset ownership and maintenance responsibility

Sukuk asset linkage and profit flow align with AAOIFI Shariah Standard No. 17 (Sukuk) and relevant IFSB governance principles

Table Mapping of Smart Contract Logic to Shariah Standards

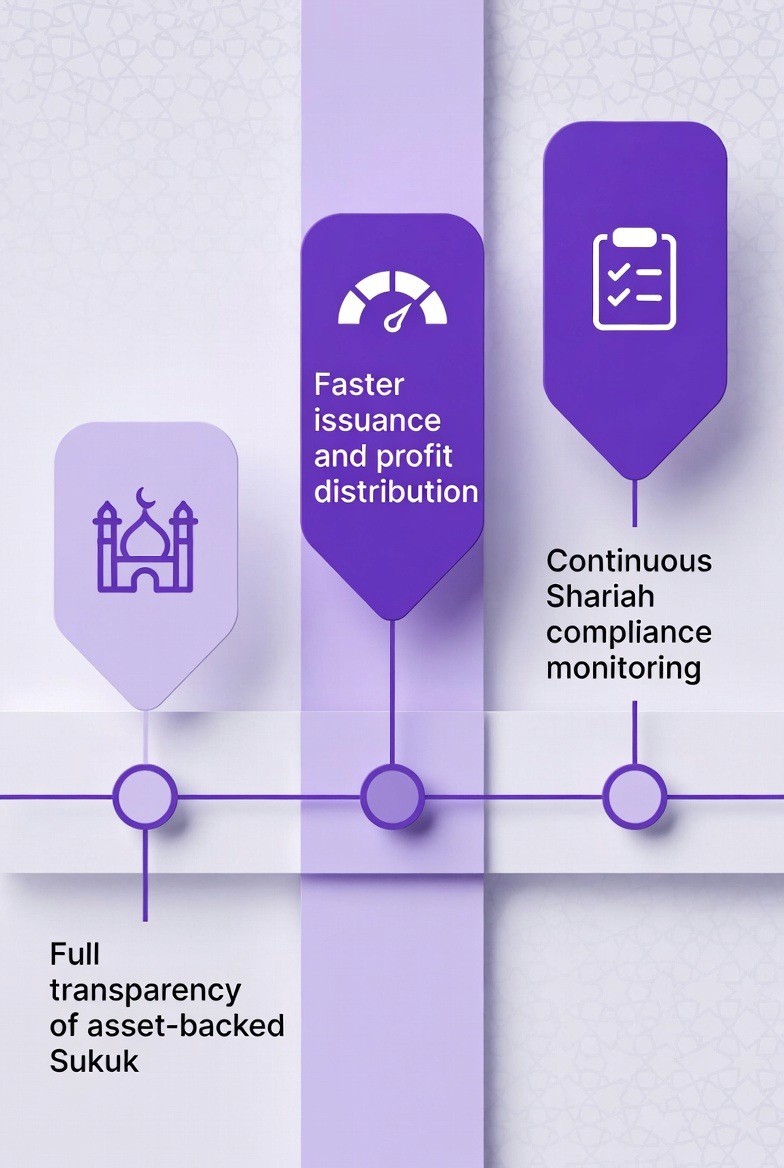

Smart Contract Benefits

Islamic banking products require constant checks to confirm asset ownership and correct profit calculation. These checks are necessary to follow Shariah rules, but they are usually done manually. As a result, settlement often takes between 7 and 14 days.

These delays increase operating costs by around 40 percent compared to conventional banking. They also increase regulatory risk because missing documents or delayed checks can lead to compliance issues.

Core problems include:

Banks must prove they own an asset before selling it to a customer.

Sukuk certificates must stay linked to real assets at all times.

Manual document checks increase the risk of errors and compliance gaps.

Smart contracts solve these problems by executing rules automatically. Instead of checking compliance after a transaction is completed, the system enforces compliance while the transaction is happening.

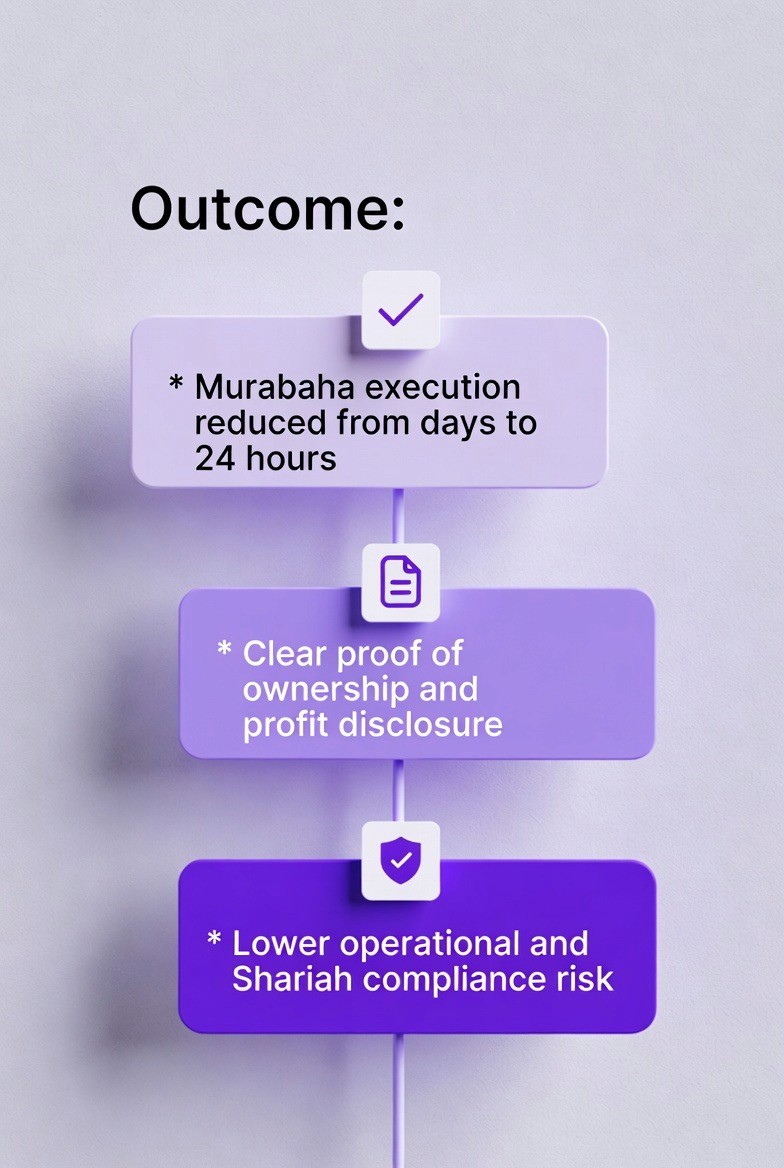

1. Cost Reduction and Speed

Automation and smart contract technology has reduced banks’ verification costs by approximately 50 to 70% . The Murabahah transaction that typically took 7-14 days to settle can be completed within a timeframe of 24-48 hours with this new system. Furthermore, banks are able to process 3 to 5 times as many transactions as they were prior to implementing the automation systems, utilizing the same amount of employees.

The use of automation also reduces the requirement of a large compliance team, reducing compliance work by about 60%. The automation also cuts down on the settlement and calculation errors by up to 80%.

2. Lower Risk and Better Compliance

Smart contracts create permanent digital records for every transaction. These records show asset ownership, profit calculations, and payment distribution. Regulators and Shariah boards can review these records at any time.

Because the data is recorded on blockchain, it cannot be changed later. Real-time monitoring also allows banks to detect problems early, before audits begin or regulators raise concerns.

3. Enhanced Trust and Transparency

Blockchain technology enables both consumers and investors to be able to independently validate that all of the information is correct. Investors can ensure that the Sukuk certificate they purchased is actually backed by the physical assets represented. Consumers can also independently verify whether or not the bank truly has the physical asset prior to purchasing it.

This enables all parties to view the exact same information with no room for confusion or misinterpretation, building additional trust within the financial community toward Islamic banking as a viable alternative to conventional finance.

Quantified Before-and-After Impact by Product Type

Many discussions of smart contracts focus on general benefits, but Islamic banks also need clear numbers. Showing measurable improvements by product type makes the value easier to understand and justify.

Below is a simple benchmark view based on real operational patterns:

Murabaha settlement:

Traditional process: ~10 days

Smart contract process: ~36 hoursIjara onboarding:

Traditional process: ~5 days

Smart contract process: Same daySukuk issuance:

Traditional process: 6–9 months

Smart contract process: 4–6 weeks

These improvements come from automated ownership checks, faster approvals, and real-time compliance enforcement.

Table Operational Impact Benchmarks by Product

Shariah Principles in Smart Contract Code

1. Prohibition of Riba (Interest)

Islamic law does not allow profit from lending money alone. Profit must come from trade, leasing, or asset ownership.

Smart contracts enforce this by calculating returns based on asset value or performance, not on time. The contract records the asset cost and profit margin separately and blocks any transaction where returns depend only on delayed payment.

2. Real Asset Ownership Requirements

Islamic finance requires banks to own assets before selling or leasing them. Smart contracts verify asset registration and ownership transfer on blockchain before allowing any sale.

They also maintain a continuous link between Sukuk certificates and their underlying assets. This prevents certificates from being issued without proper backing.

3. Profit-Loss Sharing Rules

The application of smart contract in Islamic finance is to ensure the distribution of profit/loss of an investment as it occurs in real time, in compliance with the principles of Shariah law, unlike traditional contracts which allocate a fixed percentage of profits to investors based on their participation in the investment regardless of its financial performance.

In the event of loss, Shariah principles allocate the loss to those who have provided the capital. As a result, each participant is treated fairly and transparently.

Smart Contract Design for Shariah Compliance

1. Blockchain-Based Asset Registry

An on-blockchain registry is an information repository that contains evidence of an owner of a physical asset and identifies each asset with a unique identifier on blockchain, which connects to information such as ownership documentation, valuation data, and compliance status. This provides a central location of the truth about who owns what.

2. Shariah Compliant Rule-based Profit Calculations

Shariah compliant smart contracts have rules for calculating profits built directly into their coding. These contracts use the data from each asset, perform the same calculation consistently across multiple transactions, and transfer the calculated amount of money without user intervention.

3. Permanent Ledger Entries

Once a ledger entry is made on blockchain, it cannot be modified or deleted so all entries related to an asset are permanent; including all entries related to the sale of the asset and all entries related to the funding associated with the purchase of the asset. All entries can be audited at any point throughout the life of the asset that was sold.

Smart Contract System Architecture

Asset Registry Contracts

These contracts store official records of physical assets. They require proof of ownership, track ownership transfers, and allow other contracts to verify asset status.

Product Logic Contracts

These contracts manage product-specific rules:

Murabaha: The contract has a cost-plus-profit pricing mechanism and an ownership transfer of the commodity.

Ijara: The contract has a leasing schedule, with an ownership transfer of the commodity at the end of the leasing term.

Sukuk: The contract is a link between investment certificates and the performance of the asset.

Payment Settlement Contracts

Settlement contracts hold money in escrow until certain conditions are satisfied (i.e., when payment will be made). Settlement contracts ensure that payments are made either completely or not at all and that settlement proceeds can be distributed among multiple parties simultaneously.

Audit and Reporting Modules

To ensure smart contracts are always compliant with Islamic law and financial regulation, strong governance is required. Governance in Islamic banking does not function under a single governing body. Instead, it functions using a multi-layer, permissioned governance model. Each layer of governance includes roles, approval processes, and limitations. No one entity will have complete control over the system at all times.

Governance and Shariah Board Control

Strong governance is critical to ensure that smart contracts always follow Islamic principles and financial regulations. In Islamic banking, governance does not rely on a single authority. Instead, it uses permissioned, multi-layer governance, where Shariah oversight and institutional financial governance work together. Each layer has clear roles, approvals, and limits, and no single party can control the system alone.

Dubai Islamic Bank’s governance model shows how this works in practice. DIB operates a Shariah Supervisory Department and a Shariah Coordination Department that oversee products from early design to post-transaction audit. At the same time, the bank’s executive management, risk, compliance, and IT teams handle financial, operational, and regulatory governance. Smart contracts sit at the center of these two governance layers and must satisfy both.

Shariah Governance Layer

The Shariah governance layer is led by the Shariah Board and supported by internal Shariah departments. This layer defines what is allowed under Islamic law and approves how those rules are written into smart contracts.

The Shariah Board:

1. Determines Shariah rules and regulations for the Murabaha, Ijara and Sukuk product lines.

2. Reviews the smart contract to determine if it contains interest; if title transfers to the buyer; and if profits are allocated consistent with Shariah principles.

3. Reviews and Approves the profit allocation methods; the method of transferring asset ownership; and the terms of the transaction.

4. Has total authority to either accept or reject any changes to the smart contract related to Shariah compliance.

All modifications to a smart contract must have prior Shariah approval before the smart contract may be deployed or updated. By doing this, religious compliance is enforced through design, and will never be reviewed or evaluated after the smart contract has been executed.

Institutional and Financial Governance Layer

The Institutional Governance Layer (IGL) is focused on Financial Control, Risk Management, Technology Security and Regulatory Compliance. It provides a safe operating environment for Smart Contracts to run in a Banking & Legal framework.

It consists of:

- Executive Approval for Product Deployment

- Reviewing Operational and Regulatory Exposure by Risk & Compliance Teams

- Managing Infrastructure, Access Control and System Stability by IT & Security Teams

- Monitoring Execution & Reporting by Audit Teams

Collectively these controls will provide assurance that Smart Contracts are both Shariah compliant as well as being financially stable and operationally robust.

Permissioned Blockchain and Access Control

Smart contracts for Islamic banking usually run on permissioned blockchain networks. This means only approved institutions, systems, and users can deploy contracts or submit transactions.

Additionally, since the system uses a permissioned blockchain architecture:

- Only authorized banks and partners can interact with contracts.

- Unauthorized parties cannot replace Shariah compliant contracts with non-compliant versions.

- All sensitive financial information is restricted from viewing by unapproved participants.

Thus, this structure allows for tight controls to be put in place, while at the same time, automating many tasks associated with creating a Shariah compliant sukuk.

1. Pre-deployment Review Process

Before a smart contract can be launched on a live environment, it must have gone through two governance layers (the Shariah board and the financial and technical teams). The Shariah board reviews the contract's code, as well as the profit formulas, and the rights of the owners; at the same time, the financial and technical teams review how the system will operate when it runs, including the risks associated with this operation, and how secure it will be.

The technical team has reviewed sample transactions to demonstrate that the contract performs correctly for both normal and abnormal transactions. A written approval from the Shariah Board and institutional management is needed before the contract can go into production.

2. Multi-signature Controls

In multi-signature wallets, there is a requirement for joint authority. There is a necessity to have approval of more than one person in order to deploy or modify a smart contract.

Generally:

Members of the Shariah Board will be designated as signatories with the authority to require signatures

Senior leadership and/or those responsible for compliance will provide approval for financial matters

The technical team can only execute the deployment of the smart contract once they receive all necessary approvals

The purpose of this multi-signature process is to prevent an individual from making unilateral changes and protecting both the Shariah and financial aspects.

3. Change Management

Smart Contract upgrades have to go through the exact same approval processes that were required for the original smart contract launch. The proposed changes will be evaluated for religious compliance by the Shariah Board and for financial and operational risk by the institutional teams.

The upgrade mechanisms of these smart contracts ensure they may evolve in their functionality but retain all historical transaction data. Authorized users can temporarily stop the execution of a smart contract if it is found to exhibit unforeseen, non-compliant behaviors.

By using this permissioned and layered governance model, we will ensure our smart contracts continue to be trusted, compliant, and consistent with both the principles of Islam and the regulations of banks at all times.

Integration with Banking Systems

For smart contracts to work in real Islamic banking, they must connect smoothly with the bank’s existing technology. This allows banks to use blockchain without replacing their core systems for accounts, payments, and accounting.

1. Core Banking Connection

Smart contracts communicate with a financial institution's core banking systems through an Application Programming Interface (API) gateway. The API gateway acts as a "gatekeeper" for how data is passed from the blockchain to the bank's back-office systems, including customers' account information and their lending history.

Examples of common API gateways that are utilized in this way include Apigee, AWS API Gateway, and Azure API Management. Utilizing these types of solutions helps financial institutions handle access and the security aspects of the API, as well as provide visibility and auditing capabilities.

In addition to the API Gateway there is also a Middleware Layer that acts as a translator between the Blockchain and the Core Banking System. The Middleware Layer is responsible for converting the format of the data exchanged between the two Systems so that they can interpret the data appropriately. For instance, it may convert Blockchain Transaction Data into a format that is usable by systems such as Temenos or Oracle Flexcube. The use of Middleware removes the need for manual data input and ensures that all of the relevant records remain consistent.

2. Oracle Integration

Oracles are systems that bring real-world information onto the blockchain. Smart contracts cannot see the outside world on their own, so they rely on oracles for trusted data.

In Islamic banking, oracles are commonly used to:

Confirm asset delivery from shipping and logistics companies

Verify ownership transfer

Provide market price data

The most common oracle technologies are Chainlink, Pyth, or bank-controlled private oracles which connect to third-party systems (i.e., shipping platform, customs database, or provider of valuations) for all data updates that provide evidence that the provided data is correct and has not been altered since its last update.

3. Payment System Integration

Smart contracts are used as triggers within systems that banks have in place for payment systems, rather than replacing them entirely. Once a payment condition is met by a smart contract, the smart contract will send a payment request to a payment gateway; which then converts the blockchain-based request into the format that banks use for payments and then sends the request via SWIFT, ACH, or other local real-time payment systems (such as RTGS).

Following the completion of the payment process, the payment status will be returned to the blockchain, thus keeping the smart contract records up-to-date.

4. General Ledger Synchronization

All transactions occurring with respect to a smart contract must also be recorded in the bank's accounting system. The bank monitors this for each smart contract using event listeners that identify all of the activity on the blockchain.

Whenever the smart contract indicates a payment was made, an ownership change occurred, or there were profits calculated, the event listener will capture the information and create accounting entries based upon that data. Those accounting entries will then be automatically posted to the bank's general ledger, i.e., its financial software package (SAP, Oracle Financials, etc.).

As a result, the bank's financial records will always be current, the amount of time spent reconciling transactions will decrease, and compliance with audit requirements and government regulations will increase.

Blockchain Networks Used

Islamic banks usually deploy smart contracts on permissioned blockchains, not public networks. Common choices include Hyperledger Fabric, R3 Corda, or permissioned Ethereum networks. These platforms allow banks to control who can access the system while still benefiting from blockchain transparency and automation.

Murabaha Implementation: Dubai Islamic Bank Case Study

Murabaha is a type of cost-plus financing that is based on the principles of Islamic banking. In the Murabaha model the bank purchases an asset and then resells it to the customer at the original cost of the asset plus an agreed upon profit. The profit is predetermined, is transparently communicated, and can be paid for all at once or over time. No interest is permitted under the Murabaha model.

The Dubai Islamic Bank (DIB) has been operating as a Sharia-compliant bank since its inception in the UAE and is by far the most experienced with more than thirty years of history. The Dubai Islamic Bank utilizes Murabaha through blockchain technology primarily in the trade finance space. Through smart contracts the Dubai Islamic Bank is able to automate verification of asset ownership, price transparency, and settlement of payments.

DIB operates a full Shariah Supervisory Department and a Shariah Coordination Department. These teams are involved in product design, documentation review, approval, and post-transaction audits. In December 2024, DIB partnered with Crypto.com to integrate blockchain technology into Islamic banking services in a fully Shariah-compliant way.

DIB’s Murabaha Structure

In DIB’s Murabaha contracts, the bank sells assets at cost plus an agreed profit. The system clearly separates the asset cost from the profit margin in all documents and smart contract logic. This ensures transparency for customers, auditors, and Shariah boards.

Step 1: Customer Request

A customer uses the banks on-line portal to submit an order request. The order request contains information about the products, suppliers and the estimated delivery date. DIBs credit department verifies that the customer has sufficient financial capability for the transaction, while DIB's compliance departments verify that the product does comply with Islamic rules.

Smart Contract Functions:

1. The Product Eligibility Contract will confirm that the product is Shariah compliant.

2. The credit module will pull up the customer’s profile information from their account file.

3. The pricing logic will determine the profit margin based on the limits set by the Shariah Board.

Step 2: Asset Purchase and Registration

DIB acquires an asset from the vendor; a procurement officer then registers the asset on the blockchain, which contains information about the cost of acquisition, description, and documentation of ownership by DIB.

Smart Contract Actions:

The Smart Contract validates the data registered in the Asset Registry to ensure DIB is the legal owner of the asset prior to being allowed to sell the asset again.

Step 3: Price Calculation and Agreement

The Smart Contract calculates the final sales price as the asset cost plus the approved profit margin. The Customer reviews the complete breakdown and accepts the agreement digitally.

Smart Contract Actions:

The contract separates costs and profits, thus providing a permanent record for auditing.

Step 4: Ownership Transfer

Once the buyer has accepted the terms of the smart contract, the smart contract will transfer ownership from DIB to the buyer. This event will then be recorded on the blockchain by the time, price and parties involved in the sale.

Smart Contract Actions:

Due to the fact that this is a one-way transfer, the transfer of ownership is irreversible and therefore creates a dependable compliance history for all parties.

Step 5: Payment Settlement

The buyer will pay a deposit (down payment) in an escrow contract. At the completion of the ownership transfer, the funds are paid out. Should the buyer need to delay payments, the contract will create a payment plan as well as track each individual payment.

Smart Contract Actions:

Due to the nature of the escrow, it protects the buyer's rights. It also automatically updates the payment plan. The buyer can make early payments with adjustments made according to the principles of Sharia law.

Step 6: Confirmation of Delivery

Once a delivery oracle verifies the shipping status of an asset (i.e., confirms it was delivered), the remainder of the payment will be released by the smart contract.

Smart Contract Actions:

Smart contracts confirm receipt of delivery data; Payment to be released automatically; Transaction will be marked as completed.

Step 7: Continuous Auditing for Compliance

An auditing module will continually monitor to ensure that the transfer of ownership occurred prior to the payment and that the profit did not exceed the approved limits.

Smart Contract Actions:

Audit contract collects data from all other modules; Audit contract performs automated compliance monitoring; Audit contract generates monthly reports for Shariah Board approval.

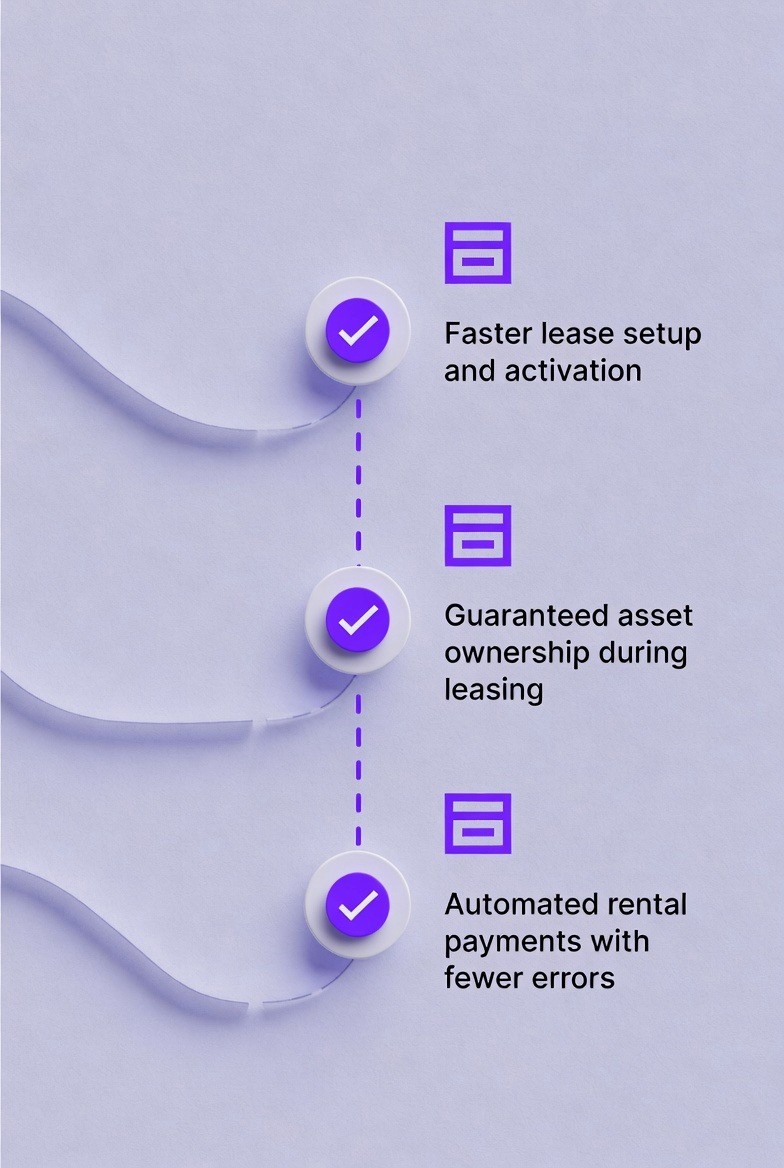

Ijara Implementation: Dubai Islamic Bank

Ijara is an Islamic leasing model where the bank owns an asset and leases it to a customer. Dubai Islamic Bank offers Ijara for both personal and corporate financing, including education, healthcare, travel, equipment, machinery, and real estate.

DIB’s Ijara Products Implementation:

Service Ijara for Personal Finance

DIB leases service from providers who have been approved by DIB (for example schools, hospitals, travel agencies), and provides the service to its customers on an installment basis allowing customers to obtain the use of important services at a Shariah compliant price.

Asset Ijara for Businesses

DIB acquires the necessary equipment, machinery or real estate and leases them to businesses. As part of the leasing arrangement, the business pays DIB for both the cost of the asset and the profit realized by DIB over time. When the leasing arrangement ends, the business has the option to buy the asset for a price established in a separate sale agreement.

Diminishing Musharakah with Ijara

The bank and the customer will co-own the asset purchased and the bank will lease the percentage of the asset owned by the bank to the customer, while the customer purchases the banks percentage of the asset over time. This type of relationship is commonly used for large capital projects and/or long term investment opportunities.

Ijara Forward

DIB will finance the acquisition of an asset that is still being built. Customers will agree to purchase assets that have not yet been constructed and delivered; however, all aspects of the financing will be structured in compliance with Sharia law.

DIB’s Ijara Risk Management

DIB uses “Promise to Lease” agreements to manage customer commitment. Independent valuers confirm asset prices. Purchase contracts include guarantees about asset value. For lease-back structures, asset values are verified before acquisition.

Step 1: Lease Request

The customer selects an asset and lease period through the bank portal. DIB reviews creditworthiness and sets lease terms based on asset value and expected use.

Smart contract actions:

Eligibility checks confirm the asset qualifies for Ijara. Credit data is retrieved. Lease payments are calculated within Shariah limits.

Step 2: Asset Acquisition

DIB acquires the asset and registers it on the blockchain as “available for lease,” including price, lifespan, and maintenance details.

Smart contract actions:

The asset registry validates ownership and tags the asset for Ijara use.

Step 3: Lease Agreement

The smart contract generates the lease agreement. The customer reviews the terms, signs digitally, and deposits security funds into escrow.

Smart contract actions:

Lease payments are calculated without interest. Ownership and lease rights are recorded separately.

Step 4: Asset Delivery

The asset is delivered to the customer. Delivery is confirmed on-chain, and the lease officially begins.

Smart contract actions:

Delivery confirmation activates the payment schedule and updates asset status.

Step 5: Ongoing Payments and Maintenance

The customer pays rent monthly. DIB remains responsible for major repairs. All maintenance events are recorded.

Smart contract actions:

Payments are tracked automatically. Maintenance records are stored on-chain.

Step 6: Lease Conclusion Options

At lease end, the customer may return, renew, or purchase the asset.

Smart contract actions:

The selected option is executed automatically, and records are permanently stored.

Step 7: Compliance Monitoring

The Audit Module has been designed to verify ownership of the Asset (DIB) at all times during the lease period, in addition to verifying compliance to the principles of Shariah as they relate to payment terms.

Sukuk Implementation: Dubai Islamic Bank

Dubai Islamic Bank is currently working on a Blockchain based Sukuk solution with Crypto.com which will utilize asset tokenization to provide for automatic distribution of Sukuk holders’ profits and provide transparency in profit calculation.

DIB’s Sukuk Innovation Approach:

Sukuk Tokenization Program

The DIB Sukuk tokenization program will convert Sukuk and other real-world assets to be represented as a digital asset on the blockchain. The use of blockchain will allow for fractional ownership of Sukuk; increase the liquidity of Sukuk and significantly reduce the time and cost associated with issuing Sukuk.

Increased Access to Markets

The use of blockchain technology to represent Sukuk as tokens will open up access to Sukuk investments to small investors who had been unable to invest in Sukuk due to their size.

Traceability of Assets

Each Sukuk remains backed by its original asset(s) and all Sukuk issued through this platform will have traceable assets backing them. All structures are compliant with AAOIFI Standards and are reviewed by the Shariah Supervisory Department of DIB.

Implementation through Collaboration

DIB has over 30 years of institutional scale experience which is being applied to the development of blockchain Sukuk and includes major Ijara-based issuances.

DIB’s Governance for Sukuk Blockchain Integration:

All blockchain Sukuk projects are reviewed and approved by the Shariah Board. Smart contracts automate approved structures, while board members retain full authority over logic and design.

Step 1: Asset Pool Formation

DIB selects revenue-generating assets, confirms ownership, values them, and registers them individually on the blockchain.

Smart contract actions:

Assets are validated, pooled, and protected from double use.

Step 2: Structure Design and Approval

DIB defines the Sukuk type, profit method, and maturity terms, then obtains written Shariah approval.

Smart contract actions:

Profit logic is encoded and locked by multi-signature approval.

Step 3: Certificate Issuance

Investors subscribe to the Sukuk and receive blockchain tokens representing ownership.

Smart contract actions:

Tokens are minted, funds are escrowed, and asset linkage is maintained.

Step 4: Asset-Certificate Linkage

The system continuously checks that certificates remain fully backed by assets.

Smart contract actions:

Alerts trigger if backing rules are violated.

Step 5: Profit Distribution

Asset income is collected, expenses are deducted, and profits are distributed proportionally.

Smart contract actions:

All calculations and payments are automated and recorded.

Step 6: Periodic Reporting

Reports are generated automatically for investors, auditors, and regulators.

Step 7: Maturity and Liquidation

At maturity, assets are sold or returned, final profits are distributed, and certificates are closed.

Step 8: Continuous Compliance

Automated checks run daily, weekly, monthly, and annually to ensure full Shariah compliance across the Sukuk lifecycle.

The Outlook

Islamic banking is changing quickly. As banks handle more transactions and offer more products, manual processes are no longer enough to support strict Shariah compliance. Banks need to work faster, control costs, and meet higher expectations from regulators, investors, and customers.

Smart contracts provide a clear solution. By placing Shariah rules directly into the system, banks can check compliance while transactions happen, not after they are finished. This reduces delays and mistakes. It also builds trust, because every transaction is recorded clearly and cannot be changed later.

In the future, Islamic banks that adopt smart contracts early will be in a stronger position. They will be able to launch products faster, reduce risk, and show clear proof of Shariah compliance at all times. As regulators become more familiar with blockchain systems, smart contracts are likely to become a standard part of Islamic banking operations.

How TokenMinds Helps with Shariah-Compliant Smart Contract Development

TokenMinds helps Islamic banks design and build smart contracts that follow Shariah rules and work smoothly with existing banking systems. The focus is not only on technology, but also on governance, transparency, and long-term use.

By working closely with bank teams and Shariah boards to clearly understand product rules and approval processes. This ensures Islamic requirements are agreed on before any code is written. Smart contracts are then built to follow these approved rules exactly.

TokenMinds also helps banks set up clear governance. This includes defining how Shariah boards, management, risk teams, and IT teams approve, deploy, and update smart contracts. Permissioned access, multi-signature controls, and audit features are included from the beginning.

Finally, TokenMinds supports system integration. Smart contracts are connected to core banking systems, payment platforms, and reporting tools. This reduces manual work and keeps data consistent. By combining Islamic finance knowledge with blockchain expertise, TokenMinds helps banks implement smart contracts that are simple to use, secure, and ready to scale.

Conclusion

Shariah compliant smart contracts assist Islamic banks in expanding their business without violating Islamic law. Smart contracts build Shariah rules into the transaction allowing the bank to automatically confirm title (ownership), calculate earnings, pay, or settle as well as ensure that Shariah laws are followed in real-time.

Smart contracts reduce cost, speed transactions, and minimize Shariah law noncompliance risk. Smart contracts provide Shariah boards, auditors, and regulatory bodies with a permanent record of all transactions.

Schedule a complimentary consultation with TokenMinds to explore how your institution can implement Shariah-compliant smart contracts that improve efficiency, reduce risk, and maintain full alignment with Islamic finance principles.

FAQ

What makes a smart contract Shariah-compliant?

It follows Islamic finance rules in its code. It blocks interest, requires real asset ownership before sale or lease, and applies fair profit-loss sharing. Transactions only run after Shariah Board approval.

How do smart contracts improve Murabaha, Ijara, and Sukuk?

They automate checks, pricing, ownership transfer, and payments. This cuts processing time from weeks to hours, lowers costs, reduces errors, and enforces compliance in real time.

Why do traditional Islamic banking systems struggle?

They use separate systems, paper records, and manual reconciliation. This causes delays, higher costs, and greater risk of compliance issues.

How is Shariah governance enforced?

Shariah Boards approve contract rules before launch. Multi-signature controls and permissioned blockchains prevent unauthorized changes. Updates require the same approvals.

How do smart contracts integrate with banks?

They connect via API gateways and middleware to core banking, payments, and ledgers. Oracles supply real-world data, and event listeners keep records in sync.

Why use permissioned blockchains?

They limit access to approved parties, protect sensitive data, and support audit and regulatory needs while preventing non-compliant actions.