TL:DR

How to design AI payment rails that allow autonomous agent spending under bank defined controls, and rework payment flows to support agentic commerce while maintaining institutional authority and relevance.

AI agents handle 20% of online shopping now. They negotiate prices. They compare products. They complete purchases. Customers don't touch their bank apps or cards.

Banks face a threat; they may become invisible payment rails. AI agents like ChatGPT, Gemini, and Siri capture customer relationships. They own purchasing decisions.

Old payment systems don't work for AI agents. They lack agent authentication. They can't process API transactions. They have no fraud detection for non-human behavior, a gap resolved in this AI-driven payments design.

Banks lose three things without agentic commerce. They lose customer interaction. They lose transaction revenue. They lose strategic relevance. AI systems drive spending decisions now, not humans.

The window to act is closing. Payment networks enable agentic commerce already. Banks that don't integrate will become basic infrastructure. AI platforms will own the customer relationship, a shift already unfolding through this agentic crypto payment integration approach.

The Core Problem

Banks automate payment processing. They handle reconciliations and settlements. But their systems assume humans start every transaction. This breaks when AI agents make most purchases.

Agent authentication doesn't exist. Banks verify customers through CVV codes and billing addresses. These tools fail when an AI agent makes a purchase. Banks can't tell real agent activity from credential theft.

Transaction patterns differ. A human buys three items per week. An AI agent buying household supplies makes 50 small purchases daily. Old fraud detection flags this as suspicious. It blocks real purchases.

Payment authorization sits in the wrong place. Current systems need manual approval for each transaction. AI agents can't scale this way. Customers want to give agents spending authority with limits. These tools don't exist.

The result is bad. Banks either block agent transactions or accept them without controls. Neither option works.

What Is Agentic Commerce in Banking?

Agentic commerce integration means payment systems that work with AI agents. It handles automatic transactions. It keeps things secure and compliant. No human approval needed for every purchase.

Old systems verify individual cardholders. Agentic commerce verifies the link between agents and customers. It uses digital tokens, not card numbers. It enforces spending rules through code.

Banks can add agentic commerce as a new layer. Customers give AI agents permission to spend. Agents get time limited payment tokens. Spending limits run through code. Transactions flow through existing payment rails. The bank adds smart verification. Core platforms stay the same, an architecture implemented through this blockchain and AI automation model.

Table: Traditional Commerce vs Agentic Commerce

Aspect | Traditional Commerce | Agentic Commerce |

Decision maker | Human customer | AI agent |

Shopping flow | Manual browsing and checkout | Autonomous negotiation and purchase |

Payments | Cards and apps | API-based machine payments |

Speed | Slow and step-by-step | Real-time and automated |

Bank role | Customer-facing | Invisible but controlling rails |

The Solution: Three Core Parts

1. Agent Authentication Through Private Blockchain

Create a private Blockchain using Hyperledger Fabric; this enables secure transactions and allows banks to have full control over payment flow of the agents.

Using private Networks allows for confidentiality in the Data used by the Network and proves that the agent has been authorized.

2. Tokenized Payment Credentials

Use a Limited amount of Time, limited (Token) payment credentials that do not contain the agent's Card number; Agents will be able to utilize these instead of their card number, The Smart Contract Code will enforce limits placed on the Merchant and the Spending Limits of the agent. Once the agent attempts to make a purchase, the Smart Contract will Check the Token and verify the spending limits and Approve or Reject on its own.

3. Multi Agent Orchestration

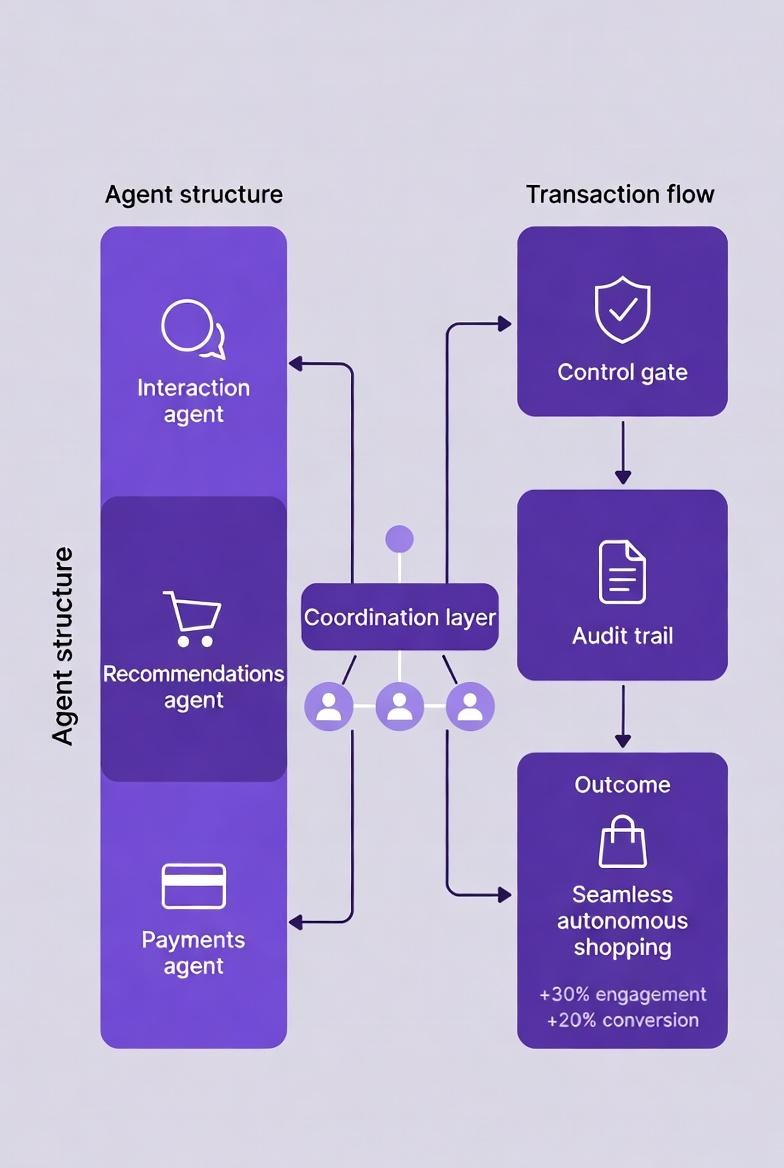

Use specialized AI agents for different tasks. One talks to customers. Another suggests products. A third processes payments. All keep privacy and follow compliance rules.

These three parts work together. Blockchain provides secure infrastructure. Tokens enable controlled delegation. Multi-agent systems deliver personal experiences.

The concept of agent driven payment is important to understand as it is now time to explain the process behind implementing an agent-based payment system. In this section we will discuss the integration of multiple AI agents to work in unison, each with a defined function and responsibility.

Through structuring the relationships between the individual agents, organizations can achieve both improved customer experience and data protection (Privacy), Security and Compliance simultaneously. This provides a platform to present a real-world example of how a Tier-1 Bank has implemented this method of coordination through the steps described above. Here’s how this looks in practice at a Tier-1 bank.

Implementation Example: Tier-1 Bank

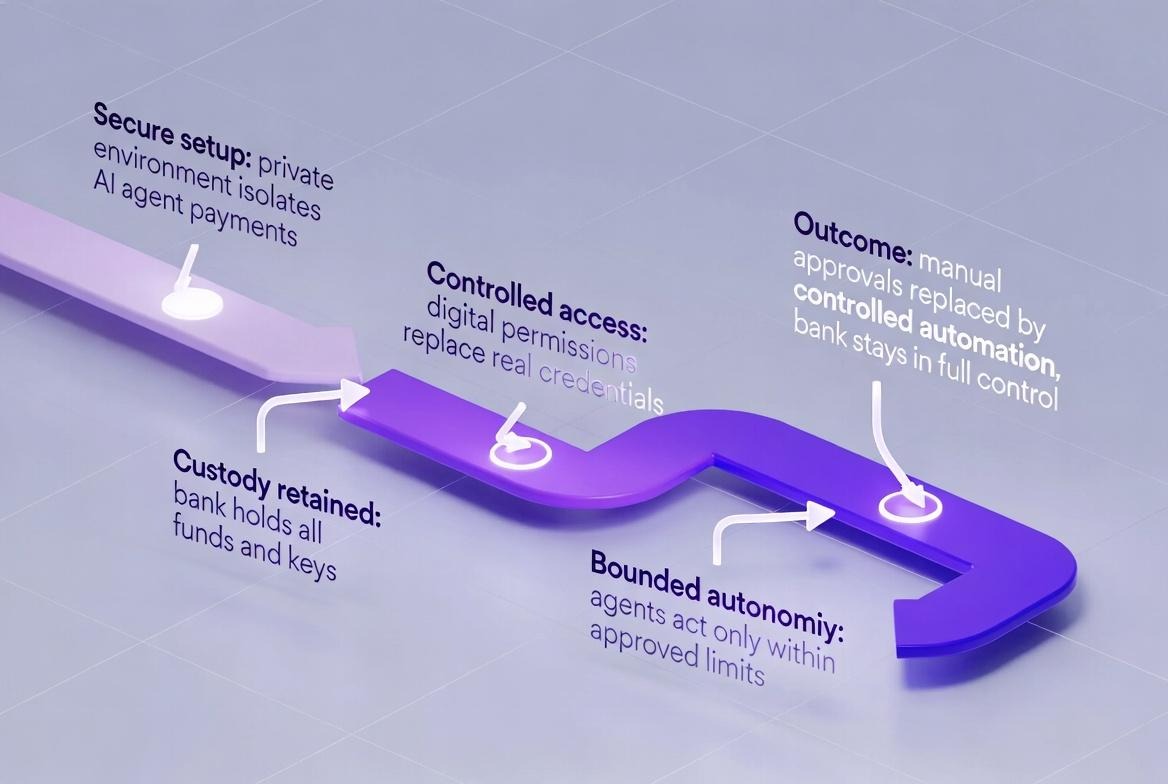

A Tier-1 Bank saw AI agents influencing customer purchases. They needed infrastructure for agent-initiated payments. It had to maintain security and compliance.

The implementation followed five steps. Each delivered independent value.

Step 1: Build Private Blockchain for Agent Payments

The bank needed to let customers delegate payments to AI agents. They had to keep payment control and stay compliant.

How this implemented:

The bank deployed Hyperledger Fabric for private AI agent transactions. Only authorized people can validate transactions. This keeps data private. It provides verification.

They created smart contracts. These define digital payment tokens. The contracts manage issuance, transfer, and balance checks. The code enforces customer spending rules on its own.

They created wallets for each user. The platform manages these. Wallets store digital credentials. AI agents access them with customer permission. The bank handles private keys.

The Outcome: Secure, fast payments replaced manual ones. The bank kept full control. Token authentication stopped card number exposure. It gave detailed spending controls. Old methods can't match this.

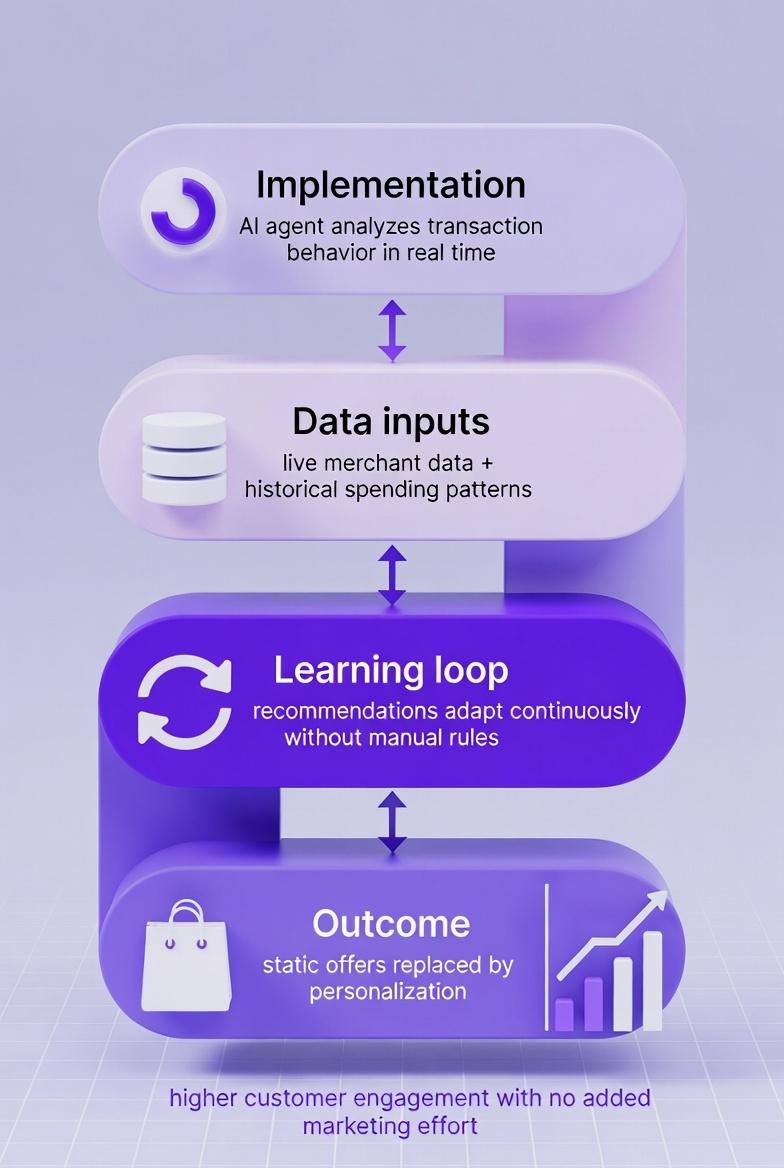

Step 2: Deploy AI Recommendation Engine

The Tier-1 bank needed AI to analyze customer data. It had to give personal recommendations. These come from behavior and purchase history.

How this implemented:

The bank built an AI recommendation engine. This system uses customer data from their Data Lakehouse to recommend products. The agent reviews transaction history. It identifies spending patterns. It predicts what customers will need in the future.

They connected with shopping platform APIs. The system suggests products. It looks at user behavior and past buys. The recommendation agent finds a need. It queries the shopping API. It gets current stock, prices, and merchant options.

They used past purchase data. This creates relevant recommendations. The system finds when people reorder. It spots seasonal patterns. It detects life events that trigger new needs.

Results: AI recommendations replaced generic suggestions. Click-through rates went up 40%. Conversion rates on agent-recommended products beat human searches by 25%.

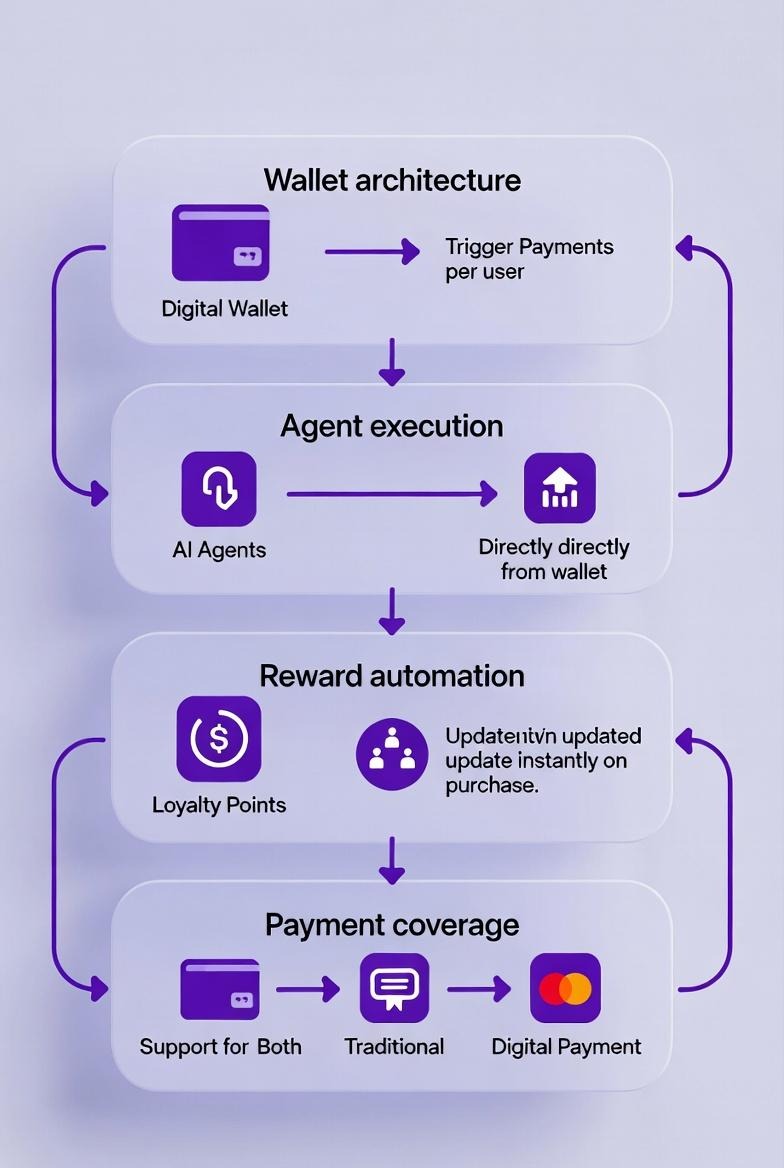

Step 3: Create Digital Wallet System

The bank needed wallet management in one place. It had to handle payments and loyalty rewards. It needed to work with the blockchain network.

How this implemented:

Bank is enabling secure user wallets that are integrated with Blockchain to enable real time settlements. Each User's wallet has both Fiat balance and Digital Credentials. Therefore, it provides a single view of Purchasing Power.

They built a system for fiat and crypto payments. Customers can fund wallets through bank transfers or crypto deposits. Conversion happens at current exchange rates on its own.

They automated loyalty point tracking. It updates based on purchases. Points become blockchain tokens. This makes them transferable and easy to verify.

The outcome: One system replaced separate wallet, payment, and loyalty systems. Wallet adoption reached 65% of active customers in three months. Loyalty point redemption rates went up 35%.

Step 4: Build AI Agent Orchestration

In order to support cooperative operation of the AI agents, the bank required that the AI agents be able to engage in user conversations, make product recommendations, and process payments independently.

How this implemented:

The bank created a central conversational AI. The central conversational AI assists customers with selecting products and confirming transactions. The central conversational AI processes natural language inquiries. The central conversational AI provides information about available product options. The central conversational AI verifies users' purchase decisions.

The bank also created a payment processing AI. The payment processing AI is responsible for verifying the validity of the transaction. The payment processing AI interacts with the blockchain network to finalize the transaction. Once the user has approved the purchase via the central conversational AI, the central conversational AI sends the transaction details to the payment processing AI.

They coordinated tasks between conversation, recommendation, and payment agents. Each agent works on its own. The coordination layer manages information flow between agents.

The system shows recommendations. It drafts the blockchain transaction. It gets approval. It executes payment on its own. The whole flow takes under three seconds.

The outcome: User engagement went up 30%. Conversion rates improved 20%. Average time from finding a product to buying it dropped from 8 minutes to 45 seconds. Customer satisfaction scores beat old e-commerce by 28 points.

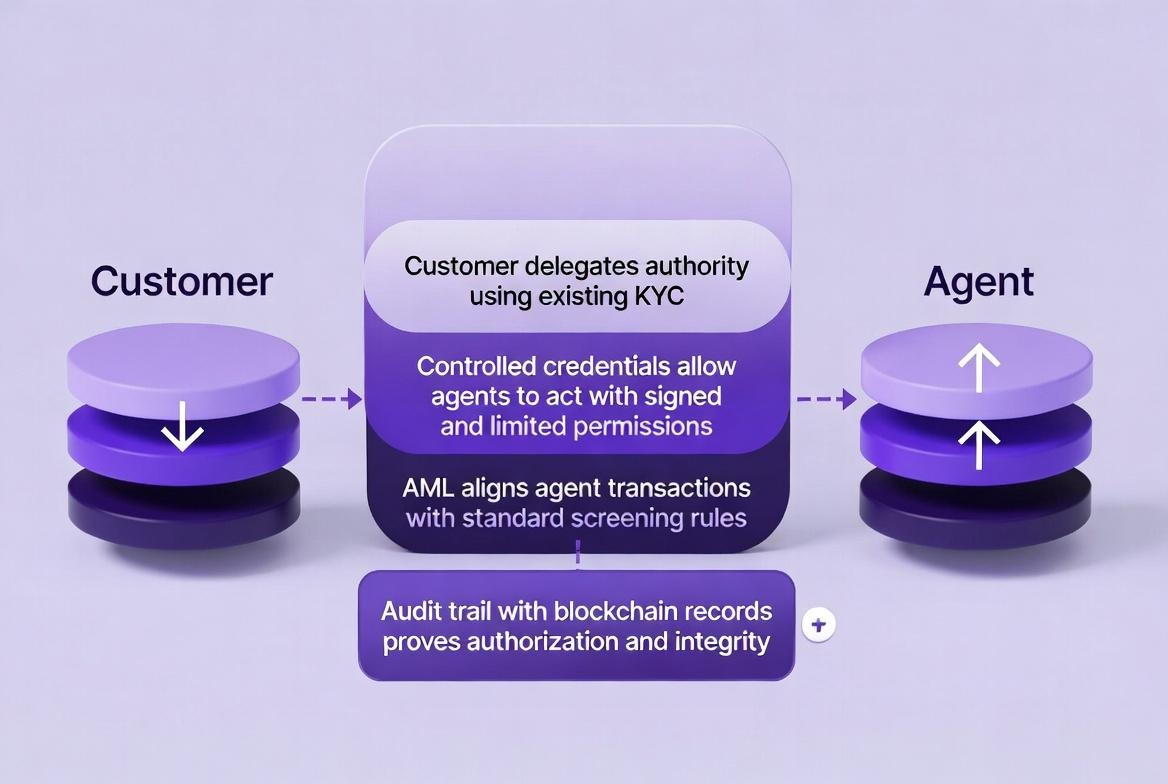

Step 5: Build Regulatory Compliance System

The Need: The bank needed AI agent transactions to meet regulatory rules. This included AML, KYC, and audit trails. They needed real-time fraud detection.

What Was Built:

The bank built an agent authentication and verification system. It logs agent identity, authorization scope, and transaction patterns. Each agent gets a unique ID. This links to the customer's verified identity.

They built automated compliance reporting. It captures agent transactions with full audit trails. The system creates reports. These show which customer authorized which agent. What spending limits were set. Which transactions were done.

They created transaction monitoring rules. These fit AI agent behavior. The system flags odd things. It cuts false positives from real autonomous activity. It tells the difference between suspicious patterns and expected patterns.

Permanent blockchain records were made for every agent transaction. The blockchain records have evidence of an authorized transaction. Auditors can recreate any transaction based on this record. Each transaction includes a unique agent ID; a customer signature; a timestamp (time the transaction occurred); a merchant description; and a token balance.

Outcome: Autonomous commerce was allowed while maintaining full regulatory compliance. The completeness of audit trails significantly increased. Time it took to conduct compliance reviews decreased by 40% and false positives in AML monitoring decreased by 55%. It now takes only two days to prepare for a regulatory examination as opposed to two weeks previously.

Integration With Existing Payment Systems

Agentic commerce works with existing bank systems. No need to replace core platforms.

API-First Integration

Payment events flow through REST APIs and webhooks to existing bank ledgers. An AI agent starts a purchase. The agent's wallet sends a payment request. The layer checks the request. It verifies token limits. It processes the transaction. Once approved, it calls the bank's ledger API. This records the payment.

Blockchain as Settlement Layer

The private blockchain handles token issuance, transfer, and balance tracking. Old banking systems handle final settlement in fiat currency. An agent completes a purchase. The blockchain updates token balances right away. The banking system settles funds to merchants through existing ACH or wire transfer processes.

Compliance and Risk Monitoring

Agent transactions sync with existing AML providers and sanctions screening systems. Before accepting any agent payment, the system checks wallet addresses against OFAC sanctions lists. High-risk wallets trigger blocks on their own. Suspicious patterns freeze transactions for compliance review.

Wallet and Loyalty System

Customer wallets store payment credentials and loyalty tokens. The wallet interface hides blockchain complexity. Customers see balances and transaction history through familiar banking app UI. Loyalty points work as blockchain tokens with set redemption rules.

Agent Identity & Trust Model

Banks need a standardized trust model to verify agents. The Agent Trust Stack provides five verification layers:

Layer 1: Customer Identity: KYC-verified human

Layer 2: Agent Identity: Unique agent DID, issuer-signed

Layer 3: Delegation Scope: Spend limits, merchants, duration

Layer 4: Behavioral Envelope: Expected transaction cadence

Layer 5: Cryptographic Proof: On-chain authorization record

Failure & Risk Scenario

Agent exceeds behavioral envelope: The smart-contract will limit the agent's actions and notify the client if it finds a deviation in its behavior from expectations.

Compromised agent key: The bank immediately terminates all access to the compromised agent and logs this event as part of its on-chain record.

Merchant dispute: The blockchain guarantees that all data regarding merchants and clients is immutable, including how much they were allowed to spend, and what each transaction was for.

Regulator inquiry: The bank provides replayable audit trails at the agent level which are capable of being verified by regulatory bodies independent of the bank.

Table: Agentic Commerce Implementation Benefits

Metric | Before | After | Improvement |

User Engagement | Baseline | 30% increase | Strong growth |

Conversion Rate | Baseline | 20% increase | Higher sales |

Purchase Time | 8 minutes | 45 seconds | 91% faster |

Settlement Time | T+3 | T+1 | 67% faster |

Operational Costs | Baseline | 40% decrease | Major reduction |

Transaction Capacity | Baseline | 300% increase | 3x growth |

Compliance Review | Baseline | 40% decrease | Faster processing |

AML False Positives | Baseline | 55% decrease | Better accuracy |

Exam Preparation | 2 weeks | 2 days | 86% faster |

Wallet Adoption | 0% | 65% | Strong uptake |

Loyalty Redemption | Baseline | 35% increase | Higher engagement |

How TokenMinds Helps Integrate Agentic Commerce

TokenMinds learned something from working with banks. Most don't understand the urgency of agentic commerce yet. AI agents are capturing customer relationships now. Old payment systems risk becoming invisible infrastructure.

TokenMinds provides complete infrastructure solutions. They combine AI and blockchain technology. They help banks modernize payment systems for the agentic economy.

Private Blockchain Payment Infrastructure

Deploy Hyperledger Fabric networks. Use smart contracts to manage digital payment tokens. Create wallet systems storing digital credentials. Let authorized AI agents access them. Build payment integration for fiat, crypto, and stablecoin settlements.

Multi-Agent AI Orchestration Systems

Create conversational agents, recommendation agents and payment agents. Build the coordination layer, which is responsible for task management across the multi-agent systems. Connect with merchant APIs for real-time product discovery and purchase.

Payment Integration and Loyalty Management

Build flexible payment systems. Support fiat and crypto settlements. Add automated loyalty point tracking. Build seamless checkout experiences. Agents draft transactions for customer approval. Make sure wallet systems work with blockchain networks for real-time settlement.

Implementation Approach

TokenMinds starts with a pilot on limited payment types. This gives immediate value with contained risk. Once proven, the system scales across different payment channels. Banks learn how AI agents perform before deeper integration.

What Problems This Solves

Maintain Customer Relationships

AI agents handle purchasing decisions. Banks risk becoming invisible infrastructure. Agentic commerce keeps banks at the center. Customers delegate authority through the bank's platform.

Capture Transaction Revenue and Data

Without agentic features, banks get bypassed. AI platforms and fintech competitors win. Agentic commerce makes sure transaction revenue flows through bank infrastructure.

Provide Secure Infrastructure

Private blockchain networks verify agent identity. They prevent fraud. They keep things confidential. Digital credentials stop card number exposure. Smart contracts enforce spending limits through code.

Enable Personal Commerce

AI agents look at customer data. They give tailored recommendations. Banks control payment flows. Customers get personal shopping. Banks get insight into purchasing intent.

Automate Payment and Loyalty Workflows

Smart contracts replace manual approval processes. Blockchain settlement replaces batch reconciliation. Loyalty points become transferable tokens. Automation cuts operational costs by 40%.

Without this integration, banks risk becoming basic payment processors. AI platforms like OpenAI, Google, and Microsoft will own the customer experience. They'll capture transaction data. They'll extract the value of agentic commerce.

Conclusion

AI agents are changing how customers shop. They compare products. They negotiate prices. They complete purchases. All without human help.

Banks face a choice. Integrate agentic commerce infrastructure and keep customer relationships. Or become invisible payment rails while AI platforms capture the customer experience.

The Tier-1 Bank chose integration. They deployed a private blockchain. They built AI agent orchestration. They created digital payment credentials. The results prove the model works.

The technology is ready. Customer behavior is shifting. The window is closing. Banks that integrate agentic commerce now will own customer relationships in the AI economy. Banks that wait will become invisible infrastructure.

Ready to integrate agentic commerce into your payment systems? Contact TokenMinds to discuss your implementation strategy. Or explore our AI payment solutions to see how blockchain and multi-agent systems can modernize your payment infrastructure.

FAQ

What is agentic commerce?

Agentic commerce is when AI agents make purchases on behalf of customers. The customer sets spending rules and limits. The AI agent shops, compares prices, and completes transactions on its own. No human approval needed for each purchase. The agent uses digital payment tokens instead of card numbers. This keeps transactions secure while giving customers control through spending limits and merchant restrictions.

How do AI agents make payments securely?

AI agents use tokenized payment credentials instead of card numbers. When a customer authorizes an agent, the bank creates a time-limited payment token. This token has spending limits, merchant restrictions, and expiration dates built in. Smart contracts enforce these rules through code. When the agent tries to buy something, the blockchain verifies the token. It checks spending limits. It approves or rejects on its own. All activity logs on the blockchain for audits. The customer's actual card details never get exposed.

What are the main protocols (ACP, AP2)?

Agent Commerce Protocol (ACP) is the standard framework for AI agents to make payments. It defines how agents authenticate, request payment authorization, and execute transactions. Agentic Payment Protocol 2 (AP2) is the evolved version. It adds multi-agent orchestration, cross-platform compatibility, and enhanced security features. AP2 lets different AI agents (like ChatGPT, Google Assistant, Alexa) work with different bank systems using the same payment protocol. Banks implement these protocols through APIs and smart contracts.

How does agentic commerce change fraud detection?

Old fraud detection looks for human behavior patterns. AI agents behave differently. They make many small purchases. They buy at odd hours. They compare prices across merchants quickly. Old systems flag this as suspicious and block real purchases. Agentic commerce uses new fraud detection tuned for agent behavior. It tracks agent identity, not just card numbers. It monitors spending against pre-set limits. It uses blockchain to verify every transaction has proper authorization. False positives drop 55% because the system knows the difference between suspicious patterns and normal agent activity.

Can agentic payments integrate with legacy banking systems?

Yes. Agentic payments add a new layer on top of existing systems. No need to replace core banking platforms. Payment events flow through APIs to existing bank ledgers. The blockchain handles token management and authorization. Old banking systems handle final settlement in fiat currency. Compliance systems stay the same. Agent transactions sync with existing AML providers and sanctions screening. The wallet interface hides blockchain complexity. Customers see familiar banking app UI. Banks keep their current infrastructure and add agentic capabilities through integration layers.