TL:DR

How to use Canton to enable liquidity movement across independent institutions without merging systems by issuing real-world assets with programmable privacy and guaranteed full completion across multiple networks, reducing settlement risk and unlocking scalable institutional capital efficiency through a real DTCC implementation architecture, with the Canton network having over $300 billion in liquidity at the time of writing.

Tokenization promises faster settlement and better capital efficiency. But the real prize is liquidity. Trillions of dollars in assets sit locked in silos. They can't move fast enough. They can't cross institutional boundaries without risk. And they can't do any of this while staying private, a constraint directly addressed in this asset tokenization guide.

Canton Network was built to fix this. It is a privacy blockchain designed for regulated financial markets. It already handles over $6 trillion in assets. Daily transaction flows reach $280–300 billion. More than 400 major institutions are connected. Goldman Sachs, HSBC, DTCC, and the European Investment Bank use it in production today. Not in the pilot. In production.

Most blockchains force a trade-off. You get speed or privacy. You get connectivity or control. Canton removes that trade-off. Each institution keeps its own system. Data stays private. And transactions complete across all parties at the same time or not at all.

That last part matters most for liquidity. Collateral that used to take hours to move now moves in seconds. Capital that sat trapped in T+2 cycles gets freed in real time. And it all happens without forcing institutions to merge into one shared system.

The Core Problem

Banks want to tokenize assets. Real estate. Bonds. Treasuries. Commodities. But they keep hitting the same walls.

Public blockchains expose everything: Every balance. Every holder. Every trade. Competitors can see your strategy. Clients can see each other's positions. Compliance becomes impossible.

Compliance can't run on public rails: KYC checks happen off-chain. Investor eligibility needs manual review. Portfolio limits need constant monitoring. This creates risk. Unauthorized investors get in. Limits get breached. Regulators step in.

Performance breaks under institutional load: Gas fees spike. Transaction times slow down. Banks process millions of trades daily. They need guaranteed throughput and predictable costs. Most chains can't deliver.

Assets sit in silos: Different platforms use different standards. Cross-platform transfers need bridges. Bridges introduce risk. There is no atomic settlement across boundaries. Deliver versus payment fails. Reconciliation piles up.

The result is clear. Public chains were not built for regulated financial markets. Institutions need purpose-built infrastructure, a gap addressed through this AI-driven RWA management approach.

Canton Network provides it.

What is Canton Network?

Canton is a privacy blockchain built for regulated real-world assets. It combines the benefits of a shared ledger with the privacy controls that institutions need, an architecture implemented through this asset tokenization model.

Unlike public chains where all data is visible, Canton uses programmable privacy. Only parties in a transaction can see it. Other participants see nothing. Even validators don't access private data.

Canton uses Daml smart contracts. Daml is a programming language built for financial workflows. It encodes legal rights. It defines obligations. It handles multi-party agreements. It provides strict authorization controls.

Canton's design supports atomic transaction composition. Multiple actions across different institutions execute as one operation. Either everything completes or nothing does. No partial failures. No reconciliation needed.

Why Canton's privacy is structural, not a workaround?

Most blockchains store asset ownership in a shared ledger like a bank's central spreadsheet that everyone can read. Canton works differently. Each asset exists as its own self-contained record that carries its ownership information with it. Think of it like a physical banknote. It belongs to whoever holds it, and you don't need to check a central registry to know that.

This structure means privacy is built into how assets exist on the ledger, not added on top. Each transaction only touches the records it needs to. Other participants never see it because they were never part of it, not because someone blocked them. This is what makes Canton's privacy fundamentally different from other blockchains, including permissioned ones like Hyperledger.

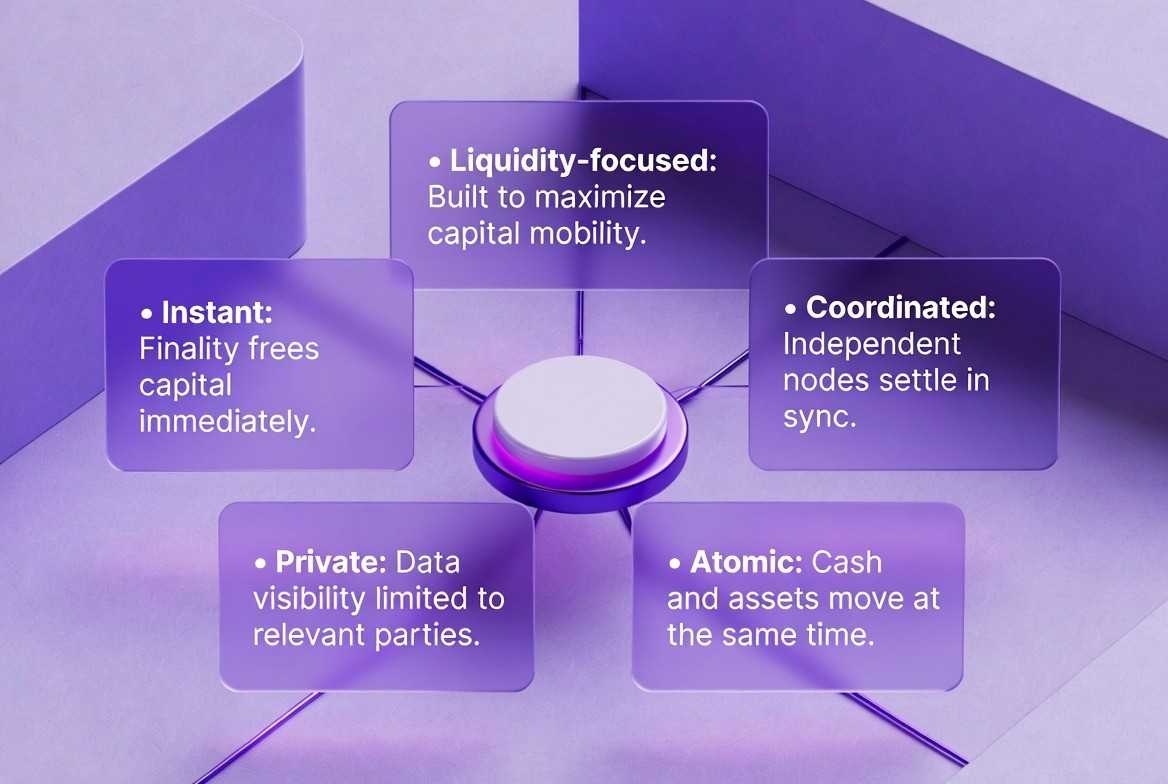

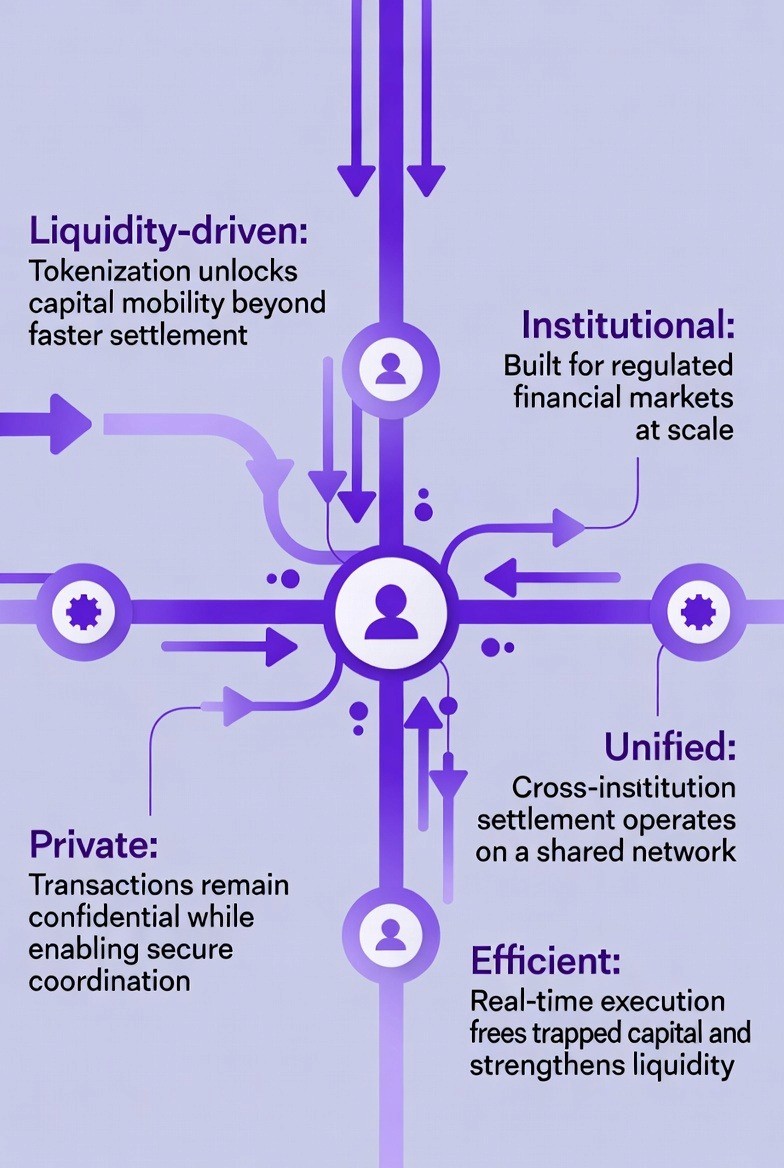

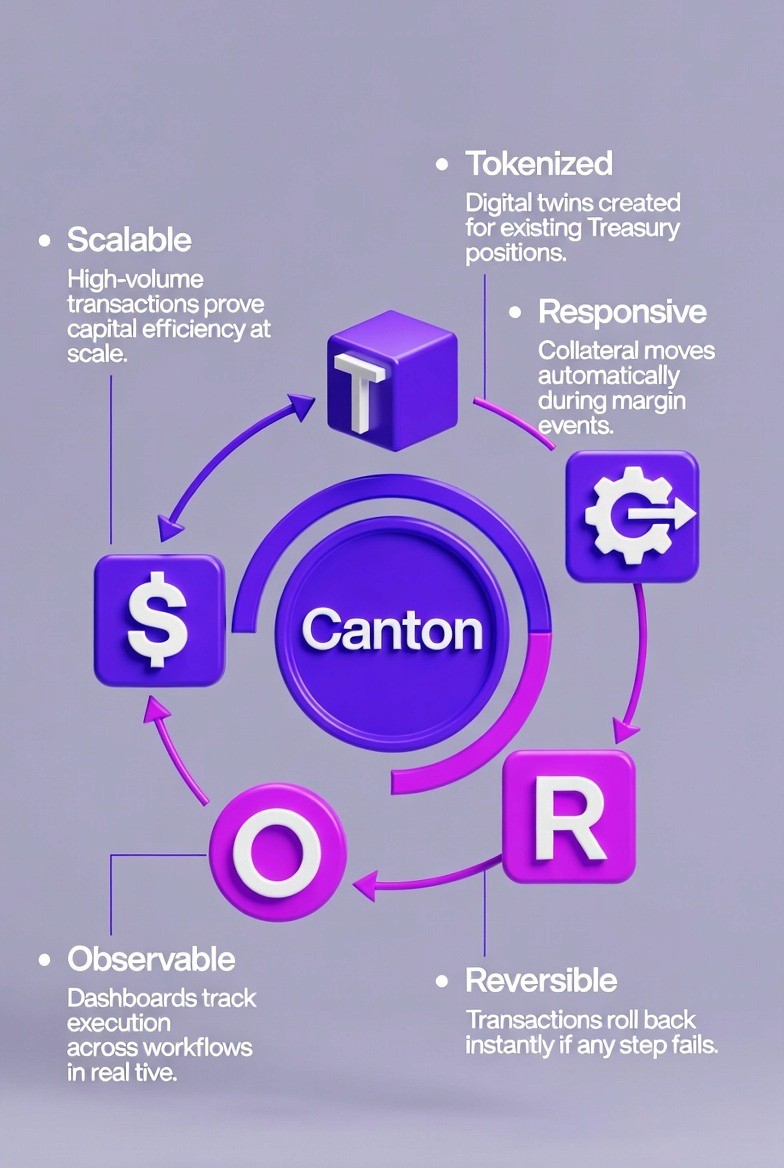

How Canton Unlocks Liquidity

Most blockchains treat liquidity as a side effect of speed. Canton treats it as the primary goal.

Here is what that means in practice.

Collateral moves across institutions without a shared ledger

Banks, custodians, and CCPs each run their own Canton node. They keep their own data. But Canton coordinates them so a collateral transfer completes across all parties at the same moment. No one has to give up their system to participate.

Atomic settlement removes the liquidity gap

In traditional markets, a margin call can take hours to resolve. Collateral is slow to move. Cash and securities don't settle at the same time. Canton closes that gap. When a transfer happens, the token moves on-chain at the exact same moment the cash moves off-chain. There is no window of risk in between.

Privacy keeps institutions willing to share the same network

Banks won't put collateral on a public chain. The data exposure is too great. Canton's privacy model means each party sees only what they need to see. That removes the barrier to participation. More participants means more liquidity.

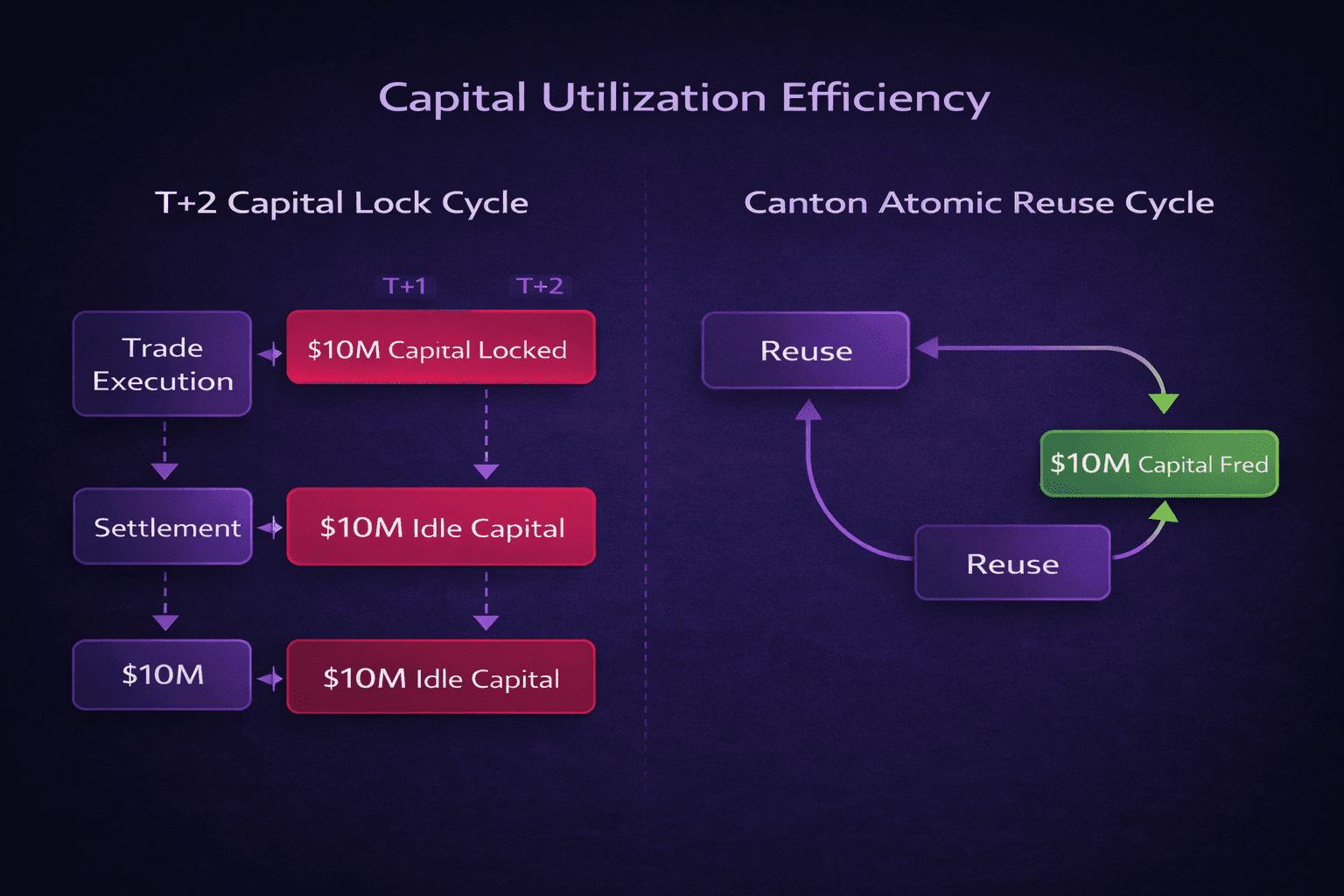

Capital that was trapped gets freed

Assets sitting in T+2 settlement cycles can't be reused until they settle. Canton's instant finality means those assets are available again right away. Institutions can do more with the same capital.

This is why DTCC chose Canton. Not just for speed. For the ability to move liquidity across the entire U.S. market infrastructure without dismantling what already works.

What Liquidity Unlock Actually Looks Like in Numbers

The liquidity argument becomes concrete when you model it. Here is a simplified example based on a standard Treasury collateral cycle.

The T+2 problem:

A firm posts $500M in Treasury collateral daily

With T+2 settlement, that collateral is locked for 2 days before it can be reused

At any given time, $1B in capital sits idle waiting for settlement to clear

That idle capital cannot be redeployed, pledged again, or used for other margin requirements

What changes on Canton:

Collateral completes settlement in minutes, not days

The same $500M can be reused within the same day

Reuse cycles drop to near-zero latency

This frees approximately 18-22% of daily deployable capital that was previously trapped in settlement lag

The compounding effect across the market:

DTCC processes trillions in collateral movements daily

Even a 10% improvement in collateral reuse velocity across the network represents hundreds of billions freed up at any given time

Institutions can meet margin calls faster, reduce over-collateralization buffers, and deploy freed capital into yield-generating positions

This is not a feature. It is a structural change to how capital flows through financial markets.

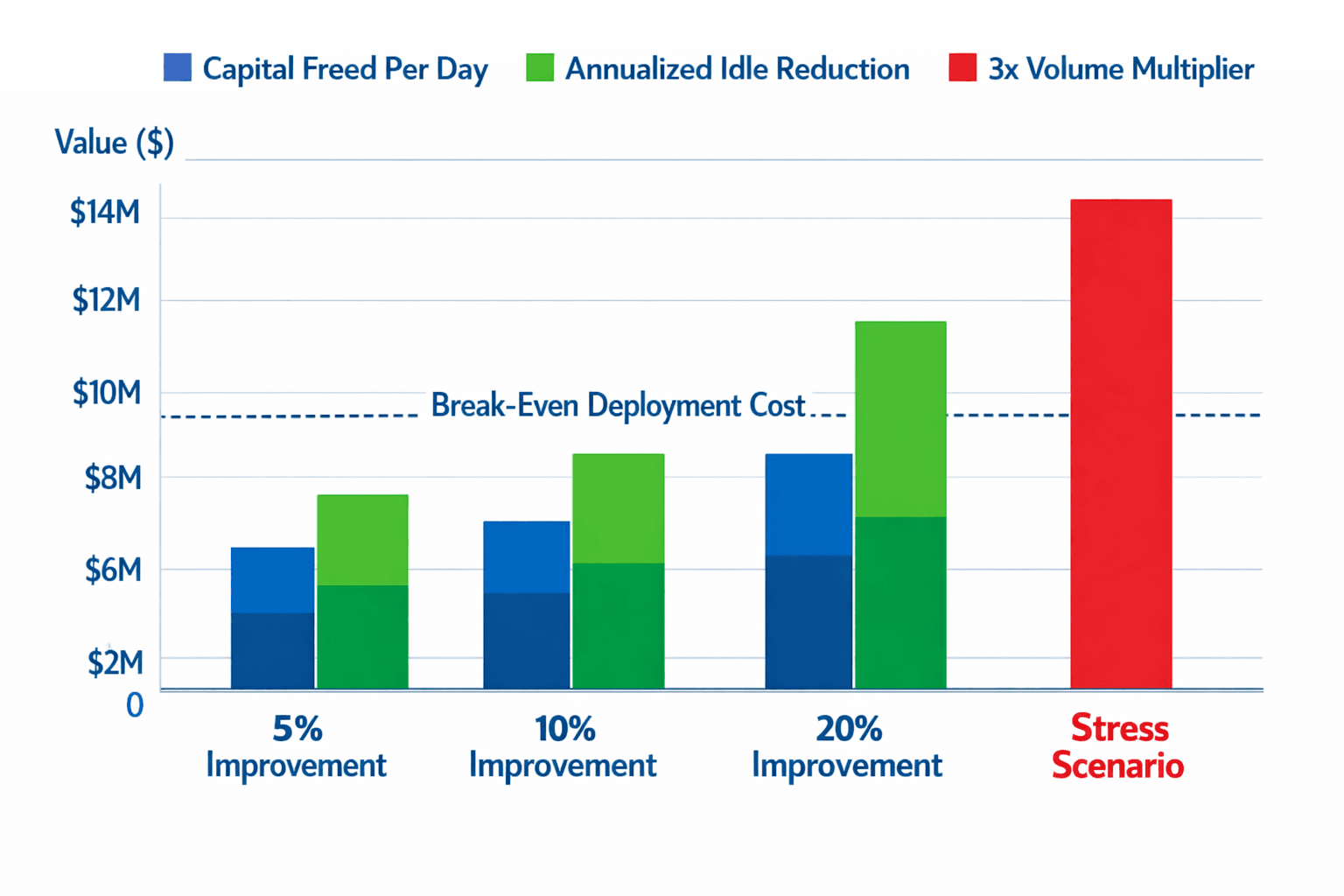

Capital Efficiency Sensitivity Analysis

The $500M example above is a baseline. The actual efficiency gain depends on how aggressively an institution can exploit faster reuse cycles. Here is what different improvement levels look like across the same daily collateral volume.

Base assumption: $500M posted daily in Treasury collateral, T+2 settlement baseline, $1B idle at any given time.

Reuse Improvement | Capital Freed Daily | Annualized Idle Reduction | What This Enables |

5% improvement | $50M freed per day | $18B reduction per year | Covers 1-2 additional margin calls without new capital |

10% improvement | $100M freed per day | $36B reduction per year | Reduces over-collateralization buffer by half for mid-size firms |

20% improvement | $200M freed per day | $73B reduction per year | Enables full same-day collateral reuse for most margin workflows |

The sensitivity analysis shows how individual variables affect capital efficiency and settlement risk under normal conditions. We now move to stress scenario modeling, where multiple shocks are applied simultaneously to test system resilience under adverse institutional conditions.

Under stress conditions:

During market stress events like the 2021 GameStop episode, margin call volumes spike 3-5x above normal

At 3x volume, the same firm is posting $1.5B daily with $3B idle under T+2

A 10% reuse improvement under stress frees $300M per day, enough to cover additional margin requirements without emergency capital raises

This is the scenario where atomic process on Canton moves from efficiency gain to systemic stability tool

The sensitivity floor:

Even at a conservative 5% improvement, the freed capital exceeds the cost of Canton infrastructure deployment within the first quarter of operation

At 20% improvement, the return on deployment is measured in months, not years

Key takeaways: Capital efficiency becomes systemic stability under stress.

Key Benefits of Canton Network

1. Unified settlement across connected institutions

Transactions settle in a coordinated way across multiple institutions instead of being fragmented.

2. Real-time coordination with atomic multi-party execution

All parties complete a transaction at the same time or it does not happen at all.

3. Privacy without losing connectivity

Unlike other permissioned blockchains where keeping data private means locking each institution into its own silo, Canton keeps each party's data private while still letting them transact with each other seamlessly.

4. High transaction capacity built for institutional scale

Canton partitions execution across applications. This avoids congestion. Each application has its own processing capacity. Transaction fees stay predictable.

Implementation Guide: DTCC Example on Canton Network

Depository Trust and Clearing Corporation is the core clearing and settlement infrastructure for U.S. markets. It connects banks, broker-dealers, and custodians.

DTCC chose Canton because it allows separate institutional systems to complete a transaction together without merging into one shared blockchain.

Why Canton:

Each institution keeps its own system

Transactions complete fully across systems or not at all

No shared global ledger required

Enables faster collateral mobility and more efficient use of capital

The pilot involved 27 market participants including investors, banks, CCPs, custodians, collateral agents, and a CSD. The goal was to use tokenized US Treasuries as collateral for margin calls enabling faster settlement, reducing counterparty risk, and improving capital efficiency.

The implementation followed three steps.

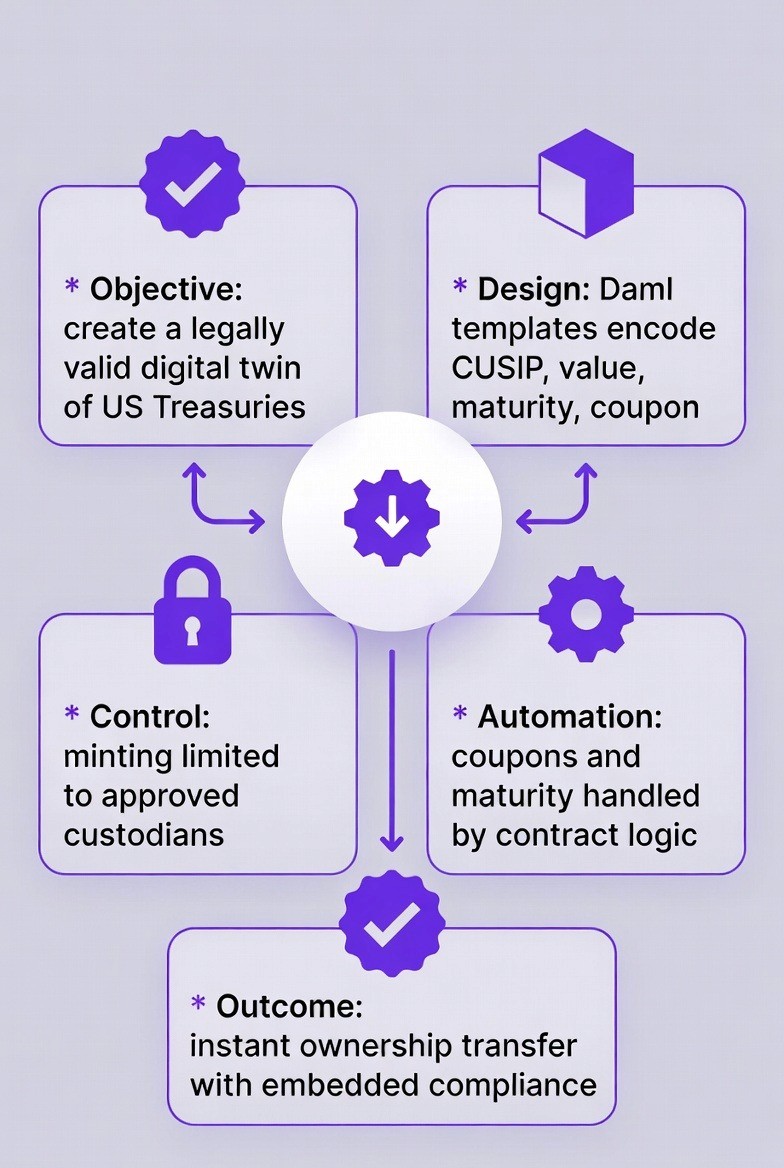

Step 1: Asset-to-Token Modeling

DTCC needed a digital version of US Treasuries that kept legal ownership intact while allowing the assets to move freely as collateral.

Implementation:

Built smart contract templates capturing key Treasury details CUSIP, face value, maturity, and coupon

Only approved custodians can issue tokens

Coupon payments and maturity are handled automatically by the contract

Outcome:

Unlike other permissioned blockchains where keeping data private means locking each institution into its own silo, Canton keeps each party's data private while still letting them transact with each other seamlessly.

When two parties settle a trade, it either completes fully for both sides or not at all, no middle ground, no manual reconciliation, no bridges needed.

Each party only sees what is relevant to them. By design, not as a workaround. This makes it safe for regulated institutions to operate on shared infrastructure.

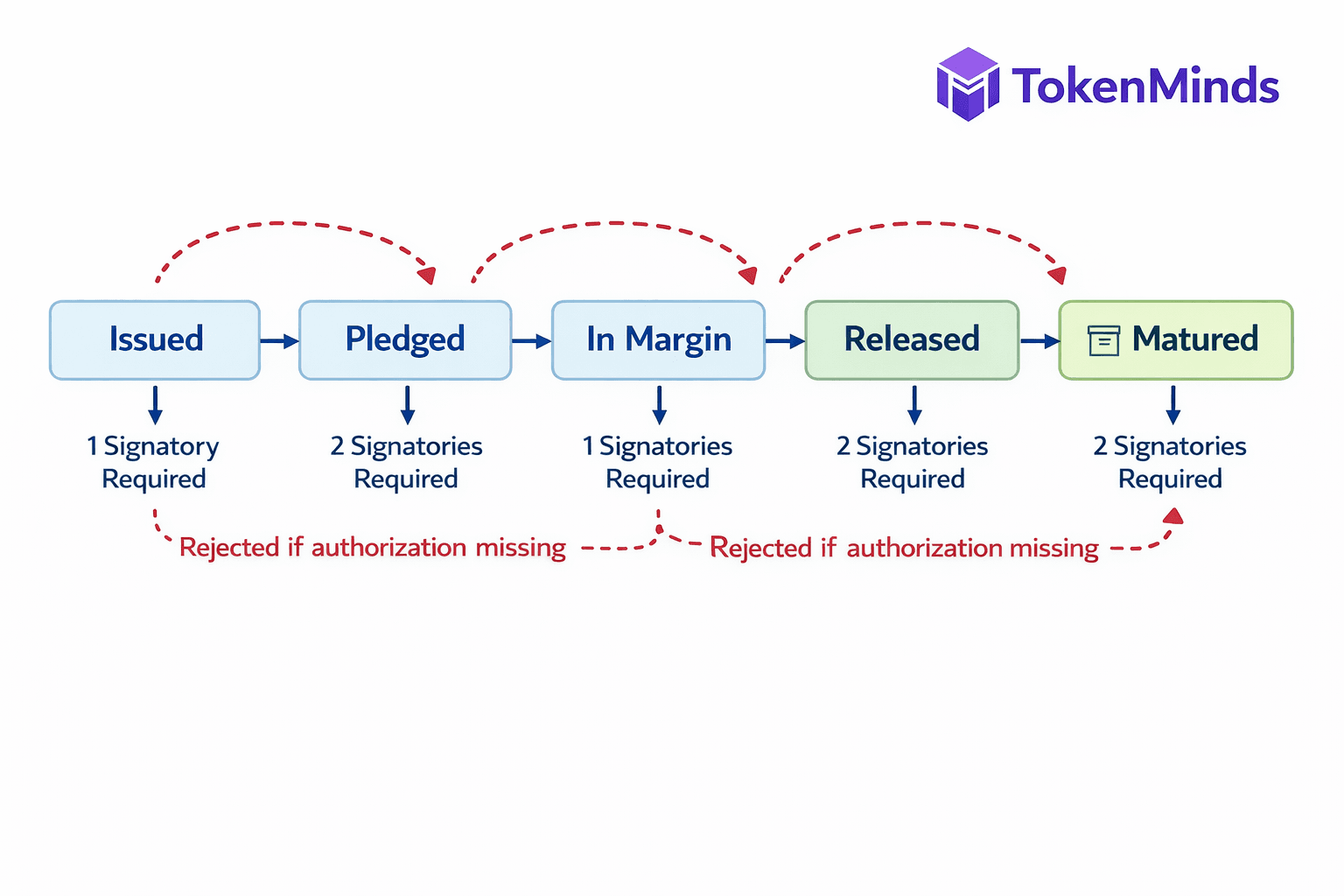

Token Lifecycle: How a Treasury Token Moves Through Its States

Most descriptions of smart contracts stop at issuance. But in a real institutional deployment, a token goes through multiple states across its life. Each state has different rules, different authorized parties, and different conditions for moving forward or reverting. This is what a Daml-based Treasury token lifecycle looks like.

Contract-Level State Machine Example:

State | What it means | Who must authorize |

Issued | Token minted, representing a physical Treasury in custody | Issuer + Custodian |

Pledged | Token locked as collateral for a specific obligation | Issuer + Custodian + Investor |

In Margin | Token actively posted to meet a margin call | Custodian + CCP |

Released | Margin obligation resolved, token returned to holder | CCP + Custodian |

Matured | Underlying Treasury has reached maturity, token redeemed | Issuer + Custodian |

Archive conditions:

A token moves from Pledged to In Margin only when the CCP validates the margin call and the custodian confirms the collateral

A token moves from In Margin to Released only when the CCP confirms the obligation is settled

A token is archived at Matured when the issuer triggers redemption and the custodian confirms physical asset release

If any required signatory does not authorize a state transition, the transaction is rejected and the token stays in its current state

Why this matters for institutions:

Every state change is an on-ledger event with a full audit trail

No party can move a token to a new state without the required co-signatories

The lifecycle logic is encoded in the contract itself, not enforced by a human process

This replaces manual custody confirmations, CCP notifications, and reconciliation steps with deterministic contract execution

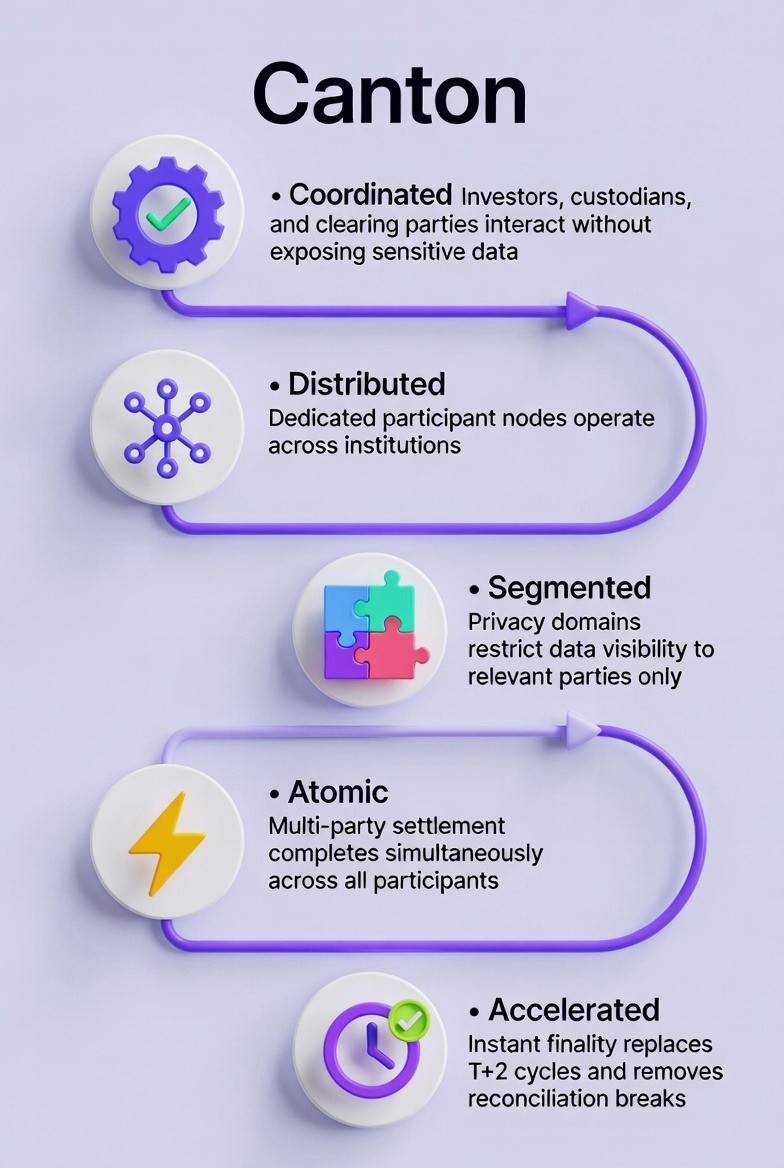

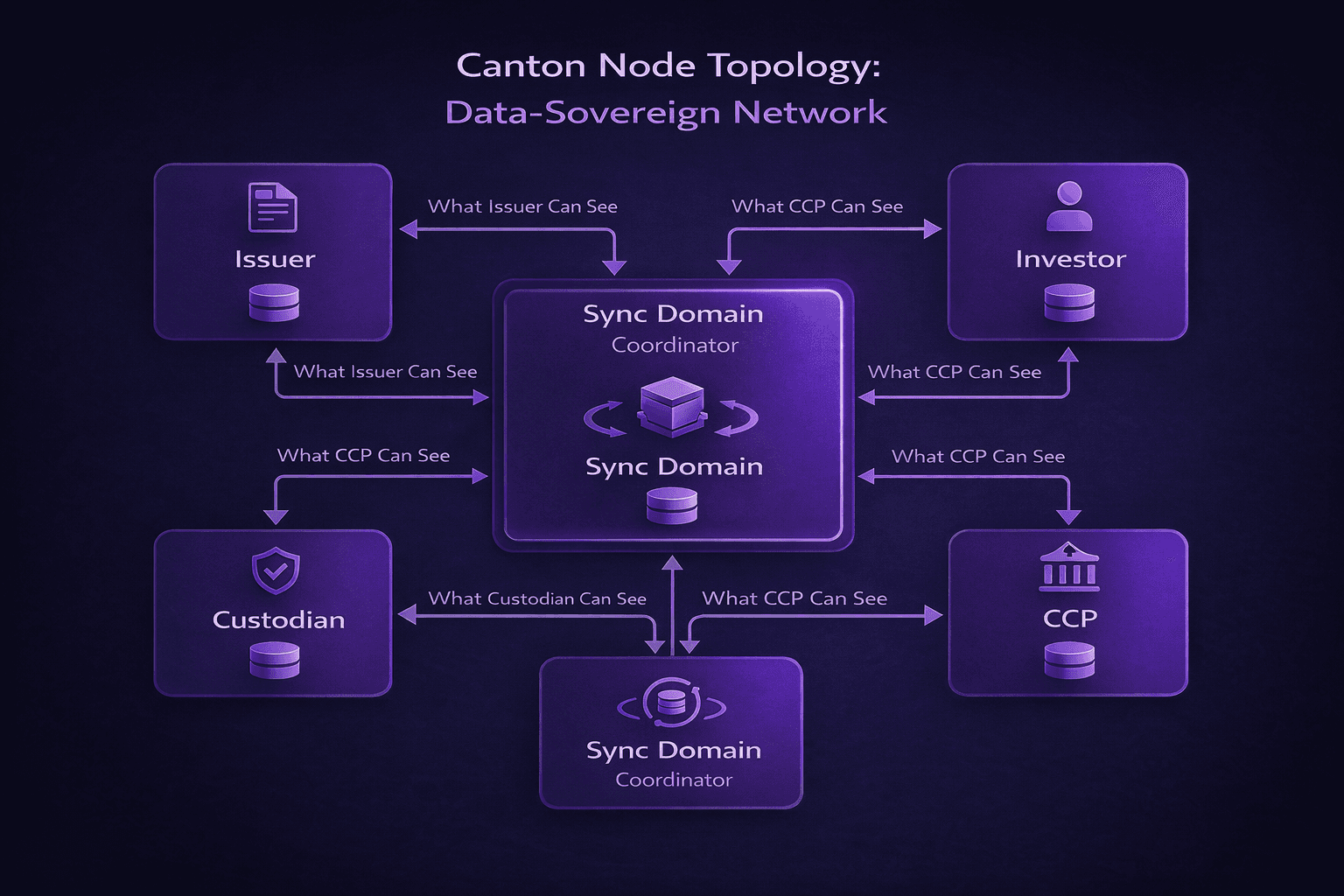

Step 2: How Each Institution Stays Private While Staying Connected

The system required coordination among investors, custodians, and clearing participants without exposing confidential data. This is one of Canton's core strengths and something no other blockchain handles natively.

Coordinated. Each institution runs its own Canton node. Think of it like each party having their own copy of the ledger that only shows what is relevant to them, while still being connected to everyone else.

Segmented. Institutions only see trades they are involved in. Not other participants' activity. Privacy domains enforce this at the transaction level not through workarounds or separate channels.

Atomic. Transactions complete for everyone at the same time or do not happen at all. Canton's sync domain coordinates this across all nodes simultaneously.

Connected to existing systems. Canton connects on-chain transactions to legacy systems like Fedwire and DTCC's existing infrastructure. The token moves on-chain at the same time the cash or securities move off-chain. Both sides settle together.

Outcome: Each institution retains full control of their own data while transacting across separate systems. Settlement is guaranteed and coordinated. Asset and cash movement happen in sync. Reconciliation is eliminated at its source.

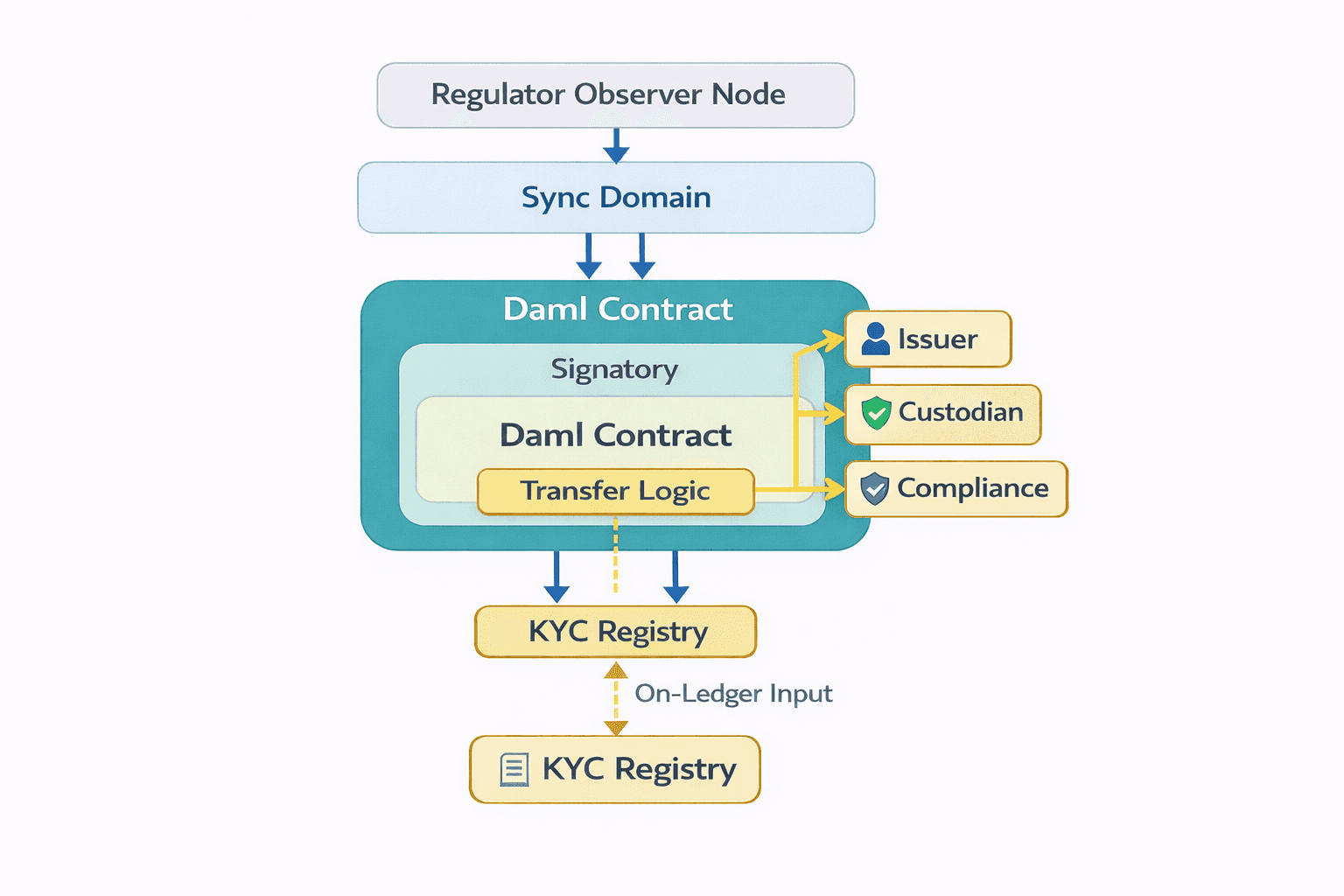

Regulatory and Governance Architecture

Compliance on Canton is not a layer added on top. It is built into the contract logic from the start. Here is how the architecture works in practice.

How regulator read-access works:

Regulators operate dedicated observer nodes within the Canton sync domain

These nodes receive read-only visibility into specific regulated contract types they are authorized to see

They do not see unrelated transactions from other participants

No participant has to expose their full activity to gain regulatory approval, only the relevant contract states are visible to the regulator by design

How KYC eligibility is encoded in Daml contracts:

Investor eligibility checks are written directly into the Daml transfer logic

Before any token transfer executes, the contract queries a verified KYC registry on-ledger

If the recipient's KYC status is expired or missing, the transfer is rejected automatically with no manual review needed

Portfolio limits work the same way: if a transfer would breach a limit, the contract blocks it at the point of execution

How role-based permissions work:

Permissions are contract-enforced, not multi-sig in the traditional sense

Each Daml contract specifies its signatories: the parties whose authorization is required to create or archive it

Minting a token requires the issuer's authorization embedded in the contract itself

Freezing an asset or blacklisting a party is implemented by archiving the active contract and creating a restricted replacement, with the custodian or compliance officer as the required signatory

No single party can act unilaterally outside the rules encoded in the contract

Step 3: Collateral Mobility and Liquidity

As the central clearinghouse for U.S. markets, DTCC needed collateral to move reliably across separate institutional systems during margin events. Slow collateral movement creates systemic risk not just for one firm, but for the entire market.

Implementation:

Each collateral transfer was structured as one coordinated transaction that only finalized after all involved institutions approved and confirmed it otherwise it was automatically cancelled

Margin-triggered collateral movements were executed across connected systems without requiring a shared global ledger

Outcome:

Institutions can settle with each other without changing or giving up their existing systems. Canton coordinates between them so everyone stays in control of their own infrastructure while still transacting together seamlessly.

Collateral that used to take hours to mobilize during a margin call now moves in a single atomic step. There is no risk of one side settling while the other doesn't. No capital gets stuck waiting for confirmation.

Banks, asset managers, and custodians can unlock trapped liquidity in their Treasury holdings while Canton ensures each party retains full privacy over their own positions.

The DTCC pilot proved this at scale. Over 500 transactions were executed across 6 complex workflows by 27 market participants. Three core workflows ran end to end: creating digital twins of existing Treasuries, delivering collateral during margin calls, and returning margin when requested. No settlement failures were reported. What used to take hours completed in minutes.

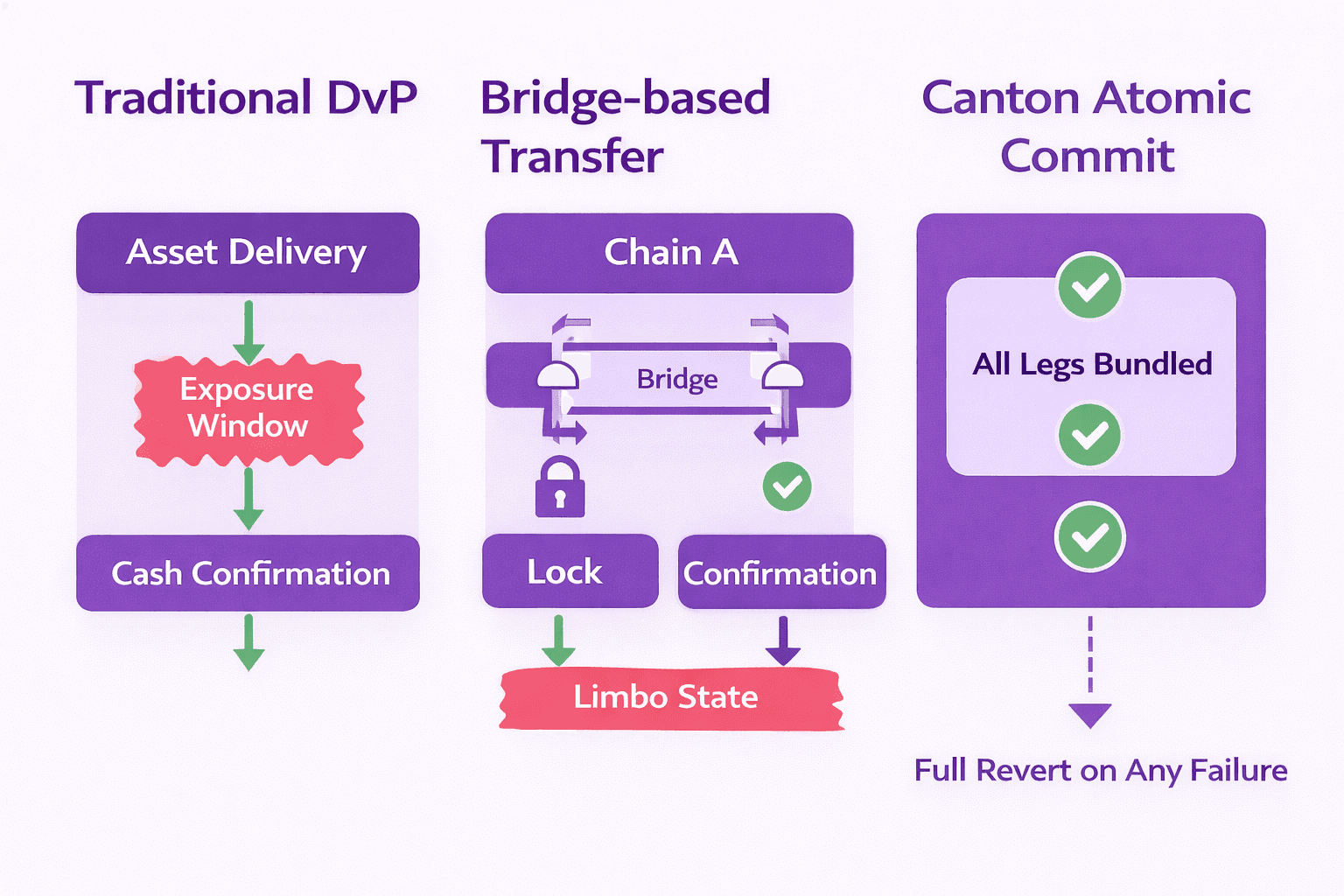

Comparison: Traditional vs Canton Network

Most discussions of atomic processes skip the failure scenarios. That is where the real difference shows.

Traditional DvP failure window:

Party A delivers the asset leg first

There is a time window before Party B confirms the cash leg

During that window, Party A has given up the asset but has not received payment

If Party B fails or delays, Party A is exposed with no recourse except manual intervention and reconciliation

In high-volume margin call scenarios, this window creates systemic exposure across the entire market

Bridge-based failure risk:

Cross-chain bridges lock assets on one chain while waiting for confirmation on another

If the bridge fails mid-transfer, assets can be locked in limbo with no automated recovery

Recovery requires manual intervention, often across multiple systems and legal jurisdictions

This risk compounds in stressed market conditions exactly when fast collateral movement matters most

Canton atomic rollback logic:

Canton does not have a delivery window. The entire transaction is structured as a single atomic unit

All legs of the transaction, asset transfer, cash confirmation, and custodian approval, are submitted together to the sync domain

The sync domain coordinates the commit across all participant nodes simultaneously

If any party fails to confirm within the transaction window, the entire state reverts automatically

No asset moves. No cash moves. No partial execution occurs. The ledger returns to its prior state with no manual cleanup needed

This means there is no failure window. There is only success or a clean rollback.

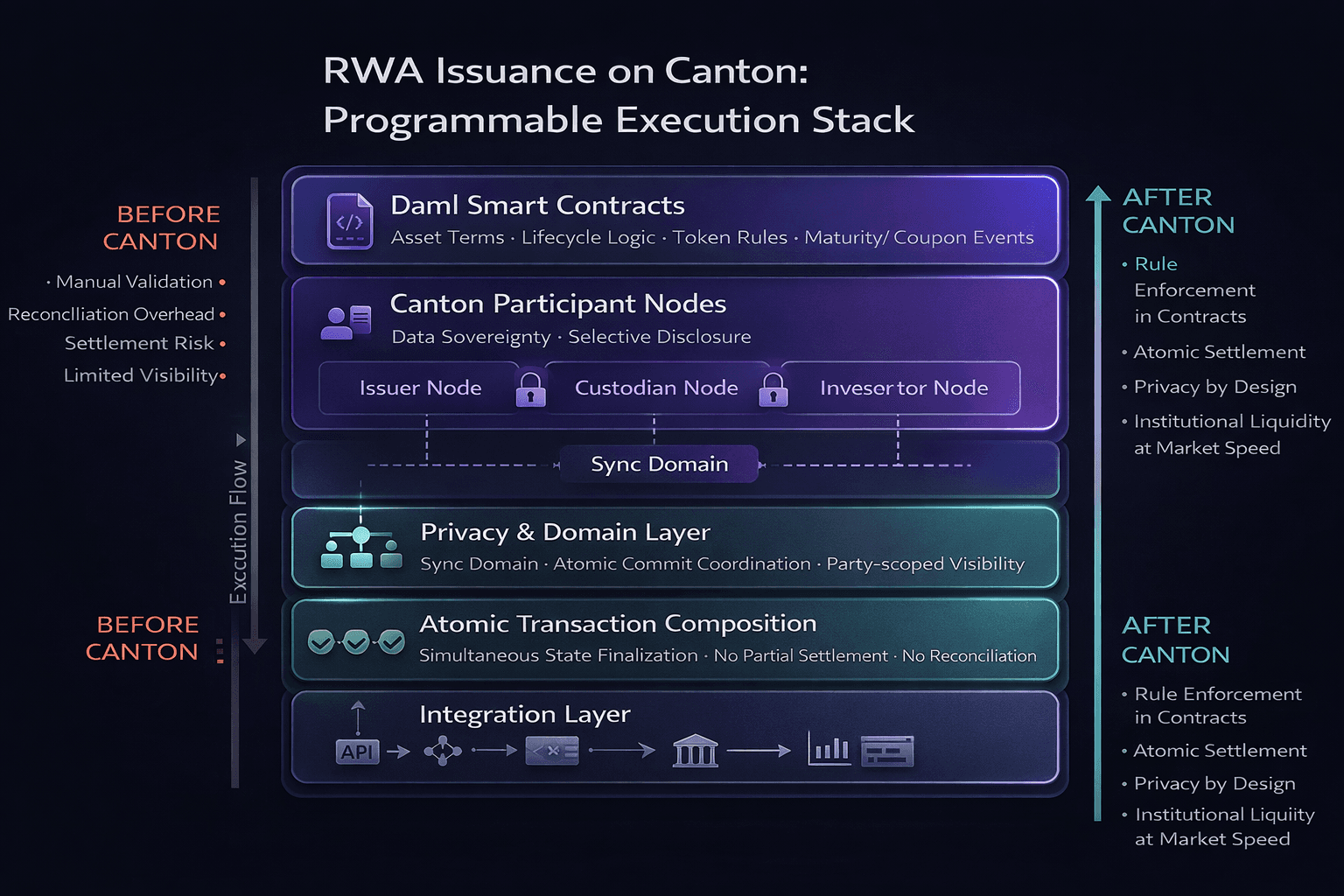

How RWA Issuance Works on Canton

RWA issuance on Canton is a programmable execution stack layered onto existing institutional systems.

Daml Smart Contracts define asset terms and lifecycle logic. They encode what the token is, who can hold it, and what happens at maturity or coupon payment.

Canton Participant Nodes give each issuer, custodian, and investor their own node. They maintain data sovereignty. Contracts are shared only with entitled parties.

Privacy and Domain Layer controls visibility and ensures atomic commit. Each party sees only their slice. The sync domain coordinates ordering across all nodes.

Atomic Transaction Composition means state transitions finalize across all parties at the same time. No partial settlement. No reconciliation loop.

Integration Layer connects the ledger to existing systems. APIs sync confirmed ledger state with custody platforms, treasury systems, and reporting tools.

Operational Architecture for Large-Scale Deployment

Conceptual scalability claims only go so far. Here is what the actual node topology and performance model look like for an institutional Canton deployment.

Node topology:

Issuer node: Runs the token issuance logic, holds the Daml templates, and is the required signatory on all minting and burning operations. Only the issuer node can authorize the creation of new tokens.

Custodian node: Maintains custody records and confirms physical asset segregation. Required signatory for transfers involving custody state changes.

Investor node: Holds the investor's token positions. Sees only its own contracts and those it is directly party to.

CCP node: Validates margin requirements and coordinates collateral calls. Sees only the positions relevant to its clearing function.

Sync domain coordinator: The Canton component that sequences transactions across all participant nodes. It does not see private contract data. It only confirms that all required parties have authorized the transaction and orders the commit.

Throughput segmentation:

Each application on Canton runs in its own execution partition

Transactions within one application do not compete with transactions in another

A spike in Treasury collateral activity does not slow down a separate money market fund application running on the same network

This is fundamentally different from shared gas markets on public chains where all applications compete for the same block space

Latency expectations:

Standard transaction finality within a single sync domain: seconds

Cross-domain atomic transactions involving legacy rail confirmation: dependent on the legacy system, typically minutes

The Canton ledger itself does not introduce material latency. The bottleneck in most institutional deployments is the integration with existing off-chain systems, not Canton's execution layer

Table: Canton vs Public Chains

Public Blockchains | Hyperledger Fabric | Canton Network | |

Privacy | All data visible to everyone | Private per channel, but siloed | Private per transaction, stays connected |

Atomic | Sequential, not guaranteed | Within channel only | Across institutions, guaranteed |

Compliance | Manual, off-chain | Manual, off-chain | Automated inside contracts |

Cross-institution transactions | Requires bridges | Not natively supported | Native, no bridges needed |

Each institution keeps its own system | No | No shared channel | Yes |

Regulatory oversight | Limited native support | Limited native support | Built-in read access for regulators |

Performance under load | Congestion, gas spikes | Better but limited composability | Partitioned, predictable costs |

Proven at institutional scale | Limited for regulated assets | Some deployments | $6T+ assets, $280–300B daily |

How TokenMinds Helps with RWA Issuance on Canton Network

From supporting RWA projects across multiple sectors, including structured products and private credit pilots, TokenMinds has learned that the real challenge is not understanding tokenization. It is translating complex operational requirements into smart contract logic that enables real-time asset mobility and liquidity without disrupting production systems, particularly when integrating with legacy custody, clearing, and reporting workflows.

TokenMinds helps institutions design and deploy privacy-first RWA infrastructure on Canton Network.

Asset Modeling: Daml contract engineering for legal digital twins of your assets.

Canton Architecture: Node setup, privacy domain configuration, and sync domain deployment.

Production Rollout: Legacy system integration and phased deployment support.

FAQ

What types of assets can be tokenized on Canton Network?

Canton supports almost any real-world asset. US Treasuries and government bonds. Corporate bonds. Real estate. Commodities like gold, oil, and natural gas. Syndicated loans. Money market funds. Carbon credits. Private equity. The key requirement is clear legal ownership that can be represented digitally.

How does Canton keep data private while staying compliant?

Canton uses programmable privacy through Daml smart contracts. Each contract defines exactly who can see what. Parties in a transaction see their data. Regulators can be granted viewing rights. Other participants see nothing. This mirrors how traditional finance works need-to-know access, by design.

What are Daml smart contracts and why does Canton use them?

Daml is a smart contract language built for financial workflows. Unlike general-purpose languages, Daml handles privacy natively. It encodes legal rights clearly. It provides strong authorization guarantees. Financial institutions find it far more suitable for multi-party agreements than general smart contract languages.

How long does it take to deploy an RWA platform on Canton?

Simple fungible tokens can deploy in 10–14 weeks including legal setup, token design, contract development, compliance integration, and pilot testing. Complex structured products take 18–28 weeks. Most institutions scale gradually rather than launching at full production right away.

Can Canton work with other blockchains?

Canton applications work with each other within the Canton Network. Interaction with external chains like Ethereum requires bridges or oracle solutions. For most institutional use cases, Canton's internal interoperability delivers more value than external bridges because only Canton can guarantee atomic settlement across participants without a shared global ledger.