TL;DR

How Banks deploy AI for RWA management to automate discovery, compliance, structuring, and lifecycle monitoring, and multi-agent systems that scale tokenization without adding headcount or regulatory exposure.

AI transforms real world asset tokenization. It changes manual, slow, error-prone processes into automated, intelligent systems. These systems discover assets. They analyze documents, while ensuring compliance and simulate scenarios. They monitor operations 24/7, a transformation structured in this RWA tokenization solution framework.

Real-world assets like buildings, bonds, and commodities are hard to manage. They take weeks to value. They cost thousands to trade. They create tons of paperwork. Property appraisals need human inspectors. Legal documents need manual review. Compliance checks happen quarterly, not all the time.

Tokenization makes things more complex. Institutions now track digital and physical versions. They monitor blockchain transactions. They report to regulators in real-time. Manual processes break under this load.

Banks and asset managers face a choice. Build AI systems that handle the entire RWA lifecycle. Or fall behind competitors who deploy intelligent automation. The gap between leaders and others grows every quarter.

AI solves five core problems. It discovers which assets are worth tokenizing. It analyzes documents in hours instead of weeks. It flags compliance risks before tokenization. It simulates market scenarios to optimize structure. It monitors tokenized assets all the time after launch, capabilities developed through this AI development approach.

Major banks already use these systems. JPMorgan processes $2 billion daily on blockchain platforms with AI monitoring. HSBC tokenized physical gold and digital bonds using automated compliance checks. BNY Mellon manages tokenized deposits for institutional clients with smart contract automation.

The technology exists. The path is clear. Institutions that build AI for RWA management now will dominate the $30 trillion tokenized asset market projected by 2034 as referenced by Boston Consulting Group report.

The Core Problem

Real-world asset management relies on humans. Analysts research markets by hand. Lawyers review contracts page by page. Compliance officers check regulations quarterly. This worked when assets stayed physical.

Tokenization breaks these manual workflows. A single commercial property becomes 10,000 digital tokens. Each token needs valuation tracking. Each trade needs compliance verification. Each holder needs KYC screening.

Asset Discovery Takes Too Long

Banks miss tokenization opportunities. Analysts screen real estate listings by hand. They review loan portfolios quarterly. They track market trends through spreadsheets. By the time research finishes, asset prices changed.

Market intelligence arrives late. Economic reports are published weekly. Property data updates monthly. Sentiment analysis never happens. Institutions make decisions on stale information, a lag reduced through this AI payment layer design for banks.

Due Diligence Creates Bottlenecks

Document review takes weeks. A commercial real estate deal needs 200+ documents. Contracts, leases, inspection reports, tax records, title documents. Junior analysts read each one. They extract key terms by hand. They miss critical clauses.

Data extraction lacks consistency. One analyst focuses on yield. Another looks at occupancy rates. A third checks for environmental risks. The final report varies based on who did the work. No standard exists.

Compliance Checks Happen Too Late

Regulatory issues surface after tokenization. Legal teams verify jurisdiction rules by hand. They check investor eligibility through spreadsheets. They review custody requirements in quarterly meetings. Problems appear when unwinding deals costs millions.

Multi-jurisdiction deals with multiple complexities. An asset in Singapore sold to US investors held by a Swiss custodian. Each jurisdiction has different rules. Manual tracking fails. Compliance violations happen.

Structure Decisions Lack Data

Teams guess at best structures. Should this asset use an SPV? A fund structure? A debt note? Decisions happen in conference rooms based on experience, not data. No one simulates different scenarios. No one tests market stress conditions.

Risk modeling happens once. At deal start. Never updated. Interest rates change. Liquidity dries up. Default odds shift. The original structure becomes bad. No one knows until losses mount.

Post-Launch Monitoring Fails

Once tokenized, assets need constant watching. Property values move. Occupancy rates change. Market conditions shift. Manual monitoring checks these monthly. Quarterly. Never in real-time.

Smart contracts execute without human oversight. A token holder tries to transfer to a sanctioned address. The contract doesn't check OFAC lists. The transaction completes. The compliance violation appears in the next audit.

The result: institutions can't scale RWA tokenization. Manual processes bottleneck everything. AI fixes this.

What Is AI for RWA Management?

AI for RWA management means intelligent systems that handle the entire asset lifecycle. From discovery to ongoing operations. No human touches every document. No analyst screens every asset. No lawyer checks every jurisdiction.

The system uses five specialized AI agents. Each handles one part of the process. Together they automate what used to take teams of people weeks to do.

Old systems verify documents once. AI systems verify all the time. Old systems flag risks quarterly. AI systems flag risks right away. Old systems create reports monthly. AI systems update dashboards in real-time.

Table: Traditional vs AI-Powered RWA Management

Aspect | Traditional RWA Management | AI-Powered RWA Management |

Asset Discovery | Manual research, quarterly reviews | All-time AI scanning, real-time alerts |

Due Diligence | Weeks of document review | Hours with automated extraction |

Compliance | Quarterly checks, post-deal discovery | Pre-tokenization checks, ongoing monitoring |

Structure Decisions | Experience-based, one-time analysis | Data-driven scenarios, stress testing |

Monitoring | Monthly/quarterly updates | 24/7 automated surveillance |

Speed | Slow, step-by-step processes | Real-time, parallel execution |

Scalability | Limited by human capacity | Handles thousands of assets at once |

The Solution: Five AI Agents Framework

AI for Real-World Assets (RWA) Management utilizes a variety of AI Agents each responsible for an area of the Asset Lifecycle. Together they enable the automation of entire processes that were previously handled by multiple people.

1. Researcher Agent (Asset Discovery & Market Intelligence)

What It Does

It collects information on existing physical assets (Real Estate, Loans, Funds),

Tracking current market conditions in regards to Interest Rates, Demand and Liquidity.

It assists financial Institutions in determining what type of assets should be Tokenized.

Use Cases

Data documentation and intelligence systems

Bank research and screening of potential assets

Identifying Market Opportunities

2. Reporter Agent (Asset Due Diligence & Analysis)

What It Does

Reviewing all of the relevant information in your company's documents (ownership records, contracts, lease agreements)

Check KPIs such as the yield on an investment, maturity date, and the level of risk that is being taken with a particular asset.

Providing a clear summary of the overall quality of the assets you have to help inform the decisions made by humans.

Key Points

The AI system will not be used to approve or reject new investments.

The AI system will provide clean and organized data.

Humans will still make the final decisions about investments.

Use Cases

Document Intelligence for AI

Systems for preparing for Risk and Compliance issues

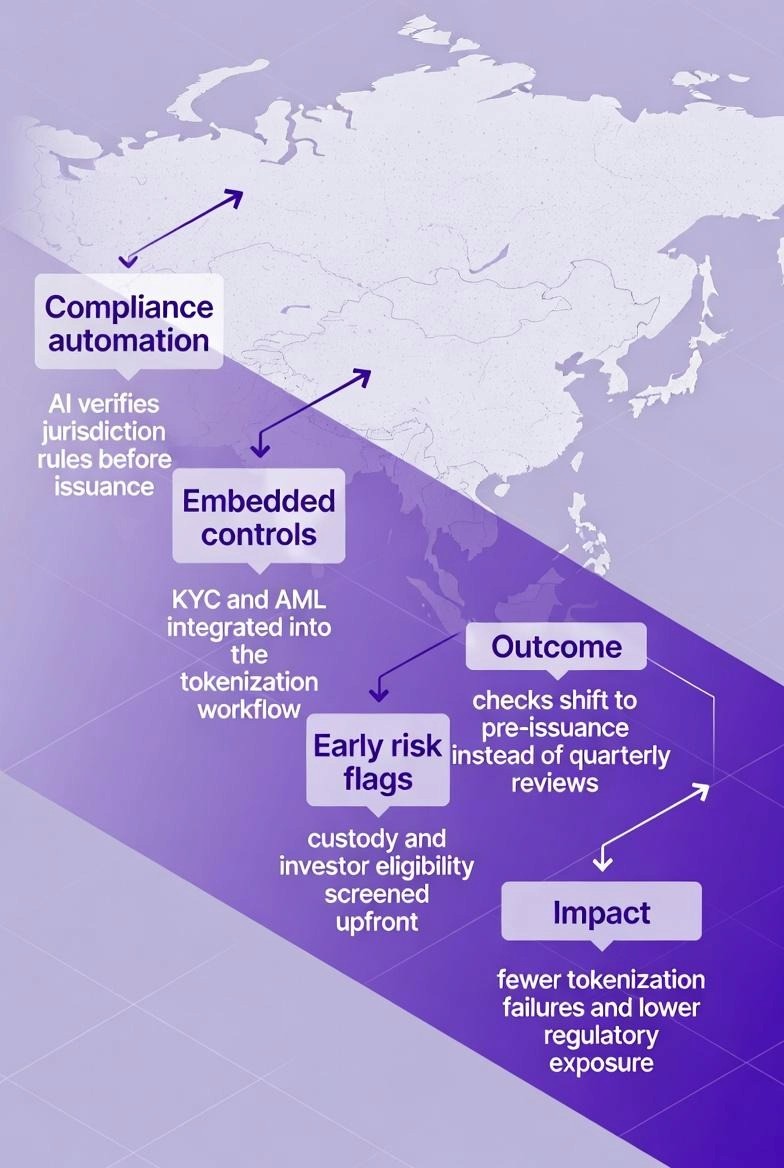

3. Tokenization Agent (RWA Compliance)

What It Does

Verifies whether the asset is able to be legally tokenized

Assesses Jurisdiction Rules, Investor Eligibility, Custody Setup

Identifies potential Compliance Risks Early

Use Cases

KYC/AML with AI assistance

Rule Engines for Jurisdiction

Automated Sanctions Screening

4. Advisor Agent (Decision Support)

What It Does

Simulates scenarios (yield changes, liquidity stress)

Helps teams choose how to tokenize

Tests different structure options

Use Cases

Bank risk modeling tools

Scenario analysis systems

Portfolio analytics (off-chain)

5. Operations Agent (Execution & Monitoring)

What It Does

Coordinates smart contract deployment

Runs compliance checks

Creates reporting updates

Monitors asset health after tokenization

Flags odd things or data changes

Use Cases

Smart contract automation

Asset surveillance platforms

Ongoing monitoring systems

The RWA Intelligence Mesh: How Agents Communicate

The five AI Agents operate through the RWA Intelligence Mesh which is a common compliance and orchestration memory layer for all of them; this allows for real-time coordination as well as auditability and transparency.

Event-Driven Architecture

The Agents communicate with each other through an Event Bus; when one Agent sends a state change it will automatically send notifications to all of the other Agents.

Researcher Agent finds an opportunity → publishes "AssetDiscovered"

Reporter Agent performs due diligence → publishes "DocumentsValidated"

Tokenization Agent begins to check compliance

The system does not require any manual handoffs or communication (i.e. email) nor do there need to be any delays. The system will auto-orchestrate the process.

Common Compliance Memory Layer

All Agents update their version of the data stored in a central Vector-Based Compliance Memory that contains:

Regulations that have been triggered

Data points that were used in compliance checks

Confidence score

Alternative compliance paths that were checked

Date and Time stamp of the decision

Version number of the Agent that made the decision

At any point in the lifecycle, Regulators will be able to replicate any decision made by the system. All approvals will be completely reconstructable and transparent.

Example Data Flow

Researcher determines undervalued Frankfurt Property → publishes event (Risk Level: 7.2/10)

Reporter validates 180 Documents (Completeness Rate: 94%)

Tokenization Agent checks EU Regulations and Similar Deals → Clears Compliance

Advisors run 10,000 Simulations → logs Risk-Adjusted Recommendation

Governance layer directs to Human (Medium Risk) → Review Process takes 15 minutes instead of 2 Weeks

Operations deploys Smart Contracts and Ongoing Monitoring

The entire process will be completed in hours versus weeks. Every Decision will be Traceable. Every Recommendation will be Explainable.

Implementation Example: JPMorgan Chase (Onyx)

JPMorgan needed infrastructure for tokenized real world assets. They wanted to discover opportunities, analyze documents, ensure compliance, optimize structures, and monitor operations. All at scale.

The implementation followed five steps. Each delivered independent value. Together they created end-to-end AI for RWA management.

Step 1: Researcher Agent

JPMorgan is using an artificial intelligence (AI) system to continuously scan markets for real-world assets that could be converted into tokens. The AI agent collects data in multiple ways: through a review of property listings; access to loan databases; reviews of economic reports; monitoring of social media trends; and analysis of other forms of data to determine what types of assets are best positioned for long-term growth investments.

The system uses natural language processing. It uses machine learning. It analyzes structured data from financial databases. It also looks at unstructured data from news feeds. It reads market reports. Then it ranks assets based on investment scores.

Outcome

Institutions can quickly find which real-world assets are worth deeper analysis or tokenization

Asset discovery shifts from manual research to ongoing, data-driven monitoring

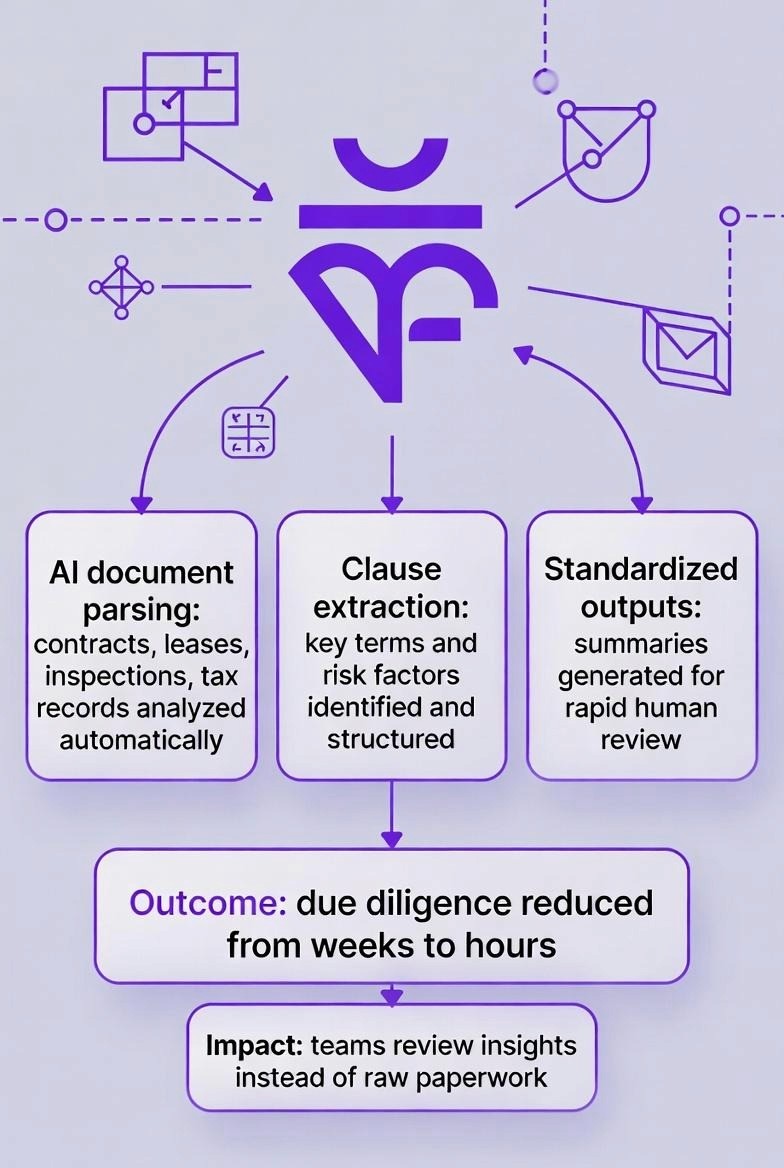

Step 2: Reporter Agent

They build AI document readers. These dig through lots of paperwork. They read contracts. They review ownership records. They check leases. They scan inspection reports. They look at tax documents. The agent pulls out the important details on its own.

This agent doesn't approve or reject anything. It just organizes the information into clean summaries. Humans can make faster decisions. The system uses optical character recognition. It uses large language models. It extracts key data fields from documents. Then it structures the information into standard templates. Human teams review these.

Outcome

Due diligence timelines drop from weeks to hours

Human teams get clean, structured summaries instead of raw paperwork

Step 3: Tokenization Agent

JPMorgan created a new generation of AI-enhanced compliance monitors that check if an asset can be legally converted into tokens and watch for problems before they occur.

These agents will use rule-based AI engines to verify that investors are eligible to purchase the tokens by cross-checking asset details against jurisdiction-specific requirements for tokenization and investor eligibility rules. They will also connect with regulatory databases and KYC / AML verification systems to determine if there are any structural or regulatory issues early on.

Outcome

Compliance issues are identified prior to their becoming significant issues

Tokenization failure is significantly reduced

Step 4: Advisor Agent

Set up AI simulation tools. These help teams figure out the best way to structure a tokenized asset. The agent runs "what-if" scenarios. What happens if interest rates spike? If liquidity dries up? It suggests whether to use an SPV (special purpose vehicle). Or a fund structure. Or a debt note. Or a trust.

Monte Carlo simulations process historical market data. Scenario modeling engines do too. They stress-test various structures. They test under different economic conditions. They output risk-adjusted recommendations with odds.

Outcome

Decision makers get clear and data-backed recommendations

Final decisions stay fully human

Step 5: Operations Agent

They deploy AI coordinators. These handle everything after the asset is tokenized. This agent makes sure smart contracts deploy correctly. It runs ongoing compliance checks. These happen monthly. Like KYC updates. It creates reports for investors. It monitors the asset's health all the time.

The system works with blockchain infrastructure. It orchestrates smart contract deployment. It uses automated monitoring scripts. These track on-chain data. They track off-chain asset data too. The system triggers alerts. This happens when thresholds get hit. Or when odd things are detected.

Outcome

Asset managers gain ongoing visibility into tokenized RWAs

Issues get detected early

This enables faster action without automated pricing or fund movement

AI Governance & Regulatory Compliance Architecture

Organizations using AI systems to manage billions of dollars in real world assets require a very high level of governance. One misstep in governance due to an AI system can result in the loss of millions of dollars. In addition, a flaw in an AI recommendation can lead to the approval of a non compliant or fraudulent tokenization. Before institutions use AI at a large scale for automated decision making, they require embedded safeguarding mechanisms in place.

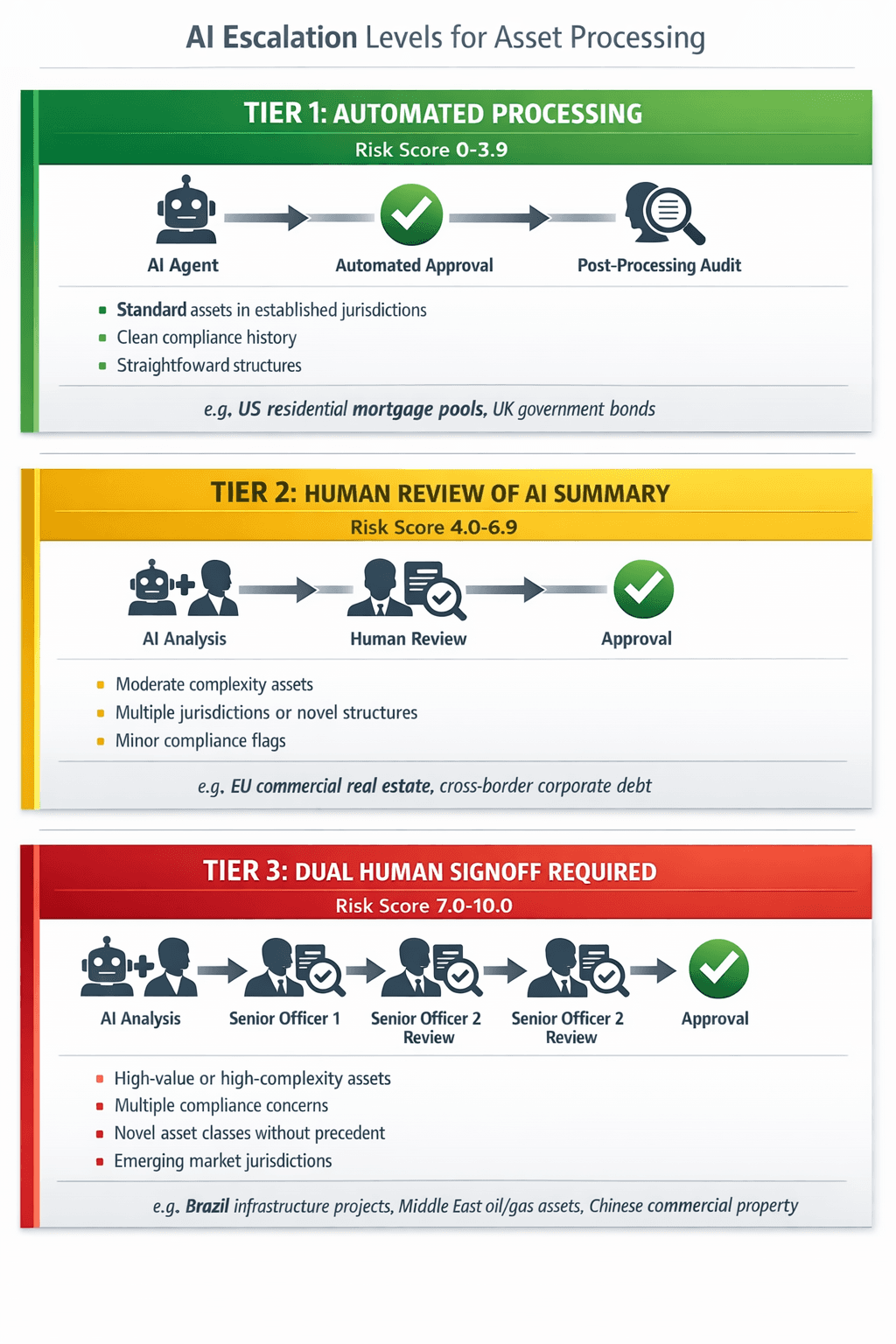

Human-in-the-Loop Escalation (Risk Score)

The governance layer routes decisions through three escalation tiers based on risk score, ensuring the right level of human oversight for every asset.

This diagram shows a tiered approach that balances efficiency with control. Low risk deals move fast. High risk deals get appropriate investigation:

Model Risk Validation Layer

Continuous validation for RWA Tokenization is required due to degradation of AI over time, changes in regulations and market conditions. Continuous Validation also provides assurance that AI Agents continue to be compliant with regulations and produce accurate results.

Drift Monitoring & Backtesting

Weekly Drift Detection: Automated process which monitors the current decisions made by the AI Agent versus its baseline performance. When there is a greater than 3% deviation from the baseline it will immediately trigger an investigation of the reason behind this discrepancy.

Quarterly Comprehensive Review: Examines the AI Agent's performance using 6-12 months of historical transactions to validate the model has produced performance at or above 85% of the historical accuracy during the period of evaluation. If the quarterly comprehensive review indicates less than 85% historical accuracy the AI Agent will be taken out of production until after mandatory re-training and compliance review have been completed.

Table: Model Risk Validation Framework

Component | Frequency | Threshold | Action Trigger |

Drift Monitoring | Weekly | >3% deviation | Immediate investigation |

Backtesting | Quarterly | <85% accuracy | Mandatory retraining |

Independent Validation | Quarterly | <80% scorecard | Escalate to risk committee |

Comprehensive Audit | Annually | Findings identified | Remediation plan required |

Real-time Metrics | Continuous | Outside limits | Auto-alert governance team |

Retraining Protocol: When thresholds are breached: (1) model suspended, (2) root cause analysis within 24 hours, (3) retraining on updated data, (4) independent validation, (5) gradual rollout with 30-day enhanced monitoring.

Integration With Existing Systems

AI for RWA management works with existing bank systems. No need to replace core platforms. The architecture adds intelligent layers on top of old infrastructure.

API-First Integration

AI agents talk through REST APIs and webhooks to existing bank ledgers. A Researcher Agent finds an asset opportunity. It sends the data to the Reporter Agent. The Reporter Agent extracts document details. It passes the structured data to the Tokenization Agent. The Tokenization Agent verifies compliance. Once approved, the Advisor Agent simulates best structures. The Operations Agent then coordinates deployment.

Blockchain as Settlement Layer

Private blockchains handle token issuance, transfer, and balance tracking. Old banking systems handle final settlement in fiat currency. An asset gets tokenized. The blockchain updates token balances right away. The banking system settles funds to token holders through existing ACH or wire transfer processes.

Compliance and Risk Monitoring

AI agents sync with existing AML providers and sanctions screening systems. Before accepting any tokenization request, the system checks wallet addresses against OFAC sanctions lists. High-risk entities trigger blocks on their own. Suspicious patterns freeze transactions for compliance review.

Data Lake Integration

AI agents pull from centralized data lakes. Customer transaction history. Asset performance data. Market intelligence feeds. Regulatory updates. Everything flows into one place. The agents query this data all the time. They update their models based on new information.

Table: Implementation Benefits

Metric | Before AI | After AI |

Due Diligence Time | 2-4 weeks | 2-4 hours |

Document Processing | Manual review | 95% automated |

Compliance Checks | Quarterly | Real-time ongoing |

AML False Positives | Baseline | 50-55% reduction |

Operational Costs | Baseline | 40% decrease |

Asset Monitoring | Monthly reports | 24/7 real-time |

Processing Capacity | 10-20 assets/month | 100+ assets/month |

Error Rate | 5-10% | <1% |

How TokenMinds Helps with AI for RWA Management

From working across forestry, energy, intellectual property, and digital asset markets, TokenMinds has learned that most institutions still underestimate how AI can transform the entire RWA lifecycle. From asset discovery and due diligence to compliance and ongoing monitoring.

The core challenge is not blockchain or smart contracts. It's the absence of AI intelligence layered on top. This leaves RWA platforms exposed to slow verification, manual compliance bottlenecks, inconsistent pricing, and fraud risk in always-on tokenized markets.

TokenMinds provides end-to-end RWA tokenization powered by a five-agent AI framework. It automates market discovery, document analysis, multi-jurisdiction compliance, structuring simulation, and post-launch operations.

Implementation Approach

TokenMinds starts with a pilot focused on one asset class. This gives immediate value with contained risk. Once proven, the system scales across different asset types. Institutions learn how AI agents perform before deeper integration.

Conclusion

Real world assets are moving to blockchain. The market will reach $30 trillion by 2034. Institutions that can't tokenize assets at scale will fall behind. Manual processes can't handle this volume. AI solves the bottleneck. Five specialized agents automate discovery, due diligence, compliance, structuring, and operations.

Major banks already deploy these systems. JPMorgan processes billions daily. HSBC tokenized gold and bonds. BNY Mellon manages institutional deposits. The technology works at scale.

FAQ

What is AI for RWA management?

AI for RWA management is intelligent automation that handles the entire real-world asset tokenization lifecycle. It uses five specialized AI agents. The Researcher Agent discovers which assets are worth tokenizing. The Reporter Agent analyzes documents and extracts key data. The Tokenization Agent verifies compliance across jurisdictions. The Advisor Agent simulates the best structures. The Operations Agent monitors tokenized assets all the time. Together they replace manual processes with automated intelligence.

How does AI reduce due diligence time?

Compliance review by analysts using OCR (optical character recognition) and large language models provide the ability for the AI to read documents on its own. Where it may have taken weeks for analysts to review contracts, leases and inspection reports, the AI is now capable of extracting key data from those documents within hours. The AI is able to find important clauses, check for inconsistencies, structure information into standardized templates and present clean summaries to the human teams reviewing the documents. Where it used to take 2-4 weeks for analysts to complete their work, it now takes 2-4 hours.

What compliance problems does AI solve?

AI catches compliance issues before tokenization, not after. The Tokenization Agent checks jurisdiction rules on its own. It verifies investor eligibility through KYC/AML databases. It flags custody requirement violations. It screens against OFAC sanctions lists in real-time. The Operations Agent then monitors all the time for compliance drift. Quarterly manual checks become 24/7 automated surveillance. False positives drop 50-55% because AI knows the difference between suspicious patterns and normal behavior.

How does the Advisor Agent optimize structure?

The Advisor Agent runs Monte Carlo simulations on historical market data. It tests different structures (SPV, fund, debt note, trust) under various economic conditions. What happens if interest rates spike? If liquidity dries up? If default rates increase? The agent outputs risk-adjusted recommendations with odds. Teams see data-backed options instead of making experience-based guesses. Final decisions stay human, but the analysis is complete.

Can AI integrate with existing banking systems?

Yes. Adding AI for RWA management adds smart layers on top of banking system infrastructure. No need to replace core banking platforms. AI agents communicate through REST api's and webhooks and pull data from current data lakes and sync with existing AML providers and sanctions screening systems. The blockchain handles the token management. Old banking systems handle fiat settlement. Compliance systems remain the same. Banks keep their infrastructure and add AI capabilities through integration.