TL:DR

Onchain, fraud-resistant measurement transforms KOL campaigns into a transparent, ROI-driven growth engine that replaces vanity metrics with real user activation, retention, and value. Web3 teams will be able to remove false engagement, reduce wasteful spend, and achieve real time confidence in the effectiveness of their campaigns by eliminating false engagement and wasteful spend through wallet based attribution and cryptographic validation.

What Is a Web3 KOL and Why It Matters

A Web3 KOL (Key Opinion Leader), is a trusted voice within the Blockchain/Crypto space who helps communities to form an opinion about new emerging technologies including DeFi platforms, NFT projects, layer two solutions, and token launches. As opposed to standard influencers, a Web3 KOL does not simply promote new technologies by increasing awareness of them with their social media reach. Instead, a Web3 KOL shapes opinions regarding technology, explains the technical aspects of protocols and guides users' behavior on chain, specifically, wallet adoption, token usage, and other on-chain activities.

What distinguishes Web3 KOLs from others, is that while their influence may be gauged through social metrics (i.e., likes/views); there are also on-chain measurable metrics that reflect their influence. These include wallet connections, token transaction volume, staking activity and community long term engagement. Therefore, Web3 KOLs are not simply marketing channels but rather, serve as growth partners that affect product adoption and create economic value to a network, which is why it is critical to accurately measure and prevent fraudulent measurement of any serious web3 campaign.

The Challenge With Traditional Web3 Marketing

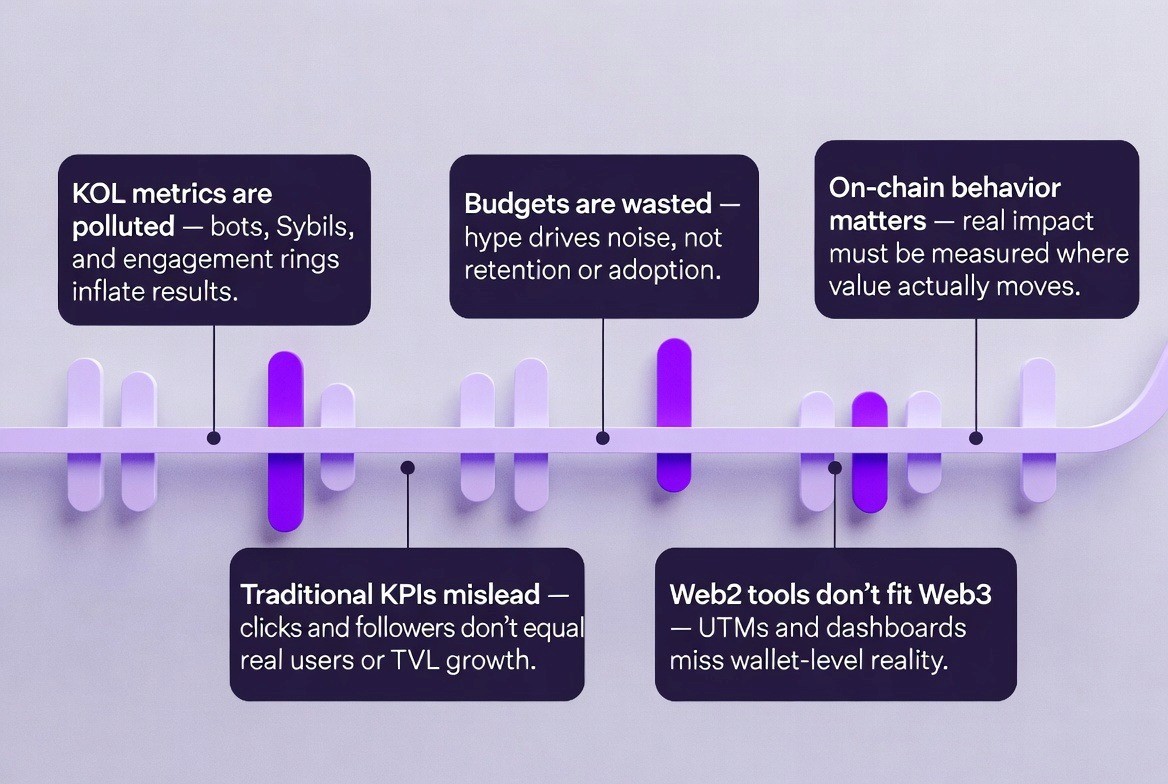

Marketing leaders running campaigns with Key Opinion Leaders (KOLs) in Web3 face a problem that traditional tools cannot solve, a challenge many teams now rethink through practical playbooks like this guide. Influencers post on social media, but the engagement numbers that appear impressive often contain up to 40% fake activity from coordinated bots, multi-wallet accounts (known as Sybils), and engagement rings designed to exploit airdrop hunters.

When marketers rely on old-fashioned metrics like clicks, views, and follower counts, they cannot see which of these numbers come from real users who will actually buy tokens, use the platform, or hold assets long-term. This results in 70% to 80% of marketing budgets being wasted on hype that creates no real growth in Total Value Locked (TVL), user retention, or product adoption, a gap many teams now address by shifting toward region-specific creator strategies like the one outlined in this approach.

The root of this problem lies in how Web3 marketing still depends on Web2 infrastructure. UTM links, screenshot proofs of reach, and agency dashboards may have worked when the internet primarily used cookies and centralized accounts. But Web3 operates differently. Users control their own wallets, and every transaction leaves a permanent record on the blockchain. The tools marketers use need to match this reality.

Table of comparison: Traditional KOL vs Web3 KOL

Aspect | Traditional KOL | Web3 KOL |

Main Goal | Drive awareness and brand exposure | Drive real product and protocol adoption |

Audience Identity | Platform accounts and cookies | Wallet-based identity |

Success Metrics | Likes, views, followers | Wallet activations, onchain actions |

Attribution | UTM links and cookies | Wallet signatures and onchain tracking |

Fraud Risk | High due to bots and fake followers | Lower with wallet verification |

Payment Model | Pay per post or impression | Pay per verified outcome |

ROI Clarity | Hard to measure real impact | Clear, data-driven ROI |

Why Blockchain-Based Attribution Works

Fortunately, a new generation of tools built specifically for Web3 makes fraud-resistant KOL measurement not just possible, but practical. These platforms use three core technologies working together: wallet-based attribution to identify who is who, smart contract event tracking to record what users actually do onchain, and cryptographic proofs to verify that activity without exposing personal data. Together, these create a system where KOL campaigns can be measured with the same reliability as bank transactions, delivering 5 to 11 times more conversions than traditional methods by filtering out bots and focusing on metrics that matter; activation, retention, and lifetime value.

In addition, as this method has already been implemented into production use cases (i.e., major DeFi projects and tokenization platforms), it is expected to report a return on investment of at least $6 for each dollar spent on marketing. This is in contrast to the approximately 70% loss rate that was seen when using traditional advertising strategies.

Understanding the Technical Flow

To run a fraud-resistant KOL campaign, marketing teams need to implement a tech stack that connects three layers: the social media touchpoint where a KOL posts, a landing page or wallet connection point where the user first engages, and the onchain events where real activity happens. Each layer requires specific tools to function properly, which is why many teams now rely on specialized Web3 marketing partners to design and operate this stack end to end.

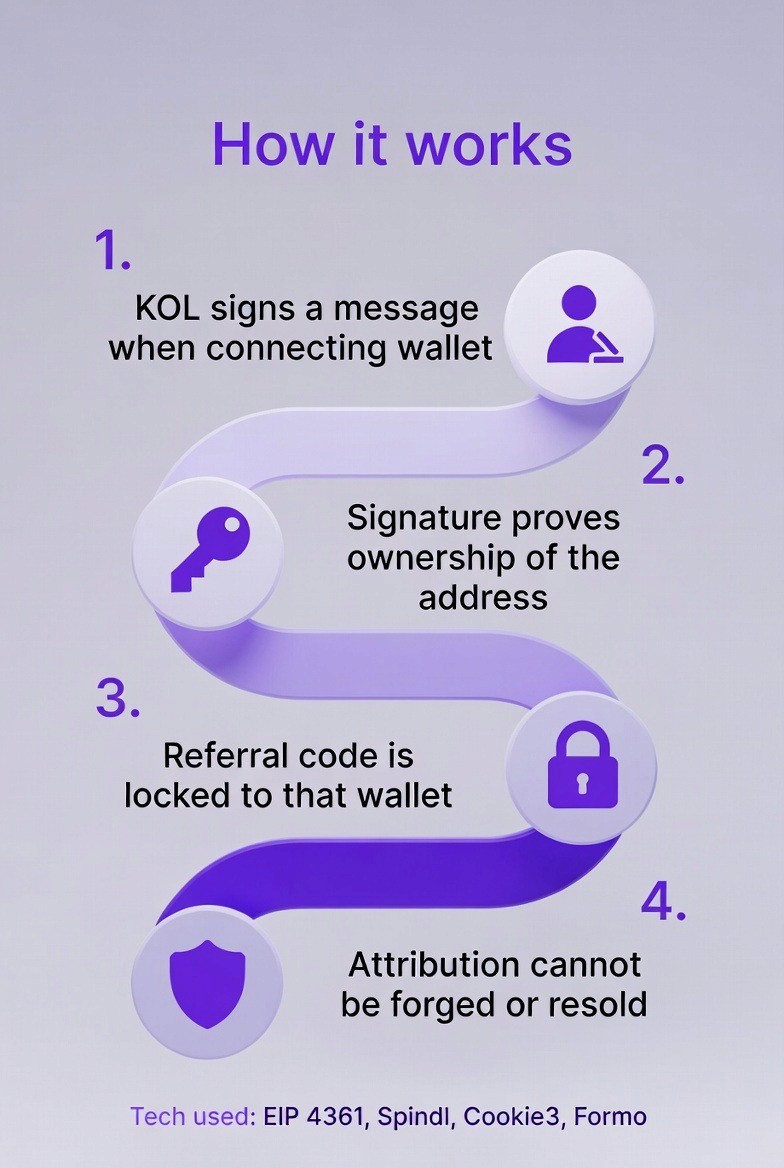

The first layer starts with wallet-based attribution. When a KOL shares an affiliate link with his/her followers or shares information on a project, that affiliate link is accompanied by a unique identifier (usually referred to as a referral code or signed message) which will be used for tracking purposes. All major platforms such as Spindl and Cookie3 utilize a technical standard called EIP-4361 (also referred to as Sign-In with Ethereum), which provides a method of proving ownership of a wallet address through a digital signature without the need to input a password or private key; the actual signature becomes a permanent record linking the KOL’s referral to the wallet address in question.

Spindl, for example, deploys a lightweight SDK (Software Development Kit) on the landing page. When a user clicks the KOL's link and arrives at the site, the SDK captures that click. When the user then connects their wallet, the SDK creates a signed message using EIP-4361. This signature proves that the same person who clicked the KOL's link is the same person who owns the wallet. That connection is now locked in cryptography and cannot be faked, even if the user attempts to create a second wallet or sell their referral to someone else.

Cookie3 takes a similar approach but adds an extra layer by indexing data across 15 or more EVM blockchain networks at once. This means that a KOL campaign running on Ethereum can be measured alongside the same user's activity on Polygon, Arbitrum, or any other connected chain. The user connects their wallet once, and Cookie3 builds a profile of that person's entire onchain history; all their token swaps, NFT purchases, DeFi positions, and contract interactions. This allows marketing teams to see not just whether a user came from a KOL, but what that user is actually worth based on their proven behavior.

Formo collects the same UTM (tracking codes used by Google Analytics) for links, however they also connect the UTM parameter with the user's wallet address. Therefore marketers are able to use the familiar UTM name convention such as "utm_source=kol_name" or "utm_campaign=token_launch" in order to identify users as well as track their wallets. Over a period of 7-30 days, wallets are grouped based on connection and are assigned to the correct marketing touchpoint.

Setting Up Wallet Attribution: Step-by-Step

To implement wallet-based attribution for a KOL campaign, follow these technical steps:

Step 1: Load the Spindl SDK onto your Landing Page.

You add the Spindl JavaScript SDK into your Landing Page HTML:

text

Then you initialize the SDK with your Project ID and Referral Code (from the KOL):

text

window.Spindl.init({

projectId: ‘YOUR_PROJECT_ID’,

referralCode: urlParams.get(‘ref’)});

Now the SDK will record where that user came in as their entry point. Once the user clicks “Connect Wallet,” The SDK is ready for the user to sign the request.

Step 2: Implement EIP-4361 Wallet Signing

Upon clicking the "wallet connection" button, prompt the user to obtain a signature from their wallet provider (e.g., MetaMask, Coinbase Wallet, etc.) via a wallet provider connection library (e.g., Web3Modal, RainbowKit). Provide the user with an EIP-4361 formatted message to be signed by the user's Ethereum account:

Service.org wants you to connect with your Ethereum account at

[User’s Ethereum wallet address]

Please enter your signature to confirm that you have read the service’s Terms of Service (see link below).

URI: https://service.org

Version: 1

Chain ID: 1

Nonce: [a random number/string]

Issued At: [the current date/time]

Once the wallet provider has obtained the user's signature, send it back to your server.

Step 3: Verify the Signature on Your Backend

Your backend receives the signed message and the signature. Verify it using a Web3 library such as ethers.js:

text

const recoveredAddress = ethers.utils.verifyMessage(message, signature);

if (recoveredAddress.toLowerCase() === userWalletAddress.toLowerCase()) {

// Signature is valid

// Link this wallet to the KOL referral code

}

This verification proves that the wallet owner signed the message, confirming that they control that address.

Step 4: Store the Attribution Data

Store the verified connection in your database:

text

INSERT INTO wallet_attribution (wallet_address, referral_code, kol_id, timestamp, chain_id)

VALUES ('0x...', 'kol_12345', 'influencer_a', NOW(), 1);

From this point forward, any onchain activity from that wallet can be traced back to the KOL who referred it.

Tracking Onchain Events: Smart Contract Integration

Once users are onchain, their real activity begins. Every meaningful interaction; a token swap, a DeFi position opened, a stake locked; creates an event on the blockchain. Leading analytics platforms like Dune Analytics and The Graph excel at capturing and organizing these events for analysis.

Dune Analytics provides pre-built dashboards and SQL queries that access raw blockchain data. When a user swaps tokens on Uniswap, for example, Dune's system automatically decodes the smart contract event (called the Swap event) and stores it in a queryable table named uniswap_v3_ethereum.Pair_evt_Swap. Each row in this table contains the wallet address, the tokens swapped, the amounts, and the timestamp. By joining this table to the wallet attribution data created in the previous section, a marketer can see exactly how many KOL referrals resulted in token swaps, and within what timeframe.

The Graph takes a more flexible approach by allowing developers to build custom indexers called subgraphs. A subgraph is a set of instructions that tells The Graph network how to listen for specific smart contract events and organize them into a format suitable for analysis.

Setting Up Event Tracking With Dune Analytics: Technical Steps

Step 1: Identify the Smart Contracts and Events

Determine which smart contract events matter for your KOL campaign. Common events include:

Transfer(token movements)Swap(DEX trades)Stake(DeFi deposits)Mint(new token creation or NFT minting)Bridge(cross-chain transfers)

Find the contract address of the protocol using a blockchain explorer like Etherscan. For example, Uniswap V3 Factory is deployed at 0x1F98431c8aD98523631AE4a59f267346ea31F984 on Ethereum mainnet.

Step 2: Write a SQL Query to Track Conversions

Log into Dune Analytics and create a new query. Write SQL to find all Swap events from wallets that came through your KOL campaign:

text

SELECT

evt_tx_hash,

evt_block_time,

sender,

amount0In,

amount1Out,

CASE

WHEN sender IN (

SELECT wallet_address FROM wallet_attribution

WHERE referral_code LIKE 'kol_%'

) THEN 'KOL_Referral'

ELSE 'Organic'

END AS source

FROM uniswap_v3_ethereum.Pair_evt_Swap

WHERE evt_block_time > NOW() - INTERVAL 30 DAY

AND sender IN (

SELECT wallet_address FROM wallet_attribution

WHERE referral_code LIKE 'kol_%'

)

ORDER BY evt_block_time DESC;

This query finds all swaps from wallets that came through a KOL referral in the last 30 days.

Step 3: Set Up Real-Time Dashboards

Create a Dune dashboard that displays:

Number of unique wallets converted per KOL

Total value swapped by KOL-referred wallets

Time between referral and first onchain action (activation latency)

7-day, 30-day retention (users who remain active)

Step 4: Export Data for ROI Calculation

Export your Dune query results to a CSV or connect Dune to Google BigQuery for further analysis:

text

SELECT

referral_code,

COUNT(DISTINCT sender) AS unique_wallets,

COUNT(*) AS swap_count,

SUM(amount0In) AS total_value,

AVG(DATEDIFF(HOUR, referral_date, evt_block_time)) AS avg_activation_hours

FROM your_export_table

GROUP BY referral_code

ORDER BY unique_wallets DESC;

This aggregated view gives you the KPIs needed to calculate ROI per KOL.

Deploying The Graph Subgraph for Custom Events

For more complex measurement scenarios, The Graph allows you to build a custom subgraph. This is valuable when your protocol issues custom events that standard tools like Dune do not yet decode.

Step 1: Set Up Your Subgraph Project

Install the Graph CLI and create a new subgraph:

text

npm install -g @graphprotocol/graph-cli

graph init --from-contract YOUR_CONTRACT_ADDRESS --contract-name YourProtocol --index-events

This scaffolds a subgraph project with the basic structure.

Step 2: Define Your Schema

Edit schema.graphql to define the data entities you want to track:

graphql

type User @entity {

id: ID!

walletAddress: String!

referralCode: String

firstActivationTime: Int

totalSwapsCount: Int

totalValueSwapped: BigDecimal

}

type Transaction @entity {

id: ID!

user: User!

eventType: String!

value: BigDecimal!

timestamp: Int!

}

Step 3: Create Event Handlers

Edit the mapping.ts file to write handlers that react to smart contract events:

typescript

import { Swap as SwapEvent } from "../generated/YourDEX/YourDEX"

import { User, Transaction } from "../generated/schema"

export function handleSwap(event: SwapEvent): void {

let user = User.load(event.params.sender.toHex())

if (user == null) {

user = new User(event.params.sender.toHex())

user.walletAddress = event.params.sender.toHex()

user.firstActivationTime = event.block.timestamp.toI32()

}

user.totalSwapsCount = user.totalSwapsCount ? user.totalSwapsCount + 1 : 1

user.save()

let transaction = new Transaction(event.transaction.hash.concatI32(event.logIndex.toI32()))

transaction.user = user.id

transaction.eventType = "Swap"

transaction.value = event.params.amount

transaction.timestamp = event.block.timestamp.toI32()

transaction.save()

}

Step 4: Deploy and Query

Deploy the subgraph to The Graph network:

text

graph deploy --product hosted-service YOUR_USERNAME/your-subgraph

Once deployed, query it with GraphQL:

graphql

query {

users(first: 100, where: { referralCode: "kol_12345" }) {

id

walletAddress

totalSwapsCount

totalValueSwapped

firstActivationTime

}

}

Preventing Fraud: Cryptographic Verification

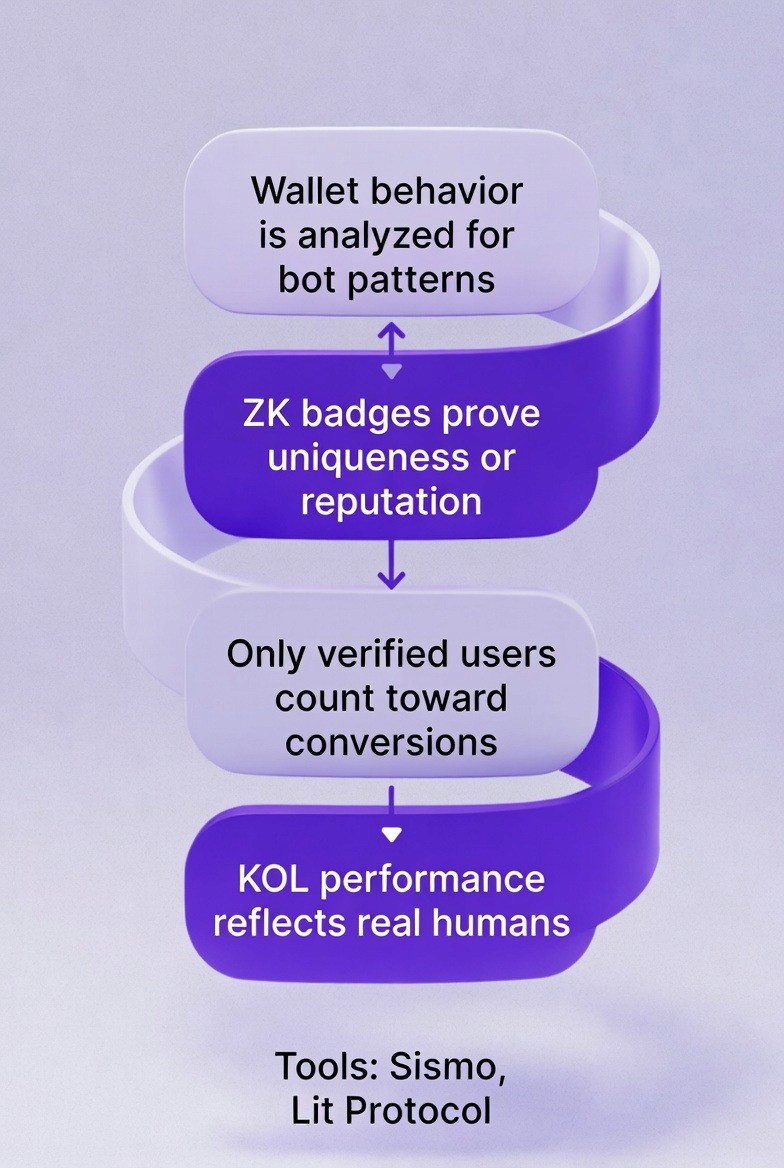

Even with wallet attribution and event tracking in place, sophisticated attackers can still attempt to artificially inflate metrics. Sybil attackers create clusters of related wallets that all refer to the same KOL, making it look like that KOL has more impact than they actually do. Cryptographic verification tools prevent this by using zero-knowledge proofs to prove that a wallet is unique without revealing the wallet's identity.

Lit Protocol and Sismo are two leading platforms for this. Lit Protocol allows you to create conditions in smart contracts that can only be unlocked if the user proves a certain fact about themselves using a zero-knowledge proof. For example, you can require that a user prove they are a unique human (detected by some offchain verification service) without the user having to share their identity.

Sismo goes further by issuing "ZK Badges"; digital credentials that prove a user meets certain reputation criteria. These badges are built using zero-knowledge proofs, meaning they cryptographically prove something is true without revealing the underlying data. For instance, a Sismo badge might prove "this wallet has completed at least 10 Ethereum transactions" without revealing which wallet it is.

Implementing Fraud Detection

Step 1: Set Up Wallet Clustering Detection

Before processing attribution data, identify wallet clusters that may be controlled by the same person or bot network. Use the following SQL approach:

sql

SELECT

wallet_a,

wallet_b,

similarity_score,

shared_ip,

same_creation_time_window

FROM wallet_relationships

WHERE similarity_score > 0.85

OR shared_ip = TRUE

OR same_creation_time_window = TRUE

GROUP BY wallet_a, wallet_b

HAVING COUNT(*) > 3;

This identifies clusters of wallets with suspicious correlations.

Step 2: Flag Suspicious Patterns

Create rules that identify common bot behaviors:

sql

SELECT

wallet_address,

'Rapid sequential swaps' AS bot_signal

FROM transactions

WHERE DATEDIFF(MINUTE, LAG(timestamp) OVER (PARTITION BY wallet_address ORDER BY timestamp), timestamp) < 1

GROUP BY wallet_address

HAVING COUNT(*) > 20;

This finds wallets that perform trades at an unrealistic speed, suggesting bot automation.

Step 3: Integrate Sismo Badge Verification

If you want to gate your campaign to only unique, verified humans, integrate Sismo's SDK into your onboarding flow:

javascript

const client = new SismoConnectClientConfig({

appId: "YOUR_APP_ID",

chains: [1, 137, 42161],

});

const sismoConnectButton = new SismoConnectButton({

config: client,

requests: [

{

auth: { authType: "twitter", isAnon: true },

},

],

onSuccess: (response) => {

// Send response to your backend for verification

verify(response);

},

});

When users connect through this flow, they prove they are verified humans without revealing personal information.

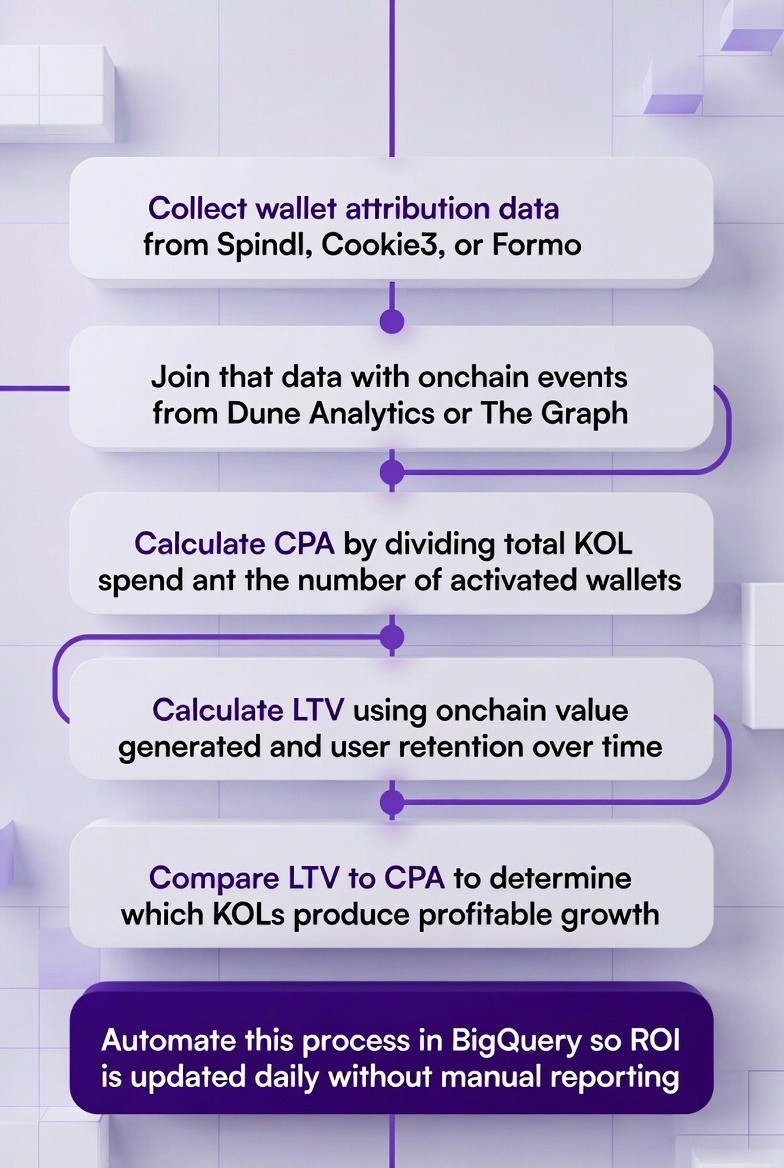

Calculating Return on Investment (ROI)

With wallet attribution, event tracking, and fraud detection in place, calculating true ROI becomes straightforward. The key metrics are Cost Per Acquisition (CPA) and Lifetime Value (LTV). CPA measures how much you spent on a KOL to get one converted user. LTV measures how much revenue that user will generate over time.

The basic formula for CPA is:

CPA = Total KOL Campaign Cost / Number of New Wallets Acquired

For example, if you paid a KOL $5,000 to promote your token and 200 new wallets activated from their referral link, your CPA is $25 per wallet.

LTV is more complex because it depends on user behavior. A simple version divides average revenue per user by churn rate:

LTV = (Average Revenue Per User) / (Churn Rate)

In a DeFi context, "revenue" might mean the fees users generate or the commissions the protocol earns. For a token launch, revenue might be the value of tokens locked or staked by the user. If your users generate an average of $500 in value and 20% churn out each month, your LTV is $2,500.

The profitable threshold is typically a 3:1 ratio of LTV to CPA. If your LTV is $2,500 and your CPA is $25, your ratio is 100:1, meaning the campaign is highly profitable.

Setting Up ROI Calculations in BigQuery: Step-by-Step

BigQuery is Google's data warehouse tool that integrates with blockchain data. Many Web3 teams use it to automate ROI calculations.

Step 1: Create a BigQuery Dataset

Log into Google Cloud and create a new BigQuery dataset named "kol_campaign_analysis".

Step 2: Import Attribution and Event Data

Load your wallet attribution table and Dune export into BigQuery:

sql

CREATE OR REPLACE TABLE kol_campaign_analysis.wallet_attribution AS

SELECT

wallet_address,

referral_code,

kol_name,

campaign_name,

referral_date

FROM your_data_source;

CREATE OR REPLACE TABLE kol_campaign_analysis.onchain_events AS

SELECT

wallet_address,

event_type,

value_usd,

event_date

FROM your_data_source;

Step 3: Calculate CPA by KOL

sql

SELECT

kol_name,

COUNT(DISTINCT wallet_address) AS wallets_acquired,

SUM(campaign_cost) / COUNT(DISTINCT wallet_address) AS cpa,

SUM(campaign_cost) AS total_spend

FROM kol_campaign_analysis.wallet_attribution

WHERE referral_date BETWEEN '2024-01-01' AND '2024-03-31'

GROUP BY kol_name

ORDER BY cpa ASC;

Step 4: Calculate LTV for Each Cohort

Segment users by KOL and track their lifetime value:

sql

WITH cohort_data AS (

SELECT

w.kol_name,

w.wallet_address,

COUNT(DISTINCT CASE WHEN e.event_date <= DATE_ADD(w.referral_date, INTERVAL 30 DAY) THEN e.event_type END) AS actions_30d,

SUM(CASE WHEN e.event_date <= DATE_ADD(w.referral_date, INTERVAL 30 DAY) THEN e.value_usd ELSE 0 END) AS value_30d,

SUM(CASE WHEN e.event_date <= DATE_ADD(w.referral_date, INTERVAL 90 DAY) THEN e.value_usd ELSE 0 END) AS value_90d,

CASE WHEN MAX(CASE WHEN e.event_date <= DATE_ADD(w.referral_date, INTERVAL 30 DAY) THEN 1 ELSE 0 END) = 1 THEN 1 ELSE 0 END AS active_at_30d

FROM kol_campaign_analysis.wallet_attribution w

LEFT JOIN kol_campaign_analysis.onchain_events e

ON w.wallet_address = e.wallet_address

GROUP BY w.kol_name, w.wallet_address

)

SELECT

kol_name,

COUNT(*) AS cohort_size,

SUM(CASE WHEN active_at_30d = 1 THEN 1 ELSE 0 END) / COUNT(*) AS retention_30d,

AVG(value_30d) AS avg_ltv_estimate,

AVG(value_90d) AS avg_ltv_90d

FROM cohort_data

GROUP BY kol_name;

Step 5: Calculate Multi-Touch Attribution

If users interact with multiple KOLs, assign credit appropriately:

sql

WITH user_journeys AS (

SELECT

wallet_address,

ARRAY_AGG(STRUCT(kol_name, referral_date) ORDER BY referral_date) AS kol_sequence,

MAX(referral_date) AS last_kol_touchpoint

FROM kol_campaign_analysis.wallet_attribution

GROUP BY wallet_address

),

attributed_value AS (

SELECT

uj.wallet_address,

uj.kol_sequence[OFFSET(0)].kol_name AS first_touch_kol,

ARRAY_REVERSE(uj.kol_sequence)[OFFSET(0)].kol_name AS last_touch_kol,

SUM(oe.value_usd) AS total_value

FROM user_journeys uj

LEFT JOIN kol_campaign_analysis.onchain_events oe

ON uj.wallet_address = oe.wallet_address

GROUP BY uj.wallet_address, first_touch_kol, last_touch_kol

)

SELECT

first_touch_kol,

COUNT(*) AS attributions,

SUM(total_value) / COUNT(*) AS avg_value_per_user,

SUM(total_value) AS total_attributed_value

FROM attributed_value

GROUP BY first_touch_kol

ORDER BY total_attributed_value DESC;

Monitoring Campaign Performance in Real-Time

Once your infrastructure is in place, set up real-time dashboards that alert you to problems immediately. Teams can use Looker Studio (free) or custom dashboards to visualize KOL performance.

Building a Real-Time Dashboard

Step 1: Connect BigQuery to Looker Studio

Open Looker Studio, create a new report, and connect it to your BigQuery dataset.

Step 2: Add Key Performance Indicators (KPIs)

Create the following card visualizations:

Wallets Acquired Today: COUNT(DISTINCT wallet_address) WHERE referral_date = TODAY()

Average CPA This Week: SUM(campaign_cost) / COUNT(DISTINCT wallet_address) WHERE referral_date >= DATE_SUB(TODAY(), INTERVAL 7 DAY)

Activation Rate (24-Hour): Wallets with at least one onchain event within 24 hours / Total wallets acquired

Churn Rate (7-Day): Wallets inactive for 7 days / Total wallets acquired

Step 3: Add Filters by KOL and Campaign

Allow stakeholders to filter the dashboard by specific KOLs or campaigns to drill down into performance.

Step 4: Set Up Alerts

Configure BigQuery scheduled queries to send alerts when metrics drift:

sql

SELECT

CURRENT_TIMESTAMP() AS alert_time,

kol_name,

weekly_cpa,

CASE

WHEN weekly_cpa > avg_cpa * 1.5 THEN 'ALERT: CPA elevated 50% above normal'

WHEN activation_rate < 0.15 THEN 'ALERT: Activation rate below 15%'

WHEN churn_rate > 0.4 THEN 'ALERT: 7-day churn above 40%'

END AS issue

FROM your_kpi_table

WHERE alert_threshold_breached = TRUE;

Scaling Your Framework Across Multiple KOLs

As your program grows, managing dozens or hundreds of KOLs requires automation. Platforms like Cookie3 and Spindl handle this at scale by allowing teams to upload KOL lists, automatically track their posts, and generate performance rankings.

Automating KOL Onboarding

Step 1: Create a KOL Master List

Maintain a spreadsheet with KOL wallet addresses, Twitter handles, audience size, and engagement rates. Upload this to your database:

sql

CREATE TABLE kol_registry (

kol_id INT PRIMARY KEY,

kol_name STRING,

twitter_handle STRING,

wallet_address STRING,

audience_size INT,

engagement_rate FLOAT,

joined_date DATE

);

Step 2: Generate Unique Referral Links

Create a backend service that generates unique UTM-tagged links for each KOL:

python

def generate_kol_link(kol_id, campaign_id):

base_url = "https://yourprotocol.com"

params = {

"utm_source": f"kol_{kol_id}",

"utm_medium": "social",

"utm_campaign": f"campaign_{campaign_id}",

"ref": f"kol_{kol_id}_{campaign_id}"

}

return f"{base_url}?{'&'.join([f'{k}={v}' for k, v in params.items()])}"

Step 3: Monitor KOL Social Posts

Use the Twitter API or a service like Brandwatch to track when KOLs post about your project. Log these posts:

sql

INSERT INTO kol_posts (kol_id, post_id, post_text, engagement_count, timestamp)

VALUES (kol_id, tweet_id, tweet_text, likes + retweets, NOW());

Step 4: Correlate Social Activity to Onchain Results

Create a table that joins KOL posts to wallet activations:

sql

SELECT

p.kol_id,

p.post_id,

COUNT(DISTINCT w.wallet_address) AS activations_post_24h,

SUM(oe.value_usd) AS value_generated_post_24h,

p.engagement_count AS social_engagement

FROM kol_posts p

LEFT JOIN wallet_attribution w

ON p.kol_id = w.kol_id

AND w.referral_date BETWEEN p.timestamp AND TIMESTAMP_ADD(p.timestamp, INTERVAL 24 HOUR)

LEFT JOIN onchain_events oe

ON w.wallet_address = oe.wallet_address

GROUP BY p.kol_id, p.post_id;

Table: Measuring Success by Industry Benchmarks

Leading Web3 projects now use these metrics to gauge KOL campaign success:

Metric | Description | Benchmark |

Activation Rate | % of referred wallets that perform at least one onchain action within 24 hours | 15-25% |

Cost Per Activation (CPA) | Total campaign spend divided by activations | $10-$50 per wallet |

7-Day Retention | % of activated wallets still active 7 days later | 30-50% |

30-Day LTV | Average value generated by a referred user in 30 days | $500-$2,000 |

LTV:CPA Ratio | Lifetime value divided by acquisition cost | 10:1 to 50:1 (highly profitable) |

Fraud Rate | % of wallets identified as Sybils or bots | <10% (with proper detection) |

ROI | (LTV - CPA) / CPA | 5-11x for top-performing campaigns |

Real Use Cases

Sapien, a decentralized data foundry that transforms collective human knowledge into verified AI training data, used Cookie SNAPS (creator activation and analytics feature within the Cookie3 ecosystem) to scale its awareness campaign and track meaningful engagement across Web3 audiences.

In June 2025, Sapien launched a Cookie SNAPS-driven campaign that activated thousands of creators in real time, generated over 50,000 organic creator posts, achieved more than 53 million impressions, onboarded 8,000+ active creators, and propelled Sapien to #3 in global mindshare on Crypto Twitter during the peak seven-day period, showing how on-chain aware campaign measurement and creator incentives can drive sizable narrative and engagement outcomes.

The Outlook

Web3 marketing is moving from hype-driven promotion to infrastructure-driven growth. By 2026, the winning teams will no longer ask how many views a KOL generated, but how many verified wallets they activated, how long those users stayed, and how much value they created onchain.

The long-term direction is clear: influencer marketing in Web3 will not be judged by impressions, but by cryptographically proven impact. Wallet attribution, onchain measurement, and fraud-resistant verification will become the baseline for any serious growth strategy.

How TokenMinds Helps Run Fraud-Resistant KOL Campaigns

TokenMinds supports Web3 teams end-to-end in building high-performance KOL programs that go beyond branding and deliver measurable growth. We help design KOL strategy, select and onboard creators, structure campaigns, and define performance KPIs based on activation, retention, and lifetime value instead of vanity metrics. Our marketing team ensures every campaign is optimized for real user acquisition, not just impressions.

We will deploy wallet-based attribution using EIP-4361, integrate onchain event tracking with Dune and The Graph, and set up fraud-resistant verification to filter bots and Sybil wallets.

Conclusion

Web3 marketing has reached a point where vanity metrics are no longer acceptable. Teams that adopt wallet-based attribution, onchain event tracking, and cryptographic fraud detection gain something Web2 marketing never offered; verifiable truth. When every referral, conversion, and transaction is tied to a real wallet and an immutable ledger, ROI becomes measurable, budgets become defendable, and growth decisions become data-driven. For DeFi projects, token launches, and Web3 platforms planning for 2026, blockchain-native measurement is no longer an upgrade, it is the new baseline for serious performance marketing.

Schedule a complimentary consultation with TokenMinds to explore how your organization can implement wallet-based attribution, fraud-resistant KOL tracking, and onchain ROI frameworks that turn influencer marketing into a predictable, high-return growth channel.

FAQ

Why do traditional KOL metrics fail in Web3 marketing?

Because likes, views, and clicks are easy to fake with bots, Sybil wallets, and engagement rings. These vanity metrics do not show which users actually transact, hold tokens, or stay active, leading to wasted budgets and misleading performance reports.

What does fraud-resistant KOL measurement really mean?

It means tying campaign results to verified onchain behavior instead of social engagement. By using wallet-based attribution, smart contract events, and cryptographic proofs, every conversion is linked to real activity that cannot be manipulated.

How does wallet-based attribution improve campaign accuracy?

When users connect their wallet through a KOL link and sign with EIP-4361, the referral is cryptographically bound to that wallet. This makes attribution permanent and tamper-proof, eliminating fake signups and multi-account abuse.

How are real conversions tracked onchain?

Smart contract events such as swaps, stakes, mints, and deposits are indexed using tools like Dune Analytics and The Graph. These events show exactly what users do after being referred, turning KOL performance into measurable business outcomes.

How does cryptography prevent Sybil and bot fraud?

Zero-knowledge tools like Sismo and Lit Protocol allow users to prove they are unique or meet reputation criteria without revealing identity. This blocks fake wallet clusters while keeping user privacy intact.

How should Web3 teams calculate true ROI from KOL campaigns?

By comparing Cost Per Acquisition (CPA) from verified wallet activations with Lifetime Value (LTV) from onchain revenue. When attribution and fraud detection are in place, teams can confidently measure which KOLs drive profitable growth instead of hype.