TL;DR

How to integrate Circle Payments Network into existing payment and treasury systems to enable real time cross border settlement, and redesign liquidity, compliance, and operations to improve capital efficiency and reliability.

Financial institutions are under increasing pressure to move money faster while using capital more efficiently. Treasurers are expected to make liquidity decisions in real time, even though cross-border settlements still take days. CFOs push for better capital efficiency, yet large balances remain locked in prefunded accounts across many currencies.

Payment teams advertise “instant” payments, but in reality, much of the liquidity sits idle most of the day. This gap between what businesses need and what payment systems can deliver has become impossible to ignore.

Traditional payment rails were designed for batch processing and long settlement cycles. They assumed that delays were acceptable. Today’s institutions need real-time, cross-border settlement without spreading capital across fragmented accounts.

This article explains how institutions integrate Circle Payments Network (CPN) to modernize cross-border settlement, an evolution increasingly enabled by agentic crypto payment integration models. It also explains why many integrations fail, not because of technology, but because organizations underestimate the operational changes required for real-time settlement at scale.

What Is Circle Payments Network (CPN)

The Circle Payments Network (CPN) is an institutional settlement layer that is intended for use by regulated financial institutions; it has been developed to facilitate the movement of funds between institutions rather than to provide services to consumers or to enable consumer trading activity.

CPN is a permissioned network. This means that only those entities who have been permitted to join may participate in the network, which includes banks, licensed Payment Service Providers, fintech companies, and larger companies with complex treasury systems, all of whom will undergo compliance and onboard review prior to being added to the network.

Stable coins (USDC & EURC), which are fully collateralized, subject to regulatory oversight, and are intended to act as alternatives to traditional fiat currencies but operate in real-time, are used as the settlement asset on CPN, with this model operationalized via stablecoin payment integration.

Institutions do not interface directly with blockchain technology as part of using CPN. Rather, they use standard REST APIs and common dashboard interfaces to connect to the blockchain-based settlement system, which is typically one of multiple public blockchain platforms (e.g., Ethereum, etc.) and other compatible networks, an abstraction layer commonly delivered by Web3 payment gateway architectures.

Key characteristics of CPN include:

Real-time, cross-border, multi-currency settlement

24/7 operation with instant settlement finality

Reduced reliance on prefunded nostro accounts

Integration with existing compliance, treasury, and reporting systems

Operationally, institutions no longer need to hold large balances in many foreign accounts. Instead, they hold USDC or EURC as a bridge asset. A cross-border payment converts from fiat to stablecoin, settles instantly, and converts to the destination currency for the recipient.

This model raises an important operational question: is the organization ready to manage liquidity, compliance, and controls in real time? The answer determines whether integration succeeds.

Global Cross Border Payments

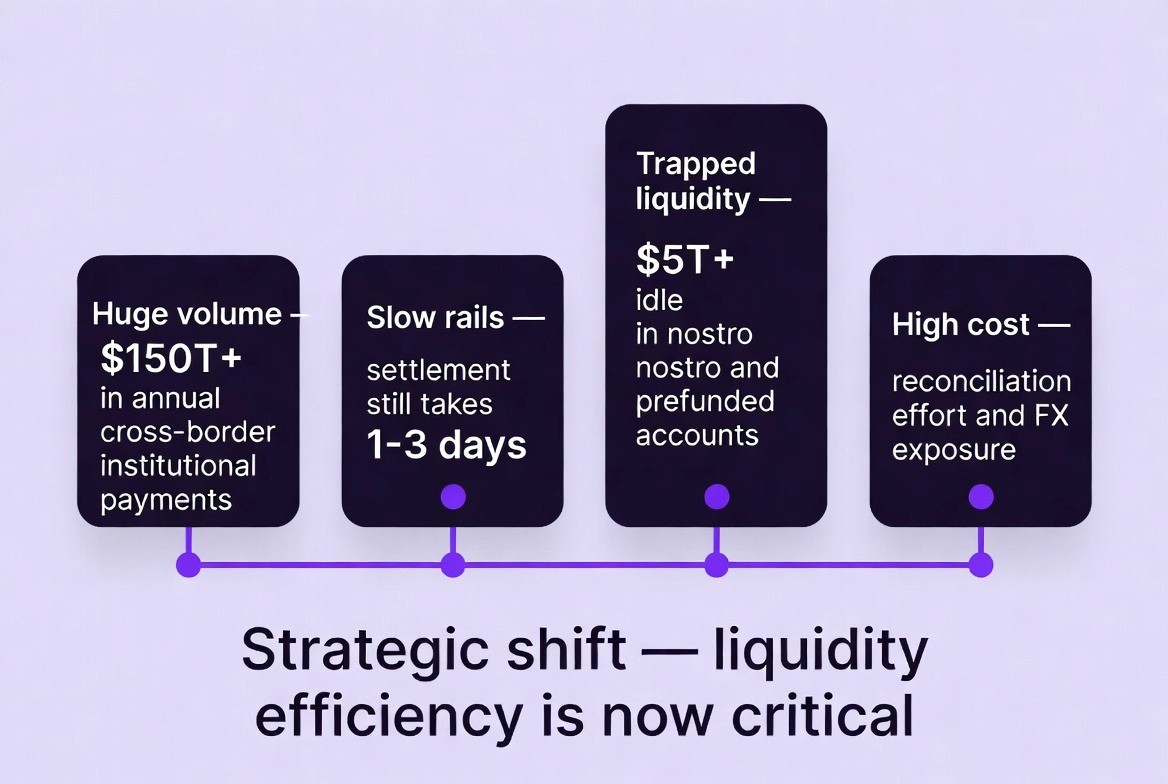

Cross-Border Payments total over $150 trillion per year. Most of that is Institutional Payment, made up of B2B activity (e.g., wire transfers), Treasury Operations (e.g., corporate-to-corporate transfer) and Trade Settlement (e.g., shipping, etc.).

While there has been significant improvement in the area of Consumer Payments (e.g., Apple Pay, Google Wallet, Zelle, etc.), Institutional Settlement is very slow and complicated.

Money still moves through a variety of antiquated Systems for Institutional Payment. Some of the key points are:

- Many multinational corporations have Prefunded Accounts in multiple countries.

- Banks also have large amounts of cash held at Correspondent Banks, which enables faster payment processing.

- The cash held in these accounts earns very little interest.

- Industry Estimates indicate over $5 Trillion is currently being held in Nostro Accounts and Prefunded Accounts worldwide. This can represent hundreds of Millions of dollars in Unavailable Capital to Large Enterprises. To Banks and PSP's, this represents Billions of Dollars.

Industry estimates suggest more than $5 trillion sits idle globally in nostro and prefunded accounts. For large enterprises, this can mean hundreds of millions in unused capital. For banks and PSPs, it can mean billions.

Operational costs add to the problem:

Settlement times average 1–3 business days

Delays increase reconciliation work and FX exposure

Treasury teams rely on manual forecasting and monitoring

As demand for real-time payments grows, infrastructure limitations become more visible. Liquidity efficiency is now a strategic priority, especially in higher interest rate environments.

Slow settlement creates an ongoing cost. Every extra day means tied-up capital, more reconciliation work, and more exposure to FX risk. Institutions that reduce settlement time gain measurable financial advantages.

Why Traditional Cross Border Payments Are Limited

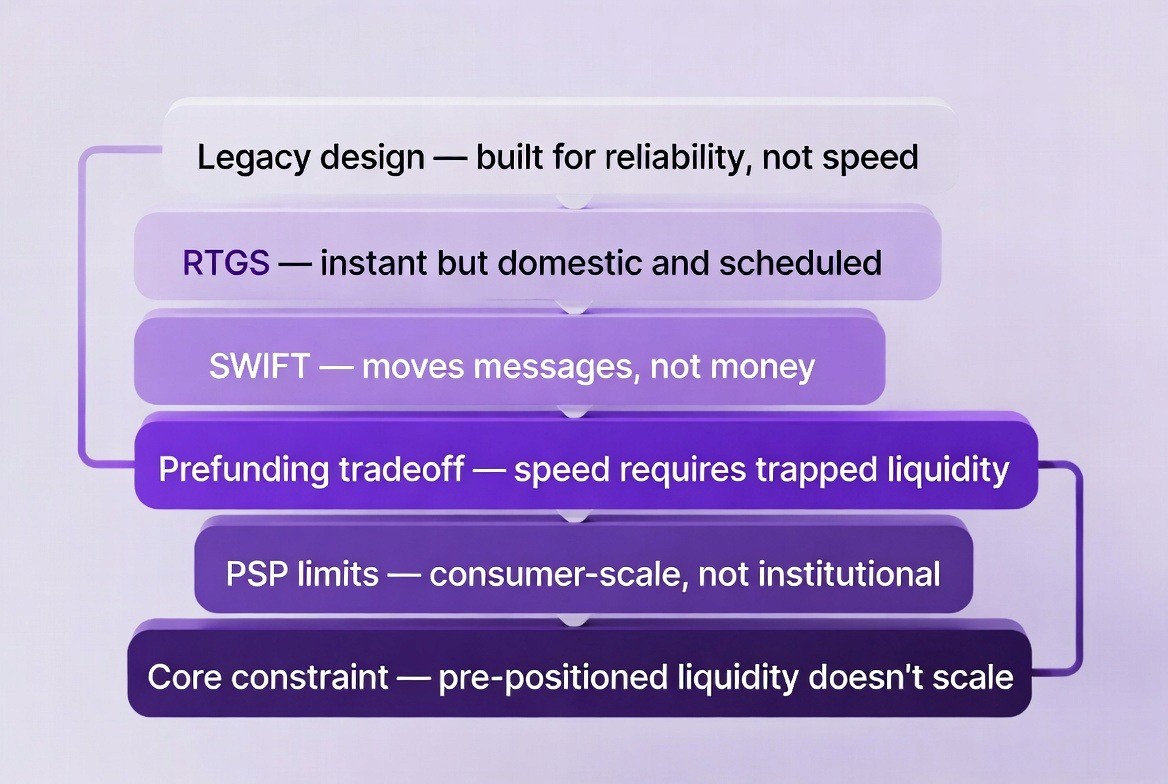

Existing payment systems were built for reliability, not speed. Their limitations come from design choices made for a different era.

The majority of the time, RTGS (Real-Time Gross Settlement) systems are operated by a nation's central bank and are primarily designed to be the central clearing system for all domestic transactions in that country (e.g. TARGET2 in Europe; FedWire in U.S.; CHAPS in the UK).

Benefits of RTGS systems:

Settlement is instant, irrevocable and final

Reliability is very high when all parties to an exchange operate within one currency zone and jurisdiction

Limitations of RTGS systems:

Only for use domestically

Operate on a fixed schedule

Not able to natively settle cross border payments

Cross border transactions will need an extra layer of infrastructure beyond just the RTGS system to enable the transaction to flow from start to finish.

SWIFT and Correspondent Banking

SWIFT is a messaging network, not a settlement system. Messages move quickly, but money moves through correspondent banks.

Characteristics of typical SWIFT transfers are:

More than one bank acts as an intermediary

The time required to settle can take anywhere from 1-3 business days or more.

A fee is charged at each intermediary bank.

There is limited visibility into who has done what in the process.

Each institution faces a trade off when using SWIFT.

Using pre-funded accounts allows for faster processing times.

However, this means that less capital is being used idly but then you must wait longer to settle the transfer.

It is impossible to achieve both of these goals at the same time using the current SWIFT model.

Global PSPs

Global PSPs provide rapid consumer experience via large global prefund of funds. When users make payments, it appears that they are made immediately as there is always liquidity available to support these transactions.

This model:

Is effective for retail and small business paymentsDoes not work economically for institutional payments

Is capital intensive to implement

Traditional methods (all) utilize pre-positioning of liquidity to offset the slower settlement times. This model does not scale effectively when capital is constrained.

Benefits for Financial Institutions

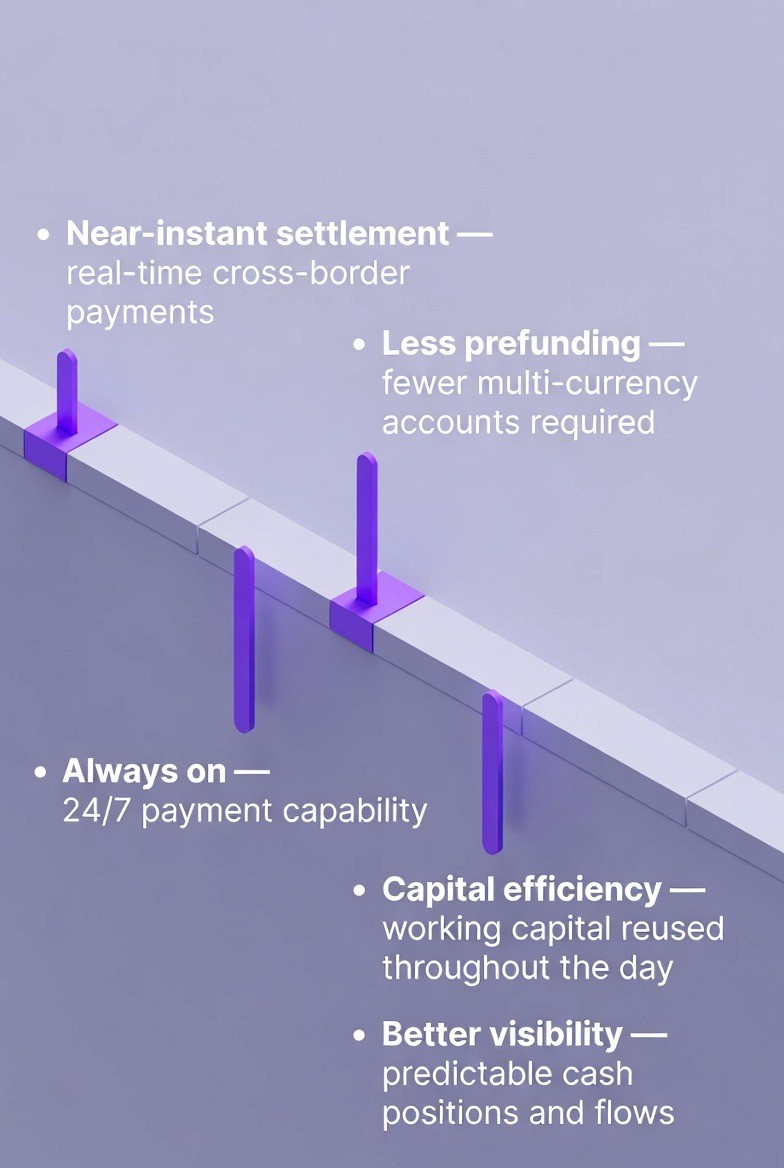

The integration of CPN provides operational and financial advantages that are tangible and quantifiable.

Some of the key advantages provided by integrating CPN include:

Sending cross-border payments with an average completion time of seconds.

Reduction in the amount of multi-currency accounts that require pre-funding.

Increased efficiency in working capital.

Payment capabilities through-out 24 hours a day.

Increase visibility and predictability of cash flow.

The ability to create new real-time payment products.

Through instant settlements, banks are able to use their capital over and over again throughout each business day. The institution is therefore able to increase its capital utilization while also maintaining the level of risk.

Historically, there has been a trade off between payment speed and capital utilization. However, CPN allows for an institution to have both capital efficiency and payment speed simultaneously.

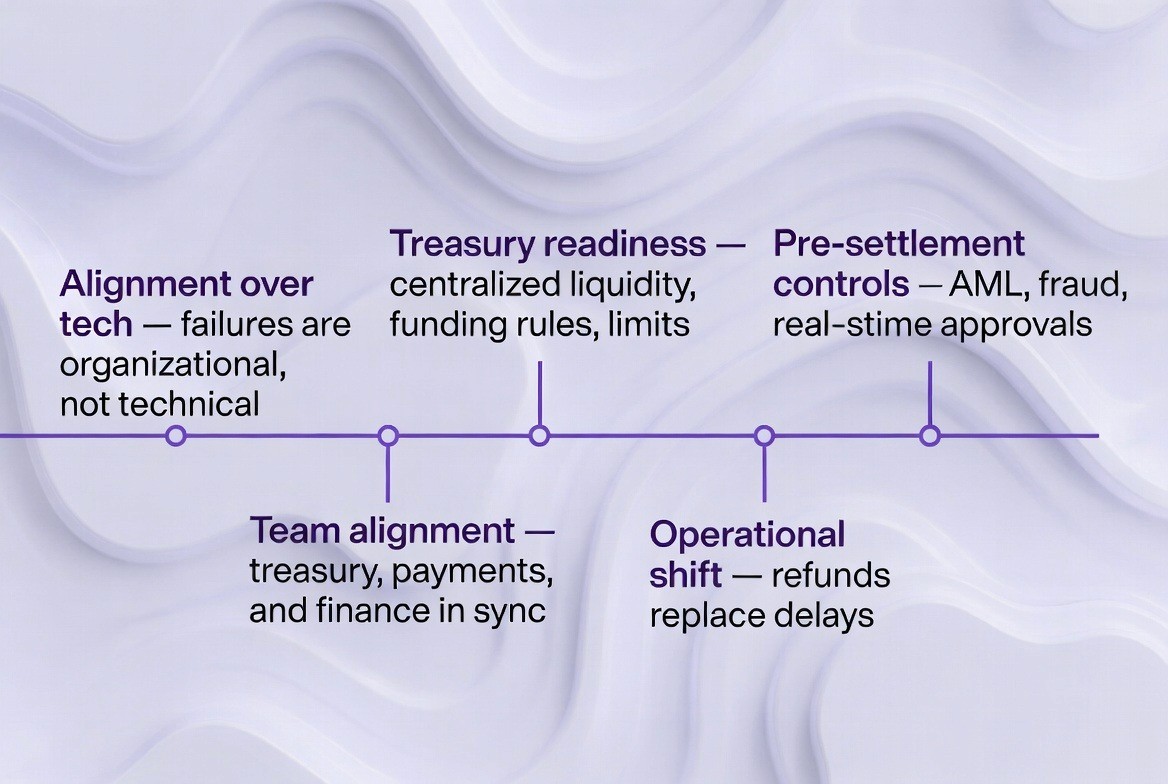

Core Integration and Design Principles

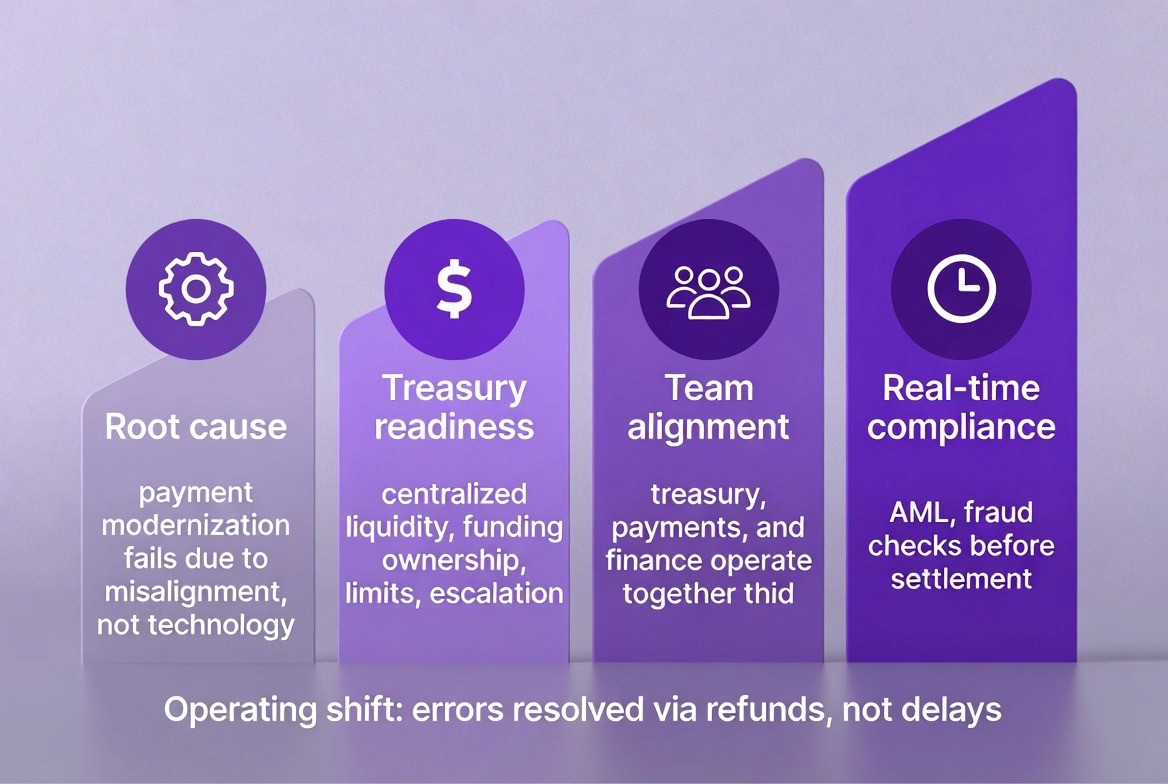

Most failed attempts at modernizing a business’s payment system is a result of lack of alignment among stakeholders rather than technical issues. Before beginning to integrate new technologies into a company's existing infrastructure, an organization should first identify and address several key areas that must be established prior to integration.

Treasury and Liquidity Readiness

To manage the real-time settlement of financial transactions, companies need to have processes for managing their liquidity needs on an ongoing basis. The necessary elements include:

Centralized liquidity pools for stablecoins

Defining who will fund and when they can replenish the funds used to settle those transactions

Established limits, buffers, and escalation procedures

Alignment of the Treasury department with departments responsible for payments and Finance

If any of these factors are missing or incomplete, it does not matter if the technology works well, as the systems will ultimately still fail operationally.

Compliance, Monitoring, and Controls

Instant settlement changes the way an organization complies with regulatory and business requirements for their transaction process. To meet some of these key requirements organizations must have systems that can perform:

Pre-settlement sanction checks (AML, Fraud screening)

Automated approval/rejection logic based on real time data

Create real time audit trails and reporting capabilities

Understand that corrections to errors are made through refunds and not delays.

Companies using post-transaction review processes will be challenged by the need to make decisions instantaneously.

System Architecture for Integrating Circle Payments

The API layer for payment requests still comes from legacy systems (such as an ERP system, a bank's portal, etc.) but an orchestration layer can:

Validate the transaction

Check that it complies with all applicable regulations and liquidity requirements

Route the payment to either CPN or traditional rails based on business rules

CPN settlement happens in real time, while the fiat payout follows standard local rails. Systems will therefore have to be able to manage both synchronous and asynchronous events.

Treasury Wallets and Reconciliation Logic

Treasury wallets hold the stablecoins required to settle and have the capability to settle. The key to the design of the treasury wallet is:

Enterprise-grade custodial control (approval)

Balance reporting in real-time

Reconciliation based on event notification using blockchain data

Error handling process defined by exceptions

The treasury wallet provides an enterprise-class financial transaction solution that integrates with current financial accounting and reporting processes while providing a real time settlement function.

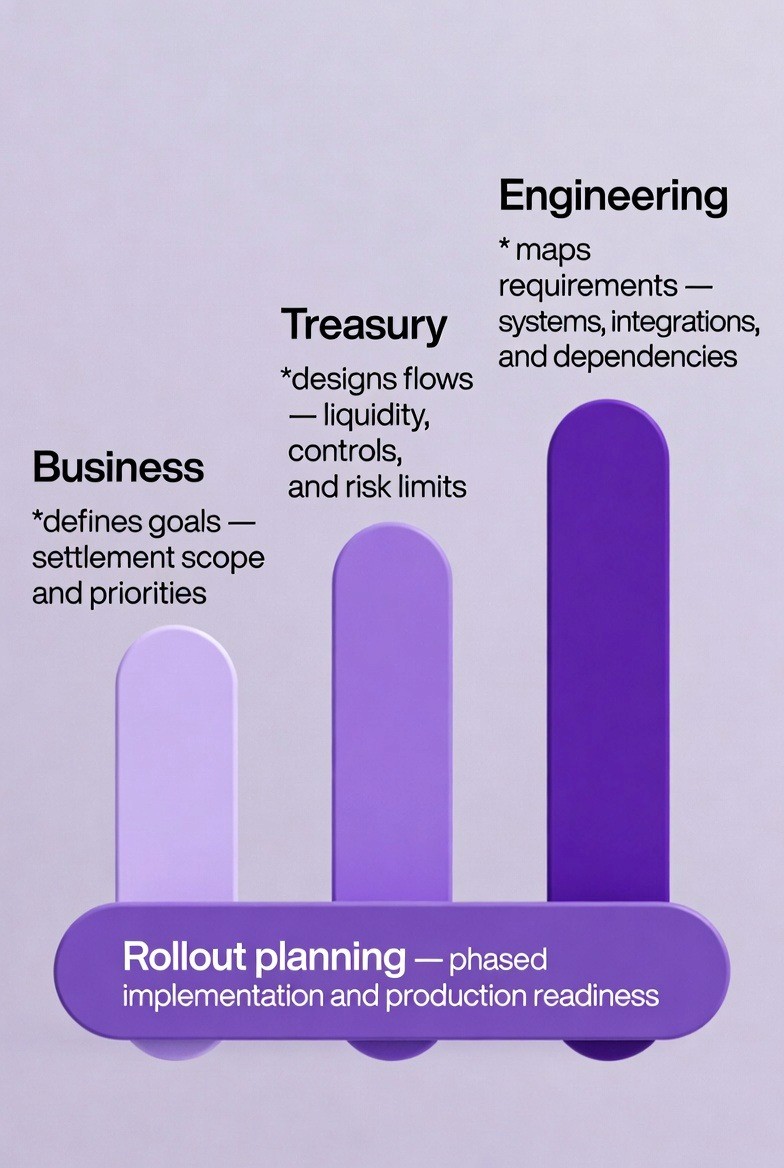

How to Integrate Circle's Real-Time, Cross-Border, Multi-Currency Payments Into Existing Systems

The following section describes the actual implementation process for how this integration was accomplished. This section is intended for platform architects and development teams that will create the architecture and write the code for the system. While there are some API's involved with the creation of the application, the majority of the complexity comes from the orchestration of the application, control mechanisms and operational processes.

Teams that treat integration as “just calling Circle APIs” usually end up with demos that work in testing but fail in production. Successful teams design for real-world conditions from day one.

Step 1: Define Integration Scope

Before any code is written, teams must clearly define what the integration will cover. Scope decisions affect system design, operational risk, and rollout timelines.

Key scope questions include:

Will CPN be used only for internal treasury movements or also for client-facing payments?

Which currencies and cross-border corridors will be supported at launch?

What transaction volume and availability levels are required?

Internal treasury vs client-facing payments

Beginning with CPN for Internal Treasury Operations, as a rule of thumb, will be your safest way to get started. The most common examples of these use cases are:

Paying international suppliers

Transferring funds among subsidiaries

Managing internal working capital

Working with internal payments allows you to test actual time settlement, liquidity behavior and reconciliation while avoiding customer facing exposure. Payment products that are client-facing need additional components:

Customer on-boarding and KYC

Real-time transaction monitoring

Providing customer support and maintaining Service Level Agreements (SLAs)

Most institutions begin using CPN internally and then expand into customer-facing applications once they feel confident in their internal operational abilities.

Corridor and currency selection

Not every Payment Corridor will enjoy equal advantages of a real-time settlement process. Teams should give priority to:

Payment Corridors that have high transaction volumes

Corridors which incur significant pre-funding fees

The most frequently used Currency Pairs (i.e., USD–EUR, USD–GBP).

Allowing technical teams to initially focus on three to five corridors reduces the overall amount of work required and the associated risks.

Volume and performance targets

Technical teams are responsible for translating the business expectations into the necessary system requirements; e.g.,

Transaction volume expected per day at initial deployment

Business growth expectations over 12 – 24 months

Uptime targets (e.g., 99.9%+); acceptable settlement time (seconds, not minutes)

These inputs determine the need for redundant systems, monitoring, and capacity planning.

Real implementation:

A multinational enterprise starts by using CPN only for internal treasury payments such as supplier payments and intercompany transfers.

The company selects USD–EUR and USD–GBP as the first supported corridors based on volume and prefunding cost.

Treasury sets an initial target of 3,000 cross-border payments per day with 24/7 availability.

Engineering aligns systems to settle payments in under one minute.

After six months of stable operations, the company expands to selected client-facing payments.

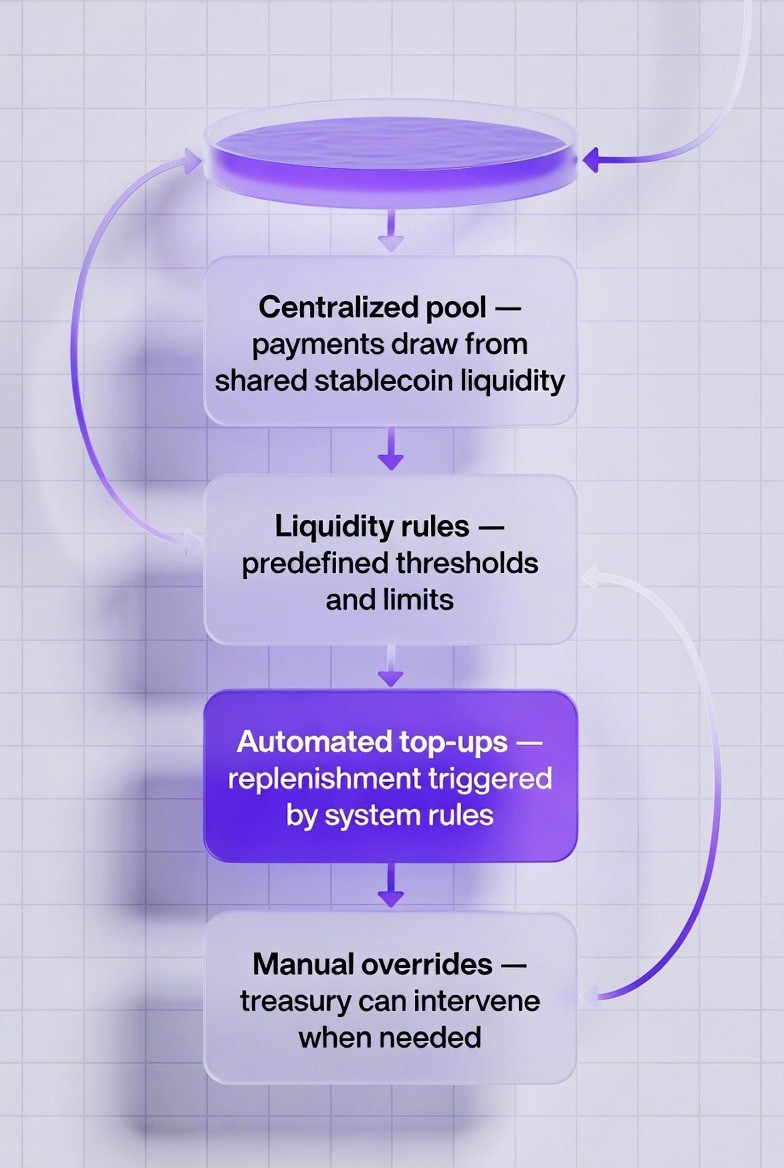

Step 2: Liquidity Model Design

Liquidity Design is an integral part of Integration and is the most important part of Integration due to its impact on Capital Efficiency, Operational Risk, and System Availability.

Centralized Stable Coin (USDC/EURC) Liquidity Pool

The majority of institutions utilize a single centralized pool of USDC and EURC that supports all CPN payment activity. The Centralized model provides:

Maximized Capital Efficiency

Ability to reuse the same capital throughout the day.

Least Amount of Total Required Liquidity

Alternative models such as Separate Pools Per Region or Business Unit, provide clarity but at the expense of additional capital. They are typically used for Regulatory or Segregation requirements.

Funding and replenishment logic

Teams should determine:

The size of the initial pool of funds based on the anticipated daily volume of transactions.

Thresholds to define minimum balances in a team's pool.

When (and how) they will replenish their pool.

A team must also have an understanding of who is authorized to approve funding activities, particularly during non-business hours.

Teams may replenish their liquidity through:

Automatically replenishing their pool once thresholds are met.

Treasury teams manually replenished their pool.

Using forecasted volumes of upcoming payments to determine when to replenish their pool.

Risk limits and controls

To support real time settlement, teams must implement real time controls. Some common controls include:

Limiting the maximum amount of a single transaction.

Placing daily limits on the total volume of transactions allowed in each currency and/or corridor.

Monitoring velocity (i.e., checking for abnormal activity).

Requiring multi-signatures to authorize large transfer requests.

Pausing settlements automatically if a limit is violated.

All of the above processes must take place prior to beginning the settlement process.

Real implementation:

A cross-border fintech PSP serving e-commerce platforms replaces prefunded EUR and GBP bank accounts with a single centralized USDC liquidity pool.

The treasury team sizes the pool to cover two days of peak transaction volume instead of total outstanding balances.

Automated rules trigger replenishment when the pool drops below a defined threshold during business hours.

Outside business hours, replenishment requests are routed to a multisignature approval workflow for risk control.

As payments settle in real time, the same liquidity is reused throughout the day, cutting idle capital by over 40% while maintaining 24/7 availability.

Step 3: Technical Architecture and Technology Stack

The process of integrating depends upon each of several components performing their designated roles within the payment flow.

Each of these components is responsible for an integral part of the overall process of processing payments.

API Gateway Layer

The API gateway acts as the conduit that is used to interact with Circle's API and facilitates all communication between the two. In addition to communicating with Circle's API, it is also used to handle:

Authentication

Rate limiting

Validation of requests

Handling errors

Options to implement the API gateway technology include:

Kong

AWS API Gateway

Apigee

A custom Node.js gateway for the API

// Example API Gateway configuration for Circle integration

const express = require('express');

const axios = require('axios');

const rateLimit = require('express-rate-limit');

const app = express();

const circleApiKey = process.env.CIRCLE_API_KEY;

const circleApiUrl = 'https://api.circle.com/v1';

Payment Orchestration Engine

The above section describes the decision-making layer of a blockchain system which performs the following functions:

Validate the payment request

Run compliance check

Determine if sufficient liquidity to settle exists (if necessary)

Choose the appropriate Settlement Rail

Settle the Transaction.

The typical technologies used for this decision-making layer would be:

Node.js using TypeScript

Redis to cache and queue items

PostgreSQL to store transactions.

// Payment orchestration service structure

interface PaymentRequest {

id: string;

amount: number;

currency: string;

sourceCurrency: string;

beneficiaryId: string;

metadata: Record<string, any>;

}

Treasury Wallet Management

Enterprise grade Treasury Wallets will hold stablecoin liquidity and perform on-chain transfers. The Enterprise Grade Treasury Wallets will also have the following features:

Multiple Signatures Approval

Policy Based Transaction Rules

Integrate with Treasury Systems

Common tools include Fireblocks, Gnosis Safe, or custom wallets using ethers.js.

// Treasury wallet management service

import { ethers } from 'ethers';

class TreasuryWalletManager {

// unchanged implementation

}

Compliance Screening Integration

All compliance checks are required to be completed prior to settlement commencement. The typical integrations included within this process are:

Sanctions screening

AML risk assessment and scoring

Fraud prevention

All of these are typically expected to be returned in millisecond timeframes.

Example:

// Compliance screening service

class ComplianceScreeningService {

// unchanged implementation

}

Database Schema

The database captures all data for:

Payment requests

Settlement records

Compliance decision (approval/denial)

Liquidity events

Reconciliation results

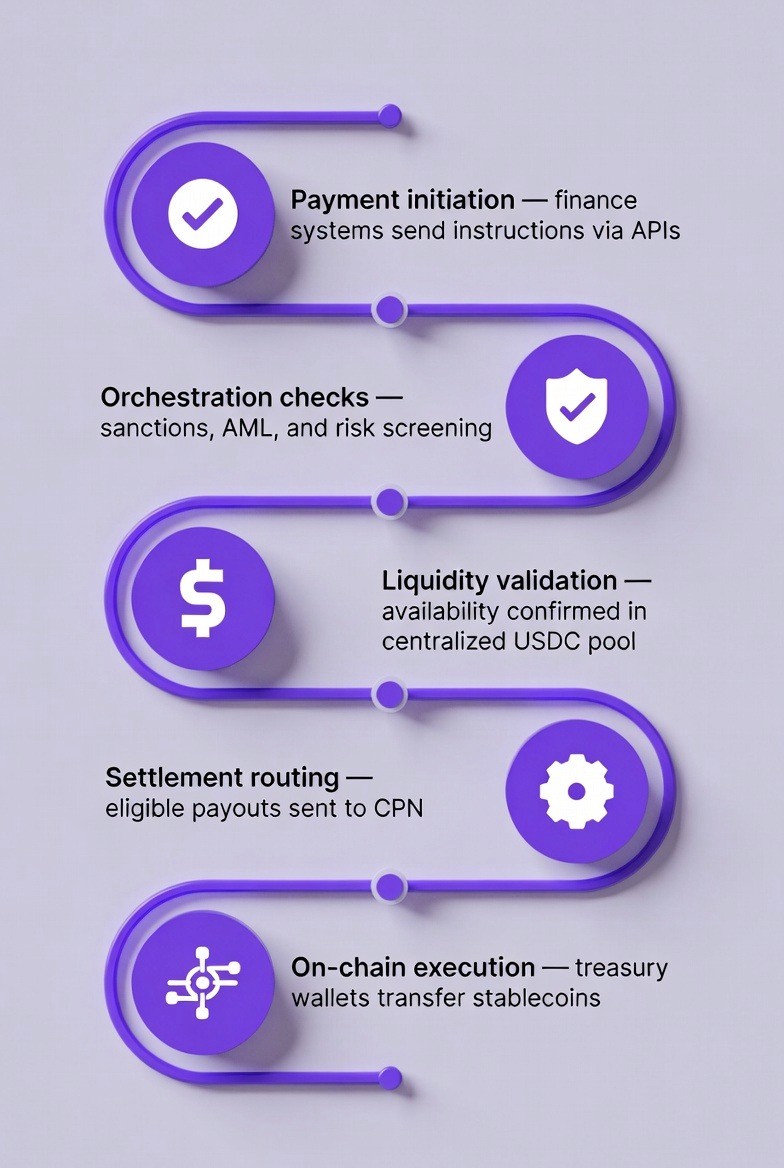

Real implementation

Existing ERP and banking systems send payment requests via APIs to a payment orchestration service.

The orchestration layer runs compliance checks and verifies available liquidity.

Eligible payments are routed to Circle Payments Network for settlement.

Treasury wallets execute stablecoin transfers on-chain.

Internal databases store payment status, decisions, and settlement references.

Step 4: Settlement Execution Flow

The settlement flow coordinates compliance, liquidity, payout, settlement and validation of settlement flows.

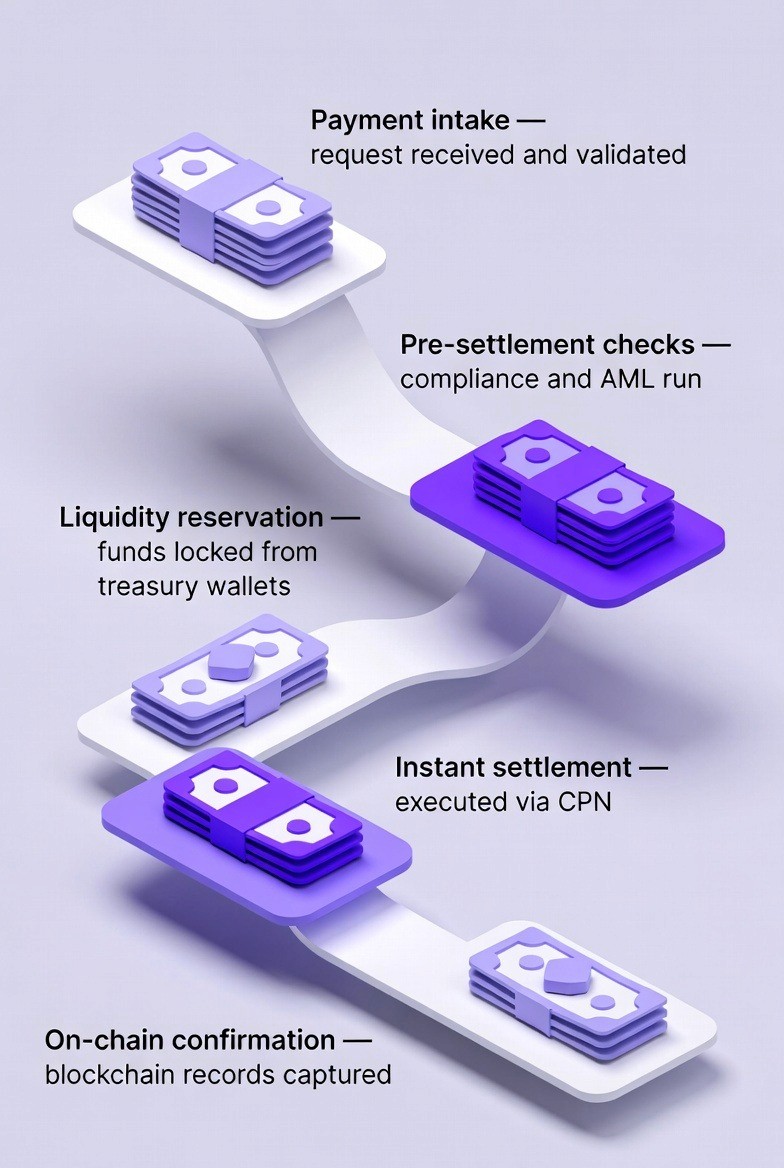

Higher level flow:

Validate payment

Run compliance checks

Hold liquidity reserve

Convert fiat currency to stable coin (if necessary)

Process on chain settlement

Confirm finality of blockchain transaction

If fiat is needed for a payout, initiate fiat payout

Record settlement and release liquidity

Real implementation

A cross-border payment request is received and validated by the trucking company.

AML and sanctions screening runs before any settlement begins.

Liquidity is reserved from the centralized USDC pool.

Settlement is executed instantly via CPN.

Local fiat payout is initiated for the recipient if required.

The blockchain transaction hash is recorded and used for reconciliation and reporting.

Step 5: Reconciliation Engine

Even though settlement is instant, accounting systems still reconcile in batches.

Reconciliation uses:

On-chain transaction hashes as source of truth

Event-driven settlement logs

Automated matching against general ledger entries

Exceptions are flagged for manual review without blocking ongoing payments.

// Reconciliation service

class ReconciliationEngine {

// unchanged implementation

}

Real Implementation Examples: Thunes

Thunes is an international payments system that supports multiple banks, PSPs and financial institutions in over 30 different markets worldwide.

In order to limit Thune's use of prefund their clients' accounts and to create a 24/7 capability for cross border transactions, Thune has integrated Circle Payments Network (CPN), which is using the United States dollar stablecoin (USDC) as a real-time settlement layer, yet still will be utilizing their current routing, compliance and payout structures.

Thune will begin this process by identifying high volume B2B corridors where there are large costs associated with prefunding and/or large delays in settling cross border transactions.

Next, Thune will combine all of the liquidity they have in USDC treasury pools rather than maintaining multiple currency balances across many jurisdictions.

Then Thune will implement a payment orchestration layer to connect their current systems to CPN so that when a transaction is initiated it can go through compliance checks, liquidity validations and routing decisions before settling the transaction.

Once completed, these three steps allow Thune to transition from their current fragmented and prefunded method of processing cross border transactions to a real time method; scope defines where CPN is utilized, the liquidity model provides the most efficient way to utilize capital, the technical architecture directs the correct payments and the execution flow provides immediate settlement with total audit ability.

With this new method Thune can now continue to provide uninterrupted cross border transactions to their clients without increasing operational or regulatory risk.

When a client initiates a cross border payout, the following occurs:

1. The client’s cross border payout request is processed and validated by Thune’s payment platform.

2. Before any funds are moved, compliance and sanctions checks are completed.

3. USDC is reserved from Thune’s centralized treasury pool to settle the transaction.

4. The funds are settled immediately through Circle Payment Network.

5. The funds are converted and disbursed domestically to the recipient through their domestic payment rails.

6. The blockchain transaction hashes are saved for future reconciliation and reporting purposes.

How TokenMinds Helps

Real-time settlement is not only about making technological upgrades to enable real-time settlement. It also requires an organizational upgrade for treasury, compliance, finance, and operational teams to be able to work in real time. Technology can facilitate this transition, but value is achieved through redesign of business operating models, control structures, and decision-making processes to support real-time settlement.

Token Minds assists institutions in making this transition through:

Evaluating readiness across treasury, compliance, and operations

Creating architectures which reflect an institution's real operating model

Establishing liquidity and risk frameworks that support an institution's internal controls

Connecting the Circle Payments Network to an institution's current systems

Compliance-readiness from Day One

Supporting pilot, scaling, and production phases

TokenMinds' goal is to help institutions to operate reliable real-time settlement at scale; we do not focus solely on connecting to new infrastructure.

Conclusion

Institutional payment infrastructure has not kept pace with business needs. Settlement remains slow, capital inefficient, and operationally complex.

CPN addresses the core constraint: settlement finality. When value settles in seconds, institutions can rethink treasury, payments, and working capital management. However, technology alone is not enough. Real value comes from correct integration and operating design. Institutions that invest in operational readiness will gain advantages in capital efficiency, customer experience, and product innovation. Those that do not will continue to bear the cost of slow settlement.

Schedule a complimentary consultation with TokenMinds to explore how your organization can integrate Circle Payments Network to modernize cross-border payments, unlock trapped liquidity, and operate real-time settlement safely at scale.

FAQ

How does CPN improve cross-border payment speed and capital efficiency?

CPN settles payments in seconds, 24/7, using stablecoins as a bridge asset, which reduces reliance on prefunded nostro accounts and allows the same liquidity to be reused multiple times per day.

Why do many CPN integrations fail in production?

Failures usually stem from operational gaps rather than technology, such as insufficient real-time liquidity controls, misaligned treasury processes, or compliance systems designed for delayed settlement.

How does CPN integrate with existing banking or ERP systems?

Integration happens through REST APIs and an orchestration layer that validates payments, runs compliance checks, manages liquidity, routes transactions to CPN or traditional rails, and handles reconciliation.

What changes are required for treasury and liquidity management?

Treasury teams must shift to centralized stablecoin liquidity pools, real-time balance monitoring, automated replenishment rules, and strict transaction limits to support instant settlement safely.