Taking a company public is a major milestone. For blockchain or tech-focused firms, a Crypto IPO (Initial Public Offering) opens access to global capital, investor trust, and lasting brand strength. Unlike early token sales, a Crypto IPO links digital assets to regulated stock markets.

It shows maturity, transparency, and readiness for institutions.

This guide explains each stage — from due diligence to investor coordination — and how token and equity structures can work under one compliant plan.

Learn more through TokenMinds How to Launch a Token and the Token Sale Landing Page.

Understanding the Crypto IPO Landscape

A Crypto IPO happens when a blockchain-based firm lists its shares on a regulated exchange.

It connects the digital asset world with the traditional capital market. Valuation depends on both company performance and token activity. Firms are measured by revenue, transparency, and the strength of their token economy.

Traditional IPOs look only at cash flow and profit. Crypto IPOs add token utility, network activity, and digital reserves. This creates a dual valuation model that mixes real assets with token economics.

Working with a crypto token development company helps make token systems secure and auditable. This is vital when tokens generate income or user activity.

The TokenMinds Crypto Due Diligence framework helps review smart contracts, audits, and reserves under strict standards.

How a Crypto IPO Differs from an ICO or STO

Each fundraising model offers different benefits.

Model | Asset Type | Regulation | Investor Profile | Typical Outcome |

IPO | Equity shares | Full securities compliance | Institutional and public investors | Long-term capital and credibility |

ICO | Utility tokens | Limited regulation | Retail and crypto investors | Fast liquidity, higher risk |

STO | Tokenized securities | Regulated issuance | Accredited investors | Compliance with blockchain benefits |

Conventional IPOs are based on profits and expansion. Crypto IPOs combine equity strength with token value.

In most cases, hybrid model is applied in the form of token systems to users and equity listing to investors. It takes a collective governance and effective due diligence to be successful.

Learn more in Token Sale Structure and Crypto Due Diligence.

Strategic Rationale for a Crypto IPO

A public listing marks business maturity. Blockchain and fintech firms pursue Crypto IPOs for several reasons.

Access to Institutional Capital

A public listing allows access to pension funds and other major investors who avoid token-only models. Regulated equity builds credibility and can raise company valuation.

Enhanced Market Visibility

Public listing shows transparency and separates strong businesses from short-term projects.

This attracts partners and media attention.

Liquidity for Early Investors

Early backers gain controlled liquidity through secondary markets without sharp token volatility.

Acquisition and Partnership Readiness

Public firms are easier to acquire because of audits and clear valuations. Legal planning tips are available in TokenMinds Token Sale Legal Consideration.

When a Crypto IPO Makes Business Sense

A Crypto IPO works best when a company has:

Steady revenue and audited accounts.

A live blockchain or token product with active users.

Clear governance that separates company and network control.

A culture of compliance backed by legal counsel.

Many firms begin with token sales to build recognition and liquidity, then move to an IPO after reaching stability.

How to Launch a Token explains how early token launches prepare firms for audits.

The Token Sale Landing Page shows how private token investors can become regulated shareholders.

The Crypto IPO Process Explained

Step 1: Strategic Assessment

Have specific targets -capital, credibility, or investor liquidity. Evaluate the IPO in relation to existing token systems. The guide on the Token Sale Structure is used to compare the hybrid and standard models.

Step 2: Crypto Due Diligence

Confirm technical, legal, and financial readiness. Tasks include:

Auditing smart contracts.

Checking token supply and governance.

Reviewing financial disclosures.

Adding benchmarks like compliance or readiness scores.

The TokenMinds Crypto Due Diligence guide helps design internal audits.

Step 3: Token Development and Technical Readiness

In case of tokens having shares, a crypto token development company ensures the standards of code and audits are met in the market. IPO filings are common in audit reports.

Step 4: Legal and Regulatory Setup

Different markets have unique disclosure rules. Work with experienced law firms. See Token Sale Legal Consideration for compliance guidance.

Step 5: Investor and Exchange Coordination

Engage exchanges early. Choose between traditional IPO, direct listing or dual structure. On the TokenMinds Token Sales page, the advisory support is described.

Case Studies: Notable Crypto IPOs

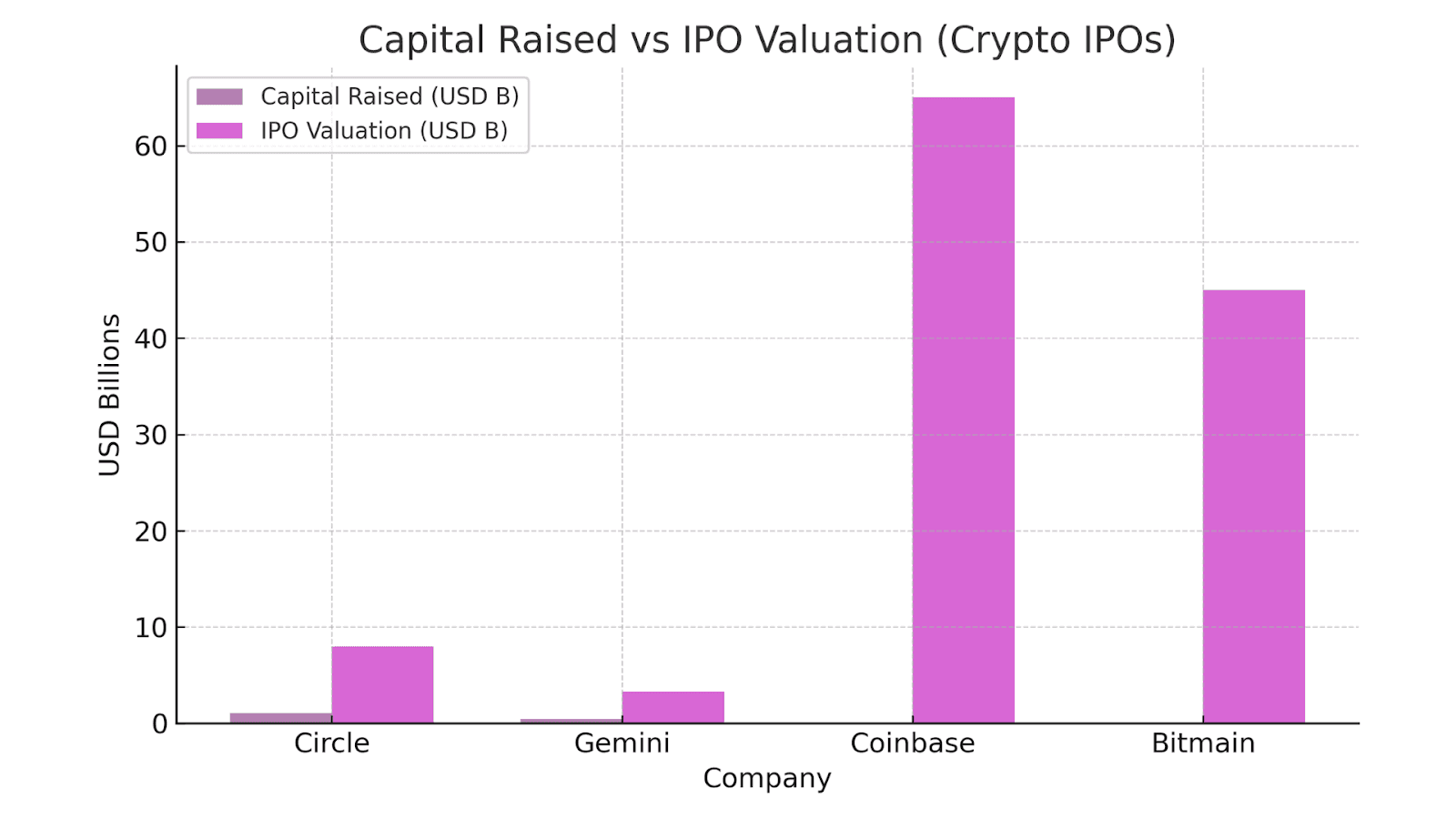

Company | Listing Type | Valuation (USD B) | Capital Raised (USD B) | Market Outcome |

Coinbase | Direct Listing | ~65 | 0.0 | High liquidity; volatile performance |

Circle | Traditional IPO (Filed) | 8.0 | 1.05 | Improved compliance image and investor trust |

Gemini | Traditional IPO | 3.3 | 0.425 | Closed above listing price |

Bitmain | Filed (Lapsed) | 40–50 | — | Listing expired; regulatory delays |

Outcomes are time-dependent, governed, and prepared. Coinbase showed scale and openness. Circle gained the trust by being compliant. Bitmain was slowed down by regulation.

Such case studies as TokenMinds Halla Gaming and Stablecoin Governance demonstrate how hybrid models remain stable following listing.

Capital Raised vs Valuation

Managing Risks and Market Challenges

Risks for public blockchain firms include:

Regulatory Uncertainty: The regulations vary across countries.

Volatility of Valuations: The market fluctuations influence the value of shares.

Dual Governance: It is not easy to combine the token and shareholder rights.

Operation Costs: It takes operational resources to comply and audits.

Reduce risk through strong legal teams, audits, and open governance. See Token Sale Legal Consideration for details.

Best Practices for Business Leaders

Conduct full crypto due diligence across technology, finance, and governance.

Collaborate with a crypto token development company to make sure everything complies.

Align token sales with fundraising timelines.

Create investor reports that convert blockchain data into KPIs.

Share updates openly after listing.

Templates and checklists are available in How to Launch a Token and Token Sale Structure.

The Future of Crypto IPOs in Global Markets

The next wave of finance will merge tokenized assets with traditional equity.

Governments now design laws to recognize tokenized shares and blockchain registries.

This change lets firms raise funds while keeping on-chain transparency.

Guides like Crypto Due Diligence and Crypto Token Development show how regulation is evolving.

This shift brings faster operations, cleaner records, and higher investor confidence.

Outreach for Citations

Reputation grows through credible references. Partnering with law firms, research groups, and blockchain platforms builds trust and boosts SEO. These citations turn this Crypto IPO Strategy Guide into a leading resource.

Citation outreach frameworks appear in TokenMinds Token Sales.

Backlink Profile and Domain Authority

TokenMinds has strong topic authority but lower domain strength than large outlets such as Cointelegraph or CCN.

Improve visibility through guest posts, expert blogs, and verified Web3 directories.

High-quality backlinks raise ranking and expand the reach of this guide.

Helpful resources include How to Launch a Token, Token Sale Structure, and Crypto Due Diligence.

Social Proof and Mentions

Visibility increases in trusted spaces. Publishing this guide across LinkedIn, Medium, Reddit (r/CryptoMarkets), and partner sites builds credibility. This kind of exposure draws organic coverage by blockchain and fintech users.

FAQs

What is the key difference between a Crypto IPO and a traditional IPO?

A Crypto IPO combines token governance with equity markets under regulation.

Is every crypto company ready for a Crypto IPO?

No. Only firms with stable revenue, audits, and legal clarity qualify.

How does crypto due diligence help?

It checks tokens, reserves, and governance for compliance and audit readiness.

What does a crypto token development company do?

It audits smart contracts and builds systems that meet IPO rules.

What is the long-term benefit of merging token and equity models?

It creates both liquidity and institutional credibility.

Conclusion

A Crypto IPO is not merely a fundraising but it is an evolution. Companies that integrate governance, transparency, and compliance may be enticed by the retail capital and institutional capital.

Organizations can establish a sustainable way to the public markets by adhering to the Token Sale Legal Consideration framework and collaborating with a crypto token development company.

Plan Your Crypto IPO with Expert Guidance

Plan IPO readiness through the TokenMinds Token Sales portal. Book your free consultation with TokenMinds today!