TL’DR

Blockchain transforms letters of credit and bank guarantees into fast, secure digital workflows that replace slow manual processes. By using smart contracts and cryptographic verification, banks can cut processing times from weeks to hours, reduce cost, fraud and disputes, and give all parties real-time visibility and trust in every transaction.

The bank guarantee and letter of credit has been a fundamental part of international commerce for many years, providing the foundation upon which trust is formed between individuals or entities that have no prior relationship. A bank guarantee provides an assurance to both parties that if one does not fulfill their obligations, the bank will make good on the obligation. A letter of credit provides an assurance of payment when certain conditions are satisfied. While they are critical components of the ability to do business internationally, the process of creating and managing letters of credit and guarantees is outdated, a gap many institutions now address through practical implementation paths like this training. As of 2025, it was estimated that about 80% of all trade finance documentation was created and processed by hand, using paper-based processes, and were physically sent from bank to exporter to insurer, etc., via a physical delivery service.

This creates serious problems. Processing a bank guarantee traditionally takes up to 30 days. The physical documents risk being lost, stolen, or forged. Banks have no real-time visibility into their guarantees once they leave the building. Business leaders at growing companies struggle to access trade finance because the process is expensive and slow. Fraud happens regularly because paper documents can be faked.

Blockchain technology offers a fundamental shift in how these financial instruments work. By digitizing the entire process and recording guarantees and letters of credit on an immutable distributed ledger, banks can process these documents in hours instead of weeks. The parties involved can see the status of their transactions in real time. Fraud becomes nearly impossible. Costs drop significantly. This is not a future possibility. It is happening now. Major banks across Australia, Europe, and Asia have already launched blockchain-based platforms that are processing thousands of transactions.

Understanding the Problem with Traditional Bank Guarantees and Letters of Credit

The Current Process

A traditional bank guarantee works like this. A tenant needs to lease retail space. The landlord requires a bank guarantee instead of a cash deposit. The tenant goes to their bank and requests a guarantee. The bank manually checks the tenant's creditworthiness, reviews the lease terms, and prepares a paper document. If the lease terms need to change, the entire process starts over.

Multiple drafts go back and forth between parties. When the document is finally complete, it gets printed, signed, and delivered physically. The landlord keeps it in a safe. The tenant's bank has no easy way to track it.

Each step in this process creates delays. Different banks use different forms and standards. There is no single version of truth that all parties can see. Reconciliation between systems is difficult and error-prone. Once the paper document leaves the bank, maintaining an audit trail becomes nearly impossible.

The Costs and Risks

The inefficiency of this system is staggering. Processing a single bank guarantee can take up to 30 days. Paper documents must be physically stored and managed. Retrieving old guarantees for compliance or audit purposes is time-consuming. Most importantly, paper documents can be forged, duplicated, or altered. In trade finance, document fraud is common. The International Chamber of Commerce estimates that fraudulent claims in traditional paper-based trade finance are substantial. For large companies handling thousands of guarantees, the administrative burden is enormous.

The majority of the time it is the small to medium enterprise (SME) that faces the greatest challenges. Often times they are unable to obtain trade finance through a bank due to their perception that manual processing of documentation is too high-risk and costly for them to engage in; this leads to the cost of processing being so high, combined with the perceived risk, that the SME is pushed outside of the traditional trade finance system; limiting overall economic growth and leaving large segments of the world's global supply chain utilizing an inefficient method.

What Is Blockchain and How Does It Work in Finance

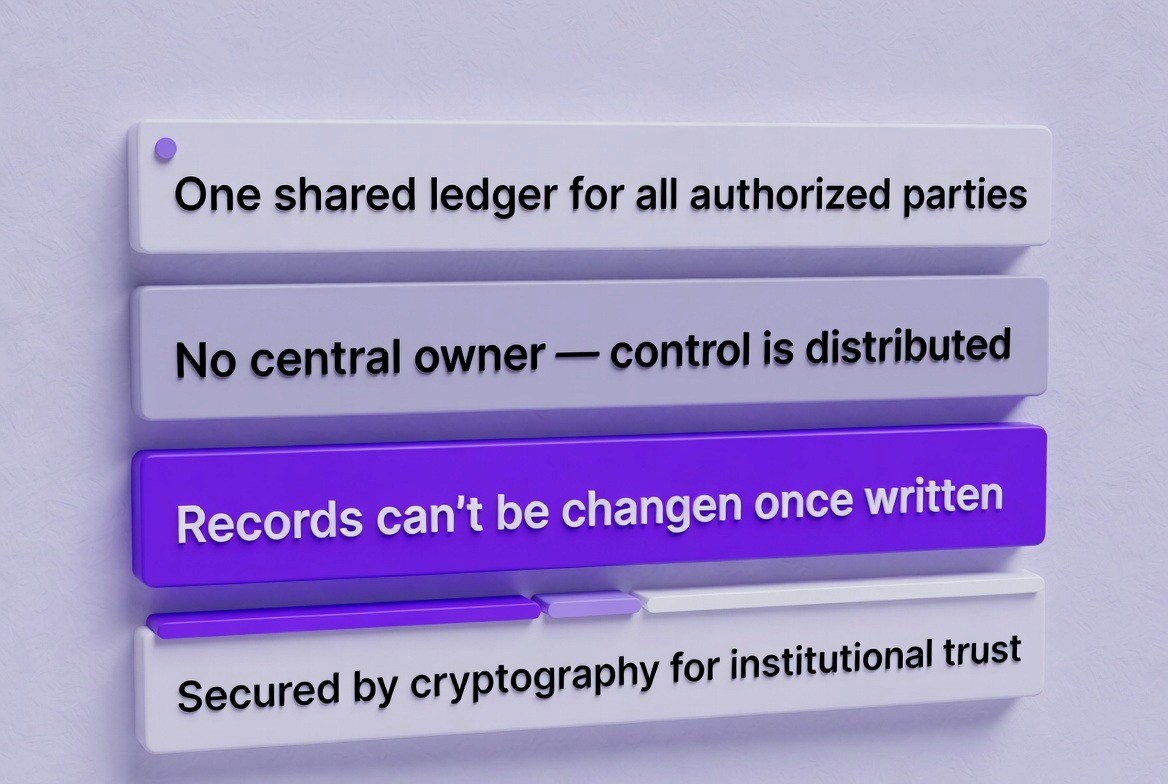

Blockchain is a shared digital ledger that multiple parties can access simultaneously. Think of it as a spreadsheet that is stored on thousands of computers at the same time. No single person or company controls the spreadsheet. Everyone with permission can see the same information. Once something is written into the ledger, it cannot be erased or changed. This immutability is enforced through cryptography, the same technology that protects your online banking, a foundation that becomes especially important in coordinated treasury operations like those described in this approach.

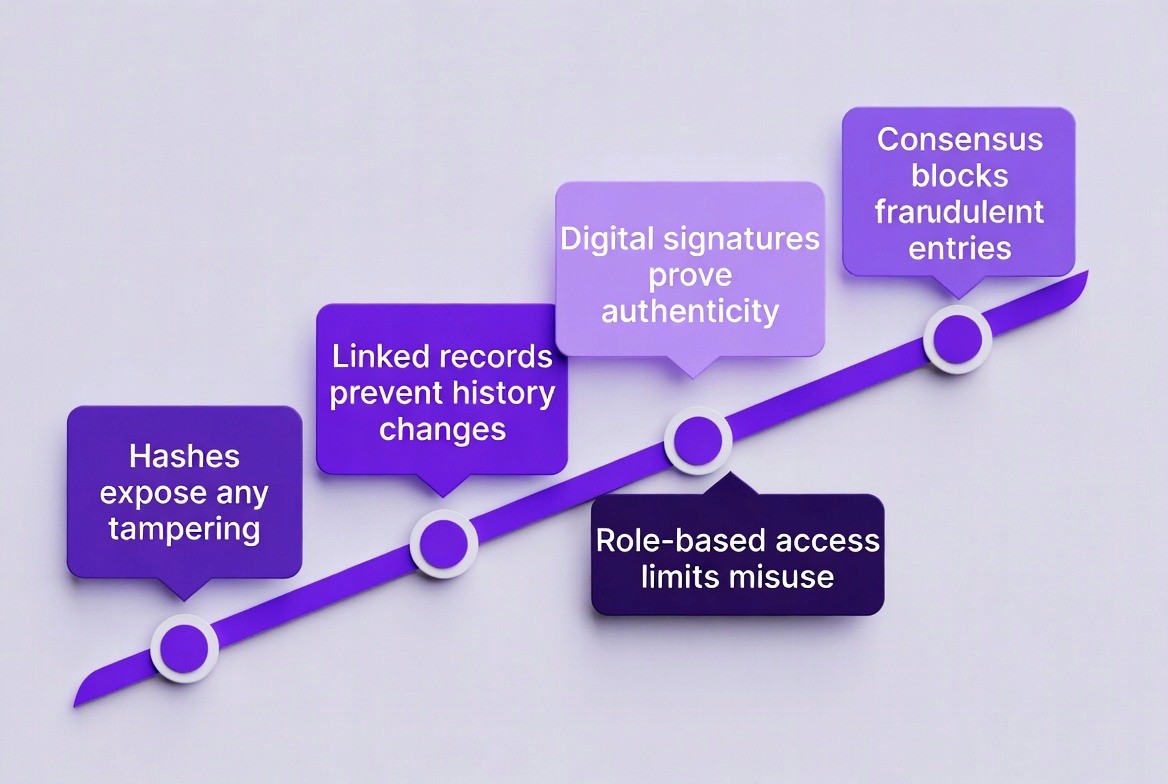

Key characteristics that enable blockchain to be applicable to bank guarantees and letters of credit include the following. A distributed ledger is first. All parties with permission to access the system have an identical version of all transaction history. Any party who attempts to alter their version of a transaction will result in the versions on their computer being out of sync with those on thousands of other computers. The attempted alteration will fail.

Second, blockchain provides immutability through a linking of each "block" of data to the previous "block" by use of cryptographic hashing. It is virtually impossible to alter one transaction record without altering every subsequent transaction record.

Third, blockchain provides transparency. All parties to the transaction can view both the details of the transaction and the date on which the transaction occurred. No party can dispute receipt of information regarding the transaction or assert that the transaction details were different from those recorded.

Finally, blockchain uses smart contracts. Smart contracts are automated computer programs that perform actions based upon predetermined criteria. As such, a smart contract could automate the payment process for a letter of credit based upon confirmation received from the shipping company that delivery of goods has occurred.

Processing time improvements are the most visible benefit of blockchain in trade finance.

Table of Processing Time Comparison:

Process | Traditional Method | Blockchain Platform | Time Saved |

Bank Guarantee | 30 days | 1 day | 29 days (96% reduction) |

Letter of Credit | 5-10 days | Under 24 hours | 4-10 days (80-90% reduction) |

Document Courier | Multiple days | Minutes | Days eliminated |

KYC Verification | 26 days | Under 5 minutes | 26 days (99% reduction) |

These advantages are not hypothetical. They are being realized through numerous live networks processing real-time transactions. The time savings equate directly into increased exporter working capital, decreased financing costs for importers and decreased operating expenses for banks.

How Smart Contracts Automate Financial Instruments

Smart contracts are the breakthrough that transforms bank guarantees and letters of credit. Instead of having people manually verify that conditions have been met, smart contracts do this work automatically, 24/7. A shift increasingly supported by bank-grade stablecoin frameworks like the one outlined in this reference

Consider a letter of credit for an international trade transaction. An importer in the United States orders machinery from a German supplier. The supplier wants protection against the risk that the importer will not pay. The importer wants protection against receiving damaged goods. A smart contract can solve both problems.

The smart contract begins recording the sale. When the German supplier ships the machinery and uploads the shipping confirmation to the blockchain, the smart contract automatically updates. When the equipment arrives at the port, an inspection company verifies the goods and submits a report on the blockchain. The smart contract checks this report. When all conditions are met, the smart contract automatically releases the payment from the importer's account to the supplier's account. The entire process that traditionally takes 10 days now happens in minutes.

This automation delivers multiple benefits. Manual errors disappear because computers execute the contract exactly as programmed. Processing times collapse. The need for intermediaries decreases. Costs fall. For a bank issuing the guarantee, the smart contract ensures that the guarantee is used correctly and that payment obligations are clear.

Blockchain Solution for Letter of Credit

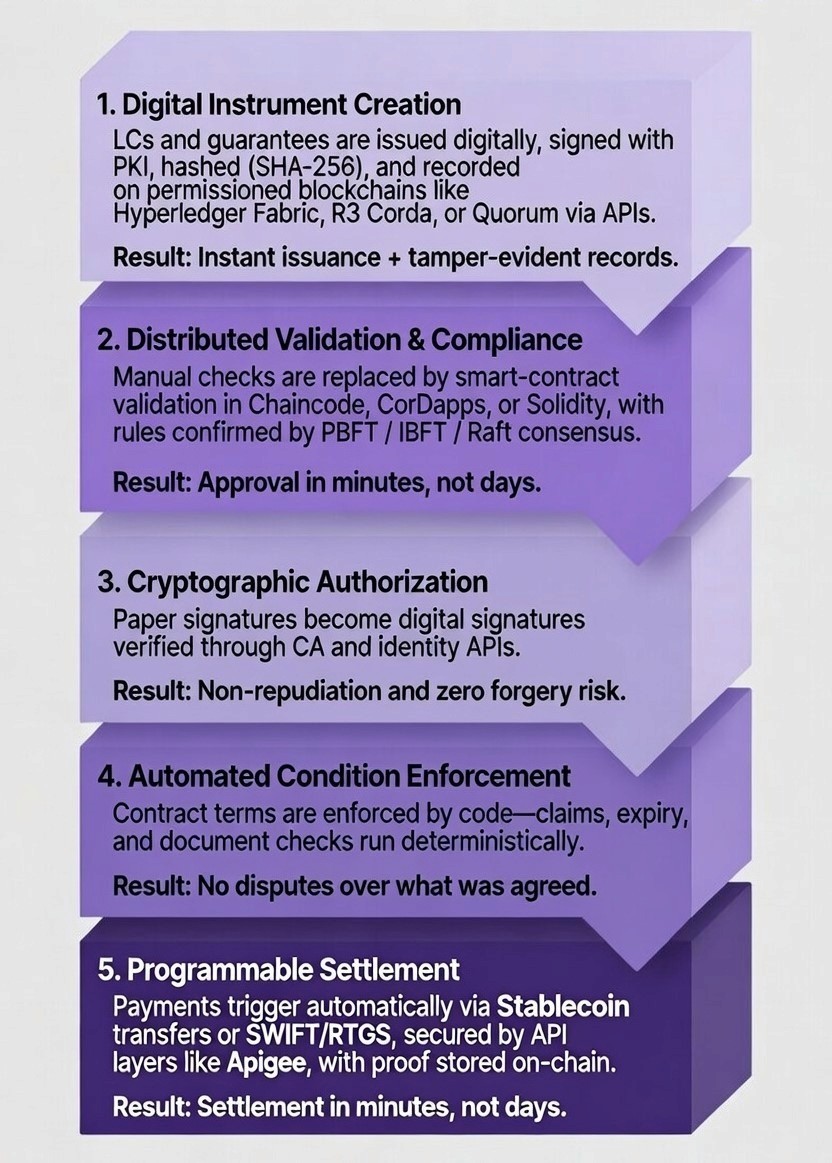

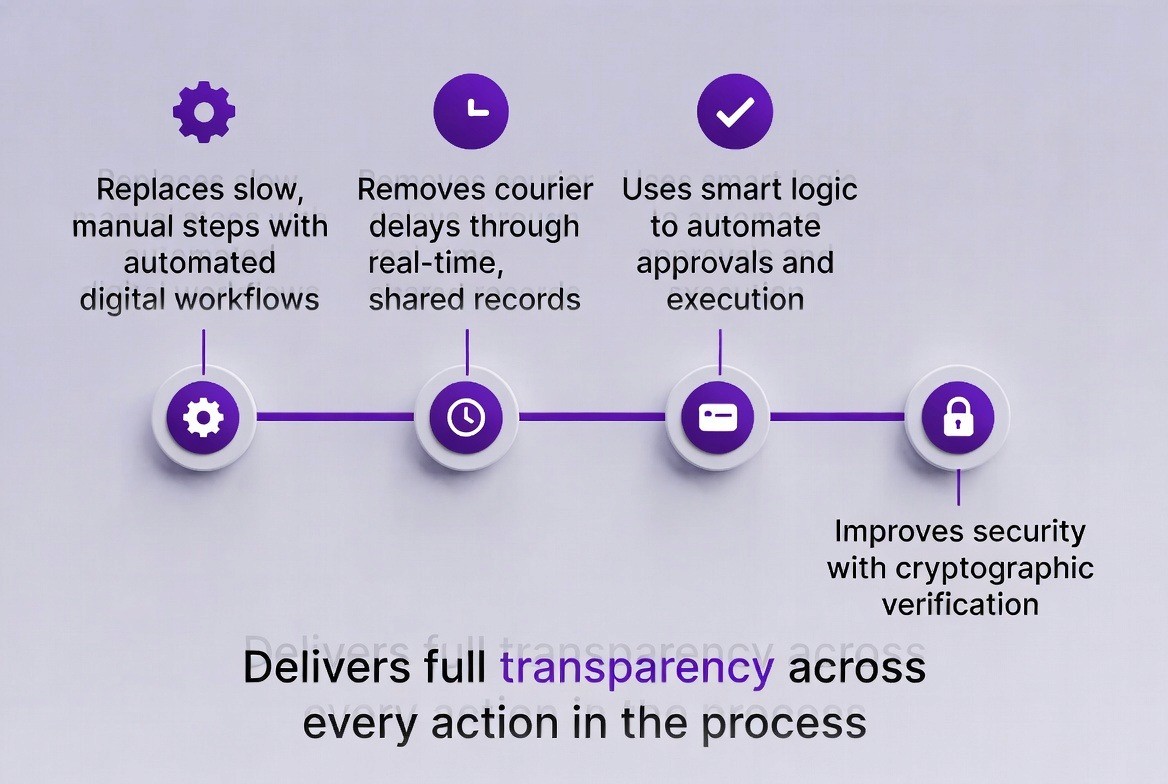

Letters of Credit usually required several days to manually process each step, as well as delayed courier service and sequential approval by banks involved in the transaction. Digital ledger technology combined with "smart" contract automation and real time verification among all parties in the transaction is what makes blockchain capable of transforming this manual process into an automatic one. Below are descriptions of the ways in which blockchain can provide significantly faster processing, virtually impenetrable security, and complete transparency of all actions taken via proven technical processes.

Traditional Model

Step 1: Credit Review and Bank Application (1-2 Days)

The importer sends a letter of credit request with information on the exporter, goods, payment amount, and payment terms. The bank then performs a credit review on the importer by reviewing their credit history, account status, as well as applying internal credit risk models. New customers will require additional due diligence by the bank before proceeding.

Step 2: Manual Creation of Letter of Credit (1 Day)

A bank officer manually enters the letter of credit into the banks system utilizing the International Chamber of Commerce (ICC) standardized forms (UCP 600), which include 20-40 specific fields containing LC terms, conditions, documentation requirements, and deadlines. Errors in the entry process can be time-consuming to correct.

Step 3: Courier Delivery and Correspondent Banking Communications (1-2 Days)

The issued letter of credit is printed and mailed via courier to the exporter's bank. The exporter's bank physically examines the LC for accuracy in accordance with the ICC rules, verifies that all the documentation submitted meets the required formats, and confirms the legitimacy of the issuing bank.

Step 4: Exporter Documentation Submissions and Verification (1-2 Days)

After export, the exporter provides the required documentation (invoices, bills of lading, inspection reports, certificates, etc.) to the issuing bank for verification against the requirements stated in the letter of credit. The issuing bank manually compares each document to verify compliance with the terms stated in the LC, including any discrepancies with respect to amounts, dates, quantities, or signatures.

Step 5: Payment Processing and Transfers (1-2 Days)

Following approval of the submitted documentation, the payment from the importer is transferred through a correspondent banking network. Funds are available to the exporter's bank within one business day; however, it may take an additional 1-2 days for funds to reach the exporter's bank.

Total Processing Time: 5-10 days (average 8 days)

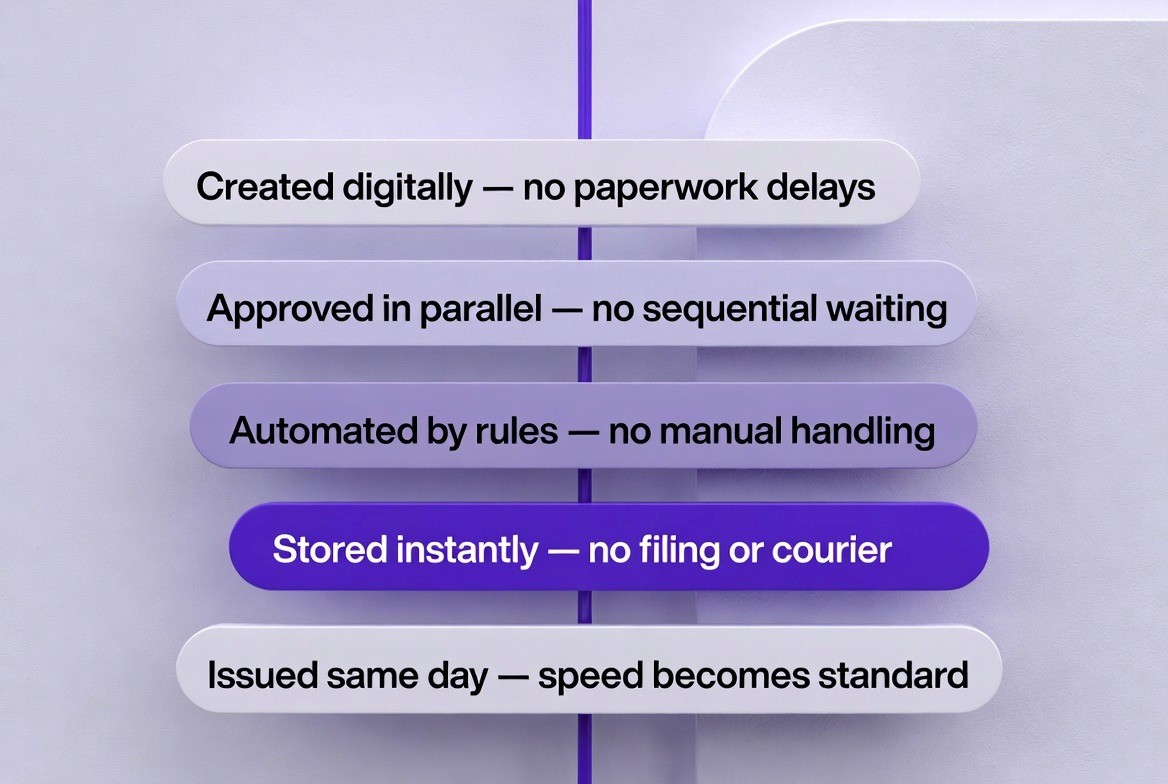

How Blockchain Enables Sub-24-Hour Processing

The blockchain solution for letters of credit transforms the entire workflow through automated validation, parallel processing, and elimination of courier delays. Here are the ten steps showing how speed is achieved:

Step 1: Digital LC Creation on Distributed Network (5 minutes). The importer logs into a blockchain trade finance platform and fills out an LC form in a web browser. The form includes dropdown menus, auto-fill functions, and real-time validation to prevent errors. Once submitted, the LC is cryptographically signed with the importer's digital signature and immediately recorded on the distributed ledger. The LC data is encrypted and stored across all participating bank nodes (typically 50+ nodes). All nodes receive identical copies simultaneously. The system generates a unique transaction ID and timestamp the moment the LC is created.

Technical flow: Client-side digital signature creation → API transmission → Node broadcast → Distributed storage → Real-time replication across all nodes

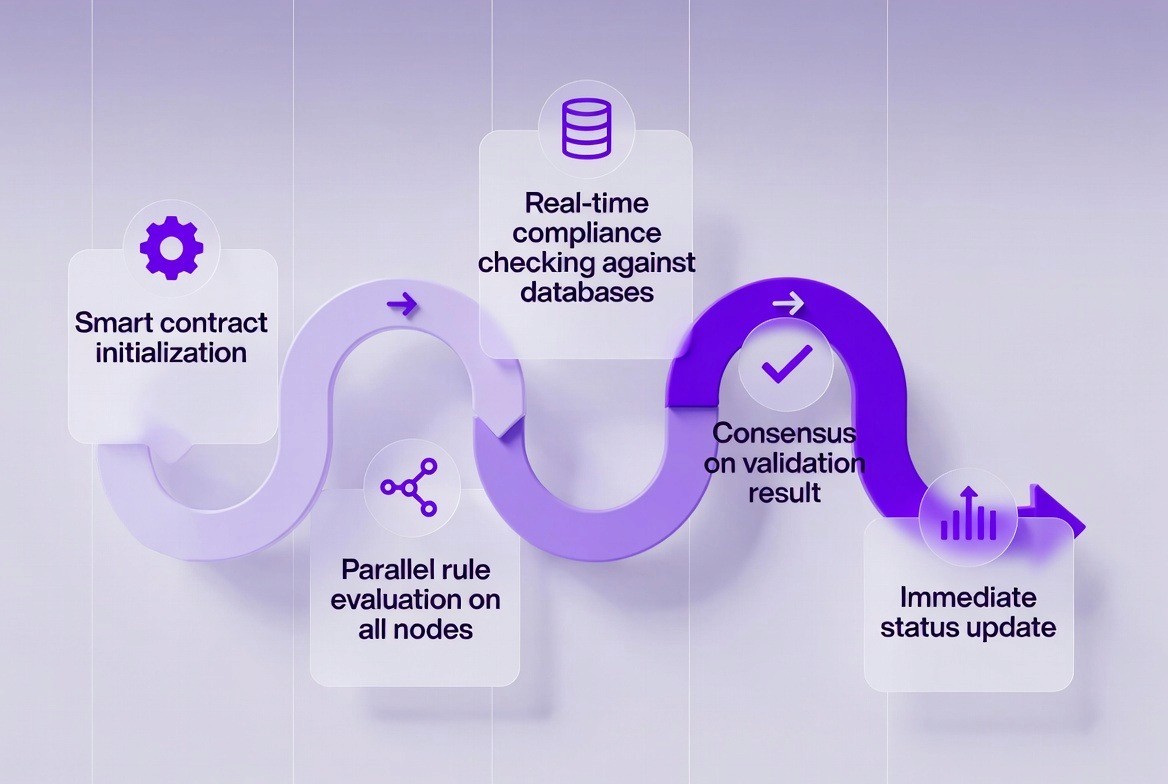

Step 2: Smart Contract Instantaneous Validation Against Compliance Rules (2 minutes). A pre-deployed smart contract automatically triggers upon LC creation. The contract executes programmed validation rules in parallel on all participating nodes:

Is the exporter name in the system database?

Is the LC amount within the importer's authorized credit limit?

Is the expiration date at least 30 days away?

Does the LC comply with sanctions screening rules?

Is the importer's account in good standing?

Are all mandatory fields populated?

If all checks pass, the smart contract returns approval status. If any check fails, the contract returns specific error message with remediation steps. This validation occurs simultaneously on all 50+ nodes in milliseconds through smart contract parallelization.

Technical flow: Smart contract initialization → Parallel rule evaluation on all nodes → Real-time compliance checking against databases → Consensus on validation result → Immediate status update

Step 3: Issuing Bank Digital Review and Cryptographic Approval (10 minutes). The issuing bank credit officer accesses the blockchain platform dashboard and views the LC in real-time without waiting for courier delivery. The officer reviews the customer details, credit limit verification, and LC terms. If approved, the officer authenticates using two-factor authentication and clicks approve. The system applies an ECDSA (Elliptic Curve Digital Signature Algorithm) digital signature using the bank's private key, cryptographically binding the approval to the bank and making it mathematically impossible to forge. The approval is recorded on the blockchain with a timestamp and hash of all LC details. All network nodes receive the signed approval and update their ledgers.

Technical flow: Officer authentication → LC data retrieval from blockchain → Digital signature generation using private key → Approval broadcast to all nodes → Consensus confirmation → Ledger update on all nodes

Step 4: Automatic Routing to Confirming Bank (1 minute). The smart contract automatically routes the approved LC to the confirming bank's node. Rather than requiring physical courier delivery, the confirmed LC is transmitted through the blockchain network to the exporter bank's node. The smart contract identifies the correct receiving bank based on the LC routing rules and sends approval notification. The LC appears instantly in the confirming bank's dashboard marked as ready for acceptance.

Technical flow: Smart contract reads LC receiver details → Automatic node-to-node transmission via peer-to-peer network → Real-time notification to receiver → LC appears in receiving bank's dashboard

Step 5: Confirming Bank Acceptance and Digital Signature (8 minutes). The confirming bank officer reviews the LC without delays. The officer verifies that the exporter is a valid customer authorized to receive payment and that the LC terms are acceptable. The officer approves by entering their digital signature using the confirming bank's private key. This signature is cryptographically linked to the confirming bank and the specific LC. The acceptance is recorded on the blockchain with all nodes updating their records.

Technical flow: Confirming bank officer authentication → LC validation against internal policies → Digital signature generation with private key → Acceptance broadcast across network → Node consensus → Immediate availability to exporter

Step 6: Exporter Real-Time LC Notification and Access (1 minute). The exporter receives an immediate notification that their LC has been approved and confirmed by both banks. The exporter accesses the blockchain platform and views the complete LC with all terms, expiration dates, required documents, payment conditions, and discrepancy handling rules clearly visible. There is no need to wait for phone calls, emails, or physical document delivery. The LC is immediately ready for operational use.

Technical flow: Event notification triggered on confirming bank approval → Notification sent to exporter via API → Exporter accesses blockchain interface → Full LC details retrieved from distributed ledger → Real-time document visibility

Step 7: Shipment Documentation and IoT Integration (5 minutes). After shipping, the exporter uploads the bill of lading directly to the blockchain platform. The bill of lading includes shipping company name, vessel name, departure date, expected arrival date, and goods description. Modern shipments include IoT (Internet of Things) sensors that continuously record location, temperature, humidity, and condition. These sensor readings are automatically uploaded to the blockchain at regular intervals (every hour). Each sensor reading is timestamped and digitally signed by the IoT device, creating an immutable shipping record that cannot be altered.

Technical flow: Exporter uploads bill of lading + digital signature → System stores on blockchain → IoT sensors continuously collect data → Sensor data transmitted to blockchain via secure API → Automatic timestamping and hashing → Real-time tracking visible to all parties

Step 8: Customs Authority Real-Time Document Access and Clearance (30 minutes). The goods arrive at the destination port. Customs authority accesses the blockchain platform (they have permission credentials to view shipments entering their jurisdiction). Customs sees the LC, bill of lading, invoice, insurance documentation, and IoT tracking data all in one interface. Customs verifies that physical goods match the blockchain documentation. If goods pass inspection, customs records approval directly on the blockchain with their official digital signature and seal. No paper documents are exchanged. Customs clearance is recorded in seconds.

Technical flow: Customs officer logs into blockchain platform with role-based access → Views LC and documents → Validates against physical goods → Records clearance approval with digital signature → Approval appears on ledger for all authorized parties

Step 9: Automated Document Compliance Verification (2 minutes). Upon document submission, the smart contract automatically runs comprehensive validation against the LC terms:

Does the invoice amount match the LC amount?

Do the bill of lading details match the shipment description in the LC?

Is the customs clearance approval present and valid?

Are all required documents cryptographically signed?

Are all signatures cryptographically valid (can be decrypted with issuer's public key)?

Do document dates comply with LC timeline requirements?

Is the inspection report within acceptable condition parameters?

If all documents pass validation, the smart contract marks the LC as complete and approved for payment. If discrepancies exist, the smart contract flags specific issues with remediation suggestions. This validation is deterministic, meaning identical documents always produce identical validation results.

Technical flow: Smart contract triggered upon document upload → Parallel validation of all document conditions → Cryptographic signature verification on all documents → Comparison against predefined LC rules → Real-time discrepancy flagging with specific details → Approval or rejection determination

Step 10: Smart Contract Automatic Payment Release and Settlement (2 minutes). Once all documents pass validation and the smart contract confirms approval, the contract automatically executes the payment instruction. For systems using Stablecoins, the funds transfer happens in seconds. For traditional banking systems, the smart contract submits payment authorization to the SWIFT network with all documentation attached, reducing processing time from 1-2 days to minutes.

The importer's bank debits the importer's account, and the exporter's bank credits the exporter's account. All parties receive real-time notification of settlement completion. The transaction is recorded on the blockchain with proof of payment, timestamp, and all participant digital signatures.

Technical flow: Smart contract triggers payment execution → Generates SWIFT message or Stablecoin transaction → Submits to settling banks → Banks execute in real-time → Confirmation sent to smart contract → Contract records settlement on blockchain → All nodes update ledger → Notifications sent to all parties

How Blockchain Prevents Fraud and Ensures Immutability

The blockchain solution implements multiple security layers that make fraud virtually impossible. Here are the ten steps showing how security is technically achieved:

Step 1: Cryptographic Hashing of All LC Documents (Automatic at creation). Every letter of credit submitted to the blockchain is immediately converted into a unique 256-bit cryptographic hash using the SHA-256 algorithm. The hash function reads every character of the LC document and produces a fixed 64-character output. If the LC amount is $100,000, the hash might be "3a7b2c9d8f4e6a1b5c3d7e9f2a4b6c8d0e1f2a3b4c5d6e7f8a9b0c1d2e3f4." If the amount changes to $100,001, the hash becomes completely different: "8f9e2d1c4b3a6f5e8d7c0b9a2e3f4a5b6c7d8e9f0a1b2c3d4e5f6a7b8c9d." This avalanche effect makes it immediately obvious if anyone alters the LC.

Technical flow: LC document submitted → SHA-256 algorithm applied → Hash calculated on all nodes independently → Hash stored as document fingerprint → Any alteration produces different hash

Step 2: Immutable Hash Chain Linking (Automatic per transaction). Each LC transaction includes not only its own hash but also the hash of the previous transaction in the chain. Block 1 contains the LC hash and a pointer to "0000" (no previous block). Block 2 contains the new transaction hash and includes Block 1's hash in its header. Block 3 contains another transaction hash and includes Block 2's hash in its header.

If someone tries to change the LC amount in Block 1, that block's hash changes. Block 2's header suddenly shows an incorrect Block 1 hash. This breaks the chain. Block 2 becomes invalid. Block 3, which references Block 2, also becomes invalid. Every subsequent block becomes invalid. To fix this tampering, the fraudster would need to recalculate hashes for every block after the change while simultaneously convincing 50+ other banks to accept this new version. This is computationally impossible.

Technical flow: Each transaction hashed → Hash linked to previous block hash → Chain of hashes creates immutability → Tampering breaks chain immediately → Network consensus rejects invalid chain

Step 3: Digital Signatures Using Public Key Cryptography (Applied to every document). When the issuing bank approves an LC, the bank uses asymmetric cryptography to create a digital signature. The bank computes the SHA-256 hash of the LC. The bank then encrypts this hash using the bank's private key (a secret 256-bit number that only the bank possesses). This encrypted hash becomes the digital signature. The LC document and the digital signature are both sent to the blockchain network.

When the confirming bank receives the LC, it decrypts the digital signature using the issuing bank's public key (a mathematically derived number that is publicly available). If decryption is successful and produces the same hash that independently computing SHA-256 of the received LC produces, then verification succeeds. This confirms the LC came from the issuing bank and has not been altered. If hashes do not match, verification fails.

This process is mathematically impossible to forge because:

The private key cannot be derived from the public key (mathematical certainty)

The private key is stored in a Hardware Security Module (HSM) that never allows it to leave the device

Without the private key, no one can create a valid digital signature

Technical flow: Document hash created → Encrypted with private key → Signature attached to document → Receiver decrypts with public key → Hash comparison verifies authenticity and integrity

Step 4: Consensus-Based Validation Before Recording (Applied before any LC is committed). Before any LC transaction is added to the blockchain, all participating nodes must validate it through a consensus mechanism called Practical Byzantine Fault Tolerance (PBFT). When an LC is submitted, the primary node broadcasts it to all 50+ participating banks. Each bank independently validates:

Is the digital signature cryptographically valid?

Does the LC format comply with blockchain rules?

Is the LC amount within authorized limits?

Are all mandatory fields populated correctly?

Are there sanctions compliance issues?

Each node votes approve or reject. With 50+ nodes and PBFT rules, approval requires approximately 75% agreement (around 37-40 votes). A single malicious bank cannot approve a fraudulent LC because it would be outvoted. Multiple malicious banks working together would need to compromise more than 25% of the network, which is economically and technically infeasible.

Technical flow: Transaction submitted to network → All nodes receive and validate independently → Each node submits cryptographically signed vote → Network counts votes → Supermajority (75%+) required for approval → Invalid transactions rejected by consensus

Step 5: Permissioned Access Control with Role-Based Permissions (Applied to every user interaction). The blockchain platform uses role-based access control. Different participants have different permissions:

Importer: Can create LCs, view own LCs, submit amendments

Exporter: Can view received LCs, submit documents, track payments

Issuing Bank: Can approve LCs, view own customer LCs

Confirming Bank: Can accept LCs, view accepted LCs

Customs: Can view and approve shipments entering their jurisdiction

Inspection Company: Can submit inspection reports

Each user logs in with credentials and their role is verified. The blockchain only displays LC details that the user's role permits them to see. If an exporter tries to view a competing exporter's LC, access is denied. This prevents unauthorized information leakage.

Technical flow: User authentication with credentials → Role verification from access control list → Blockchain filters data based on role → Only permitted documents visible → Unauthorized access attempts logged

Step 6: Encrypted Data Storage with Selective Decryption (Applied to sensitive fields). Highly sensitive data in LCs can be encrypted at the field level. For example, the importer's credit limit might be encrypted with a key that only the importer and their bank have. The LC is stored on the blockchain with this field encrypted. Other parties can see that the field exists but cannot read it. Only parties with the decryption key can read the value.

This architecture maintains the benefit of an immutable shared ledger while protecting confidential information. The encrypted data cannot be changed (immutability is maintained) but cannot be read by unauthorized parties (confidentiality is protected).

Technical flow: Sensitive data encrypted with AES-256 → Encrypted data stored on blockchain → Access control list determines who has decryption key → Only authorized parties can decrypt → Audit trail shows who accessed decrypted data

Step 7: Cryptographic Timestamp Authority (Automatic for every transaction). Every transaction on the blockchain includes a cryptographically secure timestamp. This timestamp is not just a clock reading (which could be faked). The timestamp is created by a cryptographically secure timestamp authority that:

Records the exact time down to the millisecond

Digitally signs the timestamp with their private key

Makes the timestamp immutable by including it in the blockchain hash

This creates legal evidence of exactly when the LC was created, approved, and settled. If a dispute arises about whether a claim was submitted before the deadline, the cryptographic timestamp provides proof. In traditional systems, parties argue about when documents were actually received. On blockchain, the timestamp is cryptographically proven.

Technical flow: Transaction creation → Secure timestamp authority notified → Authority records millisecond-precise time → Authority signs timestamp with private key → Timestamp included in transaction hash → Timestamp becomes immutable part of blockchain

Step 8: Automated Fraud Detection Through Smart Contract Rules (Continuous monitoring). Smart contracts enforce rules that prevent common types of fraud:

Duplicate Claim Prevention: If an exporter submits a claim for payment, the smart contract records the claim with its unique hash. If the exporter tries to submit the same claim again, the smart contract compares the new claim's hash with all previous claims. Finding a matching hash, it rejects the duplicate. Legitimate claims with different details produce different hashes and are accepted.

Overpayment Prevention: If an exporter submits an invoice for $150,000 but the LC specifies maximum $100,000, the smart contract rejects the invoice. The contract compares numbers programmatically without human error.

Double Financing Prevention: If an exporter tries to use the same invoice to secure financing from two different banks, the smart contract scans the blockchain history. Finding the invoice already used, it rejects the second LC.

Expiration Enforcement: If an LC expires on January 31 and the exporter tries to submit a claim on February 1, the smart contract rejects the claim based on date comparison.

Signature Validation: If someone uploads a forged bill of lading with an invalid shipping company signature, the smart contract verifies the signature cryptographically. Verification fails on the forged signature, and the document is rejected.

Technical flow: Smart contract monitors all transactions → Applies predefined fraud prevention rules → Compares against historical data → Detects pattern matches → Automatically rejects fraud attempts → Records rejection reason on blockchain

Step 9: Decentralized Validation Across Multiple Independent Auditors (Applied to high-value transactions). For LCs above a certain threshold (for example, above $10 million), the blockchain network requires approval from multiple independent validator nodes operated by different organizations. Rather than trusting a single bank, the transaction must be validated by at least three independent auditors from different banks and regions. Each validator independently reviews the LC and submits their approval.

This architectural requirement makes it impossible for a single corrupt banker to approve fraudulent LCs. It would require collusion between three different banks in different jurisdictions to commit fraud, which dramatically increases the cost and complexity of fraud attempts.

Technical flow: High-value LC submitted → Smart contract identifies transaction size → Routes to multi-validator queue → Three independent validators receive request → Each validator independently validates and approves → Supermajority approval required → Transaction added to blockchain

Step 10: Immutable Audit Trail for Regulatory Compliance (Continuous recording). Every action on every LC is permanently recorded on the blockchain:

When was it created? (timestamp + creator signature)

Who approved it? (approver signature + timestamp)

What amendments were made? (amendment hash + approver signature)

When was it shipped? (bill of lading submission timestamp)

When was customs clearance granted? (customs approval signature + timestamp)

When was payment released? (settlement timestamp + releasing bank signature)

Who viewed the LC? (accessor logs + timestamp)

This creates a complete, immutable audit trail that regulators can review. Compliance officers can trace the entire history of any LC in seconds. Nothing can be deleted or modified retroactively. If a dispute arises, regulators can replay the entire transaction history.

Technical flow: Every transaction recorded with timestamp → Digital signature of all participants recorded → Hash of transaction recorded → Audit trail stored on immutable blockchain → Any modification attempts detected → Compliance officers access audit trail via secure interface

How Blockchain Creates Verifiable, Transparent Transactions

Trust is built through transparency, verification, and the inability to dispute facts. Here are the ten steps showing how trust is technically established:

Step 1: Single Source of Truth Across All Participants (Automatic at network level). Traditional LC systems have multiple versions of the truth. The importer's bank has one record. The exporter's bank has a different record received via courier. Intermediary banks have their own records. Each party maintains their own database, and discrepancies arise.

On a blockchain, there is exactly one version of the LC. All 50+ participating banks maintain identical copies of every LC. When the issuing bank approves an LC, all banks see the same approval simultaneously. When the exporter submits documents, all banks see the submission simultaneously. No party can claim they did not receive information or that something was different than what everyone else sees. Every LC and every transaction has a hash that all banks can independently verify. If Bank A claims an LC says $100,000 and Bank B claims it says $200,000, the blockchain hash proves which is correct.

Technical flow: Single LC record created → Replicated to all 50+ nodes → All nodes maintain identical copy → Hash verification proves copies are identical → Any difference detected and rejected → Consensus enforces single truth

Step 2: Real-Time Visibility of LC Status to All Stakeholders (Continuous). Rather than requiring parties to send emails asking "What is the status of this LC?", all parties can see the real-time status on their dashboard:

Is the LC created? ✓

Is it approved by the issuing bank? ✓

Is it confirmed by the exporting bank? ✓

Has shipment been confirmed? ✓

Has customs cleared the shipment? ✓

Are all documents approved? ✓

Has payment been released? ✓

Each status change is timestamped and digitally signed. If a party has a question, they can check the blockchain dashboard and see the exact status with proof. This transparency eliminates miscommunication and delays.

Technical flow: LC status updates recorded to blockchain → Status changes broadcast to all nodes → All stakeholders see updates in real-time via dashboard → Status changes include timestamp and signature → No delays in status communication

Step 3: Cryptographic Proof of Document Authenticity (Applied to all documents). In traditional systems, parties worry: "Is this bill of lading real?" A fraudster might present a fake bill of lading hoping no one checks with the shipping company. On blockchain, every document has a digital signature from the creating organization. When the shipping company uploads a bill of lading, they digitally sign it. The signature is mathematically tied to the shipping company's private key.

Any party receiving the bill of lading can instantly verify its authenticity by checking the signature with the shipping company's public key. The verification takes milliseconds and does not require contacting the shipping company. The mathematical proof is absolutely certain. Either the signature is valid (the shipping company created this document) or it is not (the document is forged).

Technical flow: Document submitted with creator's digital signature → Receiver accesses creator's public key → Receiver verifies signature cryptographically → Verification succeeds or fails mathematically → No need for external verification → Proof is instant and certain

Step 4: Smart Contract Transparency in Business Rules (Permanent code on blockchain). All smart contracts used for LC processing are uploaded to the blockchain and are publicly auditable by all participating banks. Any bank can review the contract code and understand exactly what conditions trigger payment:

"Payment releases only when (Goods shipped = true) AND (Inspection passed = true) AND (Amount ≤ LC limit)"

"Amendments can only be made by issuing bank"

"LC can only be claimed once"

"Claims must be submitted before expiration date"

Because all rules are transparent and enforced by code rather than subject to human interpretation, there is no ambiguity. Every bank knows exactly what will happen under any circumstance. This transparency builds trust.

Technical flow: Smart contract code deployed to blockchain → Code publicly accessible to all authorized parties → Any party can review contract logic → Contract execution is deterministic and transparent → Execution results in expected behavior

Step 5: Consensus-Based Approval Rather Than Single Authority (Applied to all important transactions). Rather than trusting a single bank to issue an LC correctly, the blockchain requires consensus from multiple banks. When an LC is submitted, all participating banks validate it. They do not blindly trust the issuing bank. They cryptographically verify the signature, check the amounts, verify the customers exist, and check sanctions databases.

This collective validation distributes trust. No single bad actor can impose an LC on the system. The majority of banks must agree. This consensus-based approach is inherently more trustworthy than centralized systems where one person could make a critical error or corrupt decision.

Technical flow: LC submitted → Broadcast to all 50+ nodes → Each node independently validates → Supermajority (75%+) must approve → Single bad actor cannot approve invalid LC → Trust distributed across network

Step 6: Cryptographic Identity Verification (Applied to all parties). Every participant on a blockchain has a cryptographic identity consisting of a public key and private key pair. The private key is unique to that participant and proves their identity. When the exporter's bank approves an LC, their signature is mathematically tied to their identity. Later, no one can deny they approved it, because the signature is mathematically bound to their identity and the specific LC.

This cryptographic proof of identity is far stronger than manual signatures on paper documents, which can be forged. The cryptographic identity is mathematically unprovable to forge.

Technical flow: Each participant has unique private-public key pair → Identity stored in blockchain → Digital signatures tied to identity → Identity verification is cryptographic (mathematical proof) → No denial possible ("I did not sign this")

Step 7: Permanent, Undeniable Record of All Actions (Continuous recording). Every action is recorded permanently:

When did the importer request the LC? (timestamp + digital signature)

When did the issuing bank approve? (timestamp + digital signature)

When did the exporter submit documents? (timestamp + digital signature)

When were discrepancies found? (timestamp + specific discrepancy description)

When was the dispute resolved? (timestamp + resolution details + approving signature)

No party can later claim "That never happened" or "We did not approve that." The blockchain records prove what happened and when. If a dispute arises six months later, the blockchain provides complete evidence of every transaction step.

Technical flow: Action submitted → Recorded to blockchain with timestamp → Digitally signed by actor → Hash of action recorded → Action becomes immutable → Audit trail accessible to all authorized parties

Step 8: Escrow and Conditional Release Through Smart Contracts (Automated enforcement). For LC transactions, smart contracts can act as automated escrow agents. The smart contract holds the payment authorization until all conditions are met:

Goods must be shipped (verified by bill of lading)

Goods must pass inspection (verified by inspection report)

Customs must clear shipment (verified by customs approval)

All documents must be discrepancy-free (verified by smart contract document review)

The smart contract monitors all conditions continuously. The moment all conditions are satisfied, it automatically releases payment. No human has discretion to release funds early or hold them up. The rules are enforced automatically by code.

This builds trust because neither party needs to trust the other. They both trust the smart contract code, which is transparent and executed predictably.

Technical flow: Smart contract deployed → Contract holds payment condition ready → Smart contract monitors triggering conditions → All conditions become true → Contract automatically releases payment → Payment is irreversible once released

Step 9: Multi-Signature Approval for High-Value Transactions (Enhanced security for large LCs). For LCs above a certain threshold, the blockchain requires signatures from multiple parties before approval. For example, an LC for $50 million might require:

Issuing bank credit officer signature

Issuing bank risk manager signature

Issuing bank compliance officer signature

All three signatures must be present on the blockchain before the LC is activated. This multi-signature approach prevents a single person from approving fraudulent LCs. It requires collusion between multiple people within the same bank or between people in different banks, dramatically increasing the difficulty of committing fraud.

Technical flow: High-value LC submitted → Smart contract identifies threshold → Routes to multi-signer queue → Requires N signatures from authorized signers → Smart contract validates all signatures cryptographically → Only upon receipt of all signatures does LC activate

Step 10: Zero-Knowledge Proofs for Privacy With Verification (Advanced feature for competitive situations). In some cases, a party needs to prove something without revealing the details. For example, a bank might need to prove it has sufficient reserves to confirm an LC without revealing its exact reserve amount.

Zero-knowledge proofs allow a party to mathematically prove a statement is true without revealing the underlying information. A bank proves "I have >$500 million in reserves" without revealing whether reserves are $500.1 million or $5 billion. The prover generates a mathematical proof that can be verified by others, and the proof does not leak information about the actual amount.

Zero-knowledge proofs build trust by allowing verification without requiring disclosure of sensitive information.

Technical flow: Party wants to prove statement X without revealing details → Party generates zero-knowledge proof → Proof is mathematically verifiable → Verifiers check proof cryptographically → Verification succeeds or fails → Verifiers convinced of X without learning details

Blockchain Solution for Bank Guarantees

The traditional method of providing a bank guarantee typically involves large amounts of paper work and/or documentation; along with physical delivery to the party requesting the guarantee, and then manual claims processing. On average it can take a full week to manually verify claims using the traditional methods of providing a bank guarantee.

In contrast, blockchain provides for instantaneous digital issuance of the guarantee, automated processing of claims made under the guarantee, and permanent and irreversible (immutable) digital records of all activity, including sharing of such records in real time between all parties to the transaction. The technological solutions presented clearly show significant improvements over traditional methods in terms of speed, security, and trust verification of critical financial instruments.

How Blockchain Enables Same-Day Guarantee Issuance

The blockchain solution for bank guarantees transforms the process through digital creation, instant approval workflows, and automatic storage. Here are the ten steps showing how speed is achieved:

Step 1: Digital Guarantee Request Submission and Instantaneous Validation (5 minutes). The customer logs into the blockchain banking platform and creates a guarantee request form. The form captures the guarantee type (bid bond, performance bond, payment guarantee), amount, expiration date, and beneficiary details. Upon submission, the form is cryptographically signed with the customer's digital signature and immediately broadcast to all participating bank nodes.

A smart contract instantly validates the request against predefined rules: Is the customer's account in good standing? Is the guarantee amount within the customer's authorized limit? Does the amount comply with regulatory constraints? Is the beneficiary a recognized party? The validation results are returned in seconds. If all checks pass, the request is marked as ready for bank review.

Technical flow: Customer submits form via web interface → API transmits signed request to blockchain → Smart contract validates rules on all nodes → Validation results returned → Request marked as bank-review-ready

Step 2: Automated Credit Assessment Using Predefined Risk Model (3 minutes). The smart contract automatically applies the bank's credit risk model to the guarantee request. The model evaluates:

Customer's credit score (pulled from credit database via API)

Customer's historical default rate on previous guarantees

Current account balance and liquidity position

Percentage of customer's credit line already used

Guarantee type risk profile (bid bonds have lower default rates than performance bonds)

The model assigns a risk score. If the score is below the bank's tolerance level, the request is auto-approved. If the score exceeds tolerance, the request is flagged for manual review. This automated assessment that would take a bank officer 2-4 hours is now completed in minutes by the smart contract running the same model.

Technical flow: Smart contract retrieves customer financial data from APIs → Credit model applied automatically → Risk score calculated → Auto-approval or escalation determined → Result recorded on blockchain

Step 3: Digital Approval by Bank Credit Officer (8 minutes). The bank credit officer accesses their dashboard and sees the guarantee request with the smart contract's risk assessment. The officer reviews the recommendation. For requests flagged for manual review, the officer applies judgment and approves or denies. For auto-approved requests, the officer can spot-check a sample to verify the model is working correctly.

Upon approval, the officer enters their digital signature using two-factor authentication. The digital signature is generated using the officer's private key, cryptographically binding the approval to the officer and the specific guarantee.

Technical flow: Officer logs into dashboard → Sees guarantee requests with risk assessment → Reviews details → Approves or denies → Two-factor authentication required → Digital signature applied → Approval broadcast to all nodes

Step 4: Automatic Generation of Guarantee Document on Distributed Ledger (1 minute). Rather than an employee manually typing the guarantee into a template, the smart contract automatically generates the guarantee document from the approved request data. The system populates all fields:

Guarantee amount: $100,000

Expiration date: December 31, 2026

Beneficiary: ABC Construction Company

Guarantee type: Performance Guarantee

Terms and conditions: Per standard terms (referenced in guarantee terms library)

The generated document is cryptographically hashed and recorded on the blockchain. The guarantee is given a unique identifier (e.g., "BG-2026-001-00154") and a timestamp. All nodes receive an identical copy.

Technical flow: Smart contract generates document from approved data → System populates all fields programmatically → Guarantee hashed with SHA-256 → Recorded on blockchain with timestamp → Distributed to all 50+ nodes instantly

Step 5: Beneficiary Real-Time Notification and Immediate Access (1 minute). The moment the guarantee is recorded on the blockchain, the beneficiary receives a real-time notification on their mobile phone and email. The beneficiary can immediately access the blockchain platform and view the complete guarantee document. No waiting for courier delivery. No need to worry about the package getting lost. The guarantee is instantly available.

Technical flow: Guarantee recorded to blockchain → Event triggered on all nodes → Notification service sends alert to beneficiary → Beneficiary receives SMS and email → Beneficiary logs into platform and views guarantee immediately

Step 6: Smart Contract Automated Claim Handling (On-demand, seconds). If the beneficiary needs to claim the guarantee (for example, the customer fails to complete the contracted work), the beneficiary logs into the platform and submits a claim. The smart contract automatically:

Verifies that the claim amount does not exceed the guarantee amount

Verifies that the claim is being submitted before the guarantee expires

Verifies that the customer has not already exhausted the guarantee (prevents duplicate claims)

Verifies that the claim includes proper documentation (certificate of non-completion, contractor estimate, etc.)

If all verifications pass, the smart contract approves the claim and automatically initiates payment.

Technical flow: Beneficiary submits claim via platform → Smart contract validates claim against guarantee terms → All conditions checked programmatically → Claim approved or rejected automatically → Payment initiated if approved

Step 7: Issuing Bank Real-Time Claim Verification (2 minutes). Once a claim is submitted, the issuing bank is immediately notified. The issuing bank sees the claim details, supporting documentation, and the smart contract's validation result. The bank can verify that the claim is legitimate by checking the supporting documents and confirming the customer indeed failed to perform.

The bank reviews the claim and either approves or disputes it. If approved, the bank authorizes payment. If disputed, the bank submits a dispute notification.

Technical flow: Claim submitted to blockchain → All nodes notified immediately → Issuing bank receives claim notification → Bank reviews documentation → Bank approves or disputes → Bank's decision recorded on blockchain

Step 8: Automatic Payment Processing Upon Approval (2 minutes). Once the issuing bank approves the claim, the smart contract automatically processes payment. For Central Bank Digital Currency systems, funds transfer in seconds. For traditional banking systems, the smart contract generates a payment instruction that is transmitted to the bank's settlement system.

The beneficiary's account is credited, and the guarantee is marked as claimed. The smart contract records that the guarantee has been exhausted and can no longer be claimed again.

Technical flow: Bank approves claim → Smart contract authorizes payment → Payment instruction generated → Funds transmitted to beneficiary → Guarantee marked as claimed → All nodes updated → Beneficiary receives confirmation

Step 9: Automated Amendment Handling for Guarantee Modifications (5 minutes). If the customer and beneficiary need to modify the guarantee terms (extend expiration date, increase amount, change terms), they submit an amendment request through the platform. The smart contract validates:

Is the amendment requested before the guarantee expires?

Does the customer have sufficient credit line for an increased amount?

Is the amendment within regulatory constraints?

If valid, the amendment is recorded on the blockchain as a new transaction linked to the original guarantee. All participants see the amendment and its effective date.

Technical flow: Amendment request submitted → Smart contract validates amendment rules → If valid, amendment recorded as linked transaction → All nodes updated → New amendment terms take effect → Original guarantee superseded by amended version

Step 10: Automatic Settlement and Complete Transaction Closure (1 minute). Once the claim is paid or the guarantee expires without being claimed, the smart contract automatically closes the transaction. The status changes from "Active" to "Settled" or "Expired." The guarantee is removed from active reporting (though the historical record remains on the blockchain for audit purposes).

The customer's credit line is freed up for other uses. The bank's risk exposure on this guarantee is eliminated. The beneficiary receives confirmation that the transaction is complete.

Technical flow: Claim paid or expiration date reached → Smart contract closes guarantee → Status changes to settled/expired → Historical record preserved on blockchain → Credit line released → All parties notified of closure

Total blockchain processing time: 20-30 minutes (average 25 minutes) – a 95-97% time reduction

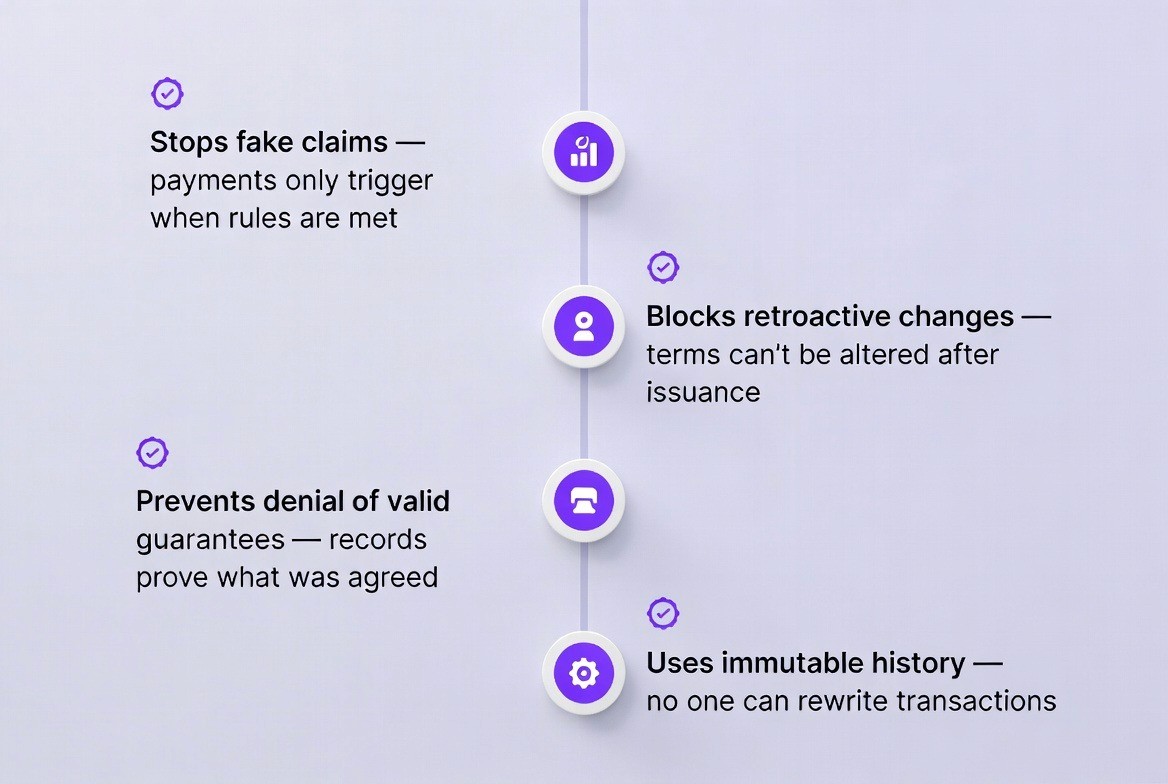

How Blockchain Prevents False Claims and Guarantee Fraud

Bank guarantee fraud includes: beneficiaries claiming payment without legitimate grounds, customers modifying guarantee terms after the fact, or banks denying legitimately issued guarantees. Blockchain prevents all these through immutable records and automated verification.

Step 1: Immutable Guarantee Record with Fingerprint Hash (Applied at issuance). When the bank issues a guarantee, the complete guarantee document is cryptographically hashed using SHA-256. The hash is recorded on the blockchain. If anyone tries to modify the guarantee after issuance—changing the amount from $100,000 to $200,000, or extending the expiration date—the hash changes.

All 50+ banks in the network have the original guarantee hash stored in their ledgers. They can instantly detect if someone presents a modified guarantee by recomputing the hash and comparing. The modified guarantee produces a different hash, proving it is fraudulent.

Technical flow: Guarantee issued → Complete document hashed with SHA-256 → Hash stored on blockchain and distributed → Any modification changes hash → Modified guarantee detected immediately by hash mismatch

Step 2: Digital Signature Authentication from Issuing Bank (Applied at issuance). The bank digitally signs the guarantee using ECDSA. The signature is mathematically tied to the bank's private key. Only the genuine bank can create this signature. If a fraudster creates a fake guarantee and signs it with their own private key, verification fails when beneficiaries check the signature against the bank's public key.

The digital signature proves:

The guarantee came from the bank that claims to have issued it

The guarantee has not been altered since issuance

The guarantee is authentic and not a forgery

Technical flow: Bank computes SHA-256 hash of guarantee → Hash encrypted with bank's private key → Signature attached to guarantee → Signature sent with guarantee → Receiver verifies with bank's public key → Verification proves authenticity and integrity

Step 3: Claim Timestamp Authentication and Deadline Enforcement (Applied to all claims). Every claim is timestamped cryptographically. If the guarantee expires on December 31, 2026 at 23:59:59 UTC, and a beneficiary tries to submit a claim on January 1, 2027, the smart contract compares the claim timestamp with the expiration timestamp.

The claim timestamp is 24 hours after expiration. The smart contract rejects the claim. The beneficiary cannot dispute this because the blockchain timestamp is cryptographically signed and immutable.

Technical flow: Claim submitted → Blockchain records millisecond-precise timestamp → Cryptographically secure timestamp authority signs timestamp → Smart contract compares with guarantee expiration → Late claims rejected automatically

Step 4: Duplicate Claim Detection and Prevention (Applied to all claims). When a beneficiary submits a claim, the smart contract generates a unique hash of the claim. If the beneficiary tries to submit the same claim again—either claiming the same amount for the same reason or submitting identical documentation—the smart contract detects the duplicate.

The smart contract compares the new claim's hash with all previous claims for that guarantee. Finding a matching hash, it rejects the duplicate claim. Only claims with different details (different amounts, different reasons, different documentation) produce different hashes and can be resubmitted.

Technical flow: Claim submitted → Claim hashed with SHA-256 → Hash compared against all previous claims for guarantee → Matching hash detected → Duplicate claim rejected → Only unique claims accepted

Step 5: Automatic Verification of Claim Documentation (Applied to all claims). When a beneficiary submits a claim, they must attach supporting documentation proving the legitimate grounds for claiming:

For performance guarantees: Contractor estimate of incomplete work, photos of unfinished work, contract terms specifying work requirements

For bid bonds: Proof that alternative bidder was required, cost difference compared to original bid

For payment guarantees: Proof of non-payment, invoices, shipping documentation

The smart contract verifies that documentation is:

Cryptographically signed by the appropriate party (contractor, engineer, bidder)

Not expired (dates are within reasonable timeframe)

Consistent with the guarantee type and terms

If documentation is missing or invalid, the smart contract rejects the claim and requests proper documentation.

Technical flow: Claim submitted with supporting documents → Smart contract verifies document signatures → Verifies document dates and content → Compares against guarantee terms → Valid documents approve claim → Invalid documents trigger rejection with remediation

Step 6: Consensus-Based Approval for High-Value Claims (Applied to claims above threshold). For claims exceeding $10 million, the blockchain requires approval from multiple independent validators, not just the issuing bank. The validators are typically senior officers from different banks in the network.

Three or more validators independently review the claim documentation and verify that:

The claim is legitimate

The documentation is authentic

The claim amount is justified

No fraud is evident

All validators must approve before payment is released. This multi-validator approval makes it nearly impossible for a single corrupt banker to approve fraudulent claims.

Technical flow: High-value claim submitted → Routed to multi-validator queue → Three independent validators receive claim → Each validator independently reviews and approves → Supermajority approval required → Payment released only upon multi-validator approval

Step 7: Smart Contract Enforcement of Guarantee Terms and Conditions (Applied to all guarantees). The guarantee terms are written into the smart contract code:

"Guarantee can only be claimed if customer fails to perform contracted work"

"Guarantee can only be claimed once"

"Guarantee can only be claimed before expiration date"

"Claim amount cannot exceed guarantee amount"

"Supporting documentation must be provided"

These terms are embedded in the smart contract and enforced automatically. No human can override these terms. If a beneficiary tries to claim twice, the smart contract prevents it. If a beneficiary tries to claim for an amount exceeding the guarantee, the smart contract reduces the payment to the maximum authorized amount.

Technical flow: Guarantee terms programmed into smart contract → Terms become immutable once smart contract deployed → Claims validated against terms → Invalid claims rejected automatically → Valid claims approved automatically

Step 8: Cryptographic Proof of Payment and Settlement (Applied after payment). Once payment is made, the smart contract records:

Payment timestamp (cryptographically secured)

Payment amount

Paying bank digital signature

Receiving bank digital signature

Bank transfer reference number

Account credited proof

All these items are hashed and recorded on the blockchain. If a dispute arises later with either party claiming payment was not made or was made in wrong amount, the blockchain provides cryptographic proof of exactly what happened.

Technical flow: Payment executed → Settlement recorded with all details → All details hashed together → Hash recorded on blockchain → Digital signatures from both banks recorded → Proof of payment immutable and tamper-proof

Step 9: Audit Trail for Regulatory Compliance and Fraud Investigation (Continuous recording). Every guarantee and every claim is recorded with complete audit trail:

When issued: timestamp, issuing bank signature, customer signature

When claimed: claim submission timestamp, beneficiary signature, supporting documentation hashes

When approved/denied: approval timestamp, approver signature, reason for decision

When paid: payment timestamp, payment proof, receiving bank confirmation

If regulators need to investigate potential fraud, they can access the complete audit trail for any guarantee. The immutable blockchain record provides definitive evidence of what occurred and when.

Technical flow: Every action timestamped and signed → Action recorded on blockchain → Audit trail forms a chain of evidence → Any tampering breaks the chain → Regulators access audit trail via secure interface

Step 10: Segregated Custody and Multi-Signature Release for Large Guarantees (Applied to guarantees above threshold). For guarantees exceeding $100 million, the funds held as security are placed in segregated custody. Payment release requires signatures from:

Bank treasury officer

Bank compliance officer

External auditor

All three signatures must be present before funds are released to pay a claim. This extreme verification prevents corruption, fraud, or unauthorized payment from any single individual.

Technical flow: Guarantee issued for $100M+ → Funds placed in segregated custody → Release requires three signatures → Three signers authenticate with private keys → All signatures must be valid → Only then are funds released

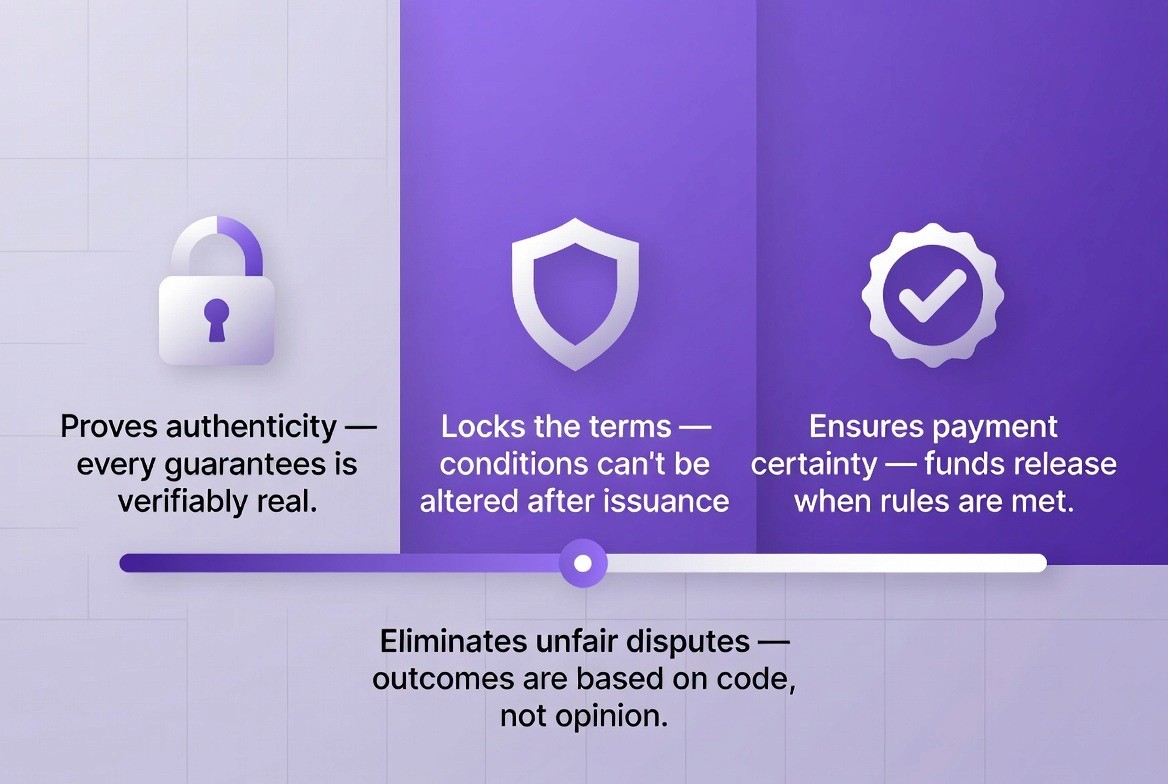

How Blockchain Ensures Beneficiaries Receive What They Are Due

Trust in bank guarantees depends on certainty that: the guarantee is authentic, the guarantee terms cannot be changed, payment will be made if terms are met, and no unfair disputes will occur.

Step 1: Transparent Guarantee Terms Accessible to All Parties (Visible at creation). When a bank issues a guarantee, all parties—the customer, the beneficiary, the bank, and regulators—can see the exact terms:

Guarantee amount: $100,000

Expiration date: December 31, 2026

Guarantee type: Performance Guarantee

Conditions for claiming: Customer fails to complete contracted work

Required documentation for claims: Contractor estimate, photos, contract reference

Payment timeline: Within 5 business days of approved claim

Because all terms are visible to all parties, there is no ambiguity. The beneficiary knows exactly what conditions must be met to claim payment. The customer knows exactly what conditions expose them to liability.

Technical flow: Guarantee created with terms → Terms stored on blockchain → All authorized parties access terms via API → Terms immutable and transparent → No party can claim ignorance of terms

Step 2: Single Source of Truth Eliminates Disputes Over Guarantee Authenticity (Verified by hash). The beneficiary receives the guarantee with an immutable hash. The beneficiary can independently verify that the guarantee they received matches the guarantee recorded on the blockchain. They compute the SHA-256 hash of the guarantee they received and compare it with the hash on the blockchain.

If hashes match, the guarantee is authentic and unmodified. If hashes do not match, the guarantee they received is fraudulent or altered. This verification takes seconds and does not require contacting the bank.

Technical flow: Beneficiary receives guarantee → Beneficiary computes SHA-256 hash of guarantee → Beneficiary retrieves blockchain-recorded hash via API → Hashes compared → Match proves authenticity → Mismatch proves fraud/alteration

Step 3: Immutable Record of Guarantee Issuance Prevents "We Never Issued This" Disputes (Permanent blockchain record). If a dispute arises with the customer claiming "We never authorized this guarantee" or the bank claiming "We never issued this guarantee," the blockchain provides proof.

The guarantee is recorded on the blockchain with the bank's digital signature. The signature proves the bank issued it. The timestamp proves when it was issued. The customer's account debit record proves the customer authorized it. No party can credibly deny the guarantee exists or was issued.

Technical flow: Guarantee issued → Recorded on blockchain with issuer signature and timestamp → Customer account debit recorded → Complete trail of issuance immutable → Later disputes resolved by blockchain evidence

Step 4: Automatic Claim Approval Based on Pre-Agreed Smart Contract Logic (No discretion). Rather than requiring a bank officer to manually review and approve claims (where bias or corruption could interfere), claims are approved automatically by smart contract logic that all parties have pre-agreed to.

The smart contract applies predefined rules:

If claim submitted before expiration AND claim amount ≤ guarantee amount AND supporting documentation present, THEN approve claim

Else, reject claim

Because the rules are programmed into the smart contract and immutable, all parties trust that the same rules will apply consistently. No bank officer can override the rules to deny a legitimate claim or approve a fraudulent claim.

Technical flow: All parties agree to smart contract rules → Rules programmed into smart contract → Smart contract deployed immutably → Claims validated against rules → Rules applied consistently without discretion → Beneficiary trusts rules will be followed

Step 5: Public Validation of Guarantee Terms by Independent Third Parties (Optional service). For important guarantees, either party can request that an independent third party (accounting firm, law firm, auditor) validate that the guarantee terms are fair and compliant with all regulations.

The third party accesses the blockchain, reviews the guarantee terms, and publishes their validation. If they find the terms to be fair and compliant, they sign their validation (digital signature). If they find issues, they document the issues. This public validation builds confidence that the guarantee is legitimate.

Technical flow: Beneficiary or customer requests third-party validation → Third party accesses blockchain guarantee → Third party reviews terms → Third party publishes validation with signature → Validation visible to all parties

Step 6: Cryptographic Proof That Beneficiary Received Funds (After payment). Once payment is made, the smart contract generates proof that the beneficiary received funds:

Receiving bank confirms receipt

Account number and amount credited verified

Timestamp of deposit

Receiving bank's digital signature

This proof is recorded on the blockchain. If the beneficiary later claims they never received payment, the blockchain provides definitive proof they did.

Technical flow: Payment authorized → Funds transferred to beneficiary account → Receiving bank confirms receipt → Receipt recorded on blockchain → Proof immutable and tamper-proof

Step 7: Zero-Knowledge Proofs for Privacy While Maintaining Verification (Optional). Some beneficiaries may not want their guarantee details publicly visible (competitive sensitivity). The blockchain can use zero-knowledge proofs to prove a guarantee exists and is valid without revealing the amount or terms.

A beneficiary can prove "I have a valid $50,000 guarantee from Bank A that expires on December 31, 2026" without revealing that the guarantee is for a specific contract or competitive bid. Third parties can verify the statement is true without learning sensitive details.

Technical flow: Beneficiary wants privacy but needs verifiability → Beneficiary generates zero-knowledge proof → Proof mathematically verifies guarantee is valid without revealing terms → Third parties verify proof → Privacy maintained while credibility established

Step 8: Permanent Appeal and Dispute Resolution Record (Transparent process). If a beneficiary claims payment was wrongfully denied, or if a customer disputes a claim, the dispute is recorded on the blockchain:

Date of dispute filed

Party filing dispute

Reason for dispute

Evidence submitted by each party

Dispute resolution authority assigned

Resolution decision

Decision reason

Appeal timeline (if applicable)

Because the entire dispute process is transparent and recorded immutably, both parties have confidence that disputes are handled fairly.

Technical flow: Dispute filed → Recorded on blockchain with details → Evidence from both parties recorded → Dispute authority reviews on blockchain → Decision recorded with reasoning → Appeal process visible if needed

Step 9: Automated Guarantee Renewal and Amendment Notifications (Proactive transparency). Rather than parties needing to remember guarantee expiration dates or amendment deadlines, the blockchain sends automatic notifications:

30 days before expiration: "Guarantee XYZ expires in 30 days. Renew or let expire."

7 days before expiration: "Guarantee XYZ expires in 7 days."

Upon expiration: "Guarantee XYZ has expired and is no longer valid."

These notifications prevent disputes caused by forgotten expirations. All parties are aware of critical dates.

Technical flow: Blockchain stores guarantee expiration date → Smart contract triggers notifications at defined intervals → Notifications sent to customer, beneficiary, and bank → Notifications include expiration details → All parties aware of critical dates

Step 10: Continuous Performance Metrics and System Audit (Ongoing assurance). The blockchain system tracks performance metrics visible to all parties:

Average claim approval time: 8 minutes

Average claim denial rate: 2.1% (indicating strong but fair validation)

Average dispute rate: 0.3% (indicating most claims are processed fairly)

Smart contract uptime: 99.97% (indicating system reliability)

Zero fraudulent claims approved in last year

These metrics build trust by showing that the system is working as intended—claims are being processed fairly and fraud is being prevented.

Technical flow: System tracks all metrics automatically → Metrics updated in real-time → Metrics visible to all authorized parties via dashboard → Metrics audited by independent third parties → Transparency builds confidence

Implementation and Integration Guide for Bank and Financial Institutions

Implementation Guide for Letter of Credit on Blockchain

System Architecture Overview

Implementing blockchain-based LCs requires integrating three main systems:

Blockchain Network Layer: The distributed ledger that maintains LC records (typically Hyperledger Fabric or Corda)

Smart Contract Layer: The automated business logic (chaincode in Fabric or Cordapps in Corda)

API Integration Layer: The connection between legacy banking systems and the blockchain

Integration with Legacy Banking Systems

Most banks have decades-old mainframe systems and databases. Complete replacement is not feasible. Instead, middleware solutions bridge the gap:

Step 1: API Gateway Implementation. Install an API gateway that sits between legacy banking systems and the blockchain network. This gateway translates between the bank's internal data format and the blockchain's standardized format. When a bank officer in the legacy system creates an LC, the system sends the LC data to the API gateway. The gateway converts the data to blockchain format and submits it to the network.

Step 2: Data Model Mapping. The legacy system's LC data model is mapped to the blockchain's data model. Field-by-field conversion ensures that information is not lost. For example:

Legacy field "LC_TYPE" (values: S, D, T) maps to blockchain field "LC_Category" (values: SIGHT, DEFERRED, TRAVELER)

Legacy field "AMOUNT" (numeric) maps to blockchain field "LC_Amount" (numeric) and "Currency" (ISO 4217 code)

Legacy field "EXPIRY_DATE" (MMDDYYYY format) maps to blockchain field "Expiration" (ISO 8601 format)

Step 3: Real-Time Synchronization. Once an LC is recorded on the blockchain, the API gateway retrieves it and updates the legacy system's database. When the importer's bank approves an LC on blockchain, the approval is transmitted back to the legacy system, updating the LC status from "PENDING" to "APPROVED" in the mainframe.

Step 4: Batch Processing for High Volume. If a bank processes thousands of LCs daily, sending each individually to the blockchain would overload the system. Instead, the gateway batches LCs into groups and submits batches every hour (or every 5 minutes for urgent LCs). This maintains reasonable blockchain throughput while processing high volumes.

Smart Contract Deployment Process

Step 1: Contract Development. Developers write the smart contract code in the appropriate language:

Hyperledger Fabric: Chaincode in Go, Java, or Node.js

Corda: Cordapps in Kotlin or Java

The contract includes business logic for:

LC creation and validation

Document submission and verification

Discrepancy flagging

Payment release conditions

Step 2: Local Testing. The contract is tested locally on a development blockchain network. Test cases include:

Valid LC creation

Invalid LC rejection (missing fields, sanctions issues)

Document submission with discrepancies

Document submission without discrepancies

Payment release

Step 3: Contract Review and Approval. The contract code is reviewed by:

Security team (for vulnerabilities)

Compliance team (for regulatory adherence)

Product team (for business logic correctness)

All participating banks (for consensus on business rules)

All banks must agree on the contract logic before deployment.

Step 4: Chaincode Packaging and Installation. The contract is packaged into a specific format. For Hyperledger Fabric, this means creating a tar.gz file containing the chaincode source code and package.json or go.mod file with dependencies. The package is installed on each node's peer:

text

peer lifecycle chaincode install lc_contract_1.tar.gz

Step 5: Endorsement Policy Agreement. The banks agree on an endorsement policy. For example, "At least 2 out of 3 major issuing banks must approve any LC creation." This policy is written into the contract deployment specification.

Step 6: Contract Deployment to Channel. Once all organizations have installed the contract and agreed on endorsement policy, the contract is deployed to the channel (the blockchain network):

text

peer lifecycle chaincode commit -C mainchannel -n lc_contract -v 1 --init-required \

--signature-policy "OR('Org1.member','Org2.member','Org3.member')"

After deployment, the contract is live and immutable. It will be used to process all LC transactions.

Endorsement and Validation Policy Configuration

The blockchain network must be configured to specify which organizations must approve which transactions:

LC Creation Policy: Requires approval from issuing bank only

LC Confirmation Policy: Requires approval from both issuing and confirming banks

Document Submission Policy: Requires approval from exporter and issuing bank

Payment Release Policy: Requires approval from confirming bank based on smart contract logic

These policies are built into the chaincode and enforced automatically.

Real-Time Data Availability and Dashboard

Banks deploy dashboard applications that query the blockchain in real-time:

Step 1: Event Listeners. The dashboard includes event listeners that monitor the blockchain for specific events:

"LC Created" event: New LC added to ledger

"LC Approved" event: Approval recorded

"Documents Submitted" event: Documents uploaded

"Payment Released" event: Settlement completed

Step 2: Real-Time Updates. When an event occurs on the blockchain, the event listener immediately notifies the dashboard. The dashboard refreshes to show the new information. If an exporter wants to know if their LC has been confirmed, they check the dashboard and see the real-time status without delay.

Step 3: Historical Queries. Users can query the blockchain to retrieve historical LC data:

"Show all LCs created on January 15, 2026"

"Show all LCs with discrepancies"

"Show all LCs settled in the last 7 days"

"Show the complete history of LC 'XYZ123' including all amendments"

Implementation and Integration Guide for Bank Guarantees on Blockchain

System Architecture for Bank Guarantee Processing

The blockchain bank guarantee system requires integration of:

Customer Portal: Web interface for customers to request guarantees

Beneficiary Portal: Web interface for beneficiaries to view guarantees and submit claims

Bank Internal Systems: Integration with customer accounts, credit systems, and settlement

Smart Contract Layer: Chaincode for validation and payment logic

Blockchain Network: Distributed ledger connecting all participating banks

Customer Portal Implementation

Step 1: Guarantee Request Form. The customer portal includes a form where customers can request a guarantee: