TL;DR

Distributed ledger technology reduces settlement risk by turning fragmented controls into shared, real-time infrastructure; using smart contracts for automated settlement and liquidity management and privacy-preserving techniques to coordinate safely without exposing sensitive data.

One of the major concerns in banking and financial markets today is still settlement risk. The moment when banks make a transfer of money or securities, one party will have given up an asset before receiving a payment from the other party represents a risk of loss due to the failure of the other party to fulfill their obligations, which is referred to as settlement risk, a challenge increasingly addressed through modern trade-finance workflows like those outlined in this reference. A fundamentally new method to enable banks to collaborate with respect to reducing the risks associated with settlement risk while keeping confidential information about each bank separate is Distributed Ledger Technology (DLT).

Banking models in traditional banking systems use a centralized management system to track ownership of assets and manage the transfer of money between account holders. While this model is successful, the entire banking industry must place total trust in a single central authority. Furthermore, this centralized model can result in slower transaction times since multiple intermediate parties must verify the accuracy of the information and approve transactions at various points during the process. DLT replaces this centralized model with a decentralized model that allows for multiple banks to maintain the same record of transactions contemporaneously, with no need for a single central authority. At the same time, DLT provides enhanced security and protection of sensitive business information through advanced encryption and privacy technologies.

The purpose of this article is to describe how DLT technology enables collaborative risk reduction among banks while protecting the confidentiality of sensitive business information. The article describes the technical basis for DLT, the methods used to reduce settlement risk, the privacy technologies used to protect confidential information, and the ways in which real-world banks are currently implementing DLT based solutions.

What is Distributed Ledger Technology and How Does It Work

Distributed Ledger Technology is a system where a record of transactions is stored and updated across many computers at the same time, rather than being stored in one central location. Think of it like this: instead of one bank keeping all the records in a secure vault that only they control, multiple banks each keep an identical copy of the same records on their own computers. When one bank wants to record a new transaction, all the banks must first agree that the transaction is legitimate before adding it to their copies of the record, a structure that becomes especially important in multi-network treasury coordination like the model described in this approach.

DLT systems are built on three core technical foundations. First, they use cryptography, which is a mathematical method of encoding information so that only people with the right keys can read it. Second, they use peer-to-peer networks, which allow computers to communicate directly with each other without needing a central server. Third, they use consensus mechanisms, which are rules that all participants follow to agree on whether a transaction is valid before it is added to the ledger.

The Traditional Settlement Process and Its Risks

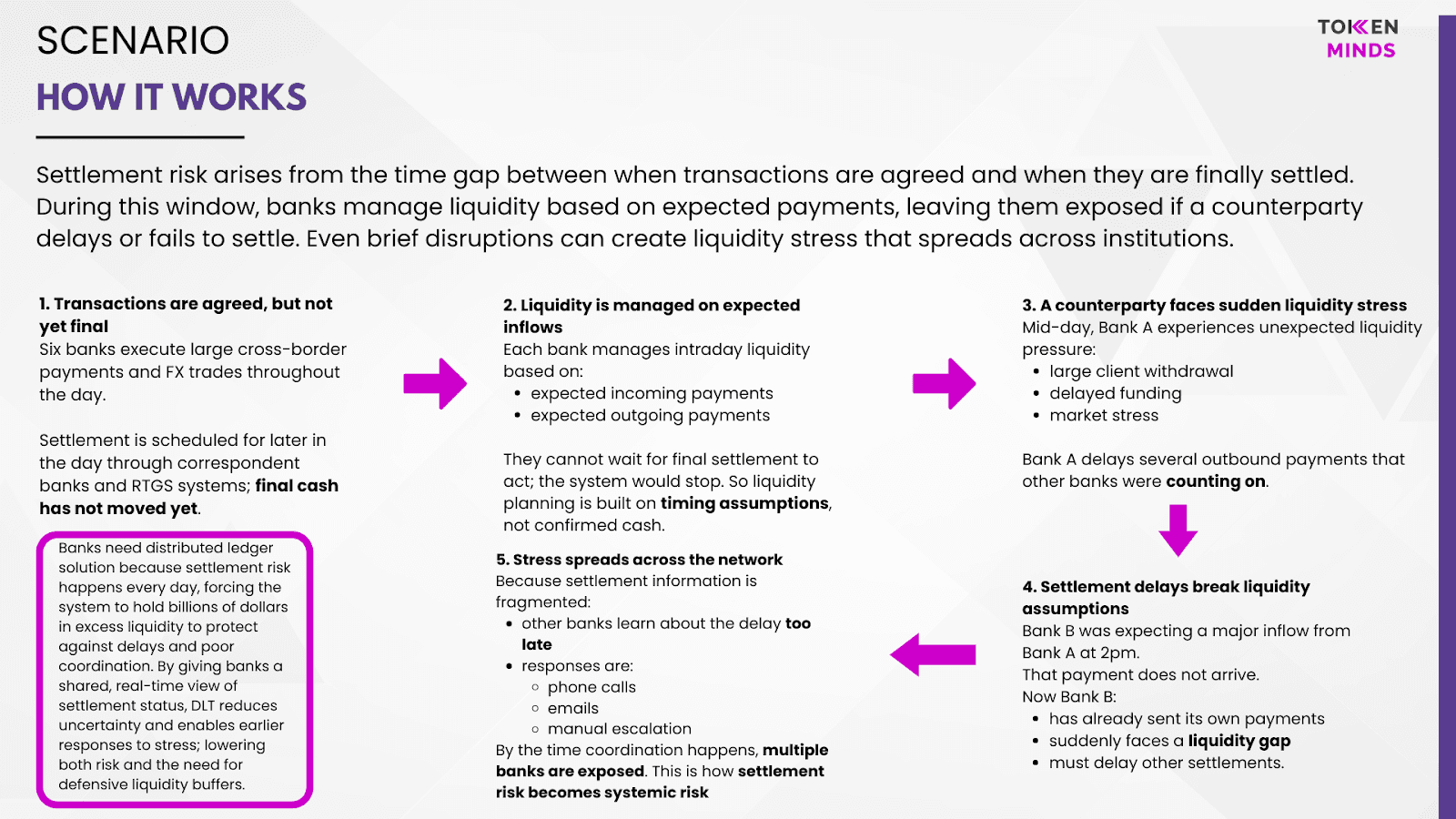

Systemic risk, however, is the direct result of a chain reaction that occurs when one bank's settlement issues are experienced by all banks in the banking network. The following example illustrates the transition from settlement risk to systemic risk:

Throughout the course of a business day six banks settle multiple large cross-border payments and foreign exchange transactions with each other. Each bank will have its final cash delivered later in the day via their correspondent banks as well as the Real-Time Gross Settlement (RTGS) systems; however, this cash has not been received or sent at the time of the execution of these settlements. As such, each bank will manage its intra-day liquidity based upon expected receipts and disbursements.

Each bank therefore can not wait until final cash is settled before acting since no bank would be able to function if the entire system did not continue to process.

Therefore, all liquidity planning is based on assumptions regarding timing of settlements and/or expectations of future payment receipts/disbursements versus actual receipt of cash.

At midday, Bank A receives a large withdrawal or delayed funding, creating an immediate liquidity shortfall. As a result, Bank A will be forced to delay several outgoing payments, which in turn delays incoming funds from those banks. Bank B had expected a significant inflow from Bank A at 2PM; however, when it does not receive that payment, it creates a liquidity shortage. Bank B has also made its own outgoing payments to other banks, so it will have to delay them as well. Due to the fact that settlement information is fragmented throughout the banking system, other banks do not find out about the delay until after it occurs.

Banks then respond with phone calls, emails and manual escalation through their management team. Ultimately, by the time the banks coordinate with one another, multiple banks are under liquidity stress. This is how settlement risk ultimately turns into systemic risk and jeopardizes the overall stability of the financial system.

Currently, banks use billions of dollars of excess liquidity as defensive buffers to mitigate this risk. DLT eliminates the need for banks to hold these excess buffers, because it provides banks with a shared, real-time view of settlement status. When all banks can see what is happening with settlement status as it develops, they can respond to potential stress signals sooner and adjust their liquidity management before there are cascading failures. The visibility provided and the ability to respond early to stress signals dramatically lower both the likelihood of settlement failures and the amount of capital banks need to maintain in reserve.

Permissioned Ledger for Settlement State

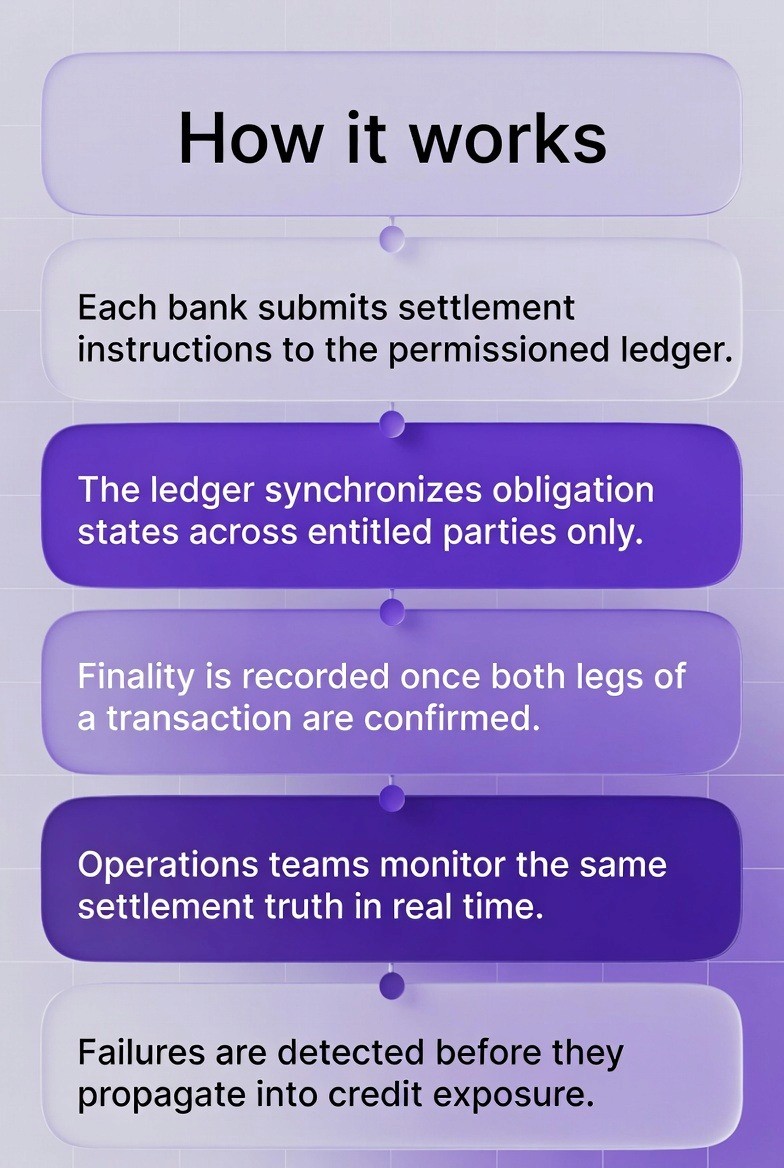

To implement the technical requirements for an Atomic Settlement, a permissioned Distributed Ledger Platform is required in order to synchronize settlement obligations and states of the banks involved while at the same time ensuring that only authorized personnel have access to the platform, a design approach often shaped by system-level guidance like this development framework.

The Architecture would transition the settlement process from each bank's own separate ledger (i.e., isolated) to a Synchronized Execution Layer where all parties can view consistent, real-time data regarding the status of payments and settlements.

Several proven DLT platforms are designed for this purpose:

R3 Corda

Corda is based on peer-to-peer settlement coordination. As opposed to sending each transaction to all members of the network, R3 Corda sends transactions only to the specific financial institutions which are part of the transaction. The settlement between Bank A and Bank B will be recorded by both Bank A and Bank B in their respective ledgers; however, other financial institutions within the network are not able to view or obtain any information about the transaction since it has been determined that they have no interest in viewing the transaction. Corda's architecture provides the benefits of keeping transactional data confidential while also allowing for atomic settlement coordination among all parties.

Hyperledger Fabric

Hyperledger Fabric utilizes a channel-based payment domain. Hyperledger Fabric enables administrators to establish multiple separate channels which contain different sets of financial institutions. For example, an administrator could establish a channel to facilitate settlement of U.S. dollar denominated transactions with Bank A, Bank B, and Bank C, while establishing a separate channel to facilitate settlement of Euro-denominated transactions with Bank D, Bank E, and Bank C. In addition to containing separate financial institutions, each channel would also maintain its own ledger entry reflecting the current status of all transactions that occurred within the channel. All transactions occurring within one channel would not impact transactions occurring within other channels.

Enterprise Ethereum Virtual Machine (EVM)

Platfroms such as Besu, Quorum, and Polygon CDK operate as private blockchain networks utilizing smart contracts to encode the settlement states and obligations associated with each transaction. Platforms utilize identical contract logic when executing the logic at each node within the network while providing the necessary cryptographic evidence that the execution results from each node within the network were consistent across all financial institutions.

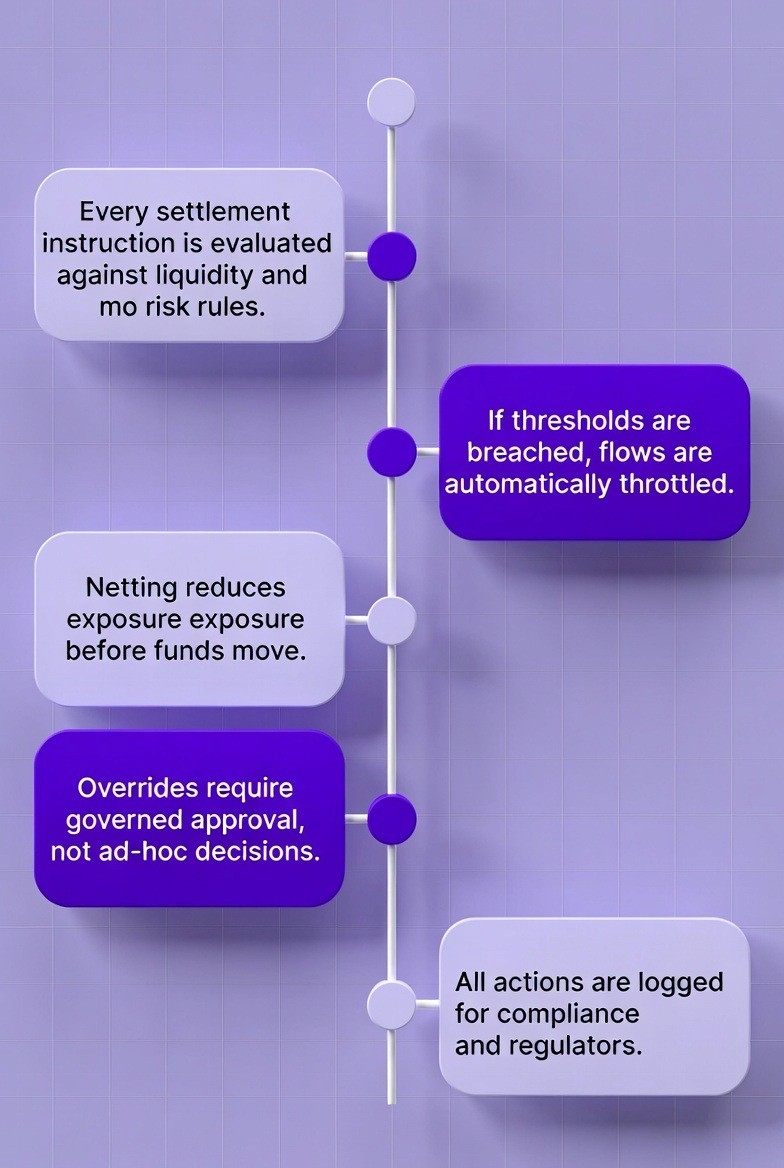

Smart-Contract Settlement Controls

Smart-contract settlement controls represent a shift from manual, post-failure response to automated, pre-failure protection. The control logic is encoded directly into settlement workflows so that unsafe transactions are blocked before they can execute.

Different DLT platforms support different programming languages for smart contracts:

Solidity is the primary language for Enterprise EVM controls. Solidity code executes identically on all nodes in an EVM-based network.

Java and Kotlin are used for smart-contract logic in R3 Corda, where contracts are called flows and are executed as point-to-point programs between two banks.

Go and Node.js are used for smart contracts in Hyperledger Fabric, where contracts are called chaincode.

The core control logic encoded in settlement contracts includes:

Thresholds for settlement risks

Smart contracts define the maximum levels of exposures that banks are willing to accept during settlement. An example would be a bank stating that it would not accept more than $10 million in total settlement exposure with Bank B at any given time. This is enforced by the contract and when Bank A attempts to settle a transaction with Bank B, the contract verifies whether this transaction will cause the total exposure between Bank A and Bank B to be greater than $10 million. If it does, the contract prevents the transaction from being processed.

Liquidity limits for intraday

Smart contracts enable banks to define the maximum amount of cash they can transfer to another entity on any one day prior to final settlement occurring. For instance, a bank may state: "I will transfer no more than $50 million in cash prior to 3PM each business day." The smart contract logs all of the cash being transferred (both incoming and outgoing) and when a bank wants to make an additional cash transfer that will exceed the defined limit, the contract prevents the additional transfer.

Rules for netting and margins

Smart contracts can be used to create automated instructions that combine individual settlements into fewer settlement transactions to minimize the amount of money that needs to be moved to effectuate settlement. An example would be where Bank A has a settlement liability of $5 million to Bank B; however, Bank B has a settlement liability to Bank A of $3 million. In this case, the settlement liability is reduced to $2 million as part of a net settlement from Bank A to Bank B. Smart contracts provide the capability to determine the net position of individual settlements and to effectuate only the net settlement, which minimizes the amount of money that needs to move to complete the settlement.

Triggering exceptions and escalations

Smart contracts can be programmed to identify specific conditions that should result in either alerting a human operator for review or taking some other type of action. Examples include: "If any settlement attempt fails for any reason, automatically perform a collateral check and notify the risk management group."

Typical modules used in smart-contract settlement controls include:

SettlementGate.sol (a Solidity contract that blocks unsafe settlements),

LiquidityThreshold.kt (a Kotlin flow that enforces intraday liquidity limits), and

NettingEngine.go (a Go chaincode that calculates and executes netting).

A code example from a settlement control contract is:

require(liquidityAvailable >= requiredAmount, "Settlement liquidity breach");

This single line of code enforces a critical rule: before executing a settlement, the contract must verify that the bank has available liquidity greater than or equal to the required amount. If this condition is not true, the contract throws an error and blocks the settlement. This simple rule, when applied to millions of transactions, prevents liquidity crises from cascading through the banking system.

The outcome of smart-contract settlement controls is that settlement protection becomes executable infrastructure rather than something that is checked after the fact through manual review. Settlement risk is prevented before it occurs rather than managed after it occurs.

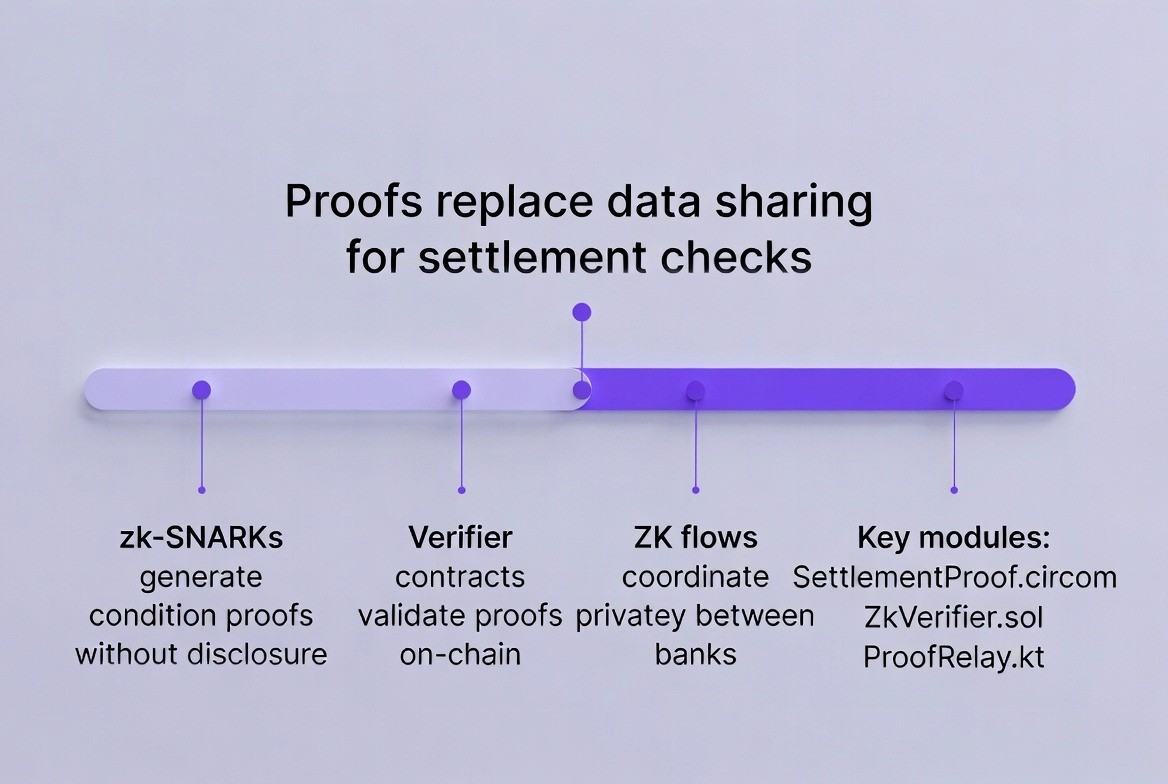

Zero-Knowledge Settlement Validation

Zero-knowledge proofs for settlement validation represent a shift from sharing sensitive data to sharing only mathematical proofs of specific settlement conditions. This enables banks to coordinate settlement risk management without exposing balances or positions to each other.

The zero-knowledge proof stack consists of several technical components:

zk-SNARK circuits are mathematical circuits that generate proofs about specific conditions. For settlement validation, these circuits generate stress-condition proofs. For example, a zk-SNARK circuit might prove "My total settlement exposure with all counterparties is below $100 million" without revealing the actual exposure to any specific counterparty or the distribution of exposure across counterparties. The circuit encodes the mathematical proof of this condition so that any verifier can confirm the proof is valid.

On-chain verifier contracts are smart contracts that verify zero-knowledge proofs. When Bank A generates a zk-SNARK proof of its settlement condition, the verifier contract receives the proof and checks whether the mathematics is correct. If the proof is valid, the contract accepts it. If the proof is invalid or has been tampered with, the contract rejects it. The verifier contract does not need to see the underlying information that the proof is based on; it only verifies that the proof itself is mathematically sound.

Corda ZK flows are settlement coordination routines for R3 Corda that incorporate zero-knowledge proofs. A Corda flow is a program that two banks execute together to reach agreement on a transaction. A zero-knowledge flow allows banks to include proofs in their coordination without exposing sensitive information.

Typical modules used in zero-knowledge settlement validation include: SettlementProof.circom (a circuit written in the circom language that defines proof generation logic), ZkVerifier.sol (a Solidity smart contract that verifies proofs on-chain), and ProofRelay.kt (a Kotlin module in Corda that transmits proofs between banks).

The technical process works like this:

First, Bank A generates a zero-knowledge proof that encodes a specific settlement condition, such as "My available liquidity exceeds $50 million and I can therefore accept this settlement without breaching my liquidity limits."

Second, Bank A sends only the proof to the settlement system, not the underlying information. Third, the on-chain verifier contract receives the proof and checks whether it is valid. Fourth, if the proof is valid, the settlement proceeds. If the proof is invalid, the settlement is blocked.

The outcome of zero-knowledge settlement validation is that banks prove settlement-risk conditions to each other without revealing balances or positions. Bank A can prove to Bank B that it has sufficient liquidity for settlement, but Bank B never learns Bank A's exact liquidity position. This enables coordination and risk mitigation while preserving the confidentiality of each bank's balance sheet.

Table: Cryptographic Techniques Used in DLT Banking Systems

Technique | Purpose | How It Works | Example Use Case |

Symmetric encryption | Protect data in transit | One key encrypts and decrypts the data | Protecting settlement instructions between two banks |

Asymmetric encryption | Authentication and digital signatures | Public key encrypts, private key decrypts | Banks signing transaction instructions |

Hash functions | Detect tampering | Create a unique fingerprint of data; any change produces a different fingerprint | Creating an unchangeable audit trail of all transactions |

Zero-knowledge proofs | Verify facts without revealing details | Create mathematical proof of a fact without revealing the fact itself | Proving available liquidity without revealing exact amounts |

Digital signatures | Prove who created a transaction | Sign with private key, verify with public key | Proving that a bank authorized a specific transaction |

How Distributed Ledger Technology Reduces Settlement Risk

Reducing settlement risk across banks is no longer just a process challenge; it is a systems problem that requires shared execution without shared data. Traditional coordination relies on delayed reconciliation, manual escalation, and bilateral controls that only react after failures occur.

Distributed Ledger Technology changes this model by turning settlement policy into executable code and coordination into automated infrastructure. The following technical steps show how permissioned ledgers, smart contracts, cryptographic validation, and event-driven governance work together to create a real-time, network-level defense against settlement risk.

Step 1: Establish a Permissioned Settlement Ledger

Goal: Move from fragmented reconciliation to synchronized finality.

How it works technically

Deploy a permissioned DLT network:

R3 Corda for point-to-point settlement coordination

Hyperledger Fabric for channel-based payment domains

Enterprise EVM (Besu, Quorum, Polygon CDK) for programmable settlement logic

Encode shared settlement state:

Interbank settlement obligations

In-flight payment states

Finality confirmations

Core system modules

SettlementState.ktPaymentChaincode.goFinalityRegistry.sol

Result

Settlement moves from isolated bank ledgers to a synchronized execution layer.

Step 2: Implement Smart-Contract Settlement Controls

Goal: Shift from post-failure response to pre-failure protection.

How it works technically

Deploy settlement controls in:

Solidity for EVM-based controls

Java / Kotlin for Corda flows

Go / Node.js for Fabric chaincode

Encode executable risk logic:

Settlement-risk thresholds

Intraday liquidity limits

Netting and margin rules

Exception and escalation triggers

Core system modules

SettlementGate.solLiquidityThreshold.ktNettingEngine.go

Result

Settlement protection becomes executable infrastructure, not after-the-fact review.

Step 3: Add Zero-Knowledge Settlement Validation

Goal: Prove risk compliance without exposing balances or positions.

How it works technically

Build a ZKP validation layer:

zk-SNARK circuits for stress-condition proofs

On-chain verifier contracts

Corda ZK flows for bilateral proof exchange

Banks generate cryptographic proofs that:

Liquidity thresholds are respected

Exposure limits are not breached

Netting constraints are satisfied

Core system modules

SettlementProof.circomZkVerifier.solProofRelay.kt

Result

Banks validate settlement-risk conditions without revealing sensitive data.

Step 4: Deploy Programmatic Governance for Settlement Events

Goal: Replace crisis calls with automated coordination.

How it works technically

Encode governance logic on-chain:

Multi-sig execution for emergency limits

On-chain voting for network thresholds

Time-locked parameter updates

Define escalation workflows:

Risk events trigger governance contracts

Approvals execute automatically once quorum is reached

Core system modules

SettlementGovernance.solMultiSigController.solTimelockController.sol

Result

Settlement-risk response becomes collective, fast, and auditable.

Step 5: Implement Event-Driven Settlement Containment

Goal: Stop cascading failures before they become systemic.

How it works technically

Build an event-driven execution stack:

Smart contracts that react to risk triggers

Oracle layer (Chainlink, API3) for real-time signals

Institutional custody integration (Fireblocks, Anchorage)

Automate containment actions:

Freeze risky settlement flows

Increase margin requirements

Trigger collateral calls

Isolate failing counterparties

Core system modules

RiskTrigger.solOracleListener.ktCollateralManager.sol

Result

Settlement risk is contained at the network level before it becomes default risk.

Technical Implementation: Programmatic Governance for Settlement Events

Settlement events that create risk; such as payment delays, liquidity stress, or collateral deterioration, must trigger coordinated responses across the banking network. In traditional banking, this coordination happens through crisis calls, escalation emails, and manual management decisions. These manual processes are slow and often fail to prevent cascading failures.

In DLT systems, settlement-event response becomes programmable and automated through governance mechanisms that are encoded directly into the DLT infrastructure.

Multi-signature execution for emergency limits

Allows multiple banks to collectively authorize changes to settlement parameters during stress conditions. For example, if a settlement crisis is unfolding, banks might need to temporarily increase their liquidity limits to prevent failure. Rather than each bank making this decision individually, multi-signature governance requires agreement from a specific group of banks; perhaps the five largest banks in the network, before any limit can be changed. This requires an attacker to compromise multiple independent banks simultaneously in order to manipulate settlement parameters.

On-chain voting for network thresholds

Uses smart contracts to allow all banks in the network to vote on changes to settlement rules. For example, if the network agrees that settlement thresholds should be lowered to reduce systemic risk, each bank can vote on the proposal through a smart contract. Once the voting period closes, the contract automatically implements the decision if a supermajority approves it. This voting process and its outcome are recorded permanently on the ledger, creating an immutable audit trail of governance decisions.

Time-locked parameter updates

Prevent sudden changes to settlement rules that might disrupt the system. When a parameter change is approved, the change does not take effect immediately. Instead, it is scheduled to take effect at a specific time in the future—perhaps 48 hours in the future. This delay allows all banks to prepare for the change and ensures no bank is surprised by an unexpected change in settlement rules.

Typical modules used in programmatic governance include

SettlementGovernance.sol (a Solidity contract that coordinates governance),

MultiSigController.sol (a contract that enforces multi-signature requirements),

TimelockController.sol (a contract that implements time-locked updates).

The outcome of programmatic governance for settlement events is that settlement-risk response becomes collective, fast, and auditable. Instead of waiting for a crisis committee to meet and manually decide on a response, the system automatically implements pre-agreed governance procedures. The decision process is transparent and recorded on the ledger, allowing regulators and auditors to see exactly which banks voted for or against each decision.

Real-World Implementation: Fnality International

Fnality International is a bank-owned consortium that provides tokenized settlement infrastructure enabling atomic, real-time payment finality between participating institutions such as JPMorgan, Barclays, Deutsche Bank, UBS, and Société Générale. Fnality does not share credit exposures or run cryptographic solvency proofs where banks must reveal financial information. Instead, it mitigates counterparty risk structurally by removing the settlement timing gaps that create liquidity stress and unsecured exposure between banks.

Through a permissioned distributed ledger and central-bank-money settlement model, Fnality demonstrates how banks can collaboratively reduce systemic and counterparty risk by sharing trusted infrastructure while keeping balance sheets, trading strategies, and client data fully confidential. Each participating bank maintains settlement accounts on the Fnality ledger.

When a bank wants to settle a transaction, it instructs the ledger to move funds. The ledger records the transaction atomically, and both parties see instant finality. The structure of the Fnality network ensures that no individual bank can see another bank's account balances or transaction history beyond the transactions in which they directly participate. The central bank connection ensures that the cash used for settlement is official central bank money, not a private banking asset, which eliminates credit risk in settlement.

The Outlook

By 2026, leading banks will embed distributed ledger technology (DLT) into payment, clearing, and trade finance operations so that they can manage and synchronize settlement and liquidity protection in real-time.

In the next phase of development, the same DLT-based model will extend into correspondent banking, securities settlement and cross border liquidity networks. Ultimately, the direction of settlement risk management will evolve away from managing a cascade of failures based on bilateral escalation through to programmable interbank infrastructure designed to prevent such failures from threatening the stability of the entire system.

How TokenMinds Helps Banks Deploy DLT for Secure Settlement-Risk Control

TokenMinds allows banks to create decentralized, privacy-protected settlement risk platforms. Our solutions include a permissive network design, a smart contract control layer, and a Zero-Knowledge proof framework. Together, they enable coordinated payment settlements while ensuring transaction confidentiality.

We focus on production-ready solutions. By integrating Distributed Ledger Technology (DLT) with Payment Rails, Treasury Systems, and Regulatory Requirements, TokenMinds helps banks move from reactive processes to a more collaborative and automated financial system. This enhances resilience in global financial markets.

Conclusion

Settlement risk has long been a major hidden threat to global banking. Minor payment delays can quickly turn into serious crises. These situations often force banks to hold large amounts of liquidity as collateral. DLT changes this by enabling real-time payment settlement while keeping balance sheet details private. As more institutions adopt DLT settlement technology, we move closer to a world where risk is managed collectively. This allows for more efficient use of capital and greater financial stability, all while maintaining confidentiality.

Schedule a complimentary consultation with TokenMinds to learn how your organization can use privacy-preserving DLT solutions. These solutions can reduce settlement risk, improve liquidity efficiency, and strengthen the interbank settlement framework.

FAQ

What is Settlement Risk and Why Is It a Problem for Banks?

Settlement risk occurs when one bank sends money or securities to another but doesn't get the payment in return on time. This risk can leave banks vulnerable until it affects the entire system. To prepare for potential delays or failures, banks often hold billions in extra reserves.

How Does DLT Reduce Settlement Risk?

DLT provides banks with a real-time, shared view of settlement status. This means they can end reliance on slow reconciliations and assumptions about future payments. By syncing settlement data, banks can spot early signs of trouble and manage their liquidity before delays lead to a larger crisis.

How Can Banks Collaborate on DLT Without Sharing Sensitive Data?

Banks can use permissioned DLTs, like R3 Corda or HyperLedger Fabric. These networks let banks share transaction details only with authorized parties. Other banks won’t see any sensitive information, allowing them to coordinate on ledger use and transactions without disclosing individual balance sheets or client data.

What Role Do Smart Contracts Play in Managing Settlement Risk?

Smart contracts let banks translate their risk management rules into code. This code blocks unsafe transactions before they happen. Smart contracts automate limits on exposure and liquidity and set triggers for escalation. This changes settlement management from reactive to proactive and real-time.

How Do Zero-Knowledge Proofs Protect Settlement Information?

Zero-knowledge proofs allow a bank to show it has enough liquidity or meets exposure limits for a transaction without revealing specific amounts. Other banks or the DLT network can verify this proof mathematically, without accessing the bank's balance sheet or position.

Why Is DLT Seen as a Long-Term Solution to Settlement Risk?

DLT changes how banks settle transactions. Before DLT, settlement was often chaotic and reactive. Now, DLT creates a cohesive, programmable, and secure settlement process. It gives banks a shared platform for settlements, automates controls, and safeguards their confidential data.