TL:DR

Tokenized receivables transform invoices into liquid on-chain assets that unlock working capital without increasing balance-sheet risk, while smart contracts automate underwriting, compliance, and settlement to modernize private-credit markets with programmable financial infrastructure.

Every business that sells products or services on credit deals with the same issue. When a company delivers something to a customer, it sends an invoice that says the customer needs to pay in 30, 60, or 90 days. During this waiting time, the company has already spent money on materials, workers, and running the business, but it has not yet gotten paid. This waiting period creates a serious problem for cash flow that stops the business from spending money on growing, hiring new workers, or buying new equipment, a challenge many teams now rethink through automated payment approaches like this implementation path.

For small and medium-sized businesses, this problem is very serious. A manufacturing company that makes 10 million dollars per year with 60-day payment terms has roughly 500,000 dollars of money stuck in unpaid invoices at any given time. To get money while waiting for customers to pay, companies usually go to banks or factoring companies. These companies take a cut that is typically 2 to 5 percent of the invoice value and make the business wait through approval processes that take many weeks. Suppliers that are further down the supply chain face even bigger problems because lenders think they are riskier and charge them even more money.

Receivables tokenization solves this problem by changing unpaid invoices into digital assets that can be sold or used to get money right away, an application of tokenization models like the one described in this overview. Instead of waiting 60 to 90 days, a business gets money within hours. Instead of paying expensive fees to middleman companies, the business gets money at 7 to 12 percent per year through lending pools that run on blockchain technology.

What is Receivables Tokenization

Receivables tokenization is the process of taking a legal promise to pay—an invoice or account receivable; and turning it into a digital token that lives on a blockchain network, a structure that mirrors how transfer-agent functions evolve in tokenized markets as shown in this model. This token represents partial ownership of the money that will be paid.

When a company sends an invoice for 50,000 dollars with 90-day payment terms, it is basically a promise from the customer to pay that amount on a specific date. In traditional banking and business systems, this promise stays locked in accounting computer systems where nobody else can easily see it, buy it, or sell it. Receivables tokenization puts this promise on a blockchain, where it becomes a digital asset that people can immediately buy, sell, or use as protection for a loan.

The tokenization process has several steps. First, the business that created the invoice provides paperwork; proof that they delivered something, information about the customer, the payment terms, and the invoice amount. Second, a tokenization platform checks this information very carefully. Third, the platform creates a digital token on the blockchain that represents this receivable. Fourth, investors can buy this token and give the business money right away. When the invoice is finally paid, the blockchain automatically sends the money to people who hold the tokens.

Different from cryptocurrencies, which are based on guessing and not connected to real business activity, tokenized receivables are backed by real invoices; real business transactions between real companies. This makes them completely different from crypto assets and much more interesting to big investment companies and conservative money managers.

The Size of the Market Today and How It is Growing

The receivables tokenization market is getting bigger very fast. In early 2025, the total real-world asset tokenization market reached about 24 billion dollars worldwide. Within this market, private credit—which includes tokenized receivables, loans, and similar things; represents about 12 billion dollars. This is massive growth from just 600 million dollars in 2021.

Table: Tokenization Market Growth

Market Type | Money Right Now (2025) | Expected to Grow to | Time Period |

Total RWA Market | 24 billion dollars | 16 to 30 trillion dollars | 2030 to 2034 |

Tokenized Private Credit | 12 billion dollars | 8 to 12 trillion dollars | 2030 to 2033 |

Tokenized Treasuries | 7.4 billion dollars | 20 to 40 billion dollars | 2026 to 2028 |

Global Factoring Market (traditional) | 400 to 500 billion dollars | 3 to 5 percent growth per year | Ongoing |

Trade Finance Market (traditional) | 1 trillion dollars | 2 to 4 percent growth per year | Ongoing |

Average Return on Tokenized Receivables | 9.65 percent per year | Stays about the same | Ongoing |

How Receivables Tokenization Changes the Finance System

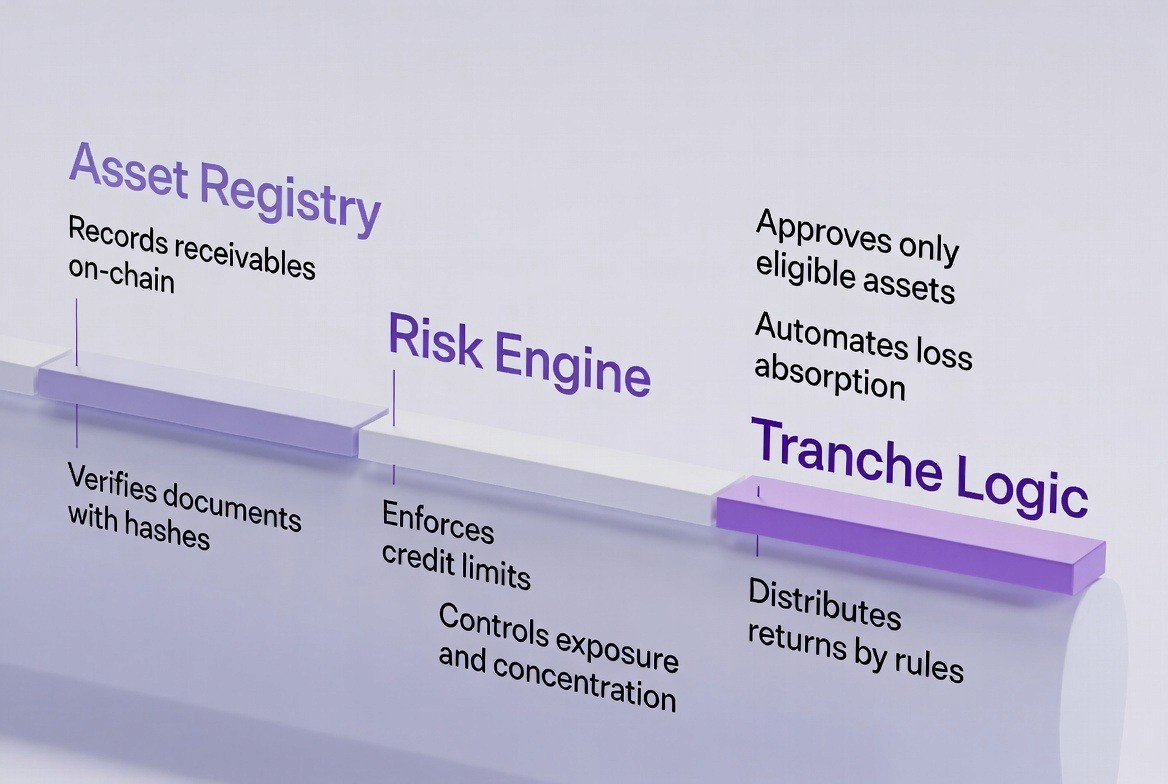

Receivables tokenization changes invoices into digital financial instruments that run on blockchain through a system with many modules. Each modele takes what banks do manually and turns it into computer code that runs automatically.

Module 1: Getting Assets Onto the Blockchain Network

This module changes accounting entries into digital assets protected by complex mathematics on the blockchain. The main blockchain networks used right now are Ethereum and other chains compatible with Ethereum (like Polygon and Arbitrum) for big institutions, and Centrifuge Chain (a special blockchain built just for real-world assets) for platforms that want real-world asset tools.

Technical Implementation: The system utilizes a two-tiered verification methodology. Off-chain storage will hold the entire invoice document in its entirety along with all associated metadata. On-chain anchoring will hold only the SHA-256 hash of the invoice data (a 256 bit fixed length hash). Hash verification works by using cryptography where hash(invoice_data_v1) ≠ hash(invoice_data_v1_modified).

Outcome: Receivables are moved from the ERP databases into unforgeable, non-alterable financial assets anchored through cryptographic methods. An immutable record exists as an audit trail for each receivable created at inception and throughout settlement.

Module 2: Using Smart Contracts for Credit Decisions

This module changes credit committees made up of people into computer code that makes credit decisions. The programming languages used are Solidity (for Ethereum, Polygon, Arbitrum) or Rust (for Centrifuge). The actual credit rules are written directly into the smart contracts, including due dates, the amount of the invoice, who owes the money, the interest rate or yield for investors, and which pools can include this receivable.

Typical Modules:

AssetRegistry.sol

AssetRegistry is a module used to store, manage, and provide access to all of the information regarding each individual Receivable. AssetRegistry utilizes a Mapping data structure that can connect an ID to the Receivable's full set of metadata including Invoice Amount, Customer Identification Number, Originator Address, Maturity Timestamp, and the SHA-256 Hash of the Original Document. AssetRegistry also contains the methods addReceivable(), getReceivableData(), and verifyReceivableHash().

RiskEngine.sol

RiskEngine uses deterministic require() statements to enforce Credit Rules and Regulations. RiskEngine checks for certain conditions in order to apply rules, these include Exposure Limits per Debtor, Concentration Limits per Customer Sector, and Portfolio Utilization Thresholds. This code will follow this format: require(exposure[debtor]=750) { assignToSeniorPool(receivableId)}.

PoolManager.sol

The PoolManager is responsible for assigning the receivable to the correct pool or tranche based upon the receipt of the receivable. Based upon the criteria established in the credit policy, the PoolManager will determine whether the receivable qualifies for assignment into either the Senior Pool, Junior Pool, or Equity Pool based upon the credit score assigned to the receivable and the quality of the underlying debtor. The PoolManager has implemented a simple logic statement: if(creditScore>=750){assignToSeniorPool(receivableId)}.

Outcome: Credit policy becomes executable code that runs with the same logic every time, removing human judgment, bias, and inconsistency. All credit decisions are transparent, auditable, and logged on-chain.

Module 3: Token Rules and Following the Law

Token Standards: ERC-3475 (structured finance tokens) is used as the token standard in this system; it enables a single smart contract to be an expression of many bond classes, each of which may have differing maturity dates, interest rates, and priority, while supporting multiple nonces (issuance batches) and storing metadata about each bond, including maturity date, yield, and terms of redemption. ERC-3643 (T-REX - Transfer Restriction Execution) provides the layering of compliance and transfer restrictions into tokens to enable regulatory compliance.

Compliance Logic Embedded: The compliance engine enforces investor whitelisting through a verified address list stored in a mapping structure. Jurisdiction filtering checks the investor's legal residence against approved jurisdiction lists. Transfer restrictions prevent unauthorized transfers through require() checks that prevent execution. Holding limits restrict the maximum number of tokens any single address can hold to ensure portfolio diversification.

Code Affect: Automatically Revert all transfers for an address that failed to pass a KYC/AML check with no need for post-transfer cleanup; if (!kycApproved[toAddress]) { revert("KYC not approved"); }.

Rules are enforced within the protocol layer (the blockchain) therefore there is no separate enforcement outside of the transaction, or after it has occurred

Compliance Enforcement Rules:

Only whitelisted addresses permitted: Only addresses which have been included in the approvedInvestors mapping are allowed to execute transfers.

Jurisdictional restrictions: require(allowedJurisdictions[investor.jurisdiction], "Jurisdiction not approved").

Restrictive transfers: Transfers cannot be executed if the receiving address does not have valid KYC approval.

Holding limits: require(balanceOf[recipient] + amount <= maxHoldingLimit, "Holding limit exceeded").

Outcome: Compliance will become part of system behavior rather than an operational burden. The blockchain will enforce regulatory requirements mechanically resulting in a 50 to 80 percent reduction in compliance cost compared to manual review processes.

Module 4: Automated Risk and Return Engine

Smart-Contract Logic for Tranche Hierarchy: The smart contract will be programmed such that senior tranche investors are provided a protected investment in their principal and receive the first distributions of cash flow from the loan or other investments, while junior tranche investors will have their yields increased as they are paid back first in case of default.

Loss Waterfall Logic: The smart contract will automatically allocate losses based upon an "if-then" condition as follows:

if (loss > 0)

{

juniorTrancheReserve -= loss;

if (juniorTrancheReserve < 0)

{

seniorTrancheReserve += juniorTrancheReserve;

juniorTrancheReserve = 0;

}

}

This ensures junior investors lose money first, protecting senior investors until junior capital is depleted. The system recalculates loss waterfalls after every settlement event.

Governance is managed through multiple people needing to approve actions (like 3 out of 5 people), voting by token holders on pool decisions, and time-locked updates for safety. The result is that risk is divided in a way that is mechanical, see-through, and can be checked.

Module 5: Instant Settlement and Money Routing

The fifth layer enables instant settlement rather than the traditional 2-day banking cycle.

Settlement Rails: The system routes payments through stablecoins (USDC, EURC) that maintain a 1:1 peg with fiat currency, tokenized deposits that represent claims on bank accounts, and CBDC pilots where available for central bank digital currency integration.

Automation Flow Process:

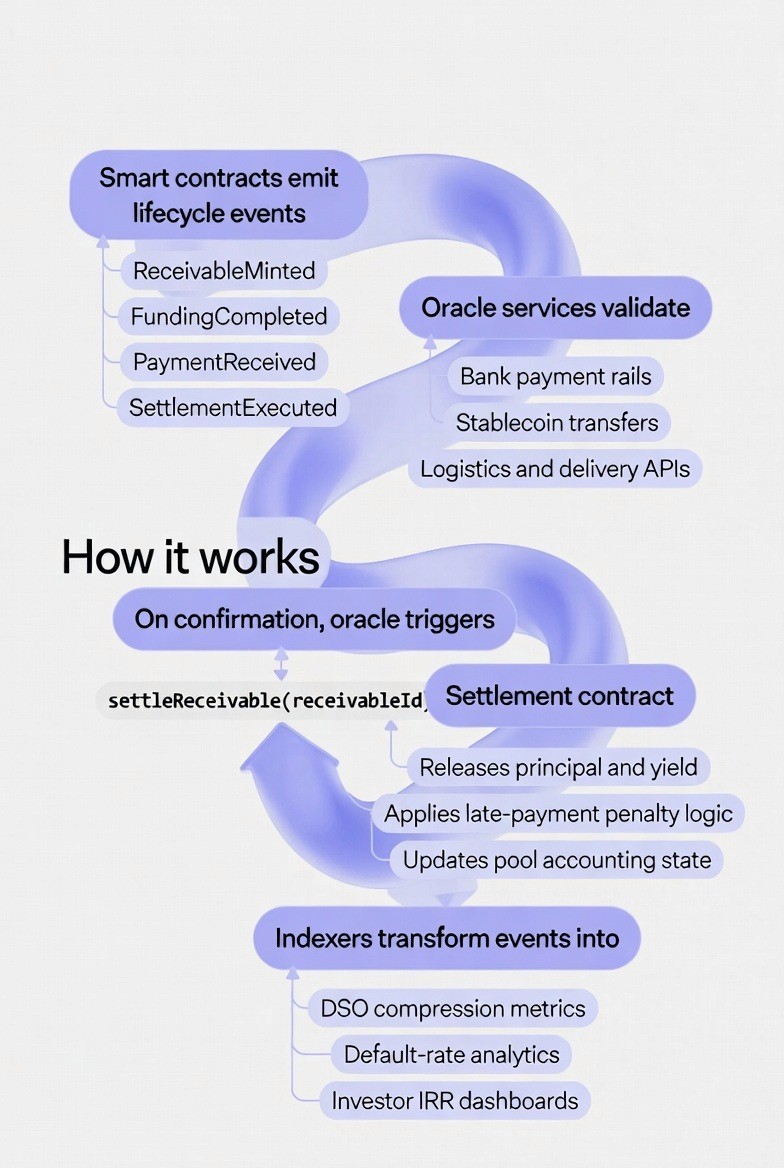

Oracle confirms payment received: Oracle services monitor bank payment rails, stablecoin transfers, and logistics APIs. Once payment is detected, the oracle triggers the settlement smart contract with proof of payment.

Smart contract validates amount: The contract checks that the received amount equals the invoice amount. Code structure: require(paymentAmount == invoiceAmount, "Amount mismatch").

Funds distributed instantly: Distribution happens atomically in a single transaction: First, senior tranche receives allocated return. Second, junior tranche receives remaining allocation. Code executes: seniorTrancheBalance += seniorAllocation; juniorTrancheBalance += juniorAllocation;

Platform fees auto-deducted: Platform fees are calculated and automatically transferred to the platform operator wallet based on pre-agreed percentage (typically 0.5% to 1% of transaction value).

Technical Stack Components:

Oracles: Chainlink or API3 serve as trusted intermediaries that connect off-chain payment information to on-chain smart contracts. They provide cryptographic proof of payment events.

Indexing: The Graph transforms raw smart contract events into queryable data. Smart contracts emit ReceivableMinted, FundingCompleted, PaymentReceived, and SettlementExecuted events. The Graph indexes these events allowing platforms to query DSO metrics, default rates, and IRR dashboards.

Custody: Fireblocks, Copper, or Anchorage manage institutional key custody and transaction signing. These services secure private keys used to approve transactions and provide multi-signature governance.

Outcome: Settlement moves from T+2 banking cycles (two business days) to near-instant capital circulation. An investor receiving payment can reinvest capital in seconds rather than waiting days, compounding returns significantly over the investment period.

How Receivables Get Turned Into Money That Can Be Easily Bought and Sold

The technical work used includes digital tokens on the blockchain using ERC-3475 or Substrate real-world asset modules, protection of documents using SHA-256 codes and IPFS file storage, putting tokens into money pools with private credit storage and big investment funds, keeping the money on company balance sheets neutral through special pool structures, and real-time information about portfolios through organized smart-contract information.

The result is that invoices move from being stuck and not easily sold to being tradable financial products, opening up working capital for companies, banks, and investors without making balance sheet risk bigger.

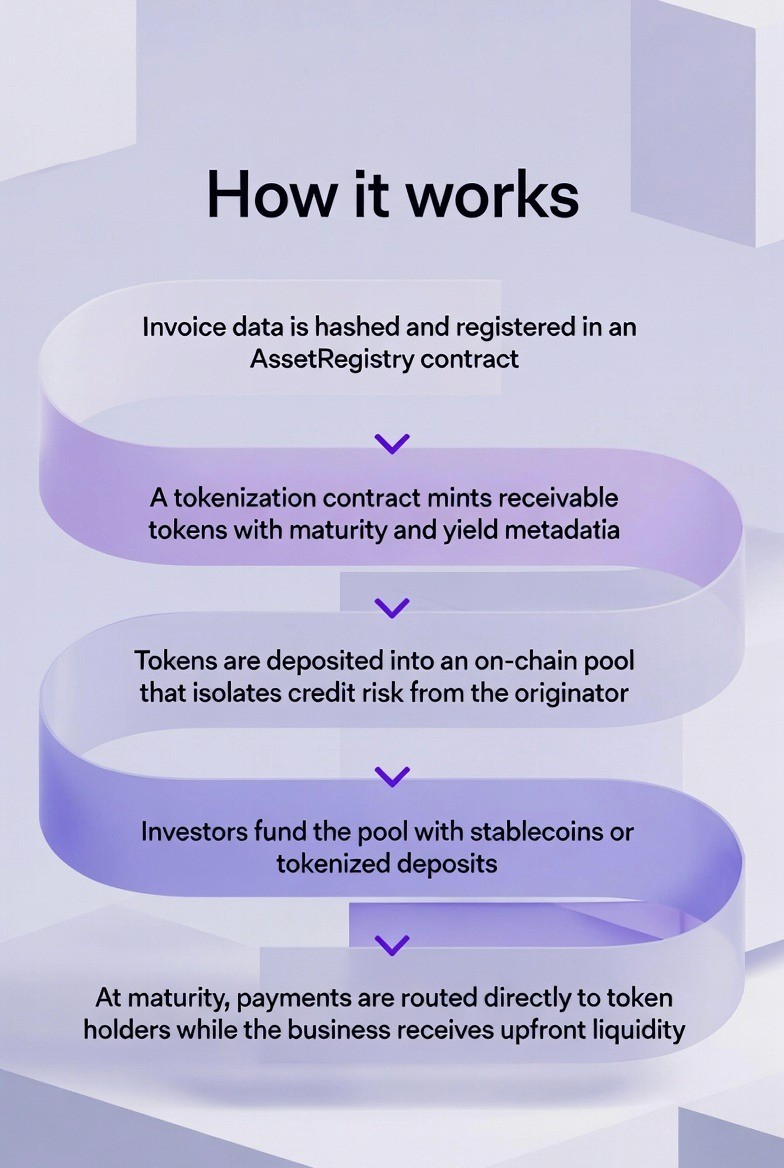

The system works this way:

Invoice information is coded and put into an AssetRegistry contract.

A tokenization contract creates receivable tokens that show when they are due and what they will pay.

Tokens go into a pool on the blockchain that separates credit risk from the company that started it.

Investors put money into the pool using stablecoins or tokenized deposits.

When the token is due, money is sent straight to people who hold tokens while the company gets money right away.

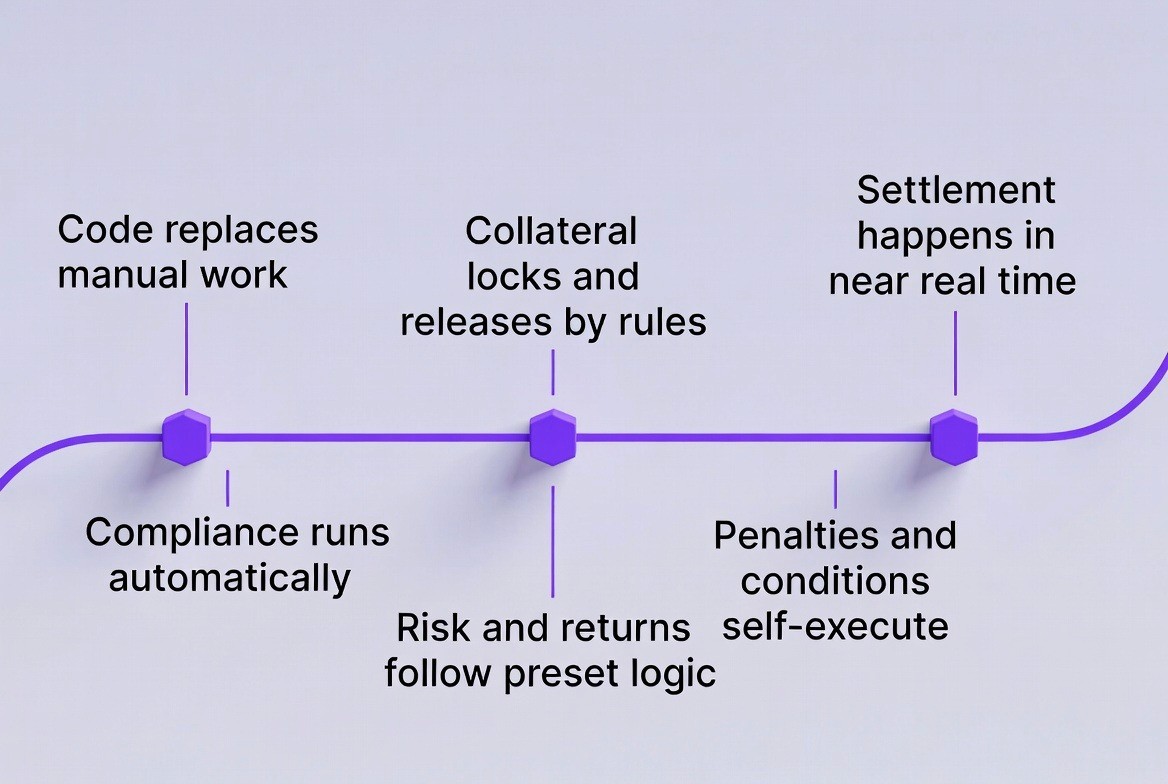

How Smart Contracts Automate Private Credit Markets

The technical foundation used includes automated credit decisions written in Solidity or Rust, following rules using ERC-3643 or Substrate at the system level, programmable risk structures with groups of investors and automatic loss allocation, money movement that is triggered by events using stablecoins and oracle services, and permanent records of all transactions for checking and reporting.

The result is that private-credit markets shift from processes done by people to money systems that run themselves, where credit decisions, following rules, and money movement all run as automatic system jobs.

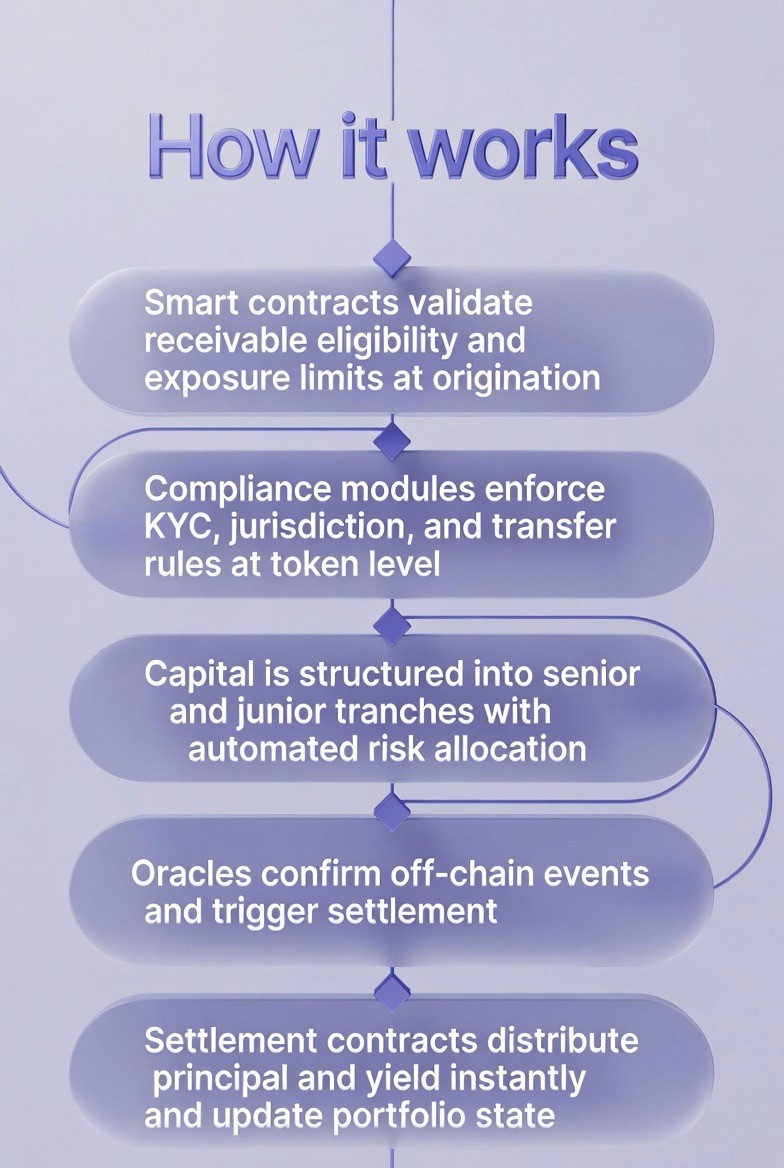

The process works this way:

Smart contracts check if receivables qualify and if exposure is too high at the start.

Following-the-law modules enforce customer checks, country limits, and transfer rules at the token level.

Money is arranged into senior and junior groups with automatic risk allocation.

Oracles confirm real-world events and start the settlement process.

Settlement contracts send money and returns right away and update pool information.

How Tokenization and Minting Process Works

The first step in receivables tokenization is origination. A business creates an invoice and wants to tokenize it. This starts when the business sends documentation to a tokenization platform. The documentation includes the invoice itself, proof of delivery (shipping confirmation, signed receipt, or customs paperwork), the customer's business information and ability to pay, the exact payment terms and due date, and the invoice amount.

Step 2: The platform's team that checks applications reviews this documentation very carefully. They confirm that the delivery actually happened, that the customer is real and can pay, and that the terms are clear and can be enforced. This process usually takes 1 to 3 business days, though some platforms can do it within hours for customers they know well.

Step 3: Once confirmed, the platform starts the smart contract process. A smart contract is a program that lives on the blockchain and runs automatically when certain conditions are met. The smart contract for this receivable will have the money amount, the due date, the interest rate or money payment to investors, the wallet of the company that created the invoice, and the wallet of the customer who needs to pay.

Step 4: The platform then creates the token. Creating a token means making a new digital token on the blockchain that represents ownership of the receivable. If the invoice is for 50,000 dollars and is being divided into pieces so multiple investors can buy it, the smart contract might create 5,000 tokens worth 10 dollars each, or 50,000 tokens worth 1 dollar each. The specific amount depends on what the platform wants and who it thinks will invest.

Step 5: Once created, the token gets a unique code on the blockchain; a protected code that connects it forever to the original invoice information. This code works like a digital fingerprint. If anybody tries to change even one letter of the original invoice, the code changes, and the system right away knows something is wrong.

Step 6: The business that created the invoice gets the token in its blockchain wallet. At this point, the business owns the token but has not sold it or gotten money yet. The business can then sell this token on a money pool or exchange, giving it to an investor in return for stable digital money (like USDC or USDT) or regular money through a connected money system.

Smart Contracts: Checking, Following Rules, and Paying Out

Smart contracts are the technical foundation that makes receivables tokenization work at big scale. Without smart contracts, the system would need people to check, approve, and pay out at every step, bringing back the delays and costs that tokenization is supposed to get rid of.

A smart contract for a tokenized receivable can do many layers of functions and controls.

1. Customer Checks and Following Rules Layer

Before an investor can buy a tokenized receivable, the smart contract checks that the investor passed customer identity and money laundering checks. The investor completes these checks away from the blockchain through the platform's staff. Once approved, the investor gets a digital proof that the smart contract recognizes. If an investor tries to send their token to another party who did not pass these checks, the smart contract stops it automatically. The system just will not do it. This removes the need for people who check compliance to review each trade, cutting compliance costs by 50 to 80 percent.

2. Collateral Lock and Release Control

If a tokenized receivable is being used as protection for a loan, the smart contract automatically locks or releases it based on how the loan is being paid. If someone pays their loan on time, they might be able to use the protection again. If they miss a payment, the smart contract automatically takes back the protection without needing court action or people to do it. This changes collateral management from people at multiple law firms doing it manually to automatic computer code.

3. Late Payment Penalty Application

A smart contract can automatically add extra fees if the customer does not pay by the due date. On the due date of the invoice, the smart contract checks if payment was received. If not, it automatically increases the amount owed by the agreed-upon extra fee (usually 1 to 2 percent per month). These penalties happen automatically, without needing the company that sent the invoice to chase the customer. The penalties give money to run the platform and encourage people to pay on time.

4. Proof That Items Were Delivered Checking

Some platforms connect with tracking systems, shipping information, or customs offices. A smart contract can automatically start the money process only after it confirms that items were actually delivered. This stops fraud and makes sure that money obligations are connected to real, checked activity instead of just signed papers that might be fake.

5. Automatic Money Routing and Settlement

When the invoice is due and payment is received, the smart contract automatically sends money to people who hold tokens. Because computer code does this instead of people in accounting, it happens instantly. Traditional settlement takes 2 business days. Blockchain settlement can happen in seconds. For an investor who holds tokens worth 100,000 dollars, getting their money in seconds instead of 2 days means they can immediately invest it again and make more money. Over a year, this difference adds up a lot.

6. Group-Based Money Return and Loss Allocation

In bigger pools of receivables, smart contracts can automatically split returns and losses between different groups of investors. Senior group holders might get promised 5 percent returns per year and get their money back first. Junior group holders might get promised 15 percent returns but need to accept losses first. The smart contract enforces these rules automatically, making sure that if 2 percent of receivables in a pool do not get paid, the junior group covers it, while senior holders are safe. This lets the pool serve safe investment companies (who want senior groups) and investors who want bigger returns (who want junior groups) at the same time.

7. Governance and Multiple People Approving Actions

Actions that matter like creating new tokens, changing how much the platform costs, or approving big payments need approval from more than one person. A smart contract can need approvals from 3 out of 5 designated people before doing these actions. If one person's security key is stolen, the attacker still cannot approve changes by themselves. This system of spreading approval makes the system more secure than traditional systems where one person controls everything.

8. Days Sales Outstanding: The Real Money Impact

Days sales outstanding measures the average number of days between sending an invoice and getting cash payment. For most businesses, DSO directly sets how much working capital they need. A company with 30,000 dollars in unpaid invoices and 200,000 dollars in yearly money has a DSO of 55 days. This means the company must pay for 55 days of running on its own while waiting for customers to pay.

Receivables tokenization makes this timeline much shorter. In actual real-world setups, a business can tokenize an invoice the same day it sends it and get money within hours. This is happening right now, not someday in the future. Platforms like Centrifuge, Defactor, and Maple Finance are actively doing this with real invoices.

The money impact is huge. Say a company has a DSO of 60 days and cuts it down to 2 days through tokenization. This is like getting a 58-day free loan. For a company with 10 million dollars in yearly unpaid invoices, cutting DSO by 58 days frees up roughly 1.6 million dollars in working capital. This money can then be used to buy more products to sell, hire more workers, or spend on building new products.

Table: How Much Working Capital Gets Freed Up by Size of Company

Company Yearly Money | Normal DSO | DSO After Tokenization | Working Capital That Gets Freed |

5 million dollars | 50 days | 3 days | 589,000 dollars |

10 million dollars | 60 days | 2 days | 1,640,000 dollars |

25 million dollars | 55 days | 3 days | 3,726,000 dollars |

50 million dollars | 65 days | 2 days | 8,767,000 dollars |

For a manufacturing company, this freed money can make growth much faster. Instead of waiting 60 days between ordering materials and getting money for finished goods, the company gets money right away. This lets the company take bigger orders, build extra supplies before busy times, and invest in machines that make things faster.

Table of Comparison: Tokenized Receivables versus Traditional Funding Methods

Traditional invoice money getting is expensive and slow. When a company needs money before customers pay their invoices, it usually goes to factoring companies. These middleman companies take a cut of the invoice value—usually 2 to 5 percent; and charge money or fees on top for the financing. For a 50,000 dollar invoice with 60-day payment terms, a factoring company might charge:

Factoring fee: 2.5 percent equals 1,250 dollars

Interest cost: 3 percent per year times 60 days divided by 365 equals 0.49 percent equals 245 dollars

Total cost to get money: 1,495 dollars

Total cost per year as percentage: 29.9 percent

Banks charge better rates but have strict rules, long approval processes, and minimum sizes for loans. A small business might not even qualify for bank financing, especially if it is new or works in a risky business.

Receivables tokenization makes these costs much lower. A platform that tokenizes an invoice and connects it to a money pool run by computer code has much lower costs to run. There are no loan workers, no long approval committees, and no office buildings to keep up. The platform's main costs are computer technology and following rules. This lets platforms charge much less.

A tokenized invoice of 50,000 dollars through a computer code pool might cost:

Platform fee: 0.5 percent equals 250 dollars

Investor return: 10 percent per year times 60 days divided by 365 equals 1.64 percent equals 820 dollars

Total cost to get money: 1,070 dollars

Total cost per year as percentage: 21.4 percent

This is still a big cost, but it is much less than traditional factoring. For a business that uses 500,000 dollars in receivables every year, the difference between 29.9 percent and 21.4 percent costs 4,250 dollars per year. For bigger businesses with millions in receivables, the savings are even bigger.

Also, the business is not locked into one factoring company. If one platform raises its costs or reduces available money, the business can go to another platform or connect straight to computer-based money pools. This competition pushes costs down over time.

Table: Costs of Different Funding Methods

Funding Method | Fee for Starting | Total Cost Per Year | Speed | Monthly Cost for 500K |

Bank Credit Line | 1 to 2 percent | 8 to 12 percent | 3 to 6 weeks | 333 to 500 dollars |

Invoice Factoring | 2 to 5 percent | 25 to 40 percent | 3 to 5 days | 1,042 to 1,667 dollars |

Trade Finance Banks | 2 to 4 percent | 12 to 18 percent | 2 to 4 weeks | 500 to 750 dollars |

Tokenized Receivables | 0.5 to 1 percent | 10 to 15 percent | Hours | 417 to 625 dollars |

The speed advantage is also very important. When a business gets a big unexpected order from a customer, it needs materials right away. If the business has to wait 3 to 6 weeks for bank approval or 3 to 5 days for a factoring company, it misses the chance. Tokenized receivables can get money within hours, letting the business take time-sensitive orders without waiting.

The Technical Guide and How Receivables Tokenization Works

For business leaders and investors to know if tokenization will work for them, it is important to understand the technical foundation. While you do not need to be a computer programmer, understanding the technology builds confidence in the system.

1. Choosing Which Blockchain to Use

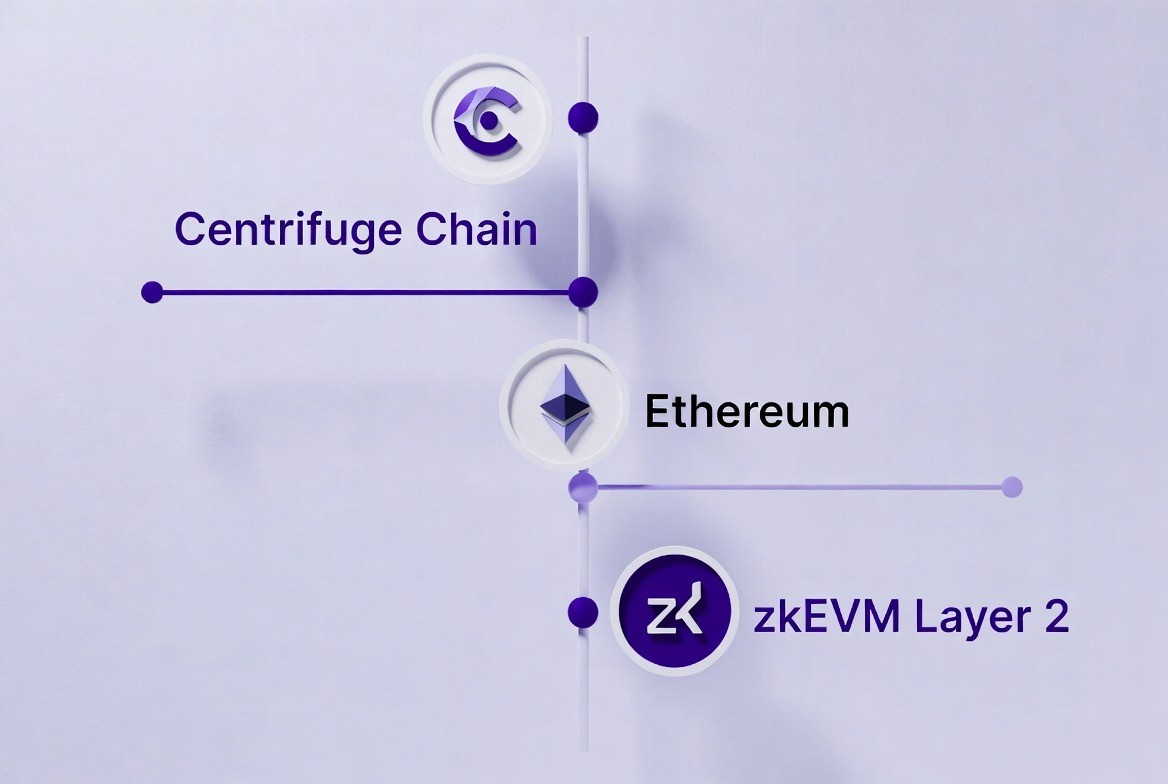

The first technical choice is which blockchain network to use. Three main choices exist: Centrifuge Chain, Ethereum (and chains like Ethereum), or zkEVM Layer 2 options.

Centrifuge Chain is a blockchain built only for real-world asset tokenization. It is written in Rust, a programming language known for being secure and fast, using the Substrate framework, which is also used by Polkadot and other big chains. Centrifuge Chain is the oldest and most specialized system for receivables tokenization. It has handled billions of dollars in tokenized assets. The good part is that it was built only for this use case, so every part; called pallets, is set up for managing pools, investor groups, workers costs, and payments. The bad part is that Centrifuge is less known to mainstream investors than Ethereum, and connecting to Ethereum's huge system of decentralized programs needs an extra step called a bridge.

Ethereum is the biggest and most developed blockchain for money programs. Ethereum uses Solidity, a programming language built only for smart contracts. Ethereum has the most official clarity, the most big institution adoption, and the deepest money pools. Most big institutions and platforms are building on Ethereum. The good part is big institution trust and system maturity. The bad part is that Ethereum's transaction costs can be high when the network is very busy, and speed is slower than some other choices.

zkEVM Layer 2 options like Polygon zkEVM or ConsenSys zkEVM offer a middle ground. These are blockchain networks that settle to Ethereum for security but process deals much faster and cheaper. They use zero-knowledge proofs, which is advanced mathematics that confirms deals are real without showing all deal details. The good part is speed, cost, and Ethereum-equal security. The bad part is it is more complicated and newer.

For big institution receivables tokenization, Centrifuge Chain and Ethereum remain the top choices as of early 2026. Ethereum dominates because almost all big asset tokenization platforms (Ondo Finance, Maple Finance, and many others) use Ethereum or Ethereum-like chains.

2. Smart Contract Rules and Computer Programming

Once a blockchain is chosen, the next technical choice is which smart contract rule to use. Several rules exist, each for different reasons.

ERC-20 is the oldest and simplest token rule. It shows how to create a fungible token—tokens where each unit is the same as every other unit. ERC-20 tokens can be moved, approved, and destroyed. ERC-20 works for simple receivable pools where all tokens represent equal claims on the same type of pool of assets. However, ERC-20 does not built-in support for complicated features like due dates, interest rates, or payback terms.

ERC-3475 is a newer rule built only for bonds and structured money. ERC-3475 lets a single smart contract represent many types of bonds (called classes), many release times (called nonces), and information for each bond. This makes ERC-3475 better for receivables tokenization because receivables naturally have due dates, interest rates, and payback terms. ERC-3475 built-in supports all of these features.

ERC-3643, also called T-REX (Transfer Restriction Execution), is a rule that puts following-the-law and transfer limits onto tokens. ERC-3643 lets tokens enforce country limits, investor permission rules, and transfer holds. This rule is essential for regulated offerings where securities rules require that tokens not be transferred to people who are not approved.

A typical setup uses ERC-3475 as the base token rule for the receivables themselves, combined with ERC-3643 following-the-law features for investors. This combination makes sure that the token built-in supports the money features receivables need, while making sure that rule requirements are enforced by computer code.

Smart Contract Implementation Guide

Building a receivables tokenization smart contract requires implementation of multiple interconnected modules. The following section provides detailed technical specifications.

Asset Registry Smart Contract Structure

The AssetRegistry contract maintains persistent storage of receivable metadata. It implements the following data structures:

text

mapping(uint256 => Receivable) receivables;

mapping(address => uint256[]) originatorReceivals;

mapping(address => uint256[]) debtorReceivals;

struct Receivable {

uint256 receivableId;

uint256 invoiceAmount;

address originator;

address debtor;

uint256 maturityDate;

uint256 discountRate;

bytes32 documentHash;

uint8 status;

uint256 amountPaid;

uint256 createdAt;

}

The contract implements the following functions:

createReceivable(): Accepts invoice parameters, validates inputs, computes the SHA-256 hash of provided documentation, stores the receivable in the mapping, and emits a ReceivableCreated event containing receivable ID, amount, maturity date, and document hash.

getReceivable(): Retrieves all metadata for a specified receivable ID. Returns the complete struct including all status information, payment history, and cryptographic proof.

verifyDocumentHash(): Takes a document and receivable ID, recomputes the SHA-256 hash, and compares against stored hash. Returns boolean true if hashes match, false if document has been tampered with.

updateRecevableStatus(): Changes receivable status (created, funded, partially paid, fully paid, defaulted) with timestamp recording. Only callable by authorized settlement contracts.

Risk Engine Smart Contract Logic

The RiskEngine contract implements deterministic credit decisions through exposure calculations and limit enforcement:

text

mapping(address => uint256) debtorExposure;

mapping(bytes32 => uint256) sectorExposure;

uint256 maxDebtorExposure = 5000000; // 5 million dollar limit

uint256 maxPoolUtilization = 80;

function checkEligibility(uint256 receivableId) public view returns (bool) {

Receivable memory rec = receivables[receivableId];

// Exposure limit check

require(

debtorExposure[rec.debtor] + rec.invoiceAmount <= maxDebtorExposure,

"Debtor exposure exceeded"

);

// Utilization check

require(

(totalPoolAssets + rec.invoiceAmount) / totalPoolCapacity <= maxPoolUtilization / 100,

"Pool utilization exceeded"

);

// Concentration check

uint256 concentration = rec.invoiceAmount * 100 / totalPoolAssets;

require(concentration <= 10, "Concentration limit exceeded");

return true;

}

This function executes deterministic checks at origination ensuring all receivables meet minimum credit standards before entering the pool. Each check is independently verifiable on-chain.

Tranche Management Smart Contract

The tranche contract manages senior and junior investor pools with automated waterfall logic:

text

struct Tranche {

uint256 targetReturn;

uint256 riskLevel;

uint256 reserveBalance;

uint256 investorCount;

mapping(address => uint256) investorBalances;

}

Tranche seniorTranche;

Tranche juniorTranche;

function distributeLosses(uint256 lossAmount) internal {

if (juniorTranche.reserveBalance >= lossAmount) {

juniorTranche.reserveBalance -= lossAmount;

} else {

uint256 juniorLoss = juniorTranche.reserveBalance;

uint256 seniorLoss = lossAmount - juniorLoss;

juniorTranche.reserveBalance = 0;

seniorTranche.reserveBalance -= seniorLoss;

}

}

function distributeReturns(uint256 returnAmount) internal {

uint256 seniorReturn = (seniorTranche.reserveBalance * seniorTranche.targetReturn) / 100;

uint256 juniorReturn = returnAmount - seniorReturn;

seniorTranche.reserveBalance += seniorReturn;

juniorTranche.reserveBalance += juniorReturn;

}

This automatically ensures senior tranches receive promised returns before junior tranches receive excess returns, and losses hit junior tranches first.

3. Off-Blockchain Systems and Connections

While smart contracts execute on-chain, the complete receivables tokenization system requires sophisticated off-chain infrastructure for document management, data indexing, oracle integration, and custody management.

Document Storage and Verification System

Document Storage Architecture: Original invoices are stored on IPFS (InterPlanetary File System) using content-addressed storage. Each document is assigned a unique content hash (typically IPFS hash Qm...). The IPFS address is stored off-chain in a database, while only the SHA-256 cryptographic hash is stored on-chain in the AssetRegistry contract.

Technical Implementation: Documents are uploaded to IPFS nodes through an API gateway. The system computes SHA-256(document_content) and stores this 32-byte hash on-chain. To verify authenticity, the system retrieves the document from IPFS, recomputes SHA-256, and compares against on-chain hash. Match indicates document integrity.

Document Chain of Custody: Every document access is logged with timestamp, accessor identity, and access type (read, verify, modify attempt). This creates an immutable audit trail. Access control rules restrict document modification after initial upload—the system only permits reading and verification, not alteration.

Document Formats Supported: Invoices in PDF format, XML structured data, and EDI (Electronic Data Interchange) formats are supported. Each format has standardized parsing logic that normalizes documents before hashing to ensure consistent hash generation regardless of formatting variations.

Indexing and Event Tracking System Using The Graph

Event Emission Architecture: Smart contracts emit structured event logs at critical lifecycle stages:

ReceivableMinted: Triggered when new receivable token is created, contains receivableId, invoiceAmount, maturityDate, originatorAddress

FundingCompleted: Triggered when pool has accumulated sufficient capital to fund receivables, contains poolId, fundedAmount, numberOfReceivables

PaymentReceived: Triggered when invoice payment is detected and processed, contains receivableId, paymentAmount, timestamp

SettlementExecuted: Triggered when funds are distributed to investors, contains receivableId, seniorAmount, juniorAmount, fees

The Graph Subgraph: A subgraph subscribes to these events and indexes them in queryable format. The subgraph defines entities for Receivables, Pools, Investors, and Transactions. Historical data is stored in a GraphQL database allowing complex queries.

Key Metrics Calculated: DSO compression metrics track reduction in days sales outstanding by comparing historical DSO against current tokenized DSO. Default-rate analytics aggregate default events by debtor sector, time period, and pool. Investor IRR dashboards calculate internal rate of return for each investor considering capital invested, returns received, and timing.

Query Examples:

"What is the total default rate across all semiconductor company receivables?"

"Calculate weighted average time-to-funding for received receivables by month"

"What is investor X's cumulative realized return including reinvested interest?"

Oracle Integration for Payment Confirmation

Oracle Network Architecture: Oracle services like Chainlink or API3 act as trusted intermediaries connecting off-chain payment information to on-chain smart contracts. Multiple independent oracle nodes verify off-chain events and submit cryptographically signed attestations to smart contracts.

Payment Rail Integration: Oracles monitor:

Bank payment rails through connections to banking APIs that push payment notifications when funds are received

Stablecoin transfer monitoring by watching for token transfers to designated wallet addresses on blockchain

Logistics and delivery APIs through connections to shipping company systems that confirm item delivery

Oracle Workflow for Payment Confirmation:

Oracle detects payment event (money arrives in escrow account, stablecoin transfer detected, or delivery confirmed)

Oracle verifies event against multiple data sources for confirmation

Oracle node signs attestation with private key: sign(paymentConfirmation)

Multiple oracle nodes independently verify and submit attestations (threshold 3 of 5 oracles must agree)

Smart contract receives attestation, validates signatures, verifies threshold met

Smart contract triggers settleReceivable(receivableId) function

Oracle Payment Validation Logic:

text

function settleReceivable(uint256 receivableId, bytes[] calldata oracleSignatures) public {

// Verify threshold signatures

require(verifyMultipleSignatures(oracleSignatures, 3), "Insufficient signatures");

// Execute settlement

Receivable storage rec = receivables[receivableId];

require(rec.status == Status.FUNDED, "Invalid status");

// Distribute to tranches and update state

distributeFunds(receivableId);

rec.status = Status.SETTLED;

emit SettlementExecuted(receivableId);

}

Late Payment Penalty Trigger: Oracles also trigger penalty logic when invoice maturity date passes without payment. An oracle calls applyLatePenalty(receivableId) which increases amount owed by percentage specified in receivable terms (typically 1-2 percent per month).

Custody and Key Management

Institutional Custody Solutions: Fireblocks, Copper, or Anchorage provide enterprise-grade custody solutions for managing private keys that control on-chain assets.

Multi-Signature Governance: The platform operator's wallet is a multi-signature wallet requiring 3 out of 5 authorized signers to approve any transaction. Private keys are held by different individuals across geographic locations, preventing any single point of compromise.

Key Management Workflow:

Initial setup: 5 keyholders each generate private keys using hardware security modules (HSMs)

Each keyholder submits public key to custody provider

Custody provider creates multi-sig wallet requiring 3 of 5 signatures

Transaction approval: Any transaction requires 3 authorized signers to sign separately

Custody provider broadcasts signed transaction to blockchain only after threshold met

Hot/Cold Storage Separation: Active transaction funds are held in hot wallets connected to the internet for quick settlement. Long-term reserves are held in cold storage (air-gapped systems) for security. Large transfers between hot and cold require multi-sig approval.

4. Safety and Checking Requirements

Any smart contract that handles money assets must go through strict safety testing. The minimum rules are formal code review by the developing team to check for logic mistakes, edge cases, and safety problems; automatic safety testing using tools like Slither (which checks for known safety issues in Solidity code); testing with random information to find unexpected behavior; safety review by a trusted blockchain safety company (which costs 10,000 to 50,000 dollars for a complete review, but is essential for big institution deployments); and protection or guarantee fund to repay users if a safety problem happens.

How TokenMinds Helps with Receivables Tokenization

TokenMinds helps banks, fintech platforms, and enterprises move from concept to production in receivables tokenization. We design and implement institutional-grade systems that combine smart-contract architecture, compliance-by-design frameworks, and deep integration with ERP, treasury, and payment infrastructure.

Our focus is on measurable operational impact. By aligning blockchain technology with real financial workflows, TokenMinds enables organizations to transform receivables into scalable liquidity engines that reduce funding friction and improve capital efficiency across modern financial markets.

Conclusion

Receivables tokenization is becoming core financial infrastructure. By turning invoices into programmable, on-chain assets, companies unlock faster cash flow, investors gain access to transparent yield backed by real economic activity, and the financial system removes long-standing friction in how capital moves. As adoption accelerates across enterprises, banks, and asset managers, those who act early will capture the greatest advantage in efficiency, liquidity, and market position over the next decade.

Schedule a complimentary consultation with TokenMinds to explore how your organization can start using receivables tokenization today to unlock working capital, attract new investors, and build a future-ready financing strategy.

FAQ

What is receivables tokenization in simple terms?

Receivables tokenization turns unpaid invoices into digital assets on a blockchain. Instead of waiting 30 to 90 days to get paid, a business can sell that invoice as a token and receive cash within hours, while investors earn returns when the invoice is eventually paid.

How is tokenized receivables different from traditional invoice factoring?

Factoring relies on banks or finance companies that charge high fees and take days or weeks to approve funding. Tokenization replaces these middlemen with automated platforms and smart contracts, cutting costs, speeding up access to cash, and opening funding to a global pool of investors instead of a single lender.

Why are investors interested in tokenized receivables?

Because they offer predictable returns backed by real business activity, not speculation. Investors earn yields from actual invoices issued by real companies, typically in the 9–12 percent range, while benefiting from transparent risk rules and automated settlement built into the blockchain system.

How does blockchain make receivables safer and more trustworthy?

Every invoice is protected with cryptographic hashes, digital signatures, and immutable records. Once a receivable is tokenized, it cannot be altered or duplicated without detection. Smart contracts automatically enforce payment rules, prevent double financing, and create a permanent audit trail for regulators and investors.

What role do banks and financial institutions play in this model?

Banks move from being manual processors to infrastructure partners. They provide custody, compliance oversight, and payment rails while blockchain platforms handle automation, transparency, and settlement, allowing banks to serve more clients with lower operational cost.

Why is receivables tokenization seen as a long-term financial shift?

Because it changes invoices from static accounting entries into liquid financial instruments. Over time, this transforms how working capital moves through the economy, making liquidity faster, cheaper, and more accessible for businesses, investors, and financial institutions alike.