TL’DR

How to build crypto narratives that connect tokenomics with real user behavior rather than short-term hype, aligning vision, utility, community, liquidity, and value accrual into a single coherent growth narrative that supports sustainable adoption and long-term value.

Technology is just one of many factors for success within the Crypto space. It does not matter how elegant the smart contract is, how fast the blockchain is, or how innovative the DeFi protocol is if you cannot clearly communicate a compelling story regarding what makes this project important enough to care about.

The sad truth is that most crypto projects will fail due to poor narratives rather than poor technology. Poor narratives are often the result of overpromising and underperforming (resulting in massive hype cycles that end in spectacular collapses) or poor narratives where they undersell their innovation in such a way that no one understands or cares about their solution.

Two examples of the same type of technology are a good example to demonstrate the power of narrative. One crypto project has captured the hearts of developers, attracted tens of billions in liquidity, created an army of community members who spread the word without having to be asked; the other launched with great fanfare, experienced a short lived "pump", and became another forgotten relic as the opportunistic traders moved on to the next new "hot" thing.

So what was the key factor to distinguish these two projects? The answer is narrative; but we are not referring to shallow, superficial marketing speak. A strong, consistent narrative that ties your vision to tangible value proposition, creates real community around the project, provides true market accessibility, and generates transparent and measurable economic value, a connection ultimately reinforced by how tokenomics are designed to sustain buying pressure after launch.

Crypto Narrative Failure Analysis

Before we dive into how to build effective narratives, let's understand why most fail. The crypto graveyard is filled with projects that had compelling whitepapers but couldn't translate technical innovation into sustainable adoption.

Narrative Failure Early-Warning System

Set red flag thresholds to catch narrative breakdown before collapse.

Pillar | Warning Signal | Red Flag Threshold |

Vision | Narrative not spreading | <30% community content uses core messaging |

Utility | Incentive dependency | DAU/MAU <15% after rewards end |

Tribe | Artificial engagement | >70% paid vs organic impressions |

Tribe | No grassroots activity | <2 community initiatives/month |

Liquidity | High trading friction | >2% slippage on $50k trades |

Value Accrual | Weak holder conviction | <20% supply held ≥90 days |

Alert System

🟢 GREEN: All metrics healthy

🟡 YELLOW: 1-2 red flags → Fix within 2 weeks

🔴 RED: 3+ red flags → Emergency narrative audit needed

All of these failure signals are connected by a common theme; they treat narrative as an afterthought in terms of marketing rather than a core strategy. Thus the solution is to create the narrative in a systematic manner so that each part of the narrative supports the other parts, an approach commonly developed through deliberate thought leadership efforts.

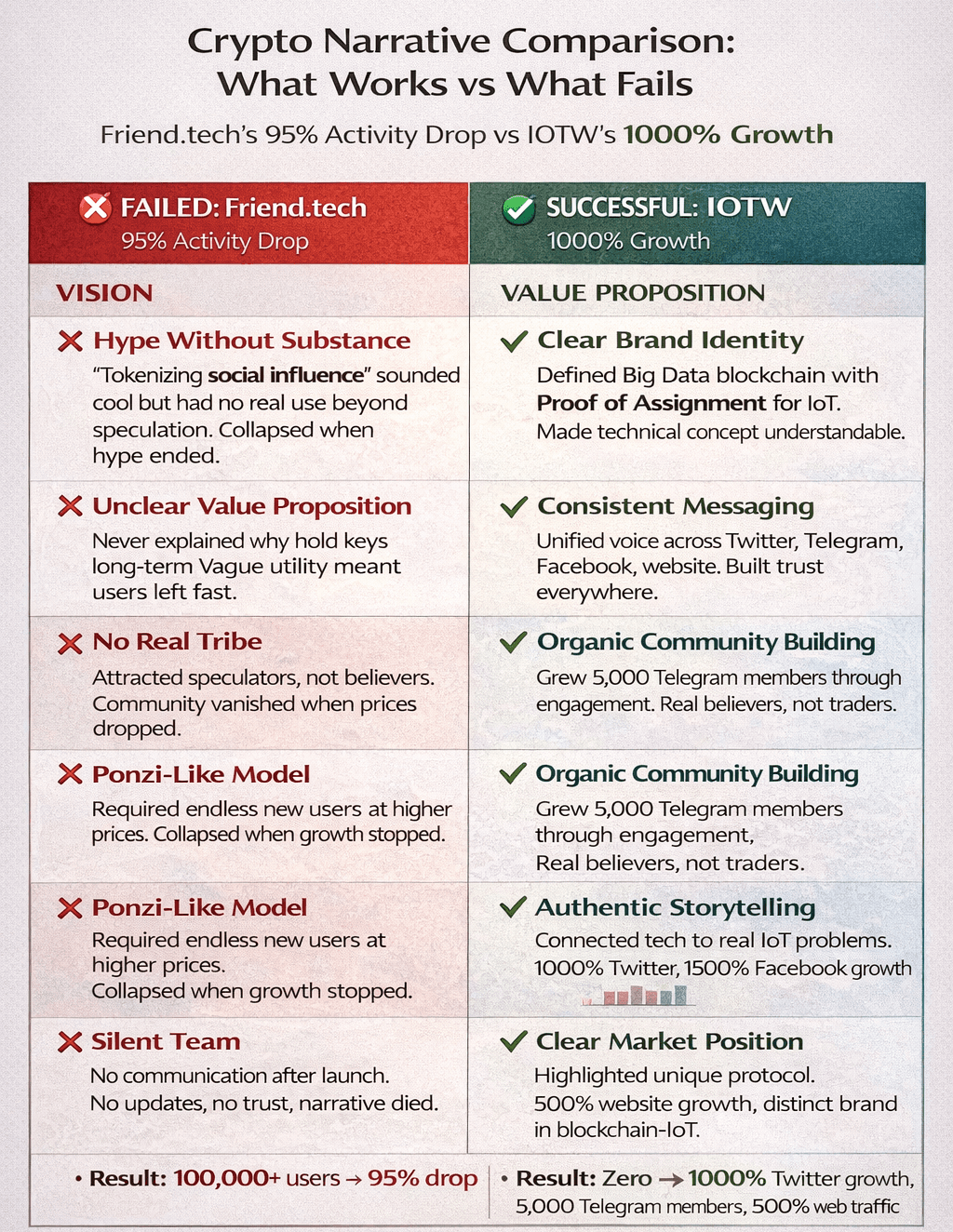

Failed Crypto Narratives Case Trudy: Friends.tech

A perfect example is Friend.tech, it generated incredible hype for “monetizing your social network” by attracting 100,000+ users via an invite-only strategy and influencer seeding; once all the new users realized there was no real sustainability to the service after the speculative frenzy ended, user activity dropped over 95%.

1. Just Hype

The idea of “tokenizing social influence” was very cool to talk about; but it didn’t really have much of a practical use case other than flipping keys to make money on hype. When you stop being active — the narrative collapses.

2. What's My Value?

Never really defined how holding onto your keys over time would be beneficial. Vagueness around value caused most users to leave as soon as the hype started to fade.

3. Where Is My Tribe?

Friend attracted people looking to speculate rather than people who believed in the cause. Because there was no shared purpose — what constituted a community — disappeared when prices dropped.

4. Built For Growth (Not Sustainability)

Needed an endless amount of new users coming in to buy at higher prices. When growth ended, so did Friend. It was built for expansion and never thought about sustainable growth.

5. Communication Black Hole

Silence from the team post-launch. No communications or updates. Trust = Gone; Narrative = Dead.

Successful Crypto Narratives Case Study: IOTW (Blockchain & IoT)

TokenMinds created a strong narrative for IOTW, that grew it from a non-existent community to an active blockchain community through its branding strategy and community building initiatives. Unlike Uniswap’s liquidity-first narrative, IOTW led with Tribe → Utility → delayed Liquidity, resulting in higher retention

The results were an incredible 1000% growth in Twitter followers, 5,000 organic telegram members, and 500% growth in visitors to their website.

1. Defining a Strong Brand Identity

A strong brand identity is necessary to create a compelling narrative. This includes defining a clear mission statement (i.e., Big Data Blockchain) and developing a consistent message that connects to the brand's core mission (i.e., "Proof of Assignment" for IoT). Developing a strong brand identity transforms an abstract technology into something tangible and understandable by which people can understand how you will deliver value.

2. Delivering a Unified Message

Consistency builds credibility and recognition across all touch points, from social media platforms to your web site. IOW, delivered the same message through the various social media platforms including but limited to, Twitter, Telegram, Facebook, etc.

3. Growing an Organically Built Community

Growing an organic community requires creating relevant and engaging content that resonates with your target audience. In order to build an engaged community, focus on providing valuable information to your audience rather than using paid advertising channels. IOW, focused on creating and publishing content that was targeted toward our audience and provided them with opportunities to engage with us through social media platforms such as Twitter, Telegram and Facebook. We grew our Telegram user base to over 5,000 users, comprised of true believers who were actively engaging with our brand.

4. Using Emotional Storytelling

The use of emotional storytelling creates an opportunity to connect the technical solution to the problems that exist within the IoT industry. When we used emotional storytelling, we created an emotional connection with our audience. This connection resulted in 1000% growth on Twitter and 1500% growth on Facebook.

5. Clearly Positioning Your Brand

Clearly position your brand against your competition. Highlight what makes your brand unique and why consumers should choose your brand. By clearly differentiating ourselves, we created a clear position for our brand within the blockchain-IoT space. This position helped to attract the correct audience and as a result, increased our web site traffic by 500%.

Table of Comparison: Friends.tech vs IOTW

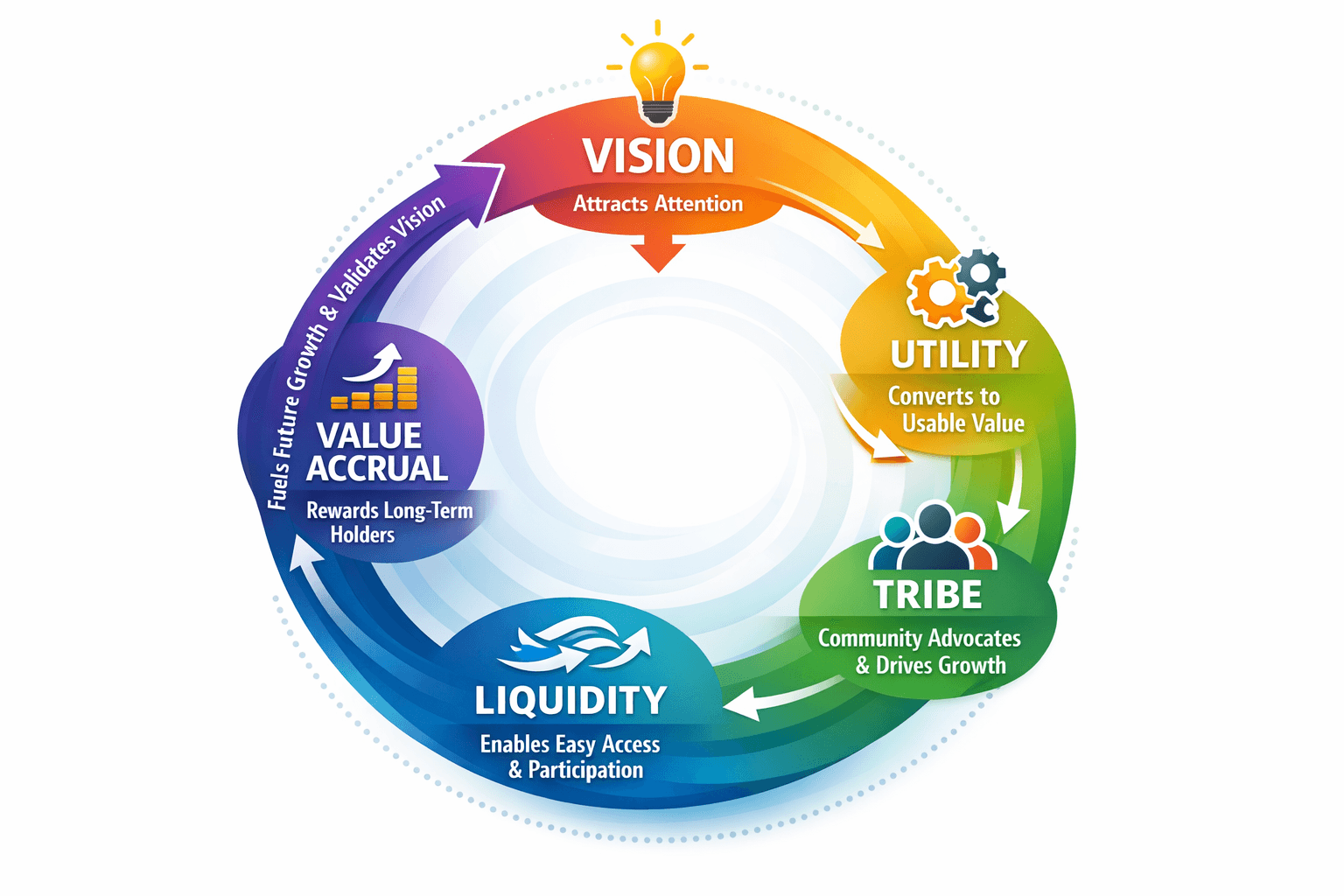

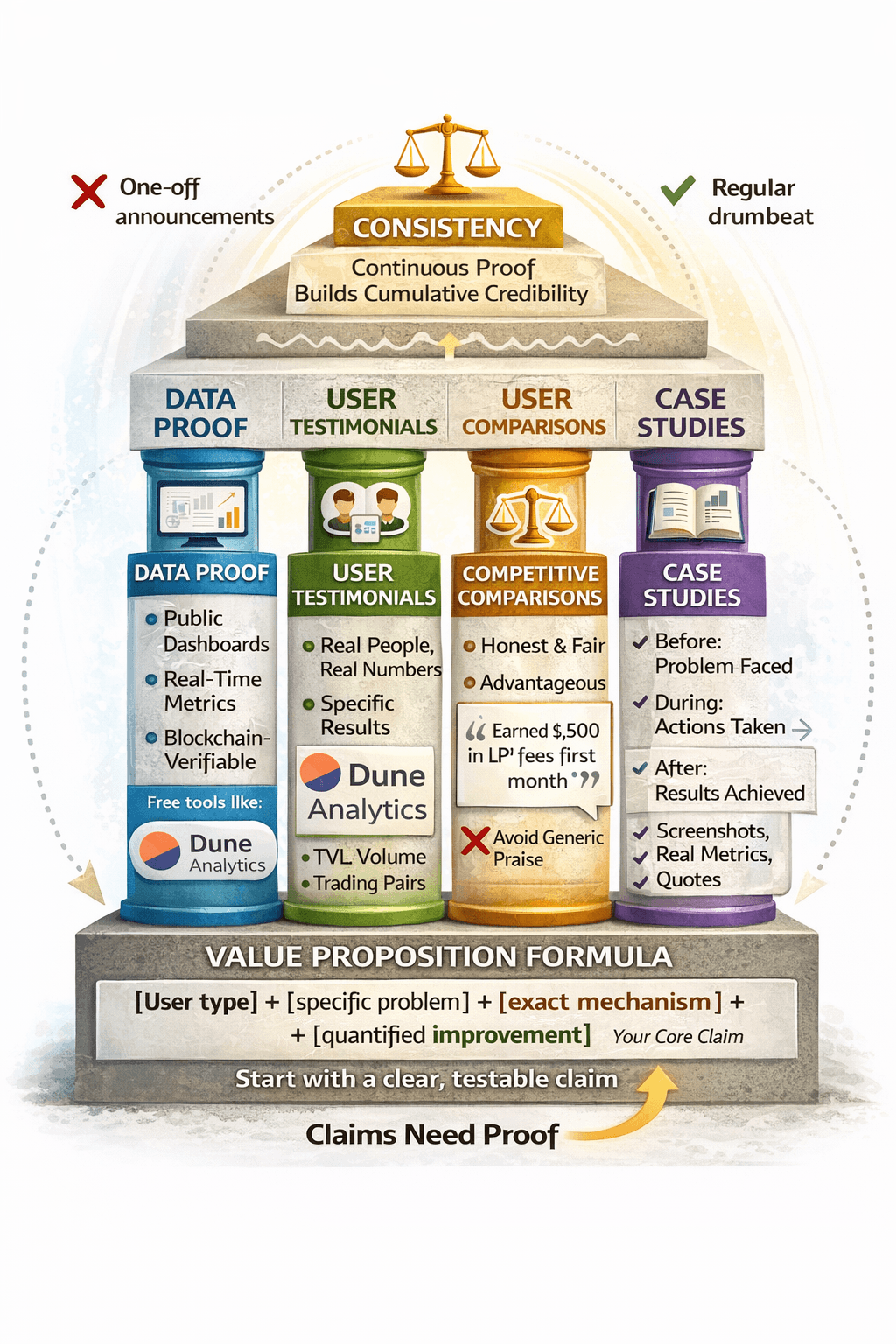

TokenMinds 5 Narrative Pillars: A Framework for Complete Narratives

Effective crypto narratives are composed of five interconnected Pillars (the “Pillars”) developed and improved upon by TokenMinds through years of experience working directly with Web3 protocols, launching tokens and developing ecosystem growth strategies, an approach refined through hands-on Web3 marketing execution.

TokenMinds implements narratives through three reusable execution playbooks. Each Pillar references one or more of these playbooks rather than reinventing distribution mechanics every time.

Playbook 1: Daily Narrative Reinforcement Loop

Purpose: Maintain visibility, coherence, and cultural alignment

Cadence: Daily → Weekly

Channels:

Twitter/X (daily signals, threads, community replies)

Discord (discussion, AMAs, pinned updates)

Telegram (announcements, short-form updates)

Playbook 2: Quarterly Trust-Building Loop

Purpose: Convert usage into credibility and long-term trust

Cadence: Monthly → Quarterly

Channels:

Dashboards (Dune, website analytics)

Medium / Mirror / Substack (deep dives)

Governance forums & reports

Investor & community updates

Playbook 3: Bear Market Communication Mode

Purpose: Preserve trust during volatility or underperformance

Cadence: Event-driven

Channels:

Blog posts explaining reality vs expectations

Twitter/X threads addressing hard questions

Discord AMAs focused on metrics, not price

Investor materials emphasizing sustainability

These playbooks are referenced throughout the five Pillars below.

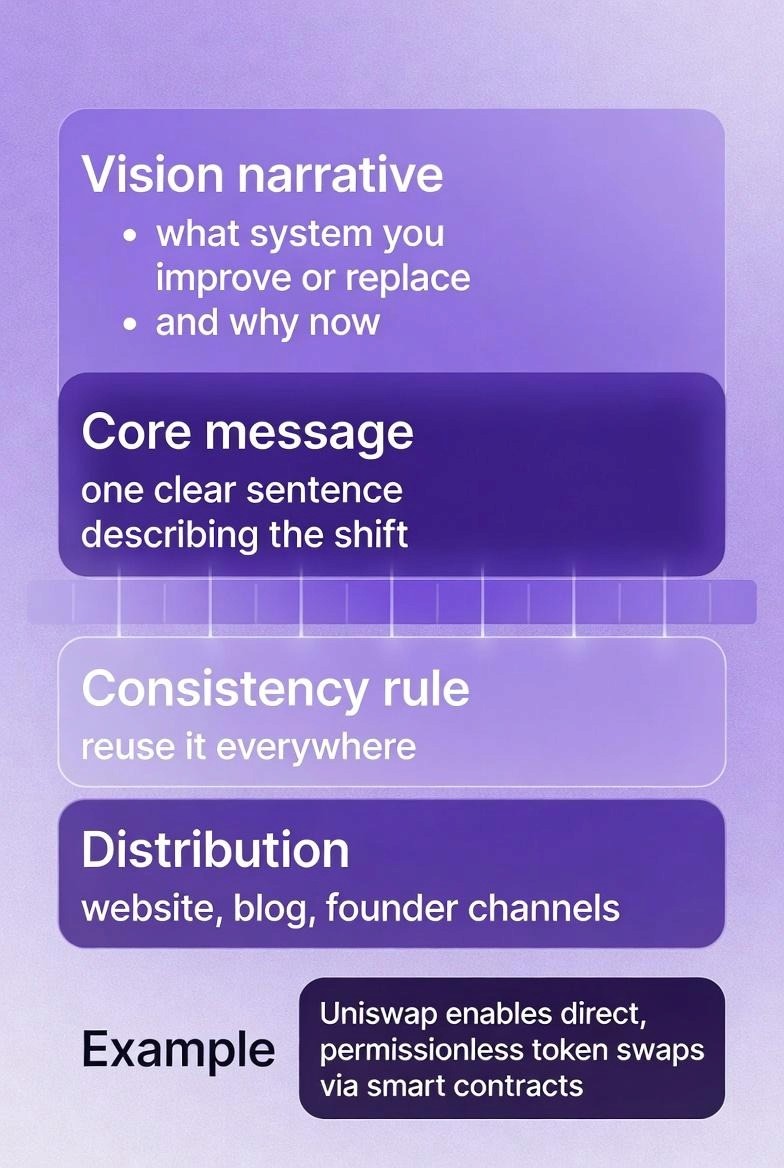

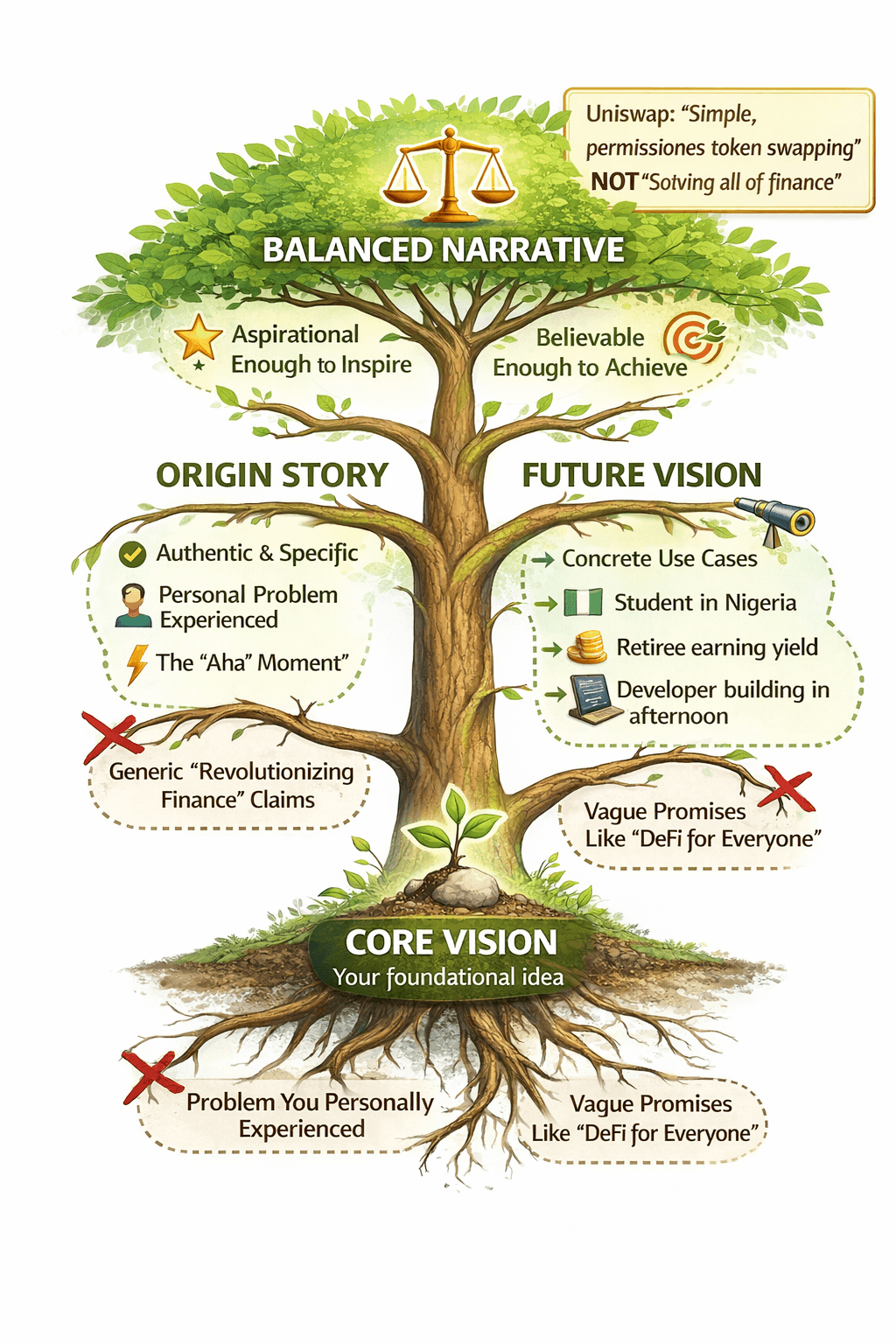

1. Vision Pillar

This is the aspirational story that will capture peoples' imagination and set you apart from all other protocols. In essence this is the "why do we exist?" question that will inspire people to take notice in the first place. Without an inspirational vision, there is no reason for people to be interested in your project or why you should be noticed above thousands of other competing protocols.

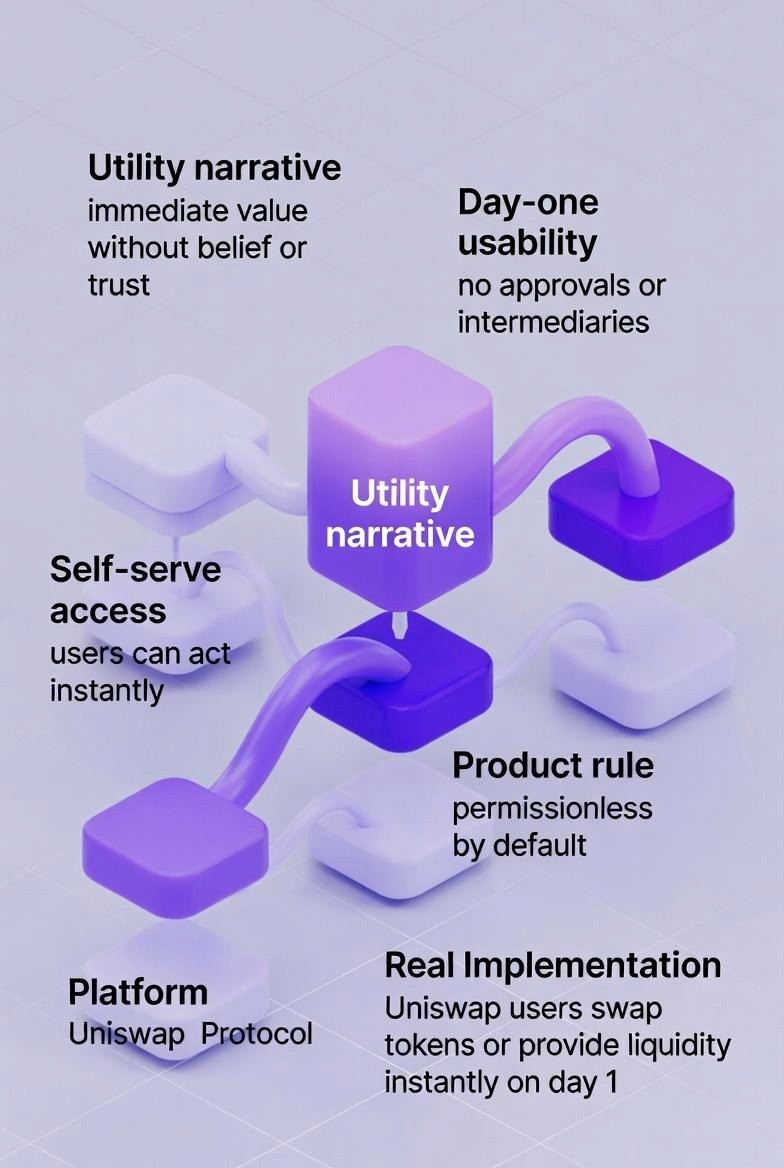

2. Utility Pillar

The utility Pillar is the tangible evidence of the problems you are solving today. The Utility Pillar takes the interest generated by your Vision Pillar and turns it into actual usage of your protocol. If your utility Pillar does not demonstrate a real-world problem being solved, your Vision Pillar will simply be a promise of potential benefits.

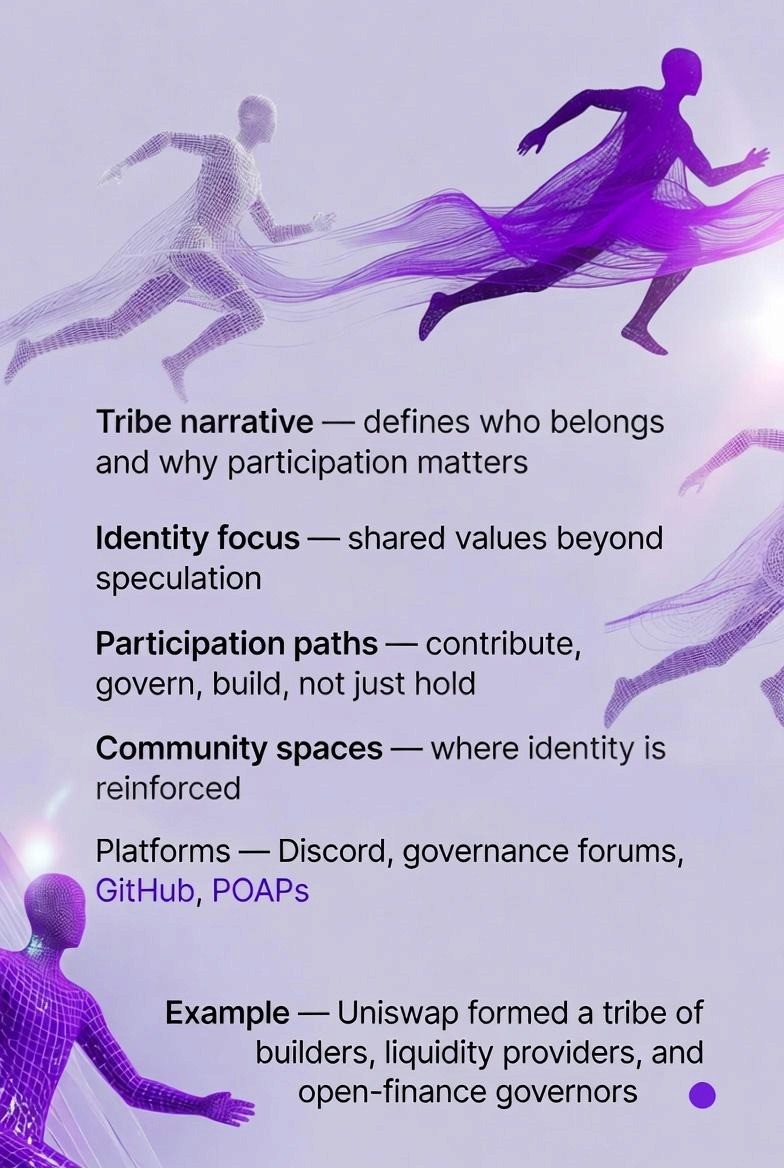

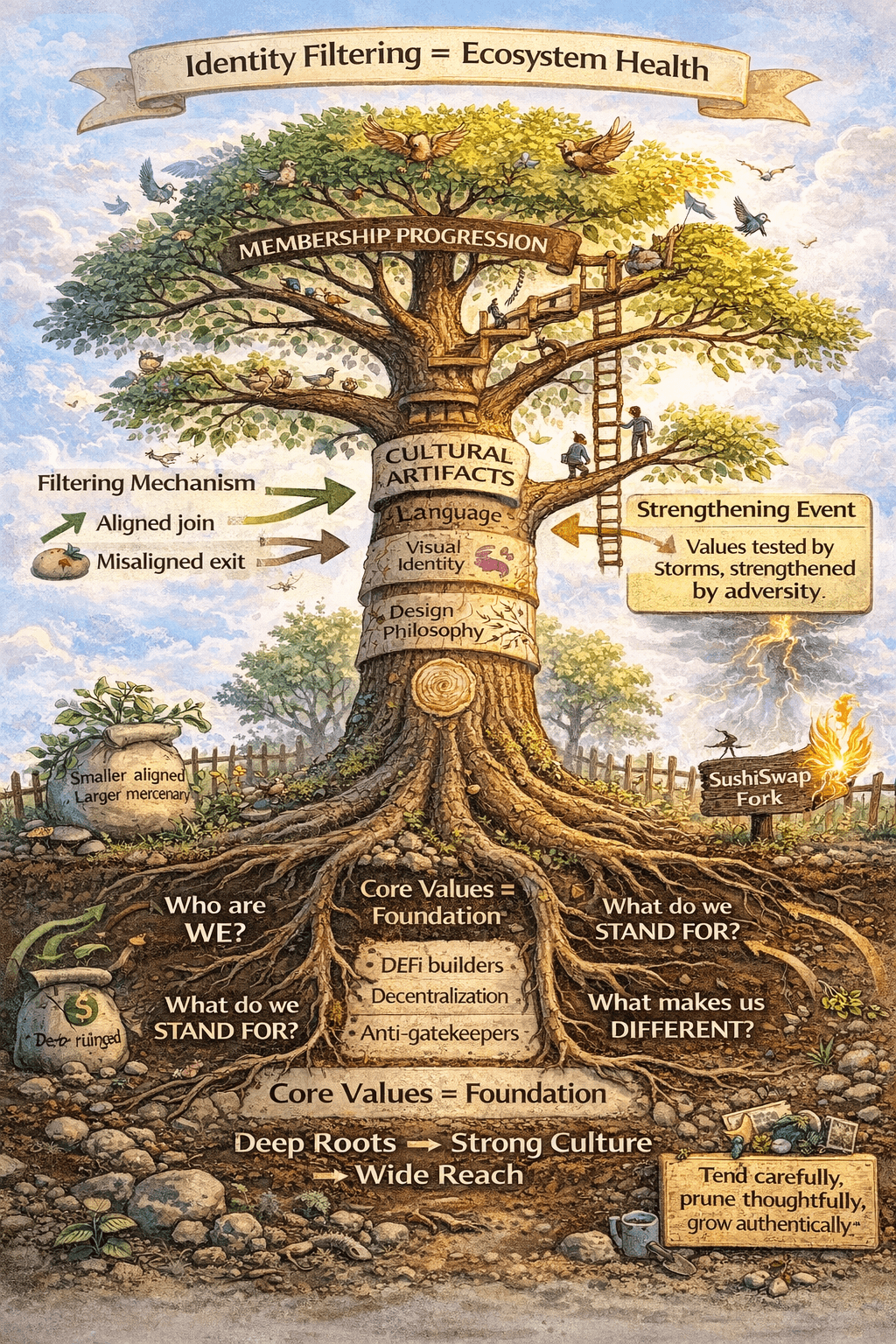

3. Tribe

The Tribe Pillar defines the shared identity and culture of your community of users which will transform them into passionate advocates for your project. The Tribe Pillar will generate organic and sustainable growth for your project through a true community of believers as opposed to paid advertising. While users may use your protocol, they will not become believers unless you have built a Tribe around your Vision Pillar.

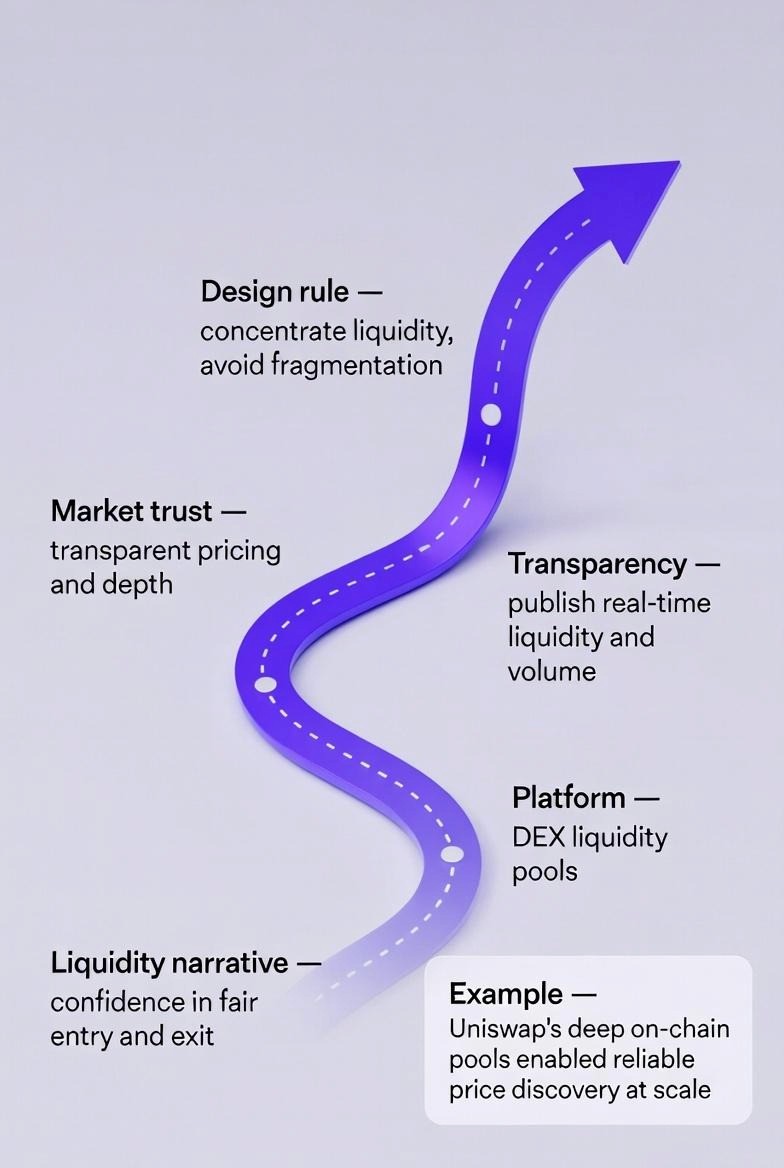

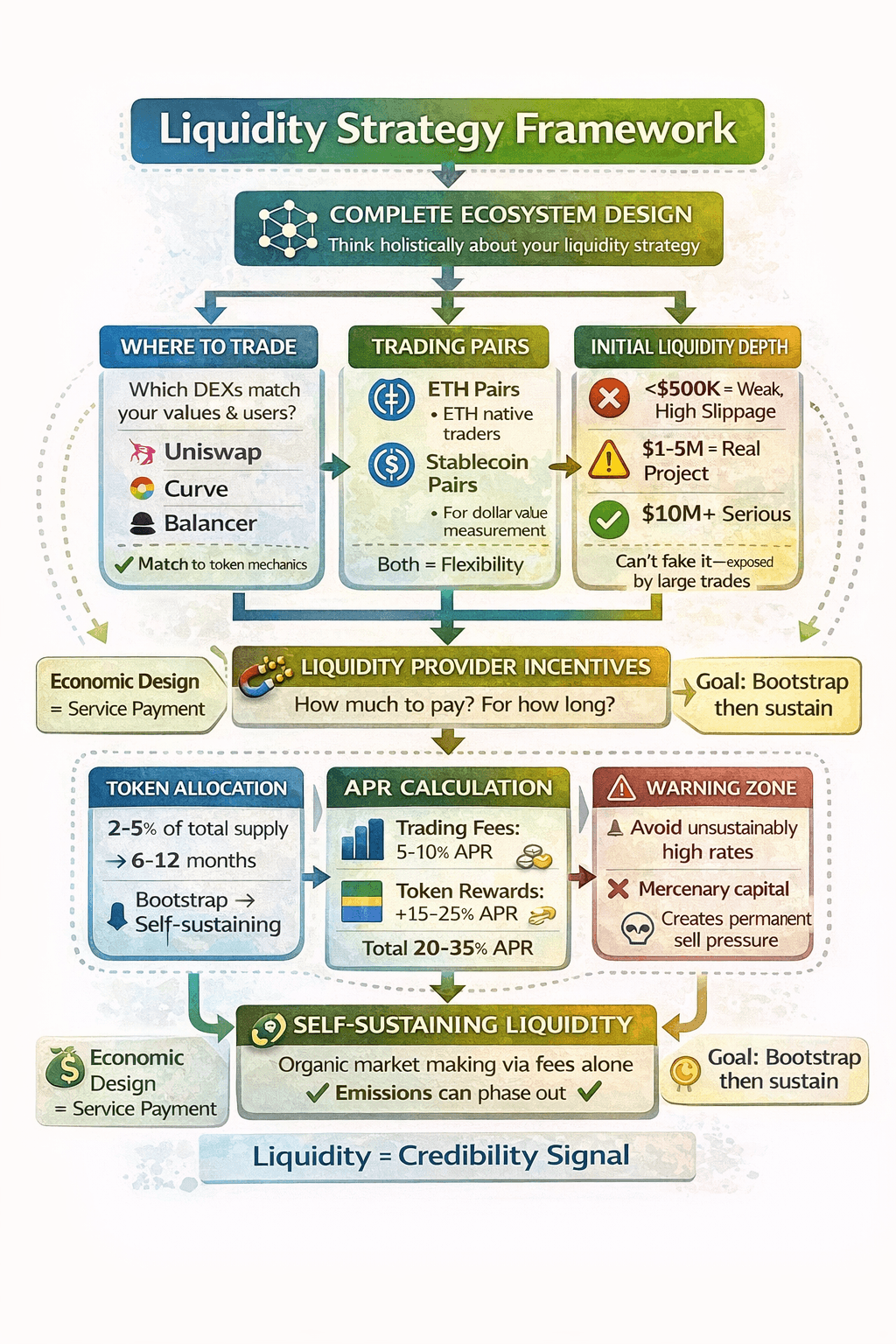

4. Liquidity

The Liquidity Pillar refers to the ability to utilize market access and trading infrastructure in order to facilitate participation in your protocol. By facilitating easy buying, selling and utilization of your token, the Liquidity Pillar reduces friction associated with utilizing your protocol as well as the price volatility inherent with your token.

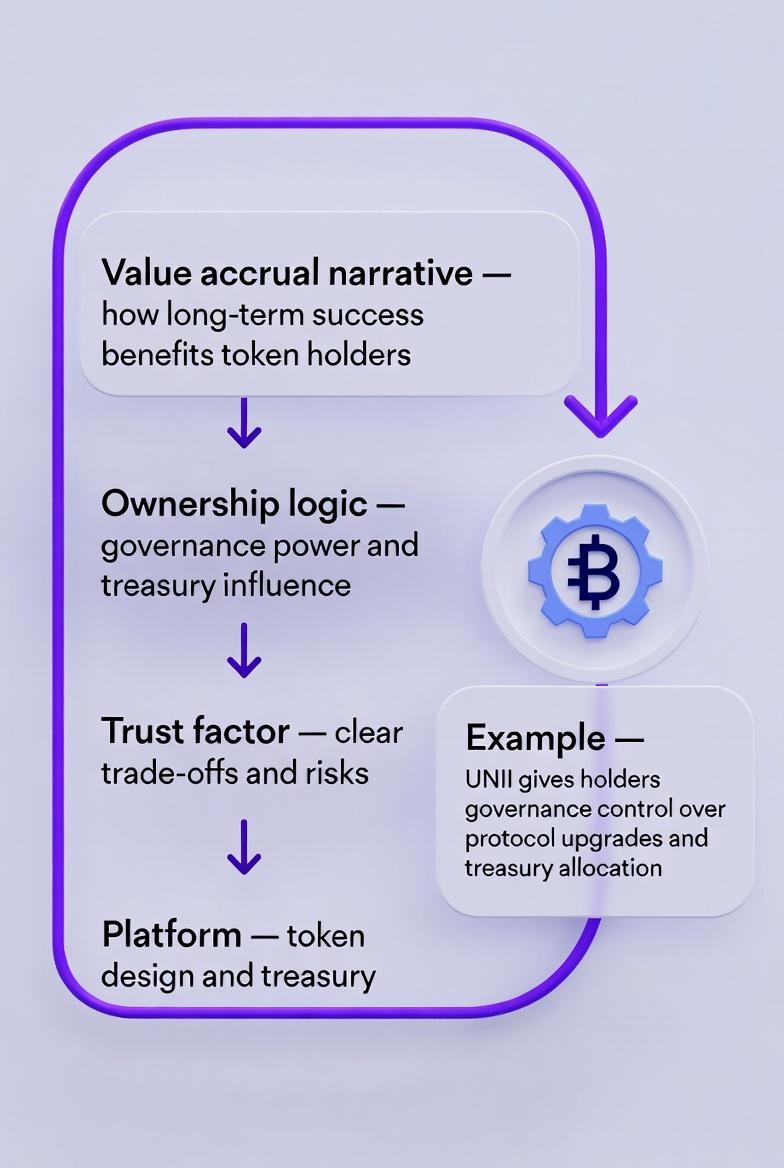

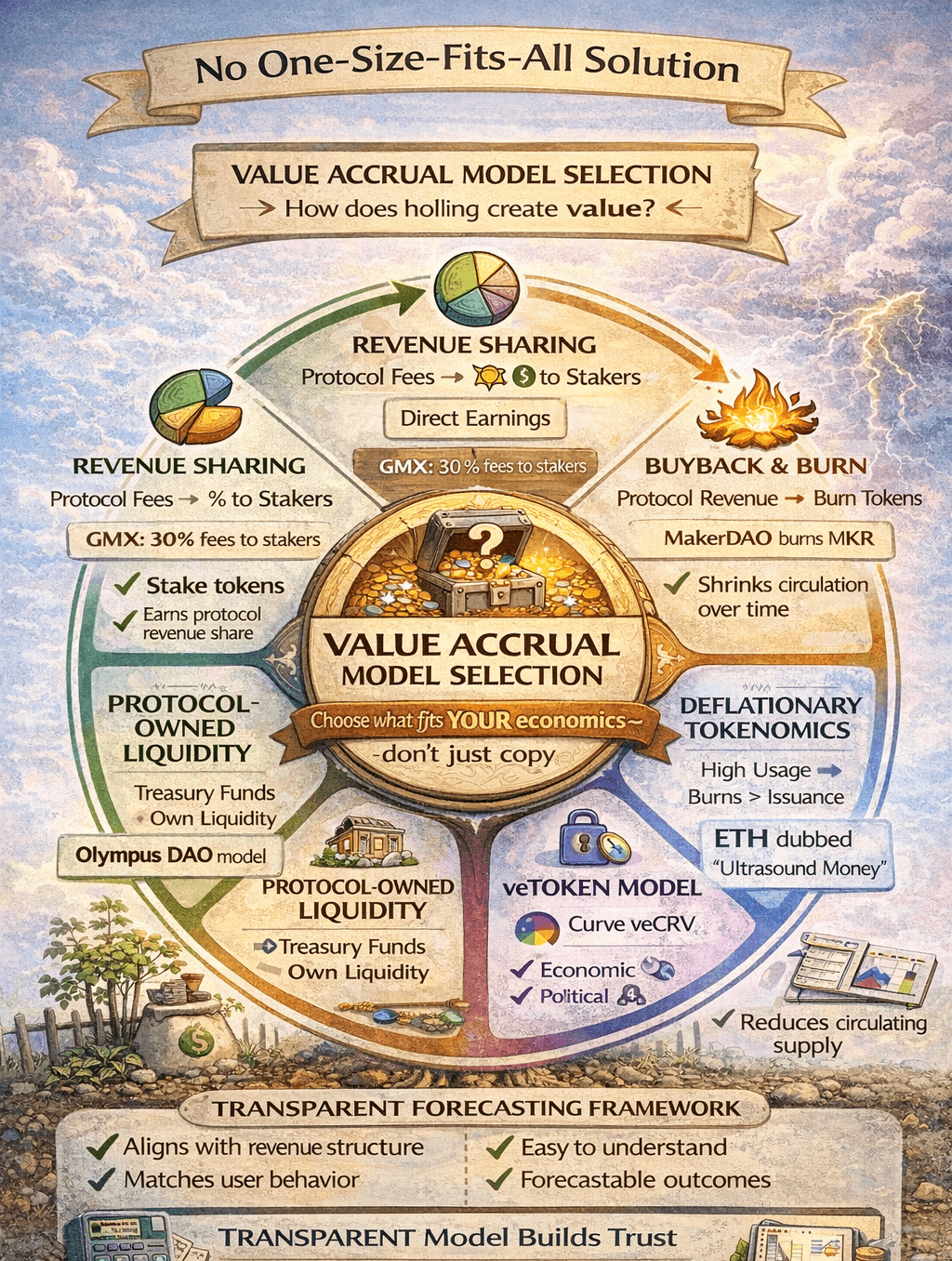

5. Value Accrual

Your Value Accrual Pillar represents an economic model which illustrates the long term reasons for holding your tokens. Your Value Accrual Pillar transforms speculative investors into stakeholders through illustrating how the growth of your protocol will translate into increasing value for your token. If your Value Accrual Pillar is vague, then you will attract short sighted investments from people who will immediately dump their investment when they witness a negative trend.

All five Pillars interact as a flywheel:

Let's walk through how to build each pillar using Uniswap as our case study for real implementation guide.

1. Vision Pillar: Crafting Vision That Inspires

Uniswap has a simple origin story as one of the reasons it has done so well. At the end of 2018 Hayden Adams was fired from his mechanical engineering job, and Hayden's friend Karl Floersch told him to use his free time learning how to build with Ethereum by building something useful. Hayden was looking into decentralized exchanges when he realized the existing ones were both clunky, and most importantly, broken.

The main reason they were broken is that all of the DEXs attempted to put traditional centralized exchange order books on-chain. However, since each block of a public ledger is created every 15-30 seconds, this would have made order matching impossible due to speed and price (gas) issues. Trades were either failing or costing absurd prices in gas fees.

Hayden's insight was elegantly simple: what if you didn't need order books at all? What if liquidity could be automatic? He discovered the concept of automated market makers, where a simple mathematical formula (x*y=k) could price trades based on the ratio of tokens in a pool. Anyone could provide liquidity and earn fees from every trade. No order matching needed. No complicated infrastructure. Just pure algorithmic trading.

There were two main reasons why it was effective for automated token swaps to be available to every user without requiring permission. One reason is there was a real problem (the inability for people to exchange tokens on decentralized exchanges). Two, the solution to this problem (automated liquidity) was both perfectly timed as DeFi began to mature.

You need these same three elements: Describe what's wrong with the current world. Explain what makes your solution possible now. Show why this is the right moment for change.

Uniswap followed this pattern. Initially: "swap any token without permission." As the product matured: "open financial infrastructure for all." The vision evolved as they earned the right to make bolder claims.

Vision Pillar Key Takeaways:

Identify a real problem with the current system

Explain what makes your solution possible now

Show why this is the right moment for change

Start with specific claims and expand as you earn credibility

2. Utility Pillar: Proving Utility With Evidence

Utility translates vision into action by converting attention into users (adoption). Many Crypto Projects have created an exciting vision for the future of their projects but have been unable to provide concrete value at the current moment.

This is where Uniswap has successfully demonstrated its ability to focus on solving very specific, immediate issues for very specific user groups. The Uniswap team did not attempt to solve all problems for all people. The Uniswap team identified discrete market segments and fully understood how they were able to alleviate the specific pain points for each segment.

For Traders: Tokens were largely unlisted on the main exchanges; to get listed was a costly process that took months → Uniswap gave everyone the ability to list any token they wanted instantly for free giving them access to over 10,000 tokens (versus about 50-200 on many other exchanges).

For Liquidity Providers: Assets sat around unused and making no money → Uniswap allowed people to become liquidity providers and earn trading fees on their assets, which turned unused assets into income.

For New Projects: The traditional way was expensive because you had to pay large fees to central exchanges, or use a decentralized exchange (DEX) that nobody used → Uniswap gave new projects the opportunity to launch day one with community-driven liquidity and worldwide exposure with no middlemen.

For Developers: Trading required a great deal of negotiation with each central exchange to integrate their trading platform into your application, and it required a lot of custom development to build the trading functionality → Uniswap made it possible for developers to add token swapping to their applications in just 10 lines of code.

Notice how specific these value propositions are. Uniswap didn't say "better trading experience." They said "swap 1000+ tokens that aren't available on Coinbase." They didn't say "earn passive income." They said "earn 0.3% of every trade in pools where you provide liquidity."

This specificity matters because it gives people concrete reasons to use your product today, not in some hypothetical future. When you're building your utility narrative, force yourself to complete these sentences for each user segment:

Utility Pillar Key Takeaways:

Focus on solving specific, immediate problems for specific user segments

Be concrete and measurable in your value propositions

Answer clearly: "What can users do today?" and "What specific problem does this solve?"

Don't promise future value; demonstrate current utility

3. Tribe Pillar: Building Tribe Through Shared Identity

Products produce users. Tribes create believers. The two are vastly different; as is the case in the Crypto space, much of what will determine whether a project survives and thrives will be based on the ability to garner organic community support and advocacy for that particular product.

Uniswap has become one of the most powerful tribes in DeFi, without the need for an aggressive marketing campaign by way of defining its values in such a manner so as to attract like-minded individuals. Decentralized, permission-less access, open source development and composability are the guiding principles of Uniswap’s decision-making process. They are not just buzzwords; they represent the real values of Uniswap’s decision making processes.

When SushiSwap (a fork of Uniswap) launched a “Vampire Attack” to take the liquidity from Uniswap, the Uniswap team could have used legal means or developed technical measures to counteract the attack. However, the Uniswap team chose to remain silent and allow the community to respond.

In doing so, the Uniswap Team sent a very strong message: we develop open protocols and encourage others to fork our protocol because we believe in permission-less innovation regardless of who uses it against us.

Tribe Pillar Key Takeaways:

Define clear values that guide decision-making, not just buzzwords

Attract like-minded believers who share your principles

Let actions demonstrate values rather than aggressive marketing

Build organic community support through shared identity and purpose

4. Liquidity Pillar: Ensuring Liquidity and Market Access

Even the best product fails if people can't easily buy and use the token. Liquidity and market access matter tremendously, yet many projects treat them as afterthoughts.

Uniswap understood this from day one because liquidity was literally their product. But when it came to the UNI governance token, they applied the same principles they'd proven with the protocol itself. The token needed to be easily accessible, deeply liquid, and available across multiple venues.

Beginning with the Distribution Strategy. A public token sale was utilized instead of a private sale, which would have resulted in a high degree of concentrated ownership, by airdropping 400 UNI tokens to all wallets that had ever been utilized on the platform. As a result of this, an instant community of 250,000+ users were formed who both emotionally invested in the success of the protocol (as they received free tokens), as well as practically participated in governance of the protocol.

However, simply distributing tokens does not generate liquidity. To create liquidity for trading UNI, a targeted liquidity mining program was initiated by Uniswap. Under this initiative, 2 million UNI tokens will be allocated each month to liquidity providers in four key pools: ETH/UNI, ETH/USDT, ETH/USDC and ETH/DAI.

This initiative was designed to serve three objectives: to establish deep liquidity for trading UNI; to reward those individuals or entities that provide such liquidity; and to distribute additional tokens to actively participating stakeholders (i.e., liquidity providers) rather than passively holding tokens.

The results were dramatic. Uniswap reached over $2 billion in total value locked within weeks. The UNI token had deep, liquid markets from day one. Someone wanting to buy $100,000 worth of UNI could do so without moving the price significantly.

Liquidity Pillar Key Takeaways:

Make tokens easily accessible through strategic distribution (e.g., airdrops to users)

Create deep liquidity from day one through targeted incentive programs

Ensure users can buy

/sell without significant price impact

Treat liquidity as essential infrastructure, not an afterthought

5. Value Accrual: Demonstrating Clear Value Accrual

The hardest narrative to get right is often the economic one. How does protocol growth translate to token value? Why should someone hold long-term rather than trading actively? What's the investment thesis beyond "number go up"?

Uniswap spent years wrestling with these questions, which might seem surprising given their success. The protocol generated billions in trading fees. Usage was massive and growing. Yet the UNI token's value proposition remained somewhat unclear.

Initially, UNI was purely a governance token. Holders could vote on protocol upgrades, treasury allocation, and grants. This has value, controlling a $3 billion treasury and governing the most-used DEX in DeFi certainly matters. But governance alone struggles as an economic value proposition because most people don't actively participate in governance, and voting power doesn't directly generate returns.

A 'Fee Switch' was built into the protocol's code which could divert a small portion (0.05%) of transaction fees generated from liquidity provision, to UNI token holders; however, there was significant disagreement over whether to activate it. Liquidity providers were concerned that diverting their fee would result in reduced liquidity. Meanwhile, UNI token holders believed they should receive a direct revenue share for their governance participation, and long-term commitment to the token.

In fact, this is an excellent example of how value sharing mechanism clarity is essential at inception, as opposed to being ambiguous until launched. This ambiguity will create continuous uncertainty, and sell pressure from those that do not believe in the long term value proposition.

Value Accrual Pillar Key Takeaways:

Clearly define how protocol growth translates to token value

Avoid ambiguity in revenue sharing mechanisms—specify them upfront

Give holders concrete economic reasons to hold long-term

Governance alone is weak; connect tokens to actual revenue or utility

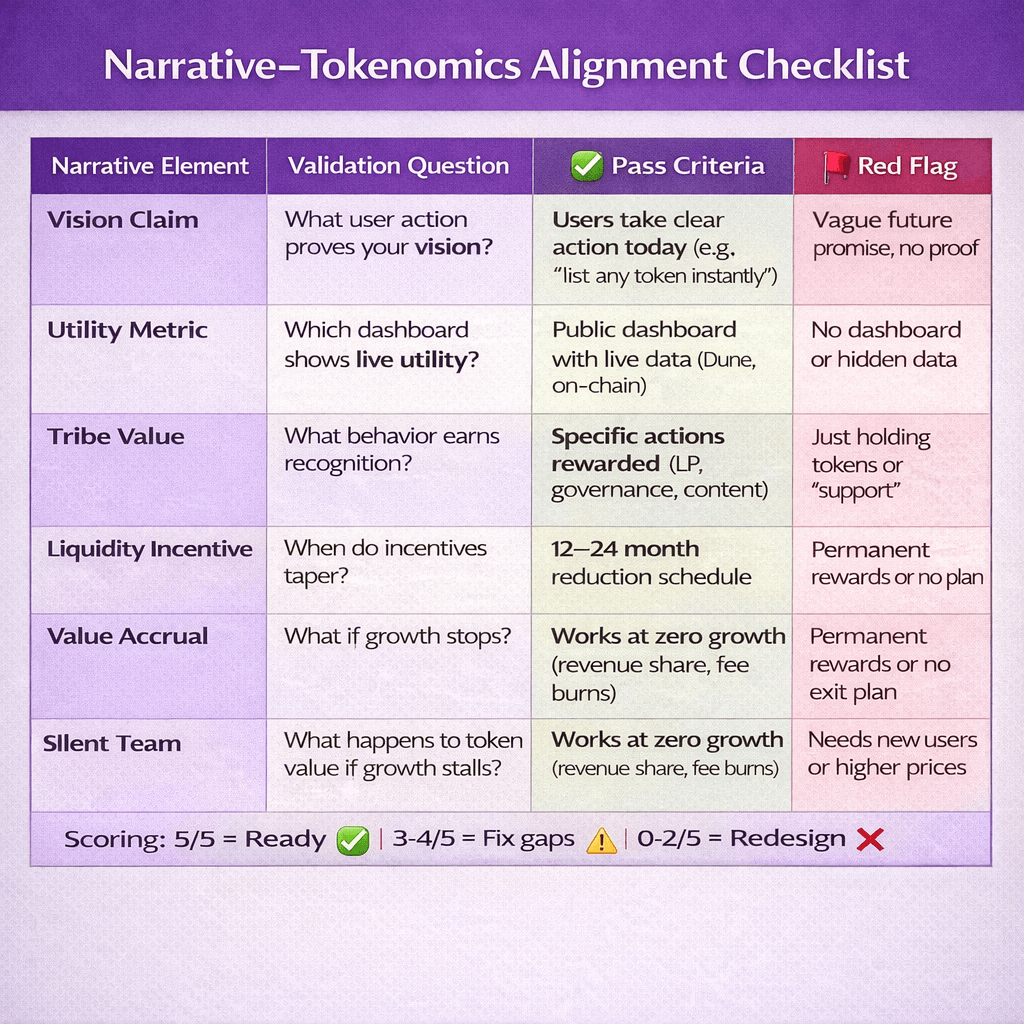

Narrative Tokenomics Alignment Checklist

Purpose: A pre-launch diagnostic tool to audit whether your narrative claims match tokenomic reality. Use this to validate coherence before going public.

How to Use This Checklist

Before Launch:

Fill out each validation question honestly

If you can't answer clearly, your narrative has gaps

Fix misalignments before going public

Example - Good Alignment:

Vision: "Permissionless token trading"

User Action: Anyone lists token in 2 clicks, no approval

Dashboard: Dune shows 5,000+ listed tokens

Result: ✅ Vision matches reality

Example - Bad Alignment:

Vision: "Democratizing finance"

User Action: Unclear what users actually do differently

Dashboard: None exists

Result: ❌ Just marketing speak

Self-Audit Scoring

5/5 Clear Answers: Ready to launch - narrative is coherent 3-4/5 Clear Answers: Fill gaps before major marketing push 0-2/5 Clear Answers: Fundamental misalignment - redesign needed

Pillar-to-Metric Mapping

Purpose: Hard-link each narrative pillar to measurable KPIs for quantifiable tracking.

The KPI Framework

Pillar | Key Metrics | What It Measures |

Vision | • % community content using core narrative language<br>• Social sentiment alignment score<br>• Organic brand mention growth rate | Are people repeating and spreading your story? |

Utility | • DAU/MAU ratio<br>• Repeat action rate (weekly/monthly)<br>• Feature adoption percentage | Are users actively using the product? |

Tribe | • % organic posts vs paid<br>• Community-led initiatives per month<br>• Active contributor count | Is the community self-sustaining? |

Liquidity | • 30-day avg slippage for $50k trade<br>• Bid-ask spread %<br>• Daily trading volume/TVL ratio | Can users easily enter and exit? |

Value Accrual | • % circulating supply held ≥90 days<br>• Revenue distributed to holders<br>• Token burn rate from fees | Does holding make economic sense? |

Track Monthly: Measure all metrics, identify weak pillars Dashboard It: Make metrics public (Dune Analytics) Course Correct: Low scores = narrative-reality gap to fix

This converts narrative theory into data-driven execution, one of the TokenMinds approach.

How TokenMinds Helps with Crypto Narratives Strategy

TokenMinds assists Web3-based projects in converting complicated technical and tokenomic concepts into accessible, believable, user-understandable, and user-trustworthy storytelling narratives.

Our team has extensive experience in assisting with a variety of Web3-based project launches and growth phases (early product-market fit through post TGE scaling), in addition to providing support for Founders, CMOs, and Executive Teams.

Token Minds will establish a clear and concise narrative pillar that ties together Vision, Utility, Community, Liquidity, and Value Accrual to create a cohesive and singular story for your customer to understand not just what you promise to deliver but also how you plan to provide it and share its value.

Conclusion

Crypto narrative building isn't mysterious or magical. It's systematic work across five interconnected pillars, each reinforcing the others to create a flywheel of sustainable growth.

Vision captures attention and differentiates you from thousands of other projects. Utility converts that attention into actual usage by solving real problems. Tribe transforms users into advocates who spread your vision organically. Liquidity ensures easy participation and reduces friction. Value accrual rewards long-term holders who then fund ecosystem growth.

When these five pillars align, you get compound growth. Each new user potentially becomes an advocate. Each advocate brings more users. Growing usage increases revenue. Revenue shared with holders creates more long-term supporters. Supporters fund development and ecosystem expansion. Better products validate the vision and attract more attention. The cycle repeats and accelerates.

Schedule a complimentary consultation with TokenMinds to explore how your project can design and execute crypto narratives that drive real adoption, deep liquidity, and durable long-term token value.

FAQ

Why do most crypto projects fail even with strong technology?

Because they fail to communicate a clear, credible narrative. Overhyped promises, unclear value propositions, and weak economic storytelling cause users and investors to lose trust and leave.

What is a crypto narrative, beyond marketing hype?

A crypto narrative is a coherent story that links vision, real utility, community identity, liquidity access, and clear token value into one consistent strategy that users can understand and believe in.

What are the five pillars of an effective crypto narrative?

Vision (why the project exists), Utility (problems solved today), Tribe (community identity), Liquidity (easy market access), and Value Accrual (why holding the token creates long-term value).

Why is value accrual the hardest pillar to get right?

Because many projects fail to clearly explain how protocol growth benefits token holders. Ambiguity around revenue sharing, governance value, or incentives creates uncertainty and sell pressure.

How does a strong narrative drive long-term token value?

When vision attracts users, utility keeps them active, tribe turns them into advocates, liquidity reduces friction, and value accrual rewards long-term holding, all five pillars reinforce each other into sustainable growth.