TL;DR

How to enable scalable, efficient, low-cost per-loan digital lending using tokenized loans by encoding loan terms as immutable smart contracts that automatically calculate interest, track repayments, detect defaults, and execute collateral on-chain, eliminating manual servicing while reducing operational cost and recovery risk.

Digital lending is a rapidly growing industry with online platforms generating tens of billions of dollars in consumer, business and short-term credit per year. Consumers expect quick approval and immediate transfer of funds; lenders wish to grow their businesses without a corresponding growth in operating expenses.

While traditional digital lending platforms have automated the application process, they are still manually servicing many aspects of the loan lifecycle. Examples include tracking repayments and payment history, processing payments, calculating and recording interest, monitoring delinquencies, and executing collateral recovery. Each loan requires human intervention as a result. Because this labor is directly tied to loan volume, costs will typically rise at a similar pace as the number of new loans serviced grows.

This creates a profitability problem, one that intensifies when future loan cash flows remain illiquid rather than treated as tokenized receivables as outlined on this guide. Small loans and short-term credit products generate low revenue per transaction. If servicing costs remain high, these products become unprofitable. Lenders either reject small borrowers or charge higher interest rates to cover overhead. Both outcomes reduce credit access.

Automation is required to solve this problem. If loan terms execute automatically without human intervention, cost per loan drops significantly. Lenders can serve more borrowers with the same resources. Profitability improves even on small transactions, a benefit that emerges from structuring loans as tokenized assets here. This makes credit accessible to users who were previously excluded.

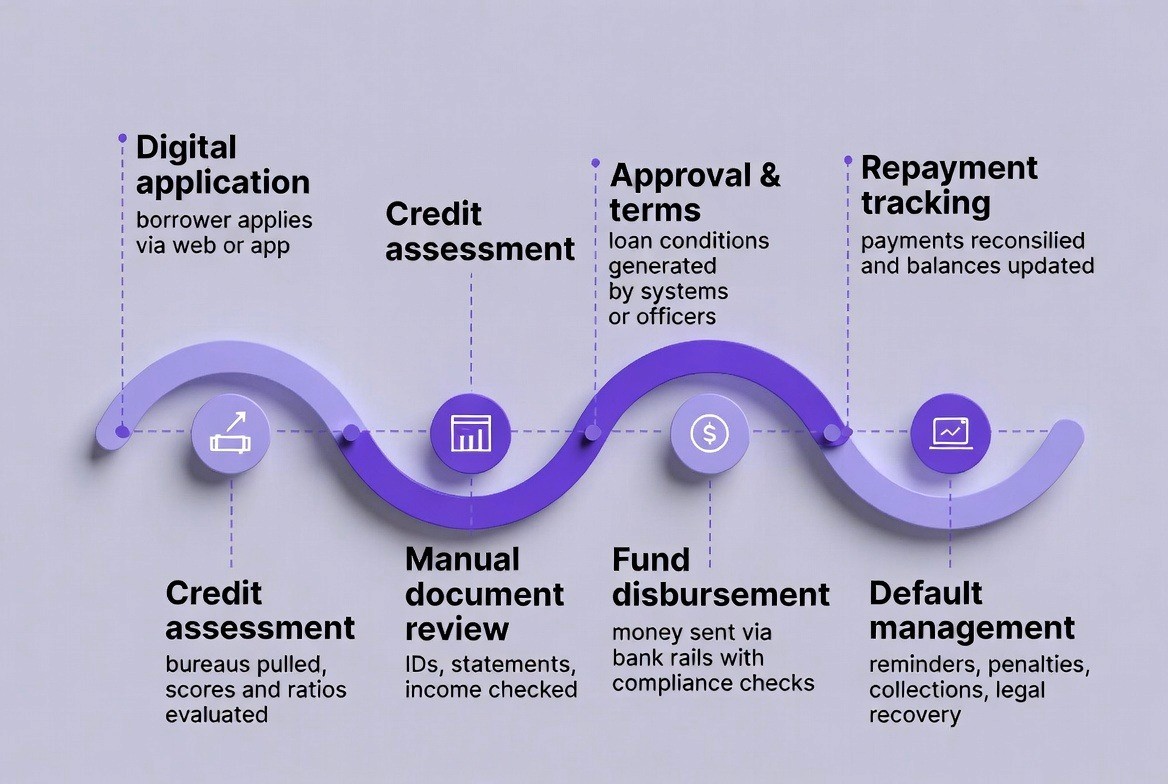

How Traditional Digital Lending Works

Traditional digital lending platforms aim to streamline loan origination through online interfaces and automated decisioning. However, despite digital front ends, the underlying loan lifecycle still depends heavily on manual operations and centralized systems.

1. Application Process: The borrower provides his/her own loan application through a website or mobile app. The applicant will enter their personal contact information and income information; in addition, he/she will enter the loan amount that he/she wants to borrow.

2. Credit Check: After providing his/her loan application, the lender requests the applicant's credit report(s) from one or more of the three major credit reporting agencies. Automated computerized systems (or a credit analyst) reviews the credit score, payment history and debt-to-income ratio of the applicant.

3. Collection of Documents: An applicant will be required to submit some sort of identification document(s) and bank statements and/or proof of income. The documents will then be manually reviewed by an employee of the company or they can use OCR technology to extract the information from the documents.

4. Loan Approval: A loan officer or the automatic underwriting system will determine whether to approve or reject the applicant's loan application based upon the findings of the previous two steps. If the applicant is approved, the automated underwriting system will create the loan terms (principal amount, interest rate, repayment schedule and collateral requirements).

5. Transfer of Funds: Once the applicant has been approved for the loan, the lender will transfer funds directly to the applicant's bank account via integration with the applicable payment rails. Also, in conjunction with the fund transfer, the lender must perform an anti-money laundering check.

6. Monitoring Repayment: At each scheduled payment date, an employee or the automatic repayment monitoring system will document the payment and apply the funds toward the principal and interest on the loan; therefore, reducing the applicant's outstanding loan balance.

7. Handling Defaults: In the event the applicant misses a payment, an employee will issue a reminder to the applicant; also, a late fee may be assessed. As a final step, if the loan was secured, an employee will have to commence collateral recovery through legal action.

Manual operations and custom software integrations are required for every single step of the loan lifecycle; delays occur during the review and approval process, as well as the disbursement process. Each manual intervention adds cost to the loan lifecycle. Additionally, risk occurs when employees make errors in tracking payments or fail to consistently enforce the terms of defaults.

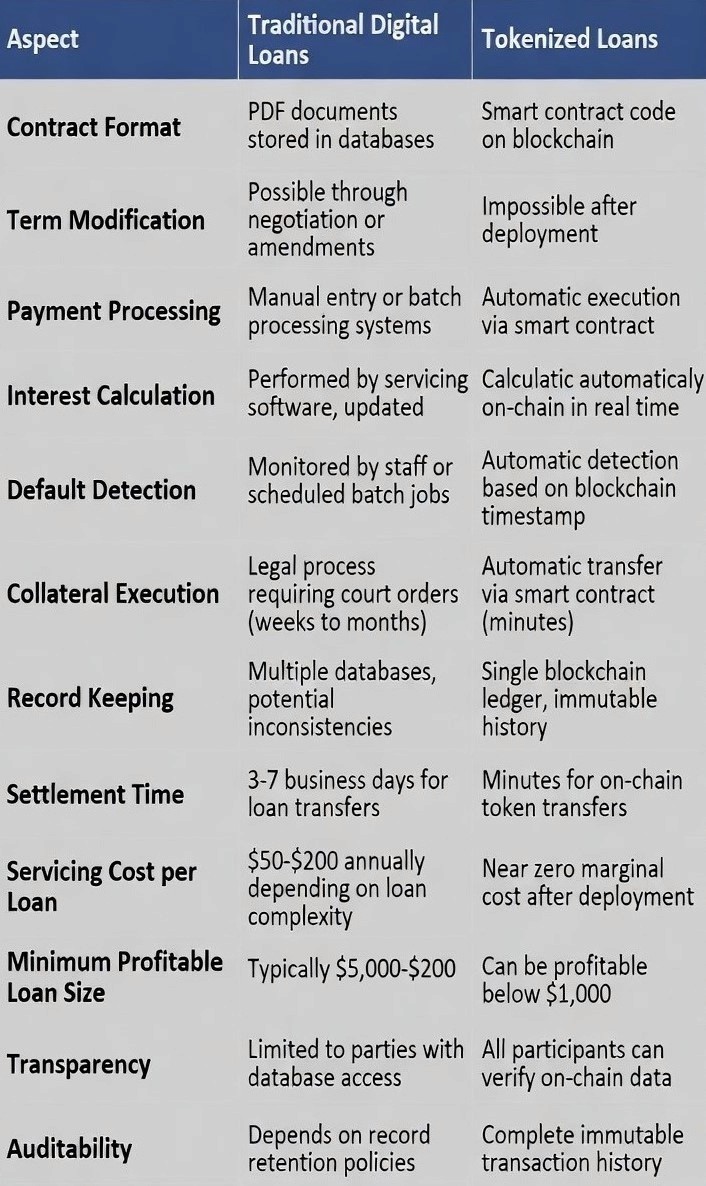

Table: Traditional vs Tokenized Loans Comparison

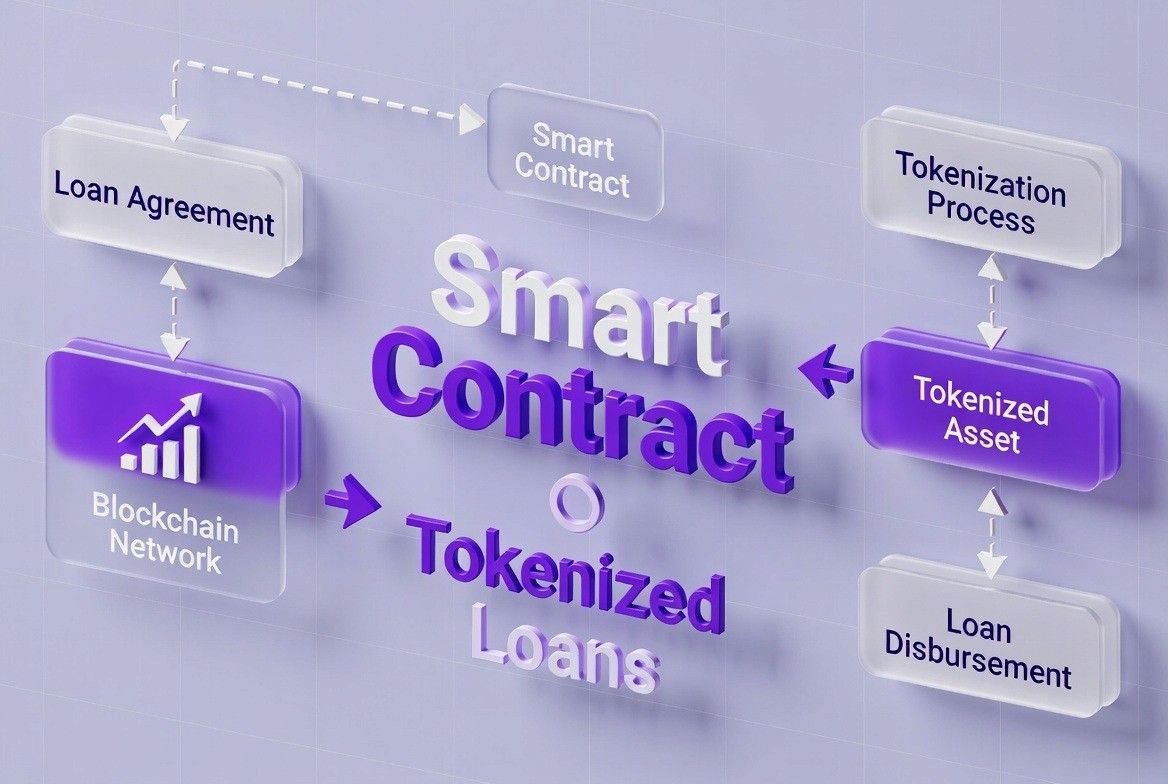

Understanding Tokenized Loans

An asset-backed loan is a type of loan in which the loan itself is represented by a token stored on a distributed ledger called a blockchain. This token includes all information associated with the loan including principal amount, interest rate, repayment schedule, borrower identity, lender identity, and collateral requirements, a structure commonly implemented through asset tokenization frameworks.

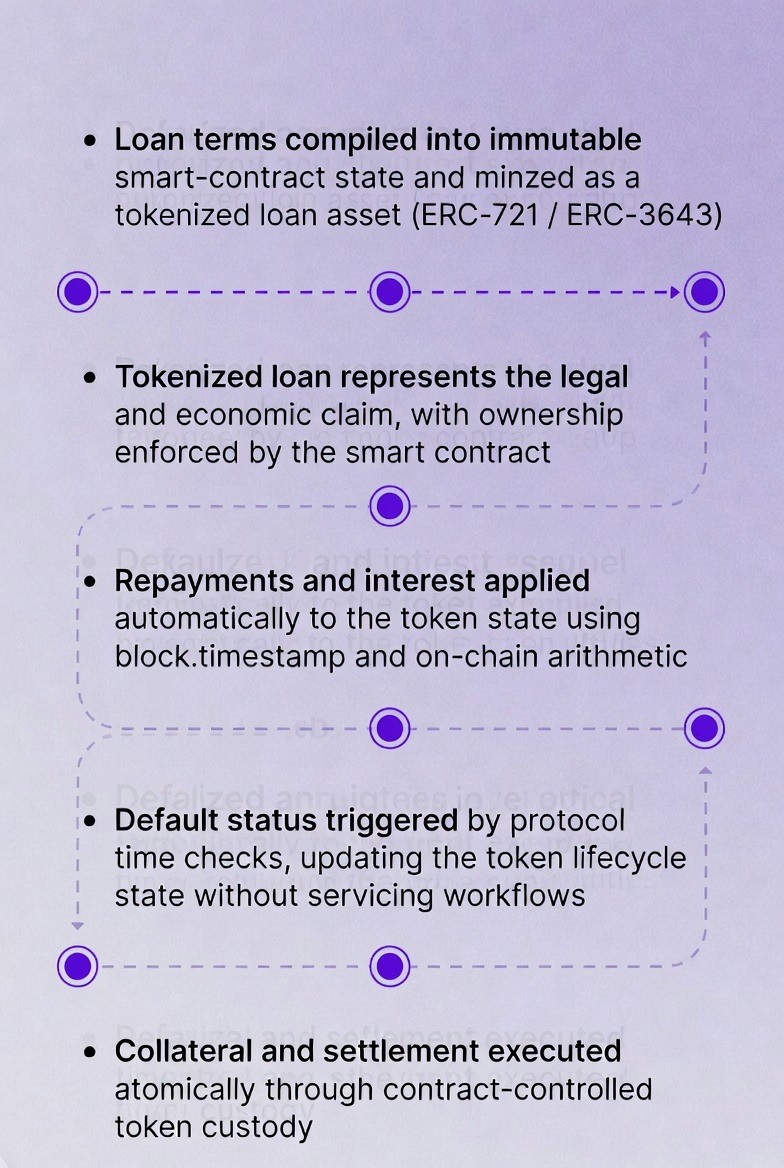

The loan terms are coded into the smart contract. Smart contracts are programs that run on a blockchain and will execute automatically upon the occurrence of certain conditions (i.e., if the borrower does not make a payment, then the collateral will be sold). The smart contract defines how the loan operates (calculates interest, tracks payments, identifies defaults, etc.) and executes the collateral recovery process.

Every action taken with regard to the loan is recorded on the blockchain; therefore, an immutable history is created that cannot be altered or removed. All parties have access to view the current status of the loan at any point in time.

Once the smart contract is deployed it cannot be modified. Therefore, loan terms are non-negotiable. Neither the lender nor the borrower may alter the interest rate, payment schedule, or collateral rules for the loan once the loan has been funded. Enforcement is automatic and predictable.

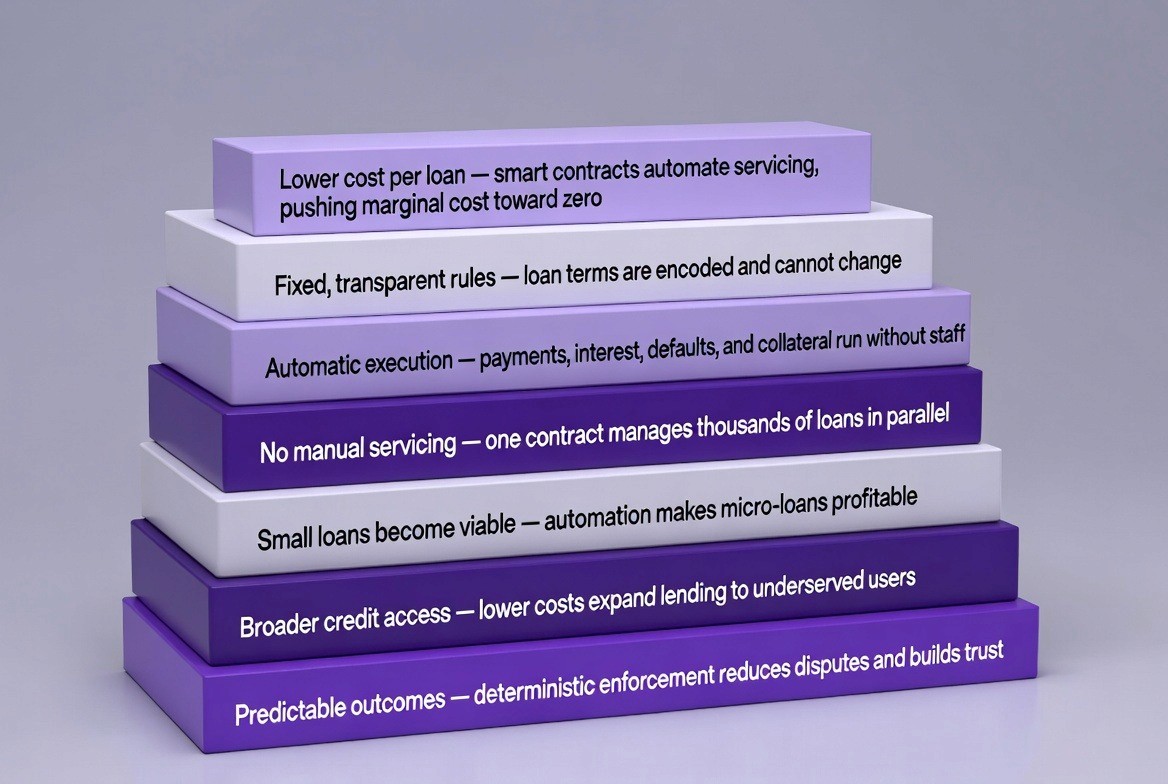

Tokenized Loans Operational Impact for Institutions

Tokenized loans provide quantifiable process improvements to both lenders and borrowers. It decreases the cost of operation by eliminating manual processing steps. The Smart contract executes the loan transaction completely automated; no human interaction required.

Lower Cost Per Loan

Each loan has a number of services, including processing of loan payments, updating of loan balances, customer service, etc., which each consume resources. When a lender uses tokenization, all of those tasks become part of the smart contract and are performed automatically. The marginal cost of servicing another loan becomes almost nothing. As such, this cost savings directly contributes to profit.

Fixed Rules

All aspects of the loan are defined by code and cannot be altered or interpreted. Both parties know the exact rules and consequences that will occur in every possible situation.

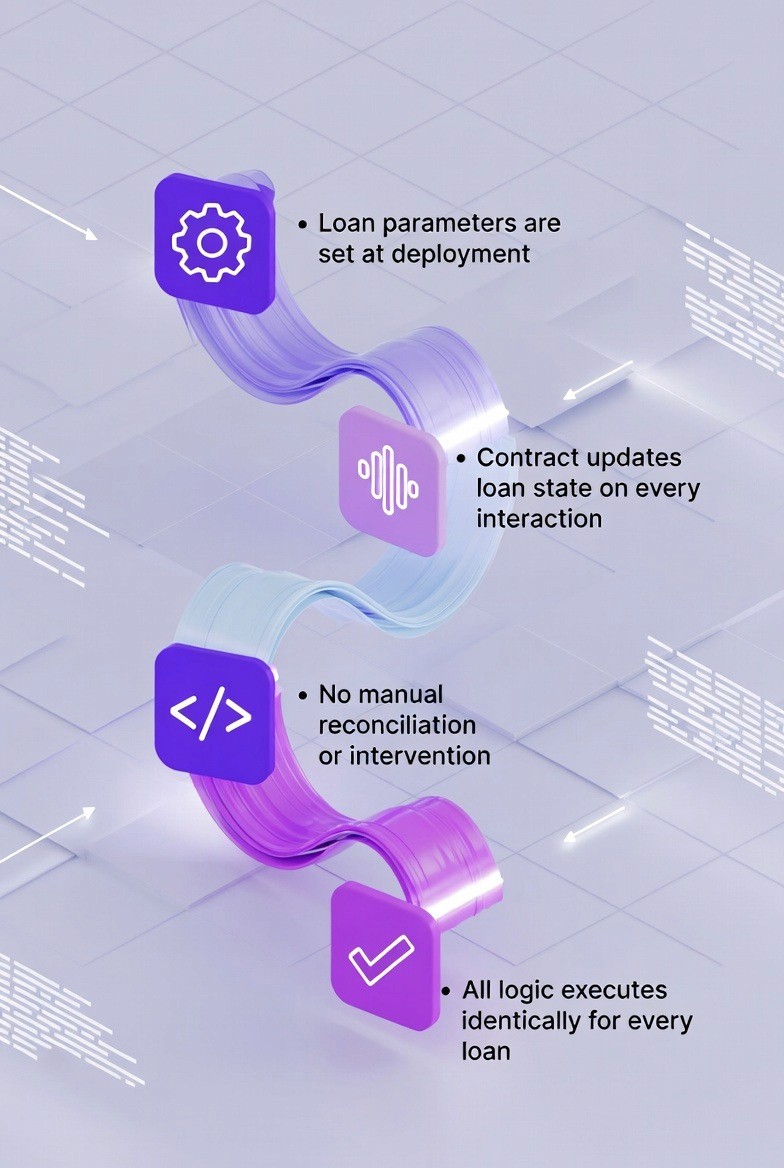

Automatic Execution

When a loan payment is due, it will be made automatically. Interest will be applied automatically. Defaults will be identified automatically. If there is collateral associated with the loan, it will be executed automatically. All of these functions will occur without the need for any staff intervention.

No Manual Servicing

For traditional loans, staff is needed to keep track of payment schedules, send out reminders to customers and maintain account balances. With a tokenized loan, all of these processes are handled by the code and one smart contract can manage thousands of different loans at the same time.

Ability to Serve Small Loans

While small personal loans and microcredit products generate relatively little in interest revenue compared to their operating expense, many lenders choose to ignore them as they find it uneconomical to lend money to individuals at such a low margin. However, the ability to lower the cost of servicing loans enables lenders to make money even from very small loan amounts. This creates new opportunities in the marketplace.

Expanded Access to Credit

By lowering the cost of servicing loans, lenders are able to provide credit to users that may have been considered too costly or unprofitable to serve in the past. This includes users with limited credit histories, low incomes, or other characteristics that may have historically resulted in higher operating expenses than the potential income generated. This expanded availability of credit increases financial inclusion and allows more people to engage in economic activities.

Predictable Outcomes

Both the lender and borrower benefit from knowing exactly how the automated enforcement process works. Lenders know that defaults will be automatically identified and collateral will be automatically seized. Borrowers know that the terms of the loan will not be changed and that collateral will be returned once all payments have been made. This predictability decreases the likelihood of disputes and builds trust.

As a result, institutions have increased efficiency of their operation as it scales. Institutions may generate higher levels of loan volume, without an increase in proportionate staffing or infrastructure costs. Revenue increases faster than expense.

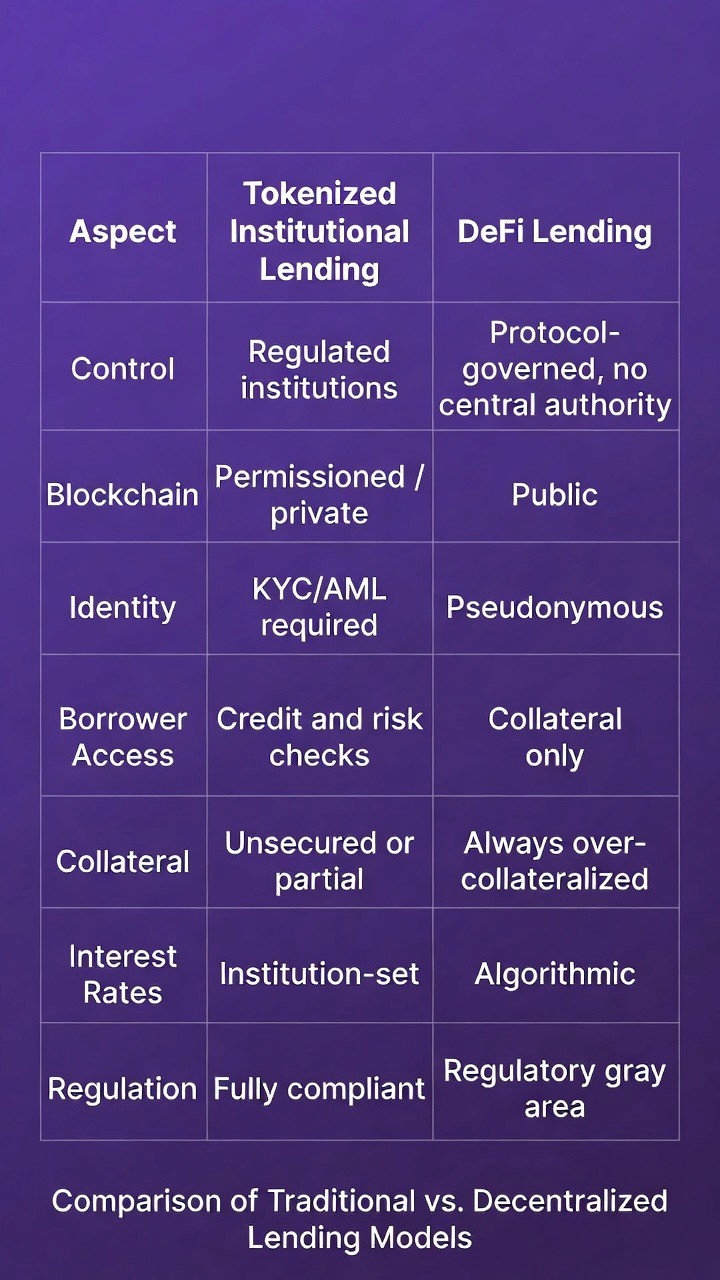

Tokenized Institutional Lending vs Decentralized Lending

Blockchain lending has evolved into a decentralized form with two subforms of lending, both use the same blockchain technology, however, they are targeting completely different markets;

Institutional Tokenized Lending is provided by banks & financial institutions which are heavily regulated entities. Before any loan is issued, users must complete an ID verification process as well as credit check. After the user's information is vetted by the issuing financial institution, their risk assessment will determine their loan to value ratio and interest rate for the loan. Institutional lenders can secure the loan through collateral, or they can choose to lend out money unsecured. In the event the user defaults on the loan, the lender has the option to legally pursue the user.

An example of ITL would be Figure Technologies’ issuance of over $5 billion in blockchain-based Home Equity Loans. This model allows for greater efficiencies through the blockchain while still adhering to all applicable regulations, and protecting the user, with operational coordination increasingly handled through tokenized transfer agent systems here.

DeFi lending is decentralized lending, or peer-to-peer lending. DeFi lending does not involve banks & other financial institutions. Any individual can utilize DeFi lending platforms such as Aave, Compound, and MakerDAO to lend cryptocurrency. Users must post at least 150%-200% of the loan amount in collateral. DeFi lending platforms do not require users to provide identification or undergo a credit check. Interest rates fluctuate in accordance with the available supply/demand of lending.

Aave is unique among its peers as it allows lending and borrowing of cryptocurrencies across multiple blockchain networks, and currently manages over $1 billion in total value locked. Compound was the first to implement an algorithmically determined interest rate model that reacts to changes in the marketplace in real-time. MakerDAO provides DAI stablecoin lending that is collateralized by cryptocurrency. When the collateral value falls below the required level, DeFi lending platforms automatically sell off the collateral. Since there is no recourse to law outside of the collateral being sold off, DeFi lending is primarily used by cryptocurrency owners that have a need for liquidity, and therefore cannot afford to sell their cryptocurrency holdings.

The fundamental distinction lies in compliance and regulation. Banking regulated institutional platforms require borrower identity verification and legal responsibility for their actions. On the other hand, DeFi is permissionless and requires no identity verification to enforce compliance; all is enforced by algorithms. Both types of lending are now processing actual loan transactions every day.

To date, institutional tokenized lending has generated billions of dollars in new consumer and business lending. While DeFi has processed over $100 billion in lending activity, it's still a relatively new space compared to traditional banking. The technology functions well in both the institutional and decentralized (DeFi) lending spaces. Ultimately, which model is chosen will be based upon which regulatory environment the lending operation falls into and what type of borrowers they want to lend to.

Table of Comparison Tokenized Institutional Lending vs DeFi

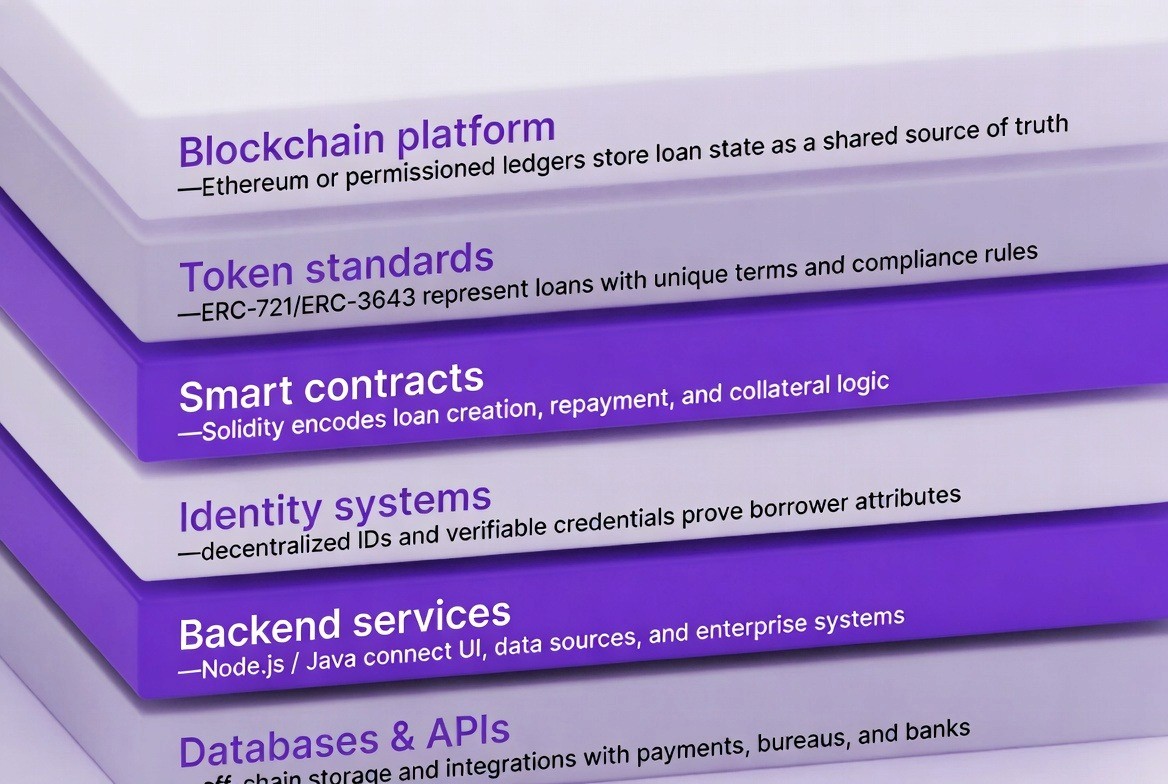

Technology Stack Used for Loan Tokenization

Tokenized lending platforms require several technical components working together.

Blockchain Platform

The blockchain serves as the distributed ledger in which the platform records the loan information. Most financial institutions use Ethereum as their primary public blockchain for tokenized assets, however some institutions may opt to use a permissioned version of ethereum or another enterprise blockchain (such as Hyperledger Fabric) to provide for controlled access and to protect user anonymity. The blockchain provides a mechanism for ensuring the integrity of the data as well as provides an immutable record of the truth for all stakeholders.

Token Standards

Each token follows one of a few standards that define how the token will be created, stored, transferred and otherwise administered. A "fungible" token is a token where each token is identical to every other token and can therefore be exchanged with any other token of the same type; this is defined by the ERC-20 token standard. Tokens such as NFTs (non-fungible) are tokens where each token is uniquely identifiable, and therefore cannot be substituted with any other token; this is defined by the ERC-721 token standard. Tokenized loans typically use ERC-721 tokens since each loan may have different terms than any other loan; ERC-3643 is a compliance-focused token standard that includes identity verification and restrictions on transfers that are required for regulated securities.

Smart Contract Language

Solidity is the primary programming language for writing smart contracts on Ethereum. It is a statically-typed language similar to JavaScript. Solidity code defines the logic for loan creation, repayment processing, and collateral management.

Identity Systems

Decentralized Identity protocols allow borrowers to prove their identity without relying on centralized databases. Verifiable credentials are digital certificates that confirm specific attributes like age, citizenship, or creditworthiness. These credentials are cryptographically signed and can be verified by any party without contacting the issuer.

Backend Services

Lending does not always take place on a Blockchain. Back-end applications, which are typically created using either Node.js or Java, serve as the interface for users, pull data from other outside systems and act as an intermediary between a Blockchain based system and a traditional off-blockchain system. They perform functions such as user login/authentication, data format and processing of API calls.

Databases and APIs

Off-Chain databases hold sensitive information that is not intended for public use. APIs provide the interface for connecting the lending platform to both payment processors and/or credit reporting agencies (bureaus) and also, core banking systems; allowing tokenized loans to work within the current financial systems.

Each component serves a specific purpose. The blockchain provides immutability and transparency. Token standards ensure interoperability. Smart contracts automate execution. Identity systems enable compliance. Backend services manage user experience. Databases and APIs integrate with legacy systems.

Smart Contract Design for Tokenized Loans

A tokenized loan smart contract contains several key functions.

Loan Creation Contract

This function generates an entirely new loan token that is created with the entire loan terms contained within it. In addition to creating a new loan token, this function also captures all of the borrower's information, lender's information, principal amount, interest rate, repayment schedule, and collateral requirements.

Repayment Schedule Logic

This function determines when payments will be made. It can either determine the payments based upon a specific date (i.e., a "due date"), a regular interval (i.e., every month), or an event-based occurrence (i.e., when a property sale is completed). The repayment schedule established for a loan is permanent and may not be changed once it is created.

Interest Calculation Logic

This function calculates the interest owing based on the outstanding principal balance and interest rate being charged. A number of different methods may be used including, but limited to, simple interest, compound interest or a completely customized method of determining interest owing. Interest calculations will automatically be generated at each

Collateral Lock Logic

This function will hold a borrower's collateral token(s) in escrow until such time as the loan is paid off in full. During the term of the loan, the borrower shall have no right to withdraw or transfer collateral held by the borrower under the loan agreement; the smart contract will have sole authority and discretion over the collateral being held in escrow.

Default Detection Logic

This function monitors the status of payments being made pursuant to the loan agreement and identifies missed payments. When a payment due date passes without receiving payment, the loan is deemed to be in a state of default and the procedures necessary to enforce the provisions of the loan agreement will be initiated.

Collateral Execution Function

Upon defaulting on a loan, this function immediately transfers collateral held by the borrower to the lender. Execution of this function does not require the involvement of courts or other governmental entities and therefore does not involve the use of any legal process whatsoever.

Code Explanation:

The Loan struct is a struct which contains each of the data fields for a single loan. This includes address fields for both the lender and the borrower, numeric value fields for the principal and the interest, timestamp fields for important dates within the loan, and boolean flag fields for the status of the loan.

The createLoan() function creates a new loan. The function allocates a unique identifier to the loan (loanID), writes down all parameters and the first status of the loan. The createLoan() function is invoked by the lender, who provides the terms of the loan.

The makePayment() function allows the borrower to pay back the loan. The function first verifies whether the user invoking it is the borrower, then it will compute how much interest is owed based upon the outstanding balance and the time elapsed since the last payment was made. The amount of interest is then subtracted from the outstanding balance. When the borrower has paid off the entire outstanding balance, the loan is flagged as being inactive and the collateral is released to the borrower.

The calculateInterest() function computes the interest owed by the borrower based upon the time elapsed since the loan was created or since the borrower's last payment, and the annual interest rate that the lender charges. The interest is computed using basis points to prevent the use of decimal arithmetic. The result of this function is the total interest owed by the borrower at the present moment.

The checkDefault() function determines if the loan is currently in default. It compares the current time with the due date for the borrower's next payment. If the borrower's next payment is overdue and the borrower still owes money on the loan, the loan is flagged as being in default.

The executeCollateral() function transfers the collateral held in escrow by the contract to the lender. The executeCollateral() function may only be invoked by the contract after the checkDefault() function indicates that the loan is in default. The execution of the transfer of the collateral is immediate and does not require consent from the borrower.

Step-by-Step Technical Implementation Guide

This section describes the complete technical process for a tokenized loan from application to closure.

Step 1: Validate Borrower Identity

The borrower develops a digital identity that is supported by verifiable attribute values (borrower name, date of birth, citizenship) which have been digitally signed by an issuer (government agency, IDV service provider) who has a good reputation and provides trustworthy information. Once the borrower sends their digital identity to the lending platform, the lending platform can verify the digital signature of the borrower's digital identity without having contact with the issuer of the digital identity and protect the borrower's private information.

Step 2: Specify Loan Details

The borrower input loan details (loan amount, loan term, type of collateral being offered). The lending platform assesses the credit risk of the borrower and calculates the interest rate of the loan based upon the credit risk of the borrower. The lending platform can assess the credit risk of borrowers using traditional credit scores, transaction history on the blockchain, and/or other types of alternative data sources. The lending platform communicates the terms of the loan to the borrower and offers the borrower the opportunity to accept the terms of the loan. When the borrower accepts the terms of the loan, the terms of the loan become frozen and can no longer be modified.

Step 3: Develop a Smart Contract

A new version of the smart contract is built and deployed onto the blockchain. A transaction is initiated in the blockchain for the deployment of the smart contract. Smart contract initialization data is the loan parameters. The blockchain verifies the smart contract deployment and assigns a unique identifier to it (contract address), which will never change during the entire duration of the loan lifecycle. This same contract address will be used to identify the loan from the beginning of the loan until its conclusion.

Step 4: Tokenize the Loan

Once a smart contract has been developed and deployed to create a tokenized version of a loan asset (such as a vehicle), that tokenized version of the loan asset will be represented by tokens which represents ownership of that loan and is held in the lender's digital wallet on the blockchain. The lender may then hold this tokenized version of the loan asset or he/she/it may transfer the tokenized version of the loan asset to another party or sell the tokenized version of the loan asset on a secondary market. This tokenized version of the loan asset would include all of the loan details including the loan term(s) and the current outstanding balance of the loan, etc.

Step 5: Secure the Collateral

If the loan collateral is to be supplied by the lender, then the lender will deposit the collateral token(s) into a smart contract. The smart contract holds the deposited collateral token(s) in an escrow account. During the duration of the loan agreement the borrower will have no ability to withdraw or transfer the collateral token(s). The smart contract contains the rules regarding when the collateral token(s) are returned to the borrower or if they are to be seized.

Step 6: Disburse the Funds

The lender pays the principal to the smart contract. The smart contract checks whether sufficient collateral has been placed by the borrower in order for the loan to be repaid as well as confirms compliance with all other terms of the loan. Upon confirmation that both requirements are met, the smart contract transfers the funds into the Borrower’s digital wallet. The smart contract can either send the funds directly to the Borrower’s digital wallet using the on-chain stablecoin or use an interface to a legacy off-chain payment system to process the movement of fiat currency to the Borrower’s bank account.

Step 7: Payment Recording

The lender begins the repayment process when they invoke the makePayment method in the Smart Contract (the Smart Contract), which will begin the repayment process for the loan. After the lender invokes the makePayment method, the Smart Contract creates a new transaction on the blockchain for each payment made toward the loan. Upon the creation of each new transaction, the Smart Contract decreases the remaining principal amount owed and also determines the next payment due date. At any time, all parties involved with the agreement are able to view the current state of the loan by accessing the loan data through the blockchain; therefore eliminating the need for lenders to monitor and account for payments made on the loan individually.

Step 8: Automatic Interest Calculation

The Smart Contract will determine the amount of interest due on the current outstanding principal, based on the time that has lapsed from when the previous payment was made, and at all other times when the Smart Contract is invoked by the borrower for recording a new payment or obtaining information regarding the loan. At both times the Smart Contract will perform the interest determination. The interest formula, which determines how the interest rate will apply, and the interest rate itself, are fixed in the source code of the Smart Contract; therefore, the interest rate cannot be changed after the Smart Contract has been deployed to the Blockchain. Thus, the borrower can see the interest rate, and how it applies to their loan.

Step 9: Automated Default Identification

The Smart Contract continuously monitors the borrower's history of payments. At a periodic time (as defined by the contract), the Smart Contract determines if the current time/date is later than the borrower's next payment due date/time. When it does, if the borrower has missed making the full outstanding balance, then the Smart Contract updates the loan's status to defaulted. The Smart Contract notifies the lender of this default via an automatic event. As with prior actions, the Smart Contract auto identifies a defaulted loan and makes that determination without the need for human review or judgment.

Step 10: Automated Execution of Collateral Transfer or Loan Closure

After defaulting on a loan, the lender can use the "transfer collateral" function of the smart contract (executeCollateral), that automatically transfers the collateral tokens into the lenders wallet. The Smart Contract executes the collateral transfer (closes the loan) with no user intervention. If the borrower repays their entire loan, the Smart Contract will execute the transfer of the collateral tokens from the lender to the borrower and close the loan. The Smart Contract will also update the metadata of the loan token to represent the final state of the loan.

Programming Logic Explained Simply

Smart contracts use basic programming logic to automate lending operations.

If-Else Conditions

These are the decision-making elements of your smart contract. The If-Else Statement examines if a particular criteria has been met (TRUE/FALSE), and will take a subsequent action. Here is How An If-Else Statement Works: "IF the amount you have paid is greater than or equal to the outstanding balance on the loan, THEN mark that loan as repaid. ELSE, Subtract the Payment from the Outstanding Balance of the Loan."

Time-Based Rules

A date/time stamp is supplied by Solidity for each event (transaction). Using that date/time stamp, you can create time-based rules. Here is an example: "IF the date and time of this event is later than the date and time of when the next payment is due, THEN mark loan as defaulted." This component enables the smart contract to enforce deadlines automatically without relying on a third-party source of time.

Numeric Thresholds

Smart Contracts use numerical (math) to execute rules with precision; smart contracts will also check the account balance to calculate a percentage and limit the amount of money that the user has access to. A possible smart contract could read: "if the collateral value is less than 150 percent of the loan value, then ask for additional collateral". Using math in smart contracts enables full automation of all actions with 100% accuracy.

State Changes

Smart contracts hold current statuses for loans (i.e., tracking where each loan is in its lifecycle) by keeping track of state variables. When certain events happen, smart contracts can cause their states to be updated. An example would be: "When we get a complete payment for the loan, update the loan's state to 'closed'". Smart contract state updates are permanent and everyone with access to the network has visibility into them. These updates provide a permanent record of all actions taken as part of the loan process (an audit trail).

The logic in smart contracts replaces many of the time-consuming manual processes that humans perform. A human loan officer may have reviewed historical payment records, calculated interest, checked the due date of payments, and decided if the borrower was in default. The smart contract will do this work, based upon pre-programmed rules, so there is no need for a human to spend time on it; it is faster, less expensive, and completely consistent.

What Code Replaces Manual Lending Operations

Traditional lending requires significant human labor. Tokenized loans replace these manual operations with code.

Removal of Paper Contracts

Traditional Loans have a loan document that may be signed on a paper document that outlines all of the terms of the loan. All of these loan documents then need to be stored, pulled up, and referenced during the entire life cycle of the loan. Tokenized Loans will contain all loan terms within the smart contract code. The blockchain will serve as the official documentation for the loan, therefore no physical storage or filing system is needed to store the loan documents.

Removal of Human Approval Steps

Credit Officers are typically responsible for reviewing a borrower's loan application and approving the disbursement of funds. Once the borrower has defaulted on their loan payment, a collection agent will determine when they should escalate the default. This process creates both delay and inconsistency, because each decision maker has different guidelines for deciding what action to take next. Tokenized Loans utilize an automatic eligibility check and automated credit scoring based upon algorithms. When the applicant meets the criteria, the loan will automatically fund. Automated defaults will occur in accordance with the code of the smart contract and do not require any human decision-making.

Automated Servicing

Traditional loan servicing is an extensive process for employees that includes tracking of payment schedules, processing of incoming payments, updating account balances, and sending payment reminders for each activity. This traditional process is based on manual or automated (computer) inquiries to databases and/or performing calculations and updating systems. Smart contracts in tokenized loans complete all functions of servicing by using contract code. In this regard, the smart contract monitors and manages schedules for payments; it will also manage processing of payments; it will update account balances; and it will automatically trigger notification events when necessary.

Automated Enforcement

In the event of a traditional loan defaulting on payments, the lender must begin the process of collections from the borrower, work out an agreement with the borrower (if possible), and take legal action against the borrower if they cannot recover the collateral. The process is typically long, costly, and uncertain. With tokenized loans, when there is a default condition (as determined by the terms of the loan), the smart contract will immediately transfer the collateral to the lender, as well as execute the terms of the loan, eliminating the need for negotiations and/or legal actions.

The operational difference is significant. Where it may have taken hours of employee time to complete manual processes associated with recovering collateral, those same processes are executed instantly via automated code. Additionally, the cost to the institution per loan has decreased significantly. The ability to lend to additional borrowers does not require institutions to add staff members; therefore, lending operations are both scalable and profitable, even for small loan amounts.

How Tokenized Loans Reduce Credit Risk

Credit risk refers to the possibility a debtor will fail to make good on an obligation (i.e., repayment) for a loan. In traditional lending, there are many issues relative to credit risk that tokenized loans resolve.

Tokenized Loans Provide Transparency

Loan status, from a borrower's perspective and a lender's perspective often differ significantly. Loan payments are disputed because the two parties don't agree with what records show. Tokenized loans store all relevant information regarding the loan on a blockchain which both parties can view. Borrowers and lenders alike can see the current balance, the payment history, and the default status. Since there is only one source of truth, this lends itself to eliminating disputes between parties and allows both to track their respective risks at all times.

Immutable Terms

Traditionally, loan contracts are amendable by the lender and/or borrower through negotiations and/or litigation. Rates of interest can be altered. Schedules of repayment can be extended. The changes lenders make introduce ambiguity into the loan agreement. Smart contracts, used to tokenize loans, contain terms that cannot be modified once deployed. A borrower does not have the option to negotiate terms. A lender cannot implement additional fees. Both parties understand how the loan functions.

Automated Instant Collateral Recovery

The recovery of collateral through a traditional method is usually accomplished by filing a claim, obtaining a judgment, seizing assets, and recovering collateral from a borrower. This traditional recovery method may take months and may include significant legal costs. Often, when a lender does recover some or all of its collateral, it will be less than what was expected. Lenders that use tokenized loans will automatically receive collateral from the borrower upon occurrence of default conditions. Upon occurrence of default conditions, the smart contract will maintain control over the collateral tokens and transfer ownership of those collateral tokens to the lender. Thus, the recovery of collateral is instant and guaranteed.

No Discretionary Decisions

Loan officers have historically had the ability to make discretionary decisions regarding a borrower's late fees, due date extensions, and other terms of a loan. A lending officer has the authority to grant a borrower relief with regards to late fees or to extend the deadline to repay a loan. However, such discretionary authority given to a lending officer may create a moral hazard and may result in inconsistent treatment of borrowers. Smart contracts that enable tokenized loans do not require the use of discretionary authority. The smart contract will operate precisely as defined; therefore, all borrowers will be treated equally in similar circumstances. The removal of discretionary authority given to lenders reduces the lender's risk and ensures equal treatment of borrowers.

The result is a more predictable credit environment. Lenders can model risk with greater accuracy. Default losses are minimized through automatic enforcement. This allows lenders to offer credit at lower interest rates while maintaining acceptable risk levels.

Integration With Existing Banking and Lending Systems

Tokenized loans do not operate in isolation. They must integrate with existing financial infrastructure.

Core Banking System Integration

Tokenized lending platforms can integrate with core banking systems via application programming interfaces (APIs). Once integrated, when a loan is funded the API will create an equivalent transaction on the core banking system as well as update the account balance accordingly. As such, the blockchain record of a loan and its associated repayments will be consistent with the traditional banking records.

Payment Rails

The majority of borrowers' money is stored in banks (traditional banking) as opposed to in crypto-wallets. As such, the most common way that a borrower would pay back the loan is by using fiat currency via traditional payment rail. This fiat currency is then received by the lending platform, converted into a blockchain-based transaction, and the lending platform will perform payment processing functions, such as currency conversion, and clearing/settlement for each system.

Accounting Systems

Institutions are required to prepare financial statements and provide information for regulatory reporting through accurate and timely accounting records. In addition, as each loan transaction is conducted in a tokenized environment, an ERP system will record all related accounting entries. Each time a loan is originated, repaid or becomes delinquent, multiple journal entries will be recorded. The middleware will have the ability to integrate with multiple blockchains, which will translate the events produced from the blockchain into the appropriate accounting codes allowing the institution to report on the two separate loan portfolios (tokenized and traditional) contained within their financial reports.

Risk and Reporting Dashboards

Senior executives and risk management personnel require access to real time data regarding the performance of all active loans. The lending platform will be able to present this data in a format that is easily recognizable to users by aggregating the information from the blockchain and presenting it using similar dashboards as those used for traditional lending platforms. Users will be able to view metrics related to total outstanding loans, average loan size, default rates, collateral coverage ratio and the overall composition of the portfolio. The utilization of real time blockchain data will enable lenders to assess risk in real time as opposed to relying upon traditional monthly reporting cycles.

Tokenized lending works differently for different institutions. In fact, some institutions have created their own proprietary middleware solutions in order to seamlessly link blockchain and legacy systems. Others rely on third party platforms, which offer pre-configured connectors, to enable them to achieve similar results.

Real Live Use Cases

Several financial institutions and platforms have deployed tokenized loan systems in production environments.

Figure Connect Marketplace operates as a platform for tokenized private credit. Figure Technologies issues blockchain-based loans secured by real estate and other assets. These loans are represented as tokens on the Provenance blockchain, a permissioned blockchain built for financial services. Each loan token contains complete loan terms, payment schedules, and collateral details.

Tokenized lending through the Figure Connect Marketplace enables institutional investors to purchase the tokenized loans. Institutional buyers may buy an individual loan, a pool of loans, etc. When a buyer buys a loan, they immediately take title to it; settlement occurs via on chain transaction within minutes as opposed to a matter of days when buying a loan in a traditional sale.

The company has issued over $1 billion in home equity lines of credit since its inception using the same tokenized business model. Homeowners use the application to electronically submit their applications and receive instant electronic credit approval; once approved homeowners have fast access to their money. Institutional investors have the ability to invest in consumer credit products (e.g., personal loans, mortgages) which are represented by tokens that provide transparency around risk information and liquidity in the secondary markets. A permanent audit trail is established on the blockchain regarding all loan related activities which provides both regulatory bodies and institutional investors with a record of loan-related transactions.

The operational structure highlights several benefits of tokenizing loans. Lower servicing costs exist for the loans as the payments are made automatically eliminating the need for manual intervention. Faster settlement times for secondary market transactions occur as title transfers occur on chain eliminating the need for third party involvement. Real-time data regarding the performance of each investor's portfolio exists as all relevant data regarding the loans is recorded on the blockchain.

How TokenMinds Helps with Tokenized Loans Deployment

TokenMinds helps financial institutions and Web3 platforms design and deploy tokenized lending systems that automate the full loan lifecycle.

We convert lending products into a smart contract architecture, define and standardize tokens, build and link collateral rules, and connect the blockchain execution environment to your current banking, payment, and regulatory processes. TokenMinds’ solution combines the scalability and efficiency of web3 with the security and discipline required in a production environment to support the mass adoption of digital lending.

Conclusion

Tokenized loans solve one of the biggest limitations of scalable digital lending by automating servicing through automated on-chain servicing instead of manual. With loan terms stored in smart contracts as blockchain tokens, the process of calculating interest, monitoring repayment, detecting defaults, and recovering collateral happens autonomously, eliminating the need for human involvement. As a result, per-loan operational expenses decrease, profitable small-ticket lending becomes possible, and the ability to increase loan volume is enabled while reducing the need to hire additional personnel or invest in new infrastructure, creating a proven and practical technology upgrade for today's digital lenders.

Schedule a complimentary consultation with TokenMinds to explore how your organization can deploy tokenized loan infrastructure to automate servicing, reduce operating costs, and scale digital lending profitably.

FAQ

1. What regulatory laws and regulations govern tokenized loan?

Tokenized loan can be classified as a type of security under regulation (such as) Securities Act of 1933 in the U.S., based on whether the loan token represents an investment contract. If the tokenized loan is classified as a security, the loan will need to register or meet the conditions of one of the available exemptions. Tokenized lending platforms will also need to have Know Your Customer (KYC) and Anti-Money Laundering (AML) processes in place. The ERC-3643 token standard has built-in compliance features that restrict transfers to verified investors only; however, the regulatory environment varies by jurisdiction and institutions would typically need to seek the advice of legal counsel prior to developing and launching tokenized lending products.

2. What occurs if there is an error in the smart contract code?

Smart contract errors can result in financial losses. Smart contract errors can include errors preventing loan repayment, such that the borrower is unable to close the loan or obtain their collateral. Smart contract errors can also allow unauthorized withdrawals from the wallet of the borrower, which can result in theft of funds. In order to minimize the risks associated with smart contract errors, the smart contract code should be audited professionally prior to its deployment into production.

3. How will borrowers be protected when a lender becomes insolvent?

If the lender (who is responsible for creating the token) goes bankrupt, then the loan token will remain as part of his bankruptcy estate. As such, it will be available for creditors and/or administrators of his estate to either take control of and continue servicing the loan or alternatively to sell the token on to some other party. Ultimately, the borrower's obligations with respect to repaying the loan are unaffected by the bankruptcy of the lender; however, the Smart Contract that was established at the time the Loan Token was created continues to operate in accordance with its terms and conditions regardless of what happens to the lender.

4. Can tokenized loan transactions be audited?

Yes. All blockchain transactions are documented permanently within an open, public ledger referred to as the "blockchain ledger." Auditors can trace the entire history of a tokenized loan from the point at which it was created, distributed, paid down and closed. Auditors can verify that the disclosed loan terms (as stated by the lender) match the smart contract code that defines the tokenized loan's behavior. Auditors can verify that all transactions occurred consistent with the defined rules of the smart contract. The degree of auditability provided by blockchain technology far surpasses that typically available through traditional lending environments, where loan records may be incomplete or have been altered. Blockchain systems exist that allow for limited access to information relative to a single transaction, e.g., a tokenized loan; however, these permissioned blockchains do provide a completely auditable trail of events.

5. What credit risk remains in tokenized loans?

While tokenized loans have significantly reduced the operational risk (the risk that the lender cannot collect on a loan) and enforcement risk (the risk that the borrower does not fulfill his obligations as per the terms of the loan) associated with lending, they do not remove the inherent credit risk (the risk that the borrower fails to repay the loan). The borrower can still be unable to repay the loan; the value of the collateral backing the loan can decline to an amount less than what was borrowed; and in the event of a borrower default when the loan was undercollateralized (i.e., there were insufficient assets pledged for the amount of the loan), the lender will incur financial loss because the automated collateral execution mechanism will not be able to recover sufficient funds to pay-off the loan.

6. How do tokenized loans deal with partial payments or early repayment?

Smart Contracts can also be written to take in part-payments and then use those part-payments toward the outstanding interest and principal. Once a Borrower has paid off the rest of their loan prior to the end of the original scheduled period, they are able to invoke the repayment method of the Smart Contract by sending an amount that represents the remaining Principal and Interest that is due. The Smart Contract will check if the amount sent is correct and if so will set the Outstanding Balance to $0 and Release any Collateral being held by the Smart Contract. There are also some Smart Contracts that can determine a Pre-Payment Penalty and add it to the amount due as a way to compensate the Lender for the early closure of the Loan.

7. Can tokenized loans be transferred or sold?

Yes. As with any asset that is based on a blockchain, you may move your loan token from one wallet to another. Therefore, if a lender wants to transfer his loan token to an additional investor he can do so; the new investor will become the new lender (the original lender no longer will be), receive all subsequent payments from the borrower and the borrower’s obligations will remain exactly the same. The smart contract will recognize the new token owner as the lender and will continue to function as it did prior to the ownership change. The creation of secondary markets for loan assets is made possible by this mechanism. Therefore investors are able to buy and sell loans utilizing the blockchain and have settlement in just a few minutes versus the days typically associated with traditional loan settlement. Therefore compared to traditional loan markets there is increased liquidity.