December 10, 2025

TL;DR:

Chainlink Runtime Environment (CRE) is a modular, cross-chain engine. It helps enterprises run secure, compliant, multi-chain workflows without changing their legacy systems. CRE connects blockchains to real-world data and automates compliance. It also handles tasks like tokenization, stablecoin management, cross-chain settlements, and AI-driven financial workflows. This engine cuts development costs and time, boosts security, and opens new business models.

Blockchain-based companies face a growing number of issues due to the evolving state of the current financial landscape. One of the primary challenges is that Smart Contracts are unable to fulfill all of the needs of a business. Companies need data feeds, cross-chain services, identity verification, compliance tools, and integration into existing, legacy systems. All of which increase costs, engineering requirements, and the total amount of effort needed.

Chainlink CRE solves many of those problems. It provides a single layer at runtime, enabling businesses to run smart contracts on multiple blockchain systems and legacy systems. It also automates data tasks, workflow and compliance, enabling teams to work faster and safer.

The Challenge for Enterprises and TradFi

Initially smart contracts were simple code on one blockchain. Smart contracts were for tokens and simple automation. The complexity of the industry has grown to where most uses today require interchain transactions, off-blockchain data, verification of identities, creation of stable coin logic and integration with traditional financial systems.

Most organizations continue to rely on older technology platforms; core banking software, custody systems and ISO 20022 messaging. Switching from these systems can save money, however it is risky and time-consuming. Organizations have trouble linking multiple systems together, while complying with regulations and maintaining security and privacy. Oftentimes this causes blockchain adoption to be delayed.

Due to this, companies are faced with a difficult decision: building expensive custom systems or giving up compliance, security, or interoperability?

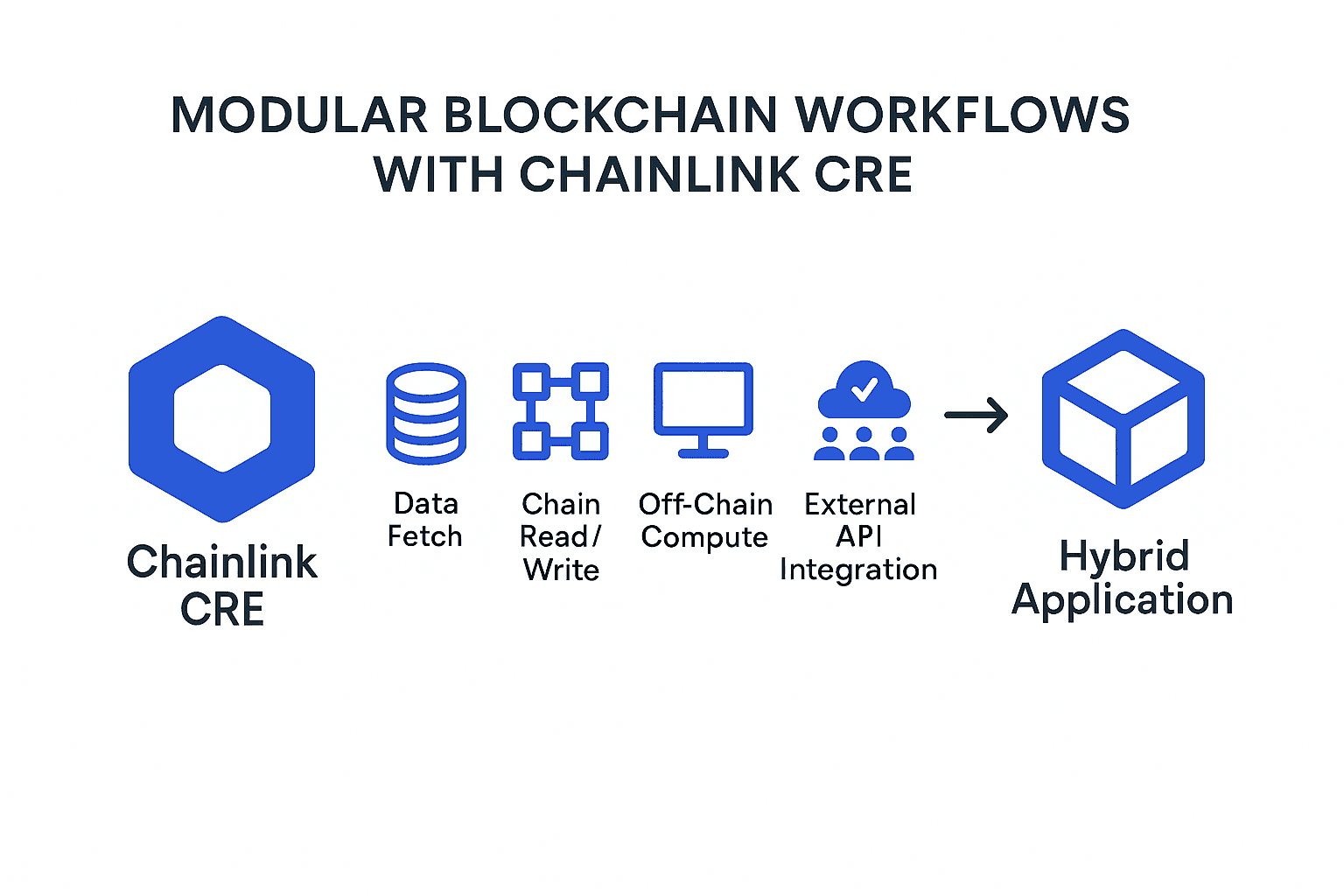

What Is Chainlink CRE?

Chainlink CRE is a modular platform for building blockchain workflows. Instead of a single large tool, it offers a set of smaller, focused “capabilities,” such as:

Data Fetch

Chain Read/Write

Off-Chain Compute

Consensus

External API Integration

Each capability is powered by a Decentralized Oracle Network (DON).

Developers can build workflows in TypeScript or Go by combining these parts. CRE then handles the execution. It triggers events, brings in data, checks compliance, and writes results to different blockchains or external systems.

A key strength of CRE is that it is chain-neutral. It works with public chains, private networks, permissioned systems, and enterprise banking tools. This allows teams to build hybrid applications without replacing their existing systems. Readers who need more background can explore this simple guide on blockchain layers, which explains how multi-layer systems work.

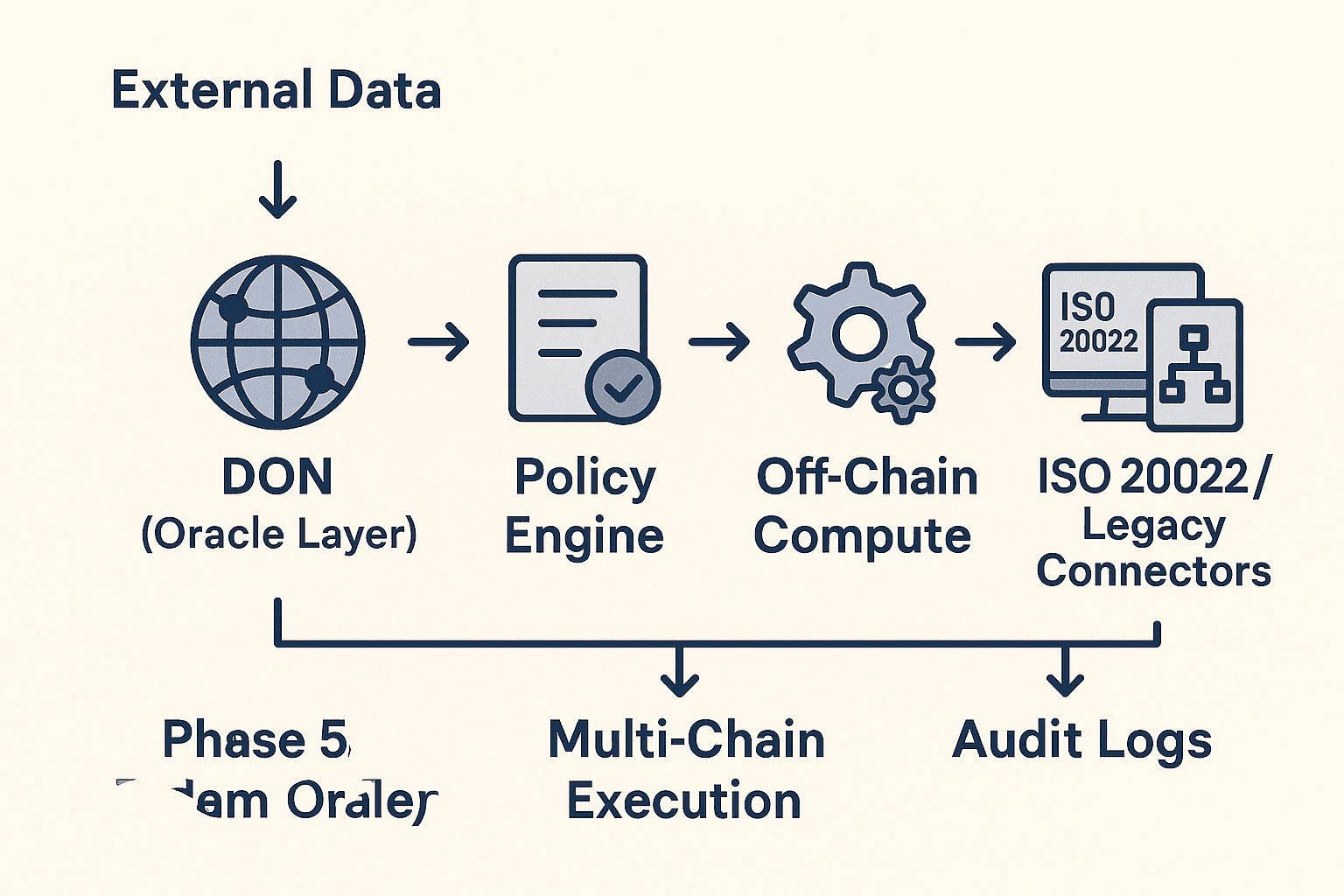

Compact Architecture Diagram & Sequence Flow

CRE works by linking data, rules, and execution across many systems at once. Below is a clear, simple view of how the parts fit together.

Chainlink CRE Capabilities and Key Features

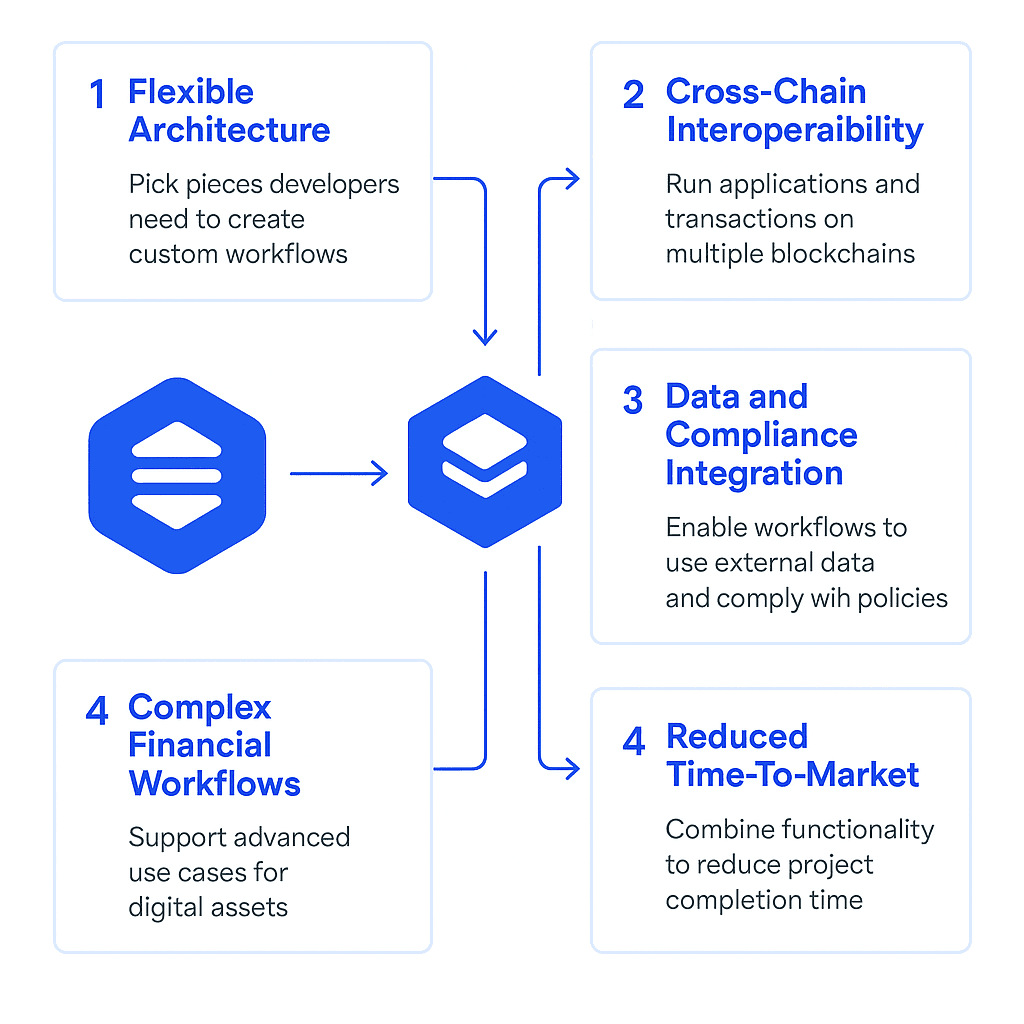

1. Flexible Architecture

CRE is designed so that developers can pick the pieces they want/need to create their own custom workflow (versus using an inflexible system). Developers now have the ability to build custom workflows as needed.

2. Cross-Chain Interoperability

CRE enables applications to run on top of multiple blockchains simultaneously, enabling developers to send/receive assets/settle transactions/data between chains without having to deal with the technical incompatibilities associated with chain-to-chain communication.

The Blockchain Development Guide is a good resource to see how this works.

3. Data and Compliance Integration

CRE enables workflows to communicate with off-chain data sources (i.e., APIs, market feeds, identity services), and supports compliance rules/privacy requirements. Organizations can enforce identity checks, audit trails, etc., in addition to being able to monitor compliance in their workflows; which is particularly important for organizations using asset-backed tokens where trust in verified data is essential.

4. Complex Financial Workflows

CRE enables teams to develop advanced workflows including but not limited to:

- Stablecoin issuance

- Proof-of-reserves

- Tokenized asset servicing

- Cross-chain settlement

- Fund NAV checks

- AI-driven data processing

- Even advanced models such as cross-chain NFT marketplaces

5. Reduced Time-To-Market

CRE reduces the amount of time required to complete a project by providing a single environment for developers to combine blockchain functionality, compliance, data operations and workflow orchestration. Projects that previously required months of development can now be completed in days or hours.

Real World Integration and Recent Adoption

1. Tokenizing real-world assets and funds

CRE supports token minting, redemption, and NAV calculations. It also connects these token systems to existing custody and asset management tools.

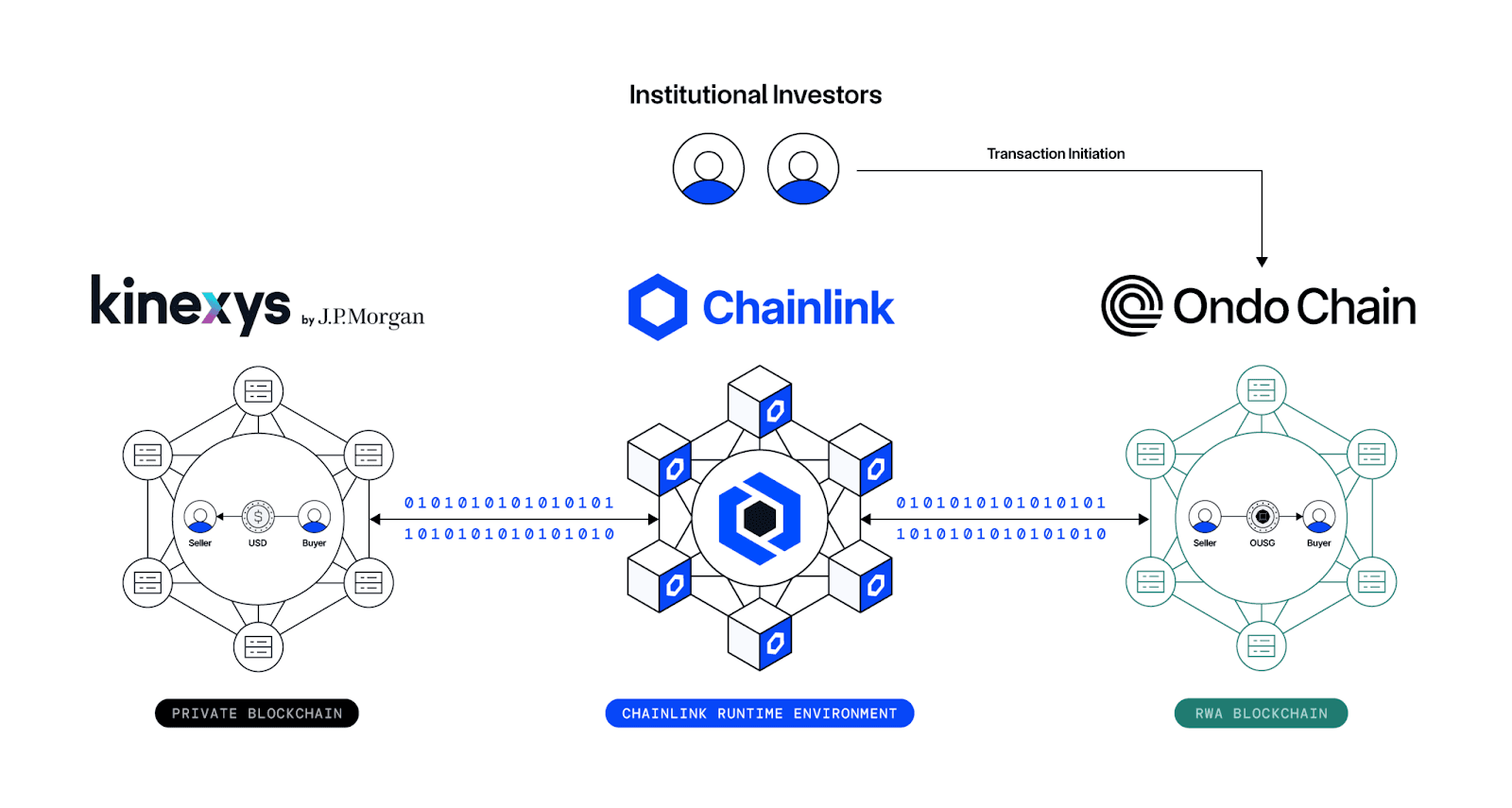

2. Cross-chain settlements (DVP)

JP Morgan’s Kinexys and Ondo Finance used CRE to complete an atomic cross-chain delivery-vs-payment settlement between a private network and a public blockchain.

3. Yield product development

Kiln is using CRE to build compliant yield strategies across multiple chains. CRE automates vault logic, settlements, and NAV checks in a transparent and tamper-resistant way.

4. Stablecoin issuance and proof-of-reserves

CRE can verify reserves, trigger minting or burning, and monitor compliance conditions for stablecoins.

5. AI-driven and data-powered blockchain apps

Companies building AI-based blockchain tools can use CRE to link data sources, off-chain compute, on-chain logic, and compliance rules.

6. Corporate Actions Processing

Swift, Euroclear, and 22 major financial institutions use CRE to simplify corporate-actions processing. CRE cuts manual work and reduces errors by automating data checks and workflows across chains.

7. Tokenized Fund Operations

UBS Tokenize and DigiFT used CRE to complete the first redemption of a tokenized fund. Swift and UBS also use CRE to manage fund workflows through ISO 20022, proving CRE works with existing banking standards.

8. Mastercard Crypto Payments

Mastercard and Swapper built a payment flow on CRE that lets 3.5 billion cardholders buy crypto on decentralized exchanges like Uniswap. CRE acts as the compliance and workflow layer that connects TradFi and Web3.

9. Cross-Border Trade Finance

Banco Inter, HKMA, the Central Bank of Brazil, Standard Chartered, and partners launched a trade finance platform that uses CRE to automate settlement for cross-border agricultural trade.

10. Real Estate and Regulated Exchanges

Balcony is adopting CRE to help bring more than $240B in real-estate assets onchain with verified data. The regulated exchange 21X also uses CRE to provide tamper-proof post-trade data for tokenized securities.

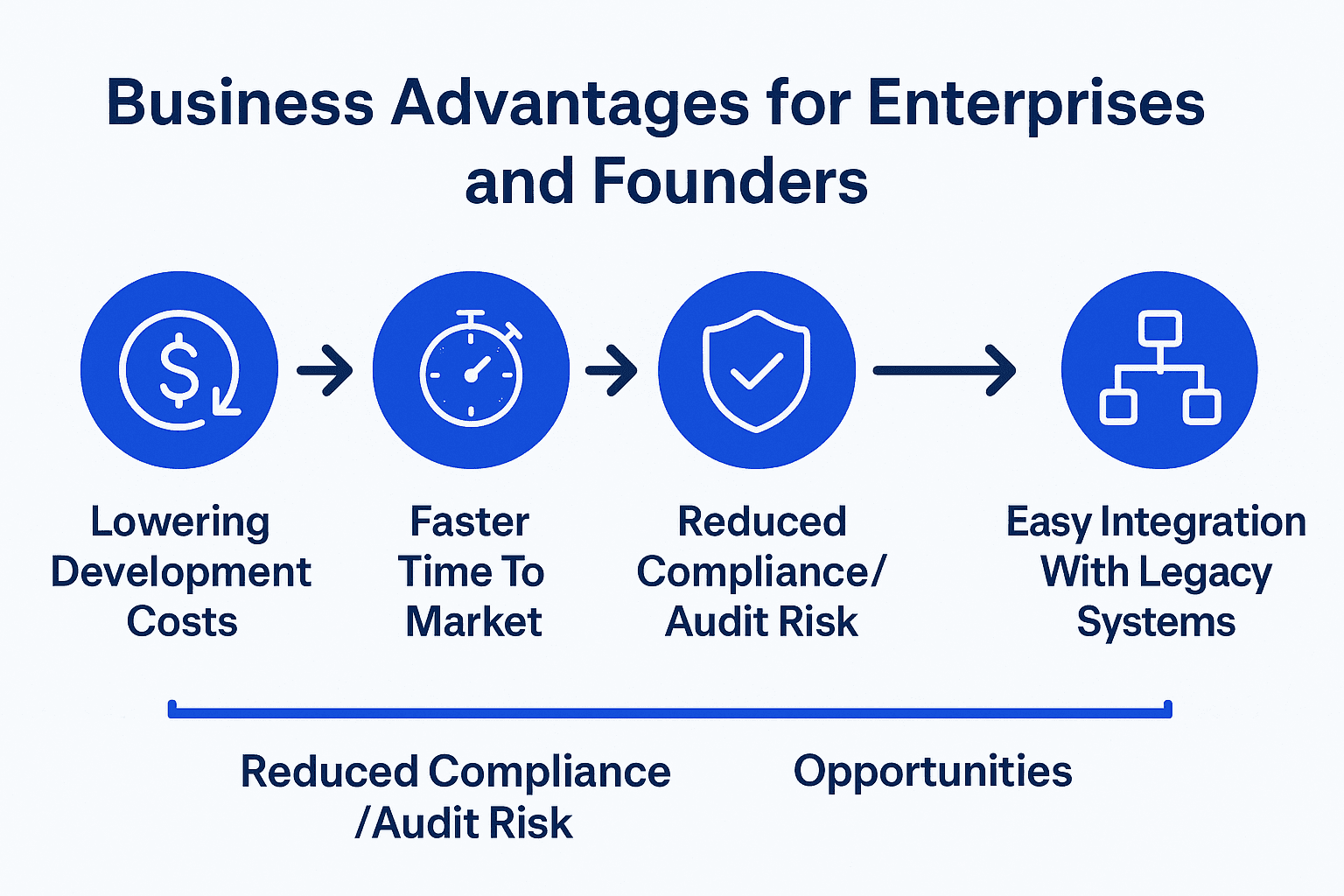

Business Benefits of Chainlink CRE

1. Lowering Development Costs

CRE eliminates the need to develop custom pipeline solutions for multi-chain applications, thereby reducing both development costs and application complexity.

2. Faster Time To Market

The use of CRE’s pre-built tools enables teams to quickly deploy a variety of applications that utilize tokenized funds, stablecoins or cross-chain applications.

3. Reduced Compliance/Audit Risk

CRE provides tamper resistant workflow capabilities as well as automated policy enforcement to reduce audit/compliance risk associated with Web3 based applications.

4. New Business Model Opportunities

Companies have reduced risk to test new tokens, cross chain workflows, hybrid data models, and AI driven asset products.

5. Easy Integration With Legacy Systems

CRE supports existing standards such as ISO 20022 enabling companies to integrate web3 functionality into existing legacy systems.

KPIs for Enterprise CRE Pilots

Teams can measure the value of CRE with simple, clear KPIs. These help leaders confirm that a pilot is working before scaling.

Key KPIs:

Reconciliation Reduction: Target 70–90% fewer manual checks.

Faster Issuance: Asset or stablecoin updates drop from days to hours.

Compliance Automation: 95%+ of checks auto-validated by CRE.

Audit Readiness: Audit logs generated in under 24 hours.

Integration Time: Linking to legacy systems completed in 2–4 weeks.

Cross-Chain Finality: Settlement executed in seconds, not hours.

CRE System Architecture

To illustrate how CRE really functions in business environments, here is a very simple, step by step, work flow example of how CRE can be used to automate Data, Compliance and Cross Chain Execution.

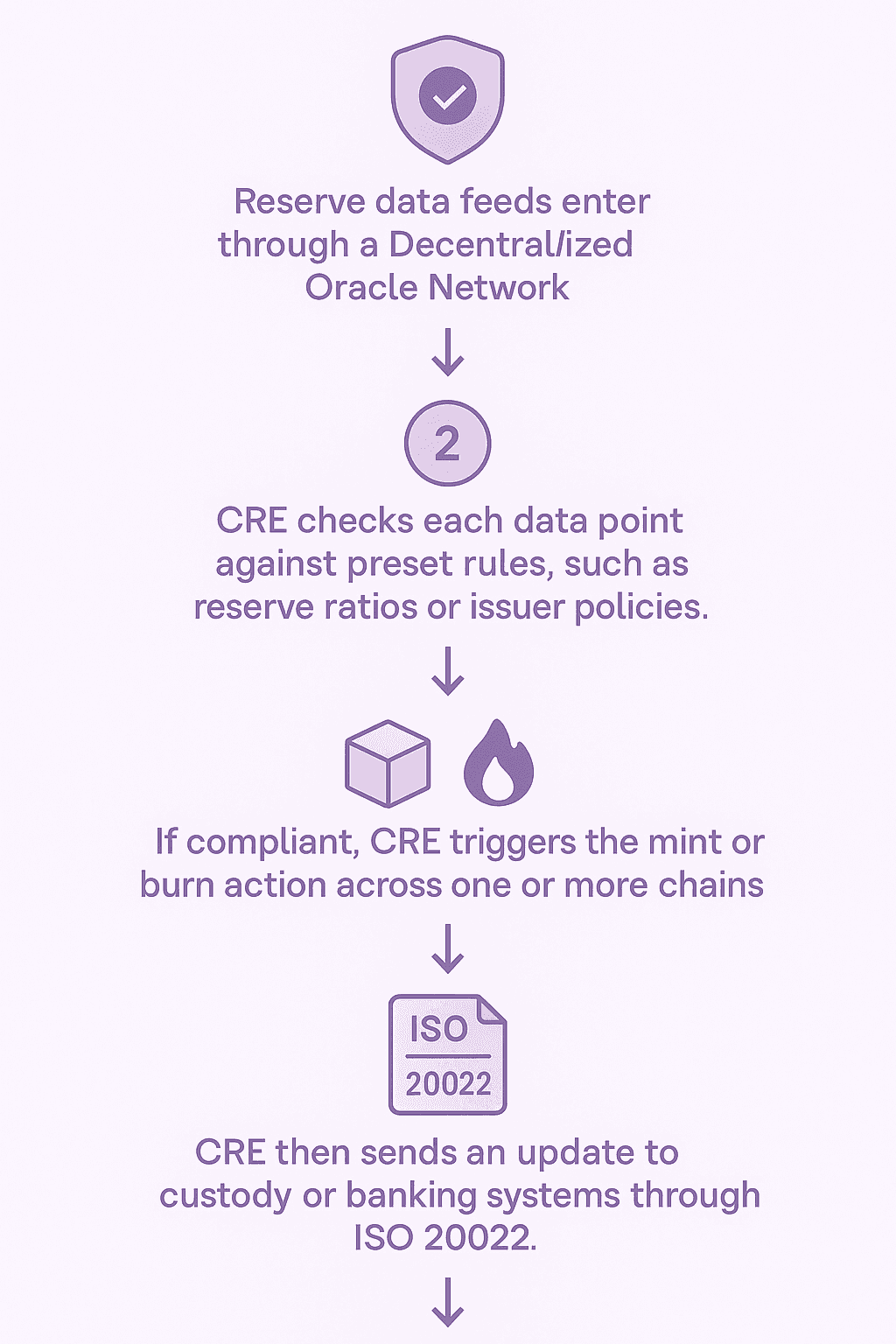

Example Workflow 1: Stablecoin Compliance & Minting Flow (End-to-End)

1. Reserve data feeds come into CRE from a Decentralized Oracle Network

2. CRE looks at each feed against a set of predetermined rules for the reserve (e.g. reserve ratio; issuer's policies etc.)

3. if the reserve is compliant, CRE will trigger the mint or burn on one or more chain(s)

4. CRE then sends an update to the custody or banking system via ISO 20022

5. The audit log is also created automatically so that auditors and/or internal teams have a record of all transactions for regulatory requirements.

This process provides a predictable, repeatable process for teams which eliminates human error and accelerates product launch.

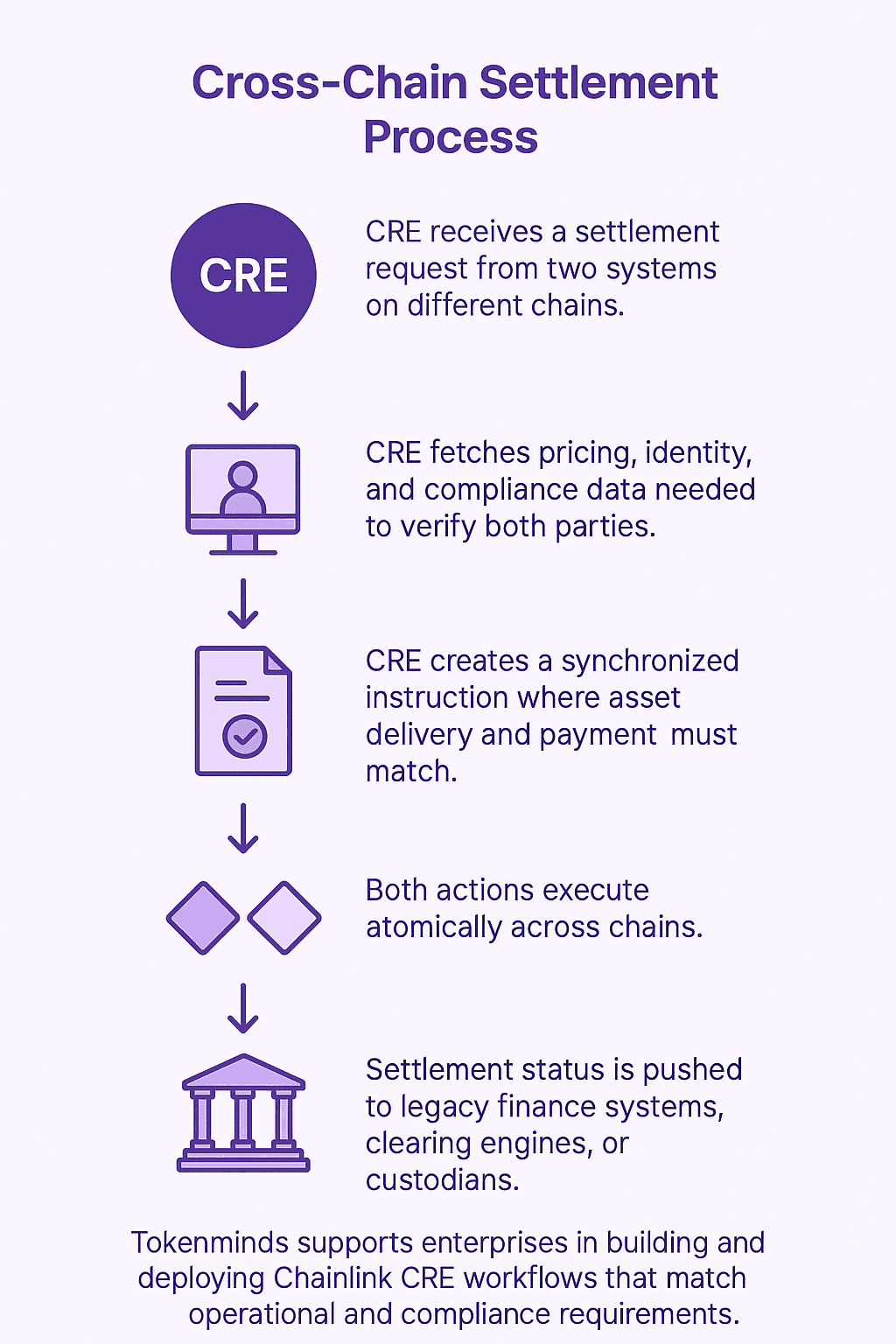

Example Workflow 2: Cross-Chain Settlement Flow (DVP)

CRE gets a request for settlement from two entities that are on separate blockchains.

CRE gathers all of the required information such as price, identity and compliance to validate both parties in this transaction.

CRE then will create an atomic instruction between asset delivery and a transfer of funds so that they are delivered simultaneously.

Both of these actions take place at the same time with each blockchain action being executed independently.

The status of the settlement is sent to legacy financial systems, clearing engines or custodians.

This process eliminates the need for the institutions to perform manual reconciliations and provides them with a safe method of settlement.

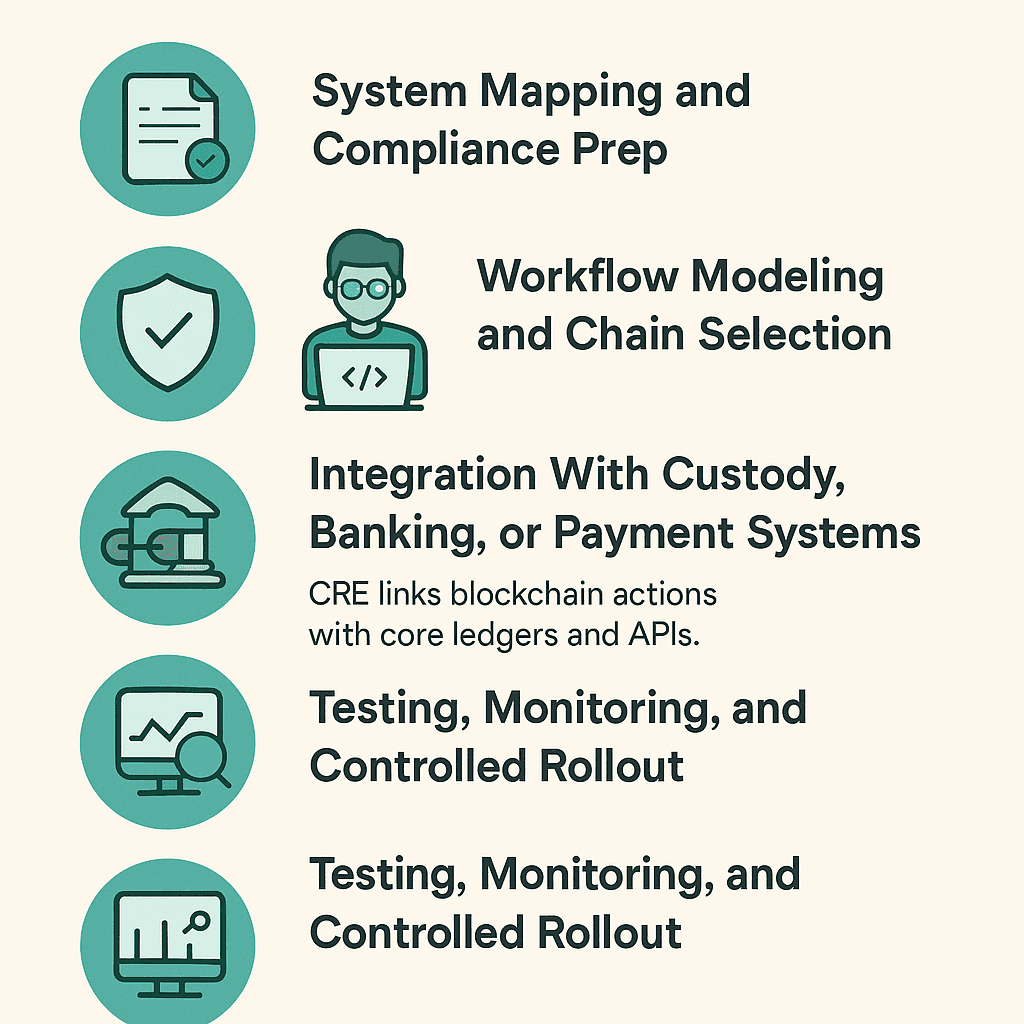

Enterprise Integration Step-by-Step

1. System Mapping and Compliance Prep

Teams review current data flows, KYC rules, asset workflows, and ISO 20022 messaging. CRE modules are matched to each requirement.

2. Workflow Modeling and Chain Selection

Developers design cross-chain workflows in CRE using TypeScript or Go. They choose which chains and networks will host each part.

3. Policy and Identity Enforcement

Compliance rules are scripted into CRE. Identity checks, reserve checks, and audit logs are automated.

4. Integration With Custody, Banking, or Payment Systems

CRE links blockchain actions with core ledgers and APIs. The institution keeps its old infrastructure while extending it with multi-chain workflows.

5. Testing, Monitoring, and Controlled Rollout

Teams run simulations, add monitoring dashboards, audit logs, and automated alerts. Production rollout happens in controlled waves.

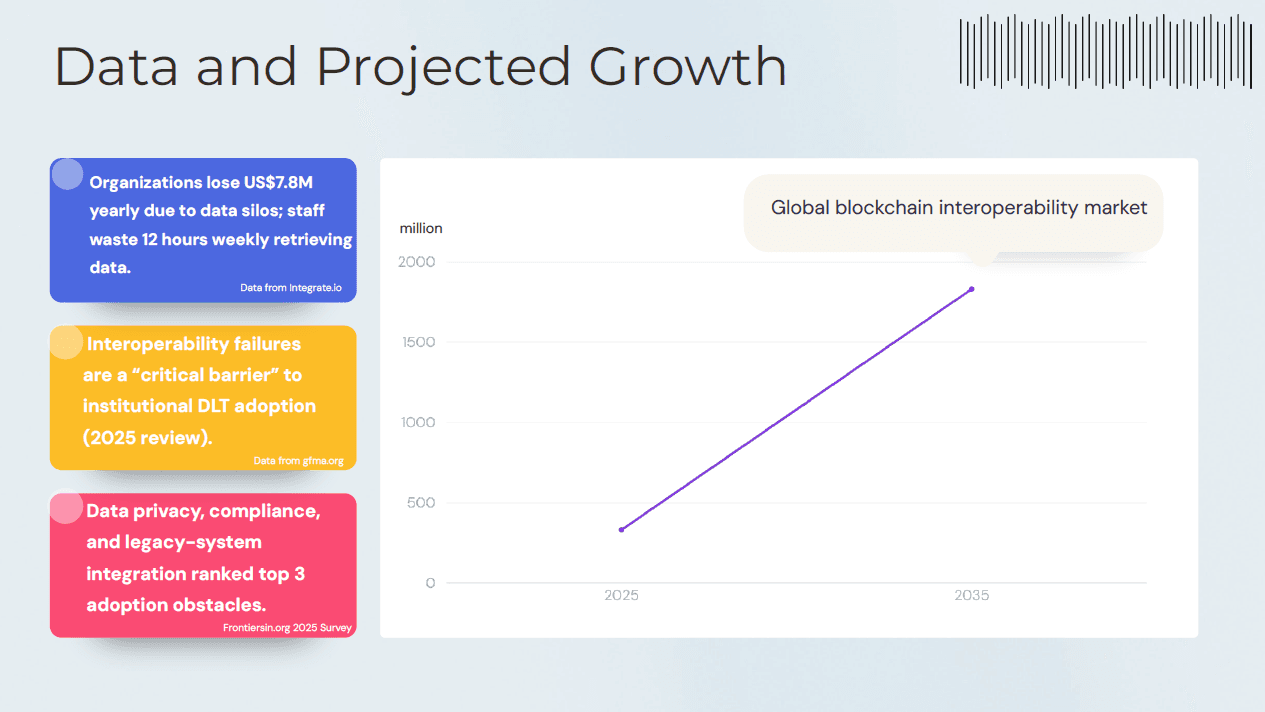

Current Data and Projected Growth

This graph shows the fast growth expected in the global Blockchain Interoperability Market over the next ten years. Right now, organizations lose millions each year because their data is stuck in isolated silos. This limits movement between platforms.

Reports highlight that the lack of interoperation is a key reason companies hesitate to adopt Distributed Ledger Technology (DLT). Other big barriers include data privacy concerns, compliance rules, and integrating legacy systems. As these challenges stack up, the demand for solutions to connect Blockchains, automate compliance, and enhance data workflows has surged. This need is evident in the market growth shown in the graph.

If your organization is exploring cross-chain CRE development, tokenization, or any blockchain initiative that requires secure data movement and compliance, our team can guide you through the entire process.

Interoperability Limitations and Considerations

1. Readiness of an Institution

The organization needs to verify its systems and team members are prepared for cross-chain workflow processing. Most companies will have to be prepared by rolling out multiple phases of system updates.

2. Regulations/Governance

Although, even with CRE (Cross-Chain REcord), the business must adhere to the same KYC (Know Your Customer) AML (Anti Money Laundering), Privacy, and Identity laws as before; the company needs to ensure compliance policies are applicable to all of the chains used by the business.

3. Reliance Upon Ecosystem Health

CRE relies upon a number of ecosystems including oracle operators, node providers and networks. The company needs to confirm the long term viability of the ecosystems being relied upon.

4. Confidentiality/Privacy of Data

Any business using or processing sensitive data should utilize privacy preserving tools and conduct audits to ensure that the sensitive data is protected. CRE has been exploring confidential computations but until CRE achieves compliance to the company's policies then the company must confirm this as well.

Security & Compliance Appendix

CRE follows a layered model that protects data, users, and regulated assets. These controls give institutions confidence during reviews and audits.

Core Controls:

Identity Enforcement: Role-based access and multi-factor approval for all critical steps.

Smart Contract Audits: Third-party reviews plus automated tests for every change.

Tamper-Proof Logging: Every action recorded so teams can trace issues without guesswork.

Encryption: End-to-end protection for all messages and data.

Governance Controls: Multi-sign approvals for minting, burning, or cross-chain actions.

Compliance Gates: Automatic KYC/AML checks before any action can run.

This model mirrors successful security setups used in tokenization, stablecoin, and regulated-platform projects found in enterprise-grade deployments.

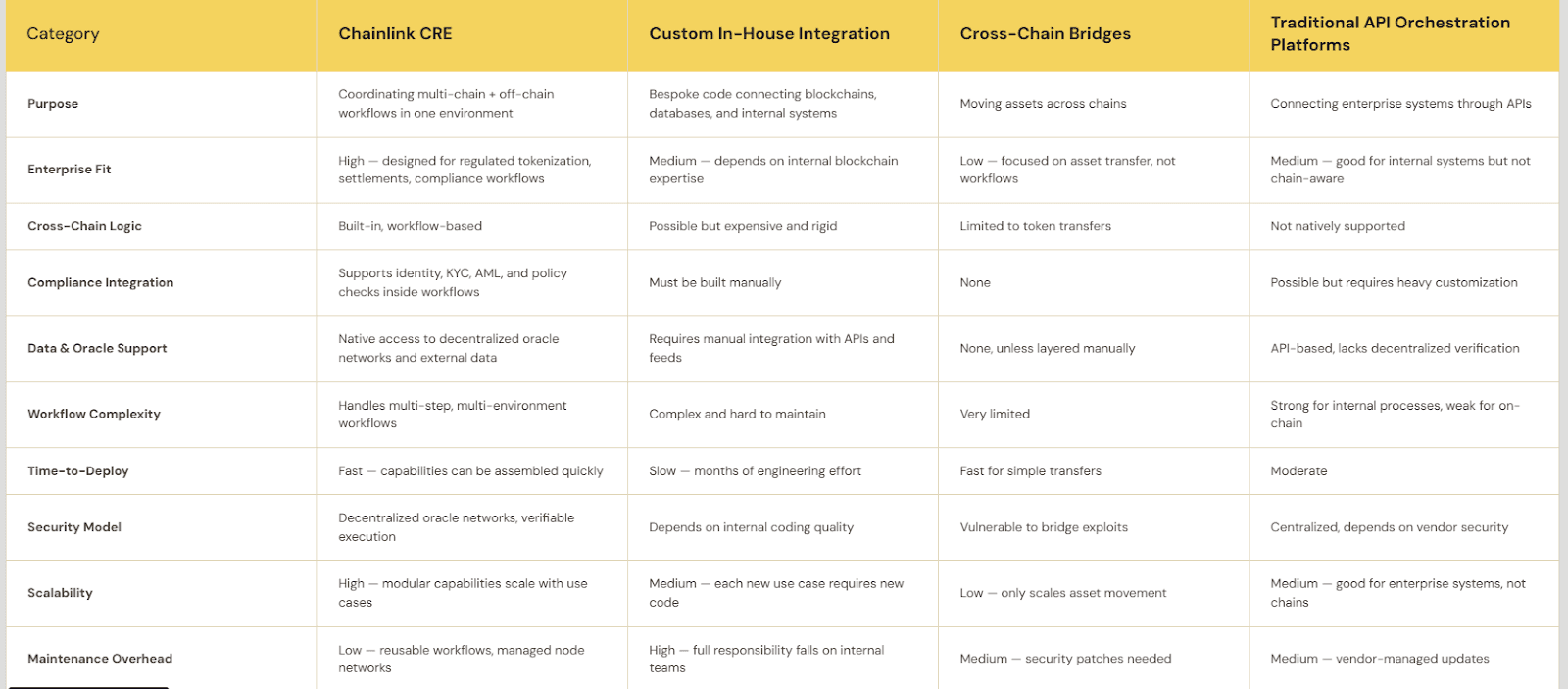

Interoperability Comparison Table

Outlook: What Chainlink CRE Means for Institutionals

CRE may become a key foundation for tokenization, asset management, cross-chain settlement, stablecoins, and hybrid workflows. AI developers, fintech teams, asset managers, and banks can use CRE to launch compliant multi-chain products with less cost and less risk.

As CRE spreads, the industry will move toward a more unified and connected blockchain ecosystem. This will support more tokenized assets, cross-chain systems, and hybrid applications across global markets.

FAQ

1. What problem does Chainlink CRE solve for enterprises?

Chainlink CRE solves the largest roadblocks to business enterprise blockchain deployment —the siloed nature of data; gaps in compliance; limitations imposed by legacy system architecture; and the inability of blockchain technologies to communicate safely across chains. With Chainlink CRE, businesses have a singular platform upon which they may operate compliant and secure workflows across multiple blockchains without having to rebuild their existing architecture.

2. How is CRE different from regular smart contracts?

On their own, smart contracts are limited to executing on a single blockchain and cannot be used to ingest external data or enforce compliance policies. CRE extends this capability. CRE provides a method for ingesting real world data; automating policy checks; executing off-chain computations; and integrating with legacy architectures —thereby enabling smart contract use cases to become practical realities for operational use in the enterprise.

3. Which industries benefit most from Chainlink CRE?

The greatest beneficiaries of CRE will be banks; fintech companies; asset management companies; custodian services; exchanges; and companies developing tokenized products and/or AI-driven workflows. CRE enables the use case of tokenization; stablecoins; settlement; yield strategies; cross-chain interactions; and regulatory workflows —and therefore is suited for both the financial industry and data-intensive industries.

4. Do companies need to replace their core systems to use CRE?

No. A major advantage of using CRE is that it can integrate with existing banking standards, APIs, and enterprise architecture (i.e., custody platforms and ISO 20022 messaging). Therefore, companies may begin to utilize blockchain-enabled features while allowing them to maintain the operation of their critical legacy systems without disruption.

5. Is Chainlink CRE secure and compliant for institutional use?

Yes. CRE has built-in compliance validation; identity checking; audit trail creation; and tamper resistant workflow creation. CRE uses decentralized oracle networks to securely process data. Businesses will still need to comply with all applicable regulatory requirements; however, CRE will enable the automation and enforcement of regulatory requirements for each chain with which businesses interact.

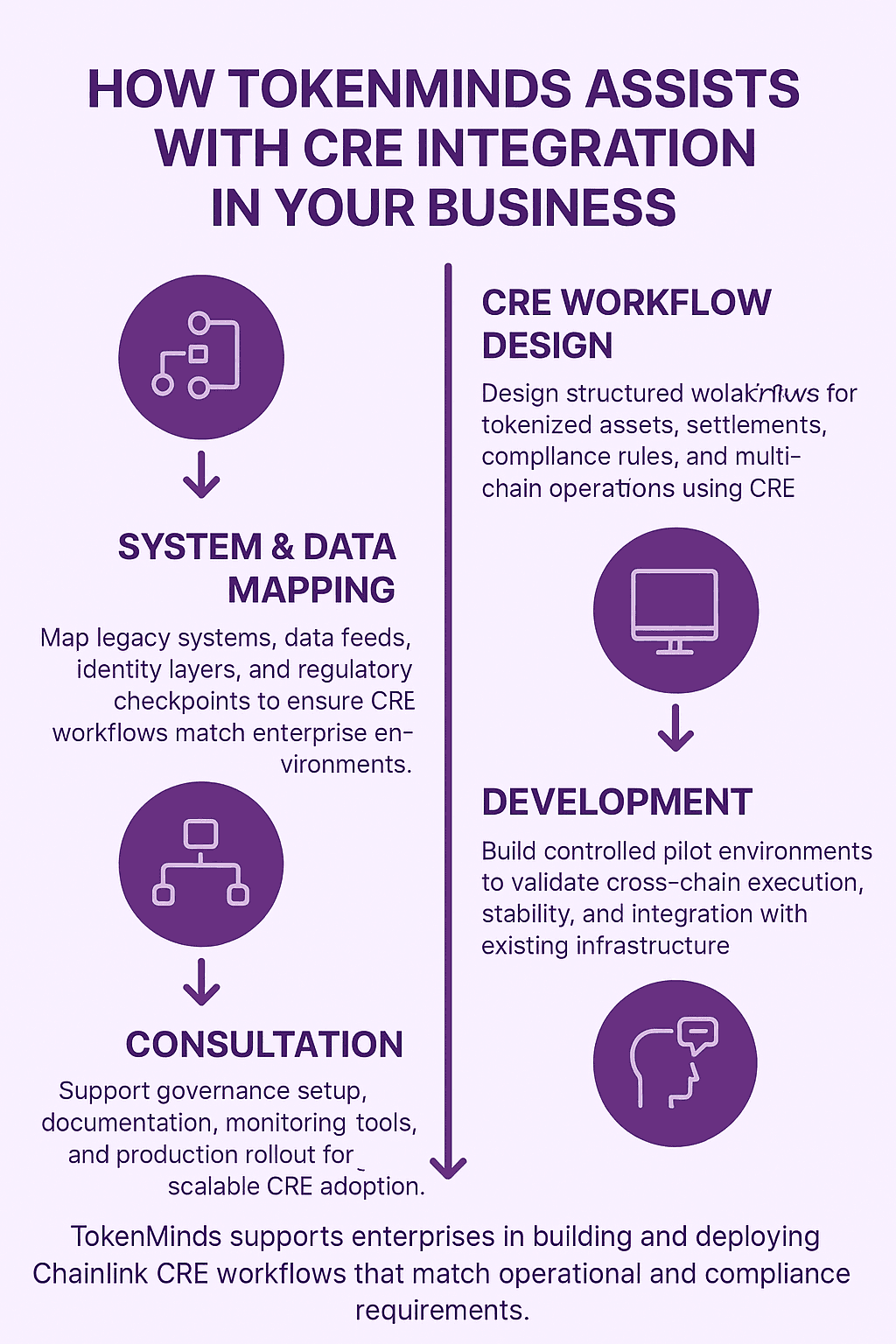

How TokenMinds Assists With CRE Integration For Your Business

TokenMinds integrates each and every CRE component—workflows, systems mapping, etc.—into your current architecture so that it is executable in a way that is predictable, compliant, and testable as part of execution paths.

1. CRE Workflow Design

TokenMinds will work with you to design a customized workflow that will allow your business to efficiently create, manage, settle and comply on tokenized assets across multiple blockchains.

2. System & Data Mapping

TokenMinds will assist in mapping legacy systems, data sources, identity layers, and regulatory checkpoints to be sure that our CRE workflow is compatible with your existing enterprise environment.

3. Development

TokenMinds will help you build out a controlled pilot development environment where we can test cross-chain execution, stability, and compatibility with your existing technology stack.

4. Consultation

TokenMinds will support you in setting up and implementing the required governance structure, creating documentation for all stakeholders, as well as installing and configuring the necessary monitoring tools to enable a seamless transition into production, ultimately supporting long-term, scalable CRE adoption.

Conclusion

Chainlink CRE represents an important step toward increased adoption of enterprise blockchain solutions. To that end, leaders looking at tokenization, cross-chain finance or AI-enabled asset products, will have a cost-effective and compliant method of building modern systems using CRE. The inclusion of cross-chain workflow capabilities, data integration and automated policy enforcement in CRE lowers risk and enables enterprises to innovate while maintaining continuity of their core operations.

Schedule your complimentary consultation with TokenMinds to find out how Chainlink CRE can be used as part of your strategy to develop secure, compliant cross-chain applications without disrupting your existing systems.

Read More

Launch your dream

project today

Deep dive into your business, goals, and objectives

Create tailor-fitted strategies uniquely yours to prople your business

Outline expectations, deliverables, and budgets

Let's Get Started