At some point every company comes at a point where growth is determined by funding. It is not always a question of an Initial Coin Offering (ICO) and an Initial Public Offering (IPO). Both are money raising methods but they are different in speed, cost and control.

The selection of the correct model determines the success in the long term in a fast-changing market. This guide makes a comparison between ICO and IPO between business leaders and investors.

Explore TokenMinds token sales solutions and ICO marketing framework for tailored fundraising plans.

What Is an Initial Coin Offering (ICO)

An ICO raises funds by issuing digital tokens on a blockchain. Tokens may give utility, access, or voting rights instead of ownership.

Tools like TokenMinds TMX TGE framework help automate compliance, track funding, and show investors real-time results.

Learn more at TokenMinds token sales platform for secure and transparent token launches.

How It Works

Planning and Whitepaper: Define goals and token model.

Pre-Sale: Offer tokens early at lower prices.

Public Sale: Sell tokens for crypto or fiat currency.

Distribution: Deliver tokens and enable trading.

Post-Sale Use: Fund operations and growth.

A strong case is TokenMinds MovitOn private sale, which reached 97% KYC compliance and raised $500,000+ in crypto and fiat. Automation built investor trust.

ICOs remove intermediaries, attract global investors, and give founders more control. A skilled crypto token development company ensures compliance and security.

Advantages of ICOs for Businesses

Global Access of Capital: Investors are welcome everywhere.

Fast and Affordable: Quicker and cheaper than traditional rounds.

Liquidity: Tokens trade soon after launch.

Community Growth: Token holders become brand advocates.

Flexible Models: Blockchain allows new funding options.

Projects using Chainlink VRF and staking like Halla Gaming earn faster trust. Results improve with ICO marketing techniques, smart token sale structure, and legal compliance.

Risks of ICOs

Regulation Changes: Laws vary worldwide.

Security Issues: Weak audits risk loss.

Market Volatility: Token prices can drop fast.

Poor Governance: Lack of oversight reduces trust.

Operational Gaps: Weak systems lead to failure.

Strong audits and transparency reduce these risks. The TokenMinds DeFi Lottery used third-party audits and Chainlink VRF to ensure fairness and safety.

A verified crypto token development company keeps launches secure and compliant.

What Is an Initial Public Offering (IPO)

An IPO makes a private company public by listing shares on an exchange. It gives access to institutional investors and boosts credibility.

Unlike ICOs, IPOs follow strict laws and need underwriters. A hybrid option, the Crypto IPO, merges blockchain and public governance.

See ICO marketing techniques and legal guidance for compliant hybrid models.

IPO Process Overview

Underwriting: Work with banks and prepare audits.

Approval: Regulators check filings.

Roadshows: Pitch to investors and set prices.

Listing: Shares trade publicly.

Post-Listing Reports: Follow disclosure standards.

TokenMinds stablecoin governance model uses multi-admin approval and real-time dashboards for transparency while keeping decentralized control.

Advantages of IPOs for Businesses

Large-Scale Funding: Raises capital for growth and expansion.

Public Trust: Builds brand credibility.

Liquidity: Offers exits for founders and staff.

Employee Incentives: Stock rewards boost performance.

Clear Valuation: Market sets the company’s worth.

Compliance with TokenMinds, supported by blockchain, is a step towards ensuring that innovations and protection of investors work together. Companies intending to do Crypto IPOs can learn ICO platform guidelines and laws.

Risks of IPOs

High Costs: Legal and banking fees are large.

Strict Oversight: Regular audits required.

Dilution: Founders lose some control.

Market Pressure: Stock prices affect plans.

Short-Term Focus: Quarterly goals dominate.

The TokenMinds advisory model uses blockchain tools for transparency, analytics, and reporting. See token sale structure resources for hybrid fundraising strategies.

ICO vs IPO: Key Comparison for Business Leaders

Factor | ICO | IPO |

Stage | Early-stage | Mature firms |

Regulation | Light rules | Heavy oversight |

Investor Type | Global crypto investors | Institutional investors |

Speed | Weeks | 6–12 months |

Costs | Low | High |

Liquidity | Fast trading | After listing |

Control | Founders keep control | Shared with public |

Transparency | On-chain data | Audited reports |

According to the analysis of TokenMinds, the Crypto IPOs reduced the time of fundraising by 40% along with full audit visibility.

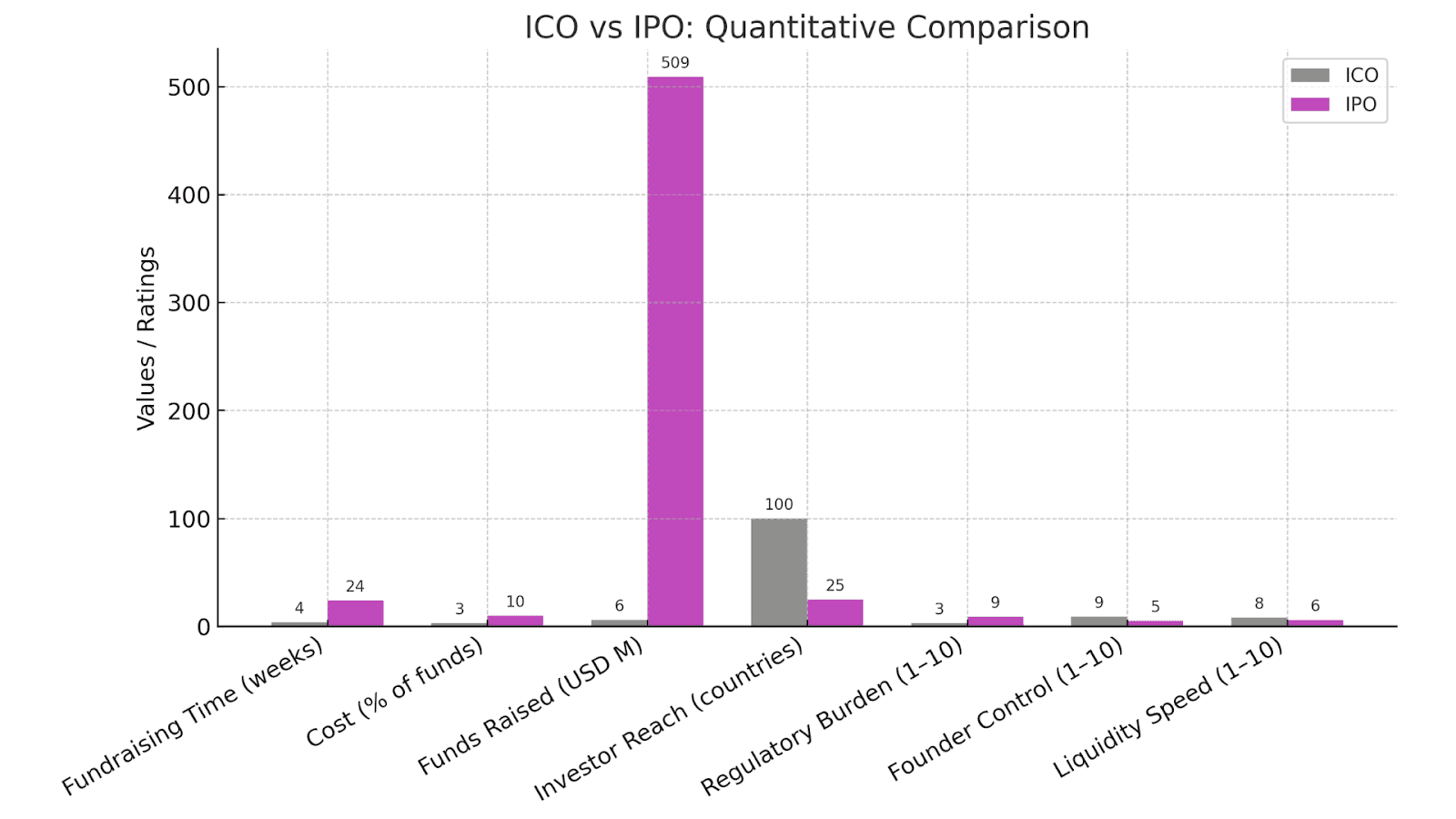

ICO vs IPO: Quantitative Comparison

A visual breakdown of key business factors such as fundraising time, cost, investor reach, regulation, and control. ICOs deliver faster, more flexible funding, while IPOs offer higher credibility and capital depth.

When to Choose ICO or IPO

ICO: Fast and flexible start up capital.

IPO: In established companies that are interested in scale, reputation.

Hybrid: In companies that balance between innovation and compliance.

The 5-phase framework of TokenMinds are planning, compliance, design, marketing, and launch are planned to be at par with business development.

Global Fundraising Trends

IPO Boom: 2,766 IPOs raised $509 billion in 2021.

ICO Growth: 875 ICOs raised $6 billion in 2017.

Hybrid Models: Crypto IPOs unite blockchain and compliance.

TokenMinds research shows hybrid models boost investor onboarding by 35% using KYC and fiat gateways. Trusted crypto token developers build secure, compliant systems.

Decision Matrix for Executives

Goal | Path | Reason |

Fast and flexible capital | ICO | Quick global access |

Institutional credibility | IPO | Builds trust and scale |

Balanced growth | Crypto IPO | Combines both strengths |

Dashboards such as TokenMinds Halla Gaming allow executives to monitor compliance and investor data on real time basis. Token sale legal guidance planning.

FAQs

1. What is the main difference between an ICO and an IPO?

An ICO issues blockchain-based tokens to raise capital, while an IPO sells company shares on a regulated exchange.

2. Can a company pursue both ICO and IPO models?

Yes. Other companies raise ICOs to finance themselves at an early stage and then convert to IPOs in their mature stages when they need institutional financing.

3. Which option raises funds faster?

ICOs usually complete within weeks. IPOs can take several months due to regulation and underwriting.

4. How can a company reduce ICO risk?

By working with a crypto token development company and following token sale legal guidelines to ensure compliance and smart contract security.

5. Why choose TokenMinds?

TokenMinds assists companies in their tour through the online and offline fundraising frameworks. Their services of ICO marketing techniques and token sales consulting help in projects to be both legal, technical and investor standards. Conclusion

Conclusion

Choosing between an Initial Coin Offering (ICO) and an Initial Public Offering (IPO) is no longer only about technology or tradition. It is a question of strategy, control, and audience.

ICOs bring agility, speed, and global reach. IPOs guarantee credibility, structure as well as trust. The future that seems to be there is hybrid models the Crypto IPOs which incorporates the transparency of blockchain and the power of regulations.

Companies can have access to the capital they need at a low cost with a high level of governance integrity through the advisory process: discovery, compliance audit, design, marketing, and execution through TokenMinds. This disciplined channel can assist start ups as well as businesses to achieve a balance between innovation and sustainability.

For businesses planning their next fundraising phase, TokenMinds token sales experts provide guidance on structure, compliance, and execution. Leaders can also become a client to design funding strategies that balance innovation and sustainability.

Get Expert Guidance for Your Next Fundraising Round

Book your free consultation with TokenMinds to discuss fundraising tactics for your Web3 business.