TL;DR

How to enable event-based conditional protection in trade finance by using blockchain to automate LC-like payments, guarantees, insurance, escrow, and receivables settlement, where funds are locked on-chain and released automatically when verified events occur, delivering instant settlement, clearer outcomes, lower credit risk, and scalable operations without added costs.

A buyer or seller of an internationally traded item has no control over the potential loss created by the external risk to their ability to complete their side of the transaction. Weather-related delays cause ships to remain at sea longer than originally planned. Political actions can result in ports being closed; therefore, trade routes may become impassible. Flooding can occur in warehouses. Extreme heat can damage the items shipped in containers. These types of external events result in financial loss to both sides of the transaction. Buyers pay for items that arrive damaged or late. Sellers experience payment delay when their items cannot be timely delivered to meet scheduled delivery obligations.

In trade protection, timing is critical. For example, if a shipment is delayed by 14 days as a result of a port closure, sellers must have instant access to working capital so that they can fill their next order and continue to operate as normal. Buyers must also know immediately whether they are liable to pay for an item that they have ordered but cannot obtain.

The traditional methods of insuring against these potential losses via collateral cannot provide the instantaneous response required to prevent the ripple effect of financial disruption to all parties involved in the supply chain.

Blockchain-based international trade systems will enable instantaneous automation of the linkage between the verification of events impacting the trading parties and the provision of financial protection to those trading parties, a structure enabled by consistent financial contract standards.

Financial Instruments Affected by Event-Based Conditional Protection

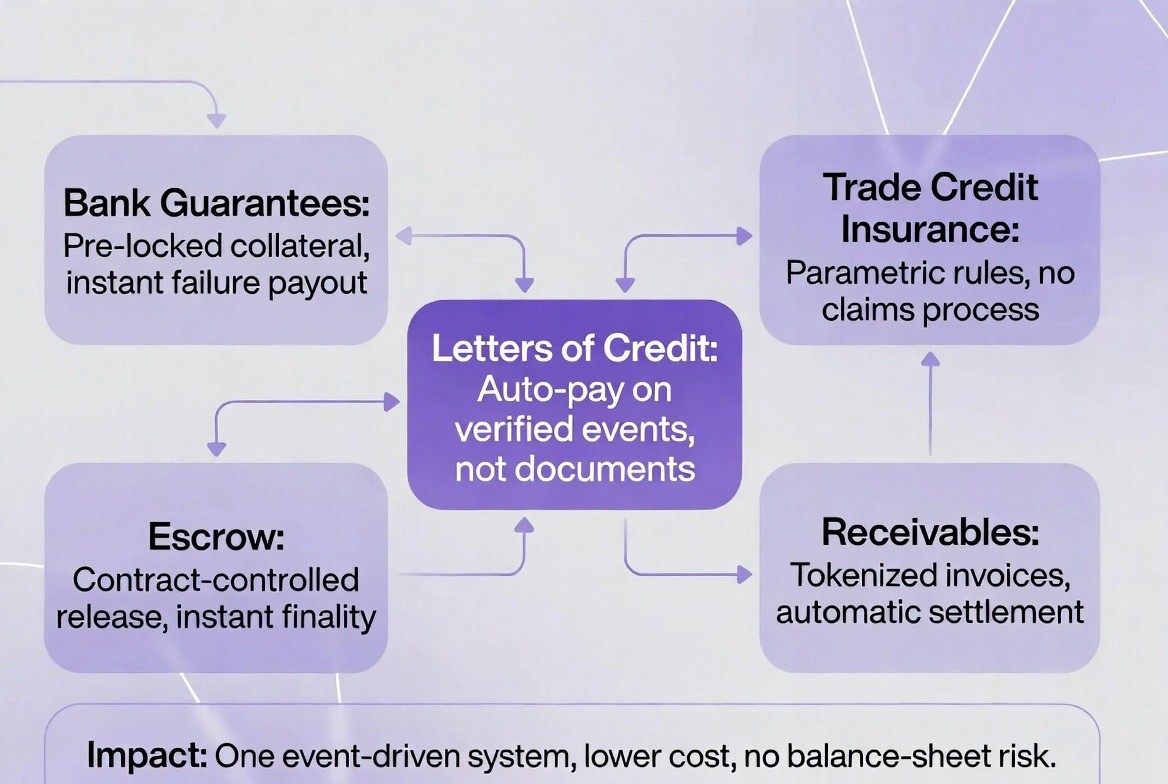

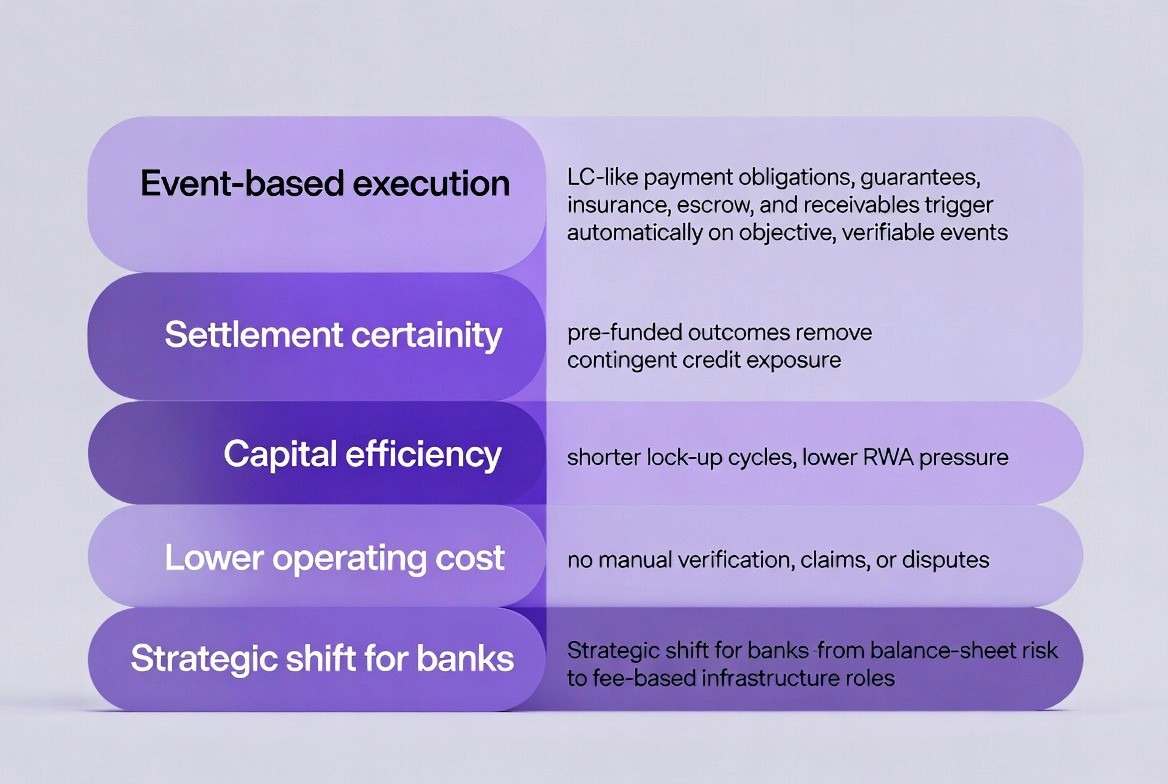

Event-based conditional protection changes how five key trade finance instruments work: letters of credit, bank guarantees, trade credit insurance, escrow arrangements, and receivables settlement. Today, all of these tools depend on checking documents after an event has already happened and on people manually approving payments. Blockchain technology replaces this process with automatic settlement that is triggered by verified events and runs without human involvement, a structure enabled by this blockchain-based receivables settlement.

Letters of Credit (LC-like Payment Obligations)

Traditional letters of credit require banks to review documents before releasing payment. Bank staff must carefully check bills of lading, invoices, certificates of origin, and packing lists to make sure they exactly match the terms of the letter of credit. In practice, 50 to 70 percent of document submissions contain errors or differences. These issues cause delays, negotiations, and changes that can take days or even weeks.

With event-based smart contracts, payment is no longer tied to document review. Instead, payment is released when verified events confirm that goods were shipped, delivered, or met agreed quality standards. For example, instead of checking a shipping document, the smart contract receives time-stamped shipping data directly from a carrier’s system. Once the conditions are met, payment is released automatically.

The new technology shifts how banks operate with their Letter of Credit (LOC) model. Instead of manually checking documentation, they will provide a system to facilitate and automate the clearing of payments. The fees that banks generate for these platforms and custody services have replaced the fees they generated from reviewing documentation and extending credit to their clients. Since the buyer has already funded the payment, which is also held in escrow by the smart contract, banks do not bear any credit risk and therefore need less regulatory capital than before.

Bank Guarantees and Performance Bonds

A performance bond issued by a traditional bank is a promise made by the bank to provide compensation for nonperformance by a seller. Performance bonds and traditional bank guarantees represent an obligation to provide compensation (a liability) from the bank's balance sheet requiring bank regulatory capital. After a failure has occurred the Buyer is required to file a Claim for Compensation with documentation; and, subsequently, bank personnel will evaluate the Claim and determine whether the compensation is warranted; this evaluation may take up to 30 business days and frequently involves dispute(s).

The performance bond based on Smart Contract technology operates in a different manner. At the beginning of the transaction, the collateral is locked within the Smart Contract. A performance guarantee is provided when measurable and objective criteria indicate that the Seller failed to fulfill its obligations - such as delivery delayed by more than 14 days or failing to comply with quality standards verified by sensor(s). The Smart Contract then automatically releases the bond to compensate the Buyer for the Seller's nonperformance without any need for a formal Claim for Compensation or manual review by bank personnel.

Trade Credit Insurance

A typical trade credit insurance model follows the same steps as most forms of property and casualty (P&C) insurance. Once an insured experiences a loss, they will file a claim with the insurance company. After receiving the claim, the insurance company assigns an insurance adjuster to evaluate the claim, determine if the event was included in the scope of the insurance policy, and make the payout determination. This process typically takes anywhere from 30 to 60 days and can result in disagreements over what events were covered by the insurance policy, as well as the amount of the payout.

Parametric trade credit insurance utilizes smart contracts to eliminate the need for an insurance claims process. Insurance companies write their insurance rules directly into the smart contract's programming. Therefore, when trusted data sources verify that a predetermined event occurred (for example, a port closure for a certain number of days), the smart contract releases the payment without the need for a claims process, adjuster involvement, or negotiation.

This approach significantly decreases the operating costs of insurers. Additionally, it provides a practical means to offer small insurance policies, whereas traditional insurance models require a minimum policy size to be economically viable because of the associated cost of processing each claim. Since smart contracts are processed at very little cost, insurers are able to offer micro-insurance policies and expand their customer base more efficiently than before.

Escrow Arrangements

Smart Contract Escrow eliminates the need for an intermediary trusted party (such as a bank or escrow company) to physically hold the funds until all terms of the escrow agreement are met. The intermediary will check to see if the conditions have been satisfied before the money is released, which creates time, cost, and risk associated with trusting an intermediary. International trade contracts create additional complexities and increased costs when dealing with multiple legal systems.

Smart Contract Escrow automates the process for release of funds based upon the predetermined conditions of the contract, eliminating the need for a trusted intermediary. Once all parties agree to the terms of the escrow contract, each party can view and verify the terms prior to depositing funds into the escrow account. When the conditions of the contract have been met, the funds are automatically transferred and settlement occurs in seconds and is final.

By utilizing smart contracts for escrow services, banks benefit from reduced costs and increased speed of execution. Rather than manually controlling the release of funds, banks provide the technical infrastructure for automated escrow services. Banks are able to scale their escrow services to large volumes of transactions without adding personnel or increasing operational complexity.

Receivables Settlement and Factoring

The process of a seller receiving cash early by selling their invoices to a factoring firm for less than they would have received if the invoice was paid in full, traditionally involves the factoring company checking the invoice for validity, assessing the buyer's credit risk, and handling the collection of payment when it is due. In cases where the buyer does delay or dispute payment the factoring firm will face additional costs as well as increased levels of uncertainty.

On the other hand, tokenized receivable and event-based settlement allow an invoice to be converted into an on-chain asset and contain built in payment rules (i.e., smart contract) so that the payment is released to the holder of the invoice automatically upon confirmation of delivery or when the payment deadline is met. Since there are clearly defined, and automatically enforceable terms, factoring firms may purchase these tokenized invoices based on those same definitions.

In doing so, financial institutions may reduce their exposure to credit risk and operational costs. The process of checking invoices for legitimacy, tracking payments made, and collecting monies owed, will all be handled through automation. Therefore, financial institutions will be able to provide receivables financing at lower costs, and provide such services to many small businesses which historically were unable to participate in traditional factoring arrangements.

Cross-Instrument Impact: A Unified Settlement System

Across all five instruments, the main change is the move from manual checks after an event to automatic execution based on verified conditions. Financial institutions benefit from lower costs, faster settlement, fewer disputes, and the ability to scale without adding staff or increasing balance sheet exposure.

By using blockchain-based, event-driven settlement, institutions can replace many separate processes; document checking, claims review, escrow management, and collections—with one shared automated system. This reduces complexity, removes duplication, and creates a single technology platform that supports multiple trade finance products.

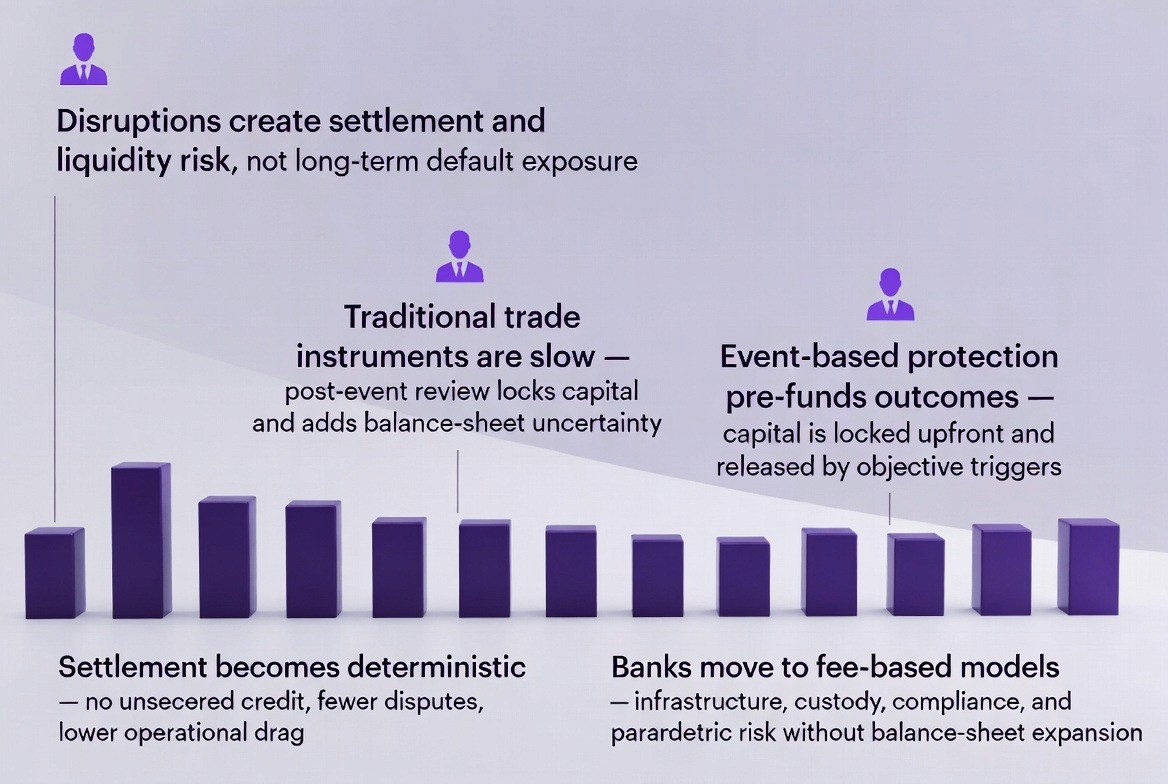

For banks, insurers, and trade finance intermediaries, international trade disruptions primarily create settlement credit risk, liquidity uncertainty, and operational cost rather than long-term counterparty default risk. Traditional instruments such as letters of credit, trade guarantees, and trade credit insurance rely on post-event document verification and discretionary settlement, tying up capital and creating prolonged uncertainty on balance sheets.

Limitations of Traditional Trade Protection Systems

Traditional trade protection depends on sequential document processing after an event has already caused financial harm. A seller whose shipment is delayed by a port closure must first gather evidence. This includes port authority notices, shipping manifests, bills of lading, and carrier confirmations. The seller submits these documents to an insurance provider or bank. The insurance provider assigns a claims adjuster to review the submission.

The adjuster verifies that the documents are authentic. The adjuster determines whether the event qualifies for protection under the policy terms. This determination is often subjective. Different adjusters interpret the same event differently. The adjuster may request additional documentation. Each request extends the timeline by 5 to 10 business days.

After the claim is approved, the insurance provider processes payment. Payment processing takes an additional 7 to 14 business days depending on banking systems and currency conversion requirements. The total timeline from event occurrence to settlement ranges from 21 to 45 days. During this period, the seller cannot access working capital. The seller may default on other obligations. The buyer remains uncertain about payment obligations.

Document-based systems also create disputes. Sellers claim that events qualify for protection. Insurance providers claim that events do not meet policy definitions. These disputes require arbitration or legal proceedings that extend timelines by months or years. The uncertainty prevents both parties from making accurate financial forecasts.

Benefits of Event-triggered Condition Protection for Financial Institutions

Event-triggered condition protection enables financial institutions to reduce settlement uncertainty, improve capital utilization, and lower operational cost by enforcing predefined outcomes at the moment disruption conditions occur, a capability typically implemented through enterprise smart contract development practices.

1. Elimination of settlement credit risk

Conditional protection through an event-based approach eliminates uncertainties associated with settling trades as it converts all potential trade disruption outcomes into pre-funded executions that can be determined at any point in time. The reason for this is that once collateral is locked prior to a trade being executed, it will be automatically released (in accordance with predetermined and verifiable criteria) after the occurrence of any objective events associated with a trade. Therefore, the bank's contingent credit exposure during any delay or disruption is shifted away from subjectively determining the impact of the event and/or providing interim exposure to objectively determining the outcome of the event which will occur upon meeting the condition.

2. Improved capital efficiency and balance-sheet optimization

Trade instruments traditionally require significant amounts of capital tied up for an extended period of time until a review of events has been completed and claims have been processed. In contrast, blockchain-based conditional protection commits capital once and reallocates it upon the initial occurrence of the trigger conditions. This results in shorter cycles of capital lock-up, lower risk weighted asset requirements, and ultimately, the ability for banks to provide increased transaction volume support without requiring an increase in their overall balance-sheet size.

3. Significant Cost Savings Associated with Dispute Resolution

As a result of eliminating manual verification of documents, claims assessment, reconciliations, and dispute resolutions, smart contracts are able to execute the terms of the protection agreements automatically using verifiable objective data inputs thereby eliminating the need for subjective interpretations of the data used to determine whether the protection agreement should pay out. As a result of this, financial institutions eliminate costly and time-consuming workflows and replace them with deterministic executions of the terms and conditions of the protection agreements thereby significantly reducing both operational costs and legal expenses.

4. Transitioning to Scalable Fee-Based Infrastructure Roles

By utilizing event-based conditional protection, banks transition from balance-sheet intensive credit intermediary roles toward fee-based roles centered around settlement infrastructure, collateral custody, compliance services, and parametric risk products. As such, banks begin to earn revenue from the execution of transactions and/or the orchestration of systems as opposed to absorbing disruption risk, thus allowing banks to develop more scalable and predictable revenue models.

5. Increased Predictability of Liquidity, Auditability and Regulatory Confidence

Given that the trigger conditions, payout formulas and execution timeline(s) are specified in advance and recorded permanently on chain, the future liquidity outcome of a trade can be modeled completely. Additionally, because every action taken from the provision of event data to the final settlement is time-stamped and verifiable, financial institutions possess real-time visibility into each trade; auditable records of each trade; and enhanced regulatory defensibility without having to rely on retroactive reconciliations.

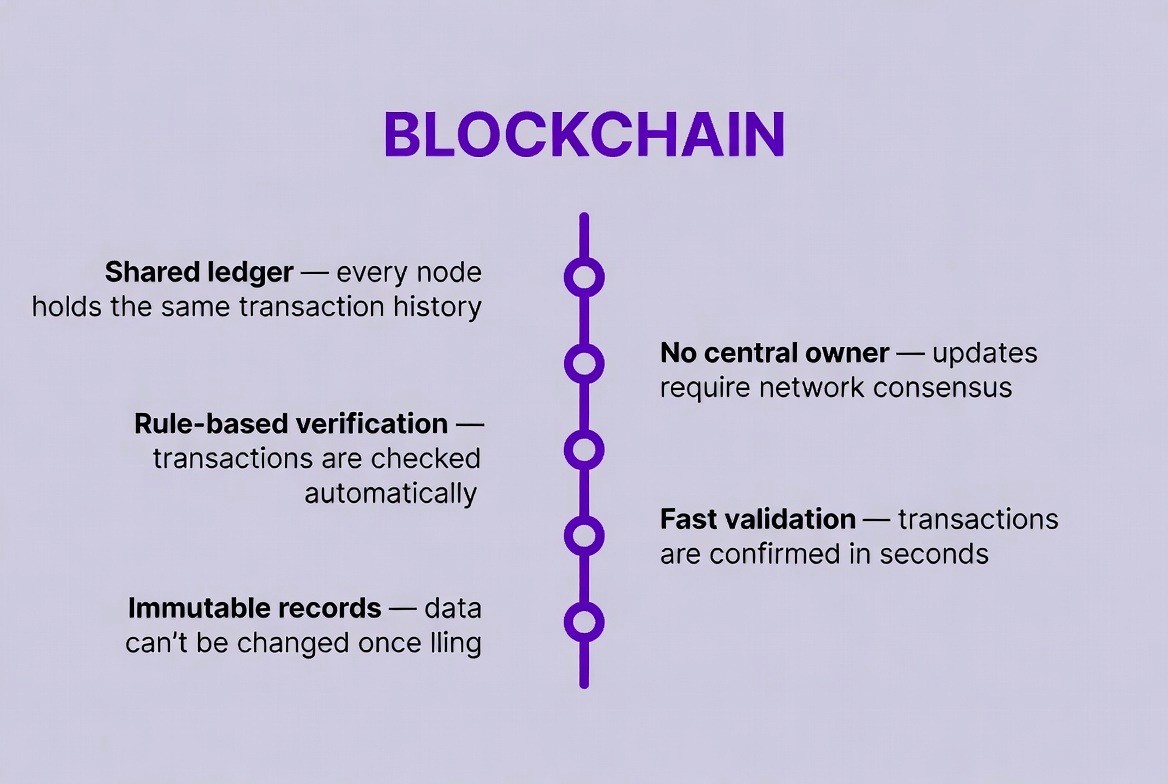

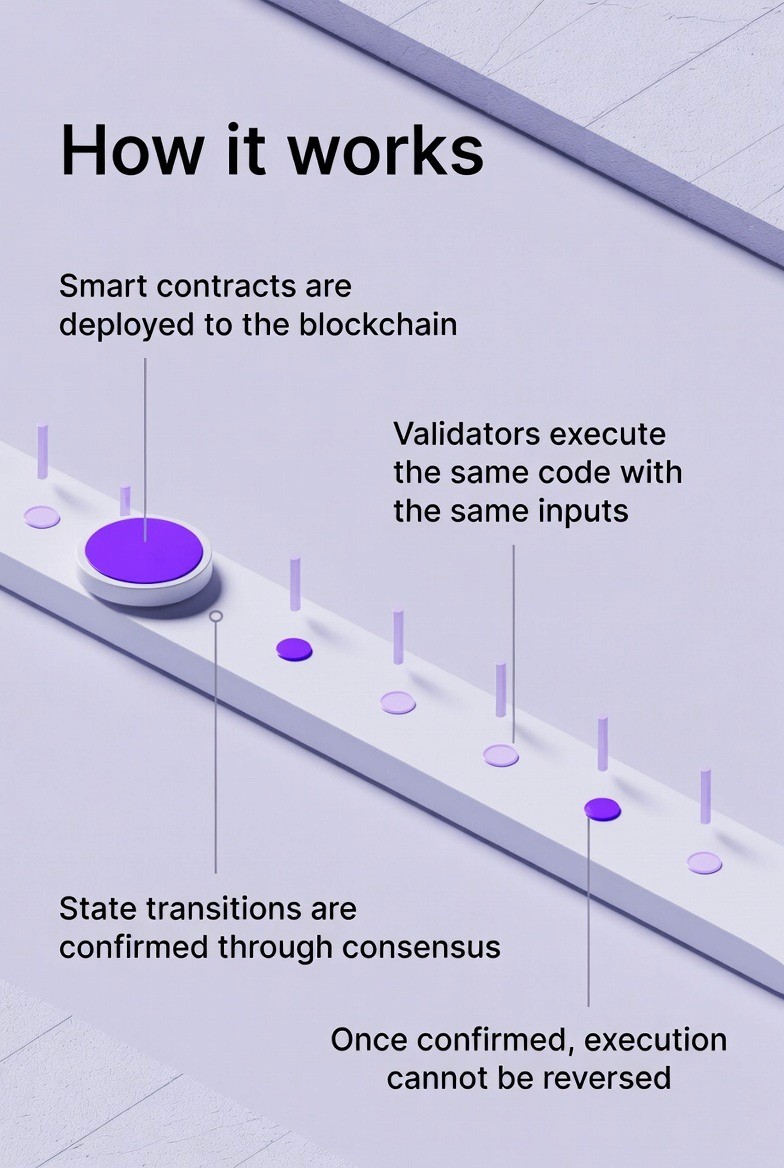

Blockchain for International Trade

Blockchain is a public ledger created and maintained by a group of computers working together as a network. Every node in this network has a duplicate of the entire history of transactions. All nodes agree on the order of all transactions (e.g., which came first). Transactions go through a process called "verification," in which the nodes verify whether the transaction violates any of the predefined rules. Once a transaction is successfully verified, it will be permanently added to a block of data; every block is locked to the prior block via cryptographic hash linking. The "chain" of blocks is the blockchain.

All data stored in a blockchain is permanent, no one can delete or alter data once it's been written into the blockchain. There is no single authority controlling a blockchain; for changes to the blockchain to occur, there must be agreement among multiple parties. Therefore, a blockchain does away with the need to rely upon a third-party intermediary to keep an accurate record.

Each time a new transaction is made in a blockchain, the network uses a validator to confirm whether the transaction meets the predetermined requirements. Validators confirm whether users have spent the same asset twice, whether they have changed their past records, and whether they've tried to create fake transactions. This validation process is automatic, and takes place in under a second.

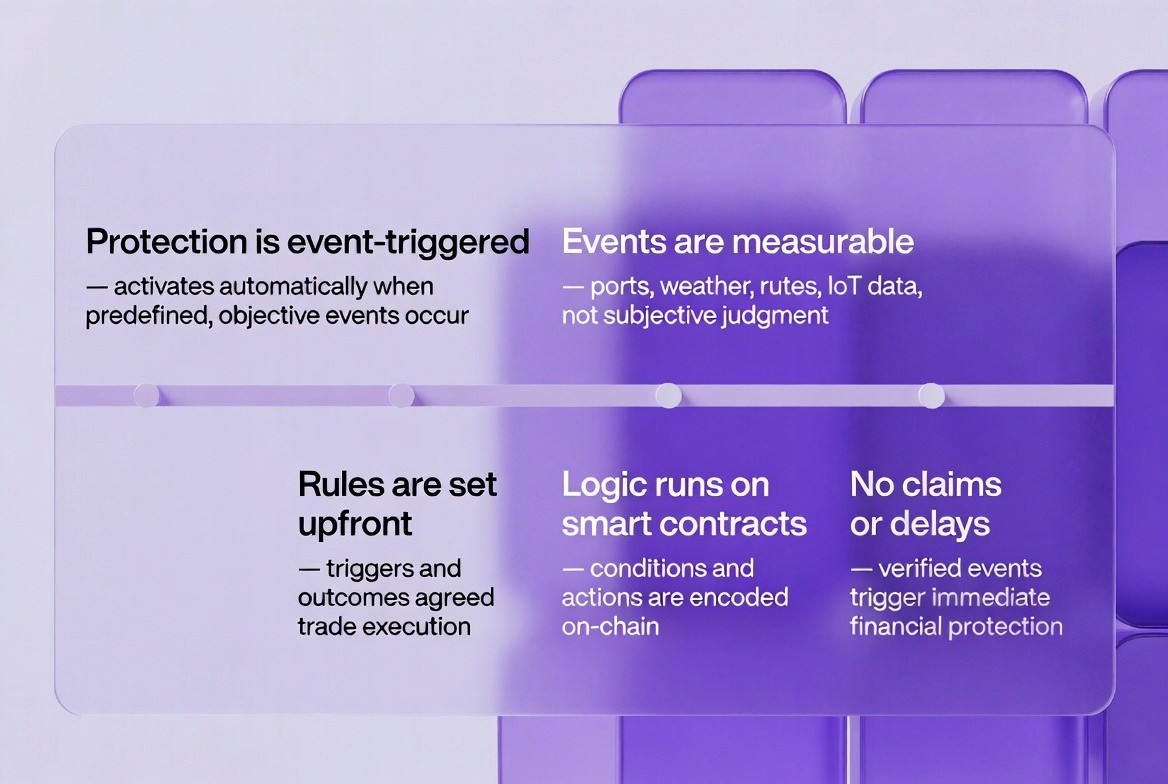

What Event-based Conditional Protection Means

Event based conditional protection refers to the method of financial protection that is triggered automatically when an externally defined event occurs. Events must be both measurable and objective. Examples of objective events include: Port closures as announced by maritime authorities; Weather conditions reported by meteorological services; Route interruptions as confirmed by shipping companies; Temperature levels as reported by IoT devices. Subjective judgments are not permitted.

The protection logic is agreed upon before trade execution. Both parties specify which events trigger protection, what form the protection takes, and how the protection is delivered. These terms are encoded into a smart contract. A smart contract is a program stored on a blockchain that executes automatically when specified conditions are met.

No manual claims are required after an event occurs. The smart contract receives verified event data from an external source. The smart contract evaluates whether the event meets the predefined conditions. If conditions are met, the smart contract immediately executes the protection mechanism. This may include releasing collateral, transferring stablecoins, activating insurance coverage, or adjusting payment terms.

How blockchain enable Event-based conditional Protection in International Trade

What makes event-based trade protection workable is the way smart contracts combine external event data with predefined rules to trigger settlement automatically, removing manual review and post-event negotiation from the process.

1. Protection logic is encoded as deterministic conditions

Protection Rules in Smart Contracts are implemented through Conditional Logic. The conditional logic for each rule is in the form of If/Then statements comparing input data to pre-defined criteria stored on-chain by the smart contract. Each smart contract includes the following:

Numeric Thresholds (Example: Wind Speed Limits)

Geographic Constraints (Distance from Shipping Route)

Time Constraints (Delivery Deadline)

Payout/ Settlement Actions

Once a Contract is deployed, the logic of the contract can no longer be modified.

2. External events are supplied as objective data inputs

External events are delivered through oracles such as Chainlink.

Examples of oracle-fed data:

wind speed from meteorological agencies

port closure notices from authorities

route disruption data from logistics providers

When oracle data arrives, the smart contract reads the value and compares it to the stored parameters.

3. Threshold checks determine whether protection activates

The contract performs numeric comparisons. Typical event classes include:

Weather events (wind speed, rainfall, temperature)

Port status events (open, restricted, closed)

Route disruption events (blocked, rerouted, suspended)

Geopolitical or regulatory events (sanctions list updates, trade bans)

Each event class is encoded with its own on-chain variables.

Example state variables:

stored threshold: wind speed > 75 mph

oracle input: measured wind speed

If the measured value exceeds the threshold, the condition evaluates to true. If not, it evaluates to false.

These checks are deterministic and produce the same outcome every time for the same inputs.

4. Boolean logic combines multiple conditions

Smart contracts use Boolean operators to model real trade scenarios.

AND requires all conditions to be true

OR requires at least one condition to be true

Example:

protection activates if wind speed exceeds 75 mph AND

the event occurs within 100 miles of the shipping route

This allows precise modeling of protection scope without human interpretation.

5. Time-based rules handle delays without external data

The contract stores expected delivery dates as Unix timestamps.

The blockchain’s consensus time is used to determine:

whether a deadline has passed

how long a delay has lasted

For example:

expected delivery date: T

current block time: T + 15 days

If the delay exceeds a defined threshold, the contract automatically triggers the corresponding protection logic, such as penalty calculation or alternative settlement terms.

6. Settlement executes immediately with finality

Once conditions are satisfied, the smart contract executes the predefined action:

releasing collateral

redirecting escrowed funds

settling tokenized payment claims

Using networks such as Hedera, settlement achieves fast, deterministic finality, a capability increasingly implemented through this bank-grade stablecoin framework. Once executed, the outcome cannot be reversed.

How Disputes are Eliminated By Design

Disputes do not occur because the decision-making process has been eliminated.

Event data is machine-measured, and therefore objectively measured;

Thresholds are numeric and predetermined;

The transaction is executed automatically and immediately;

Records cannot be changed once created, and are time-stamped.

There is no need for an interpretation of the event's circumstances, there is no need to have a claim reviewed, nor will the parties negotiate the terms after the fact. The rules that govern the trade were agreed upon prior to the start of the trade and the terms of the contract ensure the rules that were agreed upon are followed as stated.

In essence, Blockchain replaces subjective evaluation with deterministic execution and converts trade protection from a process to a deterministically executable outcome.

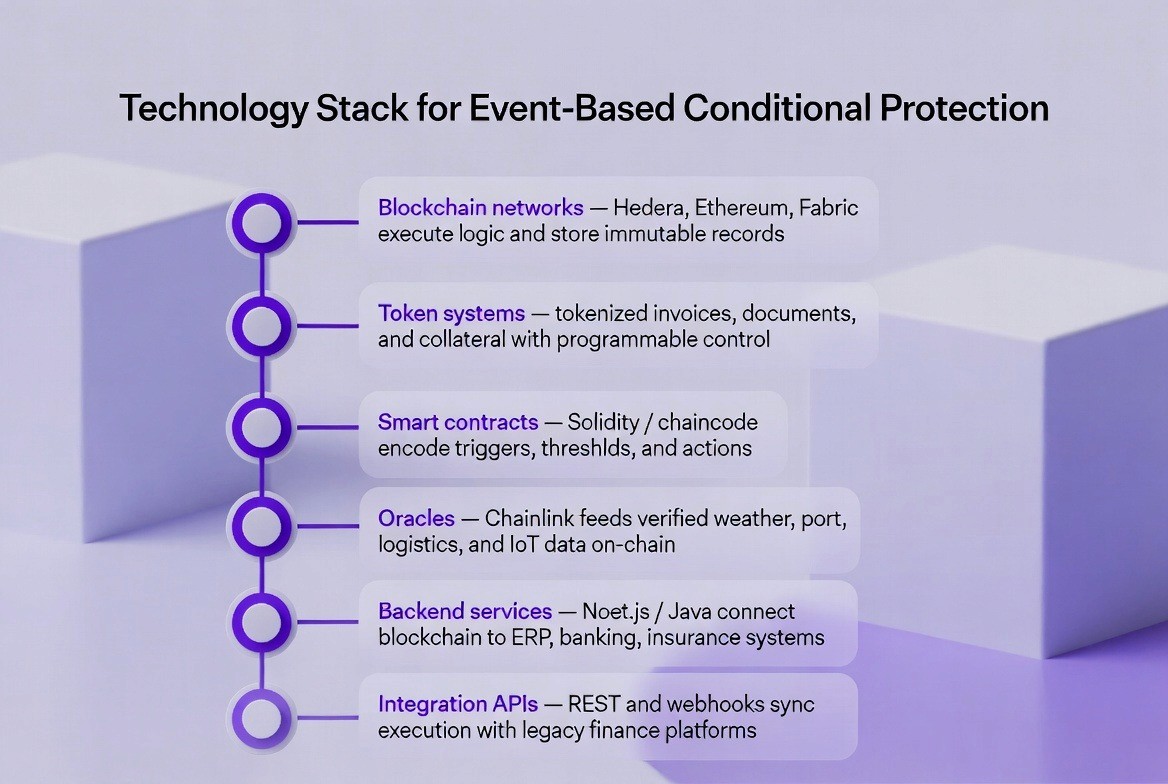

Technology Stack Used for Event-based Conditional Protection

Event-based conditional protection systems require several technical components that work together. Each component serves a specific function in the automated protection workflow.

• Blockchain networks: The system can operate on Hedera Hashgraph, Ethereum, or Hyperledger Fabric. Hedera Hashgraph provides high transaction throughput with low fees and fast finality, making it suitable for high-frequency trade events. Ethereum provides broad ecosystem support and extensive smart contract tooling. Hyperledger Fabric provides permissioned networks suitable for enterprise consortia. The blockchain network stores all transaction records, executes smart contracts, and maintains the immutable audit trail.

• Token systems: Hedera Token Service or Ethereum-based token standards enable the creation of tokenized assets. Tokenized invoices represent the legal claim to payment for delivered goods. Tokenized trade documents represent bills of lading, letters of credit, or warehouse receipts. Tokenized collateral represents stablecoins or other digital assets held as protection. These tokens are programmable, meaning their transfer and release can be controlled by smart contract logic.

• Smart contract languages: Solidity is used for Ethereum-based implementations. Hedera Smart Contracts also support Solidity. Hyperledger Fabric supports chaincode written in Go, Java, or JavaScript. The smart contract contains the conditional logic that evaluates event data and executes protection mechanisms. The contract defines which events trigger protection, what thresholds must be met, and what actions are executed.

• Oracle providers: Chainlink is the most widely used oracle network for connecting external data to blockchain smart contracts. Oracles retrieve data from external sources including weather APIs, port authority systems, shipping carrier databases, and IoT sensor networks. Oracles cryptographically sign the data to prove authenticity. The oracle delivers the signed data to the smart contract on-chain. Without oracles, smart contracts cannot access information about real-world events.

• Backend services: Node.js or Java applications provide the interface between blockchain systems and enterprise software. These services monitor blockchain events, format data for ERP systems, generate reports for compliance teams, and manage API connections to banking and insurance platforms. Backend services do not control the protection logic but coordinate system integration.

• Integration APIs: REST APIs and webhooks enable communication between the blockchain system and existing trade finance platforms. REST APIs allow ERP systems to query blockchain transaction status. Webhooks push notifications when protection events are triggered. These integration points ensure that automated blockchain execution is reflected in legacy accounting and reporting systems.

Tokenization of Trade Assets and Documents

Tokenization converts trade documents and financial claims into digital tokens recorded on a blockchain. Each token represents a legal or financial right that can be transferred, locked, or released according to smart contract rules.

A tokenized invoice is a digital representation of a payment obligation. When a seller ships goods worth 500,000 USD, an invoice token is created on-chain. The token contains metadata specifying the invoice amount, payment terms, delivery conditions, and buyer identity. The token represents the seller's legal claim to payment. The token can be transferred to a bank for trade financing or held as collateral in a smart contract.

Tokenized trade documents include bills of lading, letters of credit, warehouse receipts, and certificates of origin. A tokenized bill of lading represents ownership of goods in transit. The token contains shipping route information, container numbers, and expected delivery dates. When the goods arrive at the destination port, the token is transferred to the buyer. The buyer presents the token to claim physical possession of the goods.

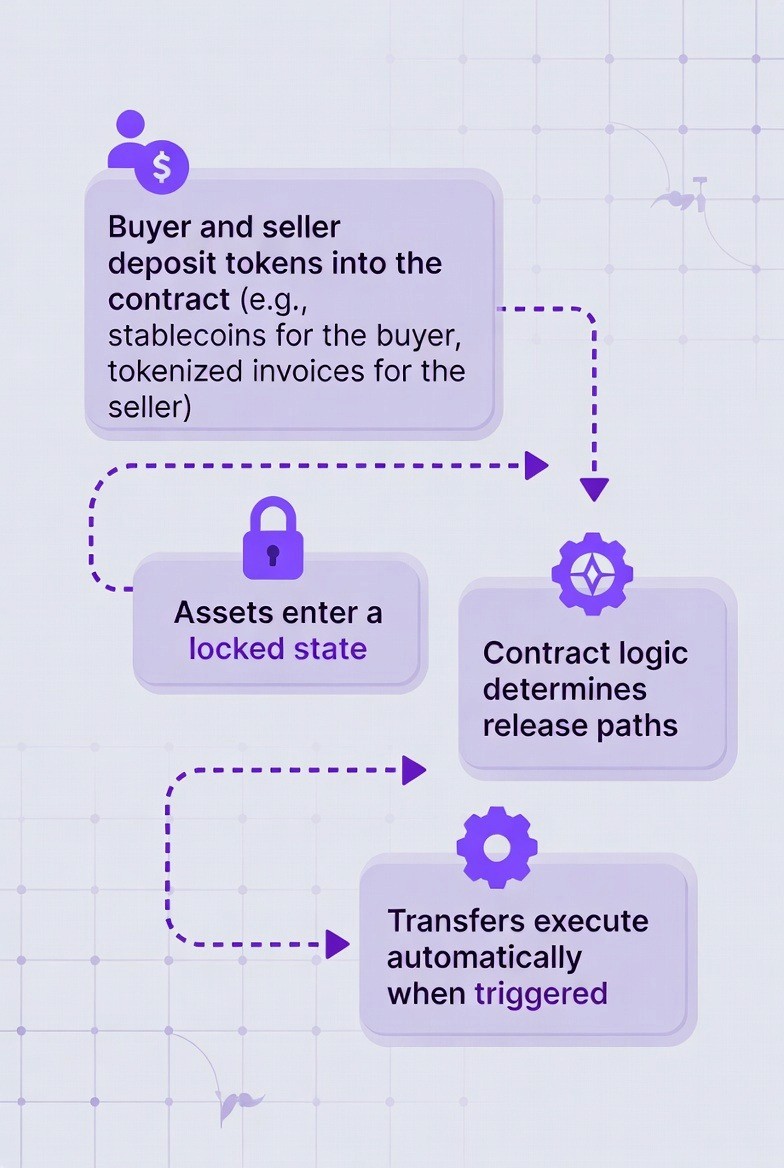

Tokens can be locked inside smart contracts. When a trade agreement is executed, the buyer deposits tokenized stablecoins into a smart contract as payment. The seller deposits a tokenized invoice as proof of shipment. Both tokens are locked. The smart contract controls when these tokens are released. If external events trigger protection conditions, the smart contract automatically transfers tokens according to predefined rules.

Token transfers are atomic. This means the transfer either completes entirely or does not occur at all. There are no partial transfers or intermediate states. Atomic transfers eliminate settlement risk where one party delivers assets but the other party fails to deliver payment.

Smart Contract Design for Conditional Protection

Smart contracts for event-based protection contain several core components. Each component defines how the contract behaves when events occur.

1. Contract variables store the terms of the trade agreement

Variables include the buyer address, seller address, invoice amount, delivery deadline, protected event types, and collateral amount. These variables are set when the contract is deployed and cannot be changed afterward. The contract also stores references to oracle addresses that will provide event data.

2. Event conditions define which external events trigger protection.

A condition might specify that if a port closure lasts longer than 7 days, the seller receives 80 percent of the invoice value from locked collateral. Another condition might specify that if shipping delay exceeds 14 days, the buyer receives a 15 percent discount on the invoice amount. Conditions are written as logical statements that evaluate to true or false.

3. Access control rules determine which addresses can interact with the contract

Only the designated oracle address can submit event data. Only the buyer and seller can withdraw released assets. Access control prevents unauthorized parties from manipulating contract execution.

4. Collateral logic manages how locked assets are held and released.

When the contract is initialized, the buyer deposits stablecoins equal to the invoice amount. The seller deposits a performance bond. These assets remain locked in the contract. If protection conditions are met, the contract calculates the amount to release based on predefined formulas. The contract then executes the transfer. If delivery completes without triggering protection, assets are returned to their original owners.

5. Insurance activation logic connects to external insurance protocols.

The smart contract can trigger parametric insurance coverage when events meet specified thresholds. For example, if weather data shows wind speeds exceeding 75 miles per hour at the shipping location, the contract automatically files a claim with an on-chain insurance provider. The insurance provider's smart contract verifies the event data and releases payment within the same block confirmation.

6. Automated condition evaluation, oracle data integration, and deterministic execution

Traditional systems rely on human judgment to determine if events qualify for protection. Smart contracts replace human judgment with predefined rules that execute identically every time the same conditions occur.

How to Implement Event-based Conditional Protection

This step-by-step guide explains how to implement event-based conditional protection, from defining trigger events and data sources to executing automated payments, coverage, and contract adjustments when disruptions occur.

Step 1: Smart Contract Deployment With Protection Parameters

The smart contract serves as the programmable agreement that defines all protection conditions, triggers, and execution logic. The contract is deployed to a blockchain network where it becomes an autonomous program that cannot be altered after deployment.

Implementation Details

The buyer and seller negotiate trade terms including invoice amount, delivery timeline, shipping route, and specific external events that trigger protection. These terms are encoded into smart contract variables. Contract variables are data storage locations within the smart contract that hold values used throughout the contract's lifecycle.

Key contract variables include:

• Buyer wallet address: The blockchain address that will deposit payment and receive refunds if conditions warrant

• Seller wallet address: The blockchain address that will receive payment and protection payouts

• Invoice amount: The total payment value, typically denominated in stablecoins such as USDC or USDT

• Delivery deadline: A Unix timestamp representing the expected delivery date

• Protection event definitions: Structured data specifying which events trigger protection, such as port closures lasting more than 7 days, weather events with wind speeds exceeding 75 miles per hour, or shipping delays beyond 14 days

• Protection payout formulas: Mathematical calculations that determine how much is paid when specific conditions are met, such as 60 percent of invoice value for weather delays or 100 percent refund for total delivery failure

• Oracle addresses: The blockchain addresses of authorized oracles that are permitted to submit external event data to the contract

The contract is written in Solidity for Ethereum-compatible networks or using Hedera Smart Contract Service for Hedera Hashgraph. The contract code includes functions for depositing assets, receiving oracle data, evaluating conditions, executing transfers, and querying contract state.

Code Structure Example

A simplified Solidity contract structure includes state variables for storing protection parameters, a constructor function that initializes the contract with buyer and seller addresses, a deposit function that allows parties to lock collateral, a receive oracle data function that accepts verified external event data, an evaluate conditions function that checks if triggers are met, and a release protection function that executes token transfers.

The contract includes access modifiers that restrict which addresses can call specific functions. Only the designated oracle address can submit event data. Only the contract itself can execute protection releases. This prevents unauthorized manipulation of contract execution.

Solidity Code:

contract TradeProtection {

address public buyer;

address public seller;

address public oracleAddress;

uint256 public invoiceAmount;

uint256 public windSpeedThreshold;

uint256 public receivedWindSpeed;

IERC20 public usdcToken;

bool public protectionActivated;

constructor(address _buyer, address _seller, address _oracle, uint256 _amount, uint256 _threshold, address _usdcToken) {

buyer = _buyer;

seller = _seller;

oracleAddress = _oracle;

invoiceAmount = _amount;

windSpeedThreshold = _threshold;

usdcToken = IERC20(_usdcToken);

}

modifier onlyOracle() {

require(msg.sender == oracleAddress, "Only oracle can call");

_;

}

function depositCollateral(uint256 amount) external {

require(msg.sender == buyer, "Only buyer can deposit");

usdcToken.transferFrom(msg.sender, address(this), amount);

}

function submitEventData(uint256 windSpeed) external onlyOracle {

receivedWindSpeed = windSpeed;

evaluateConditions();

}

function evaluateConditions() internal {

if (receivedWindSpeed > windSpeedThreshold && !protectionActivated) {

uint256 payoutAmount = (invoiceAmount * 60) / 100;

releaseProtection(payoutAmount);

}

}

function releaseProtection(uint256 amount) internal {

protectionActivated = true;

usdcToken.transfer(seller, amount);

}

}

Deployment Process

The seller initiates deployment by compiling the Solidity contract into bytecode. Bytecode is the low-level machine-readable format that blockchain virtual machines execute. The seller submits a deployment transaction to the blockchain network. This transaction includes the compiled bytecode and constructor parameters such as buyer address, seller address, and invoice amount.

Network validators verify the deployment transaction. Validators check that the transaction is properly signed, that the deployer has sufficient funds to pay transaction fees, and that the bytecode is valid. After validation, the contract is deployed to a unique contract address. This address is deterministically generated based on the deployer's address and transaction nonce.

Both buyer and seller verify the deployed contract by reading its state variables directly from the blockchain. They confirm that the contract contains the correct addresses, amounts, protection conditions, and oracle configurations. This verification ensures that the deployed contract matches the negotiated terms before any assets are deposited.

Outcome

After deployment, the smart contract exists as an autonomous program on the blockchain. The contract cannot be modified or deleted by any party. All protection logic is permanently encoded and publicly verifiable. The contract is now ready to receive asset deposits and oracle data.

Step 2: Asset Tokenization and Collateral Locking

Asset tokenization converts trade documents and payment instruments into blockchain-based tokens that can be programmatically controlled by smart contracts. Collateral locking secures these tokenized assets within the smart contract until conditions for release are met.

Tokenization Process

The seller creates a tokenized invoice representing the payment obligation. On Hedera, this uses Hedera Token Service to mint a non-fungible token with metadata containing invoice number, amount, payment terms, and goods description. On Ethereum, this uses an ERC-721 contract to mint a unique token with similar metadata stored in token properties.

The seller also tokenizes the bill of lading. The bill of lading token contains metadata specifying container ID, departure port, destination port, shipping carrier, vessel name, and expected arrival date. This token represents legal ownership of the goods during transit. The token can be transferred to transfer ownership rights.

The buyer prepares payment in the form of stablecoins. Stablecoins are cryptocurrency tokens pegged to fiat currency values. USDC and USDT are stablecoins pegged to the US dollar. Each stablecoin token represents one dollar of value. Stablecoins are fungible tokens, meaning each unit is interchangeable with any other unit of the same token type.

Collateral Deposit Mechanism

The buyer calls the smart contract deposit function to transfer stablecoins to the contract address. For a 500,000 USD invoice, the buyer transfers 500,000 USDC tokens to the contract. This transfer is executed through the stablecoin token contract's transfer function. The stablecoin contract updates its internal ledger to show that the 500,000 USDC is now owned by the trade protection smart contract address.

The seller may deposit a performance bond as additional collateral. A performance bond is a security deposit that ensures the seller fulfills delivery obligations. The bond might be 10 percent of invoice value, or 50,000 USDC. The seller transfers this amount to the smart contract using the same transfer mechanism.

The seller transfers the tokenized invoice and bill of lading to the smart contract address. These tokens are now locked in the contract. The contract's ownership records show that it holds the invoice token, the bill of lading token, 500,000 USDC from the buyer, and 50,000 USDC performance bond from the seller.

Lock State and Access Control

Once assets are deposited, they enter a locked state. The locked state means that the assets cannot be withdrawn by the buyer or seller through normal transfer functions. The assets can only be released through the smart contract's conditional release logic.

The smart contract maintains a balance mapping that tracks how much each party has deposited. This mapping is a data structure that associates addresses with amounts. The buyer's address maps to 500,000 USDC. The seller's address maps to 50,000 USDC performance bond. These mappings determine how assets are distributed when conditions trigger.

The contract enforces that locked assets can only be released through specific functions that check whether protection conditions have been met. If a protection event occurs, the release function transfers assets according to predefined formulas. If delivery completes successfully without triggering protection, assets are returned to their original depositors.

Outcome

After this step, all financial value and legal claims related to the trade are locked in the smart contract. Neither party can access these assets except through the contract's automated execution logic. The contract holds 550,000 USDC in total collateral plus tokenized documents representing the trade transaction. These assets are now ready to be released automatically when oracle data triggers conditions.

Step 3: Oracle Integration for External Data Feeds

Oracles serve as data bridges that connect blockchain smart contracts to external information sources. Smart contracts cannot directly access data outside the blockchain network. Oracles retrieve data from external APIs, verify data authenticity, and deliver the data on-chain where smart contracts can read it.

Oracle Architecture

Chainlink is a decentralized oracle network that provides external data to blockchains. A Chainlink oracle node runs software that monitors external data sources and submits data to on-chain oracle contracts. The oracle node operates independently from the trade protection smart contract but is authorized to submit data that the protection contract trusts.

For trade protection, the oracle is configured to monitor multiple data sources. Weather data comes from meteorological agency APIs such as NOAA or national weather services. Port status data comes from maritime authority websites and port operator systems. Shipping location data comes from vessel tracking services and carrier APIs. IoT sensor data comes from temperature or humidity sensors attached to shipping containers.

Data Retrieval and Verification

The oracle node polls external APIs at regular intervals, such as every 6 hours. When a query is executed, the oracle makes an HTTP request to the external API endpoint. The API returns data in JSON format. For weather data, the response includes timestamp, location coordinates, temperature, wind speed, precipitation, and data source identifier.

The oracle node verifies that the API response is authentic. For government APIs, this may involve checking SSL certificates. For APIs that support it, the oracle verifies cryptographic signatures on the data. The oracle compares the data against expected formats and ranges to detect obvious errors or manipulation.

Multiple oracle nodes can be configured to retrieve the same data from different sources. This creates redundancy and reduces single points of failure. If three oracle nodes all report that wind speed exceeds 75 miles per hour, the consensus increases confidence in the data accuracy. The smart contract can require agreement from at least two out of three oracles before accepting the data as valid.

On-Chain Data Submission

After retrieving and verifying external data, the oracle prepares it for on-chain submission. The oracle formats the data into a structured format that the smart contract expects. For a weather event, this includes event type identifier, timestamp, location coordinates, and measured wind speed value.

The oracle node signs the data package using its private key. This cryptographic signature proves that the data came from the authorized oracle and has not been altered in transit. The signature is created by hashing the data and encrypting the hash with the oracle's private key. Anyone with the oracle's public key can verify the signature by decrypting it and comparing it to a fresh hash of the data.

The oracle submits a transaction to the blockchain network. This transaction calls a specific function in the trade protection smart contract, typically named something like submitEventData or updateOracle. The transaction includes the signed data package as function parameters. The oracle pays transaction fees in the network's native token to have validators process the transaction.

Smart Contract Data Reception

The trade protection smart contract receives the oracle transaction. The contract first verifies that the transaction sender is an authorized oracle address. This check compares the transaction sender address against the oracle addresses stored in the contract variables during deployment.

The contract then verifies the cryptographic signature on the data package. The contract uses the oracle's public key to decrypt the signature and compare it against a hash of the received data. If the signature is valid, the contract accepts the data as authentic. If the signature is invalid, the contract rejects the data and the transaction reverts without changing contract state.

After verification, the contract stores the oracle data in its state variables. The contract might store the event type, timestamp, location, and measured value. This data is now permanently recorded on the blockchain and available for the contract to use in condition evaluation.

Outcome

After this step, the smart contract has access to verified external event data. The data is cryptographically signed and immutably recorded on-chain. The contract can now evaluate whether this data meets the protection trigger conditions. The oracle continues monitoring external sources and will submit additional data if new events occur.

Step 4: Automated Condition Evaluation and Execution

Technical Function

Condition evaluation is the process where the smart contract compares received oracle data against predefined trigger thresholds to determine if protection should activate. Execution is the automated transfer of locked assets according to protection payout formulas when conditions are satisfied.

Condition Evaluation Logic

The smart contract contains conditional statements that implement the protection rules. These statements use if-then logic to compare values. A typical condition checks whether a measured value exceeds a threshold value. For weather protection, the condition checks if the oracle-reported wind speed is greater than the threshold wind speed stored in contract variables.

The evaluation occurs immediately after the oracle submits data. When the oracle transaction is processed, it triggers the contract's data reception function. This function stores the oracle data and then immediately calls the condition evaluation function. The evaluation happens within the same transaction, ensuring no delay between data arrival and condition checking.

For a weather event example, the contract reads the stored wind speed threshold of 75 miles per hour. The contract reads the newly received oracle data showing a measured wind speed of 80 miles per hour. The contract executes a comparison: is 80 greater than 75. This comparison returns true. The contract also verifies that the event occurred within the specified geographic area by comparing the event coordinates against the shipping route coordinates. This location check also returns true.

Multiple conditions can be combined using logical operators. AND operators require all conditions to be true. OR operators require at least one condition to be true. For example, protection might activate if wind speed exceeds 75 miles per hour AND the event is within 100 miles of the shipping route AND the event occurs before the delivery deadline. All three conditions must evaluate to true for protection to trigger.

Protection Payout Calculation

When conditions evaluate to true, the contract calculates the protection payout amount. The payout formula is stored as a function or formula in the contract code. For weather events, the formula might specify that the seller receives 60 percent of the invoice amount.

The contract retrieves the invoice amount from storage. The invoice amount is 500,000 USDC. The contract multiplies this by 0.60 to calculate 60 percent. The result is 300,000 USDC. This is the amount that will be transferred to the seller as immediate protection.

More complex formulas can incorporate multiple variables. A delay-based formula might calculate protection as base amount plus a daily penalty. If delivery is 10 days late and the penalty is 2 percent per day, the calculation is base amount plus 10 times 2 percent, which equals base amount plus 20 percent. For a 500,000 USDC invoice, this equals 500,000 plus 100,000, resulting in 600,000 USDC owed to the seller.

Automated Execution Process

After calculating the payout amount, the contract immediately executes the transfer. The contract calls its internal release function. This function verifies that the contract holds sufficient balance to cover the payout. The locked balance is 500,000 USDC from the buyer. The payout amount is 300,000 USDC. The contract has sufficient funds.

The contract calls the stablecoin token contract's transfer function. The transfer function parameters specify the sender address as the trade protection contract address, the recipient address as the seller's wallet address, and the amount as 300,000 USDC. The stablecoin contract verifies that the trade protection contract has authority to transfer these tokens, which it does because the tokens are held in the contract's balance.

The stablecoin contract updates its internal ledger. The trade protection contract's balance decreases from 500,000 USDC to 200,000 USDC. The seller's wallet balance increases by 300,000 USDC. This balance update is atomic, meaning it either completes fully or not at all. There is no intermediate state where tokens are lost or duplicated.

The entire sequence from oracle data submission to condition evaluation to transfer execution occurs within a single block confirmation. On Hedera, this takes 3 to 5 seconds. On Ethereum, this takes 12 to 15 seconds. From the user perspective, protection activates instantly once the external event data reaches the blockchain.

State Updates and Event Emission

After executing the transfer, the contract updates its state variables to reflect the new status. The contract sets a protection activated flag to true. This flag prevents the protection from being triggered multiple times for the same event. The contract stores the activation timestamp and the payout amount in permanent storage.

The contract emits an event log. Event logs are special blockchain records that applications can monitor. The protection activated event log includes the event type, trigger condition, payout amount, recipient address, and timestamp. Off-chain monitoring systems can detect this event log and notify relevant parties or update external databases.

Outcome

After this step, the protection has been automatically activated and executed. The seller has received 300,000 USDC in their wallet. The remaining 200,000 USDC remains locked in the contract pending final delivery outcome. All condition evaluations and transfers are recorded on-chain. The process occurred without any manual intervention or human decision-making.

Step 5: Instant Settlement and Immutable Record Creation

Settlement is the finalization of asset transfers where ownership changes are confirmed and irreversible. Immutable record creation ensures that all transaction details are permanently recorded on the blockchain where they cannot be altered or deleted by any participant.

Transaction Confirmation Process

When the smart contract executes the protection transfer, it broadcasts a transaction to the blockchain network. This transaction contains all the operation details including sender address, recipient address, token amount, contract state changes, and event logs. The transaction is digitally signed by the contract to prove its authenticity.

Network validators receive the transaction and add it to their transaction pool. Validators are network nodes responsible for verifying and confirming transactions. Each validator checks that the transaction is properly formatted, that signatures are valid, that the contract has sufficient balance to execute the transfer, and that all smart contract logic executed correctly.

A validator selects the transaction from the pool and includes it in a new block. A block is a batch of transactions that are processed together. On Hedera, blocks are created every 3 to 5 seconds. On Ethereum, blocks are created approximately every 12 seconds. The validator broadcasts the new block to all other network nodes.

Other validators verify the block by re-executing all transactions in the block and confirming that they produce the same state changes. If the majority of validators agree that the block is valid, the block is confirmed and added to the blockchain. This consensus process ensures that all nodes maintain identical records and that invalid transactions cannot be confirmed.

Settlement Finality

Once a transaction is included in a confirmed block, it achieves settlement finality. Finality means the transaction is permanently recorded and cannot be reversed. On Hedera Hashgraph, finality is achieved within 3 to 5 seconds using the hashgraph consensus algorithm. On Ethereum, practical finality is achieved after approximately 15 minutes when the block is deep enough in the chain that reorganization becomes computationally infeasible.

From the seller's perspective, the 300,000 USDC appears in their wallet balance immediately after block confirmation. The wallet software queries the blockchain and reads the updated balance from the stablecoin contract's state. The seller can now use these tokens for any purpose including paying suppliers, converting to fiat currency, or transferring to other parties.

The buyer sees their locked balance decrease from 500,000 USDC to 200,000 USDC in the trade protection contract. The buyer knows that if delivery completes successfully despite the weather event, they will pay the remaining 200,000 USDC to the seller. If delivery fails entirely due to the weather event, the 200,000 USDC will be refunded to the buyer. These outcomes are determined by the contract logic and cannot be altered.

Immutable Record Structure

The blockchain stores a complete record of every step in the protection activation sequence. This record includes the contract deployment transaction showing the initial contract code and parameters, the asset deposit transactions showing when the buyer and seller locked collateral, the oracle data submission transaction showing when and what event data was delivered, the condition evaluation and execution transaction showing the protection trigger and transfer, and all state changes to contract variables and token balances.

Each transaction includes a timestamp based on the block creation time. This provides an authoritative chronological record of events. The sequence shows that the contract was deployed at timestamp T0, assets were deposited at timestamp T1, oracle data was received at timestamp T2, and protection was executed at timestamp T2 plus 3 seconds. This timeline cannot be disputed because it is recorded in the blockchain's consensus time.

Every transaction includes cryptographic hashes that link it to previous transactions. The current block contains a hash of the previous block. The previous block contains a hash of the block before it. This creates a tamper-evident chain where any attempt to modify historical records would invalidate all subsequent blocks. The computational cost of rewriting blockchain history makes it practically impossible for any party to alter past transactions.

Audit and Verification Access

All transaction records are publicly accessible through blockchain explorers. A blockchain explorer is a web application that allows anyone to query and view blockchain data. Users can search for the trade protection contract address and see every transaction involving that contract. They can view the exact timestamps, amounts, sender and recipient addresses, and event logs.

Auditors can verify that protection was triggered correctly by examining the on-chain data. They can see the oracle data that was submitted, verify the oracle's signature, check that the measured values exceeded the threshold values, confirm that the payout calculation followed the formula defined in the contract code, and verify that the transfer occurred to the correct recipient address with the correct amount.

This verification can be performed at any time in the future without cooperation from the buyer, seller, or oracle. The blockchain record is self-contained and self-verifying. This eliminates the need for parties to maintain separate documentation systems or rely on trusted intermediaries to provide transaction history.

Integration With Enterprise Systems

Backend monitoring services detect the protection activation event by subscribing to the smart contract's event logs. When the protection activated event is emitted, the monitoring service receives a notification. The service retrieves the transaction details including payout amount and recipient address.

The monitoring service formats this data and sends it to the seller's ERP system through a REST API call. The API payload includes transaction ID, amount, timestamp, and event type. The ERP system creates an accounting entry recording the 300,000 USDC receipt. The accounts receivable balance is updated. The cash flow forecast is adjusted to reflect the immediate liquidity.

Similar notifications are sent to the buyer's financial systems, insurance platforms, and any other integrated applications. All systems update their records simultaneously based on the same authoritative blockchain data. This eliminates discrepancies between different parties' record systems and ensures everyone has the same view of the transaction status.

Outcome

After this step, settlement is complete and irreversible. The seller has received 300,000 USDC with finality. The transaction is permanently recorded on the blockchain. All parties can independently verify that the protection was activated correctly based on objective event data. Enterprise systems are updated with the transaction details. The remaining contract balance of 200,000 USDC will be settled according to the final delivery outcome following the same automated process.

Real Use Cases

Arbol x Chainlink

Arbol uses Chainlink to access trusted weather data from NOAA. This data is fed directly into smart contracts. In Arbol's crop insurance model, set thresholds for drought, rainfall, or temperature are coded on-chain. Chainlink oracles provide verified NOAA data continuously. When the data goes beyond these thresholds, the smart contract triggers payouts automatically. This means no manual claims, inspections, or adjuster reviews are needed. It highlights a strong example of event-based, data-driven protection based on real-world conditions.

The Outlook

Event-based conditional protection for international trade transforms how risks are managed. By using blockchain, smart contracts, and oracles, it eliminates the delays and disputes common in traditional trade. Sellers and buyers benefit from immediate, automatic protection triggered by verified events, ensuring faster settlements and predictable cash flows.

For Banks and insurers, it means streamlined processes and lower dispute resolution costs. As blockchain adoption grows, this solution will become the new standard for global trade risk management, offering greater efficiency and security than traditional systems.

How TokenMinds Helps with Implementation of Event-based Conditional Protection

TokenMinds helps organizations and institutions implement blockchain-based event-driven conditional protection for international trade. We work with stakeholders to convert commercial risk terms such as port closures, weather disruptions, and delivery delays into deterministic smart contract logic that executes automatically when verified external events occur.

This includes designing protection triggers, settlement conditions, collateral structures, and payout formulas that are agreed upfront and enforced on-chain without manual claims or subjective interpretation.

Conclusion

Event-based conditional protection represents a fundamental shift in how international trade risk is managed. By replacing document-driven claims and subjective judgment with deterministic smart contracts triggered by verified real-world events, blockchain turns protection into an automated, enforceable outcome rather than a delayed negotiation. Sellers gain immediate liquidity when disruptions occur, buyers receive predictable payment protection, and banks and insurers reduce operational friction while improving transparency and auditability.

Schedule a complimentary consultation with TokenMinds to explore how your organization can implement event-based conditional protection using blockchain to reduce trade risk, accelerate settlement, and create predictable outcomes across complex global supply chains.

Frequently Asked Questions

1. How reliable are blockchain networks for time-sensitive trade protection?

Enterprise blockchain networks such as Hedera Hashgraph and Ethereum maintain operational uptime exceeding 99.9 percent. Transaction confirmation times are consistent and predictable. Hedera confirms transactions in 3 to 5 seconds. Ethereum confirms transactions in 12 to 15 seconds. Network downtime events are extremely rare and typically last less than one hour. For critical applications, systems can deploy contracts to multiple networks simultaneously to ensure redundancy.

2. Are smart contracts legally enforceable in international trade?

Smart contracts are recognized as valid contract execution mechanisms in many jurisdictions. The legal enforceability depends on the governing law specified in the trade agreement. Parties should include provisions stating that the smart contract code represents the binding terms of the agreement. Several jurisdictions including Wyoming, Singapore, and Dubai have enacted legislation explicitly recognizing smart contracts. Legal frameworks continue to develop as blockchain adoption increases.

3. How accurate is oracle data from external sources?

Oracle accuracy depends on the quality of the underlying data source. Oracles that retrieve data from government meteorological agencies, official port authorities, and regulated shipping carriers provide highly accurate information. Chainlink oracle networks use multiple independent data providers and aggregate results to reduce the impact of single-source errors. Smart contracts can require data consensus from multiple oracles before activating protection. This multi-oracle approach increases reliability.

4. What happens if an oracle provides incorrect data?

Oracle networks implement reputation systems and economic incentives to discourage incorrect data submission. Oracles stake collateral that can be forfeited if they provide false data. Data consumers can challenge oracle submissions if they detect inaccuracies. Smart contracts can include dispute resolution mechanisms that pause execution if data accuracy is questioned. For high-value trades, parties can require data from multiple independent oracles and only execute when all oracles agree.

5. Is settlement truly final or can it be reversed?

Blockchain transactions are final after network confirmation. Once a smart contract executes a token transfer and the transaction is confirmed in a block, the transfer cannot be reversed by any party. This differs from traditional payment systems where transactions can be reversed through chargebacks or bank interventions. Finality provides certainty but also requires careful contract design because erroneous executions cannot be automatically undone.

6. How do blockchain systems handle privacy for confidential trade data?

Public blockchains record transaction amounts and addresses but do not inherently expose business identities. Parties can use separate addresses for each trade to prevent transaction linking. Private or permissioned blockchains restrict data visibility to authorized participants only. Zero-knowledge proofs allow parties to prove that conditions are met without revealing the underlying data. Encrypted data can be stored off-chain with only cryptographic hashes recorded on-chain for verification purposes.

7. What is the cost of operating event-based protection systems compared to traditional methods?

Blockchain transaction fees vary by network but are typically measured in cents or single-digit dollars per transaction. Oracle data feeds require ongoing subscription fees ranging from 50 to 500 USD per month depending on update frequency. These costs are significantly lower than traditional insurance premiums and claims processing fees. Traditional trade insurance often costs 0.5 to 2 percent of cargo value. Event-based protection reduces costs by eliminating manual processing labor while providing faster execution.